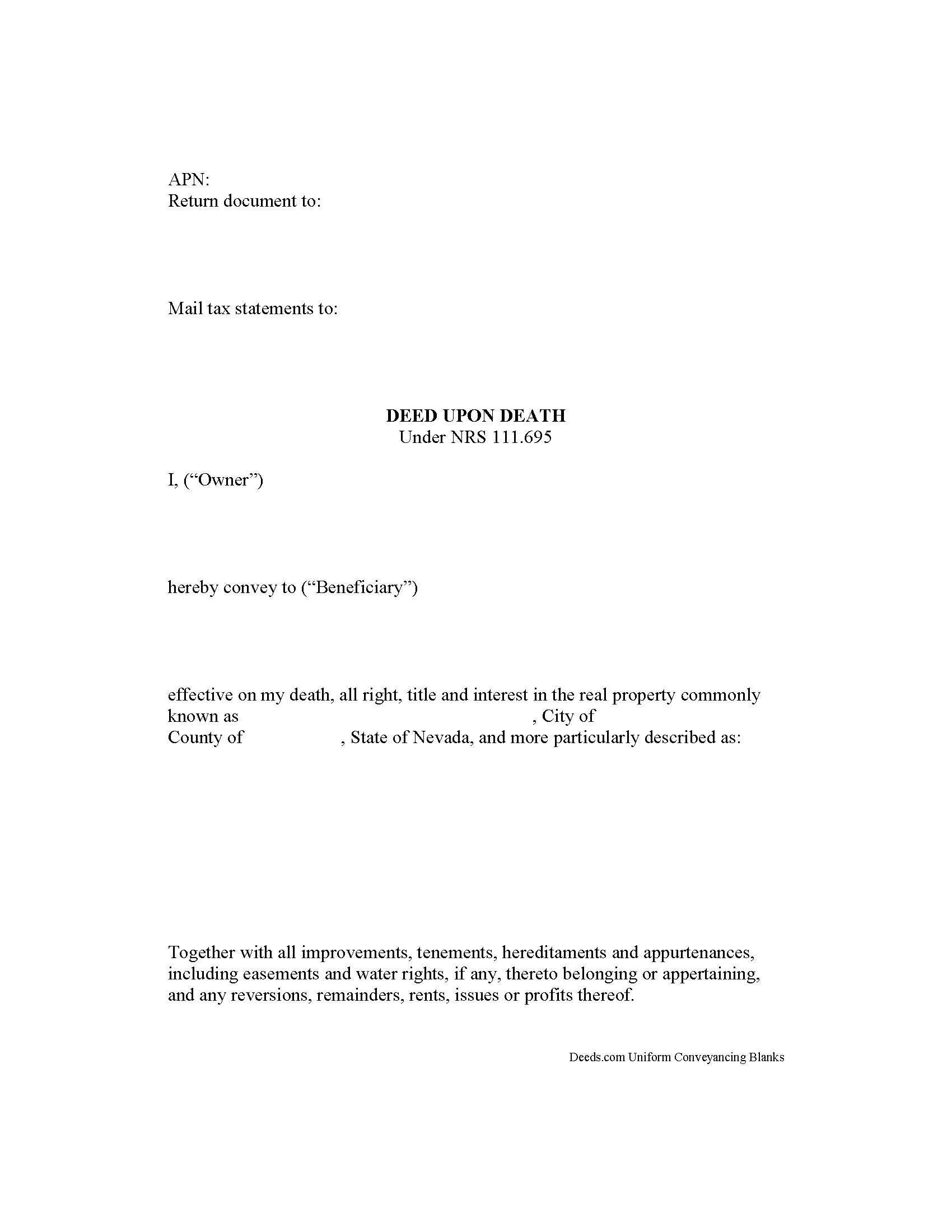

Clark County Transfer on Death Deed Form

Clark County Transfer on Death Deed

Fill in the blank form formatted to comply with all recording and content requirements.

