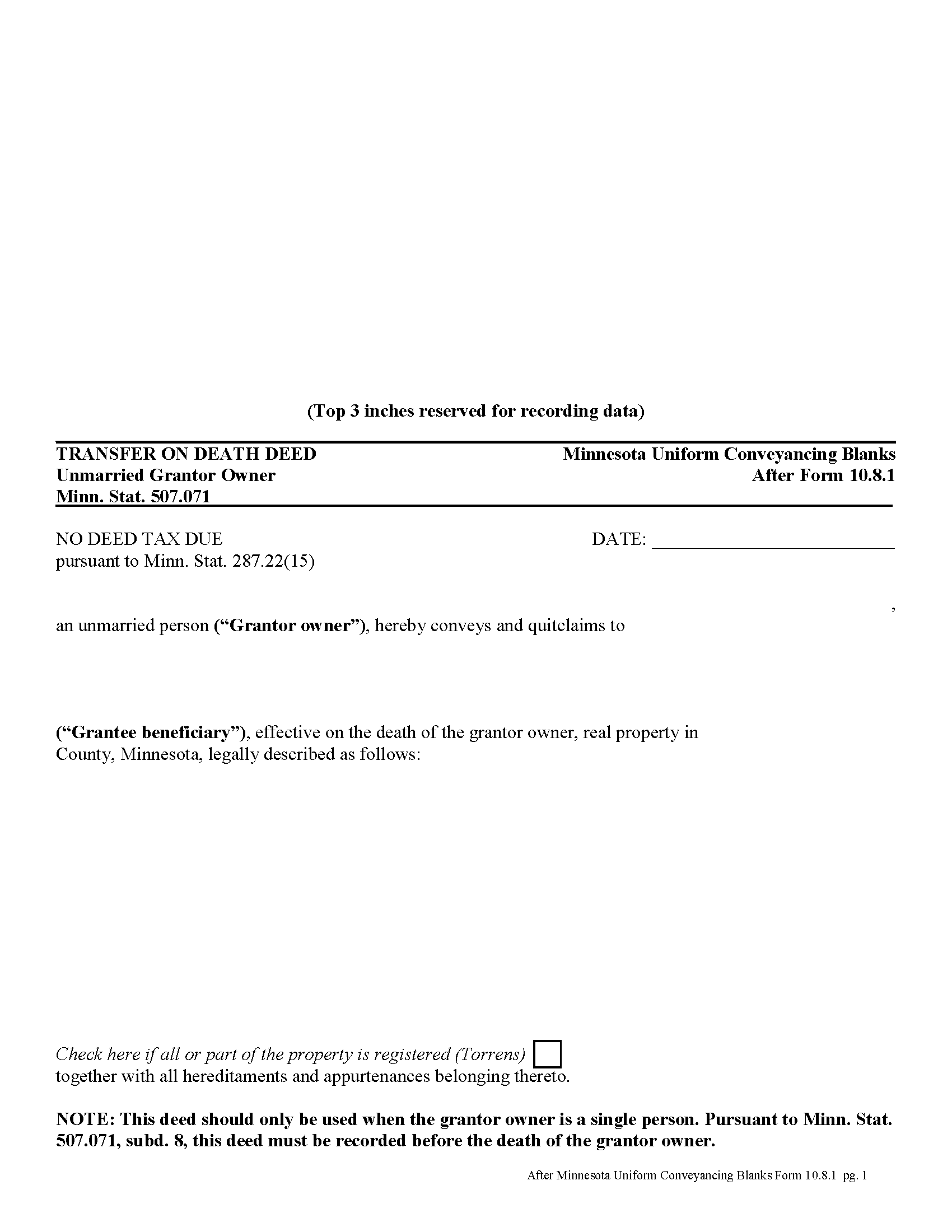

Cottonwood County Transfer on Death Deed by Unmarried Owner Form

Cottonwood County Transfer on Death Deed by Unmarried Owner

Fill in the blank form formatted to comply with all recording and content requirements.

