Mille Lacs County Transfer on Death Deed Form

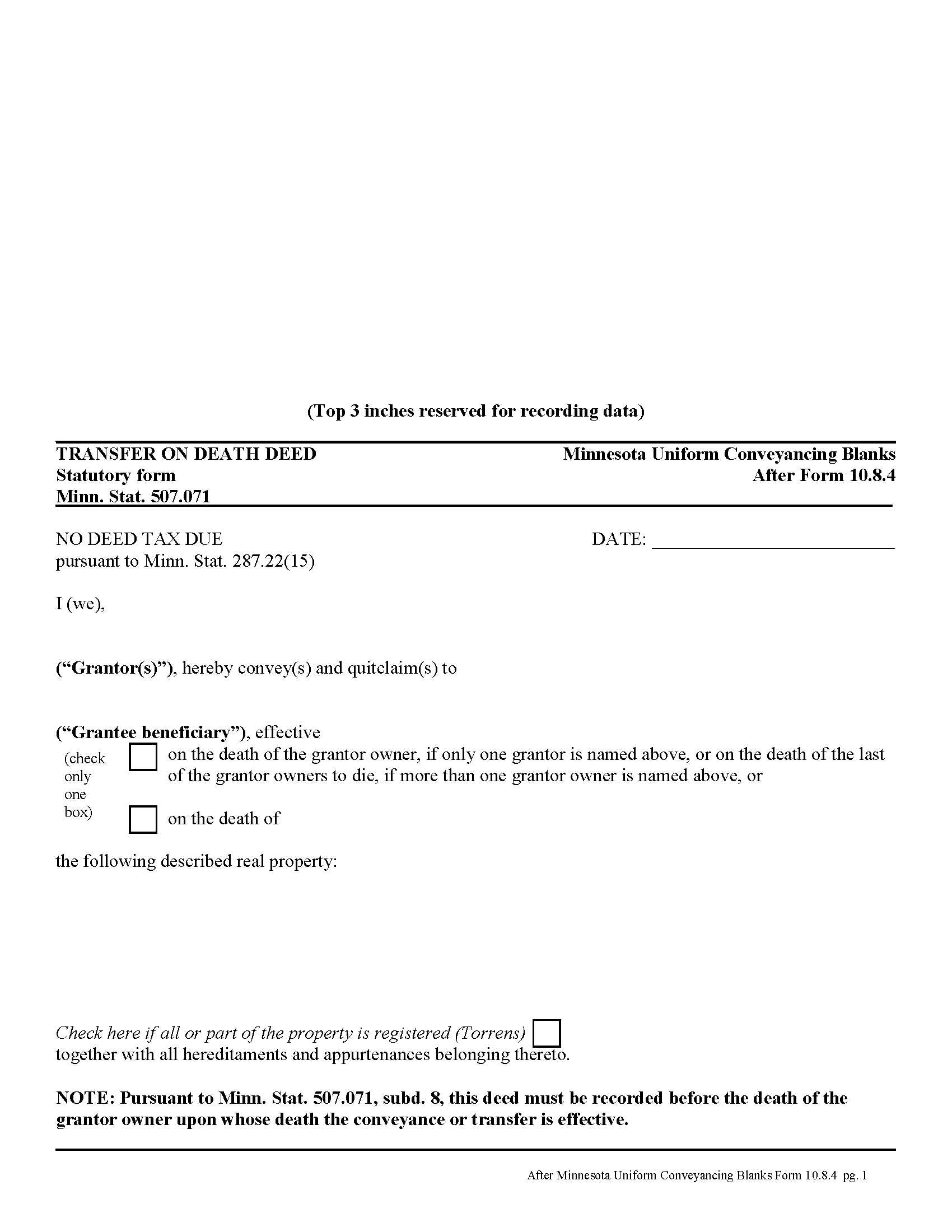

Mille Lacs County Transfer on Death Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

