Issaquena County Deed of Trust and Promissory Note Form

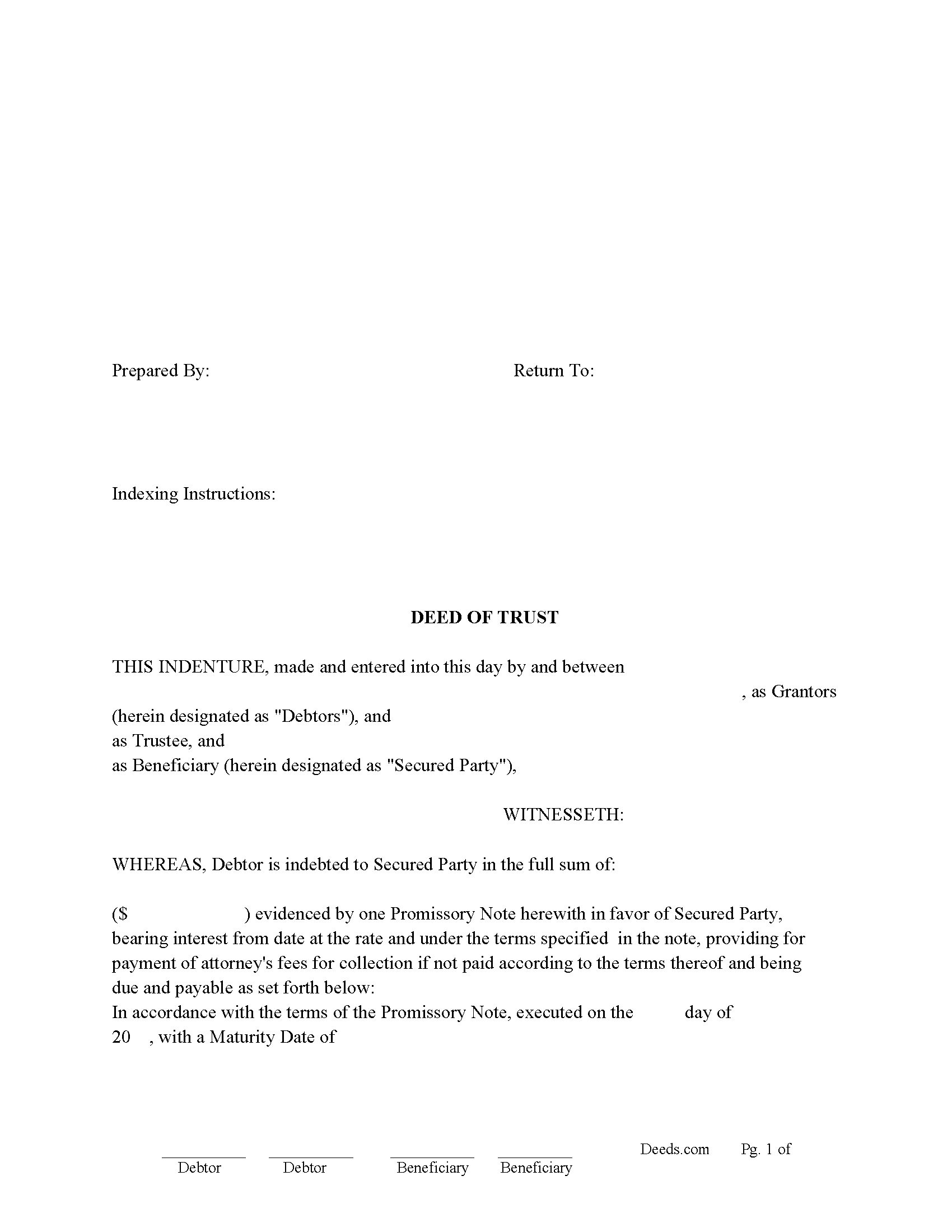

Issaquena County Deed of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

