Dallas County Revocation of Beneficiary Deed Form

Dallas County Revocation of Beneficiary Deed Form

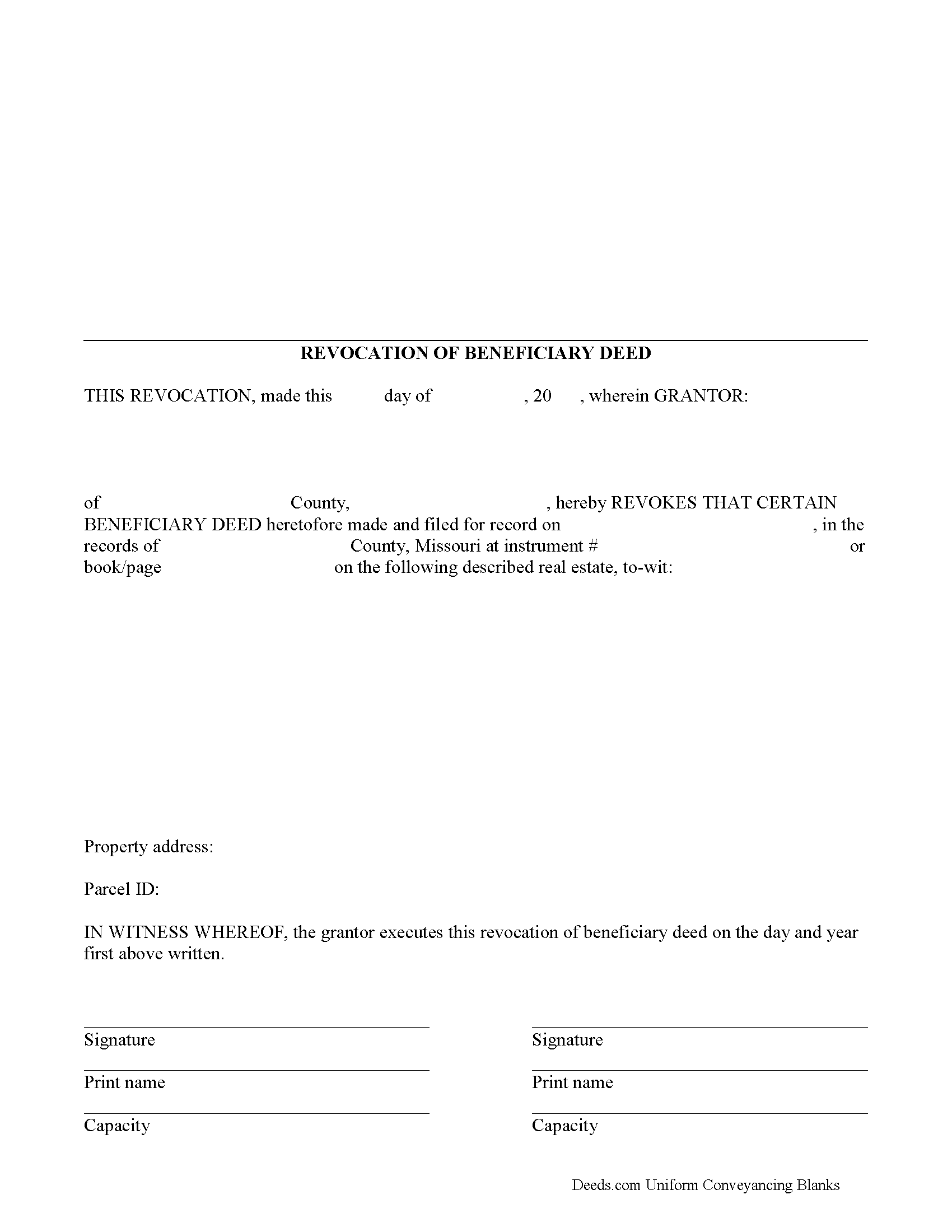

Fill in the blank form formatted to comply with all recording and content requirements.