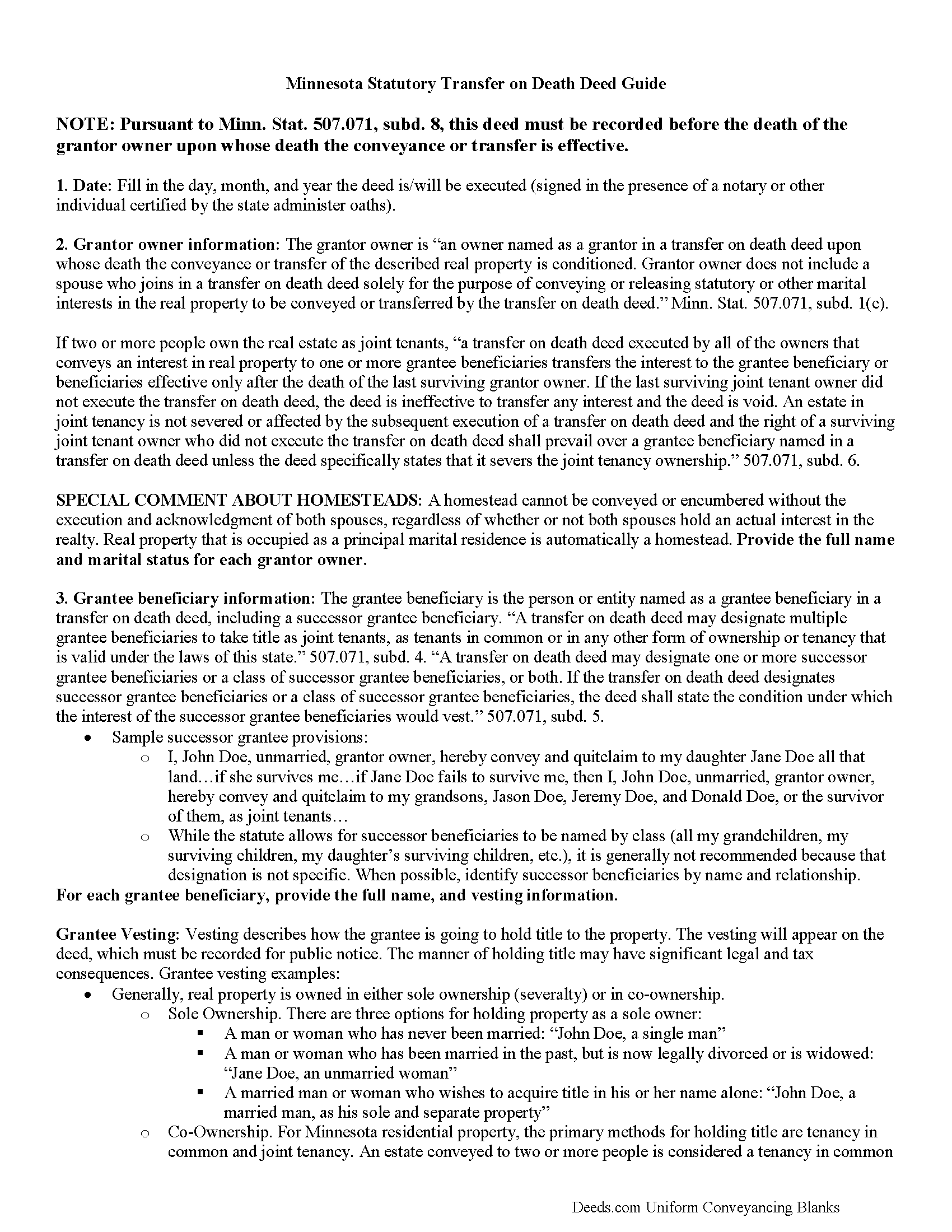

Mille Lacs County Transfer on Death Deed Guide

Line by line guide explaining every blank on the form.

