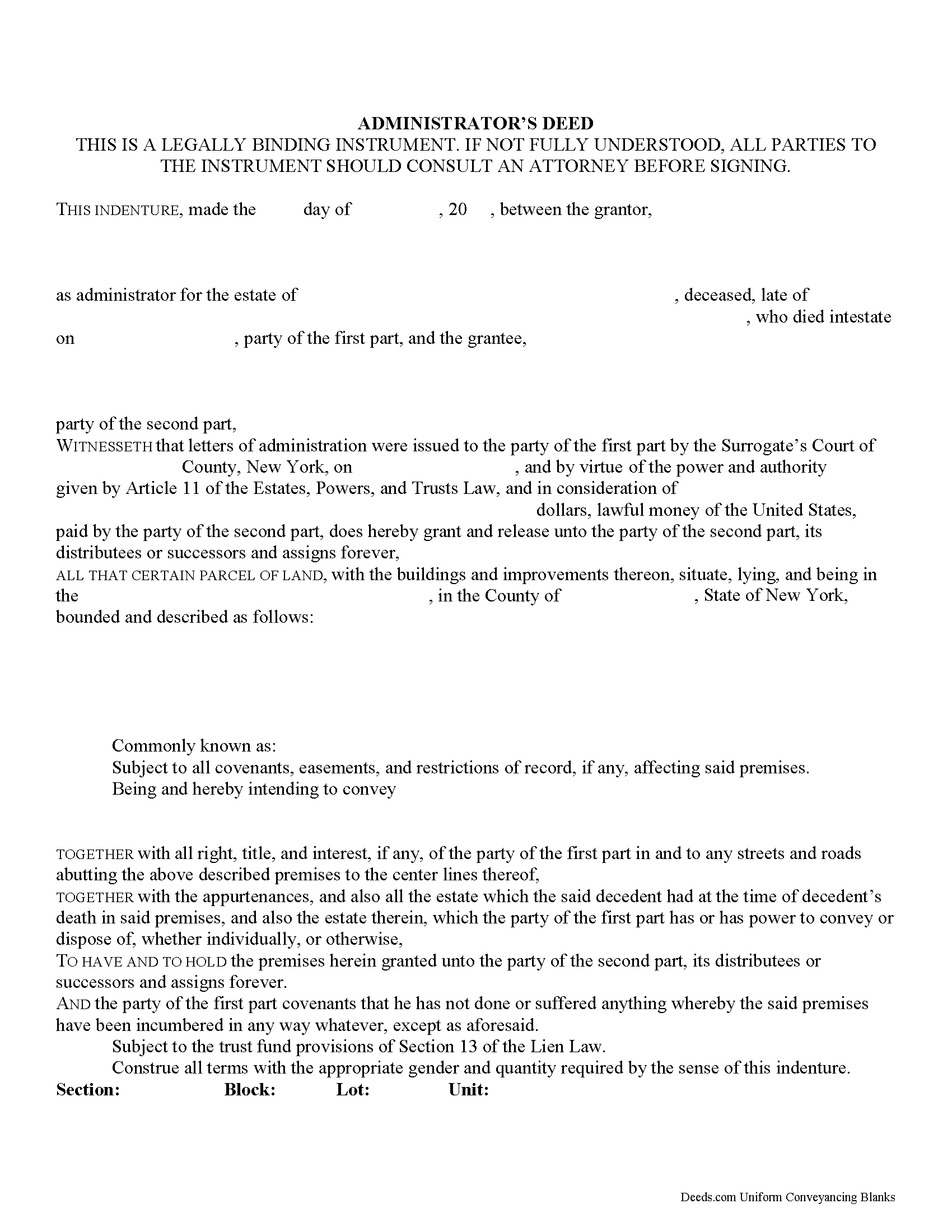

Orange County Administrator Deed Form

Orange County Administrator Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

