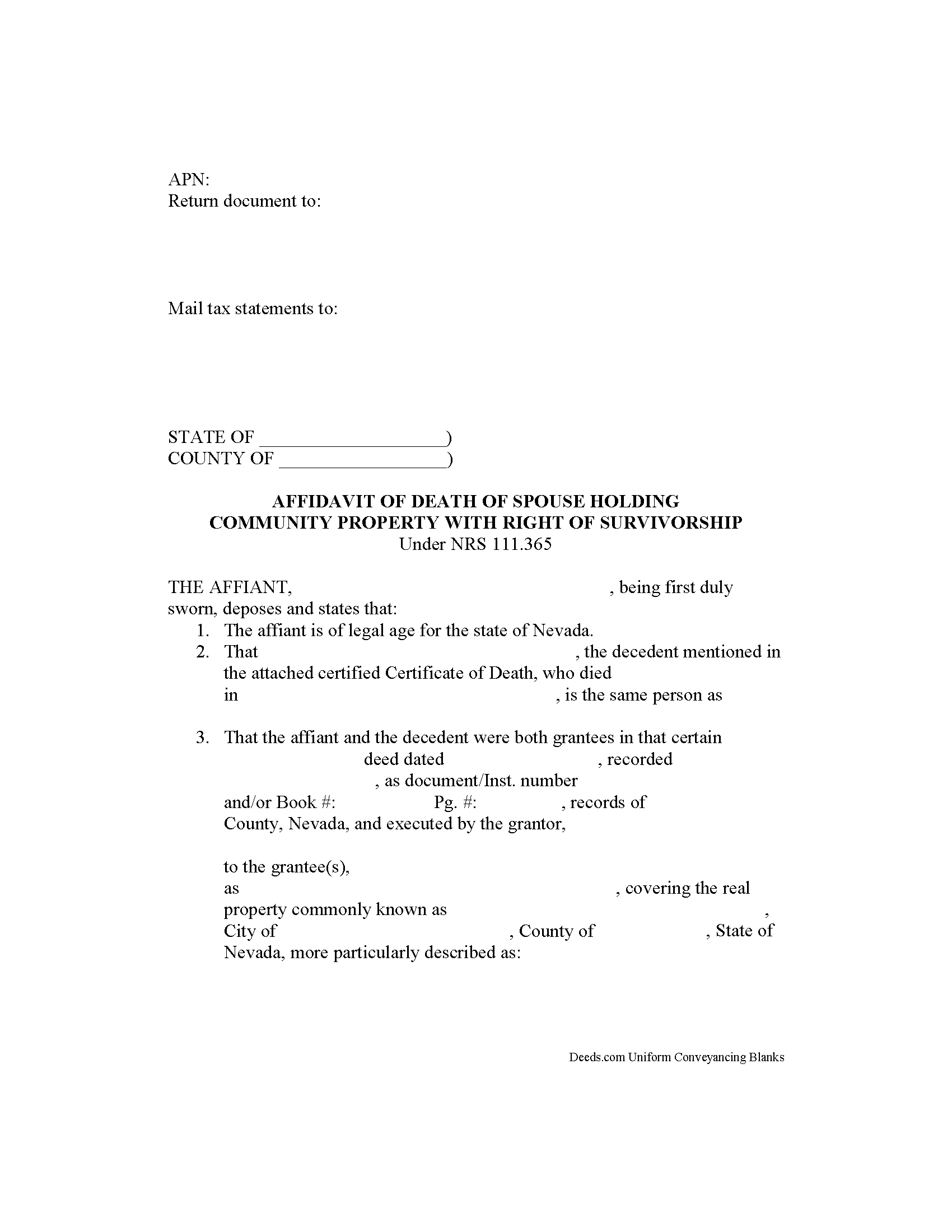

Clark County Affidavit of Death of Spouse Holding Community Property Form

Clark County Affidavit of Death Form

Fill in the blank form formatted to comply with all recording and content requirements.

