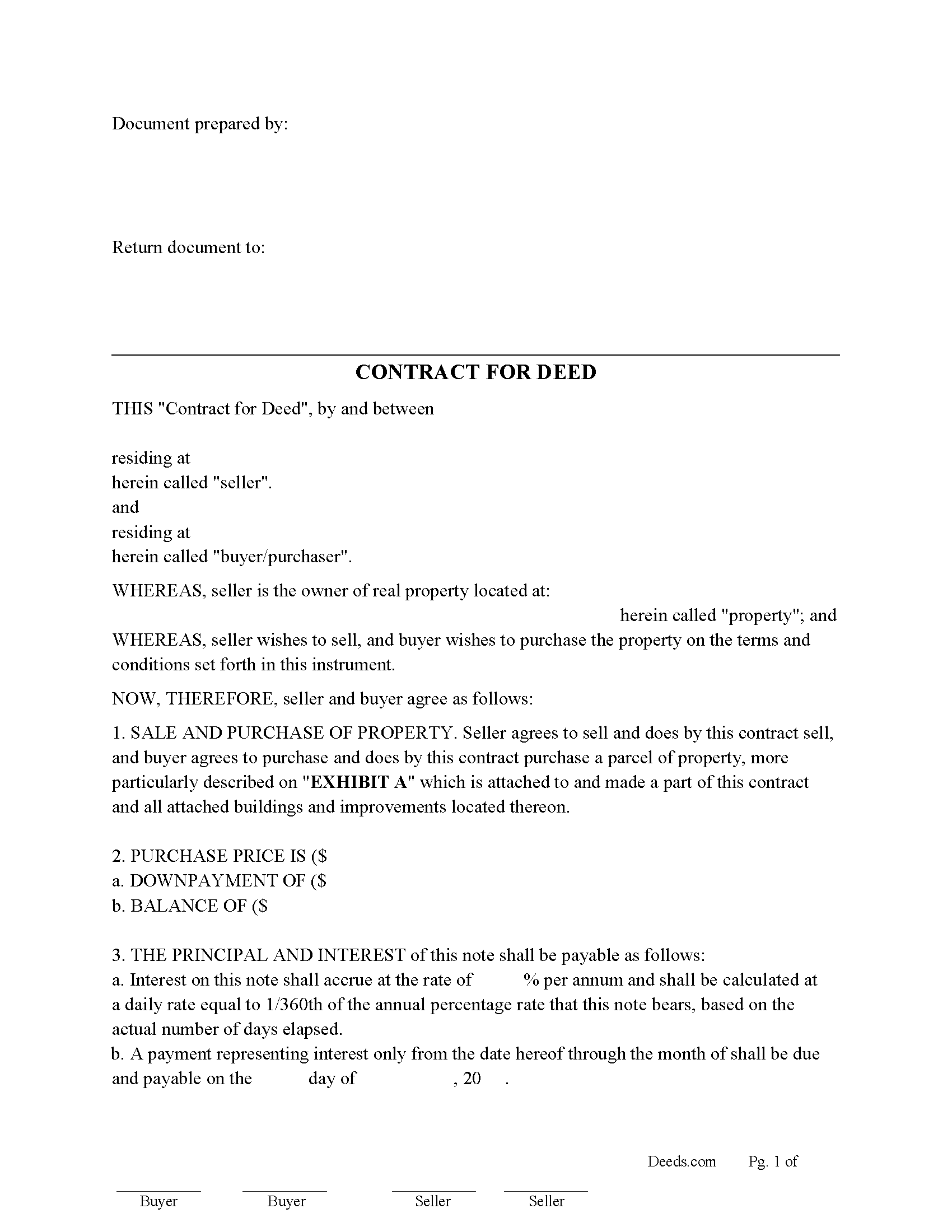

Cibola County Contract for Deed Form

Cibola County Contract for Deed Form

Fill in the blank Contract for Deed form formatted to comply with all New Mexico recording and content requirements.