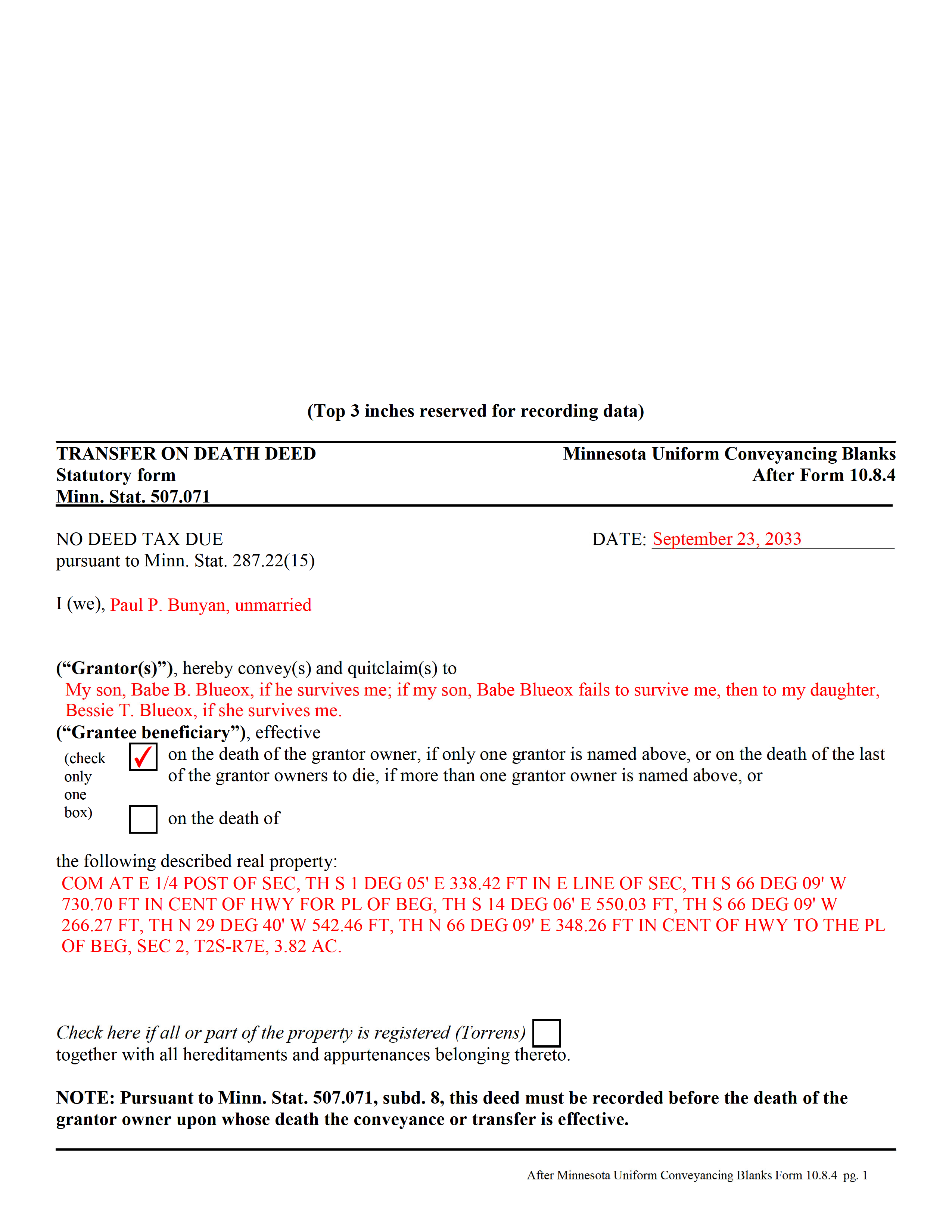

Mille Lacs County Completed Example of the Transfer on Death Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Minnesota and Mille Lacs County documents included at no extra charge:

Where to Record Your Documents

Mille Lacs County Recorder

Milaca, Minnesota 56353

Hours: 8:00am to 4:30pm Monday through Friday

Phone: (320) 983-8308

Recording Tips for Mille Lacs County:

- Bring your driver's license or state-issued photo ID

- Verify all names are spelled correctly before recording

- Check that your notary's commission hasn't expired

Cities and Jurisdictions in Mille Lacs County

Properties in any of these areas use Mille Lacs County forms:

- Bock

- Foreston

- Isle

- Milaca

- Onamia

- Pease

- Princeton

- Wahkon

Hours, fees, requirements, and more for Mille Lacs County

How do I get my forms?

Forms are available for immediate download after payment. The Mille Lacs County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Mille Lacs County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Mille Lacs County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Mille Lacs County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Mille Lacs County?

Recording fees in Mille Lacs County vary. Contact the recorder's office at (320) 983-8308 for current fees.

Questions answered? Let's get started!

Minnesota's transfer on death deeds are governed by Minn. Stat. 507.071.

Transfer on death deeds are useful estate planning tools for owners of Minnesota real estate. In most cases, when a land owner dies, his/her real property enters the probate system along with the rest of the estate. Some people avoid probate by owning property as joint tenants. The nature of joint tenancy includes the right of survivorship, which, by function of law, automatically distributes a deceased joint tenant's title rights to the surviving tenants. Joint tenants, however, share a current interest in the real property, and all owners must execute any changes or reconveyances. By executing and recording a transfer on death deed instead, owners still avoid the need for probate distribution of that portion of their assets. Transfer on death deeds do NOT pass a current or future interest in the property, so the owner's interests are fully protected while he/she remains alive.