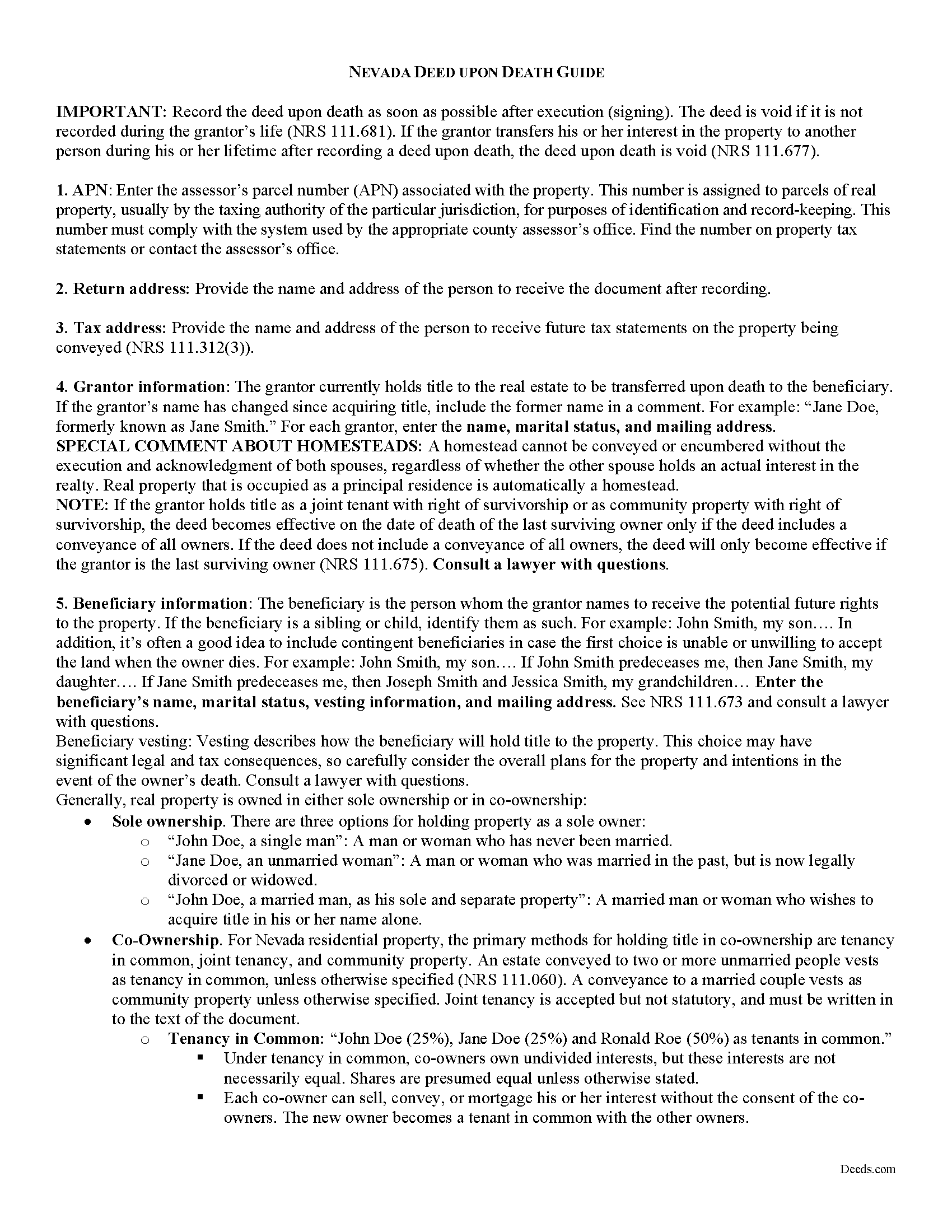

Clark County Transfer on Death Deed Guide

Line by line guide explaining every blank on the form.

