Beaverhead County Deed of Trust and Promissory Note Form

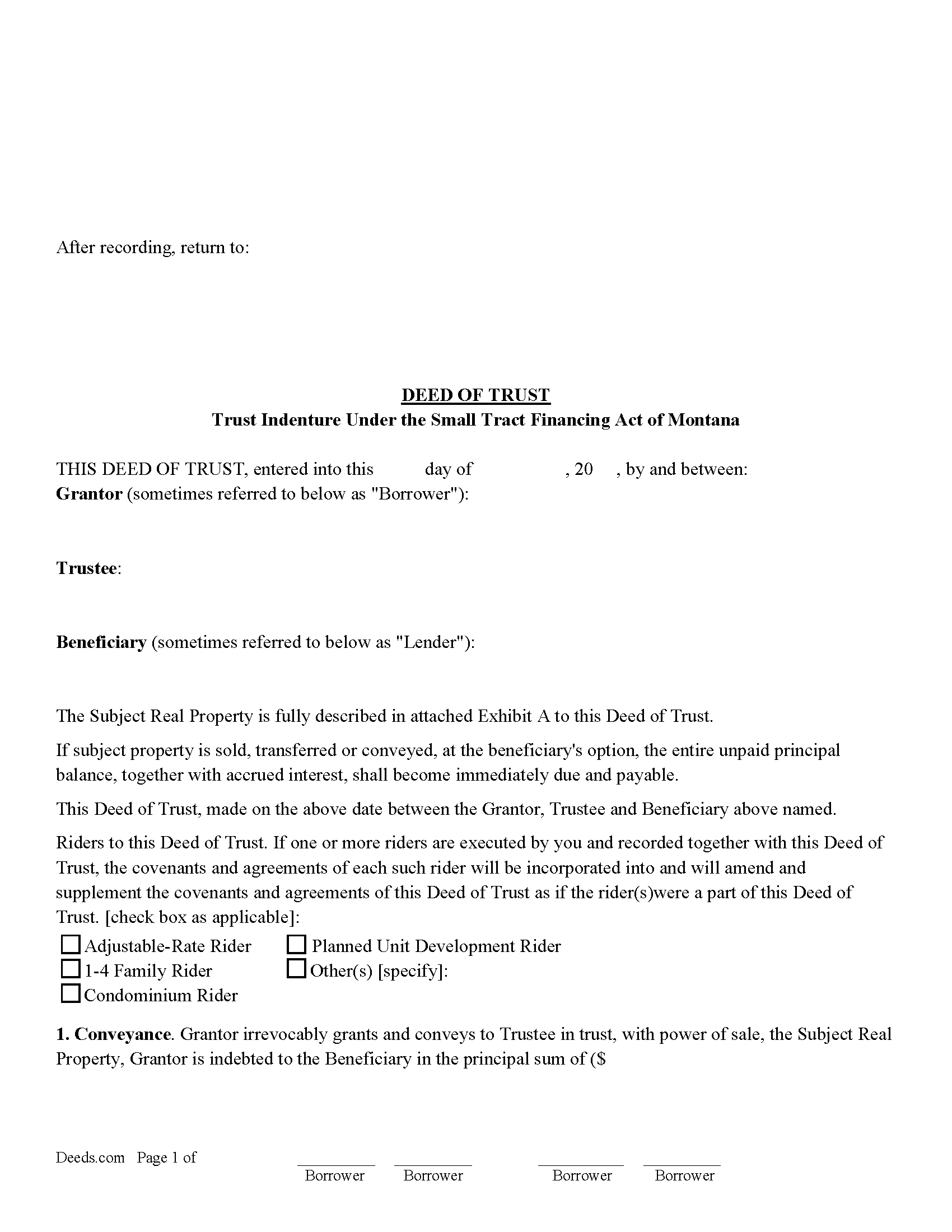

Beaverhead County Deed of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

