Download Missouri Beneficiary Deed Legal Forms

Missouri Beneficiary Deed Overview

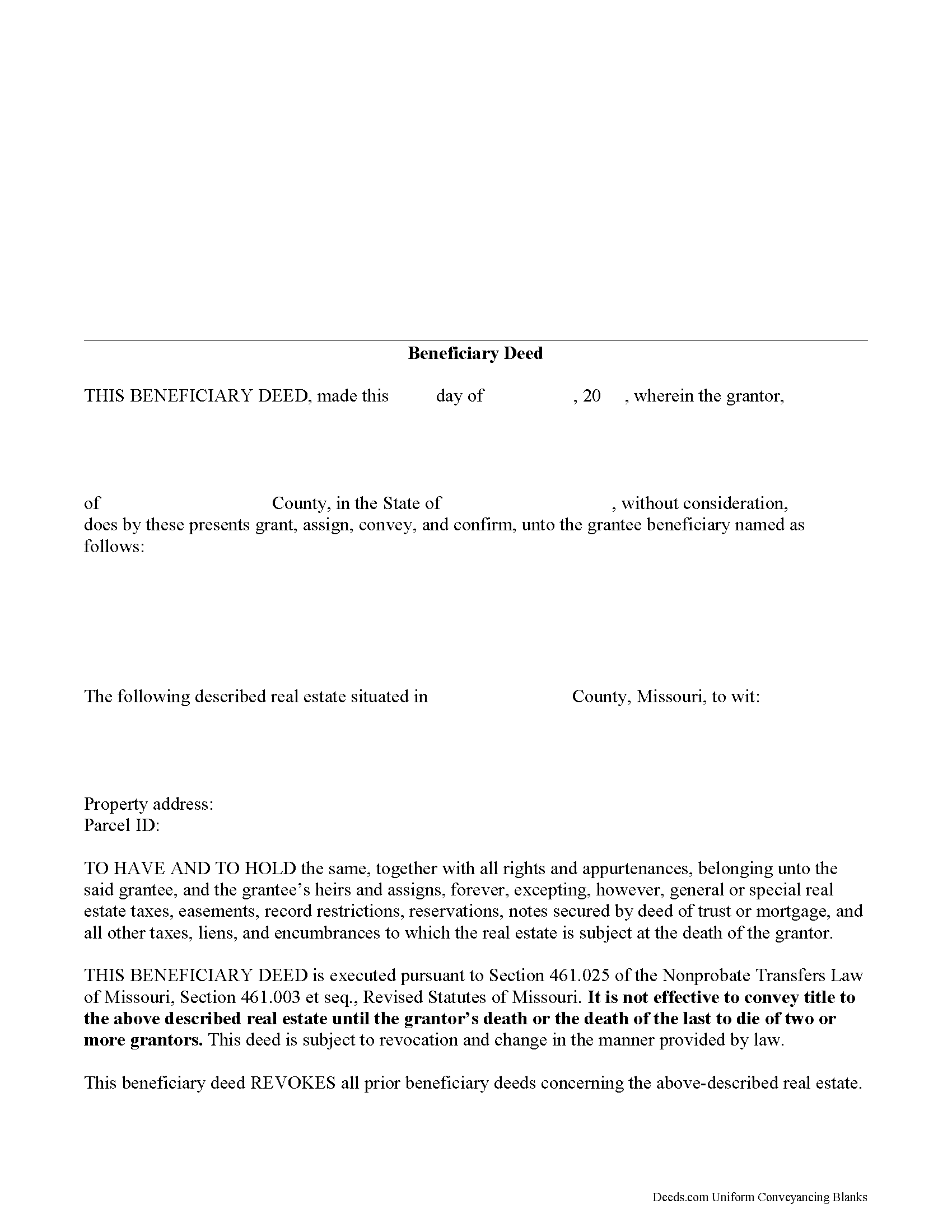

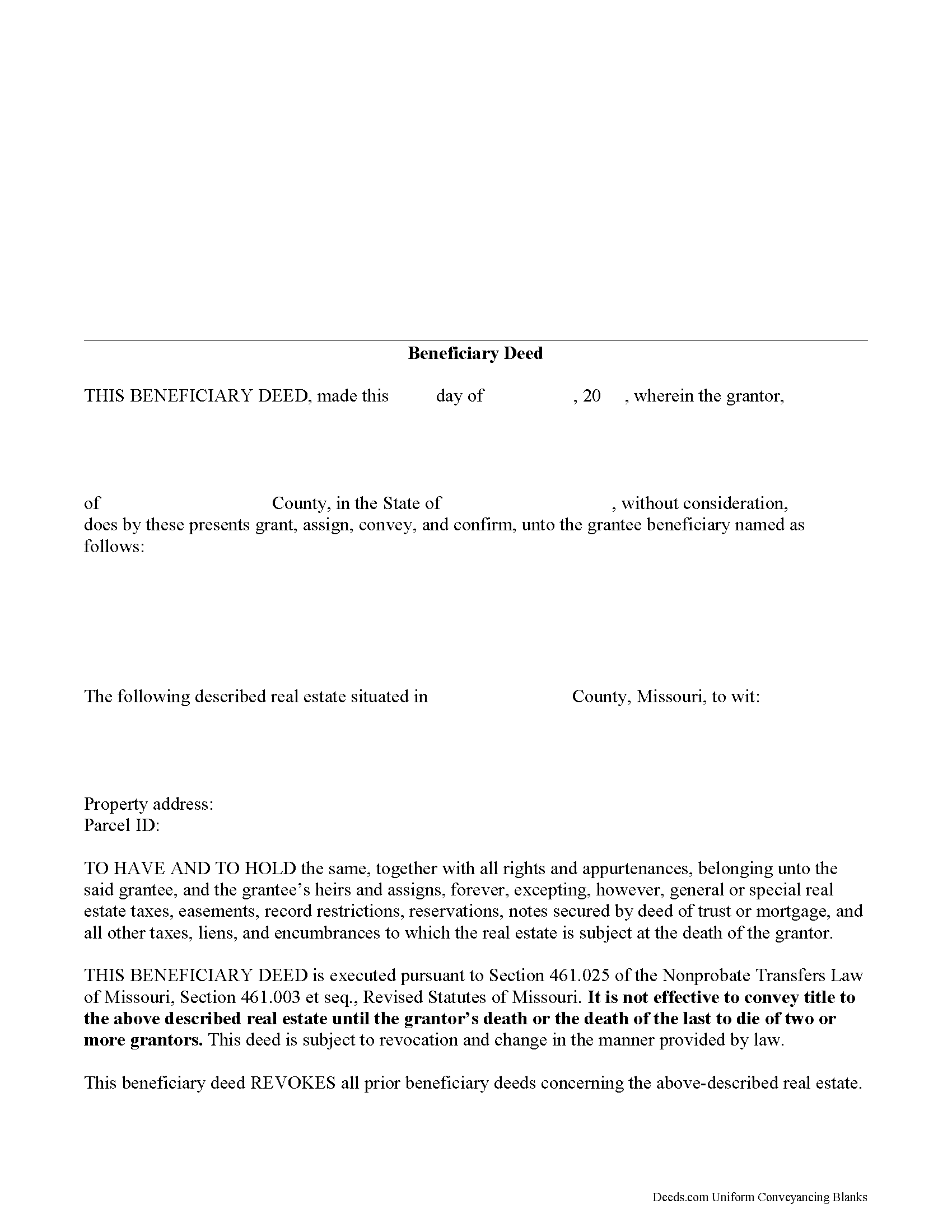

Enacted in 1989, the Missouri Nonprobate Transfers Law (Sections 461.003 et seq, Revised Statutes of Missouri (2012)) allows those who own real property in Missouri the option of conveying real property after death, but without the need for probate distribution.

One distinctive feature of this useful estate planning tool is its flexibility. The grantor retains absolute ownership of and control over the Missouri real estate, with the freedom to sell, rent, mortgage, or otherwise use the land at will with no penalty for waste or obligation to inform the named beneficiary. He or she may also change details about beneficiaries or even revoke the beneficiary deed outright by executing and recording a new document containing the updated information. For the beneficiary deed and any related changes or revocations to be valid, however, the deed must be recorded during the grantor's lifetime.

This flexibility is possible because the transfer of ownership is incomplete. There is no statutory obligation to notify grantees of their beneficiary status, so there is typically no consideration (something of value, usually money) paid for the potential future interest in the real estate. The transfer of ownership rights is completed when the grantor dies and the beneficiary records the appropriate documentation.

Overall, Missouri beneficiary deeds are a simple and effective estate planning tool for individuals who want to pass on real property rights outside of the probate process. Even so, it is essential to review how executing a beneficiary deed might impact taxes, as well as eligibility for local, state, and federal benefits and asset-based programs.

(Missouri BD Package includes form, guidelines, and completed example)