Judith Basin County Beneficiary Deed Revocation Form

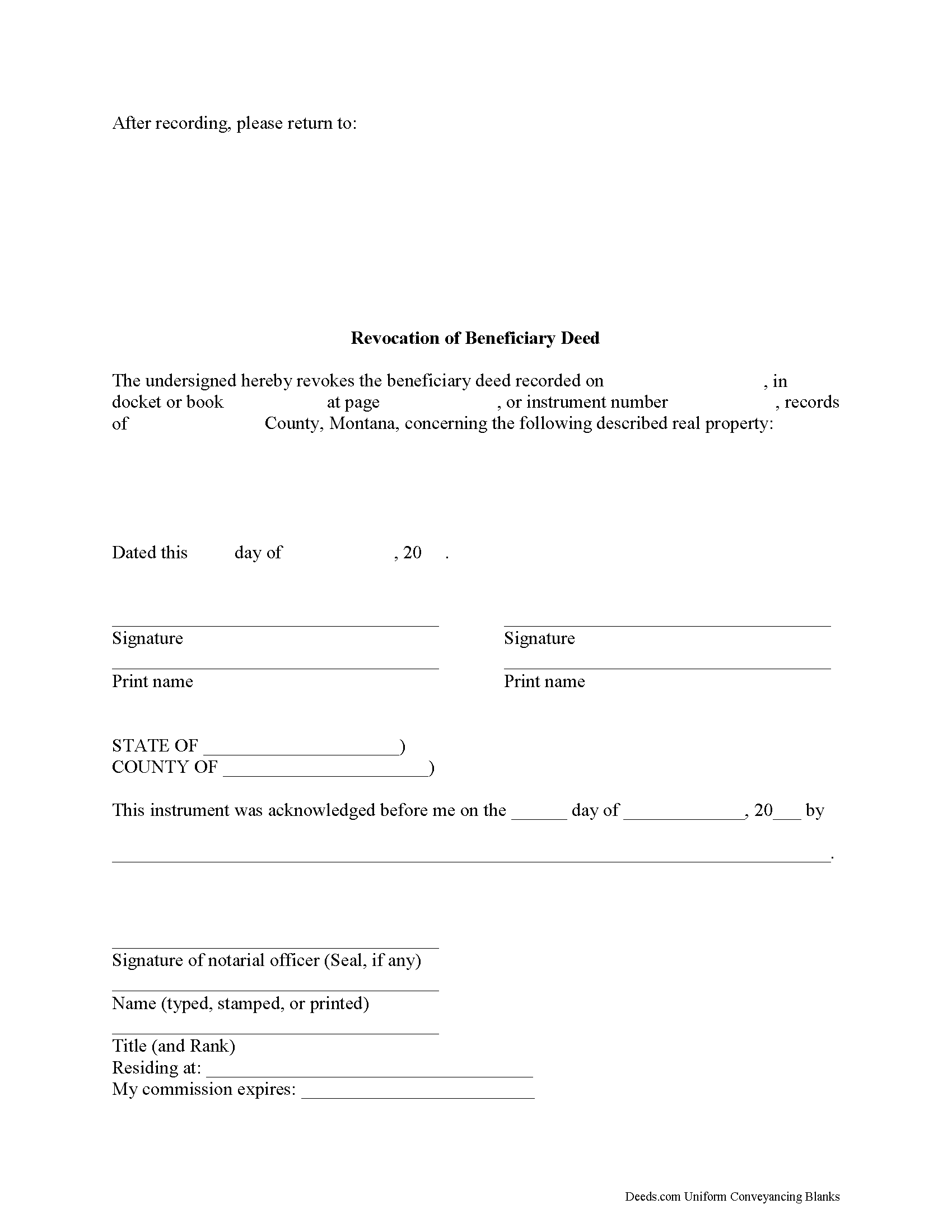

Judith Basin County Revocation of Beneficiary Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

