Stillwater County Deed of Trust and Promissory Note Form

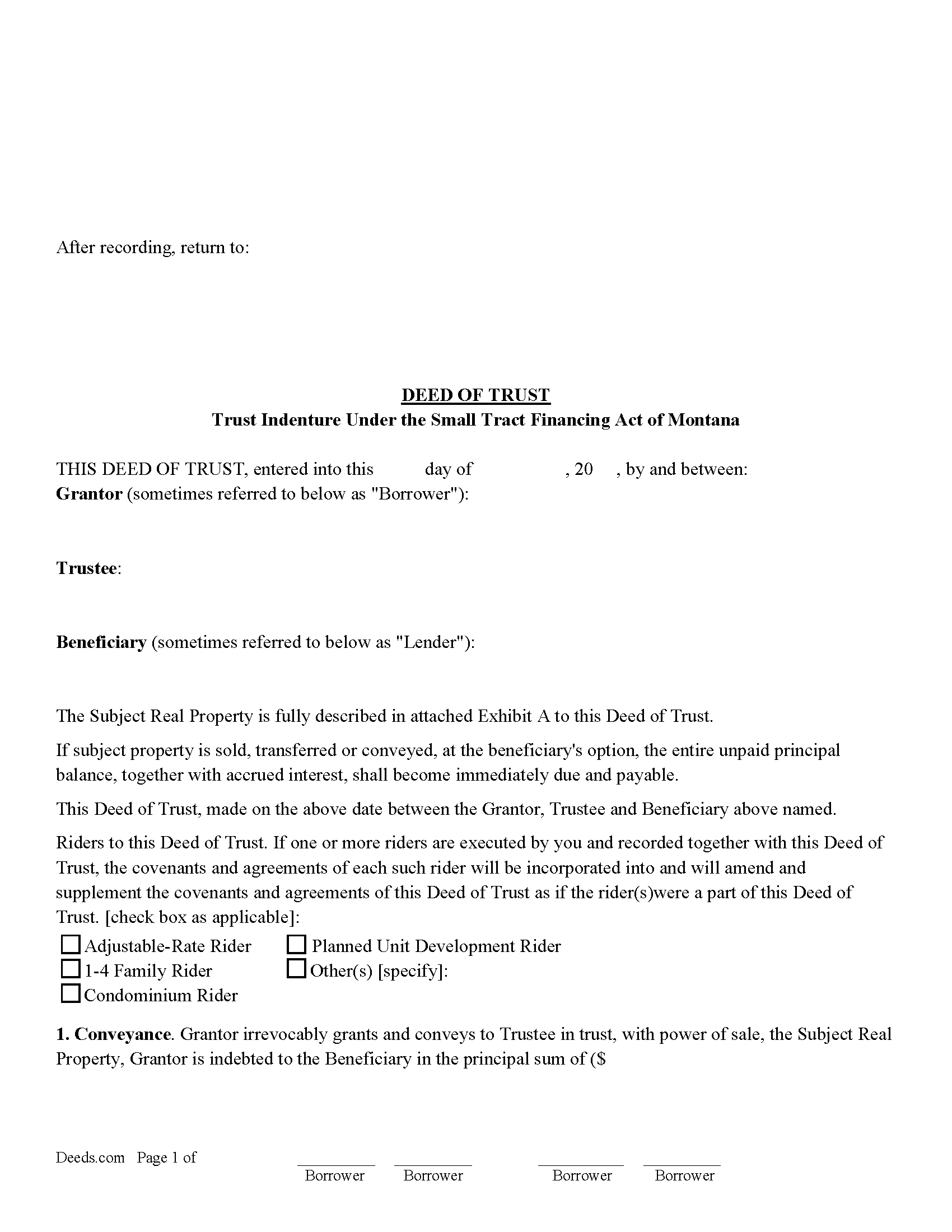

Stillwater County Deed of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