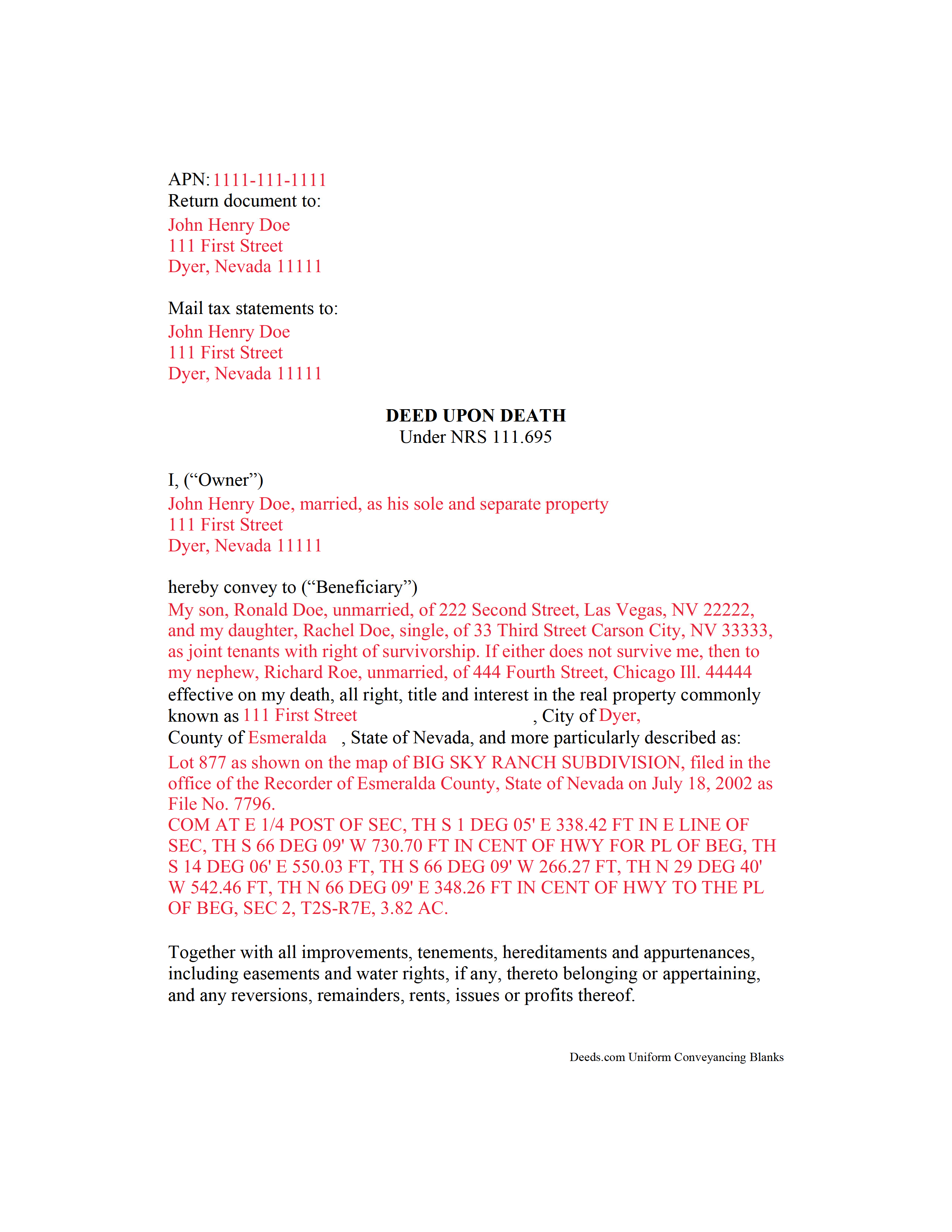

Clark County Completed Example of the Transfer on Death Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nevada and Clark County documents included at no extra charge:

Where to Record Your Documents

Clark County Recorder's Office

Las Vegas, Nevada 89106-1510

Hours: Monday through Friday 8:00 AM to 5:00 PM

Phone: (702) 455-4336

Northwest Branch Office

Las Vegas, Nevada 89129

Hours: Monday through Thursday 8am - 5pm. Closed 12:00 - 12:30pm

Phone: (702) 455-4336

Henderson Branch

Henderson, Nevada 89015

Hours: Monday through Thursday 8am - 5pm. Closed 12:00 - 12:30pm

Phone: (702) 455-4336

Recording Tips for Clark County:

- Bring your driver's license or state-issued photo ID

- Ask if they accept credit cards - many offices are cash/check only

- Ask about accepted payment methods when you call ahead

Cities and Jurisdictions in Clark County

Properties in any of these areas use Clark County forms:

- Blue Diamond

- Boulder City

- Bunkerville

- Cal Nev Ari

- Coyote Springs

- Henderson

- Indian Springs

- Jean

- Las Vegas

- Laughlin

- Mesquite

- Moapa

- Moapa Valley

- Nellis Afb

- North Las Vegas

- Searchlight

- Sloan

- The Lakes

Hours, fees, requirements, and more for Clark County

How do I get my forms?

Forms are available for immediate download after payment. The Clark County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Clark County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Clark County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Clark County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Clark County?

Recording fees in Clark County vary. Contact the recorder's office at (702) 455-4336 for current fees.

Questions answered? Let's get started!

Nevada's statutory transfer on death instrument for real property is called a deed upon death. It is governed by NRS 111.655-111.699 (2013), inclusive, and incorporates the Uniform Real Property Transfer on Death Act into its text. Like other transfer on death deeds, THE EXECUTED DEED, AS WELL AS ANY CHANGES OR REVOCATIONS, MUST BE RECORDED IN THE COUNTY WHERE THE LAND IS LOCATED, DURING THE OWNER'S NATURAL LIFE.