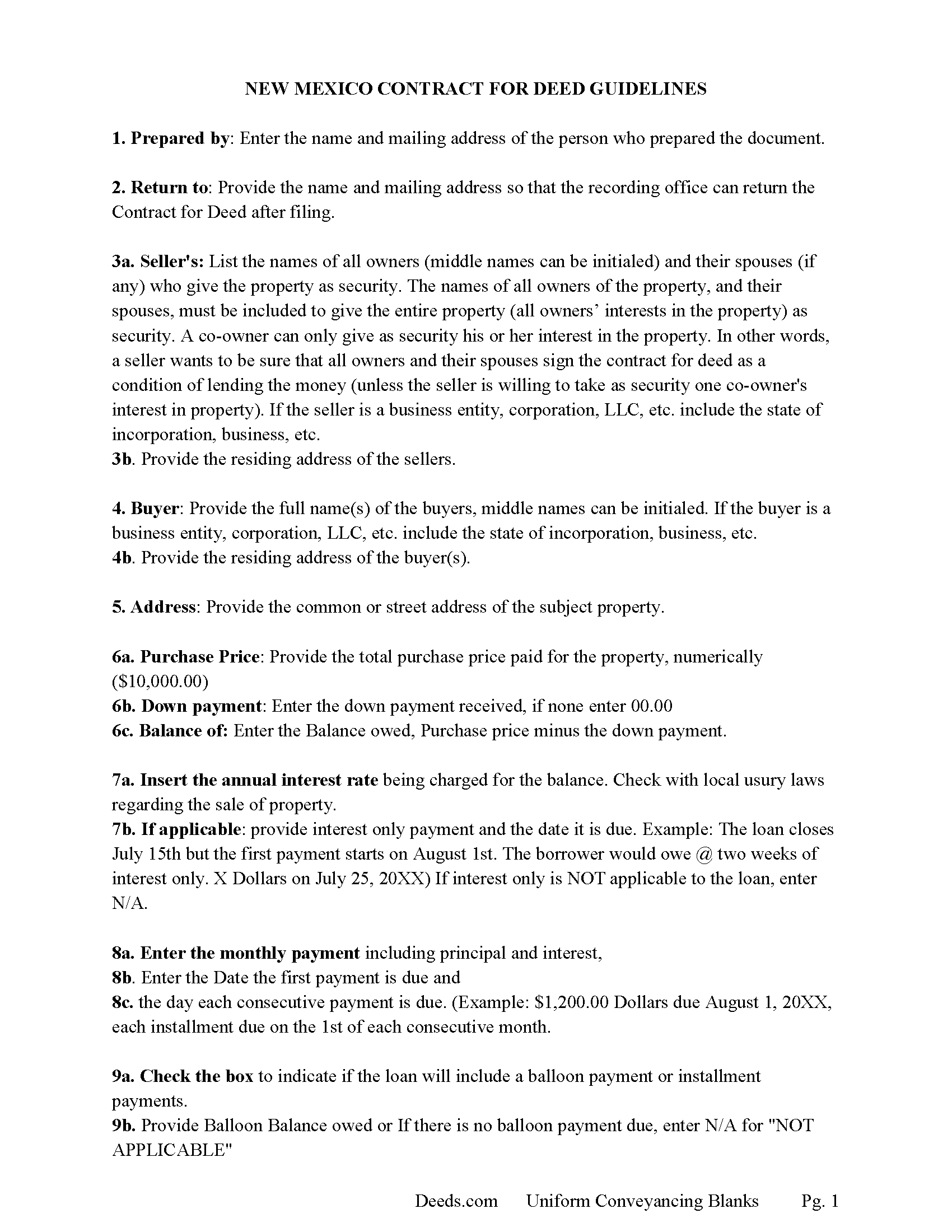

Cibola County Contract for Deed Guide

Line by line guide explaining every blank on the Contract for Deed form.

