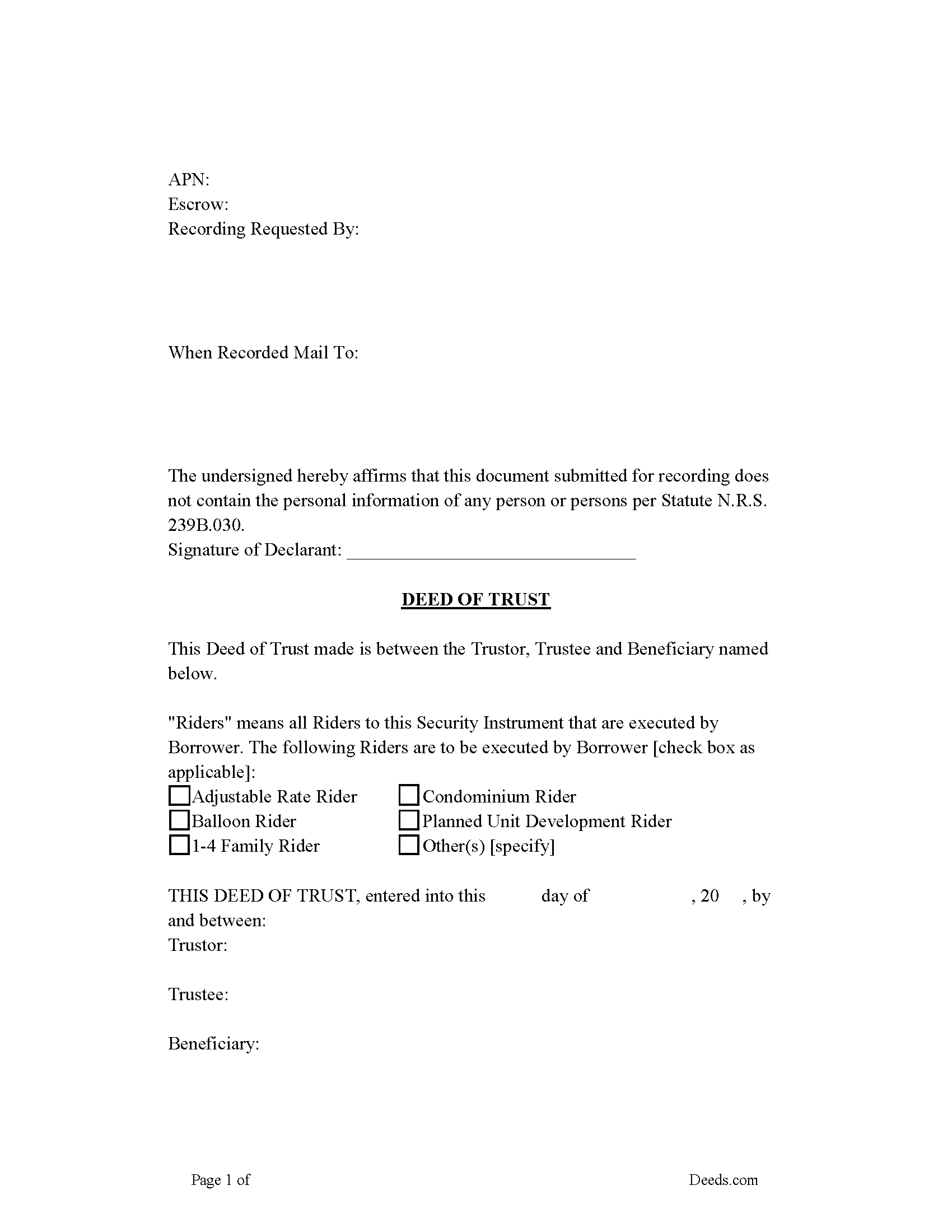

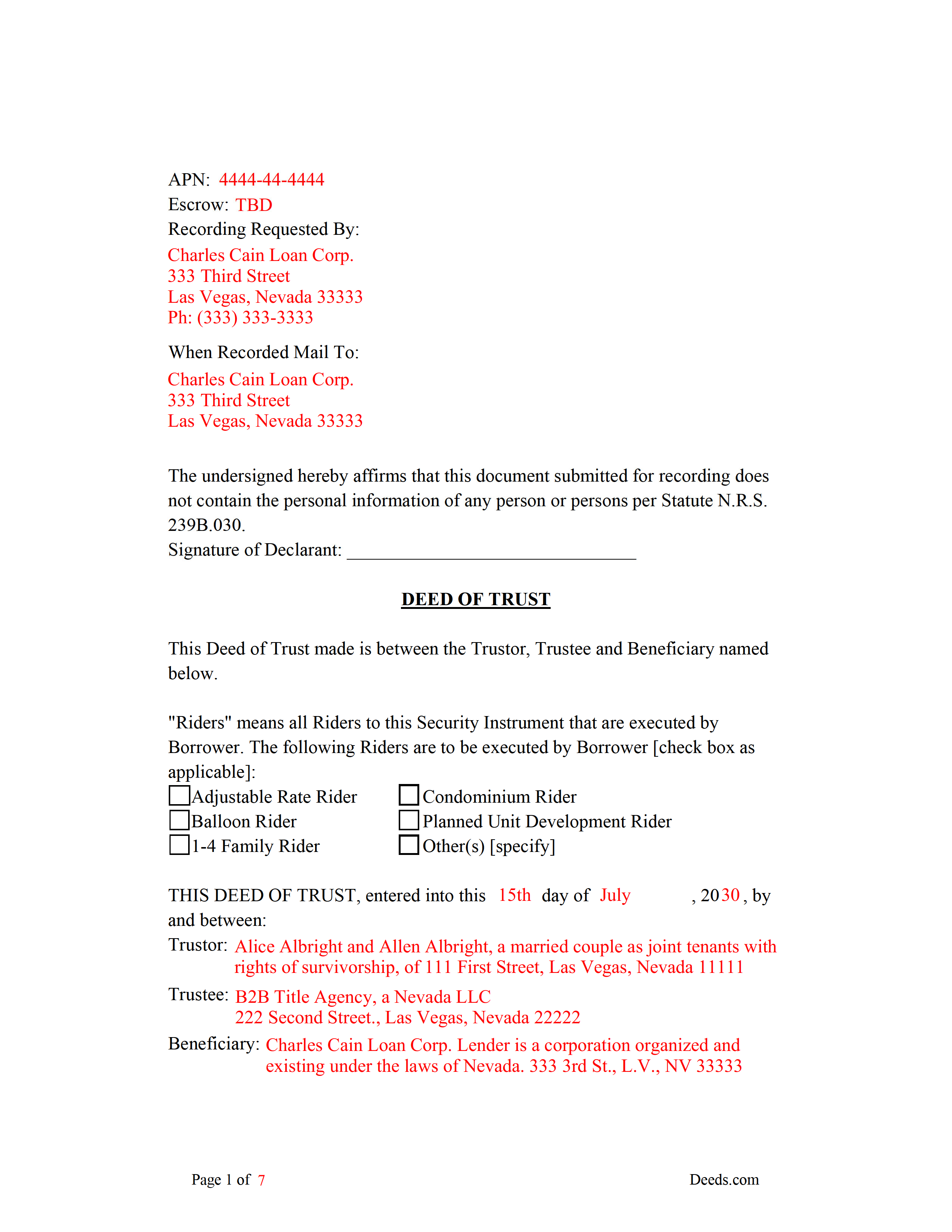

Washoe County Deed of Trust Form

Washoe County Deed of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