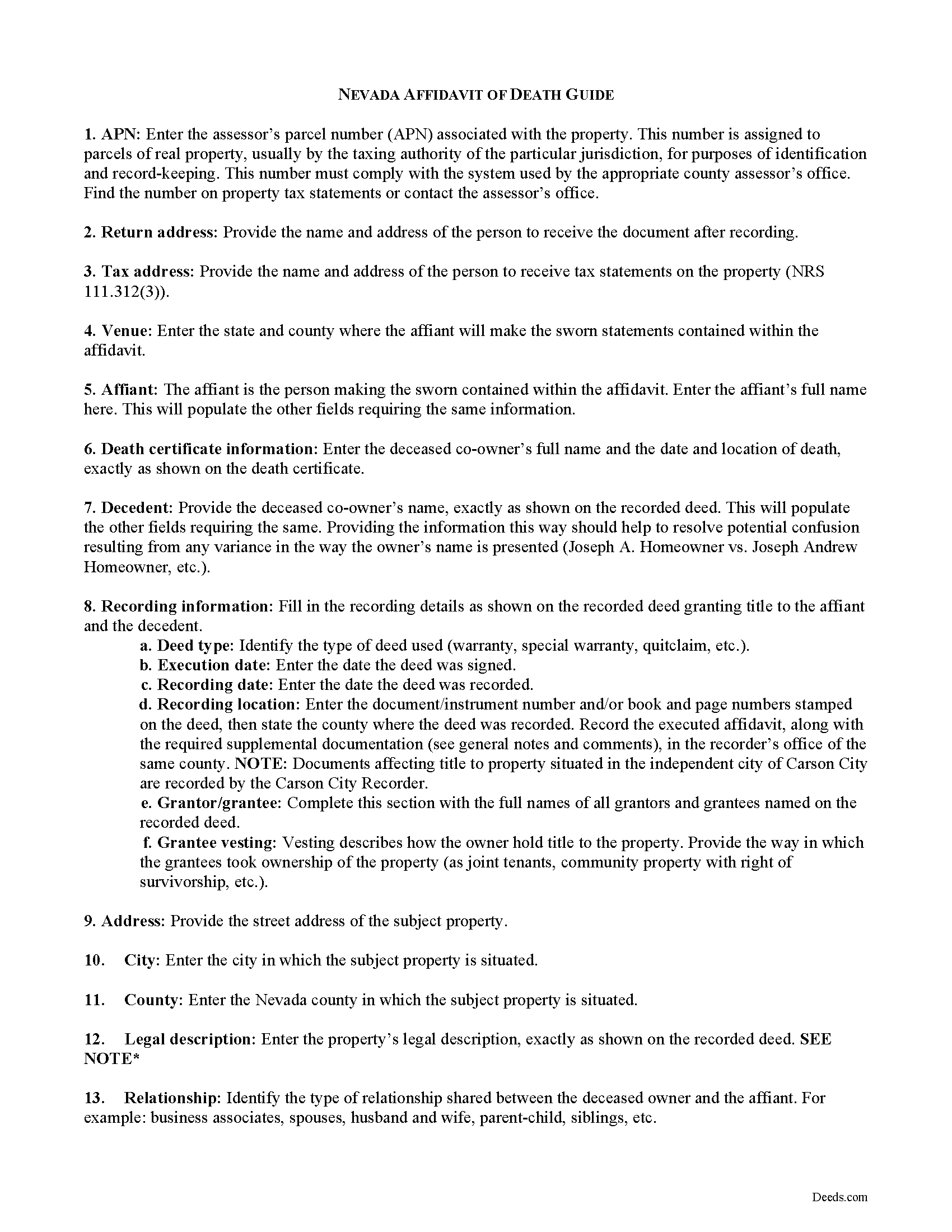

Clark County Affidavit Guide

Line by line guide explaining every blank on the form.