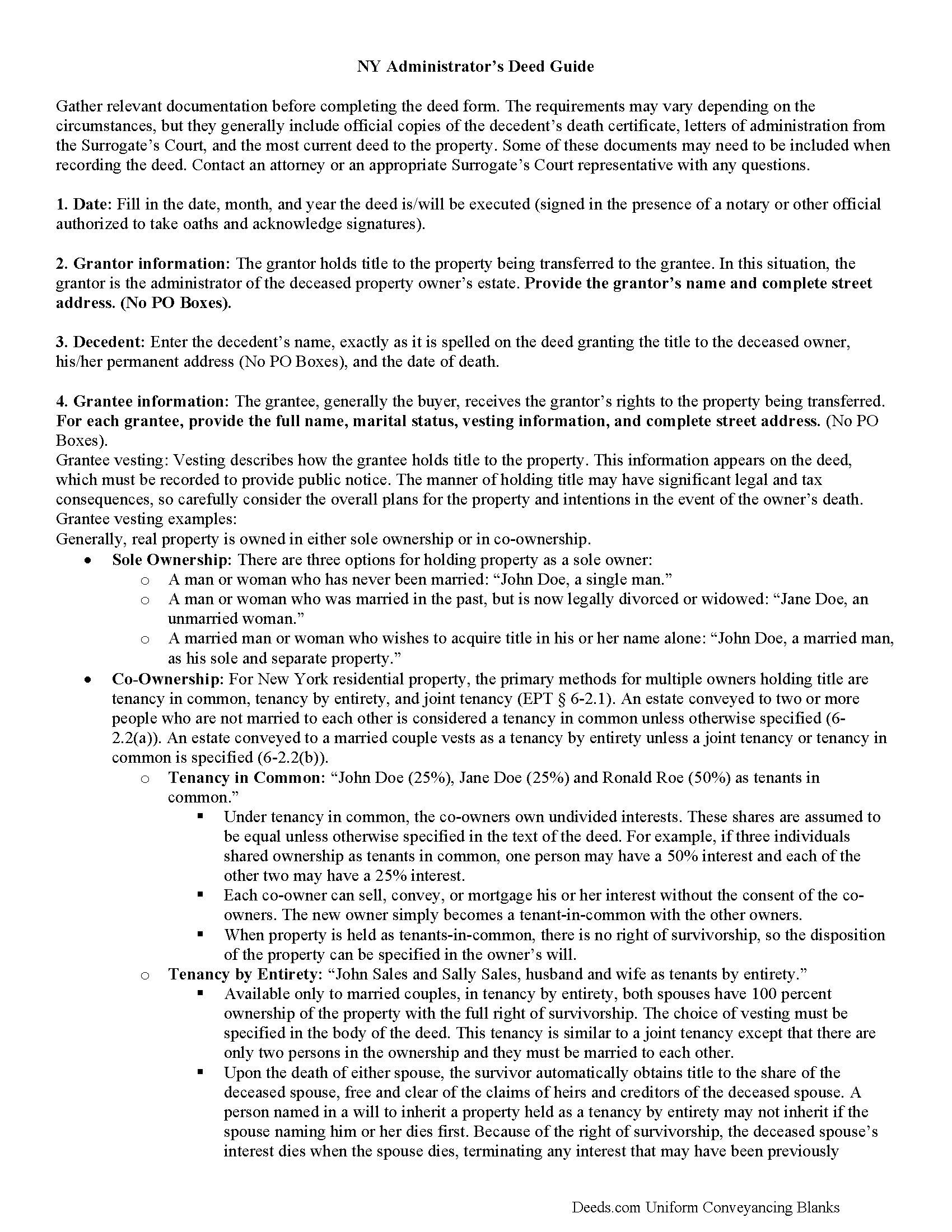

Orange County Administrator Deed Guide

Line by line guide explaining every blank on the form.