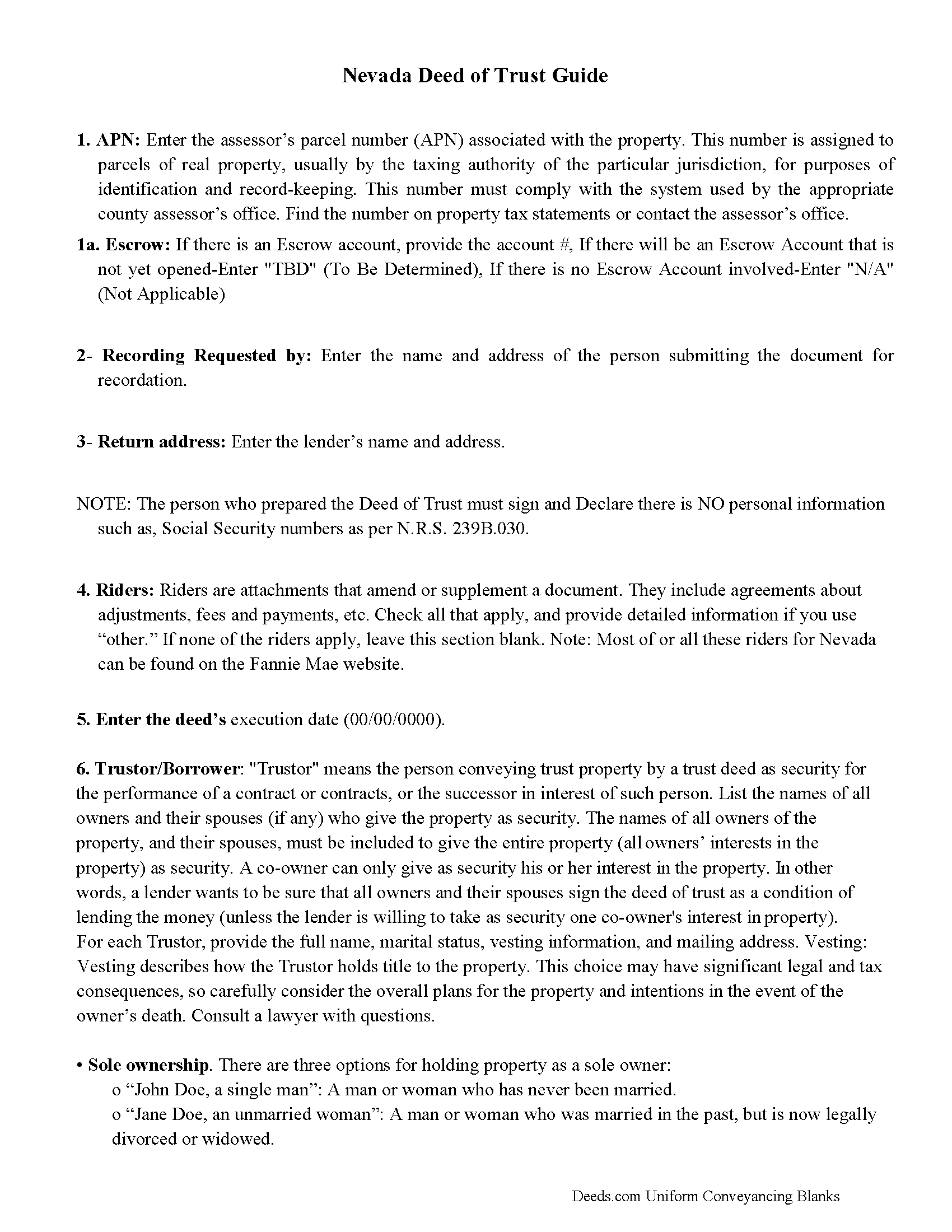

Washoe County Deed of Trust Guidelines

Line by line guide explaining every blank on the form.

