Harrison County Administrator Deed Form

Last validated November 27, 2025 by our Forms Development Team

Harrison County Administrator Deed Form

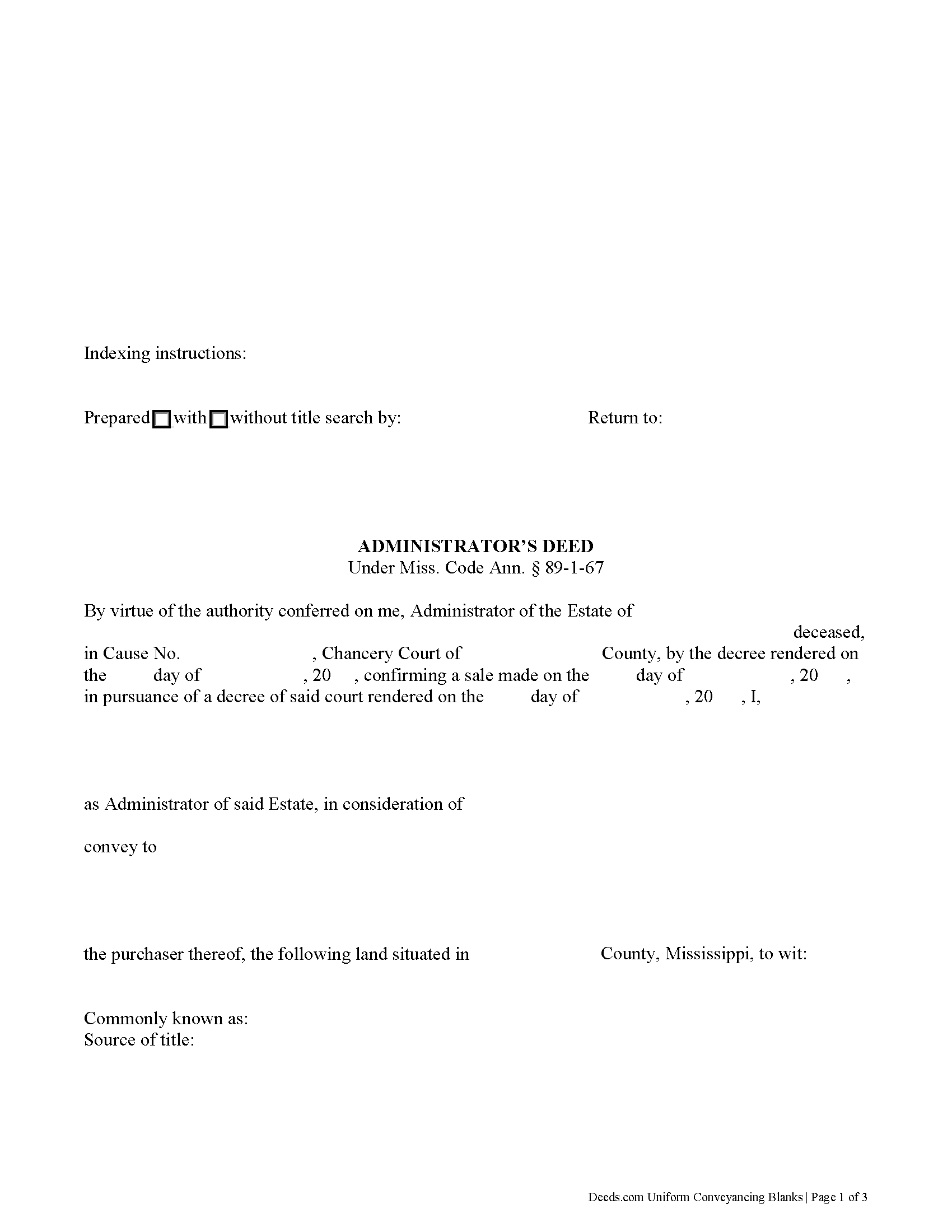

Fill in the blank form formatted to comply with all recording and content requirements.