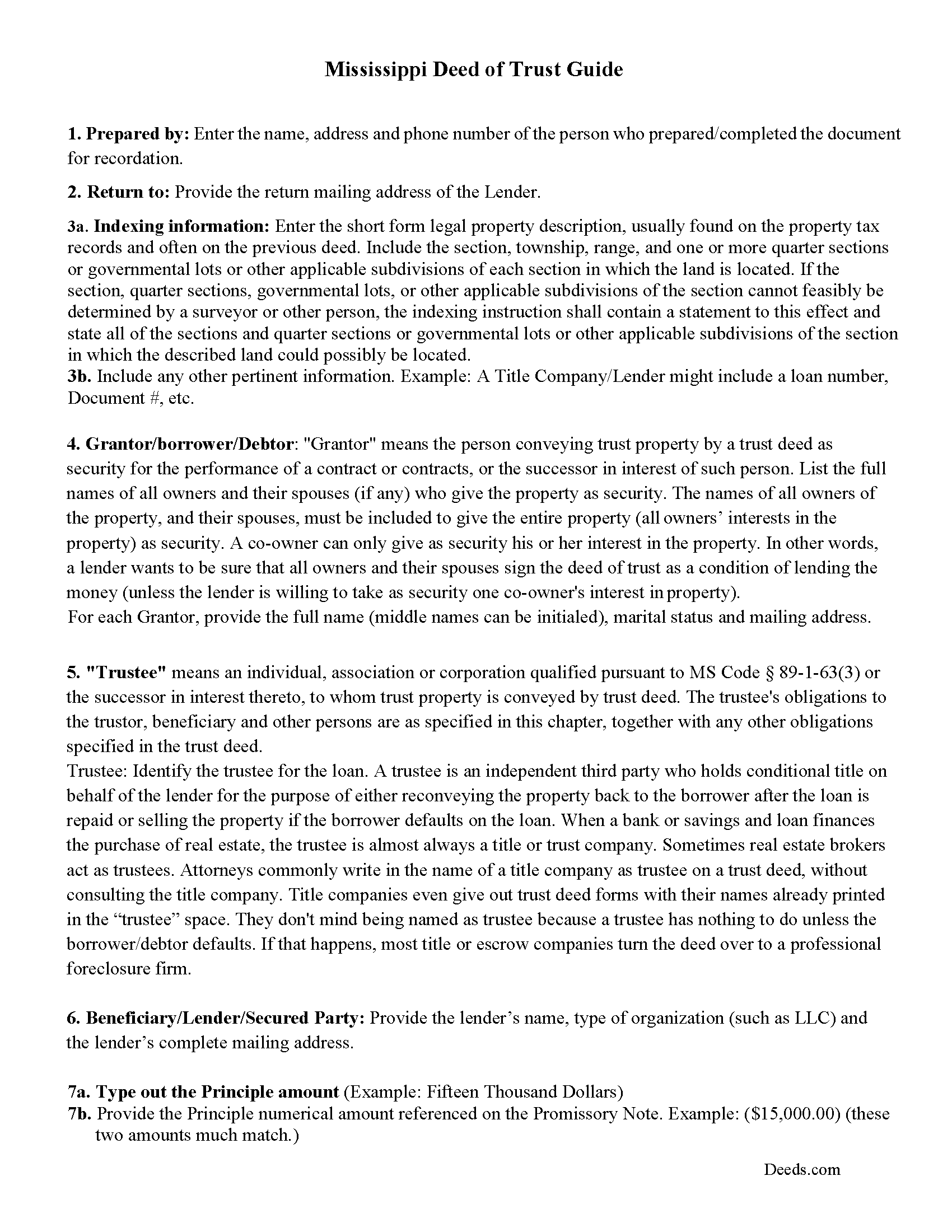

Issaquena County Deed of Trust Guidelines

Line by line guide explaining every blank on the form.

