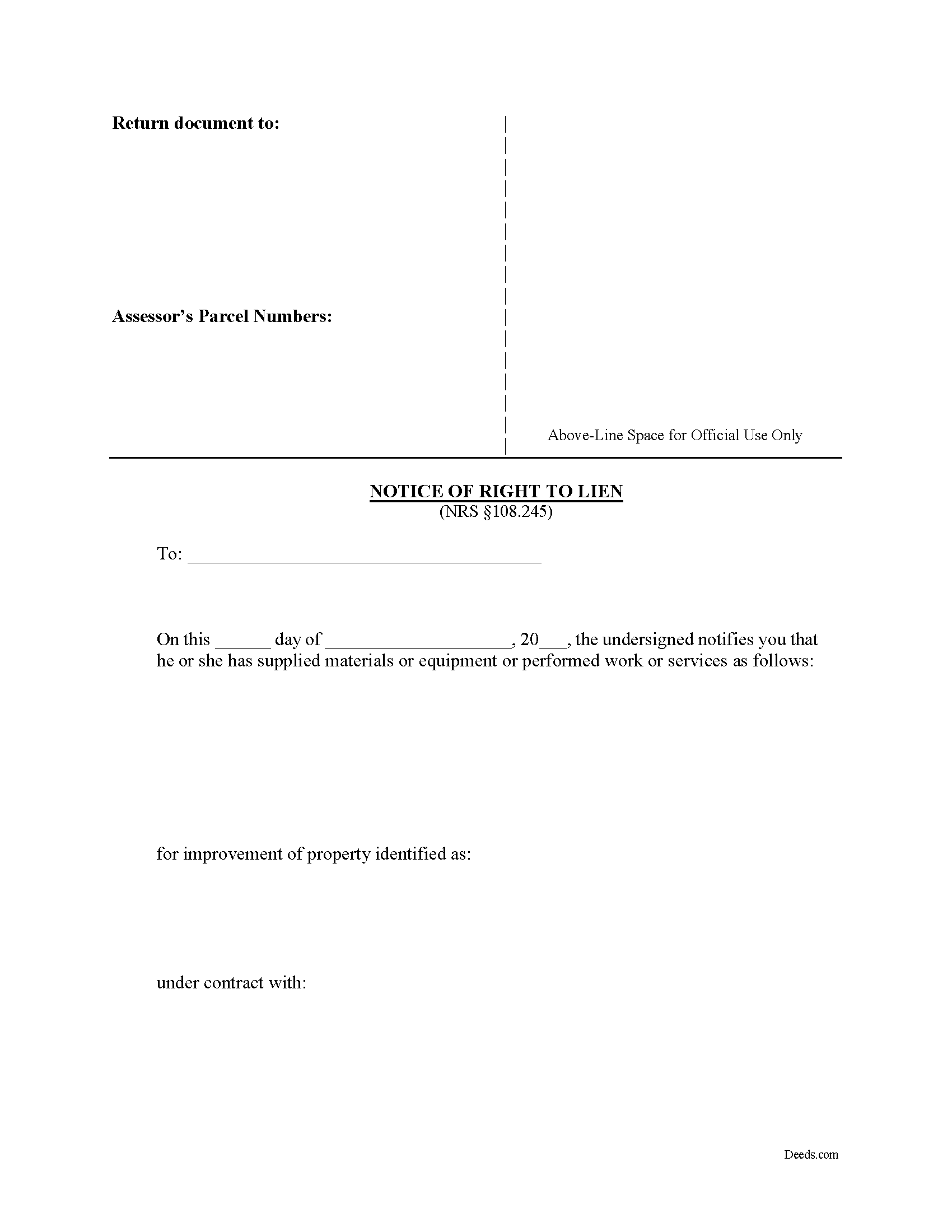

Clark County Notice of Right to Lien Form

Clark County Notice of Right to Lien Form

Fill in the blank form formatted to comply with all recording and content requirements.