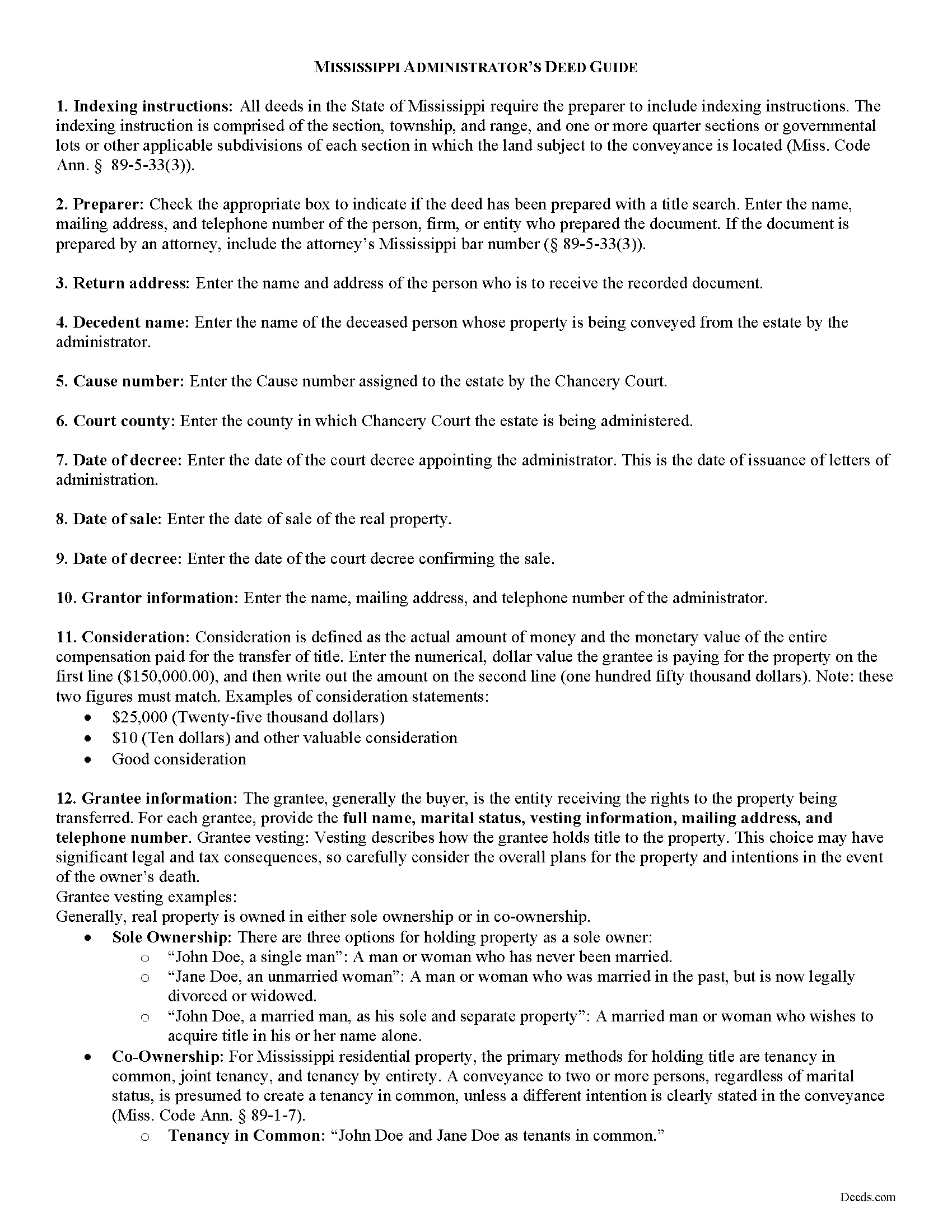

Harrison County Administrator Deed Guide

Line by line guide explaining every blank on the form.