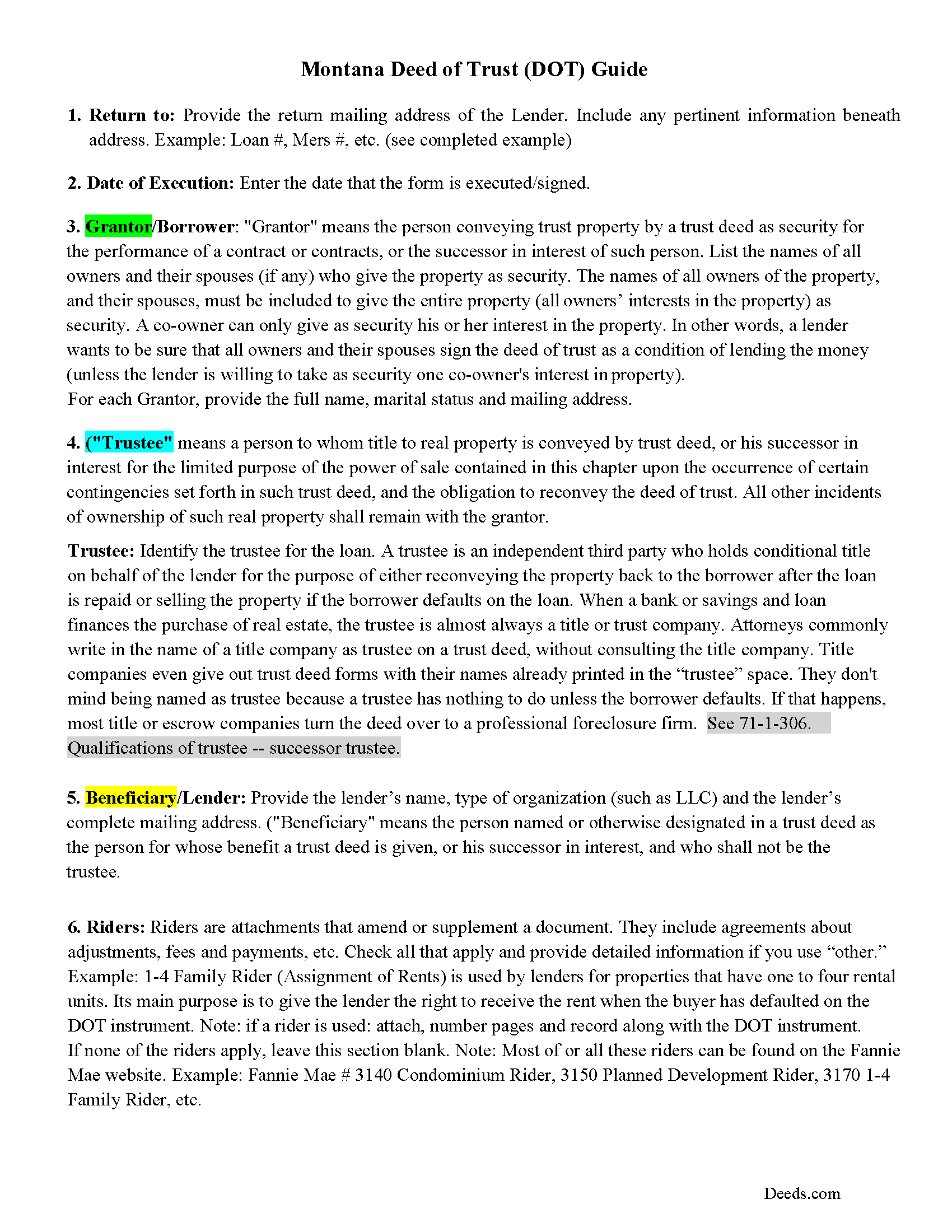

Beaverhead County Deed of Trust Guidelines

Line by line guide explaining every blank on the form.