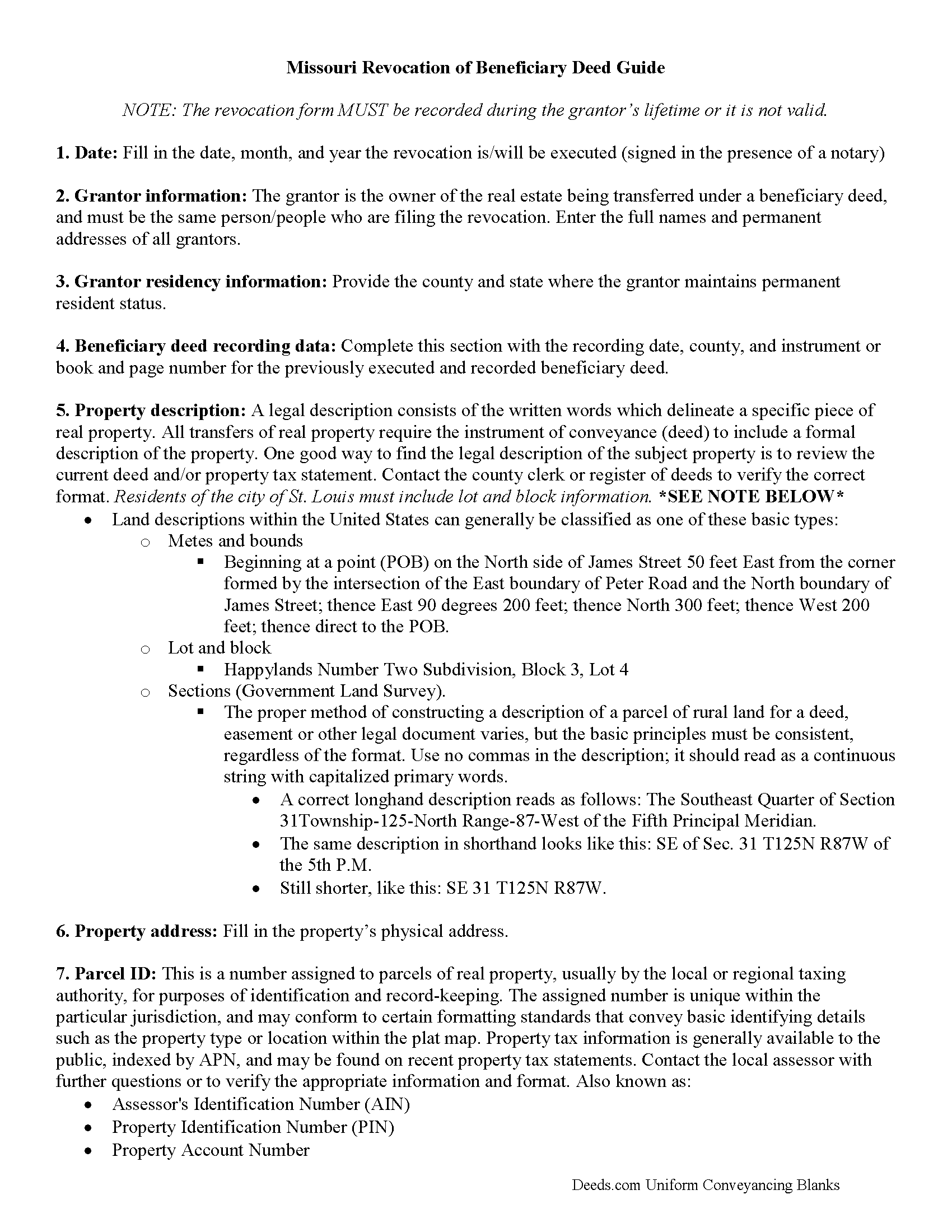

Dallas County Revocation of Beneficiary Deed Guide

Line by line guide explaining every blank on the form.