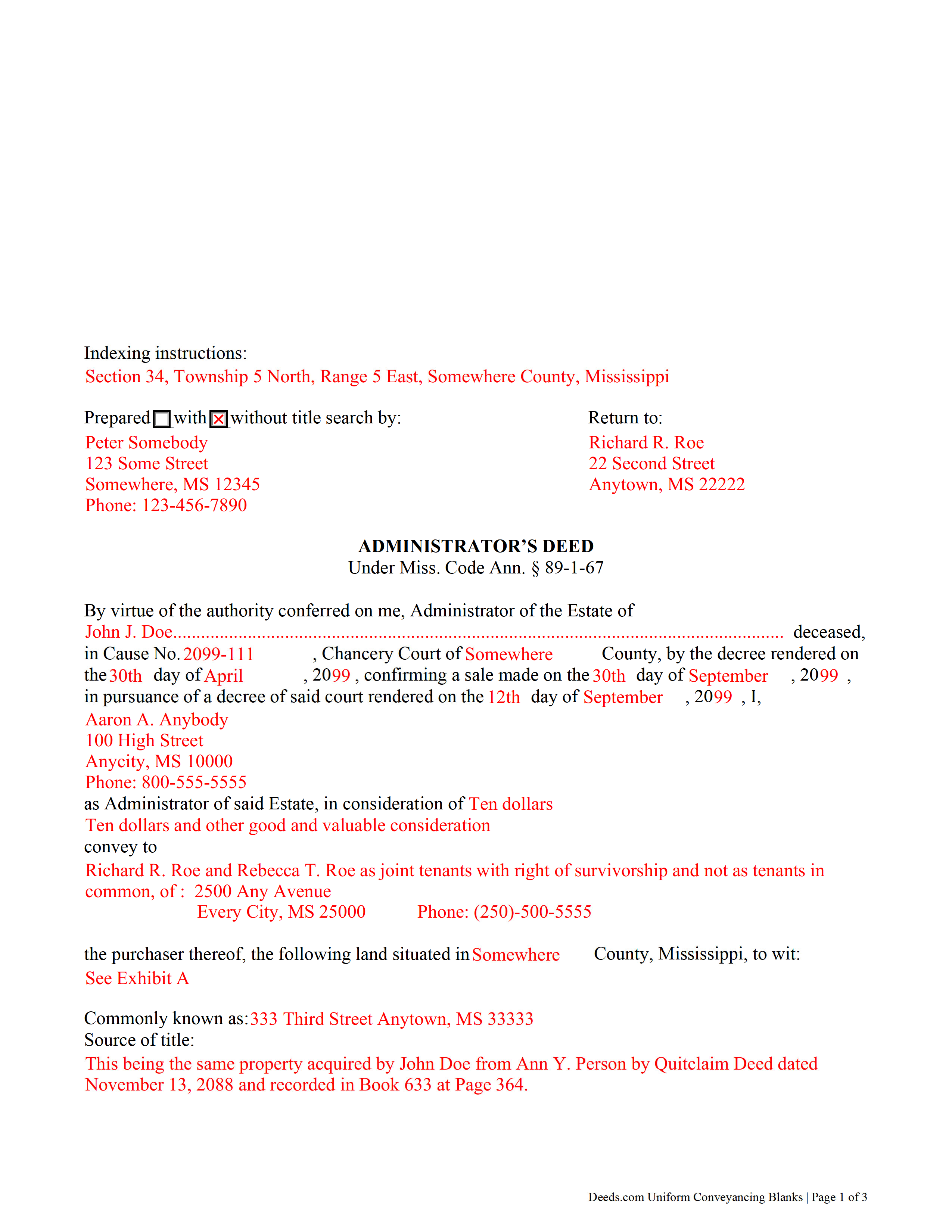

Harrison County Completed Example of the Administrator Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Mississippi and Harrison County documents included at no extra charge:

Where to Record Your Documents

Chancery Clerk: Recording Department - Gulfport

Gulfport, Mississippi 39501 / 39502-0860

Hours: 8:30 to 4:30 M-F

Phone: (228) 865-4032

Chancery Clerk: Recording Department - Biloxi

Biloxi, Mississippi 39530 / 39533-0544

Hours:

Phone: (228) 435-8220

Recording Tips for Harrison County:

- Double-check legal descriptions match your existing deed

- Leave recording info boxes blank - the office fills these

- Have the property address and parcel number ready

- Recording early in the week helps ensure same-week processing

Cities and Jurisdictions in Harrison County

Properties in any of these areas use Harrison County forms:

- Biloxi

- Diberville

- Gulfport

- Long Beach

- Pass Christian

- Saucier

Hours, fees, requirements, and more for Harrison County

How do I get my forms?

Forms are available for immediate download after payment. The Harrison County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Harrison County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Harrison County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Harrison County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Harrison County?

Recording fees in Harrison County vary. Contact the recorder's office at (228) 865-4032 for current fees.

Questions answered? Let's get started!

