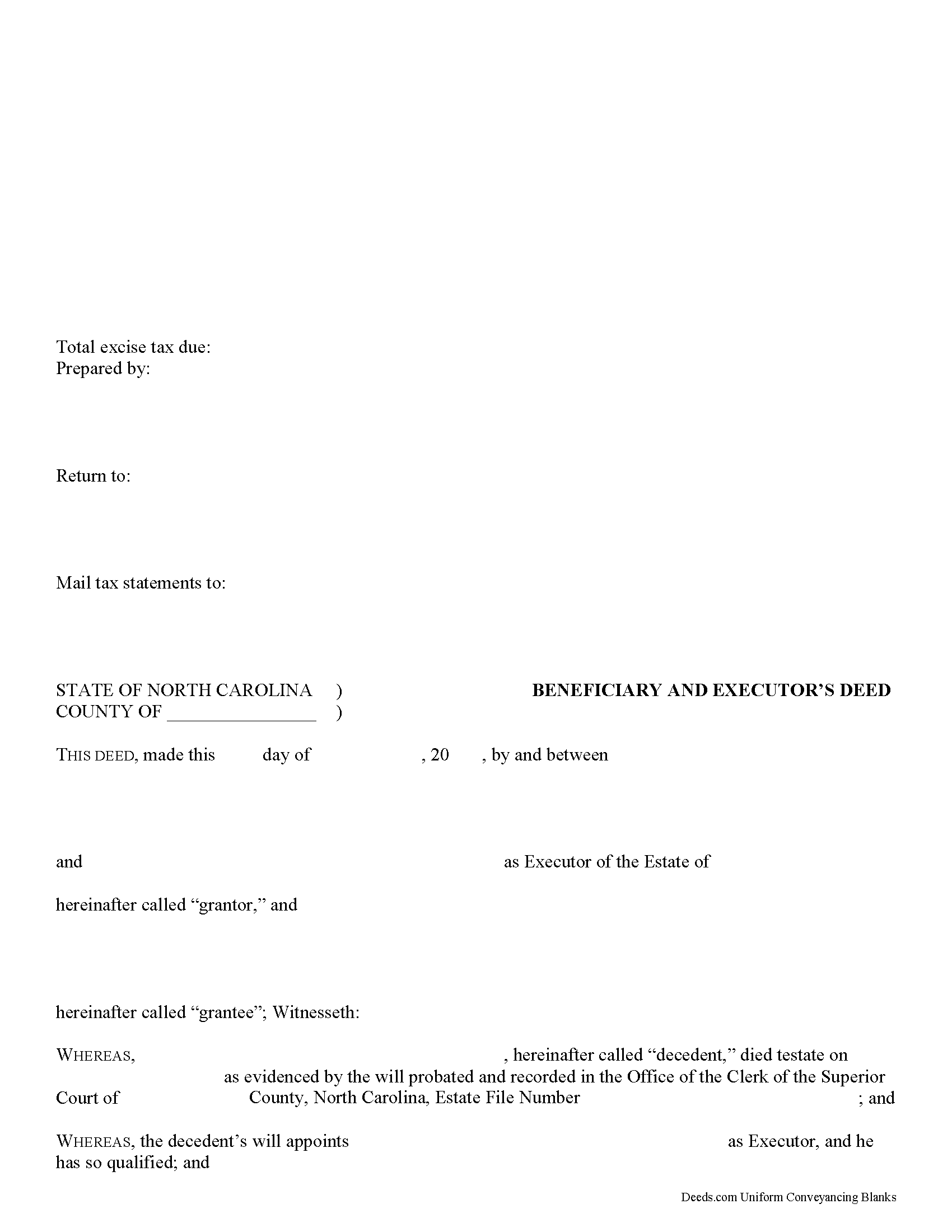

Alamance County Beneficiary and Executor Deed Form

Alamance County Beneficiary and Executor Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