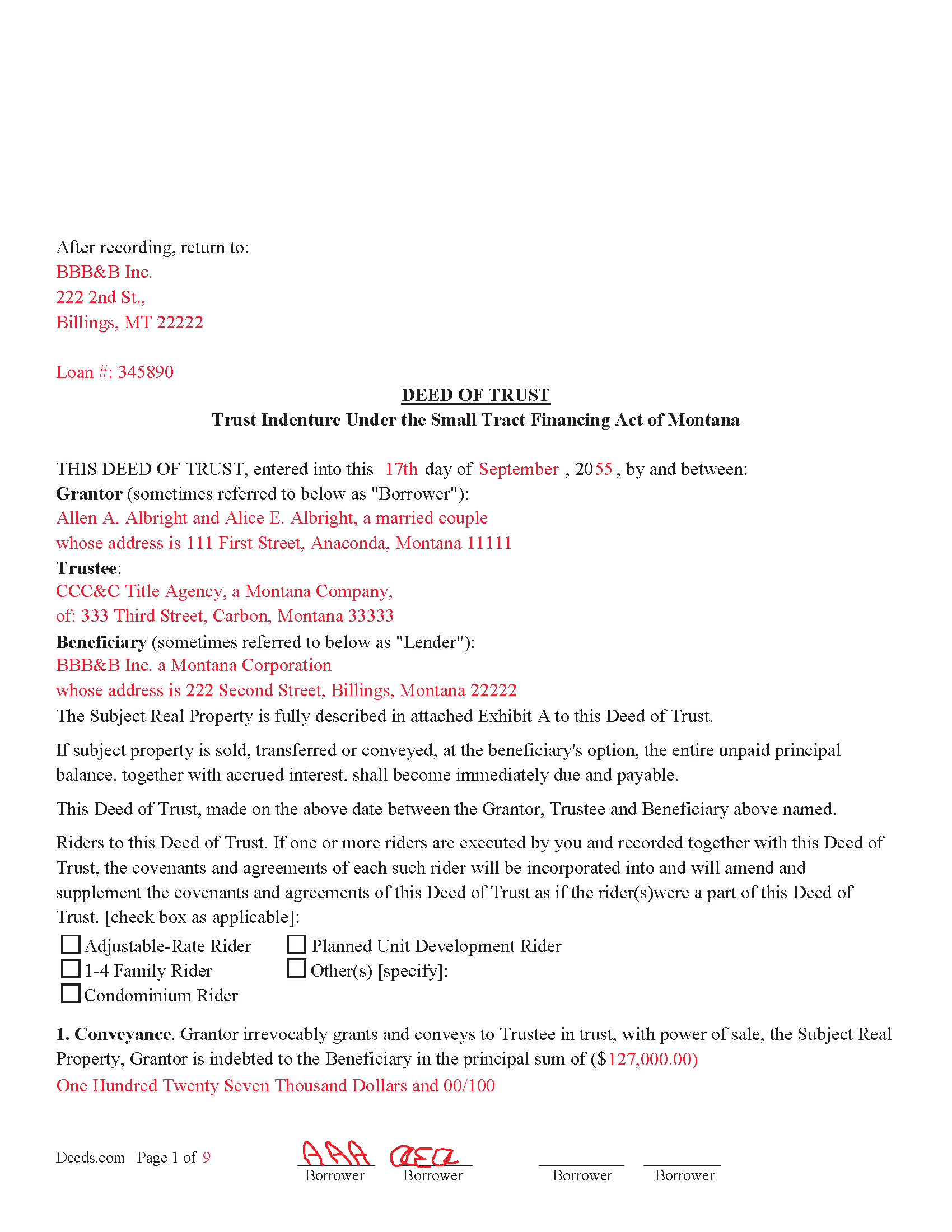

Beaverhead County Completed Example of the Deed of Trust Document

Example of a properly completed form for reference.