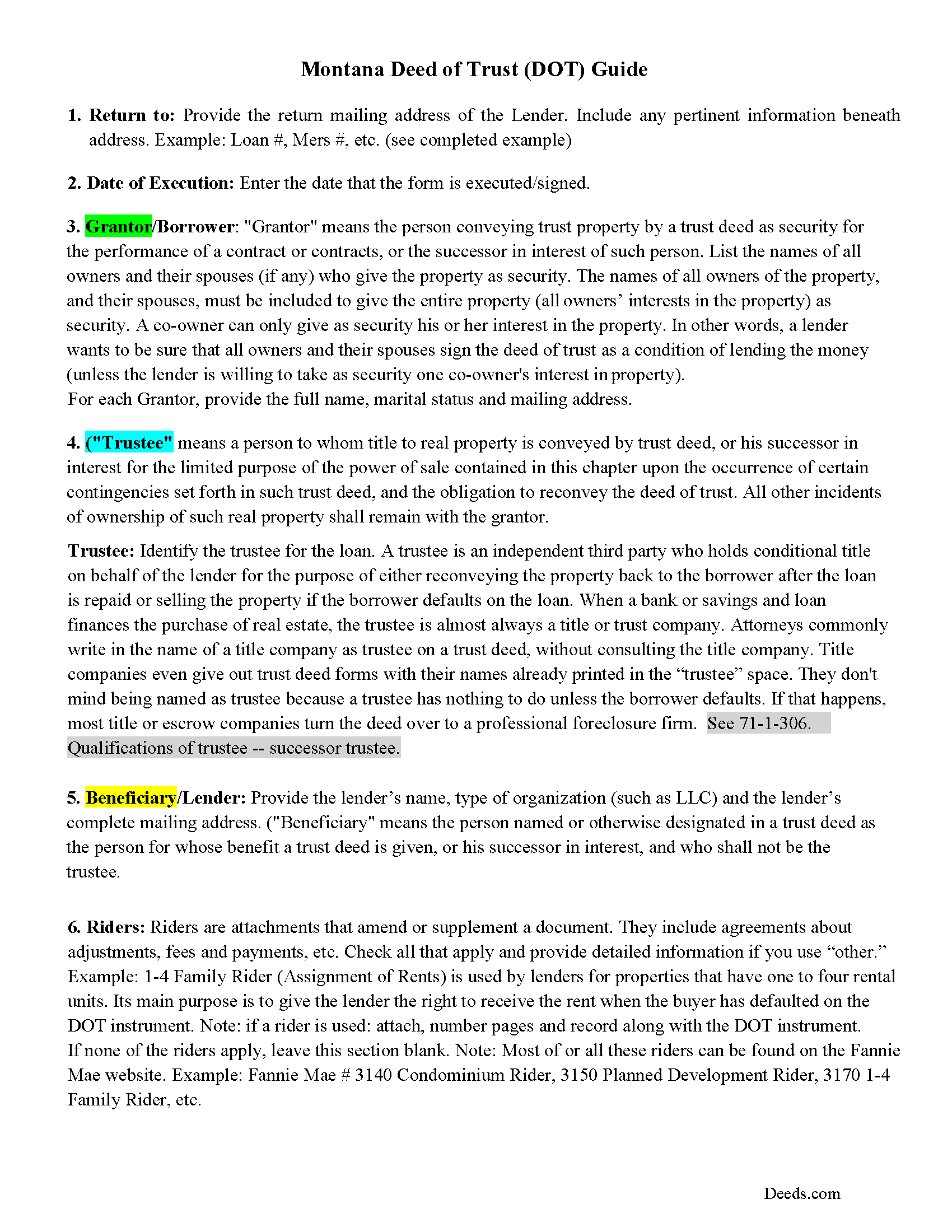

Stillwater County Deed of Trust Guidelines

Line by line guide explaining every blank on the form.

