Stillwater County Beneficiary Deed Affidavit of Death Form

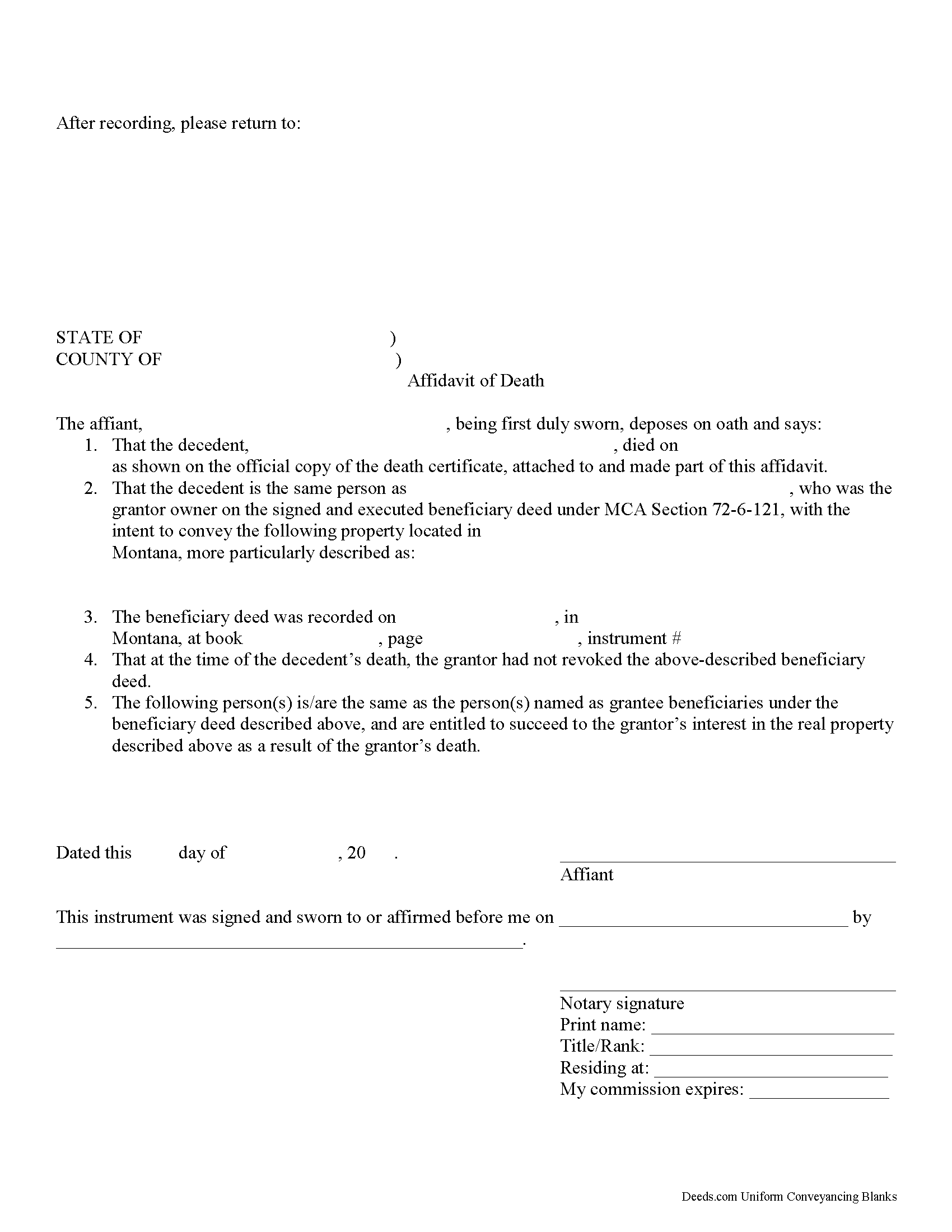

Stillwater County Affidavit of Death Form

Fill in the blank form formatted to comply with all recording and content requirements.