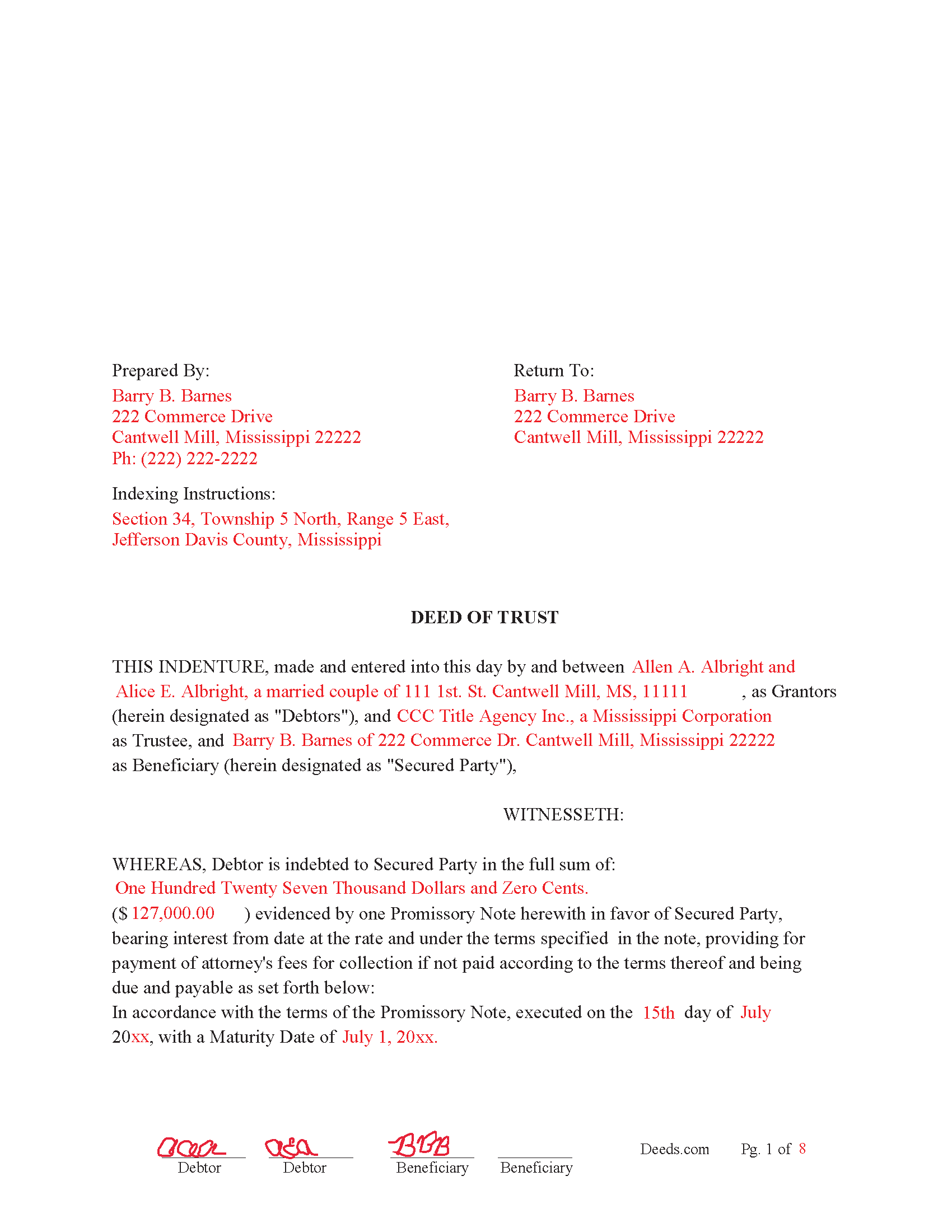

Issaquena County Completed Example of the Deed of Trust

Example of a properly completed form for reference.