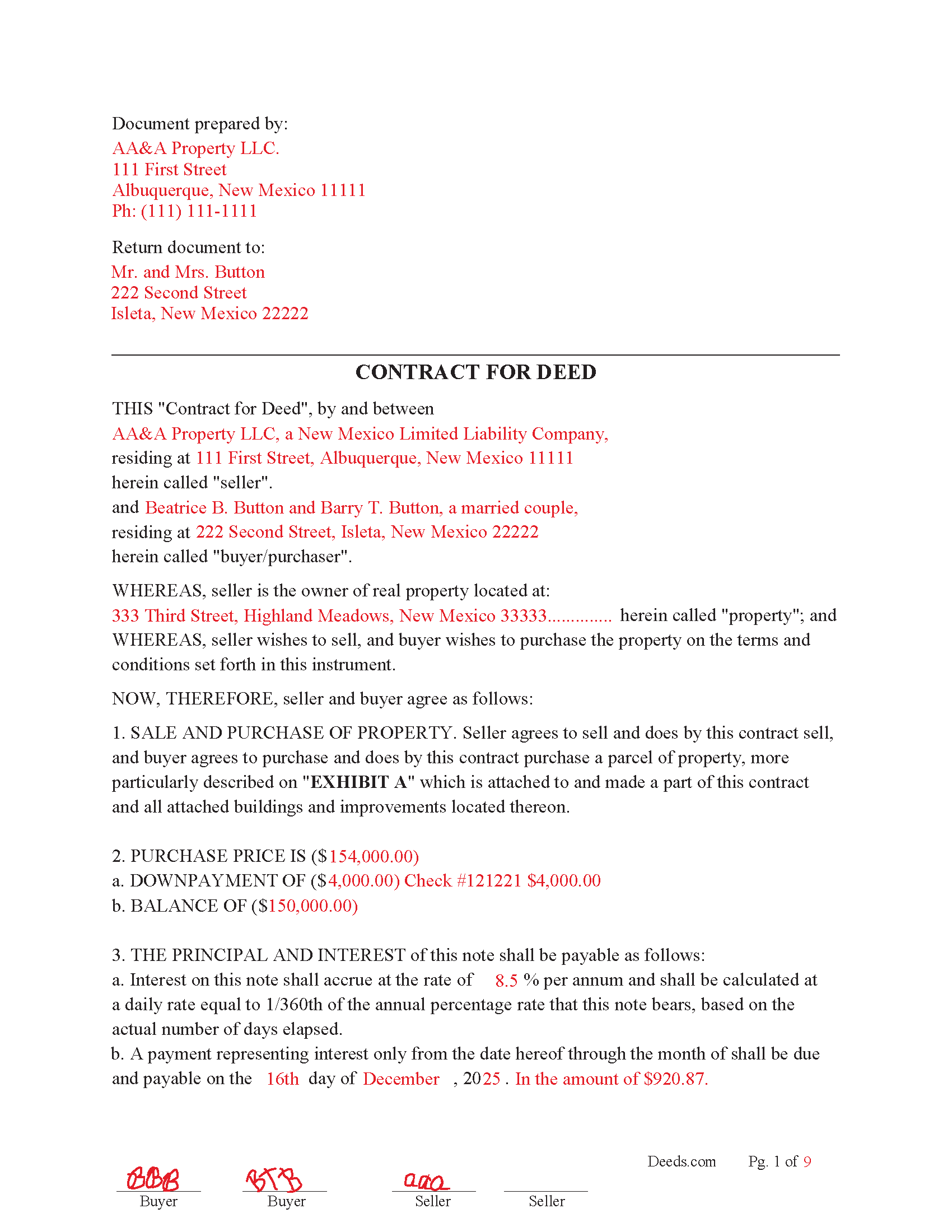

Cibola County Completed Example of the Contract for Deed Document

Example of a properly completed New Mexico Contract for Deed document for reference.

