Rockland County Correction Deed Form

Rockland County Correction Deed Form

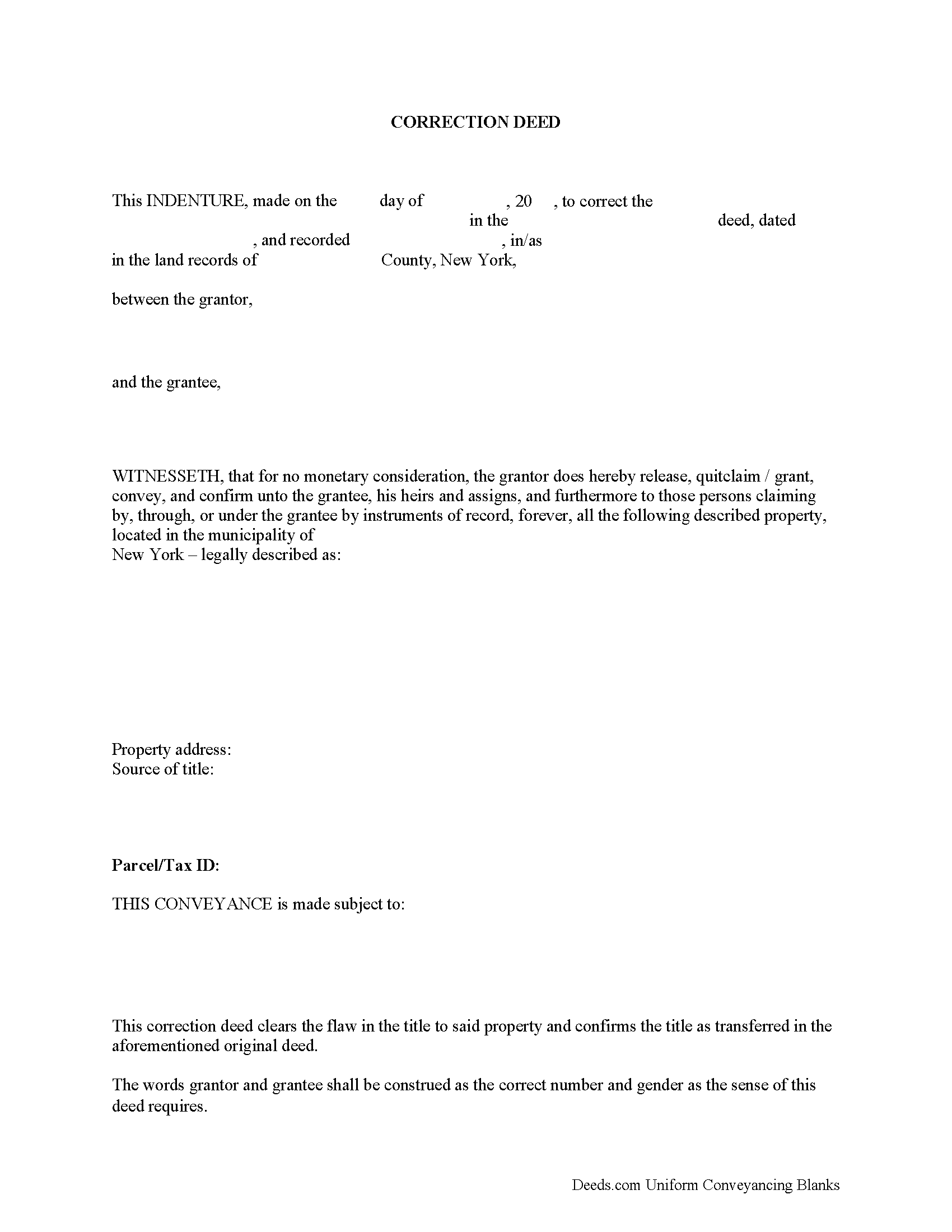

Fill in the blank form formatted to comply with all recording and content requirements.