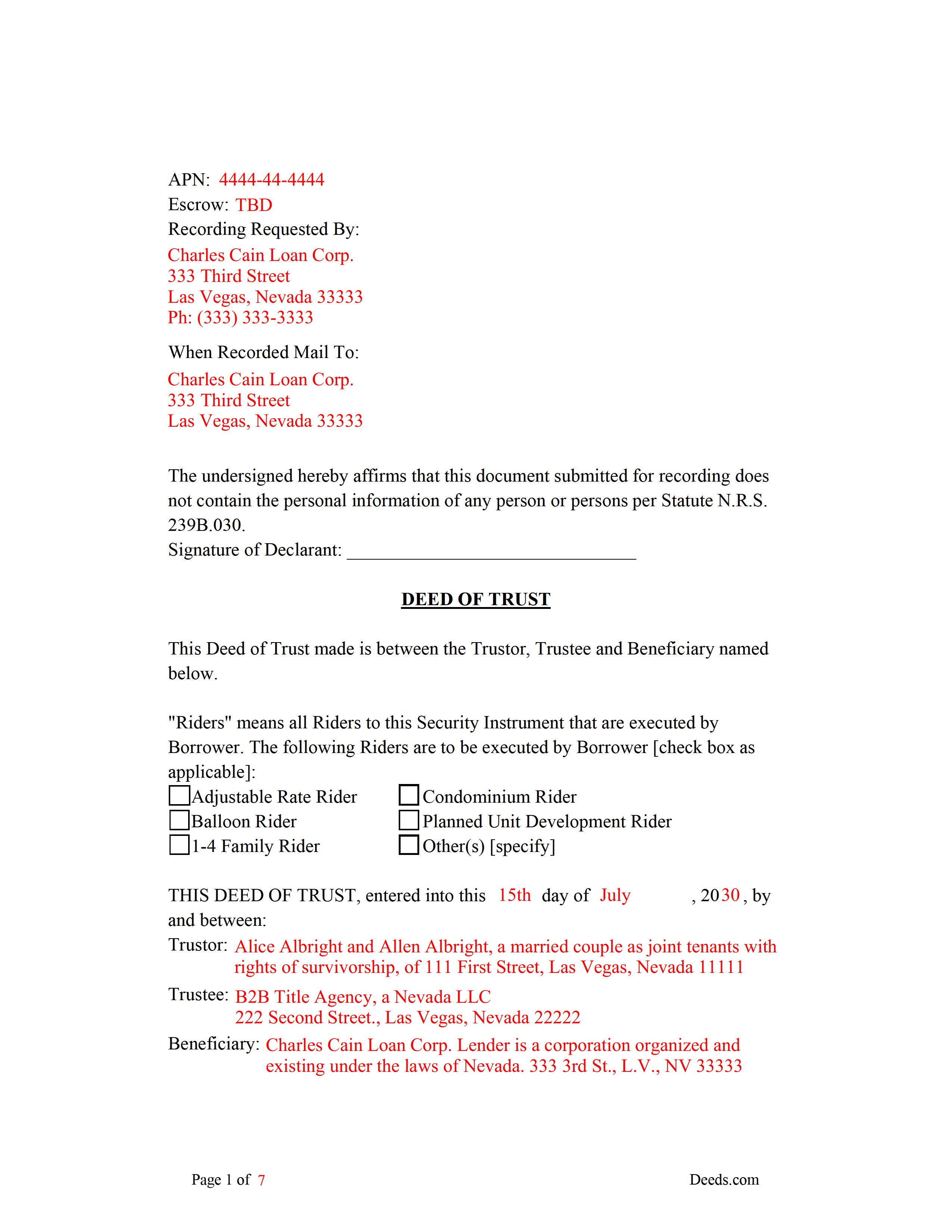

Washoe County Completed Example of the Deed of Trust

Example of a properly completed form for reference.