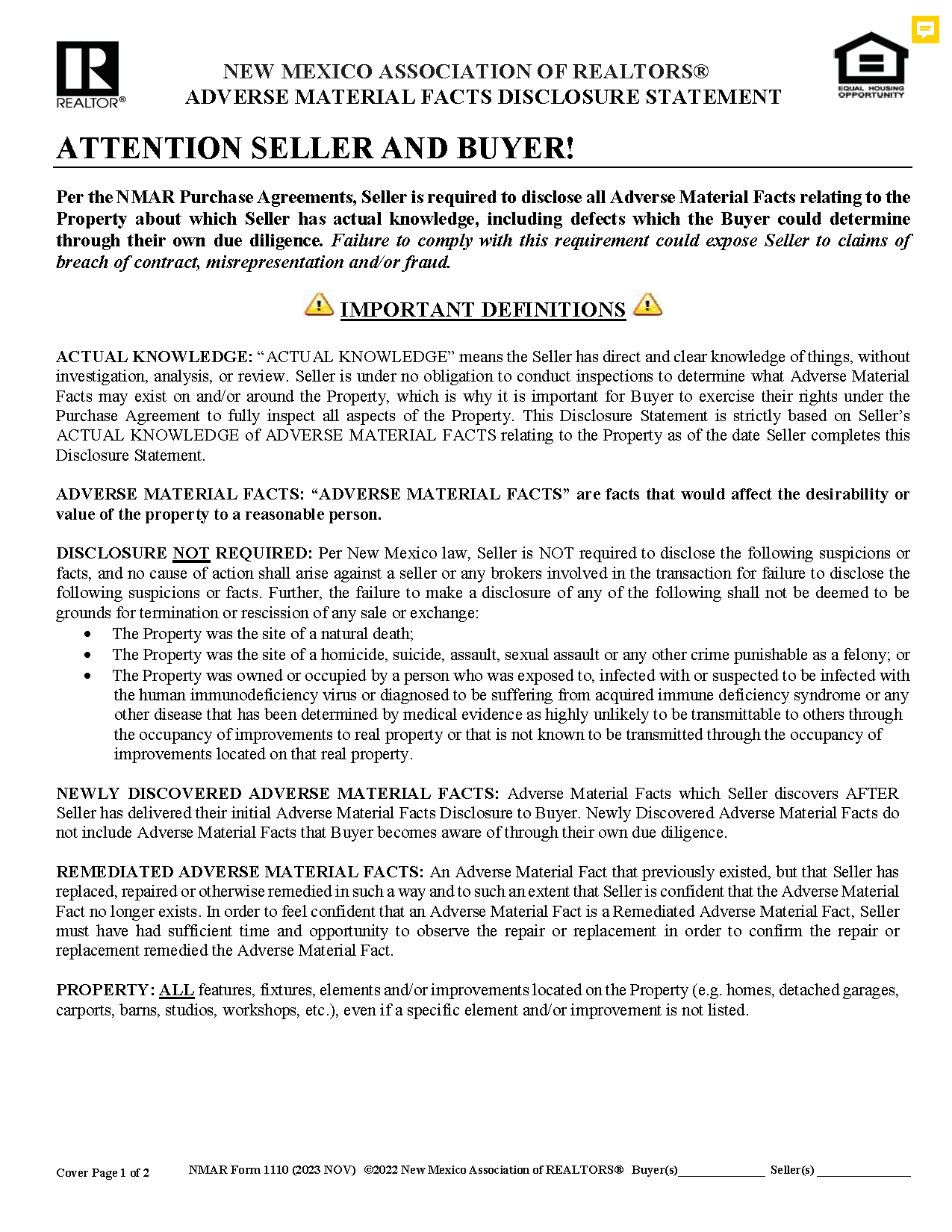

Cibola County Adverse Material Facts Disclosure Statement

Fill in the blank form formatted to comply with all New Mexico content requirements.

Cibola County Estimated Property Tax Waiver Form

NM Stat § 47-13-4(F). A prospective buyer may waive the disclosure requirements of this section by signing a written document prior to the time the offer to purchase is to be made in which the buyer acknowledges that the required estimated amount of property tax levy is not readily available and waives disclosure of the estimated amount of property tax levy.

Cibola County Lead Based Paint Disclosure Form

Applicable to residential property built before 1978.

Cibola County Lead Based Paint Brochure

Brochure for buyers if applicable.

All 7 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional New Mexico and Cibola County documents included at no extra charge:

Where to Record Your Documents

Cibola County Clerk

Grants, New Mexico 87020

Hours: 8:30 to 4:30 M-F

Phone: (505) 285-2535 or 2537

Recording Tips for Cibola County:

- Ensure all signatures are in blue or black ink

- Double-check legal descriptions match your existing deed

- Ask if they accept credit cards - many offices are cash/check only

- Request a receipt showing your recording numbers

- If mailing documents, use certified mail with return receipt

Cities and Jurisdictions in Cibola County

Properties in any of these areas use Cibola County forms:

- Bluewater

- Casa Blanca

- Cubero

- Fence Lake

- Grants

- Laguna

- Milan

- New Laguna

- Paguate

- Pinehill

- San Fidel

- San Rafael

Hours, fees, requirements, and more for Cibola County

How do I get my forms?

Forms are available for immediate download after payment. The Cibola County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Cibola County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Cibola County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Cibola County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Cibola County?

Recording fees in Cibola County vary. Contact the recorder's office at (505) 285-2535 or 2537 for current fees.

Questions answered? Let's get started!

In New Mexico, a Contract for Deed (also called a real estate contract, installment land contract, or owner-financing agreement) is a useful tool for property transactions where the buyer cannot or does not want to obtain conventional financing, and the seller agrees to finance the purchase over time. However, due to the risk to buyers, especially in low-income and rural areas, New Mexico has adopted specific legal protections—especially under SB 449 (2023), codified in NMSA 1978, Chapter 47, Article 13.

When a Contract for Deed Is Useful in New Mexico

-Buyer lacks access to traditional mortgage financing.

-Useful for buyers with poor credit or limited income.

-Sellers can attract more buyers by offering seller financing.

-Seller wants to retain legal title until full payment.

-Protects seller if buyer defaults.

-Legal title remains with the seller until the full contract amount is paid.

-Installment payments are agreeable to both parties.

-Can include structured payments over years.

Interest and terms are flexible between parties.

-Rural or undeveloped property.

-Banks may not lend on raw land or mobile homes without permanent foundation.