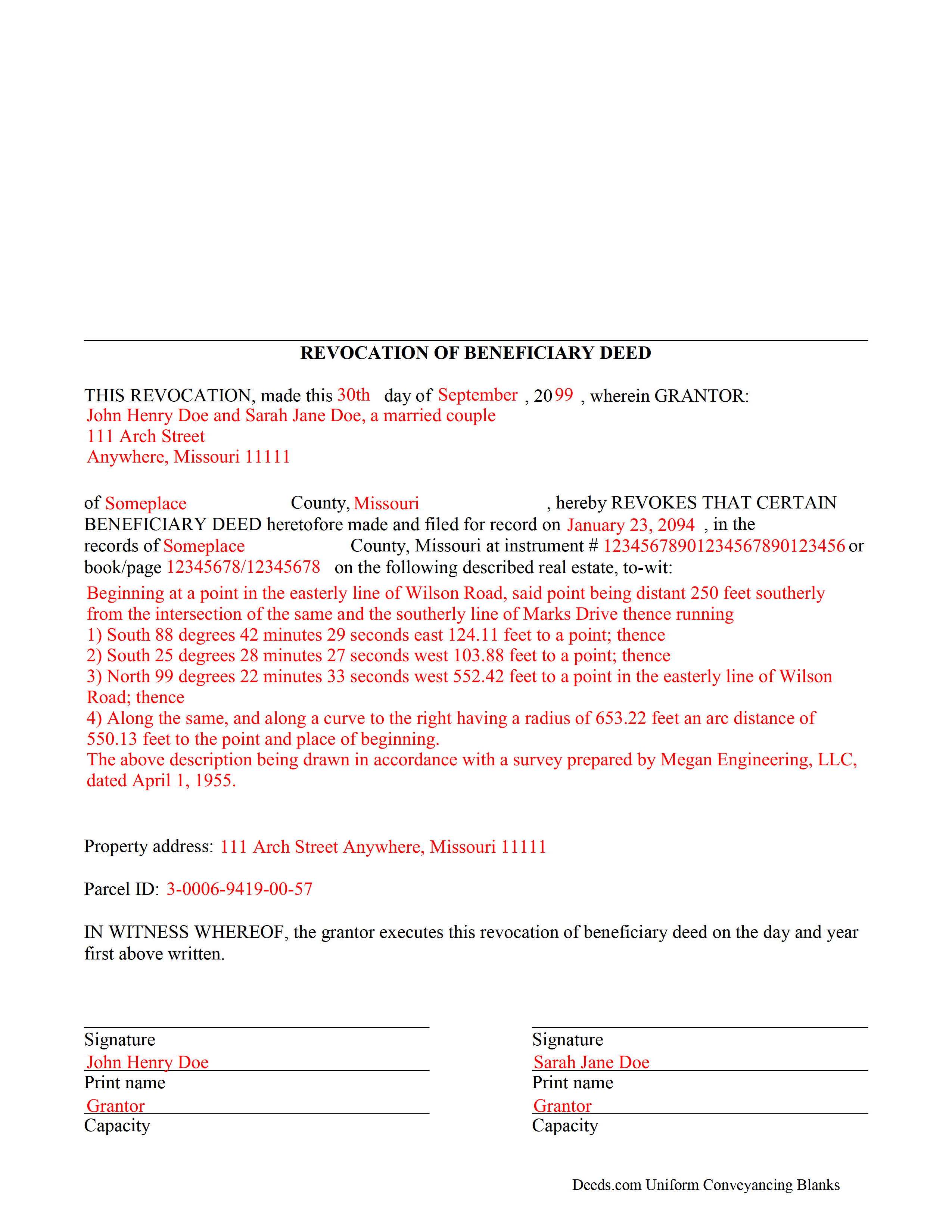

Dallas County Completed Example of the Revocation of Beneficiary Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Missouri and Dallas County documents included at no extra charge:

Where to Record Your Documents

Dallas County Recorder of Deeds

Buffalo, Missouri 65622

Hours: 8:00am to 12:00 & 1:00 to 4:00pm Mon - Fri

Phone: (417) 345-2242

Recording Tips for Dallas County:

- Ensure all signatures are in blue or black ink

- Verify all names are spelled correctly before recording

- Recorded documents become public record - avoid including SSNs

Cities and Jurisdictions in Dallas County

Properties in any of these areas use Dallas County forms:

- Buffalo

- Elkland

- Long Lane

- Louisburg

- Tunas

- Urbana

- Windyville

Hours, fees, requirements, and more for Dallas County

How do I get my forms?

Forms are available for immediate download after payment. The Dallas County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Dallas County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Dallas County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Dallas County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Dallas County?

Recording fees in Dallas County vary. Contact the recorder's office at (417) 345-2242 for current fees.

Questions answered? Let's get started!