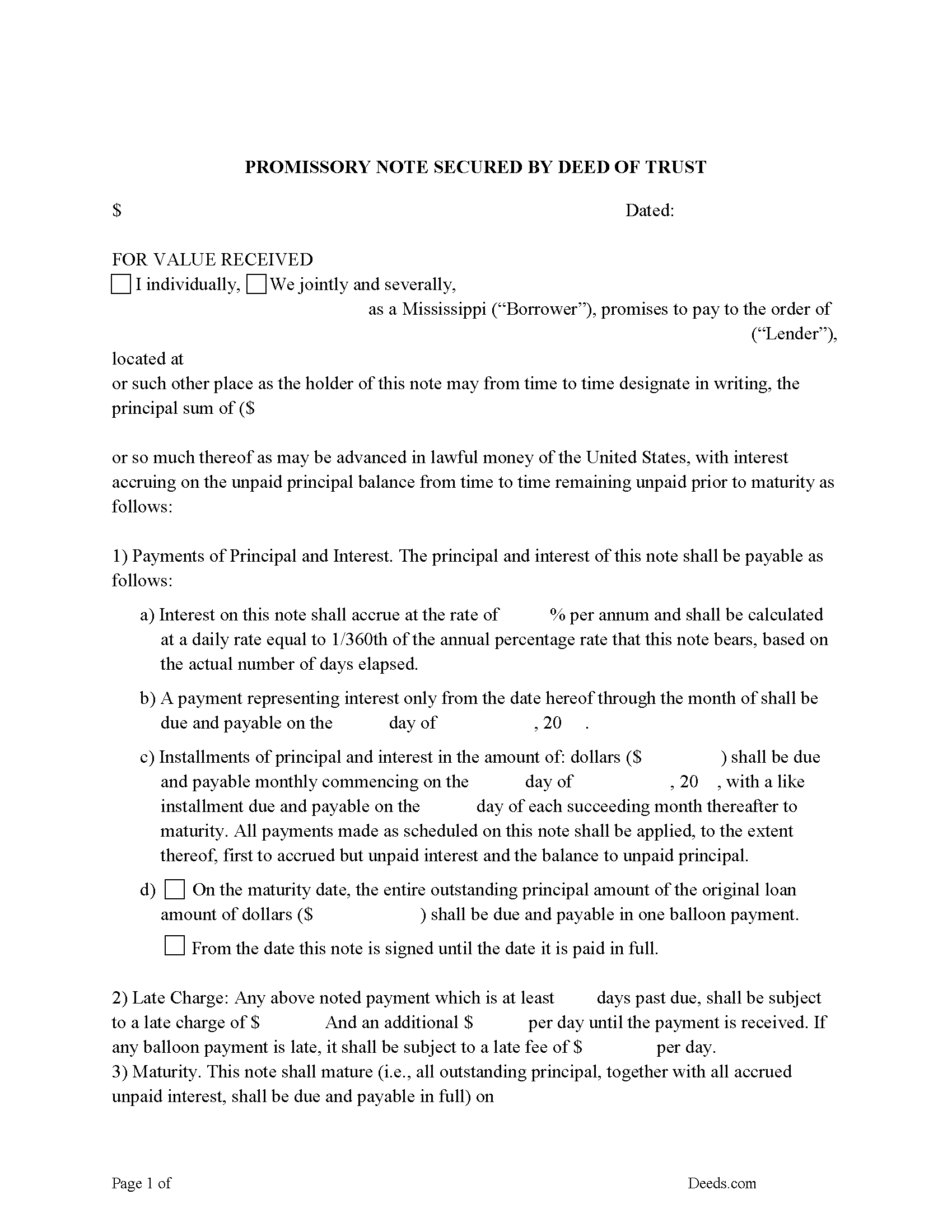

Issaquena County Promissory Note Form

Note that is secured by the Deed of Trust.

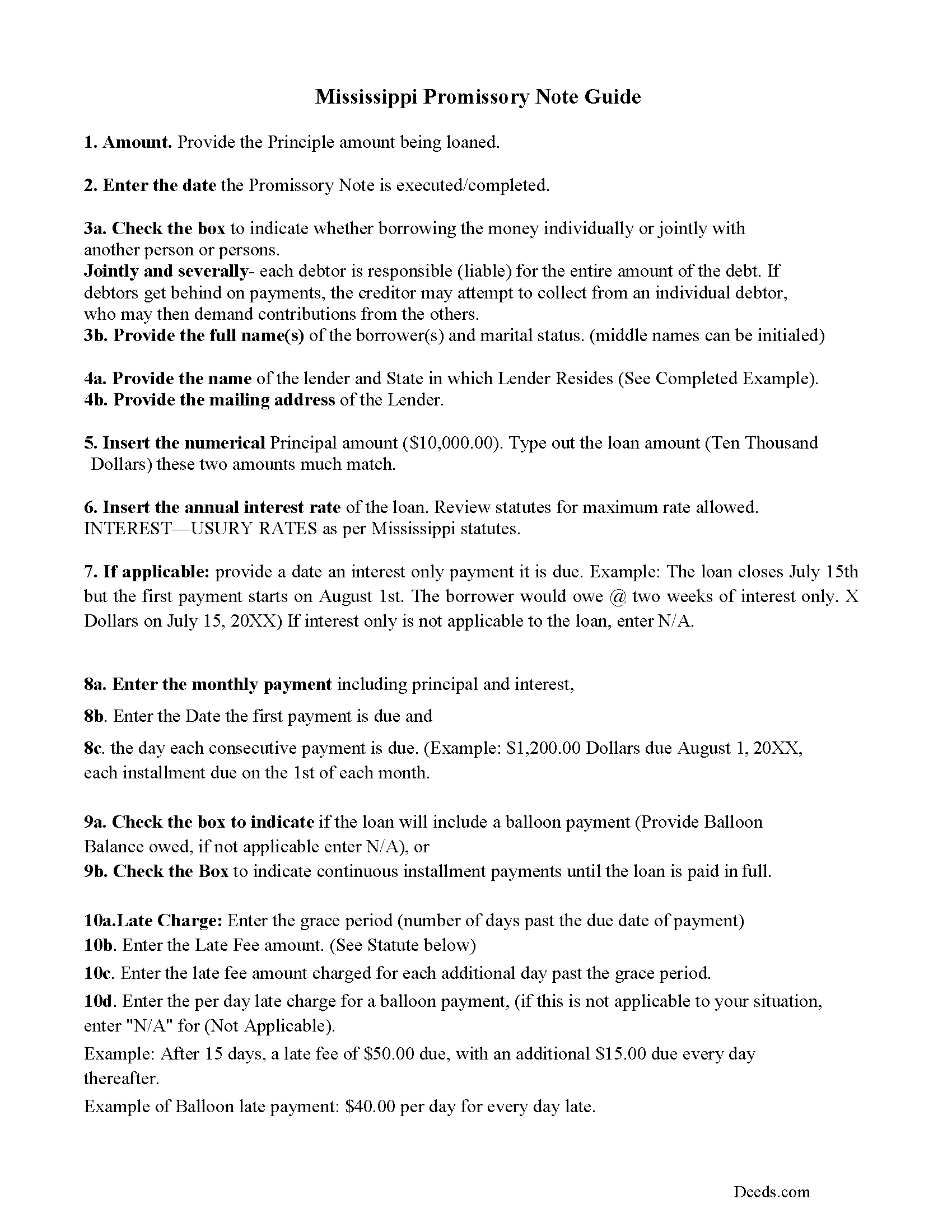

Issaquena County Promissory Note Guidelines

Line by line guide explaining every blank on the form.