Why the Law Requires Certain Disclosures Before Accepting an Offer

Under New Mexico’s Real Estate Contract Act (SB 449, 2023), sellers must protect buyers from unexpected tax and condition issues, especially in installment contracts. Two required disclosures are:

1. Estimated Property Tax Levy (NMSA 1978, § 47-13-4)

“Prior to accepting an offer to purchase,” the seller or seller's broker shall: (1) request from the county assessor the estimated amount of property tax levy with respect to the property and shall specify the listed price as the value of the property to be used in the estimate.”

Purpose:

Protects buyers from sudden property tax increases after purchase.

Ensures buyers understand the future property tax liability based on the full sale price (not past assessments).

Prevents tax-related defaults that could lead to foreclosure.

2. Adverse Material Facts Disclosure Statement Under general real estate disclosure duties (aligned with NMREC rules and principles of good faith), sellers must disclose any known adverse material facts about the property.

What are “adverse material facts”?

Issues that significantly affect value or use of the property:

Structural damage

Unpermitted additions

Water damage or mold

Title problems or pending legal issues

Environmental hazards

Zoning violations

Easements or encroachments

Purpose:

-Prevents buyer deception or later claims of fraud or nondisclosure.

-Builds trust and compliance with NM real estate law.

-Required even more so when the seller is financing the transaction (i.e., they are acting almost like a lender).

Summary: Why These Steps Matter

Requirement Purpose ------------------------------Why It Matters

-Tax Levy Estimate-----To disclose expected annual tax cost based on sale price Protects buyers from unforeseen, unaffordable tax hikes

-Adverse Material Facts Disclosure----To inform the buyer of known serious defects/issues Prevents lawsuits for fraud, ensures buyer is fully informed.

Recording of the Contract (within 30 days) Required by SB 449-----Makes the buyer’s interest official and enforceable

Common Contract for Deed procedures.

Before accepting an offer, request the tax estimate from the county assessor (most counties have a form or online system). Unless buyer agree to waiver, see waiver form included.

-Fill out and provide the Adverse Material Facts Disclosure Statement (a form used in NM real estate practice).

-Draft the Contract for Deed with clear terms.

-Record the contract with the County Clerk within 30 days of execution.

Important: Your property must be located in Cibola County to use these forms. Documents should be recorded at the office below.

This Contract for Deed meets all recording requirements specific to Cibola County.

Our Promise

The documents you receive here will meet, or exceed, the Cibola County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Cibola County Contract for Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

WAYNE C.

July 11th, 2021

Wonderful forms, been coming here for years (since 2012) for my deed forms and they have never failed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Zennell W.

November 24th, 2024

Quick fast and easy transaction.

We are grateful for your feedback and looking forward to serving you again. Thank you!

Josephine H.

April 26th, 2022

This was so helpful! I was able to get the right forms. Presto! Peace of mind.

Thank you for your feedback. We really appreciate it. Have a great day!

Daniel D.

June 3rd, 2019

Easier than I expected. I followed the downloaded examples step by step, and before I knew it, the form was completed correctly and good to go. Thank you, Daniel D.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Linda D.

April 27th, 2019

It was quick & easy so thank you!

Thank you Linda.

Willie S.

January 5th, 2021

So easy and fast. Since covid-19 is here, this option is perfect.

Thank you!

diana l.

July 19th, 2024

Easy to use & got my one question answered in less than 5 minutes! Excellence.

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!

Matthew G.

February 19th, 2019

Second time using Deeds.com. Easy and professional

Thank you Matthew. Have a great day!

Patricia A.

December 13th, 2022

This service was a godsend since I am currently disabled.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Connie J L.

August 26th, 2020

Fast and easy to use. Easy to print.

Thank you!

Ming Z.

September 28th, 2022

Definitely 5 Stars !

Thank you!

Richard L.

December 17th, 2020

Service was very convenient; I received prompt assistance with my document - staff was very helpful.

Thank you!

Ardys A.

January 13th, 2019

Very pleased with all the info I received and not just a blank form.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ronald C.

January 31st, 2019

My goal was to find the Covenant, Conditions, and Restrictions for my HOA. From what I can read, these documents should be attached to our Deed (single family, patio home in New Hanover County). I am not sure if I have a copy of my Deed. I would need to check my Safe Deposit Box. Unfortunately, I was not successful at finding these documents from your Website. If you can help me find them, I would appreciate that.

It is most common to obtain a copy of CC&Rs directly from the HOA. Alternatively, they are also usually a matter of public record recorded with the local recorder and you can obtain a copy there.

Tracy A.

April 27th, 2022

Thanks, it was a big help!!!

Thank you!