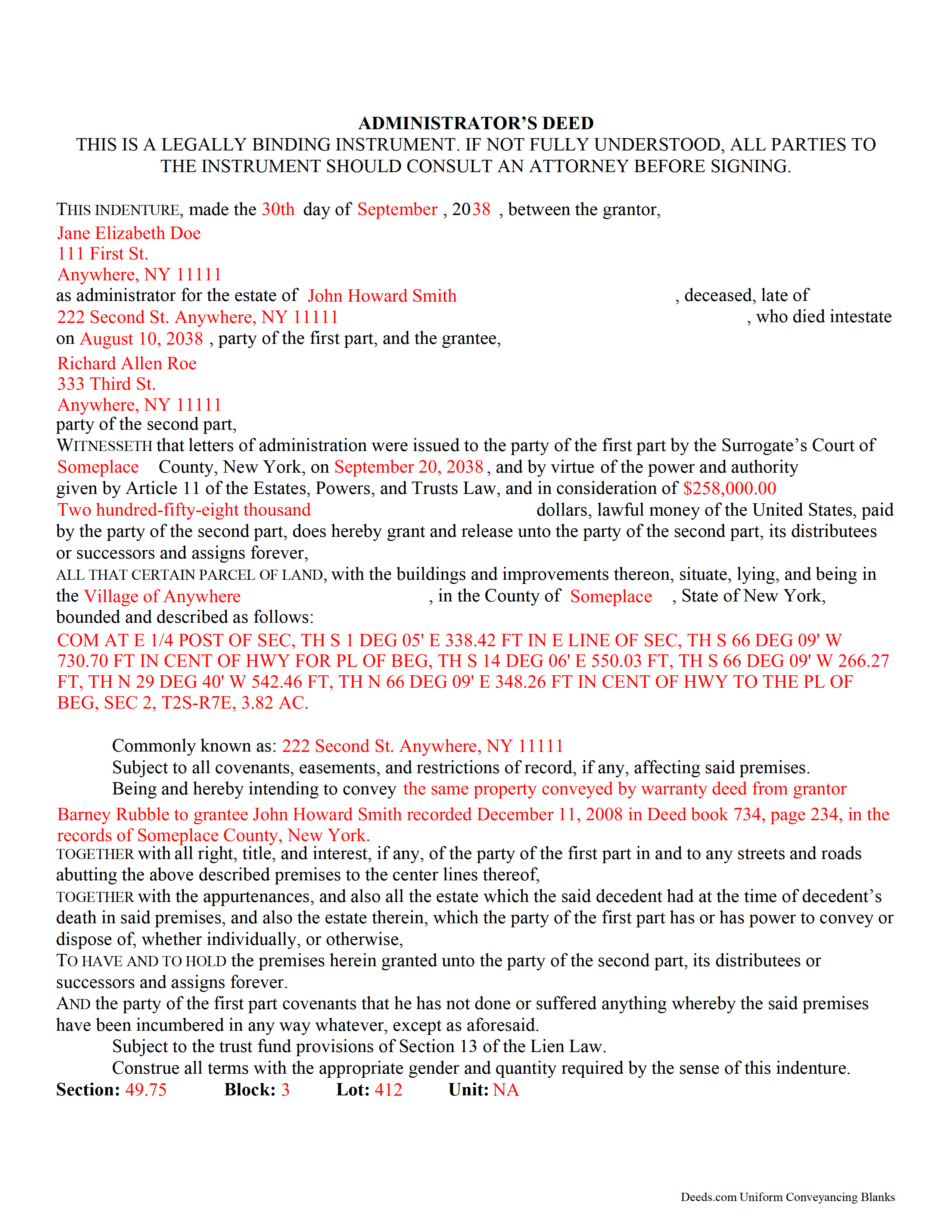

Orange County Completed Example of the Administrator Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional New York and Orange County documents included at no extra charge:

Where to Record Your Documents

Orange County Clerk

Goshen, New York 10924

Hours: Monday - Friday 9:00am to 5:00pm

Phone: (845) 291-2690 & 291-3292

Recording Tips for Orange County:

- Double-check legal descriptions match your existing deed

- Both spouses typically need to sign if property is jointly owned

- Request a receipt showing your recording numbers

- Have the property address and parcel number ready

Cities and Jurisdictions in Orange County

Properties in any of these areas use Orange County forms:

- Arden

- Bellvale

- Blooming Grove

- Bullville

- Campbell Hall

- Central Valley

- Chester

- Circleville

- Cornwall

- Cornwall On Hudson

- Cuddebackville

- Florida

- Fort Montgomery

- Goshen

- Greenwood Lake

- Harriman

- Highland Falls

- Highland Mills

- Howells

- Huguenot

- Johnson

- Maybrook

- Middletown

- Monroe

- Montgomery

- Mountainville

- New Hampton

- New Milford

- New Windsor

- Newburgh

- Otisville

- Pine Bush

- Pine Island

- Port Jervis

- Rock Tavern

- Salisbury Mills

- Slate Hill

- Southfields

- Sparrow Bush

- Sterling Forest

- Sugar Loaf

- Thompson Ridge

- Tuxedo Park

- Unionville

- Vails Gate

- Walden

- Warwick

- Washingtonville

- West Point

- Westtown

Hours, fees, requirements, and more for Orange County

How do I get my forms?