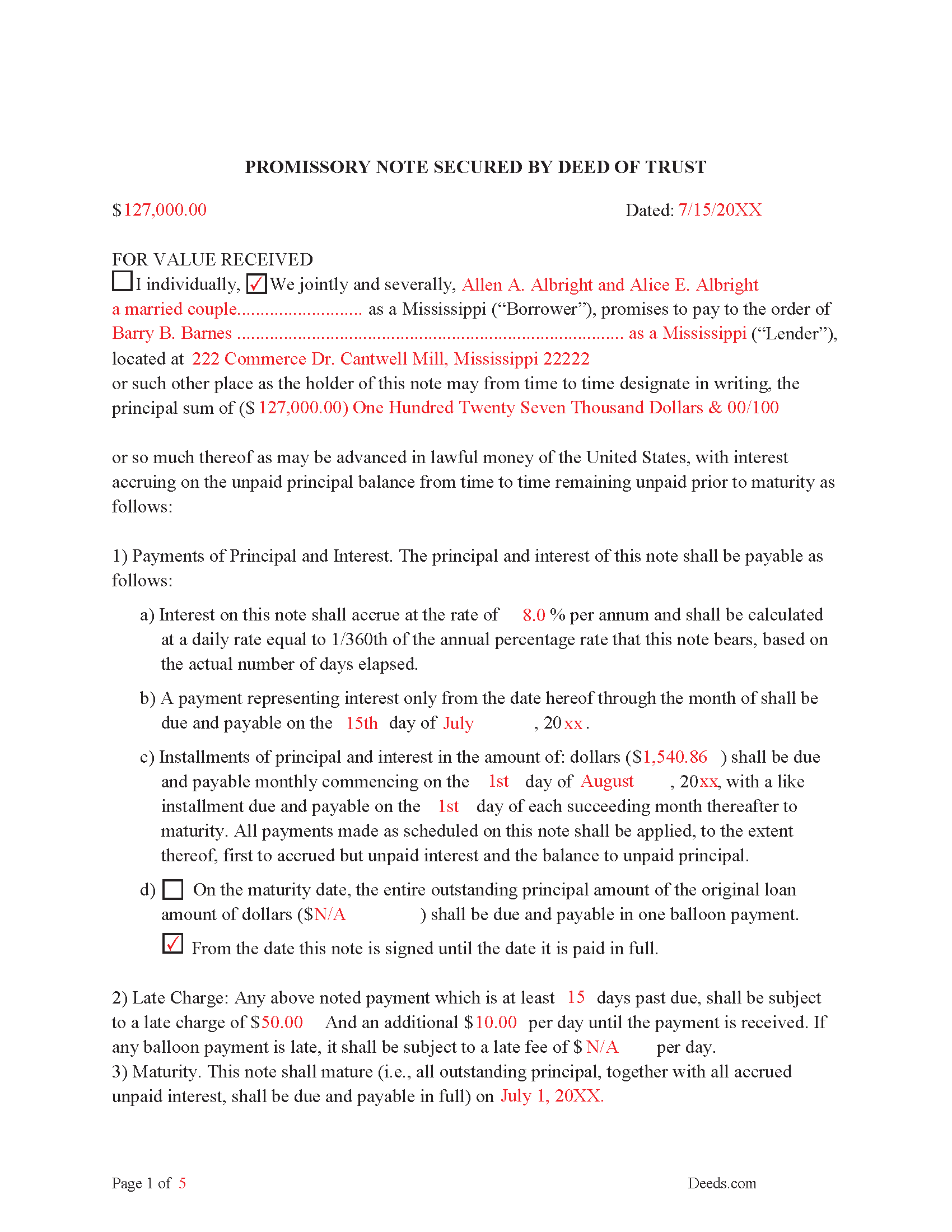

Issaquena County Completed Example of the Promissory Note Document

Example of a properly completed form for reference.