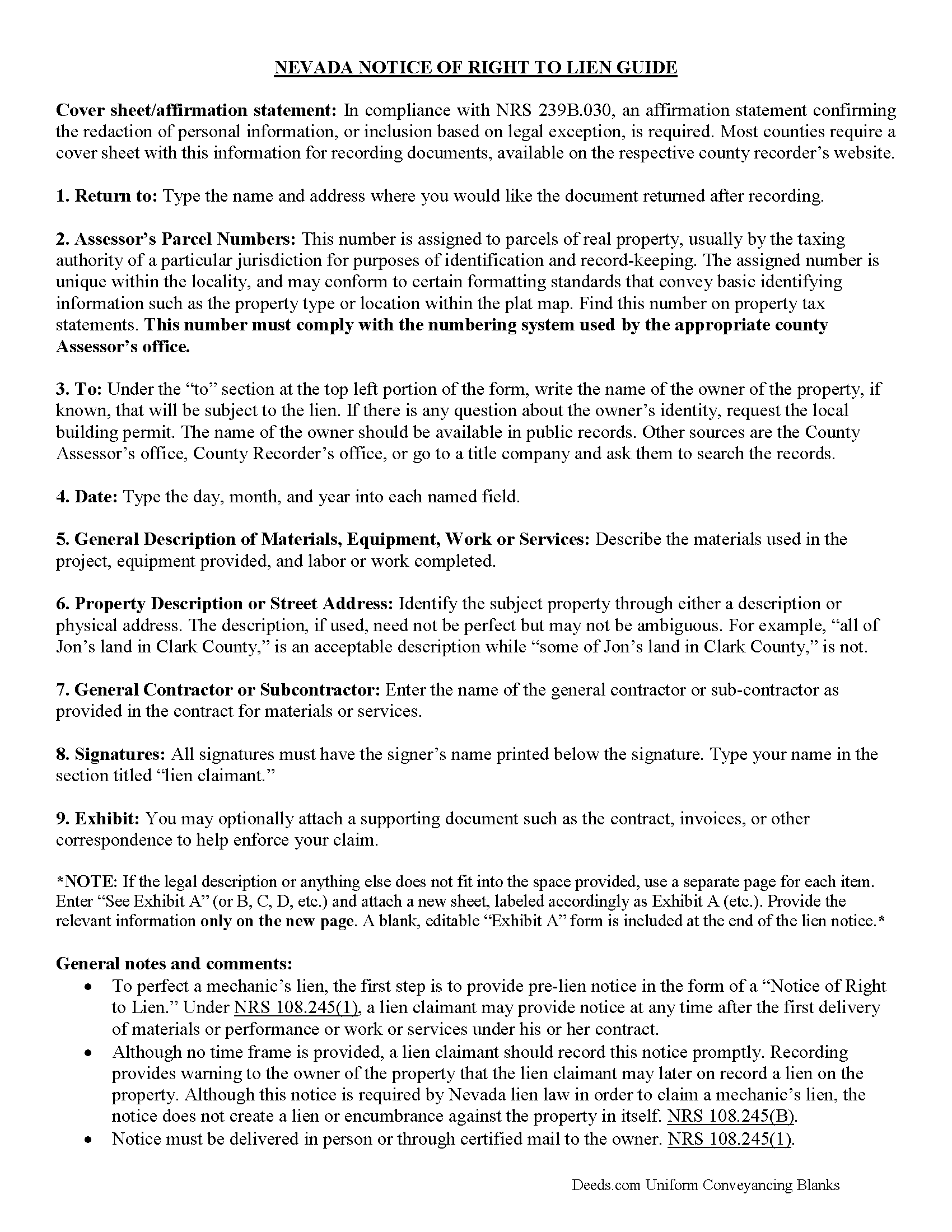

Clark County Notice of Right to Lien Guide

Line by line guide explaining every blank on the form.