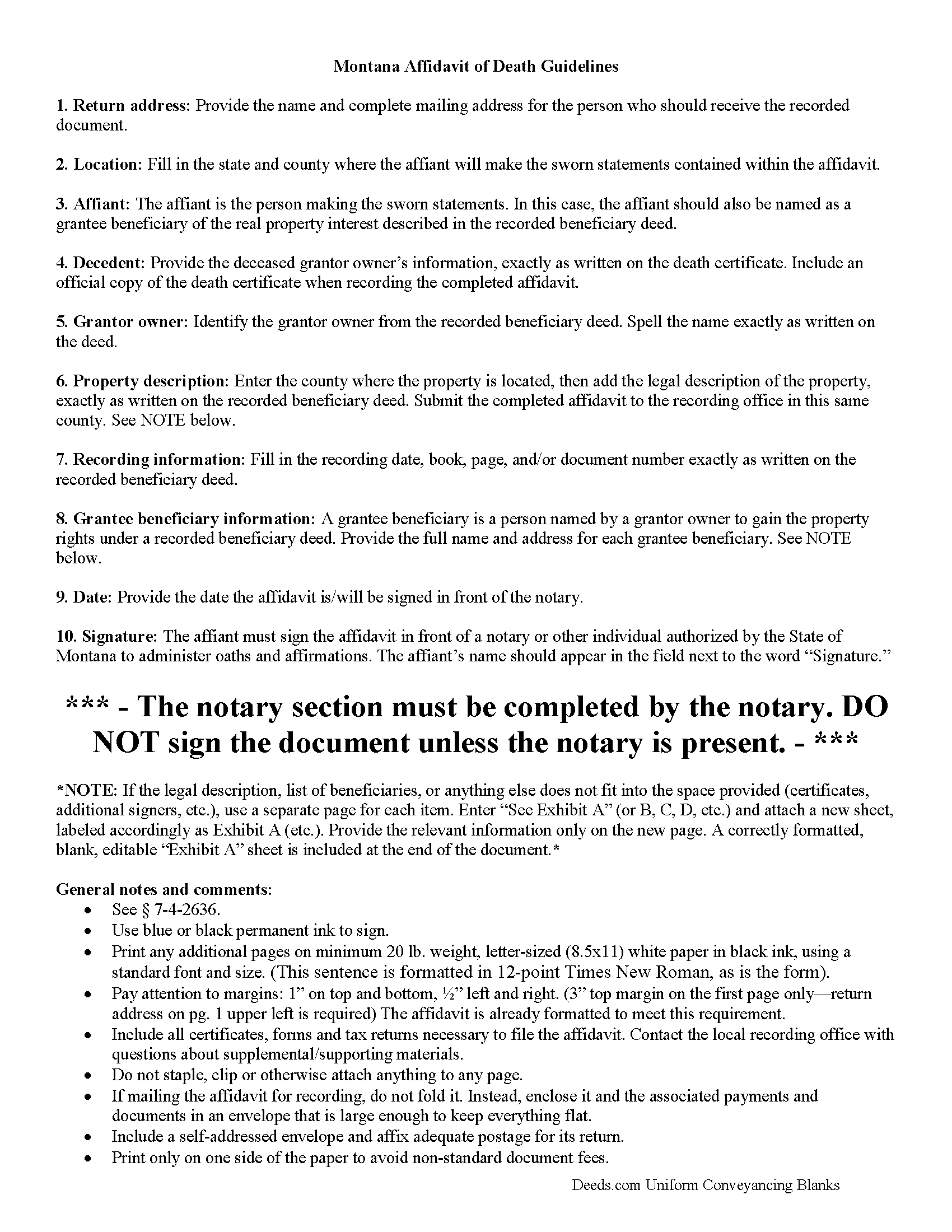

Stillwater County Affidavit of Death Guide

Line by line guide explaining every blank on the form.