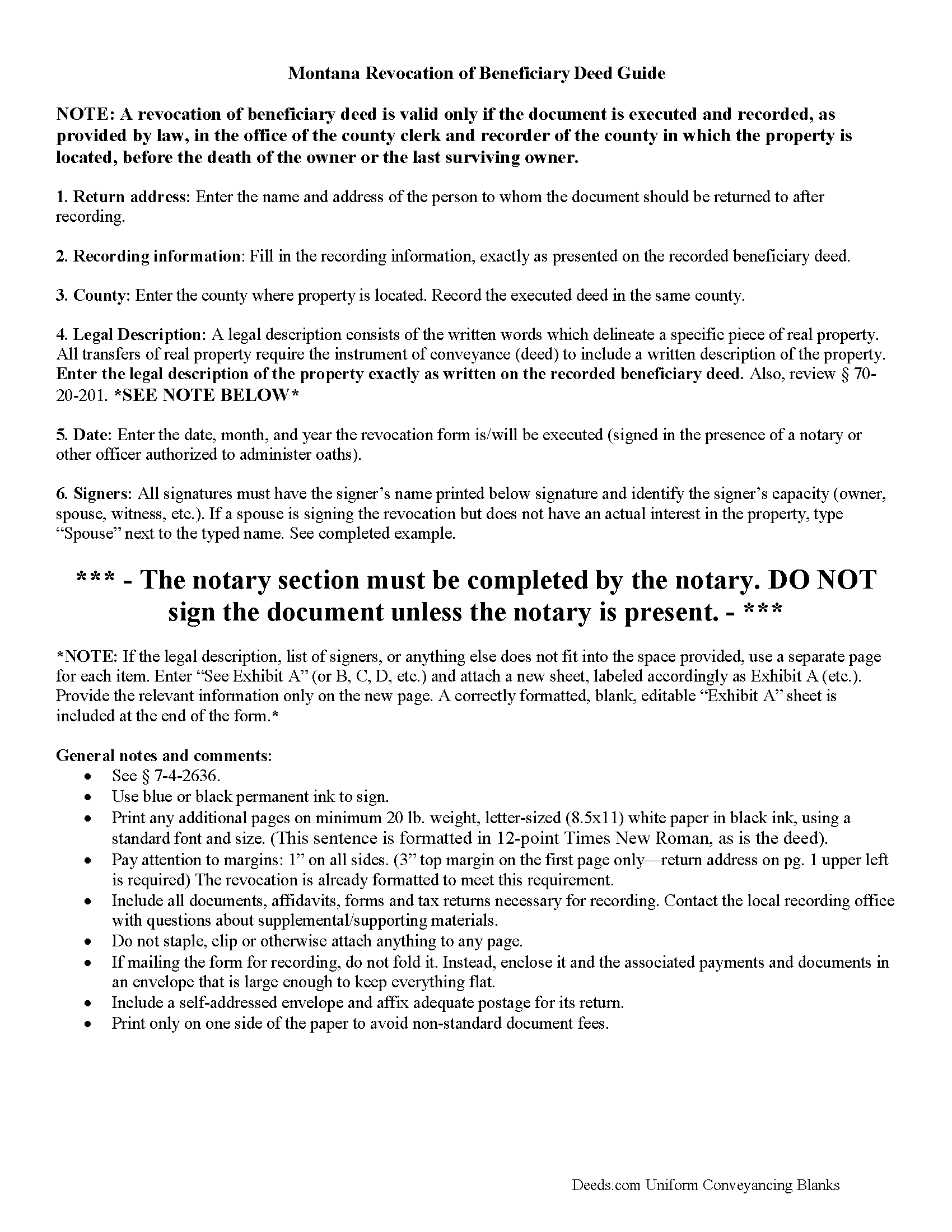

Judith Basin County Beneficiary Deed Revocation Guide

Line by line guide explaining every blank on the form.