Transfer on death deeds/deeds upon death make it possible for owners of real estate in Nevada to convey their land to one or more designated beneficiaries after their death, with no need to subject the property to probate distribution. Significantly, transfers included in deeds upon death are not affected by directions included in wills. As such, these deeds comprise only one part of a regularly updated overall estate plan.

When correctly executed and recorded, a deed upon death only contains a potential future interest in the property, so there is no requirement to pay consideration or to give notice to any named beneficiary. In addition, the owner retains absolute control over the property, including the right to change beneficiary designations, revoke the deed, sign sales, rental, or mortgage agreements, and use the land in any other lawful way without penalty.

After the owner's death, the surviving beneficiary claims the property by recording an affidavit of death of grantor, along with an official copy of the owner's death certificate. Alternately, if the beneficiary is unable or unwilling to accept the transfer, the statutes provide a method to disclaim it.

Overall, Nevada's deed upon death offers a flexible tool for estate planning. Because each circumstance is unique, take the time to fully understand the benefits and drawbacks that accompany these documents, including the potential impact on taxes, benefit eligibility and repayment, and other financial concerns. Contact a local attorney with specific questions or for complex situations.

(Nevada TOD Package includes form, guidelines, and completed example)

Important: Your property must be located in Clark County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed meets all recording requirements specific to Clark County.

Our Promise

The documents you receive here will meet, or exceed, the Clark County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Clark County Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Alberta P.

April 14th, 2019

form was east to use...instructions came in handy.

Thank you for your feedback. We really appreciate it. Have a great day!

Leonard N.

January 21st, 2021

Nice and clear. Can't wait to process the completed documents at the Recorder's Office

Thank you!

JACQUELINE R.

March 23rd, 2021

We have been waiting for a Title Company to put a release of Lien together for the past 3 months. I figured it was taking way to long and decided to use template here instead. In less than hour I was able to add all the information on the template and provide forms to our Seller to use. We were buying and he didnt think they were necessary. But I refused to pay him in full until he agreed to sign papers at the bank, and of course in front of a notary. We turned around and filed the Release of lien paperwork at County Clerks office, we officially own our house. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

D. Jeffrey C.

June 10th, 2024

Generally I find the process works well, and the support personnel on the other end are usually fairly helpful.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Andrew H.

November 11th, 2020

Very efficient does what it says on the box.

Thank you!

Kellie Z.

December 4th, 2020

Wow! So much simpler & faster than I had expected. I had thought it would take weeks to get filed & took days- yea! Super easy & speedy!

Thank you!

Bobby T.

June 17th, 2020

Great!! Helps me out

Thank you!

Hans S.

April 22nd, 2022

This is my first time using this service so having not yet filed the documents I purchased, I will say that I am impressed at how comprehensive the instructions are that accompany the document I purchased.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Donna R.

November 17th, 2021

This was a seamless process. It probably took one minute to fill out my information and upload the document. It was formatted and sent immediately. It was processed the next day at the county recorders office. I have zero complaints. Before finding this company I spent an entire day calling and leaving messages at other e-filing companies like simplfile and others but they all required subscriptions. I just needed to file a single document now and then so that was not a good fit. (And those companies I found out still require the customer to do all the work!). Deeds.com kept me informed throughout the process every step. I'm happy to write this review. Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Shonda S.

January 21st, 2023

This is the best thing I have ever done with this being my first time doing a quick claim. This has save me and my family money instead of paying a lawyer. Thanks again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Angela J M.

September 29th, 2023

Quick turnaround (about 24hrs) easy process.

Thank you for your feedback. We really appreciate it. Have a great day!

Claude F.

February 8th, 2021

quick and easy to use, thank you

Thank you!

Michael B.

November 17th, 2020

I'm very pleased with the service provided by Deeds.com. After a format issue caused my scanner, it was a very smooth and speedy process. Highly recommended.

Thank you for your feedback. We really appreciate it. Have a great day!

James G.

November 18th, 2019

Deed.com had some hard to find mineral interest deeds for Oklahoma.I'm an attorney in Texas with no Ok experience. The examples on Deed.com were very useful and saved me lots of time. James G.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jena S.

April 7th, 2020

I love how quick the turnaround is, my only request would be for an email notification be sent once an invoice is ready and then once a document is recorded and ready to download (only because I have a large caseload and it's very easy to forget things sometimes).

Thank you!