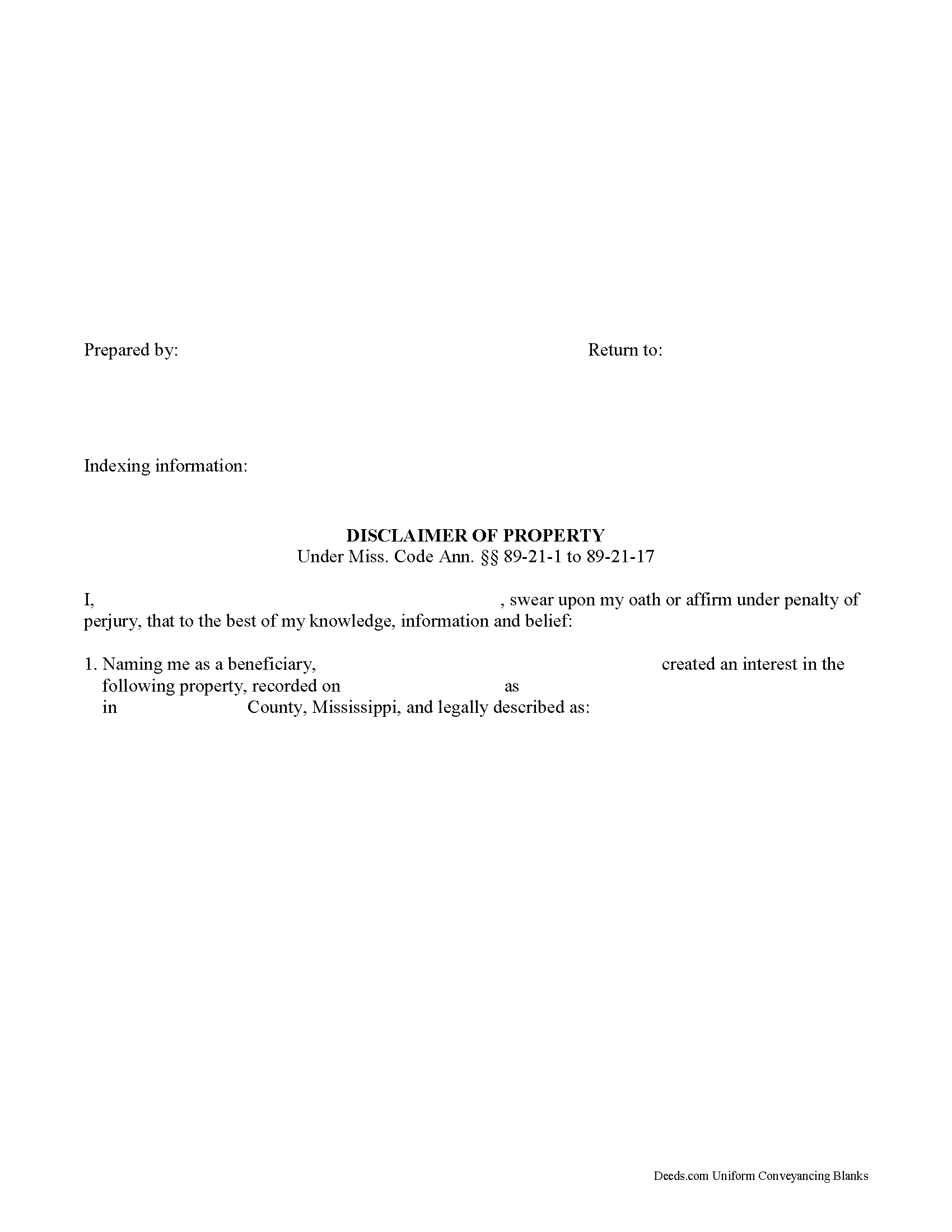

Tate County Disclaimer of Interest Form

Tate County Disclaimer of Interest Form

Fill in the blank form formatted to comply with all recording and content requirements.

