Fillmore County Deed of Full Reconveyance for Deed of Trust Form

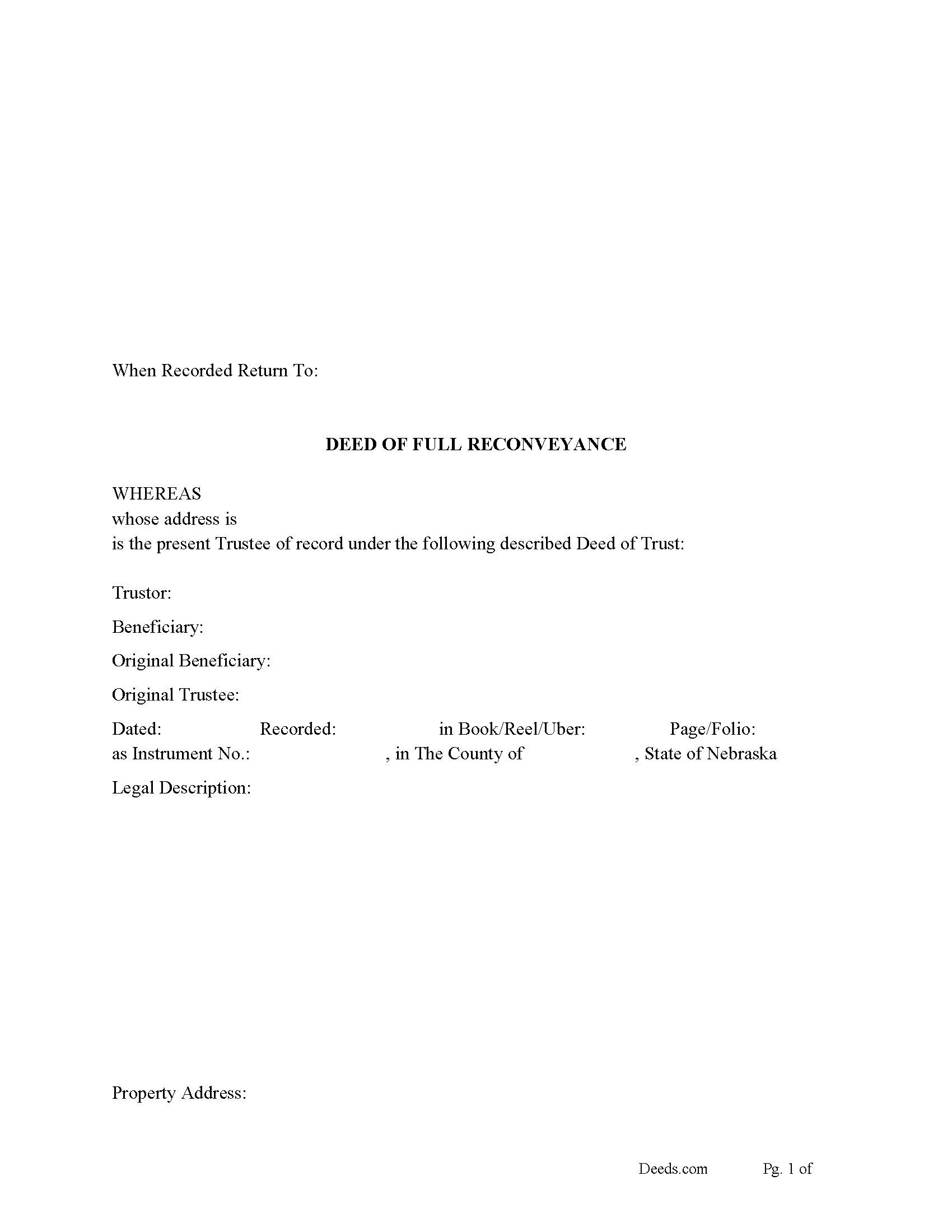

Fillmore County Deed of Full Reconveyance Form

Fill in the blank form formatted to comply with all recording and content requirements.