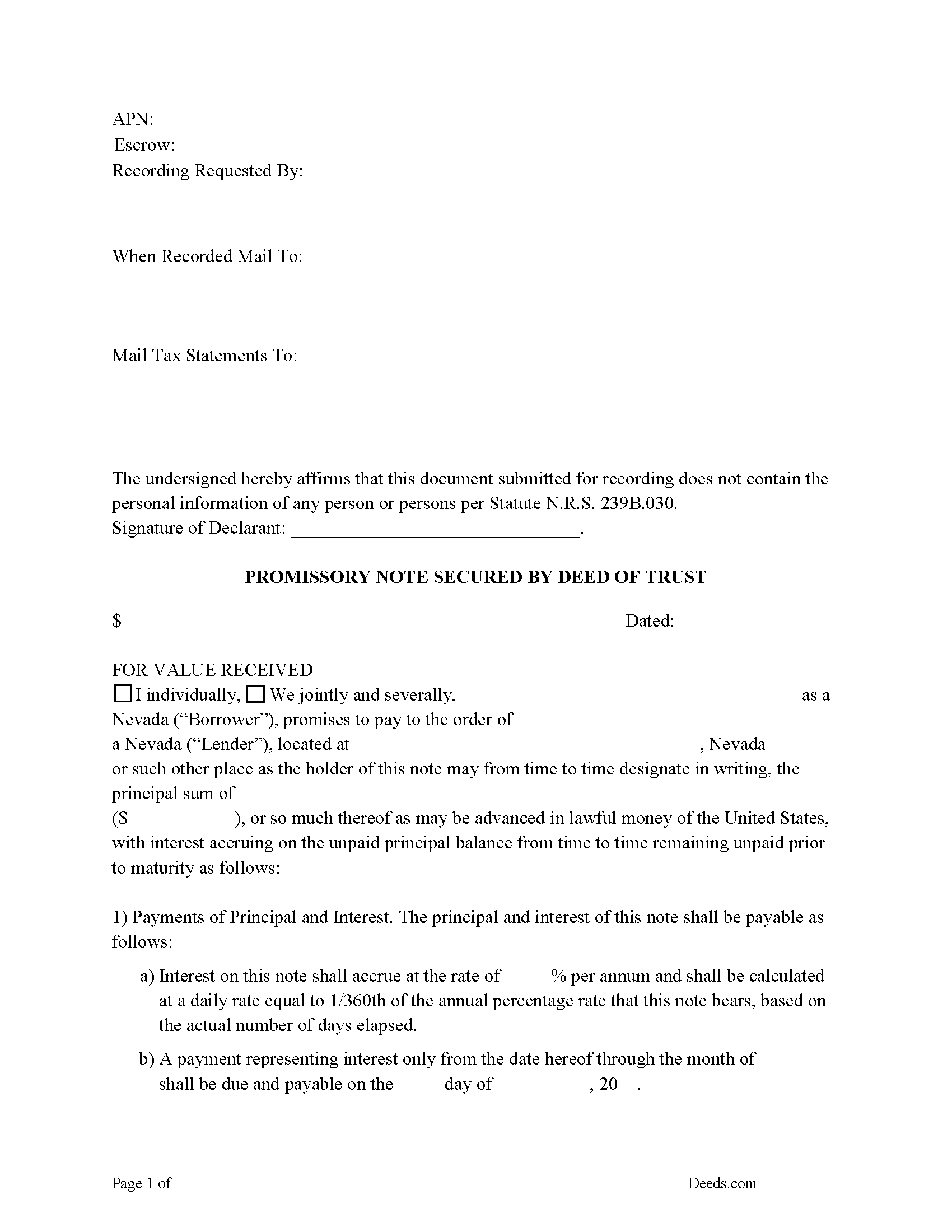

Washoe County Promissory Note Form

Note that is secured by the DOT.