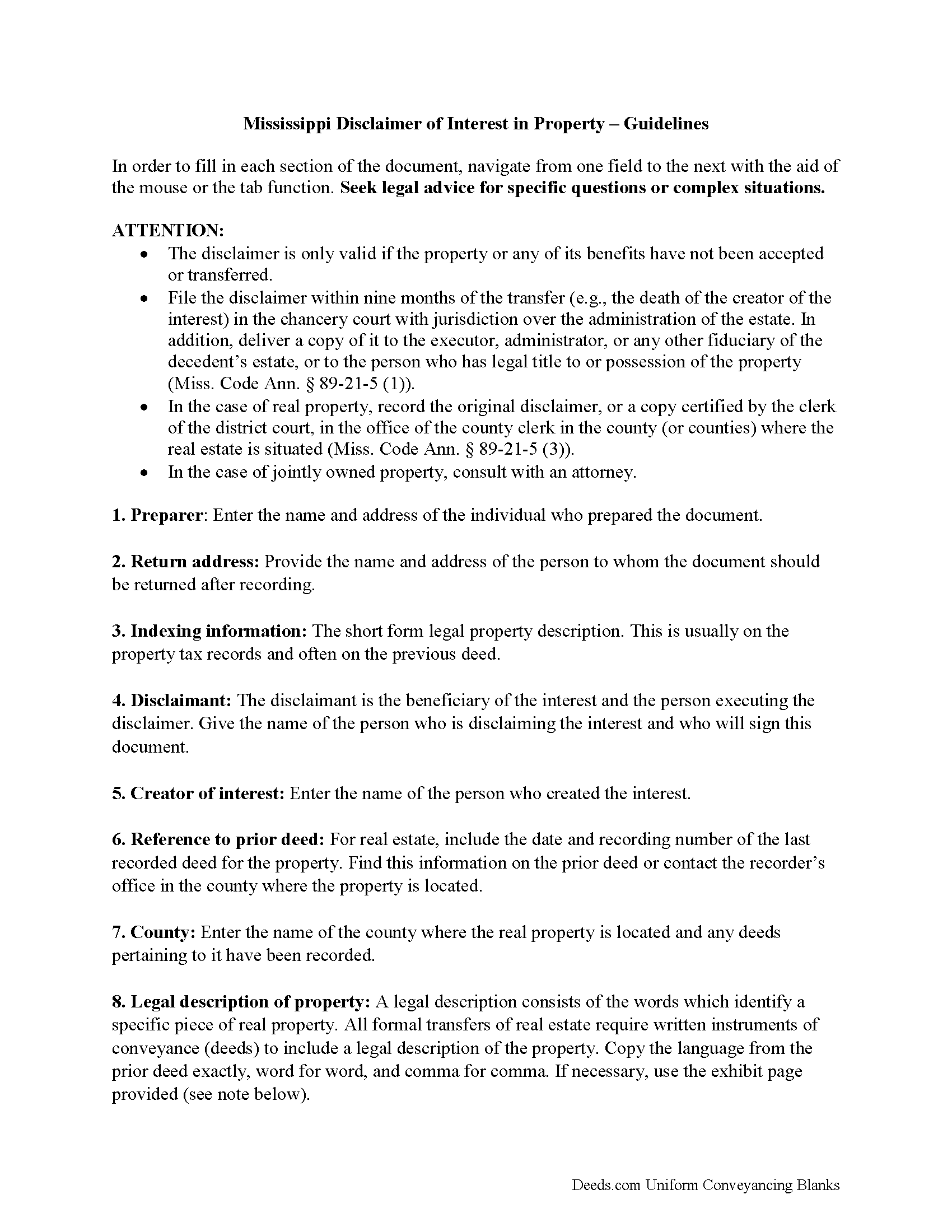

Tate County Disclaimer of Interest Guide

Line by line guide explaining every blank on the form.