Forms are available for immediate download after payment. The Orange County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Orange County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Orange County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Orange County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Orange County?

Recording fees in Orange County vary. Contact the recorder's office at (845) 291-2690 & 291-3292 for current fees.

Questions answered? Let's get started!

Transferring New York Real Property with an Administrator's Deed

Administrator's deeds are used to transfer title to real property when the owner died intestate (without a last will and testament).

The Surrogate's Court appoints an administrator to distribute the deceased individual's estate according to the rules set out in section 4-1.1of New York's Estates, Powers, and Trusts Law (EPT). The surrogate (the judge managing the case) issues documents called letters of administration, authorizing the administrator to begin his/her duties. If the estate includes real property, those duties could include using an administrator's deed to sell it.

Administrator's deeds contain the same information as warranty or quitclaim deeds, but they also include details about the administrator and the deceased owner. The administrator acts as the grantor on the deed, and his/her signature must be notarized. Some cases may require a witness to sign the deed in front of the notary, too. Note that at sections 309-a and 309-b, New York's Real Property Law (RPP) sets out specific notary statements based on whether the deed is signed inside or outside the state.

In addition to the standard state and local forms that accompany deeds submitted for recording, administrators might need to attach letters of administration from the Surrogate's Court, certified copies of the decedent's death certificate, and other supporting documentation as appropriate. Depending on the circumstances, the sale might also require court approval.

Probate procedures can be complicated, and each situation is unique. Seek assistance from an attorney or from the surrogate responsible for the case with any questions about this process.

(New York AD Package includes form, guidelines, and completed example)

Important: Your property must be located in Orange County to use these forms. Documents should be recorded at the office below.

This Administrator Deed meets all recording requirements specific to Orange County.

Our Promise

The documents you receive here will meet, or exceed, the Orange County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Orange County Administrator Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4574 Reviews )

Patricia G.

July 10th, 2019

Very easy to order and download all the promised forms and instructions

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Catherine R.

August 7th, 2019

What a great way to put my mind at ease. It was easy to fill out and printed out nicely.

Thank you for your feedback. We really appreciate it. Have a great day!

Mary Z.

December 2nd, 2021

Awesome forms, easy to complete and print.

Thank you!

Sandra W.

April 7th, 2019

I think this is going to be a very resourceful website, really have not had a chance to fully navigate yet. I look forward to accessing more.

Thank you!

David R.

January 11th, 2019

Great source of all required legal documents and supplements.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Filomena G.

March 8th, 2025

very helpful

Thank you!

Laryn A.

March 3rd, 2020

Very happy with the beneficiary deed forms packet. It was helpful to have an example of a properly filled out form. The only suggestion would be is to show where the exemption code should be placed on the form.

Thank you for your feedback. We really appreciate it. Have a great day!

edward d.

March 19th, 2023

used before awesome forms

Thank you!

Kevin M.

April 2nd, 2022

good so far. will wait to see what happens

Thank you!

Anthony G.

February 17th, 2021

I have only used the service on one occasion but so far it has been great. Extremely simple to use.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Susann T.

November 4th, 2020

I have been very happy with the prompt assistance that I have received from deeds.com! How refreshing this is when so often good customer service seems rare these days!

Thank you for your feedback. We really appreciate it. Have a great day!

Charles F.

November 19th, 2020

Quick and Easy

Thank you for your feedback. We really appreciate it. Have a great day!

Christine L.

April 18th, 2019

I would like the ability to edit the document.

Thank you for your feedback Christine.

KELLY P.

July 19th, 2021

That was easy!!

Thank you!

Maria S.

January 10th, 2019

The paperwork/forms are fine, but there isn't enough explanation for me to figure out how to file the extra forms (which I do need in my case). The main form, Deed Upon Death is fine. I think the price is pretty high for these forms. I wouldn't have purchased it because there are places to get them for much cheaper (about 6 dollars), but this site had the extra forms I wanted (property in a trust and another form). Unfortunately these were included as a "courtesy" and there are no instructions for them. So three stars for being clear about what was in the package, having the right forms that I need, but instructions for putting them to use and price took a couple of stars off. Downloading was easy and once you download you can type the info into the PDF--that makes working with the forms much easier.

Thank you for the feedback Maria. Regarding the supplement documents, it is best to get assistance from the agency that requires them. These are not legal documents, they should provide full support and guidance for them.