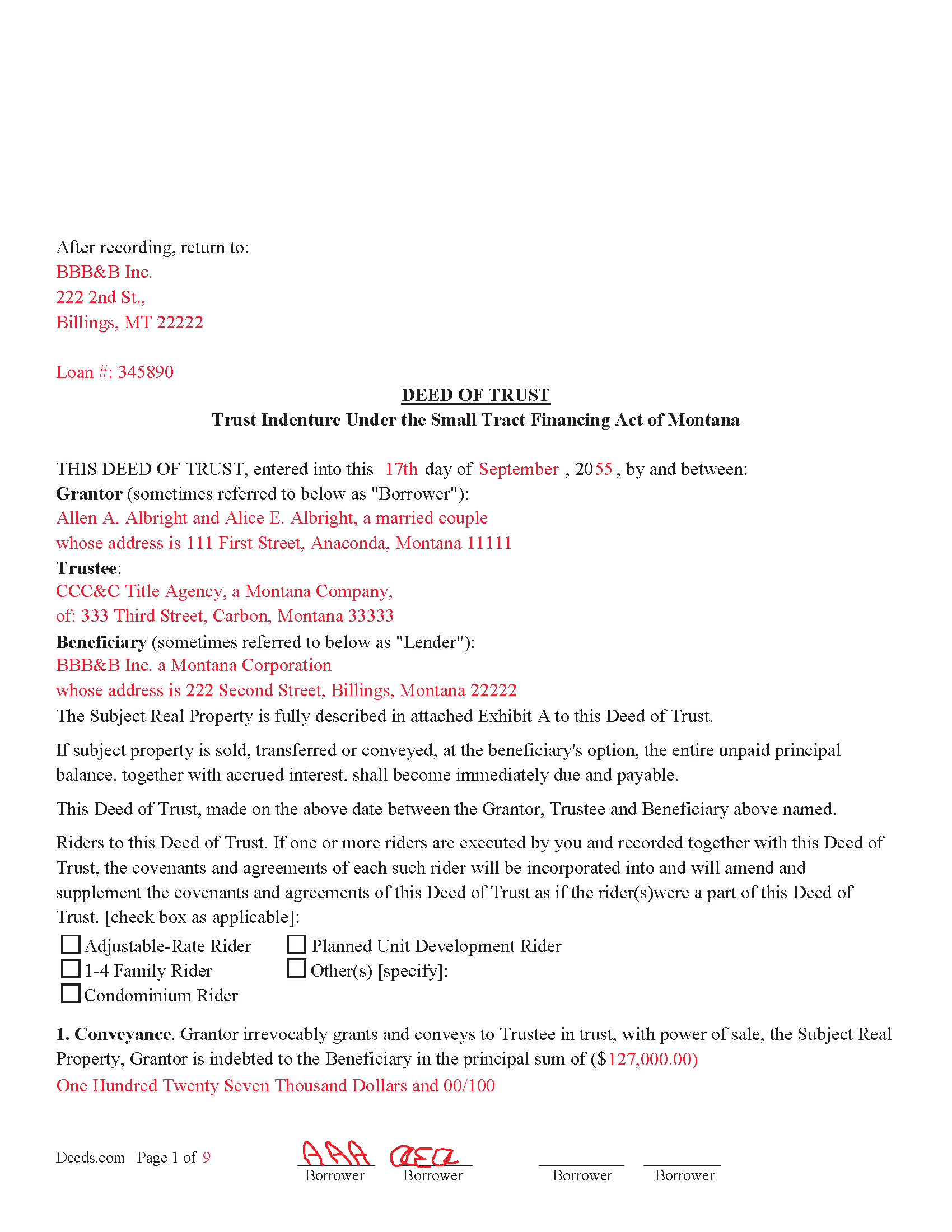

Stillwater County Completed Example of the Deed of Trust Document

Example of a properly completed form for reference.