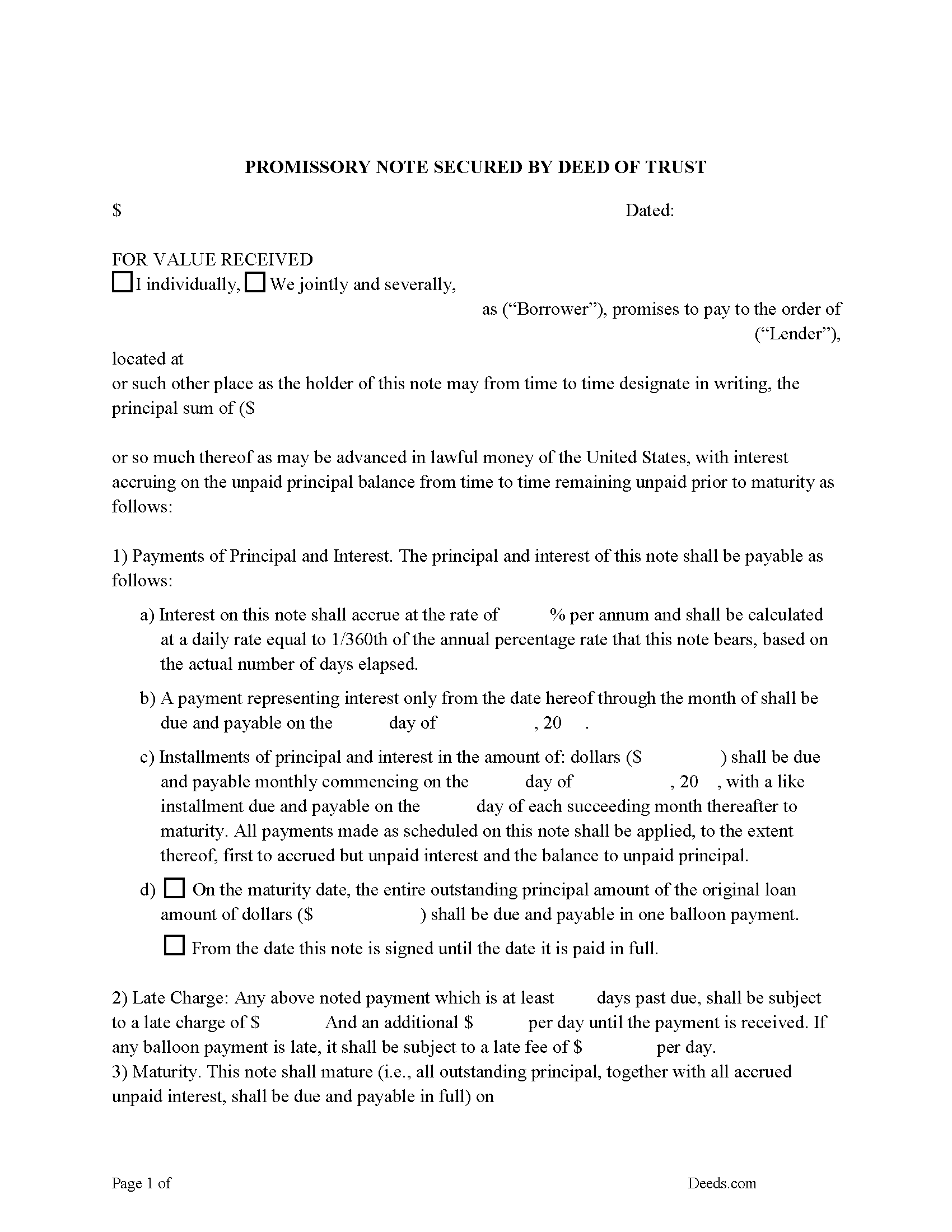

Beaverhead County Promissory Note Form

Note that is secured by the Deed of Trust document.