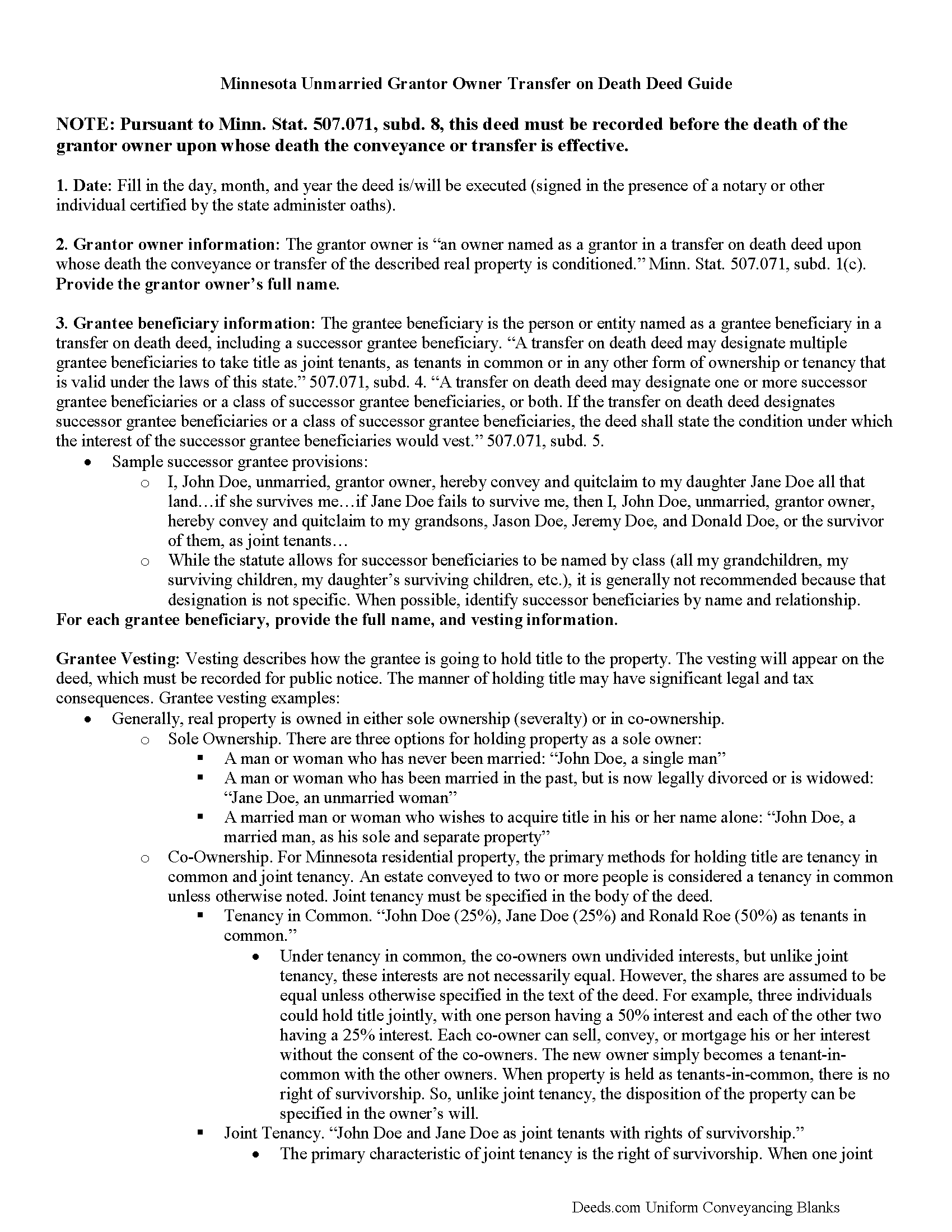

Cottonwood County Transfer on Death Deed by Unmarried Owner Guide

Line by line guide explaining every blank on the form.