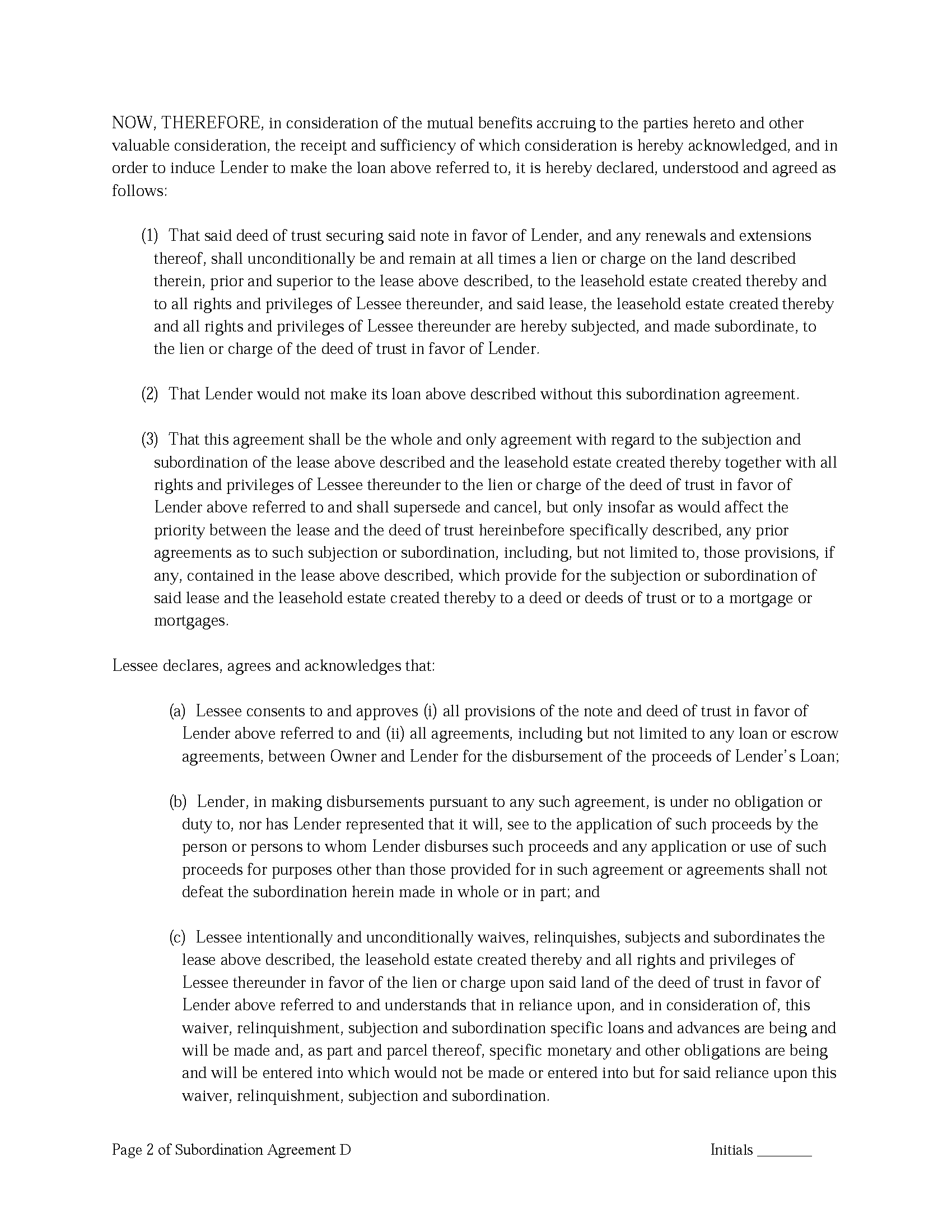

Issaquena County Subordination Clauses

Used to place priority on claim of debt. Included are 4 clauses for unique situations. If needed, add to Deed of Trust as an addendum or rider.