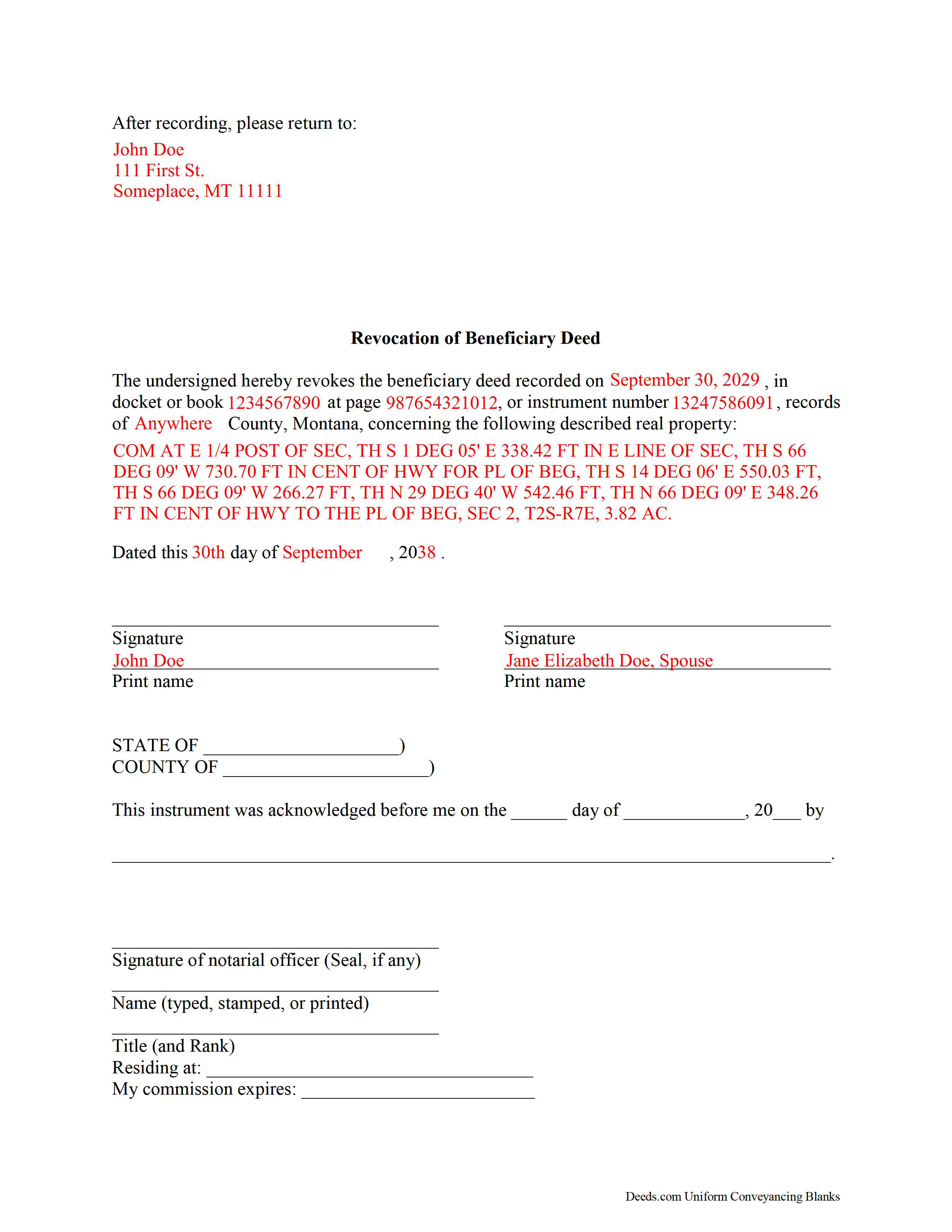

Judith Basin County Completed Example of the Revocation of Beneficiary Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Montana and Judith Basin County documents included at no extra charge:

Where to Record Your Documents

Judith Basin County Clerk / Recorder

Stanford, Montana 59479

Hours: 8:00 to 12:00 & 1:00 to 5:00 Mon-Fri

Phone: (406) 566-2277 Ext 109 or 110

Recording Tips for Judith Basin County:

- Double-check legal descriptions match your existing deed

- Verify all names are spelled correctly before recording

- White-out or correction fluid may cause rejection

- Check margin requirements - usually 1-2 inches at top

- Some documents require witnesses in addition to notarization

Cities and Jurisdictions in Judith Basin County

Properties in any of these areas use Judith Basin County forms:

- Geyser

- Hobson

- Moccasin

- Raynesford

- Stanford

Hours, fees, requirements, and more for Judith Basin County

How do I get my forms?

Forms are available for immediate download after payment. The Judith Basin County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Judith Basin County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Judith Basin County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Judith Basin County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Judith Basin County?

Recording fees in Judith Basin County vary. Contact the recorder's office at (406) 566-2277 Ext 109 or 110 for current fees.

Questions answered? Let's get started!

Revoking a Montana Beneficiary Deed

A revocation of a recorded beneficiary deed must be lawfully executed and recorded during the owner's life or it has no effect.