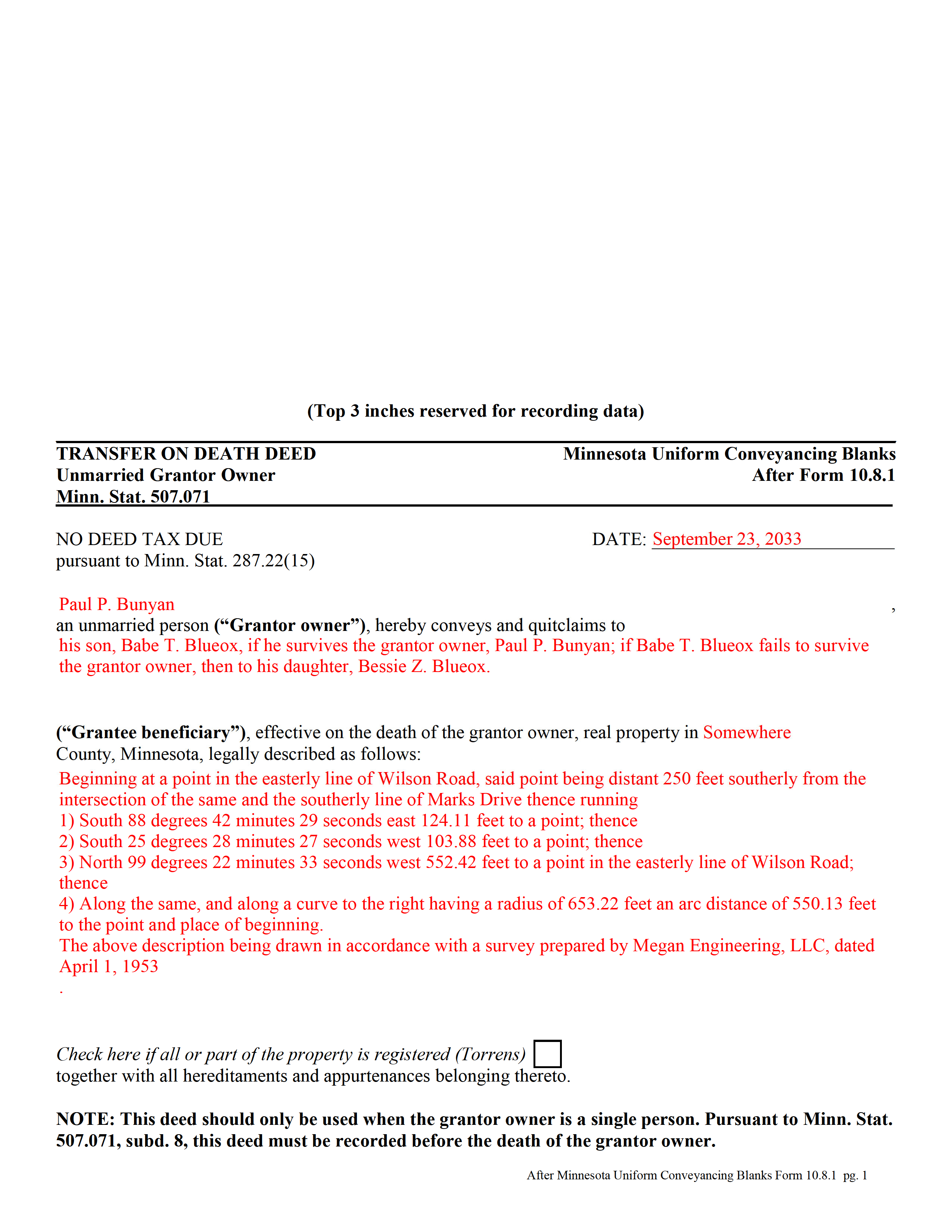

Cottonwood County Completed Example of the Transfer on Death Deed by Unmarried Owner Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Minnesota and Cottonwood County documents included at no extra charge:

Where to Record Your Documents

Cottonwood County Recorder

Windom, Minnesota 56101

Hours: 8:00 to 4:30 M-F

Phone: (507) 831-1458

Recording Tips for Cottonwood County:

- Bring your driver's license or state-issued photo ID

- Verify all names are spelled correctly before recording

- Double-check legal descriptions match your existing deed

- Request a receipt showing your recording numbers

- Have the property address and parcel number ready

Cities and Jurisdictions in Cottonwood County

Properties in any of these areas use Cottonwood County forms:

- Bingham Lake

- Jeffers

- Mountain Lake

- Storden

- Westbrook

- Windom

Hours, fees, requirements, and more for Cottonwood County

How do I get my forms?