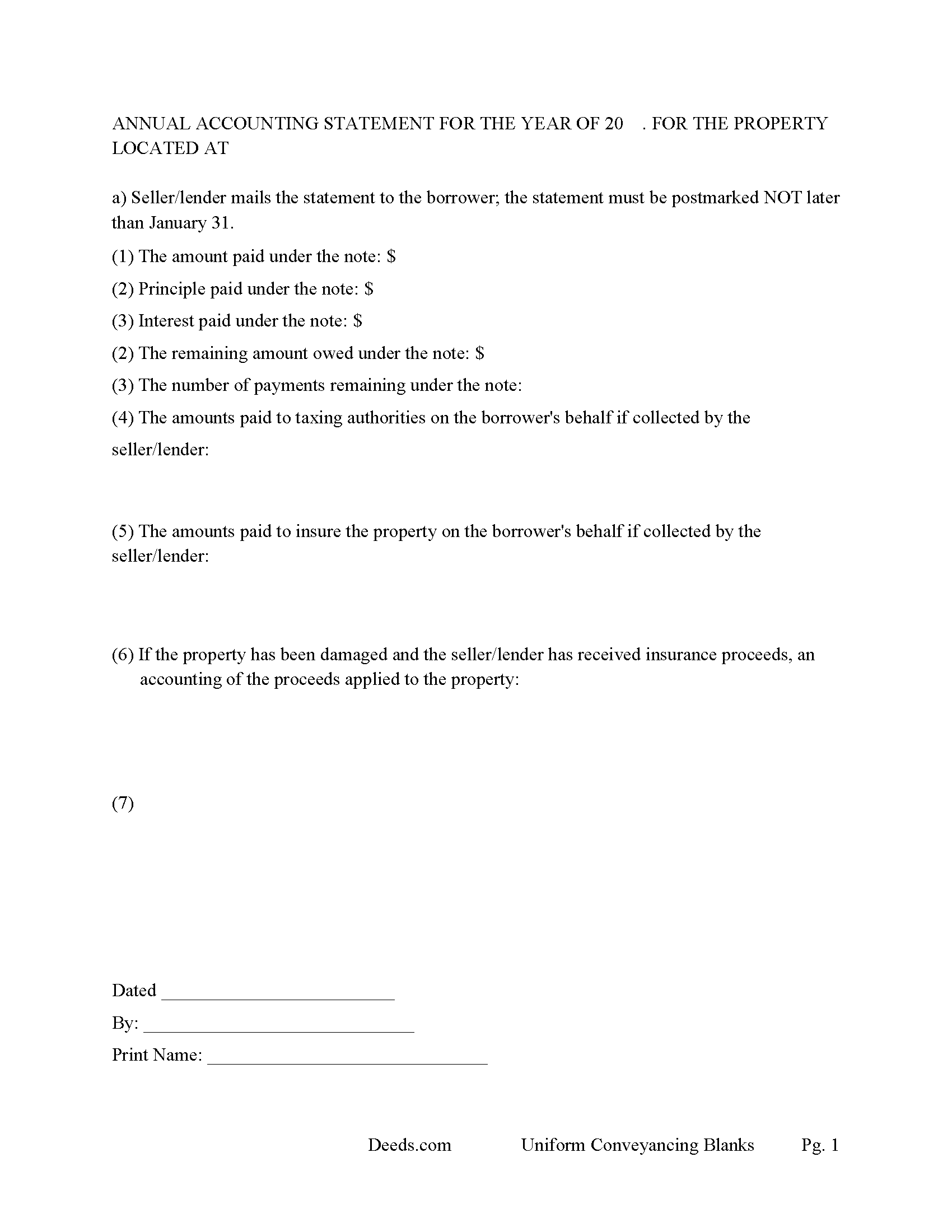

Issaquena County Annual Accounting Statement

Mail to borrower for fiscal year reporting.

All 8 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Mississippi and Issaquena County documents included at no extra charge:

Where to Record Your Documents

Issaquena County Chancery Clerk

Mayersville, Mississippi 39113

Hours: 8:00 to 4:00 Monday through Friday

Phone: (601) 873-2761 or 6287 or 6297

Recording Tips for Issaquena County:

- Bring your driver's license or state-issued photo ID

- White-out or correction fluid may cause rejection

- Avoid the last business day of the month when possible

- Check margin requirements - usually 1-2 inches at top

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Issaquena County

Properties in any of these areas use Issaquena County forms:

- Grace

- Mayersville

- Valley Park

Hours, fees, requirements, and more for Issaquena County

How do I get my forms?

Forms are available for immediate download after payment. The Issaquena County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Issaquena County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Issaquena County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Issaquena County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Issaquena County?

Recording fees in Issaquena County vary. Contact the recorder's office at (601) 873-2761 or 6287 or 6297 for current fees.

Questions answered? Let's get started!

In Mississippi, a Deed of Trust (DOT) is the most commonly used instrument to secure a loan. If the DOT has a "Power of Sale" clause, foreclosure can be done non-judicially, saving time and expense, because the trustee doesn't require the court's involvement. This process is called a Trustee Sale. Explained in Mississippi 89-1-55 - "How lands sold under mortgages and Deeds in Trust"

There are three parties in this Deed of Trust:

1- The Grantor (Borrower)

2- Beneficiary (Lender) and a

3- Trustee (Neutral Third Party)

Basic Concept. The Grantor (Borrower) conveys property title to a Trustee (Neutral Party). A Trustee or beneficiary/Lender can take action against any person for damages.

(The beneficiary or holder of any deed of trust, including his agents, employees, successors, assigns, attorneys-in-fact or other legal representatives, may appoint a trustee or substitute a trustee, with or without the permission of the mortgagor or mortgagors. The trustee or substitute trustee so appointed may be a natural person, partnership, corporation, limited liability company, professional association or any other legal entity.) (MS Code 89-1-63)(3))

Debtors/Borrowers shall be in default under the provisions of this Deed of Trust if Debtor

(a) shall fail to comply with any of Debtor's covenants or obligations contained herein,

(b) shall fail to pay any of the Indebtedness secured hereby, or any installment thereof or interest thereon, as such Indebtedness, installment or interest shall be due by contractual agreement or by acceleration,

(c) shall become bankrupt or insolvent or be placed in receivership,

(d) shall, if a corporation, a partnership or an unincorporated association, be dissolved voluntarily or involuntarily, or

(e) if Secured Party in good faith deems itself insecure and its prospect of repayment seriously

impaired.

This form can be used by a party financing residential property, rental property, condominiums or small office buildings. Note: if the property being financed is rental, see (Assignment of Leases and Rents Form) it acts to induce the lender to finance.