Rockland County Correction Deed Guide

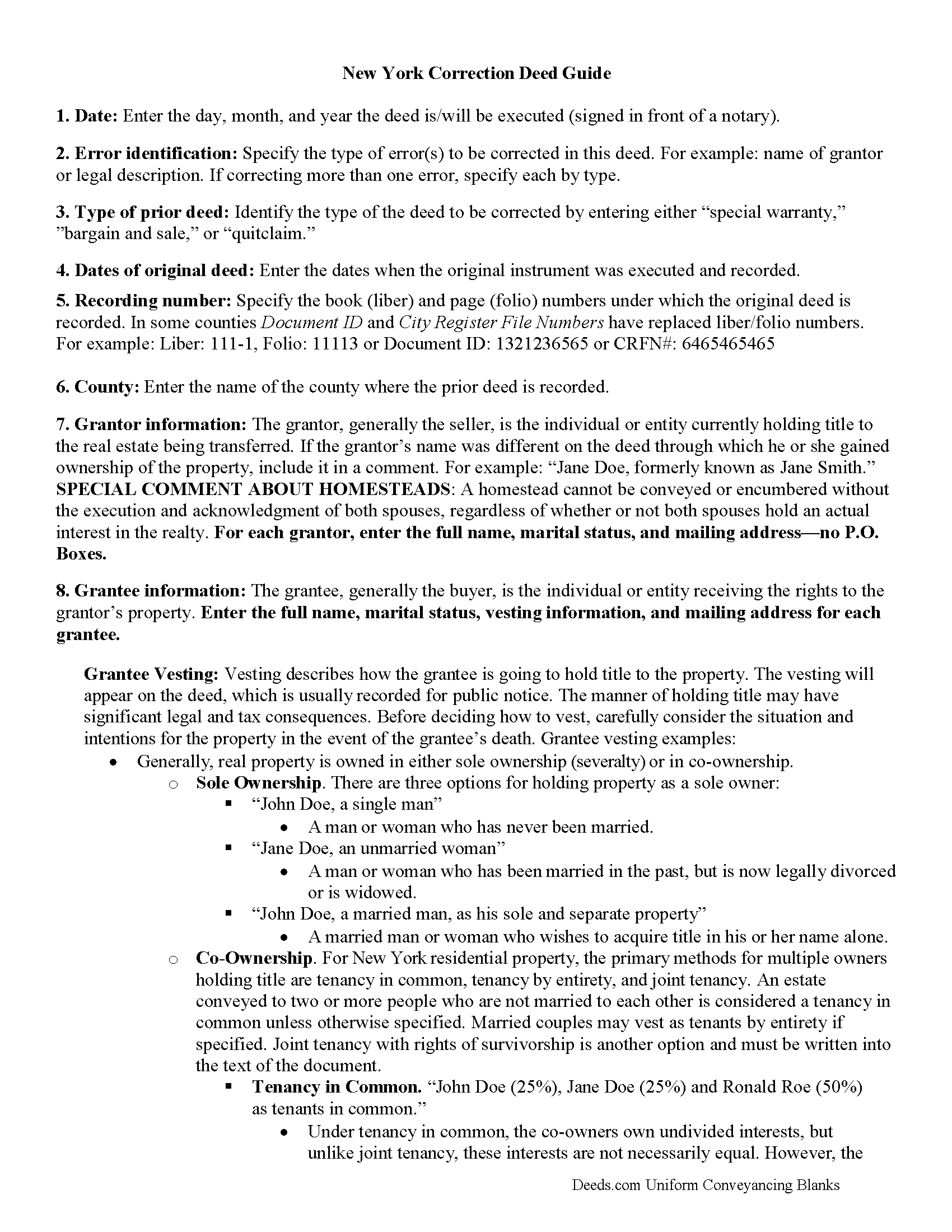

Line by line guide explaining every blank on the form.