An administrator's deed is a fiduciary instrument used in probate proceedings to convey property from an estate. An administrator is a personal representative appointed by the Chancery Court when the decedent dies intestate (without a will), or a testate decedent does not name an executor of his/her will (or the named executor cannot or will not serve).

The administrator's deed under Miss. Code Ann. 89-1-67 quitclaims the grantor's title to a purchaser. In addition to meeting the form and content requirements for standard transfers of real property, administrator's deeds contain pertinent information about the estate, including the source of the administrator's authority to sell.

Use an administrator's deed to convey title to the decedent's real property pursuant to a decree of the Chancery Court following petition for sale. The administrator may need to sell real property when the decedent's personal property is insufficient to pay the estate's outstanding debts, or when the sale is in the best interest of the distributees, as determined by the Court.

The probate process can be complicated, so contact an attorney with questions about administrator's deeds or any other issue related to probate in Mississippi.

(Mississippi AD Package includes form, guidelines, and completed example)

Important: Your property must be located in Harrison County to use these forms. Documents should be recorded at the office below.

This Administrator Deed meets all recording requirements specific to Harrison County.

Our Promise

The documents you receive here will meet, or exceed, the Harrison County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Harrison County Administrator Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4614 Reviews )

Steven C.

May 1st, 2019

Easy but a little overpriced

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

cosmin B.

March 19th, 2021

It's all good!!!!

Thank you!

Guadalupe G.

November 10th, 2022

Easy but why charge???

Thank you!

Kathy-Louise A.

February 9th, 2025

I found the process of downloading and completing the documents very user friendly. Thank you for the Declare Value instructions. It was easy to follow, though a sample of the declaration form would be very useful. I didn't know how to list my "capacity" so I left it blank so the recorder could advise me. Otherwise, thank you so much for being available for people who are capable of completing simple legal tasks without the expense of a lawyer. Thank you, thank you, thank you!!!

Your appreciative words mean the world to us. Thank you.

Pamela L.

November 10th, 2019

The packet was very comprehensive and easy to use (I had just one question that wasn't clearly explained). II appreciate that the forms are kept up to date.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Matilde A.

October 25th, 2021

Very easy to navigate... will be back to use!

Thank you for your feedback. We really appreciate it. Have a great day!

Cathy S.

November 11th, 2021

My experience on the site was very easy to navigate to find just what I needed.

Thank you!

Jonathon K.

September 1st, 2023

Recording deeds from the comfort of my office has never been simpler thanks to Deeds.com. The service is affordable, fast, and extremely user friendly. I highly recommend anyone who needs a deed recorded in the state of Florida to look into this website, it has made my job much easier.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

DENISE E.

February 25th, 2021

I just submitted a beneficiary deed and it was accepted immediate and then recorded the next day! I like that I receive email messages notifying me of the process. The process was super easy and seamless. It's saved me so much time that I did not have to drive to downtown Phoenix to have this document record it. I love Deeds.com.

Thank you for your feedback. We really appreciate it. Have a great day!

Kathryn C.

April 20th, 2022

descriptions for some areas were longer than what would print out on document - it showed and was visible on the form but would not print out - for example in the legal description. would be nice in fill in areas could be extended as needed

Thank you for your feedback. We really appreciate it. Have a great day!

Frank R.

January 20th, 2020

Our notary. Marie was prompt, courteous and professional. Would definitely use again and reccomend

Thank you for your feedback. We really appreciate it. Have a great day!

Robert R.

August 26th, 2025

Big savings and easy to use. Thanks so much.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

AKILAH S.

March 14th, 2024

It was a little challenging and I had to call to speak to someone a few time but I got it done and and over with so I'm happy.

It was a pleasure serving you. Thank you for the positive feedback!

Dianne J.

August 25th, 2020

Happy to give you a 5 star rating. We have never been a position to get changes on and record our own deed. You made the process very easy. Submitted my forms on a Friday, made one correction that was requested of me, paid our fees and the received notification of deed being recorded the next Tuesday. Wonderful work on your part and super easy for me. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Bennie W.

January 9th, 2021

I used the Quitclaim form. The form was easy to complete without using the example or guide. $21 was a fair price compared to paying a lawyer.

Thank you for your feedback. We really appreciate it. Have a great day!