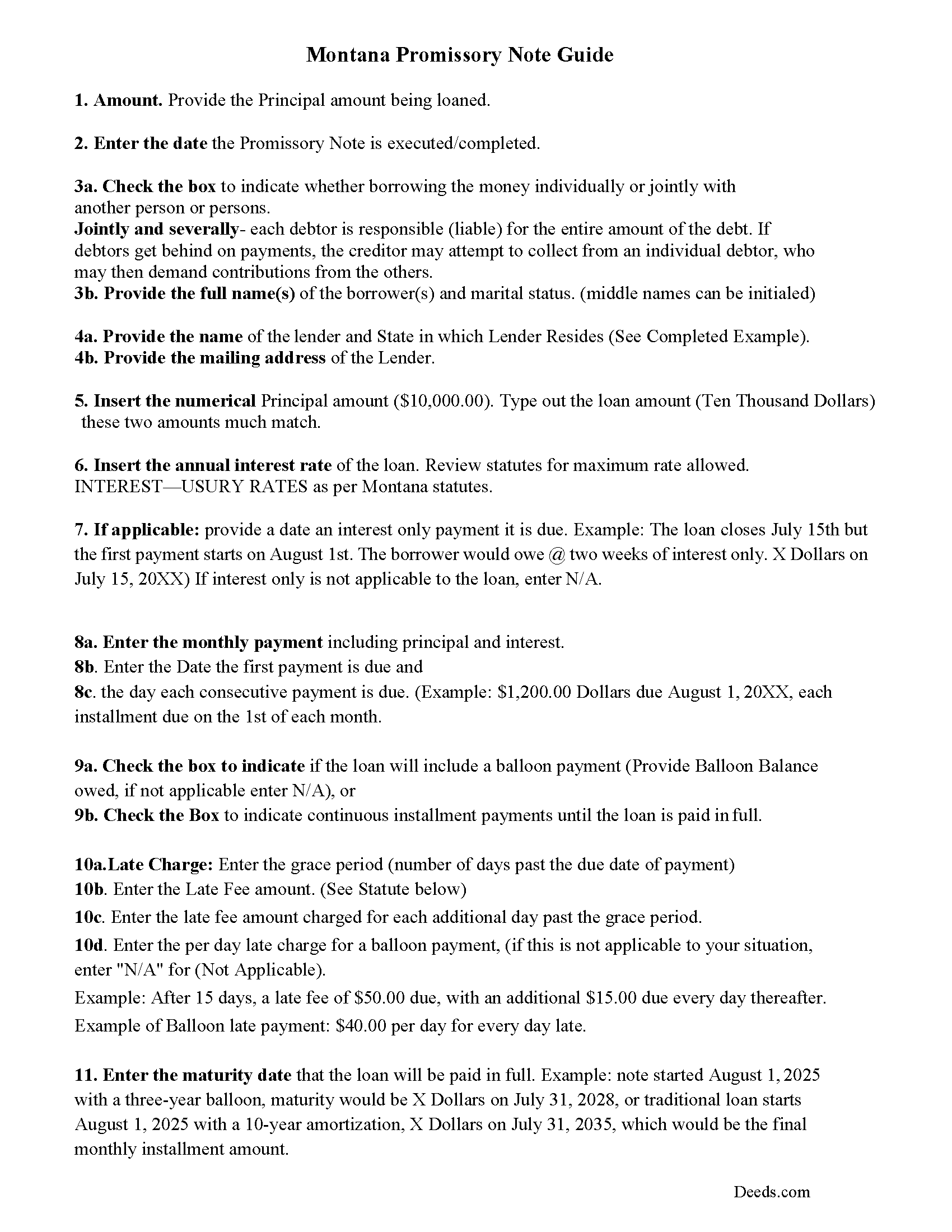

Beaverhead County Promissory Note Guidelines

Line by line guide explaining every blank on the form.