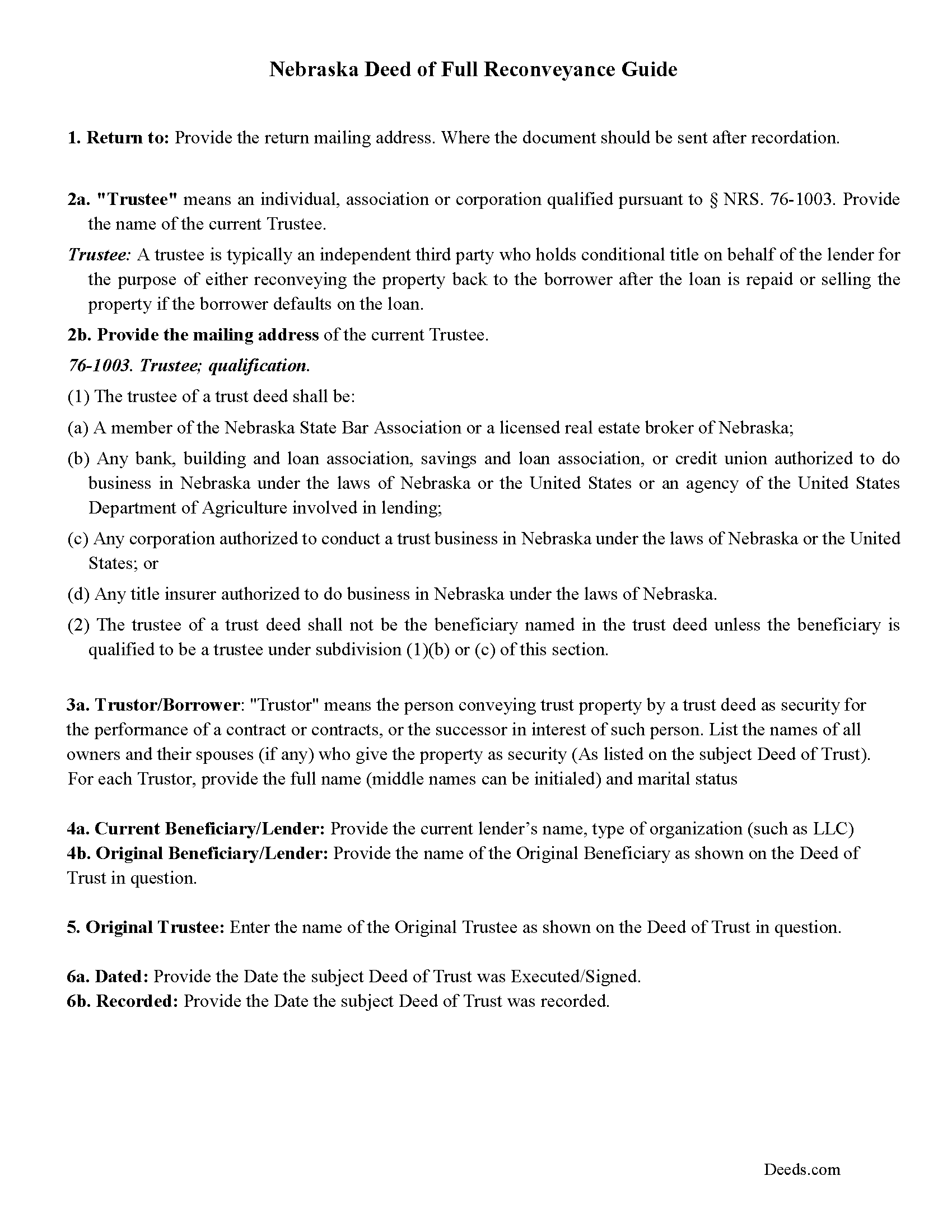

Fillmore County Deed of Full Reconveyance Guide

Line by line guide explaining every blank on the form.