In 2007, the Montana Legislature enacted the state's beneficiary deed law, found at Montana Code Annotated Section 72-6-121. All following parenthetical references identify the part of that section which contains additional information.

Beneficiary deeds are nontestamentary documents that convey a potential future interest in real property, but they only become effective when the owner dies (11). Until that point, the owner retains absolute title to, control over, and use of the property, including the freedom to modify or revoke the beneficiary designation, or to sell the property to someone else. This flexibility is what makes beneficiary deeds so useful; it allows the owners to respond quickly if circumstances change. Note that if the real property is owned as joint tenants with right of survivorship and if the revocation is not executed by all the owners, the revocation is not effective unless executed by the last surviving owner (6).

If an owner executes and records more than one beneficiary deed concerning the same real property, the document recorded closest to the owner's death is the effective beneficiary deed (8). Even though the recording date directs the transfer, it makes sense to execute and record a revocation because it adds an endpoint to the original deed and helps to preserve a clear chain of title (ownership history). This is important because any perceived irregularities can add unnecessary complexity to future sales of the property.

Revoking a beneficiary deed is a simple process, but it may not be appropriate in all cases. Contact an attorney with specific questions or for complex situations.

(Montana BD Revocation Package includes form, guidelines, and completed example)

Important: Your property must be located in Judith Basin County to use these forms. Documents should be recorded at the office below.

This Beneficiary Deed Revocation meets all recording requirements specific to Judith Basin County.

Our Promise

The documents you receive here will meet, or exceed, the Judith Basin County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Judith Basin County Beneficiary Deed Revocation form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4574 Reviews )

Monica U.

January 23rd, 2021

Thank You. Good Service. Questions were answered.

Thank you for your feedback. We really appreciate it. Have a great day!

ROBERET D.

November 18th, 2021

after a poor start was able to get to the forms page and find what I was looking for and every thing worked good. Just getting to the right area was a struggle but we made thanks Bob

Thank you for your feedback. We really appreciate it. Have a great day!

Dianne W.

July 14th, 2020

Thank you for responding so quickly to my question. I was able to locate the form and get everything downloaded. Once I saw the icon, it was easy peasy!!

Thank you!

Richard O.

June 2nd, 2020

Thank you for providing this service. It was quick and easy.

Thank you for your feedback. We really appreciate it. Have a great day!

davidjrhall e.

March 13th, 2023

So far its been good. The David Jr Hall Estate Trust is a Business Blind Trust and we are looking forward to working with your platform and seeing how far we can go.

Thank you!

Ken W.

March 24th, 2025

Deeds.com provides outstanding service! Quick e-recording, at a reasonable price, and if there are any issues, they work with you to resolve them. I'm recommending them to everyone I know who buys and sells land.

Knowing our customers are happy is our top priority. Thank you for the wonderful feedback!

JIM H.

July 21st, 2022

Excellent service Always find the documents in minutes. Supporting docs is a super plus!

Thank you!

Jan H.

October 15th, 2020

This is a great service. It was easy to find and the instructions were complete and easy to follow.

Thank you!

Heather R.

May 31st, 2019

Fast and convenient service.

Thank you Heather, we appreciate your feedback.

Melissa S.

April 13th, 2020

Not what I can use.

Thank you!

Harry C.

February 11th, 2019

I got the wrong state and now they want to charge me again for the proper state. My fault, BUT!!!!

Sorry to hear that Harry. We've gone ahead and canceled the order you made in error. Have a wonderful day.

Sera E.

January 25th, 2022

East, fast, reliable. Great service!

Thank you!

Brad T.

November 9th, 2019

I didn't spend a lot of time there but seems to be a good site with a valuable service.

Thank you!

Jessica B.

September 23rd, 2021

Amazing service. Immediate responses at all hours of the day and prevent late in the evening! Patient and friendly. I will say that Adobe scan did not work well for me. Notes app for IOS has a scan feature and that seemed to work best.

Thank you for your feedback. We really appreciate it. Have a great day!

Laura D.

February 4th, 2023

Great forms - I got several property deeds and really appreciated that they came with the required state forms (for NY). the sample completed form is also really helpful. Attorney wanted hundreds- with this form it is the same amount of work but I can file myself for the cost of lunch!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!