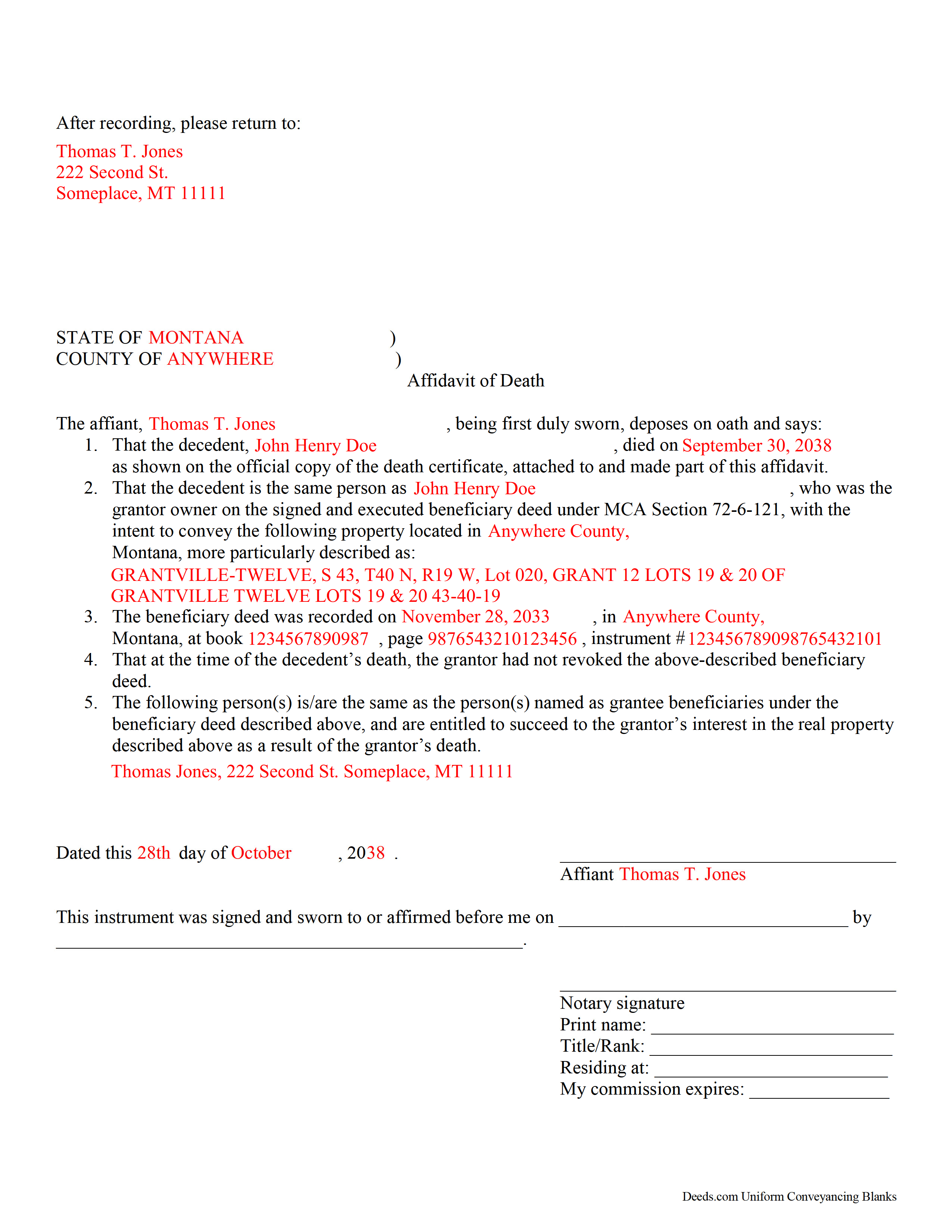

Stillwater County Completed Example of the Affidavit of Death Form

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Montana and Stillwater County documents included at no extra charge:

Where to Record Your Documents

Stillwater County Clerk / Recorder

Columbus, Montana 59019

Hours: 8:00 to 12:00 & 1:00 to 5:00 Mon-Fri

Phone: (406) 322-8000

Recording Tips for Stillwater County:

- Double-check legal descriptions match your existing deed

- Bring extra funds - fees can vary by document type and page count

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Stillwater County

Properties in any of these areas use Stillwater County forms:

- Absarokee

- Columbus

- Fishtail

- Nye

- Park City

- Rapelje

- Reed Point

Hours, fees, requirements, and more for Stillwater County

How do I get my forms?

Forms are available for immediate download after payment. The Stillwater County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Stillwater County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Stillwater County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Stillwater County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Stillwater County?

Recording fees in Stillwater County vary. Contact the recorder's office at (406) 322-8000 for current fees.