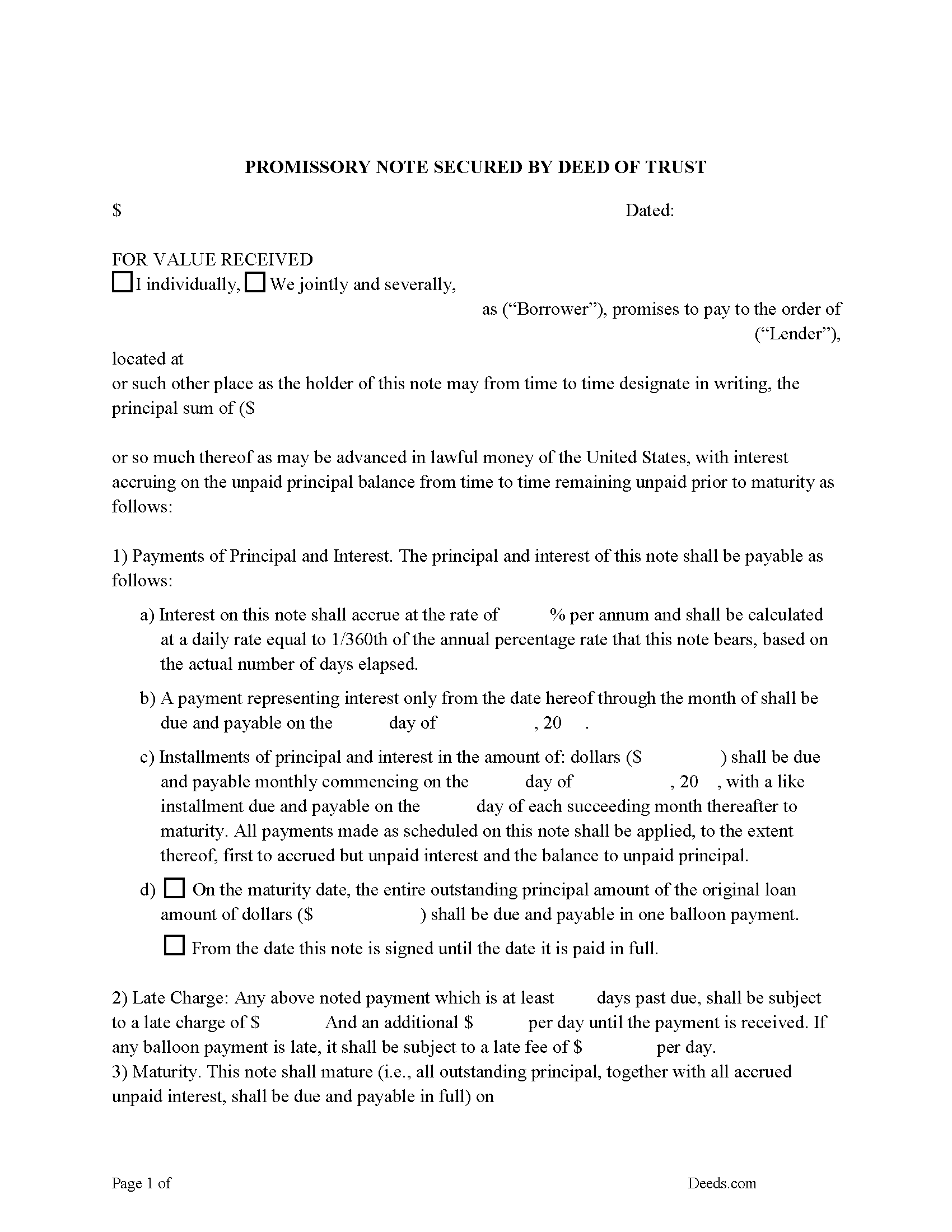

Stillwater County Promissory Note Form

Note that is secured by the Deed of Trust document.