Unlike most other real estate deeds, transfer on death deeds do not convey any rights or interests to the beneficiaries until the grantor owner's death. But, under Minn. Stat. 524.2-702, named beneficiaries must outlive the grantor owners by at least 120 hours to become eligible for the property. The owner retains absolute title to and control over the real property until death. He/she may rent, use, sell or reconvey the land at will, and with no obligation to the beneficiary (Minn. Stat. 507.071, subd. 10). As a result, the beneficiary has no guarantee of any present or future interest in the property. In addition, a "transfer on death deed that is executed, acknowledged, and recorded in accordance with this section is not revoked by the provisions of a will" (subd. 19).

Transfer on death deeds allow flexibility -- in addition to individuals, the grantor owner may "transfer an interest in real property to the trustee of an inter vivos trust even if the trust is revocable, to the trustee of a testamentary trust or to any other entity legally qualified to hold title to real property under the laws of this state" (subd. 9).

Under Minn. Stat. 507.071, transfer on death deeds must:

- convey or assign an interest in real property (subd. 2)

- name one or more grantee beneficiaries (subds. 2 and 4)

- explicitly state that it takes effect at the death of the named grantor owner(s)

- comply with other Minnesota deed requirements including joinder of spouse in conveying homestead (507.02, subd. 2)

- standard recording requirements regarding legibility, recordability, notarization, and original signature (507.24)

- Notice recording statutes (507.34, 508.48, 508A.48)

Ultimately, transfer on death deeds offer a useful alternative for Minnesota land owners who wish to pass property to specific beneficiaries without probate intervention.

NOTE: All actions related to executing, revoking, or otherwise changing a Minnesota transfer on death deed must be submitted for recording in the county where at least part of the land is located, while the grantor owner is alive. (507.071, subd. 8).

Important terms:

Grantor owner: "means an owner named as a grantor in a transfer on death deed upon whose death the conveyance or transfer of the described real property is conditioned" (subd. 1c).

Owner: "means a person having an ownership or other interest in all or part of the real property to be conveyed or transferred by a transfer on death deed" (subd. 1d).

Beneficiary or grantee beneficiary: "means a person or entity named as a grantee beneficiary in a transfer on death deed, including a successor grantee beneficiary" (subd. 1a).

(Minnesota TOD Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Mille Lacs County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed meets all recording requirements specific to Mille Lacs County.

Our Promise

The documents you receive here will meet, or exceed, the Mille Lacs County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Mille Lacs County Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4588 Reviews )

Charles F.

November 19th, 2020

Quick and Easy

Thank you for your feedback. We really appreciate it. Have a great day!

Lana B.

August 25th, 2019

Was very helpful!

Thank you!

Mark M.

October 1st, 2020

So nice to find the forms I was looking for. Great site!! Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

diana l.

July 19th, 2024

Easy to use & got my one question answered in less than 5 minutes! Excellence.

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!

Kevin H.

August 6th, 2024

Quick and easy to find the forms I needed. And the download was easy.

Thank you for your feedback. We really appreciate it. Have a great day!

Carolyn D.

March 18th, 2022

The sight provided exactly what I needed and was easy to use. I was able to download the type of Deed I used and was completely satisfied with the website.

Thank you for your feedback. We really appreciate it. Have a great day!

Deborah B.

January 6th, 2019

Easy download, and super easy to fill out. Had them recorded Friday with zero issues. Recommended.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

James D.

January 2nd, 2019

good product, but would prefer an editable document, such as word

Thanks for your feedback James.

Mary P.

February 11th, 2019

Excellent easy to follow instructions.

Great to hear Mary, Have a wonderful day!

ROBERT P.

August 26th, 2022

Got what I needed

Thank you!

Scott G.

June 4th, 2024

Frankly, if our tax dollars were being used to run government "services" correctly, we wouldn't need Deeds.com Since the sun will burn out before government is run correctly, Deeds.com provides an important, efficient, time-saving service that, all things considered, offers big savings over time-and-soul-draining struggles with government agencies.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

John K.

September 3rd, 2021

The website was very easy to work. The documents were just what I needed and everything that my state and county required.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Bruce J.

November 8th, 2019

Fast results

Thank you!

Annette H.

April 7th, 2022

Clear directions. Giving a sample filled-in set of forms was great! Economical cost. Will refer others & use Deeds.com again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Bob B.

September 14th, 2021

Good so far. Will be great if you get the deed recorded.

Thank you!