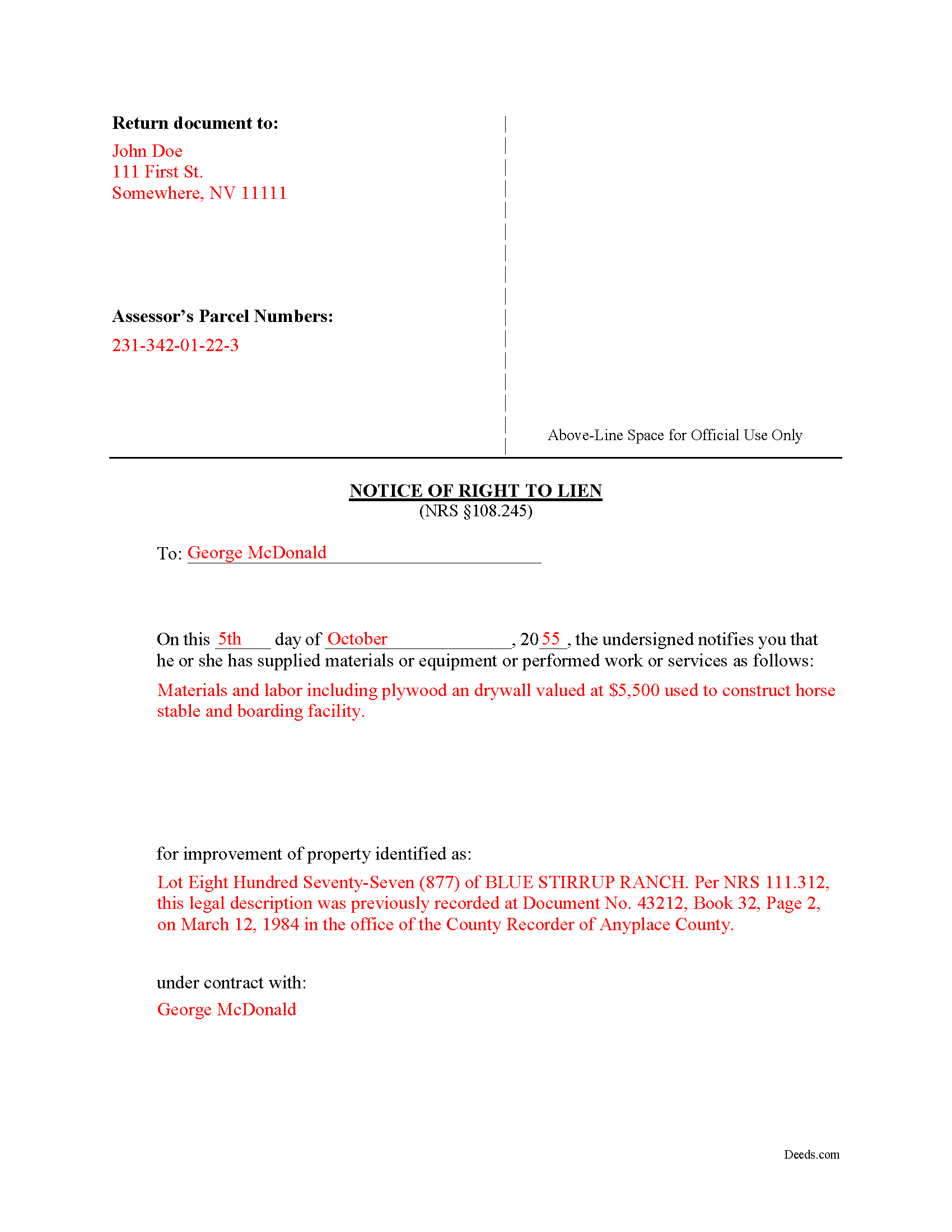

Clark County Completed Example of the Notice of Right to Lien Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nevada and Clark County documents included at no extra charge:

Where to Record Your Documents

Clark County Recorder's Office

Las Vegas, Nevada 89106-1510

Hours: Monday through Friday 8:00 AM to 5:00 PM

Phone: (702) 455-4336

Northwest Branch Office

Las Vegas, Nevada 89129

Hours: Monday through Thursday 8am - 5pm. Closed 12:00 - 12:30pm

Phone: (702) 455-4336

Henderson Branch

Henderson, Nevada 89015

Hours: Monday through Thursday 8am - 5pm. Closed 12:00 - 12:30pm

Phone: (702) 455-4336

Recording Tips for Clark County:

- Bring your driver's license or state-issued photo ID

- Documents must be on 8.5 x 11 inch white paper

- Both spouses typically need to sign if property is jointly owned

- Some documents require witnesses in addition to notarization

Cities and Jurisdictions in Clark County

Properties in any of these areas use Clark County forms:

- Blue Diamond

- Boulder City

- Bunkerville

- Cal Nev Ari

- Coyote Springs

- Henderson

- Indian Springs

- Jean

- Las Vegas

- Laughlin

- Mesquite

- Moapa

- Moapa Valley

- Nellis Afb

- North Las Vegas

- Searchlight

- Sloan

- The Lakes

Hours, fees, requirements, and more for Clark County

How do I get my forms?