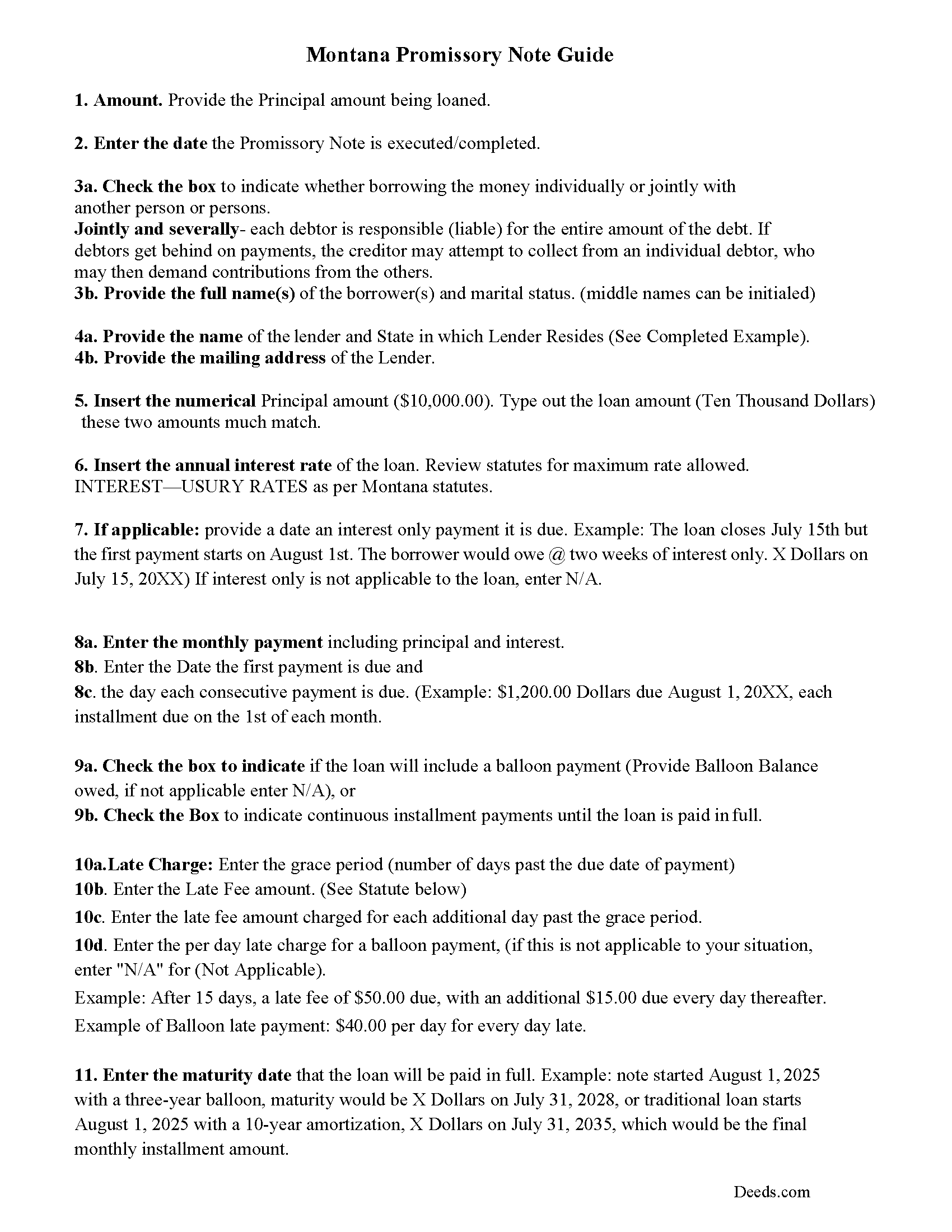

Stillwater County Promissory Note Guidelines

Line by line guide explaining every blank on the form.