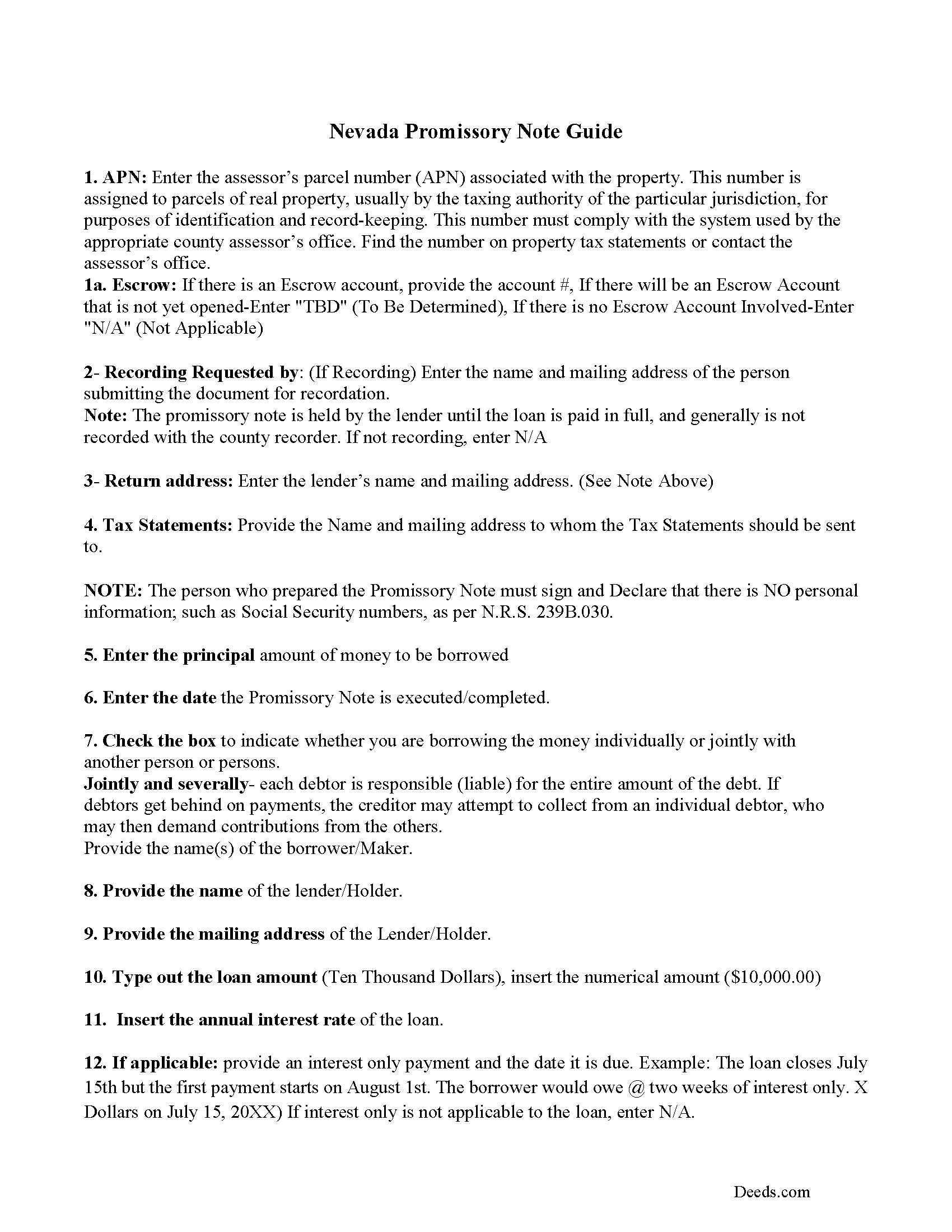

Washoe County Promissory Note Guidelines

Line by line guide explaining every blank on the form.