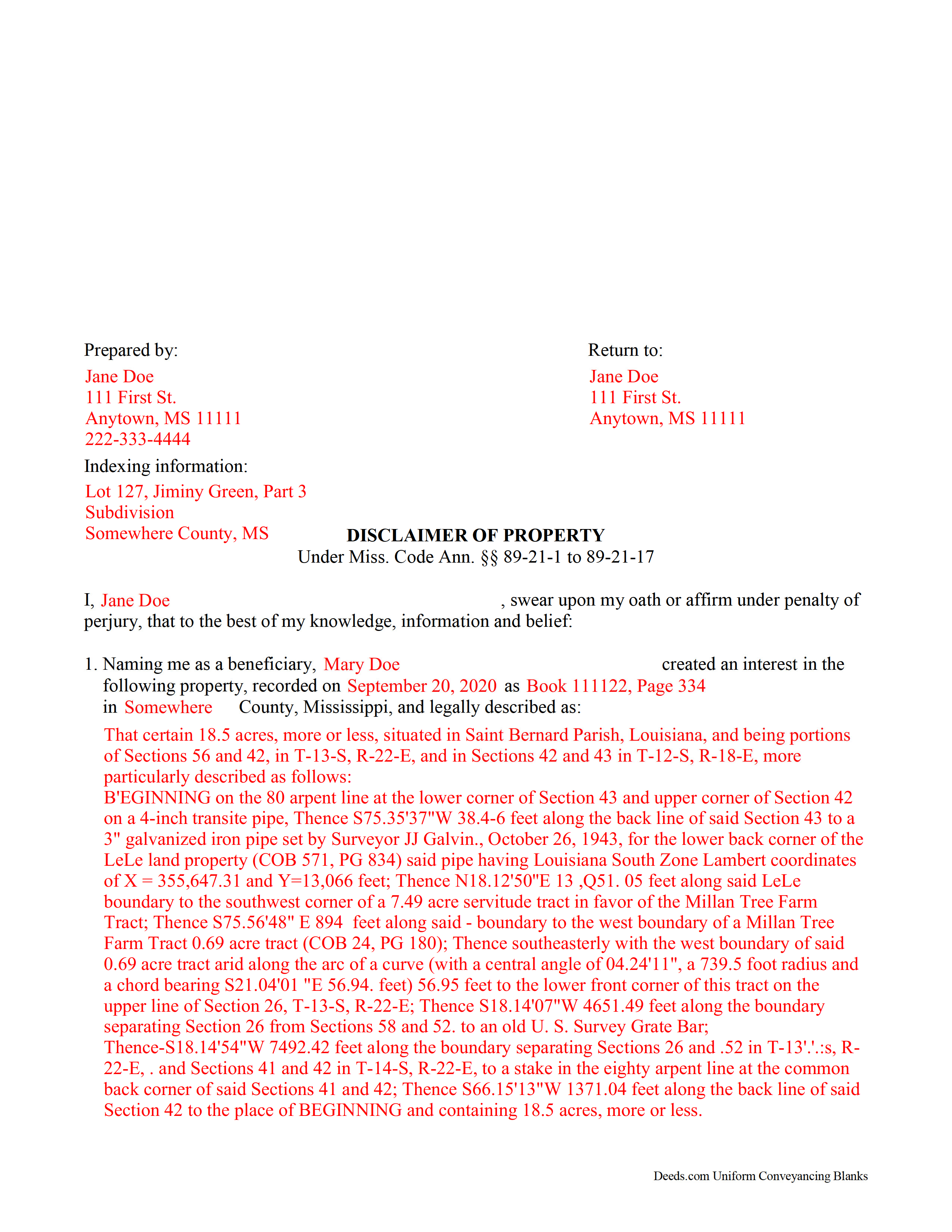

Tate County Completed Example of the Disclaimer of Interest Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Mississippi and Tate County documents included at no extra charge:

Where to Record Your Documents

Tate County Chancery Clerk

Senatobia, Mississippi 38668

Hours: 8:00 to 5:00 M-F

Phone: (662) 562-5661

Recording Tips for Tate County:

- Check that your notary's commission hasn't expired

- White-out or correction fluid may cause rejection

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Tate County

Properties in any of these areas use Tate County forms:

- Arkabutla

- Coldwater

- Independence

- Senatobia

Hours, fees, requirements, and more for Tate County

How do I get my forms?

Forms are available for immediate download after payment. The Tate County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Tate County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Tate County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Tate County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Tate County?

Recording fees in Tate County vary. Contact the recorder's office at (662) 562-5661 for current fees.

Questions answered? Let's get started!

Under the Mississippi statutes, the beneficiary of an interest in property may renounce the gift, either in part or in full (Miss. Code Ann. 89-21-1 to 89-21-17). Note that the option to disclaim is only available to beneficiaries who have not acted in any way to indicate acceptance or ownership of the interest.

The disclaimer must be in writing and include a description of the interest, a declaration of intent to disclaim all or a defined portion of the interest, and be signed by the disclaimant (Miss. Code Ann. 89-21-7).

File the disclaimer within nine months of the transfer (e.g., the death of the creator of the interest) in the chancery court with jurisdiction over the administration of the estate. In addition, deliver a copy of it to the executor, administrator, or any other fiduciary of the decedent's estate, or to the current holder of legal title or possession (Miss. Code Ann. 89-21-5 (1)). In the case of real property, record the original disclaimer, or a copy certified by the clerk of the district court, in the office of the county clerk in the county (or counties) where the real estate is situated (Miss. Code Ann. 89-21-5 (3)).

A disclaimer is irrevocable and binding for the disclaiming party and his or her creditors (Miss. Code Ann. 89-21-9 (2)), so be sure to consult an attorney when in doubt about the drawbacks and benefits of disclaiming inherited property. If the disclaimed interest arises out of jointly-owned property, seek legal advice as well.