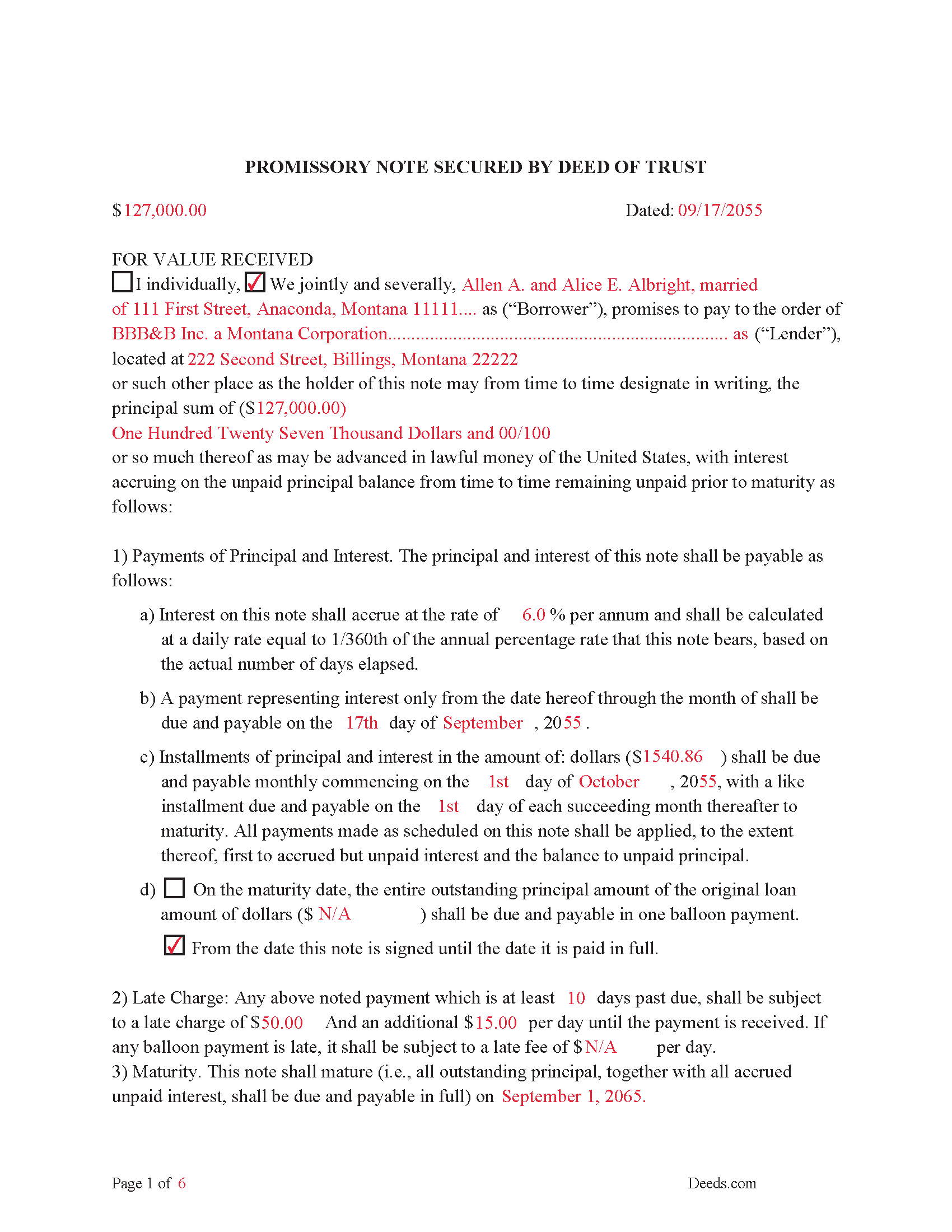

Stillwater County Completed Example of the Promissory Note Document

Example of a properly completed form for reference.