Washoe County Completed Example of the Promissory Note

This Nevada Promissory Note is filled in and highlighted, showing how the guideline information, can be interpreted into the document.

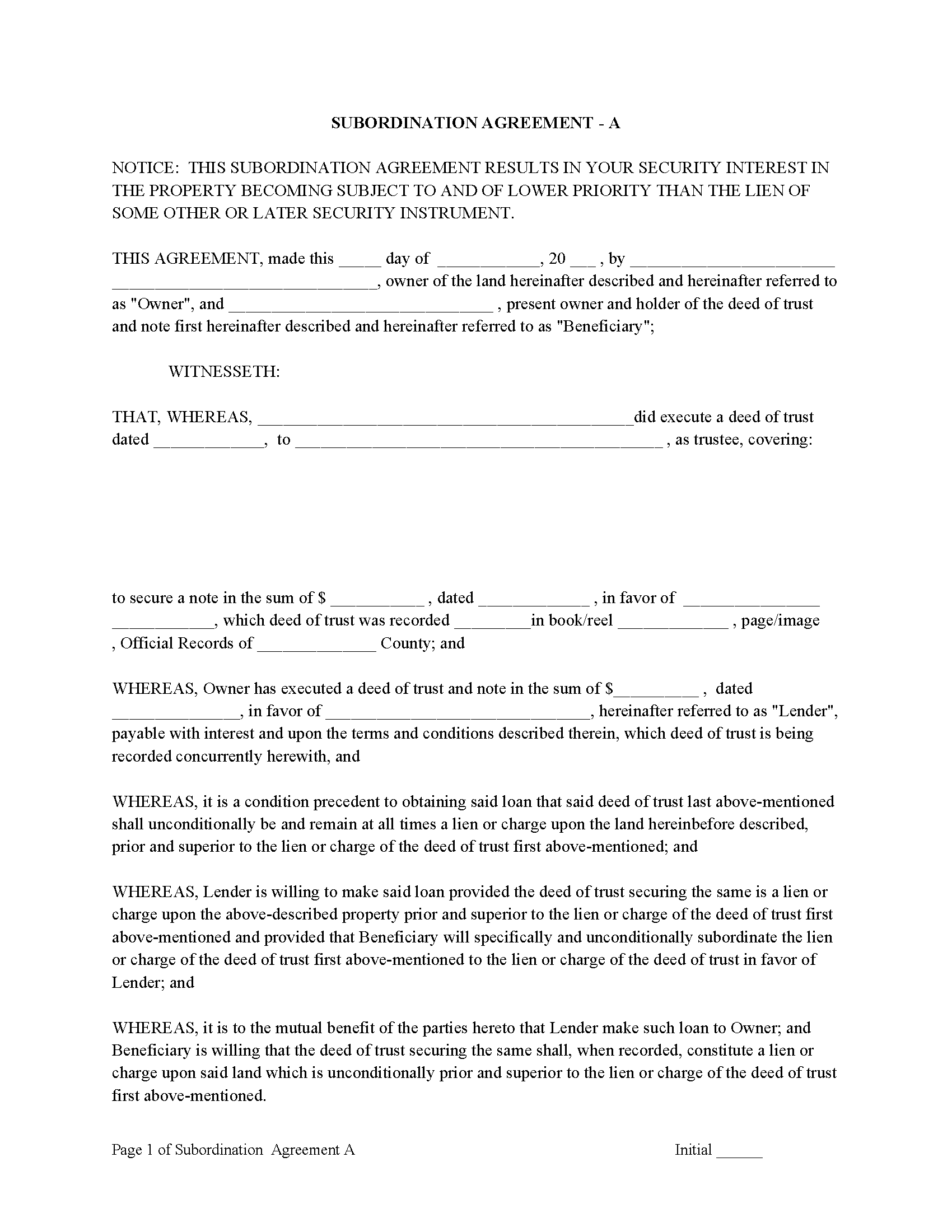

Washoe County Subordination Agreements

Used to place priority on claim of debt. Included are 4 clauses for unique situations. If needed, add to Deed of Trust as an addendum or rider.