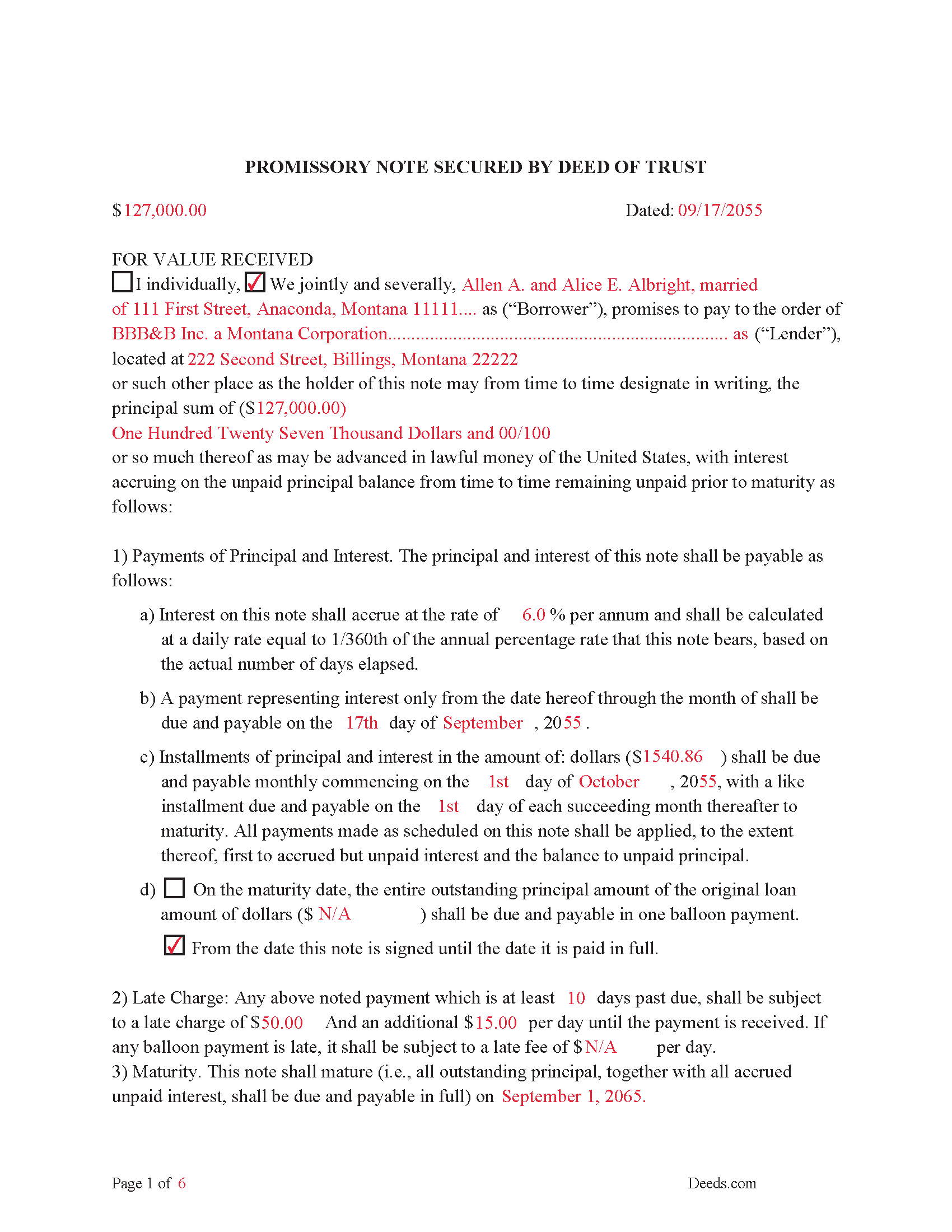

Beaverhead County Completed Example of the Promissory Note Document

Example of a properly completed form for reference.