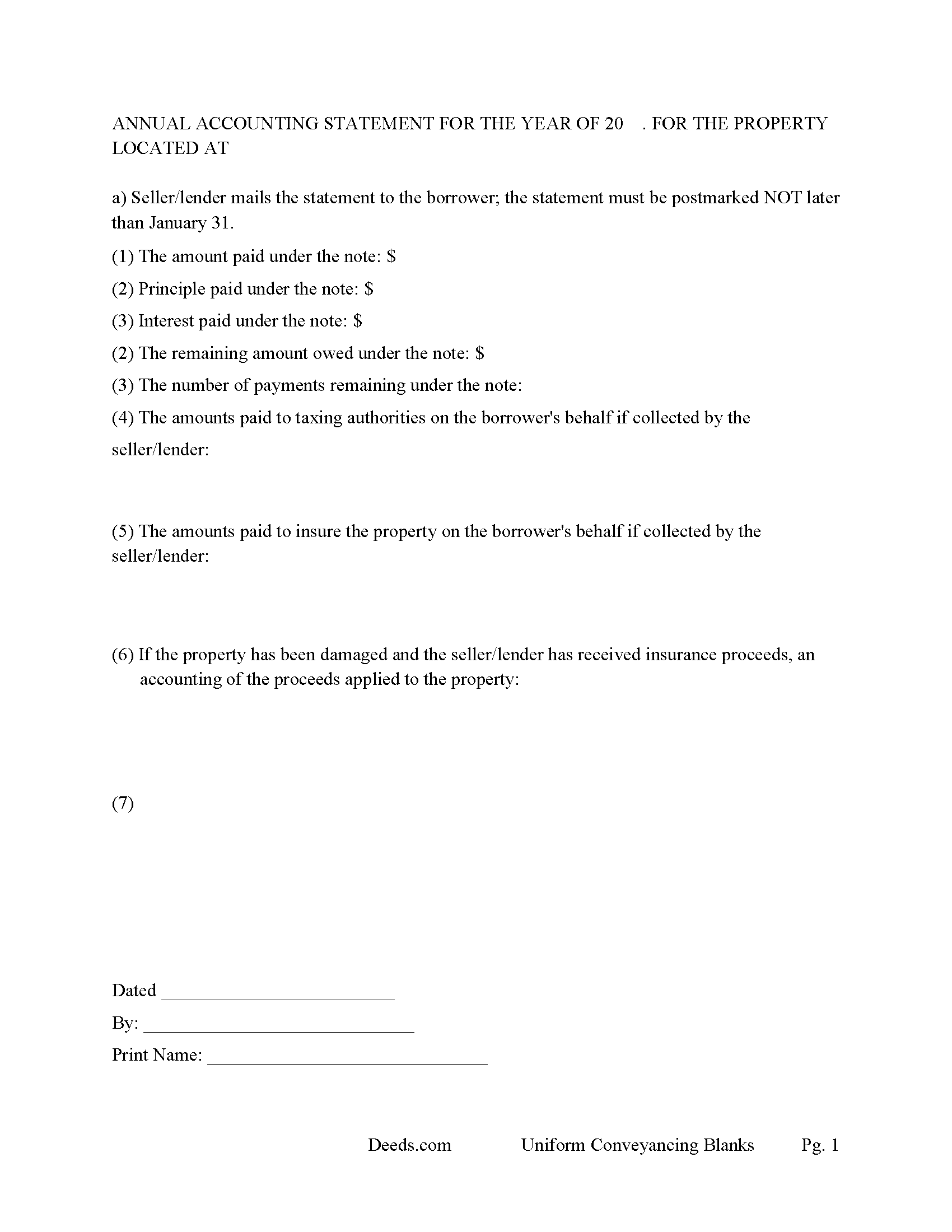

Stillwater County Annual Accounting Statement Form

Fill in the blank Deed of Trust and Promissory Note form formatted to comply with all Montana recording and content requirements.

All 7 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Montana and Stillwater County documents included at no extra charge:

Where to Record Your Documents

Stillwater County Clerk / Recorder

Columbus, Montana 59019

Hours: 8:00 to 12:00 & 1:00 to 5:00 Mon-Fri

Phone: (406) 322-8000

Recording Tips for Stillwater County:

- Recorded documents become public record - avoid including SSNs

- Check margin requirements - usually 1-2 inches at top

- Request a receipt showing your recording numbers

- Mornings typically have shorter wait times than afternoons

Cities and Jurisdictions in Stillwater County

Properties in any of these areas use Stillwater County forms:

- Absarokee

- Columbus

- Fishtail

- Nye

- Park City

- Rapelje

- Reed Point

Hours, fees, requirements, and more for Stillwater County

How do I get my forms?

Forms are available for immediate download after payment. The Stillwater County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Stillwater County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Stillwater County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Stillwater County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Stillwater County?

Recording fees in Stillwater County vary. Contact the recorder's office at (406) 322-8000 for current fees.

Questions answered? Let's get started!

A Deed of Trust with Trust Indenture Under the Small Tract Financing Act of Montana is the preferred form of financing in Montana for properties not exceeding 40 acres and under $500,000.00 in financing.

71-1-302 Policy- Because the financing of homes and business expansion is essential to the development of the state of Montana and because financing of homes and business expansion, usually involving areas of real estate of not more than 40 acres, has been restricted by the laws relating to mortgages of real property and because more financing of homes and business expansion is available if the parties can use security instruments and procedures not subject to all the provisions of the mortgage laws, it is the public policy of the state of Montana to permit the use of trust indentures for estates in real property of not more than 40 acres as provided in this part.

This form includes the Power of Sale clause, which allows for a non-judicial foreclosure, saving time and expense, in general:

Non-judicial foreclosure takes (130-180 days) compared to @1 year -- judicial foreclosure

In a non-judicial foreclosure Borrower has no right of redemption vs. an additional year beyond a judicial foreclosure.

Typically, no frivolous lawsuits filed to slow down a non-judicial foreclosure vs. common in a judicial foreclosure.

Typically, no deficiency judgement upon completion of sale in a non-judicial foreclosure vs. deficiency judgment used in judicial foreclosure.

71-1-304 Trust indentures authorized -- power of sale for breach in trustee

(1) A transfer in trust of an interest in real property of an area not exceeding 40 acres may be made to secure the performance of an obligation of a grantor or any other person named in the indenture to a beneficiary. However, a trust indenture may not be substituted for a mortgage that was in existence on March 5, 1963.

(2) When a transfer in trust of an interest in real property is made to secure the performance of the obligation referred to in subsection (1), a power of sale is conferred upon the trustee to be exercised after a breach of the obligation for which the transfer is security.