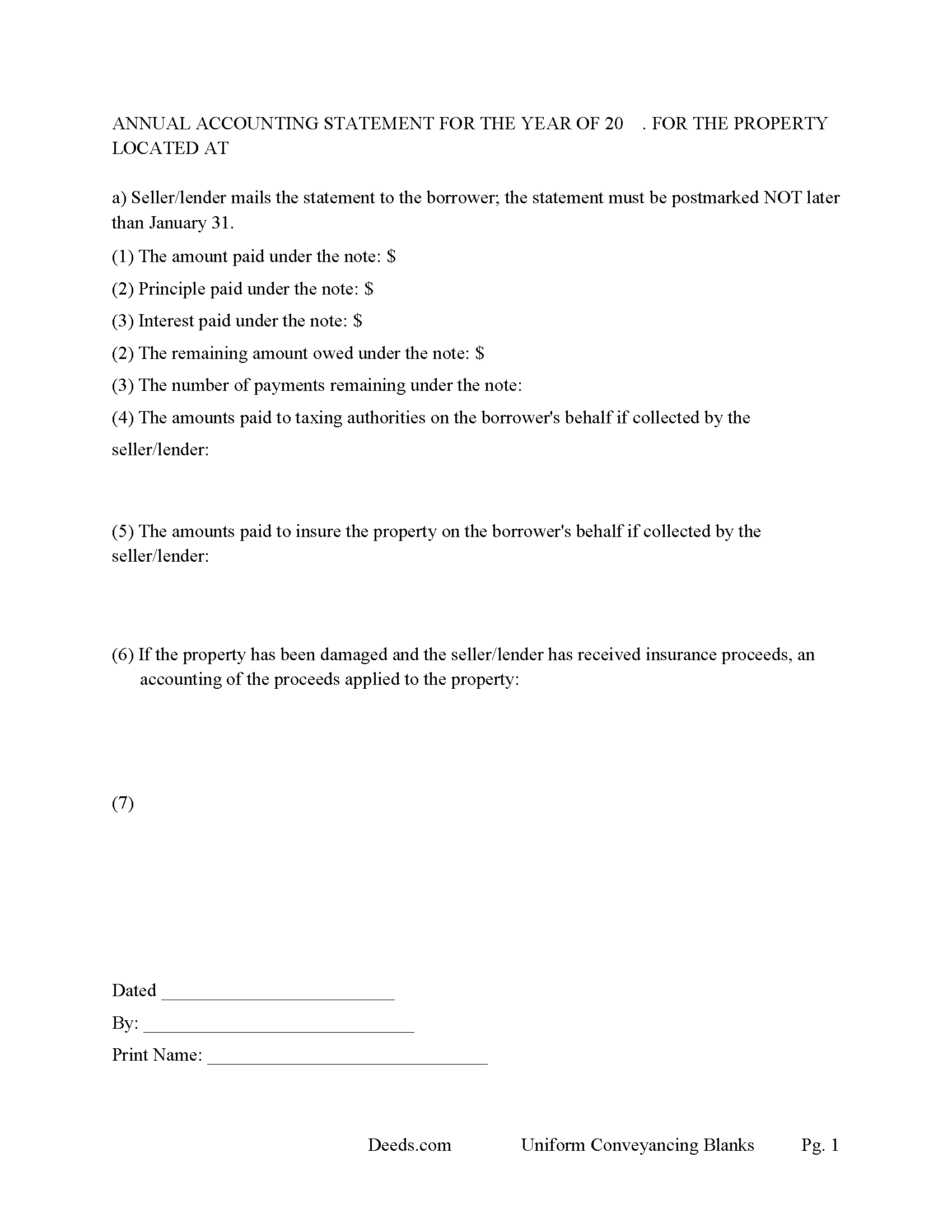

Washoe County Annual Accounting Statement

Mail to borrower for fiscal year reporting.

All 8 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nevada and Washoe County documents included at no extra charge:

Where to Record Your Documents

Washoe County Recorder

Reno, Nevada 89512

Hours: 8:00 to 5:00 M-F

Phone: (775) 328-3661

Recording Tips for Washoe County:

- Double-check legal descriptions match your existing deed

- Verify all names are spelled correctly before recording

- Both spouses typically need to sign if property is jointly owned

- Recording fees may differ from what's posted online - verify current rates

- Some documents require witnesses in addition to notarization

Cities and Jurisdictions in Washoe County

Properties in any of these areas use Washoe County forms:

- Crystal Bay

- Empire

- Gerlach

- Incline Village

- Nixon

- Reno

- Sparks

- Sun Valley

- Verdi

- Wadsworth

- Washoe Valley

Hours, fees, requirements, and more for Washoe County

How do I get my forms?