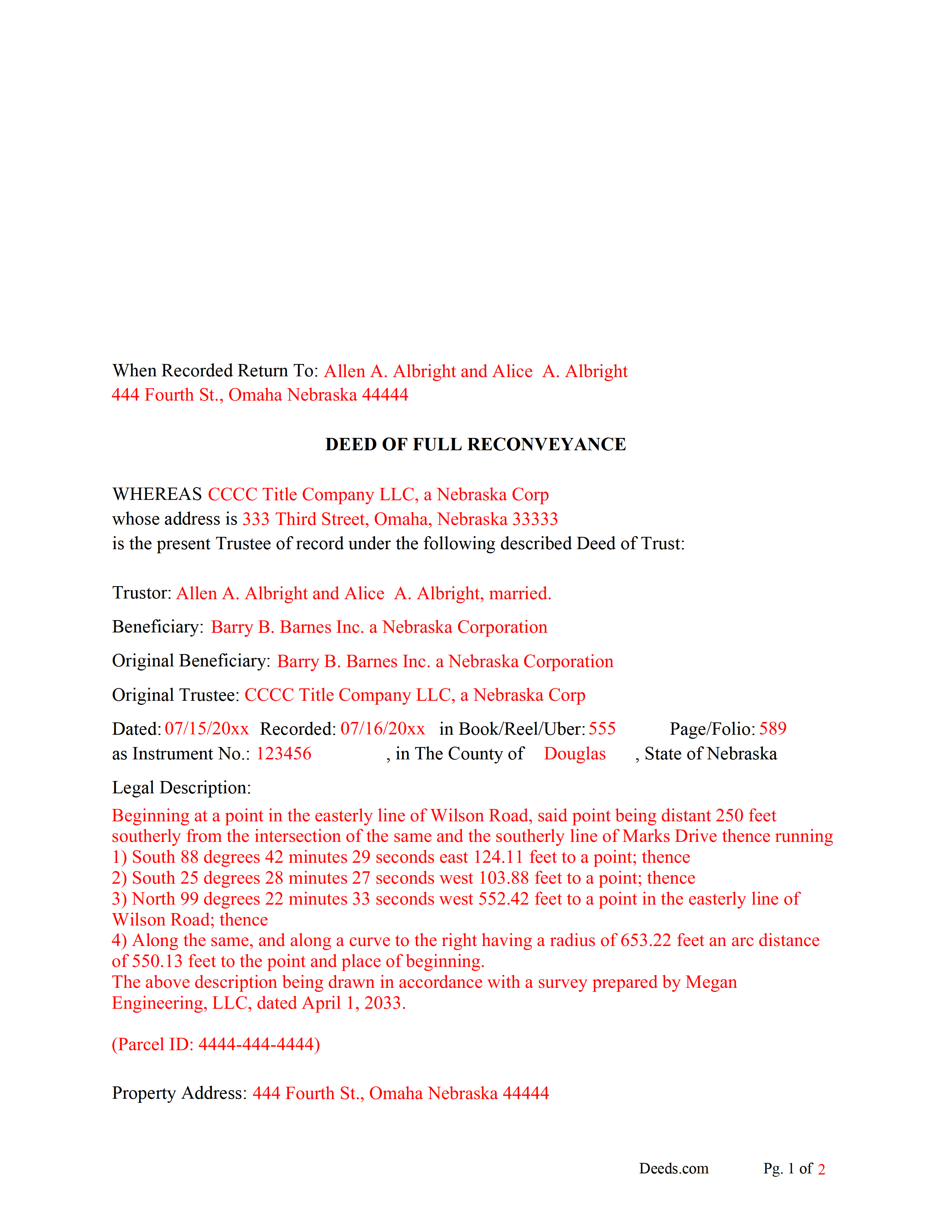

Fillmore County Completed Example of the Deed of Full Reconveyance Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nebraska and Fillmore County documents included at no extra charge:

Where to Record Your Documents

Fillmore County Register of Deeds/Clerk

Geneva, Nebraska 68361

Hours: 8:00am to 4:30pm M-F

Phone: (402) 759-4931

Recording Tips for Fillmore County:

- Double-check legal descriptions match your existing deed

- Leave recording info boxes blank - the office fills these

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Fillmore County

Properties in any of these areas use Fillmore County forms:

- Exeter

- Fairmont

- Geneva

- Grafton

- Milligan

- Ohiowa

- Shickley

- Strang

Hours, fees, requirements, and more for Fillmore County

How do I get my forms?