Rockland County Completed Example of the Correction Deed Document

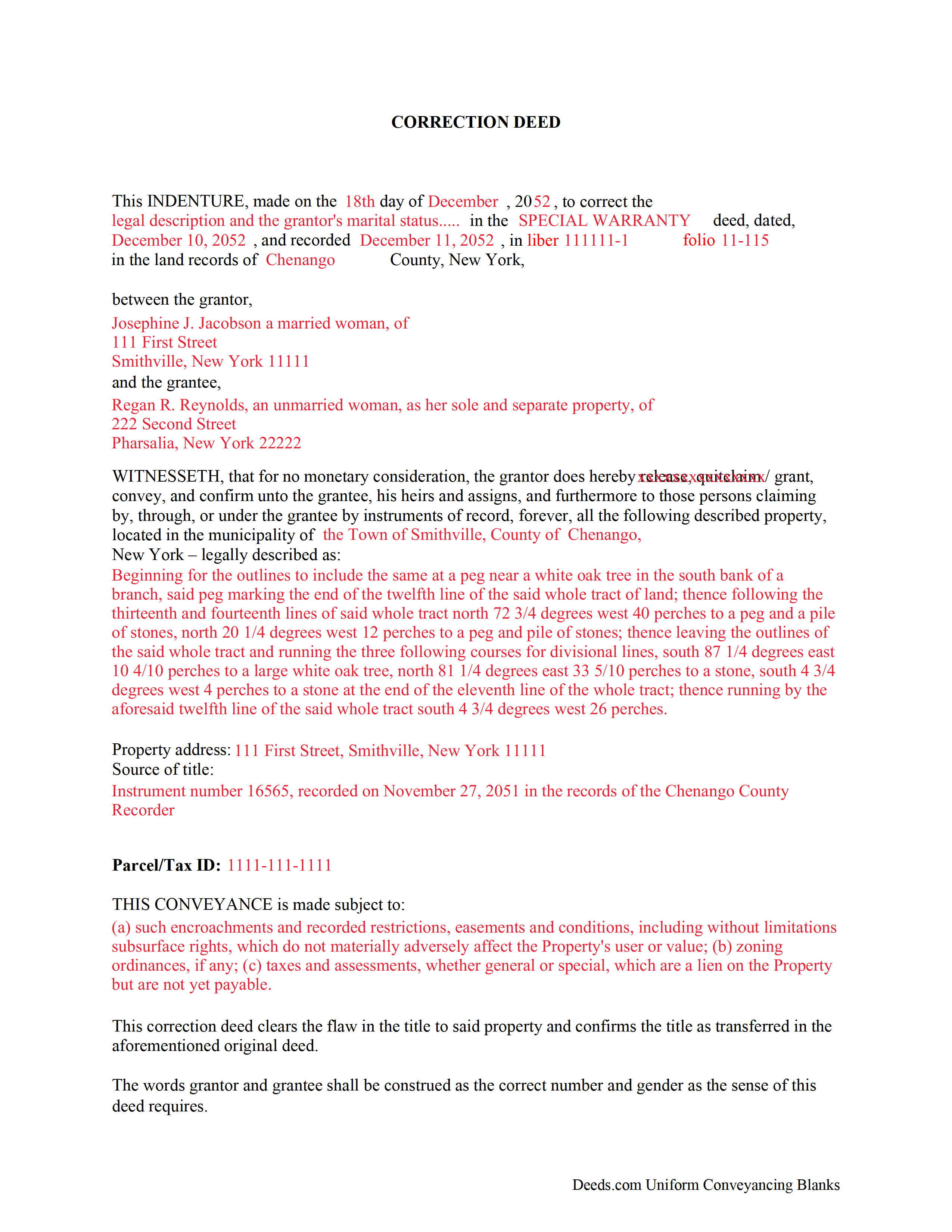

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional New York and Rockland County documents included at no extra charge:

Where to Record Your Documents

Rockland County Clerk

New City, New York 10956-3549

Hours: 7:00am - 6:00pm M-F / Recording: 7:00am - 5:00pm

Phone: (845) 638-5070

Recording Tips for Rockland County:

- Ensure all signatures are in blue or black ink

- Bring your driver's license or state-issued photo ID

- Check margin requirements - usually 1-2 inches at top

- Recording fees may differ from what's posted online - verify current rates

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Rockland County

Properties in any of these areas use Rockland County forms:

- Bear Mountain

- Blauvelt

- Congers

- Garnerville

- Haverstraw

- Hillburn

- Monsey

- Nanuet

- New City

- Nyack

- Orangeburg

- Palisades

- Pearl River

- Piermont

- Pomona

- Sloatsburg

- Sparkill

- Spring Valley

- Stony Point

- Suffern

- Tallman

- Tappan

- Thiells

- Tomkins Cove

- Valley Cottage

- West Haverstraw

- West Nyack

Hours, fees, requirements, and more for Rockland County

How do I get my forms?

Forms are available for immediate download after payment. The Rockland County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Rockland County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Rockland County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Rockland County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Rockland County?

Recording fees in Rockland County vary. Contact the recorder's office at (845) 638-5070 for current fees.

Questions answered? Let's get started!

Correction deeds are sometimes called confirmatory instruments. As such, they confirm and perfect an existing title created earlier and remove any defects from it, but they do not pass title on their own. They make explicit reference to the instrument that is being corrected by indicating its execution and recording date, the place of recording and the number under which the document is filed. They also need to identify the error or errors by type before supplying the correction in the subsequent body of the deed.