Forms are available for immediate download after payment. The Washoe County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Washoe County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Washoe County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Washoe County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Washoe County?

Recording fees in Washoe County vary. Contact the recorder's office at (775) 328-3661 for current fees.

Questions answered? Let's get started!

In Nevada, a Deed of Trust is the most commonly used instrument to secure a loan. Foreclosure can be done non-judicially, saving time and expense. This process is called a Trustee Sale.

There are three parties in this Deed of Trust:

1- The Trustor (Borrower)

2- Beneficiary (Lender) and a

3- Trustee (Neutral Third Party)

Basic Concept. The Trustor (Borrower) conveys property title to a Trustee (Neutral Party). A Trustee or beneficiary/Lender can take an action against any person for damages.

In this Deed of Trust the Trustor/Borrower appoints the Lender as an Attorney in Fact, allowing the lender to prepare, sign, file and record this Deed of Trust, financing statements; any documents of title or registration, or like papers, and to take any other action deemed necessary, useful or desirable by Lender to perfect and preserve Lenders security interest against the rights of interest of third persons. This appointment coupled with stringent default terms makes this Deed of Trust more suitable for parties or investors financing/selling their own homes, rental property and condominiums.

Trustor (Borrower) shall take reasonable care of the Subject Real Property and the buildings Lender has Right to Inspect Subject Real Property

This Document includes Covenants from Nevada Revised Statutes 107.30

In default Deed of Trust follows foreclosure process pursuant to the provisions of Nevada Revised Statutes 40.462.

(Nevada DOT Package includes form, guidelines, and completed example)

Important: Your property must be located in Washoe County to use these forms. Documents should be recorded at the office below.

This Deed of Trust meets all recording requirements specific to Washoe County.

Our Promise

The documents you receive here will meet, or exceed, the Washoe County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Washoe County Deed of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

Lillian B.

October 27th, 2022

Easy peasy

Thank you!

Victoria S.

March 13th, 2021

Deed.com is AMAZING! I only had about 2 weeks to get my quit claim deed recorded by my county office before my refinace due date approached. When I uploaded my quit claim to Deed.com I got it electronically recored by county register's office in "24 hours"!!! Deed.com is quick and efficient and I will dedinitely be using Deed.com again if I ever need a document recorded again.

Thank you for your feedback. We really appreciate it. Have a great day!

Marci C.

November 6th, 2024

Excellent Service! Quick and easy! Will definitely be using again!

Knowing our customers are happy is our top priority. Thank you for the wonderful feedback!

franklin m.

October 14th, 2020

good format, helpful instructions

Thank you!

Tracey M.

August 9th, 2022

Using Deeds.com was unbelievably quick and easy to file a deed restriction with our local county office. From uploading the initial file to deeds.com, to having a fully recorded document was right on one hour - and all from the comfort of my home. I found your service was easy to use and your staff were very quick in responding to my filing. I will definitely use and recommend deeds.com in the future.

Thank you for your feedback. We really appreciate it. Have a great day!

Rebecca V.

May 18th, 2023

The staff is Great to work with, Thank You

Thank you!

Logan S.

April 27th, 2020

Wonderful experience. Was preapred to wait days, recording was finished in less than an hour.

Thank you!

Kevin H.

August 6th, 2024

Quick and easy to find the forms I needed. And the download was easy.

Thank you for your feedback. We really appreciate it. Have a great day!

Melody P.

November 10th, 2021

Great service, as always!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rick H.

May 11th, 2019

Website easy to use. Sample feed from helpful. Will know more after county reviews application.

Thank you Rick, we really appreciate your feedback.

Debra M.

November 8th, 2021

Easy Peasy. Great experience.

Thank you for your feedback. We really appreciate it. Have a great day!

Peter N.

March 21st, 2020

Your website was easy to use and I was able to accomplish my task. Thank You very much.

Thank you for your feedback. We really appreciate it. Have a great day!

William T.

July 6th, 2024

Very informative and user friendly. Thank you.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

A R M.

May 1st, 2021

Great so far. Just downloaded all the documents, and they seem to be easy to save and are fillable. A R M

Thank you for your feedback. We really appreciate it. Have a great day!

Regina G.

May 18th, 2022

Very good customer service. Would recommend them highly.

Thank you!