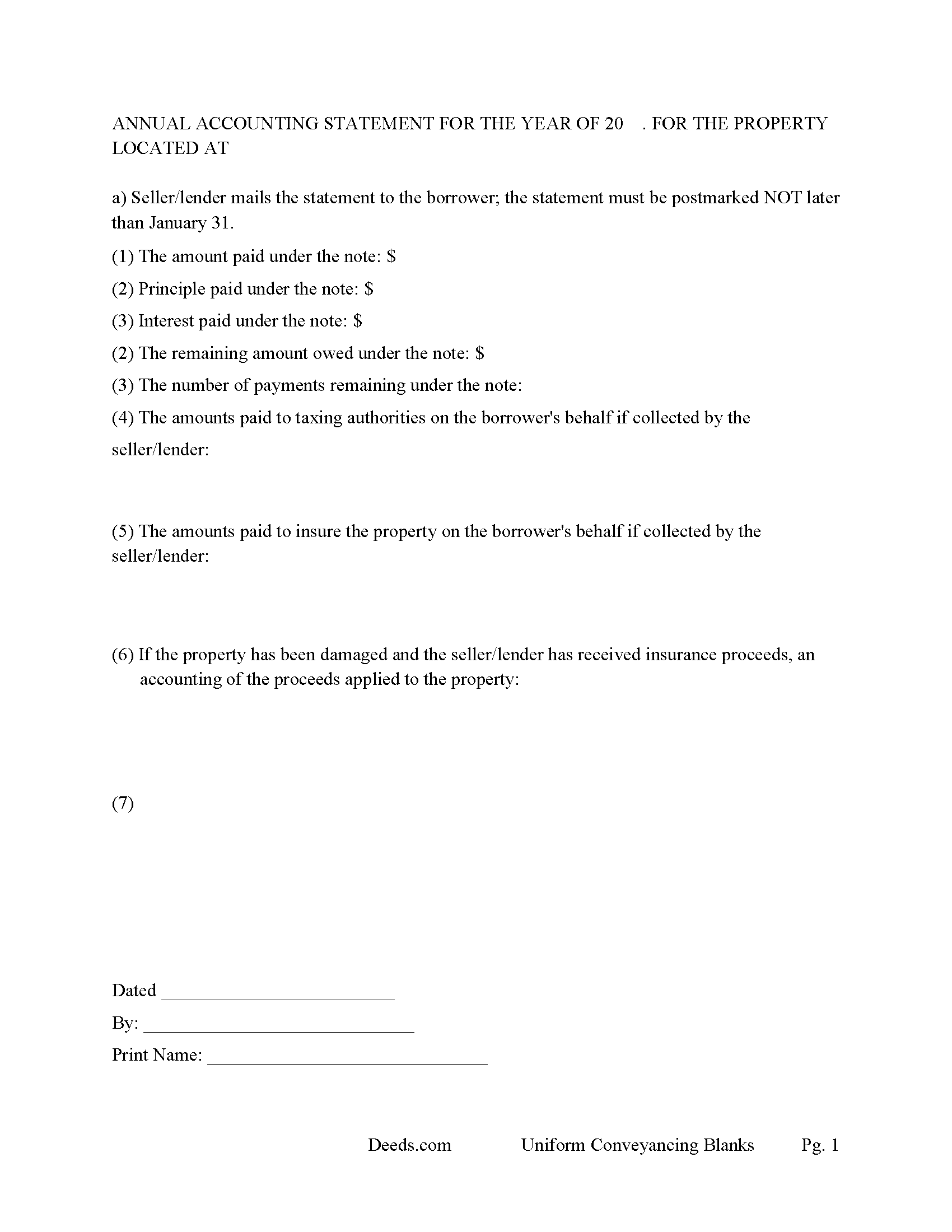

Beaverhead County Annual Accounting Statement Form

Fill in the blank Deed of Trust and Promissory Note form formatted to comply with all Montana recording and content requirements.

All 7 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Montana and Beaverhead County documents included at no extra charge:

Where to Record Your Documents

Beaverhead County Clerk / Recorder

Dillon, Montana 59725

Hours: 8:30 to 4:00 M-F

Phone: (406) 683-3720

Recording Tips for Beaverhead County:

- Ensure all signatures are in blue or black ink

- Double-check legal descriptions match your existing deed

- Recording fees may differ from what's posted online - verify current rates

- Check margin requirements - usually 1-2 inches at top

- Some documents require witnesses in addition to notarization

Cities and Jurisdictions in Beaverhead County

Properties in any of these areas use Beaverhead County forms:

- Dell

- Dillon

- Glen

- Jackson

- Lima

- Polaris

- Wisdom

- Wise River

Hours, fees, requirements, and more for Beaverhead County

How do I get my forms?

Forms are available for immediate download after payment. The Beaverhead County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Beaverhead County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Beaverhead County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Beaverhead County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Beaverhead County?

Recording fees in Beaverhead County vary. Contact the recorder's office at (406) 683-3720 for current fees.

Questions answered? Let's get started!

A Deed of Trust with Trust Indenture Under the Small Tract Financing Act of Montana is the preferred form of financing in Montana for properties not exceeding 40 acres and under $500,000.00 in financing.

71-1-302 Policy- Because the financing of homes and business expansion is essential to the development of the state of Montana and because financing of homes and business expansion, usually involving areas of real estate of not more than 40 acres, has been restricted by the laws relating to mortgages of real property and because more financing of homes and business expansion is available if the parties can use security instruments and procedures not subject to all the provisions of the mortgage laws, it is the public policy of the state of Montana to permit the use of trust indentures for estates in real property of not more than 40 acres as provided in this part.

This form includes the Power of Sale clause, which allows for a non-judicial foreclosure, saving time and expense, in general:

Non-judicial foreclosure takes (130-180 days) compared to @1 year -- judicial foreclosure

In a non-judicial foreclosure Borrower has no right of redemption vs. an additional year beyond a judicial foreclosure.

Typically, no frivolous lawsuits filed to slow down a non-judicial foreclosure vs. common in a judicial foreclosure.

Typically, no deficiency judgement upon completion of sale in a non-judicial foreclosure vs. deficiency judgment used in judicial foreclosure.

71-1-304 Trust indentures authorized -- power of sale for breach in trustee

(1) A transfer in trust of an interest in real property of an area not exceeding 40 acres may be made to secure the performance of an obligation of a grantor or any other person named in the indenture to a beneficiary. However, a trust indenture may not be substituted for a mortgage that was in existence on March 5, 1963.

(2) When a transfer in trust of an interest in real property is made to secure the performance of the obligation referred to in subsection (1), a power of sale is conferred upon the trustee to be exercised after a breach of the obligation for which the transfer is security.

(3) A trust indenture executed in conformity with this part may be foreclosed by advertisement and sale in the manner provided in this part or, at the option of the beneficiary, by judicial procedure as provided by law for the foreclosure of mortgages on real property. The power of sale may be exercised by the trustee without express provision in the trust indenture.