Promissory Note secured by Deed of Trust

A Deed of Trust and Promissory Note are usually executed/signed at the same time. The Promissory Note contains the finance terms.

Details:

1. Dollar amount of Principle Owed

2. Installment payments or Balloon payment (common with owner financing, borrower can establish history of payments and equity, which banks attractive when financing)

3, Late Charges, $ owed after so many days, with $ owed for each additional day.

4. Default Rate: If Borrowers go into default an increased interest rate is charged, until note is out of default.

5. Overdue Loan Fee: In addition to any other remedies available to Lender if this Note is not paid in full at the Maturity Date, Borrowers shall pay to Lender an Overdue Loan Fee, which fee shall be due at the time this Note is otherwise paid in full. The "Overdue Loan Fee" shall be determined based upon the outstanding principal balance of this Note as of the Maturity Date and shall be:

(a) one percent (1.0%) Of such principal balance if the Note is paid in full on or after thirty (30) days after the Maturity Date but less than sixty (60) days after the Maturity Date, or

(b) two percent (2.0%) of such principal balance if the Note is paid in full on or after sixty (60) days after the Maturity Date.

The obligations of Borrower to Lender under this Note and the Additional Obligations herein remain in full force and effect until Lender has received payment in full of all obligations.

This Note and the Loan Documents are made in and shall be governed by the State of Mississippi. Upon Lender's request, the venue of any legal action in connection with this Note or the Loan Documents shall be in _________County, Mississippi.

Attorney's Fees and Costs: Borrower shall pay all costs incurred by Lender in collecting sums due under this Note after a default, including reasonable attorneys' fees, whether or not suit is brought.

This Deed of Trust and Promissory Note, has stringent default terms and is suitable to owner selling/financing or investor financing.

(Mississippi DOT Package includes forms, guidelines, and completed examples) For use in Mississippi only.

Important: Your property must be located in Issaquena County to use these forms. Documents should be recorded at the office below.

This Deed of Trust and Promissory Note meets all recording requirements specific to Issaquena County.

Our Promise

The documents you receive here will meet, or exceed, the Issaquena County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Issaquena County Deed of Trust and Promissory Note form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

patricia l.

February 16th, 2019

found this site very easy to use

Thank you for your feedback. We really appreciate it. Have a great day!

Eddie S.

May 19th, 2022

love the site very helpful and easy.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Patricia R.

October 26th, 2022

Very quick to respond with the obvious answers. I asked what form to use when adding my daughter to deed. Answer: talk to an attorney duh.

Thank you!

Joseph R.

February 17th, 2021

So easy to use. I like the way they kept me informed to the progress being made on my filing. If the occasion occurs I'll definitely use them again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Timothy G.

June 3rd, 2019

Downloadable documents, instructions and a completed sample form were just what I needed. Very pleased and easy to use. Deeds.com will be my first stop for any future documents I may need. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Samantha W.

March 5th, 2022

Great place to get the forms you need. The instructions were clear and made it easy to complete. Pricing was great, especially compared to similar providers.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lillian F.

September 13th, 2019

Very well satisfy with my results. I could not ask for better service d

Thank you for your feedback. We really appreciate it. Have a great day!

Heidi S.

April 21st, 2022

I do not enjoy the process of not knowing how something works. When I get to a new website I cringe inside. When I find one that works I am pleased to have function. Thank you for making it easy for a lay person

Thank you for your feedback. We really appreciate it. Have a great day!

Diane J.

October 20th, 2021

Worked great very quick and easy without the sample model for my state would have been difficult for me thank's

Thank you for your feedback. We really appreciate it. Have a great day!

Kimberly H.

June 24th, 2021

Excellent and Helpful as well as patient. Great Service.

Thank you!

Jacqueline B.

November 7th, 2020

Very easy process to have this document recorded through Deeds.com! The amount of time it saved me was greatly appreciated. highly recommend Deeds.com!

Thank you for your feedback. We really appreciate it. Have a great day!

Kolette S.

February 7th, 2020

The forms are nice; however, they do not display the "th" after the day or the second digit of the year. You can type them in, but they will not print out. I just left them blank and will handwrite.

Thank you for your feedback. We really appreciate it. Have a great day!

Patricia P.

July 14th, 2021

Easy to use and super convenient.

Thank you for your feedback. We really appreciate it. Have a great day!

Michelle N.

June 28th, 2023

I was very pleased with the service I received. I sent a Quit Claim deed to be filed and received a response the next morning that it was complete.

Thank you for your feedback. We really appreciate it. Have a great day!

Shirley S.

June 11th, 2025

Laborious process to gain access; need to indicate PRIINT when complete and inform that if page is backspaced, entered info disappears, necessitating starting all over again. There is only one “A” provision, when some documents have several more. Space is too limited in some instances to provide what is necessary for recording. Thank you

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!