Questions answered? Let's get started!

Transferring Title under a Montana Beneficiary Deed

In 2007, the Montana Legislature enacted the state's beneficiary deed law, found at Montana Code Annotated Section 72-6-121. All following parenthetical references identify the part of that section which contains additional information. The statute outlines the requirements for a beneficiary to gain ownership of real property from a beneficiary deed at 72-6-121(12).

The process involves completing and recording an affidavit of death. This document must contain the information specified in 7-4-2613(1)(c), including recording details from the beneficiary deed, a full legal description of the property interest, names and addresses of all surviving grantee beneficiaries, and evidence of the owner's death. In addition, attach an official copy of the deceased owner's death certificate. When the affidavit of death is completed and notarized, submit it to the clerk and recorder in each county in which the real property or any part of the real property is located.

Beneficiaries take ownership of the property subject to any mortgages, taxes, and obligations of record (1), including claims from the department of public health and human services may assert a claim pursuant to 53-6-167 for medical assistance (7). Because of these or other reasons, some beneficiaries may decide not to accept the transfer. In that case, follow the procedures outlined in 72-2-811 to disclaim the interest.

Each circumstance is unique, so contact an attorney with specific questions or for complex situations.

(Montana BD Affidavit of Death Package includes form, guidelines, and completed example)

Important: Your property must be located in Stillwater County to use these forms. Documents should be recorded at the office below.

This Beneficiary Deed Affidavit of Death meets all recording requirements specific to Stillwater County.

Our Promise

The documents you receive here will meet, or exceed, the Stillwater County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Stillwater County Beneficiary Deed Affidavit of Death form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4591 Reviews )

Daniel D.

June 3rd, 2019

Easier than I expected. I followed the downloaded examples step by step, and before I knew it, the form was completed correctly and good to go. Thank you, Daniel D.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michelle M.

July 3rd, 2020

The website was easy to navigate and great communication on every step of the process.

Thank you for your feedback. We really appreciate it. Have a great day!

eric m.

January 28th, 2025

it was a smooth superb timely experience

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Barbara M.

November 21st, 2020

We love this service - so easy to use and quick. It is the second time we have used Deeds.com, in two different states. Wonderful service!

Thank you for your feedback. We really appreciate it. Have a great day!

Mildred S.

November 8th, 2021

This was an excellent service to amend a deed. It was a little frustrating at first, but well worth it, as they review your documents before submission to your "Recorder of Deeds" to make sure they are not rejected. Would definitely use them again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rhonda D.

February 24th, 2021

The boxes do not allow you to add the entire information. The after recording return to box would not let me add a zipcode.

Thanks for the feedback Rhonda, we’ll take a look at that input field.

Lori G.

October 28th, 2020

This was so easy and seemless. I wish I had found deeds.com for eRecording sooner! I submitted my documents from the comfort of my office, they were great about communicating in a timely manner with updates. The next day I had copies of my recorded documents! I would highly recommend deeds.com!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

JAMES V.

August 5th, 2020

I initiated an order at 8:30PM on a Tuesday. I already had a response waiting for me when I opened my email the next morning. Very responsive. I'm very happy with this service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Karl H.

January 5th, 2021

Still in process, but it is well explained. I would recommend it to anyone in Texas.

Thank you for your feedback. We really appreciate it. Have a great day!

Ronald S.

December 7th, 2020

fantastic forms, great service!

Thank you for your feedback. We really appreciate it. Have a great day!

Pauline G.

May 2nd, 2019

Found just what I needed!!! Instructions were easy to follow and I accomplished the task like a professional. Thank you Deeds.com!!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Maggie C.

April 29th, 2020

Easy to use fantastic website. Immediately found the Sheriff's Deed I needed.

Thank you!

Dennis D.

November 7th, 2019

Thanks for the efficient process and instructions.

Thank you for your feedback. We really appreciate it. Have a great day!

Clarence R.

March 27th, 2023

service from your team was quick and very accurate. My experience was excellent.

Thank you!

Mary C.

August 30th, 2022

The Deeds.com site made is relatively simple to download a Beneficiary Deed form specific to St Louis, which is great, because neither the city or state provide this. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!