(3) A trust indenture executed in conformity with this part may be foreclosed by advertisement and sale in the manner provided in this part or, at the option of the beneficiary, by judicial procedure as provided by law for the foreclosure of mortgages on real property. The power of sale may be exercised by the trustee without express provision in the trust indenture.

(4) If a trust indenture states that the real property involved does not exceed 40 acres, the statement is binding upon all parties and conclusive as to compliance with the provisions of this part relative to the power to make a transfer, trust, and power of sale.

If the parameters of the trust indenture are not met (example: the subject property is 50 acres or $600.000.00) then it converts to a mortgage and treated as mortgage in foreclosure.

71-1-305 Trust indenture considered to be mortgage on real property A trust indenture is deemed to be a mortgage on real property and is subject to all laws relating to mortgages on real property except to the extent that such laws are inconsistent with the provisions of this part, in which event the provisions of this part shall control. For the purpose of applying the mortgage laws, the grantor in a trust indenture is deemed the mortgagor and the beneficiary is deemed the mortgagee.

71-1-321 Deeds of trust and trust deeds not invalidated The Small Tract Financing Act of Montana does not invalidate or preclude the use in this state of instruments, sometimes denominated deeds of trust, trust deeds, or trust indentures, which are not executed in conformity with this part, but in which a conveyance for security purposes is made to a trustee or trustees for the benefit of one or more lenders. Such instruments are considered to be mortgages and are subject to all laws relating to mortgages on real property. Every such instrument, recorded as prescribed by law, from the time it is filed for record is constructive notice of its contents to subsequent purchasers and encumbrancers.

(Montana DOT Package includes forms, guidelines, and completed examples) For use in Montana only.

Important: Your property must be located in Stillwater County to use these forms. Documents should be recorded at the office below.

This Deed of Trust and Promissory Note meets all recording requirements specific to Stillwater County.

Our Promise

The documents you receive here will meet, or exceed, the Stillwater County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Stillwater County Deed of Trust and Promissory Note form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4591 Reviews )

April J.

September 14th, 2021

The example and guide were invaluable! Easy to use and easy to fill out.

Thank you!

David R.

January 11th, 2019

Great source of all required legal documents and supplements.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Leonard N.

January 21st, 2021

Nice and clear. Can't wait to process the completed documents at the Recorder's Office

Thank you!

Gladys F.

September 21st, 2020

The process was very friendly and easy to use. I appreciated the status updates as well as clear instructions on what was needed to get the file ready for recording.

Thank you!

Caroline M. L.

January 3rd, 2020

Hopefully, I am on the correct site to transfer ownership of a time share to my son. I am a senior, and this site is easy to follow if I am on the correct site. : )

Thank you for your feedback. We really appreciate it. Have a great day!

Lisa J.

November 29th, 2019

Thank you so much for your time.

Thank you!

Haydee P.

November 15th, 2022

Thanks for advertising the forms and sharing to the public for easy access. I have been looking for a lawyer to process the papers but did not realize that I can do it myself until I googled the information. I found your website. Thanks again

Thank you for your feedback. We really appreciate it. Have a great day!

Gregory K.

October 18th, 2021

Easy to work with. Fair price. Nice, efficient service. Would definitely use Deeds.com again for any legal documents.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mary B.

February 8th, 2023

Your information was orderly and very clear and helpful. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Harold F.

April 24th, 2020

You're a creditable company that performs well and provides what I requested.

Thank you!

David S.

October 20th, 2020

I downloaded the quit claim deed form and saved it on my computer. I opened it with Adobe and filled it out. The space for the legal description was too small (2 lines only) which did not allow enough room for the long property description that I had.

Thank you for your feedback. We really appreciate it. Have a great day!

Anne W.

April 8th, 2021

3 stars for ease of use on the website. Subracted 2 stars for the forms being PDFs that you are unable to complete online, they have to be printed. Very inefficient.

Thank you for your feedback. We really appreciate it. Have a great day!

Evan W.

February 2nd, 2021

Quick service. Thank you

Thank you!

DeBe W.

January 27th, 2024

Thanks for the quick response. That really helps when you're under a time deadline.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Kevin M.

May 14th, 2019

All I can say is WOW. They were so fast and professional. I received my copy of my deed that same day I requested it. There was some confusion on my part but within minutes it was explained.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!