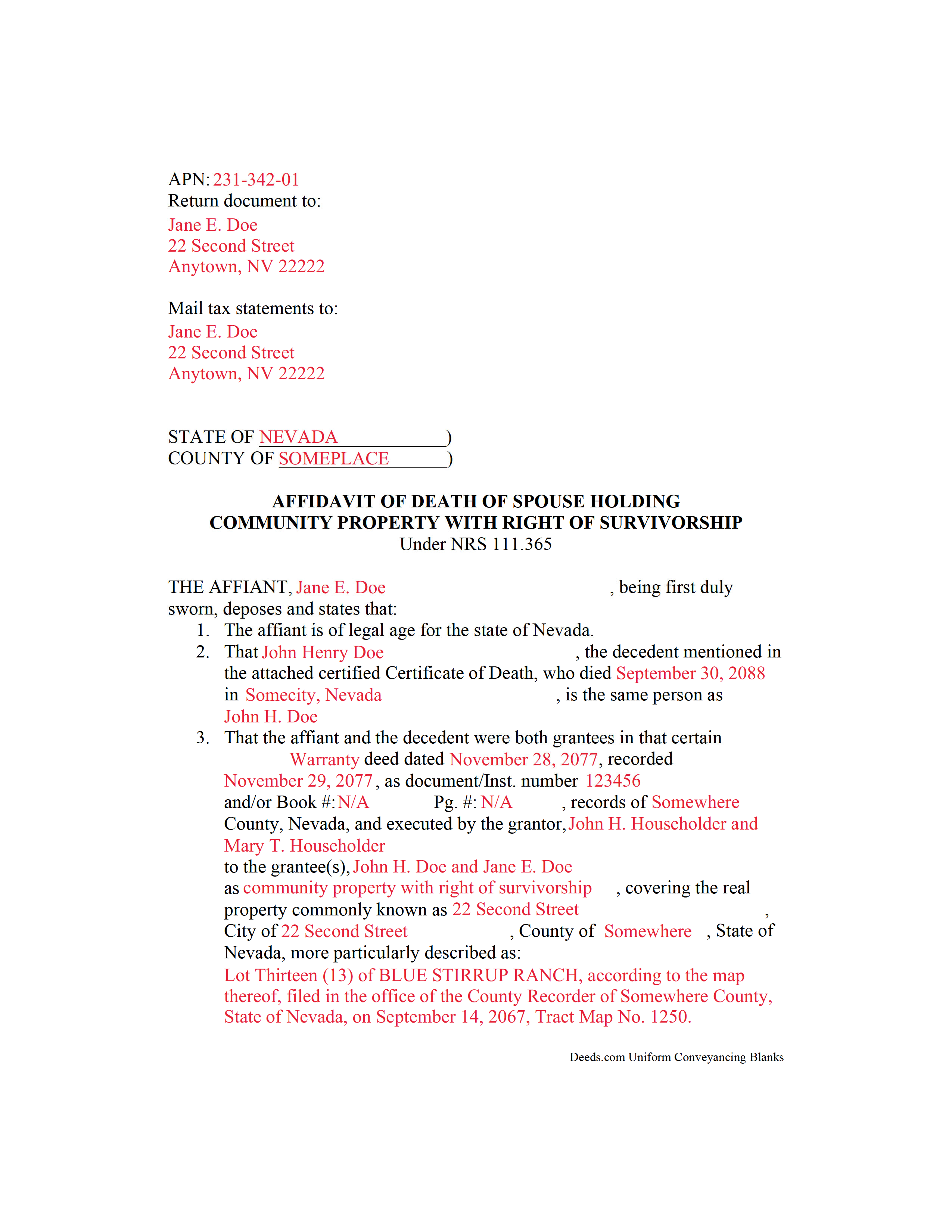

Clark County Completed Example of the Affidavit of Death Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nevada and Clark County documents included at no extra charge:

Where to Record Your Documents

Clark County Recorder's Office

Las Vegas, Nevada 89106-1510

Hours: Monday through Friday 8:00 AM to 5:00 PM

Phone: (702) 455-4336

Northwest Branch Office

Las Vegas, Nevada 89129

Hours: Monday through Thursday 8am - 5pm. Closed 12:00 - 12:30pm

Phone: (702) 455-4336

Henderson Branch

Henderson, Nevada 89015

Hours: Monday through Thursday 8am - 5pm. Closed 12:00 - 12:30pm

Phone: (702) 455-4336

Recording Tips for Clark County:

- Recording fees may differ from what's posted online - verify current rates

- Bring extra funds - fees can vary by document type and page count

- Recording early in the week helps ensure same-week processing

Cities and Jurisdictions in Clark County

Properties in any of these areas use Clark County forms:

- Blue Diamond

- Boulder City

- Bunkerville

- Cal Nev Ari

- Coyote Springs

- Henderson

- Indian Springs

- Jean

- Las Vegas

- Laughlin

- Mesquite

- Moapa

- Moapa Valley

- Nellis Afb

- North Las Vegas

- Searchlight

- Sloan

- The Lakes

Hours, fees, requirements, and more for Clark County

How do I get my forms?