Forms are available for immediate download after payment. The Clark County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Clark County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Clark County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Clark County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Clark County?

Recording fees in Clark County vary. Contact the recorder's office at (702) 455-4336 for current fees.

Questions answered? Let's get started!

The notice of right to lien form is used to put a property owner on notice that the person providing labor or materials for a construction project might have a lien claim against the property. In accordance with NRS 108.245, the notice of right to lien must be filed by every lien claimant, besides a prime contractor or other person who contracts directly with an owner or sells materials directly to an owner or one who performs only labor.

The notice shall be filed at any time after the first delivery of material or performance of work or services under a contract. The notice must also be served by delivering it in person or through certified mail to the owner of the property.

The notice is not a lien and does not provide actual or constructive notice of a lien for any purpose. The notice is merely a required step to notify a property owner of a potential future lien on his or her property.

Unless the notice form is filed and notice has been given, Nevada law will not permit a lien for materials or equipment furnished or for work or services performed, except for labor only. The notice does not need to be verified, sworn to or acknowledged by a notary public.

A lien claimant who is required under NRS 108.245 to give a notice of a right to lien to an owner and who gives such a notice has a right to lien for materials or equipment furnished or for work or services performed in the 31 days before the date the notice of right to lien is given. A claimant also has a right to a lien for the materials or equipment furnished or for work or services performed anytime thereafter until the completion of the work of improvement.

The notice should be recorded promptly in a public records office. Although Nevada law does not state a timeframe for recording the notice, it should be recorded as soon as practicable without any delay.

Although this guide and accompanying forms are prepared substantially in accordance with Nevada lien law, they are not a complete substitute for the advice of a competent, licensed attorney familiar with statutory and case law. Each case is unique and penalties for missing a deadline or misstating facts can be severe, so contact an attorney with specific questions or for complex situations.

Important: Your property must be located in Clark County to use these forms. Documents should be recorded at the office below.

This Notice of Right to Lien meets all recording requirements specific to Clark County.

Our Promise

The documents you receive here will meet, or exceed, the Clark County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Clark County Notice of Right to Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Susan G.

January 11th, 2025

Very easy to use!

We are thankful for your continued support and feedback, which inspire us to continuously improve. Thank you..

Lisa M.

August 30th, 2023

Awesome and so easy to use!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

IVAN G.

September 4th, 2020

This Guys are accurate and FAST, Thanks Staff- KVH.!!!! you were awesome!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jaime S.

May 26th, 2021

To call an affidavit of minor correction a Correction Deed in your descriptions is incorrect. They are two different products. I did not intend to purchase an affidavit. I intended to purchase a Correction Deed.

Thank you!

Masud K.

June 20th, 2020

Deeds.com did an excellent job in providing me the Real Estate documents I needed. You delivered the documents fast and they were accurate. I greatly appreciate your help. Thanks for everything

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Debby R.

July 6th, 2021

Very easy to use

Thank you!

Christopher S.

October 5th, 2024

very easy to use, and comprehensive...I like the e-recording package

We are grateful for your feedback and looking forward to serving you again. Thank you!

DAVID E.

January 2nd, 2025

Very professional and knowledgeable. Great communication.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Rebecca H.

December 14th, 2020

Very pleased with the ease of this deed form. Completing the deed form to make sure everything was in my name took ten minutes. Thanks.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Diana D.

June 23rd, 2020

I was very pleased as to how fast and easy the service was. I recommend this service to any one. It's not expensive and it was worth it. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Tami C.

May 11th, 2021

Excellent service, easy to follow instructions.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

April L.

March 21st, 2020

It was easy and I will use it again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kevin M.

May 13th, 2020

Maricopa County Recorders office directed to use Deeds.com for all forms, etc. Easily found the Warranty Deed form, instructions & sample form I was looking for.

Thank you!

David H.

May 25th, 2021

So So

Thank you!

Angela T.

June 21st, 2019

I love this website .. it has been very helpful in so many ways.. thank you so much..

Thank you!