A new real property transfer report, RP-5217-pdf (or RP-5217NYC), with original signatures must accompany all deeds in New York, including correction deeds; the same goes for the tax affidavit TP-584, which both seller and buyer must sign. Forms are available at the county recording office or can be ordered online (but not downloaded). As a correction, the transaction may be exempt from transfer tax. Be sure to include proof that the transfer tax was paid, either by including the original cover page of the prior deed, or by providing an affidavit stating that transfer tax was paid with the prior document.

Furthermore, counties often require a cover page, which may be specific to the county or city and provided on their websites. It serves to identify the document more easily and may be called "recording and endorsement (cover) page." New recording fees per page must be paid for a correction instrument.

(New York CD Package includes form, guidelines, and completed example)

Important: Your property must be located in Rockland County to use these forms. Documents should be recorded at the office below.

This Correction Deed meets all recording requirements specific to Rockland County.

Our Promise

The documents you receive here will meet, or exceed, the Rockland County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Rockland County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4601 Reviews )

Carolyn G.

September 1st, 2021

I was extremely pleased with this experience, which literally took a minimum amount of time. One recommendation: make certain that when documents are uploaded that they have been received in the appropriate file. The lack of clarity caused me to upload twice or three times. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Fernando B.

June 11th, 2021

It works

Thank you!

Daniel S.

August 28th, 2019

Fast. Easy. More than I expected. Hope it all works with MD bureaucrats.

Thank you for your feedback. We really appreciate it. Have a great day!

Julian H.

January 6th, 2023

I had no issues downloading the template. The price was reasonable and the document was compliant with the law for Alabama Mechanics Liens, which saved me some time and effort. Nice aide. Thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Susan A.

April 23rd, 2021

The warranty deed form, the explanation and the example were well worth the price, as they gave me more confidence I was filling the deed out correctly. I cross referenced all of it with the county registrars website and the previous warranty deed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jacquelyn W.

February 4th, 2022

Great site with great info. Almost made the job seamless but form would not adjust to my longer than usual legal description -- I ended up having to recreate the form in word processing software (Libre). But could not have done it without the guidelines.

Thank you!

Christine L.

May 13th, 2025

User friendly!

Thank you!

Wes C.

March 26th, 2022

The forms are easy to use and the examples and guidance are easy to understand and follow.

Thank you for your feedback. We really appreciate it. Have a great day!

Donna C.

June 24th, 2021

I was very impressed with the system. Easy to navigate. Took less than 15 minutes to get what I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michelle A.

January 5th, 2025

deeds.com is user-friendly and very easy to navigate. Guides, samples, and free supplement forms are available for every State and are frequently updated. The cost is economical. I recommend these products

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

ELIZABETH A P.

January 11th, 2019

THE FORMS WERE GOOD, EASY TO UNDERSTAND. NICE TO BE ABLE TO DOWNLOAD THEM INSTANTLY. LIKED THAT I DID NOT HAVE TO JOIN ANYTHING WITH ONGOING FEES.

Thank you Elizabeth, have a great day!

Anthony P.

December 7th, 2021

Documents exactly as described, no complaints.

Thank you!

Gregory G.

April 4th, 2019

Quick and Easy/Immediate Access after payment. Now seeking other forms needed ASAP! Thanks!

Thank you!

LuAnn F.

September 8th, 2022

Simple and quick access to the form I needed

Thank you!

Don R.

January 26th, 2022

From Pennsylvania here. Documents are great and easy to fill out however you are lacking a couple of things. You only provide the option for a Grant Deed when you purchase by your county which is Mercer County for me. Why not give the ability to get a Warranty Deed that better protects the Grantee? Also, being from Pennsylvania and in a county that mined Buituminous Coal we are required to include the Coal Severance Notice and Bituminous Mine Subsidence and Land Conservation Act Notice. You can check the box on your Deed form that they are required and attached but you do not provide the verbiage or form for this. You state that you know what each county requires and include everything required but you do not include these two required Notices. This has been a requirement for years and the wording never changes. I had to look for these Notices and hand type this information and include it on another seperate page after the Notary section on the Deed. The Grantor has to sign the Coal Severance Notice and be witnessed by a Notary so I had to add another place for the Notary and will have to pay twice for witnessed signatures when it could have been included in your document. My Deed from 2003 was done that way and then the Notary statement after that so it was only one notarized witness of signature.

Thank you for your feedback. We really appreciate it. Have a great day!