(4) If a trust indenture states that the real property involved does not exceed 40 acres, the statement is binding upon all parties and conclusive as to compliance with the provisions of this part relative to the power to make a transfer, trust, and power of sale.

If the parameters of the trust indenture are not met (example: the subject property is 50 acres or $600.000.00) then it converts to a mortgage and treated as mortgage in foreclosure.

71-1-305 Trust indenture considered to be mortgage on real property A trust indenture is deemed to be a mortgage on real property and is subject to all laws relating to mortgages on real property except to the extent that such laws are inconsistent with the provisions of this part, in which event the provisions of this part shall control. For the purpose of applying the mortgage laws, the grantor in a trust indenture is deemed the mortgagor and the beneficiary is deemed the mortgagee.

71-1-321 Deeds of trust and trust deeds not invalidated The Small Tract Financing Act of Montana does not invalidate or preclude the use in this state of instruments, sometimes denominated deeds of trust, trust deeds, or trust indentures, which are not executed in conformity with this part, but in which a conveyance for security purposes is made to a trustee or trustees for the benefit of one or more lenders. Such instruments are considered to be mortgages and are subject to all laws relating to mortgages on real property. Every such instrument, recorded as prescribed by law, from the time it is filed for record is constructive notice of its contents to subsequent purchasers and encumbrancers.

(Montana DOT Package includes forms, guidelines, and completed examples) For use in Montana only.

Important: Your property must be located in Beaverhead County to use these forms. Documents should be recorded at the office below.

This Deed of Trust and Promissory Note meets all recording requirements specific to Beaverhead County.

Our Promise

The documents you receive here will meet, or exceed, the Beaverhead County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Beaverhead County Deed of Trust and Promissory Note form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

MARY LACEY M.

April 11th, 2024

I am extremely impressed with the quality of this service. They are a pleasure to work with and I know I can rely on them.

Thank you for your feedback. We really appreciate it. Have a great day!

Sean M.

January 2nd, 2023

This was exactly what I needed. For $25-$30 it gave me the formatted document I needed and made it so easy to input the info. I wouldn't recommend it to someone who has no clue what they're doing, but for somebody who knows all the info and just needs a formatted page to input it onto, this is perfect.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

L. Candace H.

April 29th, 2021

So far it's been good & informative. I have not chosen forms for download but I like the site. Thanks

Thank you!

Justine John S.

February 17th, 2022

Splendid! I will definitely and absolutely recommend you guys and this company to my co-investors !

Thank you!

REBECCA B.

May 8th, 2023

Documents arrived instantly. Performed exactly as stated. Will use website again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jeffrey S.

February 1st, 2024

Web site was clear to understand and easy to use. Found what I needed quickly and crossed it off my to do list. Thanks, JS

We are grateful for your feedback and looking forward to serving you again. Thank you!

lindsey r.

October 18th, 2021

easy to use

Thank you!

Anthony G.

February 17th, 2021

I have only used the service on one occasion but so far it has been great. Extremely simple to use.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dorothy R.

August 27th, 2019

Actually, it was user friendly once I figured out where to go to get the forms. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Patricia H.

May 17th, 2022

I really like this site and it's actually recommended by many County Recorders. I especially like that there's not join up/monthly fee. It's easy to use and the customer support is outstanding. They're very helpful and patient.

Thank you for your feedback. We really appreciate it. Have a great day!

Terry S.

March 23rd, 2022

Worked well for us except for not being able to edit. Got it completed and recorded with the county clerk! Having the instructions and example made it easy!

Thank you for your feedback. We really appreciate it. Have a great day!

William C.

March 31st, 2020

Excellent service. Reasonably priced. Highly recommend.

Thank you for your feedback. We really appreciate it. Have a great day!

Mildred S.

November 8th, 2021

This was an excellent service to amend a deed. It was a little frustrating at first, but well worth it, as they review your documents before submission to your "Recorder of Deeds" to make sure they are not rejected. Would definitely use them again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Janet M.

December 17th, 2020

This site is amazing! What a time saver from driving somewhere and standing around waiting.

Thank you!

Robert M.

February 22nd, 2020

Best site of its kind I have ever found. Informative, intuitive, and best of all, everything worked on the first try. I will be HAPPY to recommend it. --- A retired full prof of business administration

We appreciate your business and value your feedback. Thank you. Have a wonderful day!