One of the many useful aspects of the Nonprobate Transfers Law of Missouri (RSMo Sections 461.003 to 461.081) is the option to revoke a previously recorded beneficiary deed. Revocation is specifically addressed in RSMo 431.033. The option to revoke is possible for several reasons: the grantor is not required to notify the beneficiary of the potential future interest; there is no consideration given in exchange for property rights; and the transfer of ownership is not completed until the grantor or grantors have all died. As a result, the named beneficiary has no actual interest in the real estate.

A grantor on a beneficiary deed may change or revoke beneficiary designations at will, and with no obligation to the individuals named as beneficiaries on the deed. To accomplish this, the original grantor (or grantors) may record a signed, notarized notice of revocation with the same office that accepted the original beneficiary deed. While effective, real estate that is not re-conveyed under a new beneficiary deed reverts back to the grantor's estate at his/her death, and is then distributed via the probate process. Alternately, the grantor may execute a new beneficiary deed, designating someone else as the beneficiary. Recording the new deed removes the prior beneficiary's name and replaces it, identifying the current beneficiary's information.

Note that any change in beneficiary designation must be executed and submitted for recordation during the grantor's lifetime.

(Missouri Revocation of BD Package includes form, guidelines, and completed example)

Important: Your property must be located in Dallas County to use these forms. Documents should be recorded at the office below.

This Revocation of Beneficiary Deed meets all recording requirements specific to Dallas County.

Our Promise

The documents you receive here will meet, or exceed, the Dallas County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Dallas County Revocation of Beneficiary Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

Hoang N.

June 18th, 2020

Thank you for helping. Deeds online service is so good. I would refer to my friends or whoever if they need this services. once again you guy is doing great work

Thank you!

Francisco C.

January 25th, 2023

well first time my company is using and this what can say. excellent service im very happy, you guys did my job very professional and quickly so congratulations... i will recommend to every one.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Katherine H.

March 30th, 2023

extremely thorough by covering all bases, easy to understand, direct access, fair price with no strings attached. I recommend the service to everyone.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jay W.

February 7th, 2019

your service is more than I expected easy to navigate, great info, easy to understand. other other sites every time you go to next page there is something to buy to get the info you want. Jay

Thank you!

CAROL C.

July 30th, 2020

Deeds.com is very user friendly and quite simple to use. Customer service is also prompt in responding to any inquiry. I have been pleased with them since I began using them over 3-years ago.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gladys B.

January 23rd, 2019

Good and fast service. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Rob F.

April 16th, 2025

They are fantastic. I am a little technically challenged, but very helpful and respectful. Highly recommended. Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kathy-Louise A.

February 9th, 2025

I found the process of downloading and completing the documents very user friendly. Thank you for the Declare Value instructions. It was easy to follow, though a sample of the declaration form would be very useful. I didn't know how to list my "capacity" so I left it blank so the recorder could advise me. Otherwise, thank you so much for being available for people who are capable of completing simple legal tasks without the expense of a lawyer. Thank you, thank you, thank you!!!

Your appreciative words mean the world to us. Thank you.

April K.

October 27th, 2020

Thank you so much! Quick and easy. Received it in under 5 minutes.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dominick D.

October 21st, 2020

Deed.com was easy to work with, not just a website, they have real people that speak to you. They were extremely helpful with a VERY difficult Northeast county. They made the process smooth and effortless.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kenneth K.

October 8th, 2019

It was fast and easy to use.

Thank you!

Lori G.

June 17th, 2019

I needed to add my husband to my deed. an attorney would charge me $275.00. I decided to file myself. This makes it easy. Not done w/the process yet. But so far so good! :)

Thank you for your feedback. We really appreciate it. Have a great day!

Sharon B.

April 3rd, 2024

Downloaded pdf form was difficult to use,/modify and has too much space between sections.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Terralynn J.

July 18th, 2019

I was very pleased to find ONLINE, Deed Revision Document(s) and their explanation. I ordered these document Forms, downloaded them and Printed them. Now, I will be able to fill them out in the privacy of my home. Instructions were also included, how to file this new Deed, after I complete it and have it Notarized. This has saved me time and emotional stress following the death of my husband. THANK YOU.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jena S.

April 7th, 2020

I love how quick the turnaround is, my only request would be for an email notification be sent once an invoice is ready and then once a document is recorded and ready to download (only because I have a large caseload and it's very easy to forget things sometimes).

Thank you!