Forms are available for immediate download after payment. The Cottonwood County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Cottonwood County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Cottonwood County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Cottonwood County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Cottonwood County?

Recording fees in Cottonwood County vary. Contact the recorder's office at (507) 831-1458 for current fees.

Questions answered? Let's get started!

Transfer on Death Deed by Unmarried Grantor Owner -- Minnesota Form 10.8.1

In Minnesota, transfer on death deeds are governed by Minn. Stat. 507.071.

While the statute provides a basic form, as well as overall content requirements, the state authorized the development of uniform conveyance documents for some specific situations. For example, to add clarity, there is a form specifically designed for use by unmarried grantor owners. A correctly-completed basic statutory form is valid in most cases, but it asks for information that may not apply to a single individual. By providing incorrect or conflicting information, even if it is unnecessary, the grantor owner might inadvertently cause the property to revert to the deceased owner's estate for probate distribution.

This transfer on death deed form is for use ONLY by unmarried grantor owners.

As with other transfer on death deeds, this form must be executed and RECORDED during the grantor owner's lifetime.

(Minnesota TOD Deed by Unmarried Owner Package includes form, guidelines, and completed example)

Important: Your property must be located in Cottonwood County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed by Unmarried Owner meets all recording requirements specific to Cottonwood County.

Our Promise

The documents you receive here will meet, or exceed, the Cottonwood County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Cottonwood County Transfer on Death Deed by Unmarried Owner form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Peter M.

February 3rd, 2020

Quick and complete. Thanks!

Thank you!

Gloria J.

July 23rd, 2021

I needed a Missouri Notice of Intent to Sell without a named designated buyer. Mo Statutes require notice be notarized and filed 45 days before any closing to protect buyer from liens. You do not have that document. We are flipping a house so it must be filed. Our lawyer was on vacation. Cannot find one anywhere on net. Finally got a template from our title company.

Thank you for your feedback Gloria.

April L.

November 13th, 2019

The warranty deed forms I received worked fine.

Thank you!

Allan y.

July 13th, 2019

I liked the guide and example to follow to fill out the form. Very helpful!!

Thank you!

Maria H.

September 18th, 2020

Great job. Helped me through some technical difficulties and got it done!

Thank you for your feedback. We really appreciate it. Have a great day!

Daniel D.

June 3rd, 2019

Easier than I expected. I followed the downloaded examples step by step, and before I knew it, the form was completed correctly and good to go. Thank you, Daniel D.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Terrence R.

January 24th, 2020

So far so good I was able to find the documents I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

ROBERT P.

August 26th, 2022

Got what I needed

Thank you!

Vicki G.

November 24th, 2020

Thank you for this service, saved me from driving down town. It was quick and very easy to navigate. Have a great Thanksgiving break.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Stephanie B.

May 28th, 2020

Really great, relevant and straight forward forms. Deeds.com is excellent and helps you avoid costly errors on documents.

Thank you for your feedback. We really appreciate it. Have a great day!

David W.

February 9th, 2021

Excellent assistance provided by your forms, guide and example.

Thank you!

JOHN M.

October 20th, 2019

THANKS FROM A 92 YEAR OLD LADY

Thank you!

Stanley C.

September 11th, 2019

Amazingly simple, easy to download and use. Excellent service, Thank You

Thank you!

Charles W.

December 26th, 2022

in one of the reviews, the person said they wished that there was more room allowed for use in the grantor section. the reply was that they were sorry but there was only enough room for what was there considering margins, etc. that is not true. on the forms i downloaded there was plenty of extra room at the top of the page (about 2 inches) that was not being used.

Thank you!

Russell B.

March 15th, 2023

complete package as promised at a very reasonable cost. Easy forms to complete. Thank you. Definitely 5 stars!!!

Thank you for your feedback. We really appreciate it. Have a great day!