Forms are available for immediate download after payment. The Clark County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Clark County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Clark County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Clark County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Clark County?

Recording fees in Clark County vary. Contact the recorder's office at (702) 455-4336 for current fees.

Questions answered? Let's get started!

Nevada Affidavit of Death of Spouse Holding Community Property with Right of Survivorship

The requirements for an affidavit of death in Nevada are contained in NRS111.365.

For Nevada real estate owned by spouses as community property with right of survivorship, the death of one spouse means that his or her property rights are conveyed to the remaining spouse, without the need for probate distribution. This transfer technically happens "as a function of law" when one owner dies.

Even so, surviving spouses must initiate the process by recording an affidavit of death, accompanied by a certified copy of the death certificate, to terminate all title to or interest in real property of the deceased spouse. After the affidavit is recorded in the office of the recorder of the county or counties in which the real property is located, the deceased owner's rights are presumed to be terminated, and vested solely in the surviving spouse.

The days and weeks following the death of a family member are often difficult, but timely recording of the affidavit of death is important. It preserves a clear chain of title, which makes future conveyances of the property less complicated. In addition, updated records ensure that property tax bills and assessments are sent to the correct recipients.

(Nevada AOD of SHCP Package includes form, guidelines, and completed example)

Important: Your property must be located in Clark County to use these forms. Documents should be recorded at the office below.

This Affidavit of Death of Spouse Holding Community Property meets all recording requirements specific to Clark County.

Our Promise

The documents you receive here will meet, or exceed, the Clark County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Clark County Affidavit of Death of Spouse Holding Community Property form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Juanita B.

November 12th, 2020

Very easy and fast transaction. Thank you for complete set of forms needed for property transfer.

Thank you for your feedback. We really appreciate it. Have a great day!

Greg S.

August 19th, 2022

The Beneficiary Deed is easy to fill out, expecially with the examples/explanations provided. The only recommendation I would make is to state that the Parcel ID and the Assessor's ID are one in the same. I looked everywhere for something that mentions "Assessor's ID" in my paperwork to no avail. Upon calling the Maricopa Assessor's number in Maricopa I was told that they are the same.

Thank you for your feedback. We really appreciate it. Have a great day!

Allan A.

June 5th, 2020

Excellent service, communication and done in a timely fashion. Worth the cost for the convenience and safety

Thank you!

JAMES M.

July 17th, 2023

The forms are just what I needed! Easy to navigate.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

gene h.

July 10th, 2020

Had used website while working as Land Rep for major oil company (retired 2.5 years ago). Recently had need to do some online research and went back to Deeds.com to find needed documents. Same as before, website provides a great service at a great price.

Thank you for your feedback. We really appreciate it. Have a great day!

Marilyn L.

September 3rd, 2020

Good!!

Thank you!

CHARLES H.

December 3rd, 2022

Easy to fill-in forms, easy instructions, worth purchasing

Thank you!

Nello P.

January 4th, 2021

very satisfied, useful, and of great assistance

Thank you!

LIDIA M.

February 3rd, 2021

excellent

Thank you!

Jimmy P.

November 20th, 2024

They sent me everything I would need to do this. Easy purchase -Easy download. Great!! I'll be back here for all my document needs.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Matthew M.

February 15th, 2023

Needed copy of deed in trust. Found info here, paid on line and then printed the docs. Easy to use, no driving to city offices, No parking fees, no waiting in line. Done fast and easy. Love it.

Thank you for your feedback. We really appreciate it. Have a great day!

Susan Mary S.

August 24th, 2020

Thank you for the thorough assortment of forms!

Thank you for your feedback. We really appreciate it. Have a great day!

Joyce H.

August 11th, 2020

I found the site very easy to use and upfront about the cost. I had tried two other sites both of which had hidden costs until after I filled out the forms.

Thank you for your feedback. We really appreciate it. Have a great day!

Christine K.

March 26th, 2021

This site was fast and easy to use. I would highly recommend using them. Thank you Deeds.com!!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Anna S.

July 17th, 2020

You guys are awesome, The service, expertise and quick communication were amazing. I think you guys are charging to little, but you didn't hear that from me. Thank you for making this process quick and easy.

Thank you for your feedback. We really appreciate it. Have a great day!