Forms are available for immediate download after payment. The Fillmore County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Fillmore County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Fillmore County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Fillmore County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Fillmore County?

Recording fees in Fillmore County vary. Contact the recorder's office at (402) 759-4931 for current fees.

Questions answered? Let's get started!

When a Deed of Trust has been paid in full the beneficiary/lender is responsible to deliver (a reconveyance in recordable form duly executed by the trustee) to the trustor/borrower. (Any beneficiary who fails to deliver such a reconveyance within sixty days after receipt of such written request shall be liable to the trustor or his or her successor in interest, as the case may be, for five thousand dollars or actual damages resulting from such failure, whichever is greater.) (76-1014.01)

(If a trustee fails or refuses to execute a reconveyance required by the beneficiary, the beneficiary shall appoint a successor trustee that will execute a reconveyance.) (76-1014.01)

This form can be used by the original beneficiary/lender or current beneficiary/lender- original trustee or current trustee,

(Nebraska DOFR Package includes form, guidelines, and completed example) For use in Nebraska only.

Important: Your property must be located in Fillmore County to use these forms. Documents should be recorded at the office below.

This Deed of Full Reconveyance for Deed of Trust meets all recording requirements specific to Fillmore County.

Our Promise

The documents you receive here will meet, or exceed, the Fillmore County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Fillmore County Deed of Full Reconveyance for Deed of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Nora P.

January 10th, 2019

I'm typing along and suddenly I can't fit anything more into the page and there's plenty of room. This is my 2nd time using this site. No problem the first time years ago. Now it's an issue, looks like I'll need a typewriter to finish the form. Where do I find a typewriter?!! I can't complete the legal description!

Thanks for your feedback Nora. If you are unable to find a typewriter you can always do as the guide suggests and use the included exhibit page.

Jeffrey T.

December 1st, 2022

First Time User here. Simple and easy. Delivered Deed in excellent time. Sure beats going to the recorder's office.

Thank you for your feedback. We really appreciate it. Have a great day!

Kay Y.

February 27th, 2024

Fast and easy service.

Your words of encouragement and feedback are greatly appreciated. They motivate us to maintain high standards in our service.

Kathyren O.

April 25th, 2019

Very helpful and I will be using your services in the near future. Thank you Kathyren Oleary

Thanks Kathyren, we really appreciate your feedback.

Lisa C.

July 2nd, 2020

Great. Thank you. Received information quickly. Helped out a lot.

Thank you!

John Z.

November 5th, 2021

Very easy to use. Straight forward. Am glad I found the tools to process an important document of property ownership. Thanks much. Will recommend to friends and family.

Thank you!

Willie T.

March 8th, 2019

Great

Thank you for your feedback. We really appreciate it. Have a great day!

ziad k.

June 4th, 2024

FIRST TIME USER EXCELENT SERVICE.

Thank you for your feedback. We really appreciate it. Have a great day!

Susan N.

August 28th, 2022

Easy to use.

Thank you!

joni e.

October 25th, 2019

It was everything that I needed. The county clerk's office kept telling me to get a lawyer for this form, but I didn't need one. Saved myself hundreds of dollars. I've used them many times.

Thank you for your feedback. We really appreciate it. Have a great day!

Vickie G.

January 14th, 2019

The form and instruction were perfect. Thank you.

Thank You Vickie!

Matt G.

May 10th, 2019

The process went smoothly and gave me what I needed. As an improvement, I would recommend that deeds.com sends an email when there is a new message in the portal. I didn't get any updates and had to log in to track progress each time.

Thank you for your feedback. We really appreciate it. Have a great day!

Emanuel W.

December 16th, 2021

Excellent service! We surely use again

Thank you for your feedback. We really appreciate it. Have a great day!

Bethany F.

April 6th, 2022

quick and easy to use

Thank you!

Barbara P.

August 13th, 2024

So easy and fast!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!