(Mississippi DOI Package includes form, guidelines, and completed example)

Important: Your property must be located in Tate County to use these forms. Documents should be recorded at the office below.

This Disclaimer of Interest meets all recording requirements specific to Tate County.

Our Promise

The documents you receive here will meet, or exceed, the Tate County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Tate County Disclaimer of Interest form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

Rhonda H.

September 24th, 2020

Love the names on the example! thanks for the smiles!

Thank you for your feedback. We really appreciate it. Have a great day!

SHEDDRICK H.

June 17th, 2023

I got exactly what I paid for. No fraudulent transaction on my card. I like that. This is an excellent service. Straight and to the point help. That e-recording process looks like a winner. When I get my forms filled out I might use that.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michael D.

June 14th, 2024

Quick and easy!

Thank you!

Alex Q.

July 26th, 2023

The best people to work with! Thank you for all you do. We send documents from all states to Deeds.com to record for us. They are professional, keep us updated and always notify us if there is an issue with one of our documents prior to sending to recording and that saves us money and time! Thank you!!

Thanks for the kind words Alex. We appreciate you!

Crystal P.

April 16th, 2024

This service is amazing! We have tried several other online recording services which all disappointed. Deeds.com got all three of our documents recorded same day as invoice payment. Thank you for the quick turn around! We will be using this service often.

We are sincerely grateful for your feedback and are committed to providing the highest quality service. Thank you for your trust in us.

Rosemary W.

February 27th, 2021

considering the current epidemic your fees save me time and parking fees. with help from DC recorder of deeds I was directed to the correct link to process my deed

Thank you for your feedback. We really appreciate it. Have a great day!

Christina P.

July 28th, 2023

Fantastic!! The gals at Deeds really seem to have their stuff together! Great Forms, easy, exhaustive, and most importantly... accepted at the recorder the FIRST TIME!

Thank you so much for your review! Your feedback is highly appreciated, and we look forward to assisting you again in the future!

Julie D S.

January 24th, 2020

thank you for all the forms

Thank you!

Robert C.

May 31st, 2023

Not easy to navigate as a first time user. I printed the first page but lost the link to the second page.

Thank you for taking the time to provide us with your valuable feedback. I'm sorry to hear that you've encountered difficulties with our website's navigation, particularly as a first-time user.

Furthermore, your comments about the website's navigation have been taken into account. We continually strive to improve our website and make it as intuitive and user-friendly as possible. Your feedback is crucial for us in achieving this goal.

Thank you again for your feedback. If you have any other suggestions or need further assistance, please don't hesitate to contact us.

Julie K.

September 4th, 2023

The process for obtaining document itself was easy, and the included guide and example are great! I do have an issue with the format itself, though. The form has pre-defined text boxes, which cannot be altered without partially rebuilding the entire document. For the 'property description' field on the Mineral Deed form, the text box is not large enough for the rather lengthy legal description entered on my original plat. Fortunately, I have a copy of Adobe Pro, so I have been able to re-build the doc to accommodate this short-coming.

Thank you for taking the time to provide feedback on our legal form. We're pleased to hear that you found the process for obtaining the document and the included guide beneficial.

We understand and appreciate your concern regarding the formatting and size limitations of certain fields, especially the 'property description' field. Our forms are designed to adhere to specific formatting requirements that are often mandated for legal compliance. Making direct alterations to the document can result in them becoming non-conforming, which is why we advise customers to use an exhibit page when their legal description is extensive or does not fit.

Duane S.

June 5th, 2019

Really glad to find your site. Made filing so much easier.

Thank you for your feedback. We really appreciate it. Have a great day!

Robin G.

June 2nd, 2020

Very Pleased. Was so easy and No hidden cost. Second time I have used their services. Would not use any other deed website.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Charles S.

July 2nd, 2021

Easy to set up and fast service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Brenda A.

April 22nd, 2020

This company and it's customer service ARE wonderful. GREAT tool to assist you with any situation you may have. I HAVE RECOMMENDED THEM TO MY FRIENDS AND FAMILY.

Thank you!

Gary M.

April 18th, 2020

Death of JT form was excellent. You have the best documents out there. I wish I could have read the sample just so I knew my information was entered correctly. Real problem is County wants a bar code on documents to get recorded. Now? Need four deed forms so the expense starts to be prohibitive. I would rather pay more and get multiple access.

Thank you for your feedback. We really appreciate it. Have a great day!