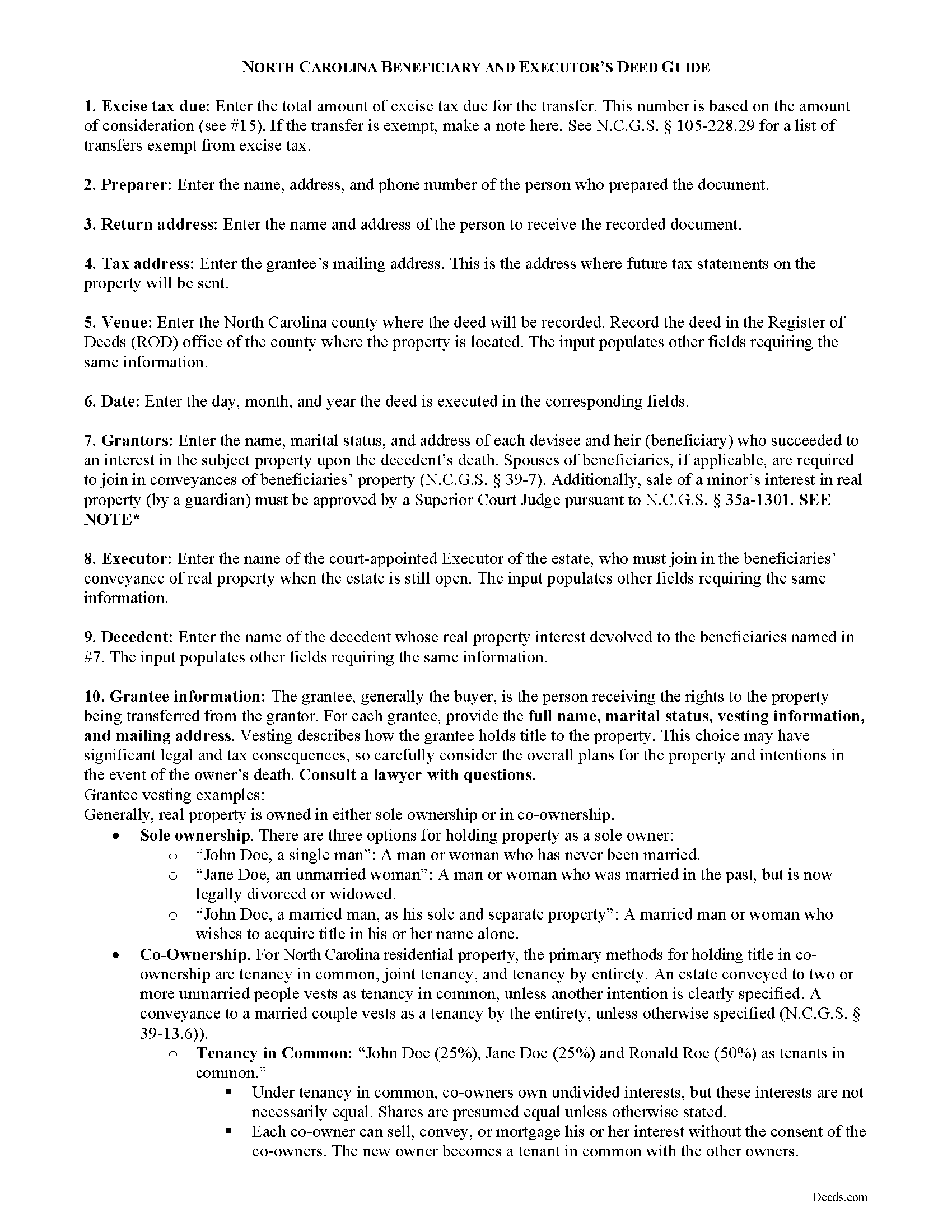

Alamance County Beneficiary and Executor Deed Guide

Line by line guide explaining every blank on the form.

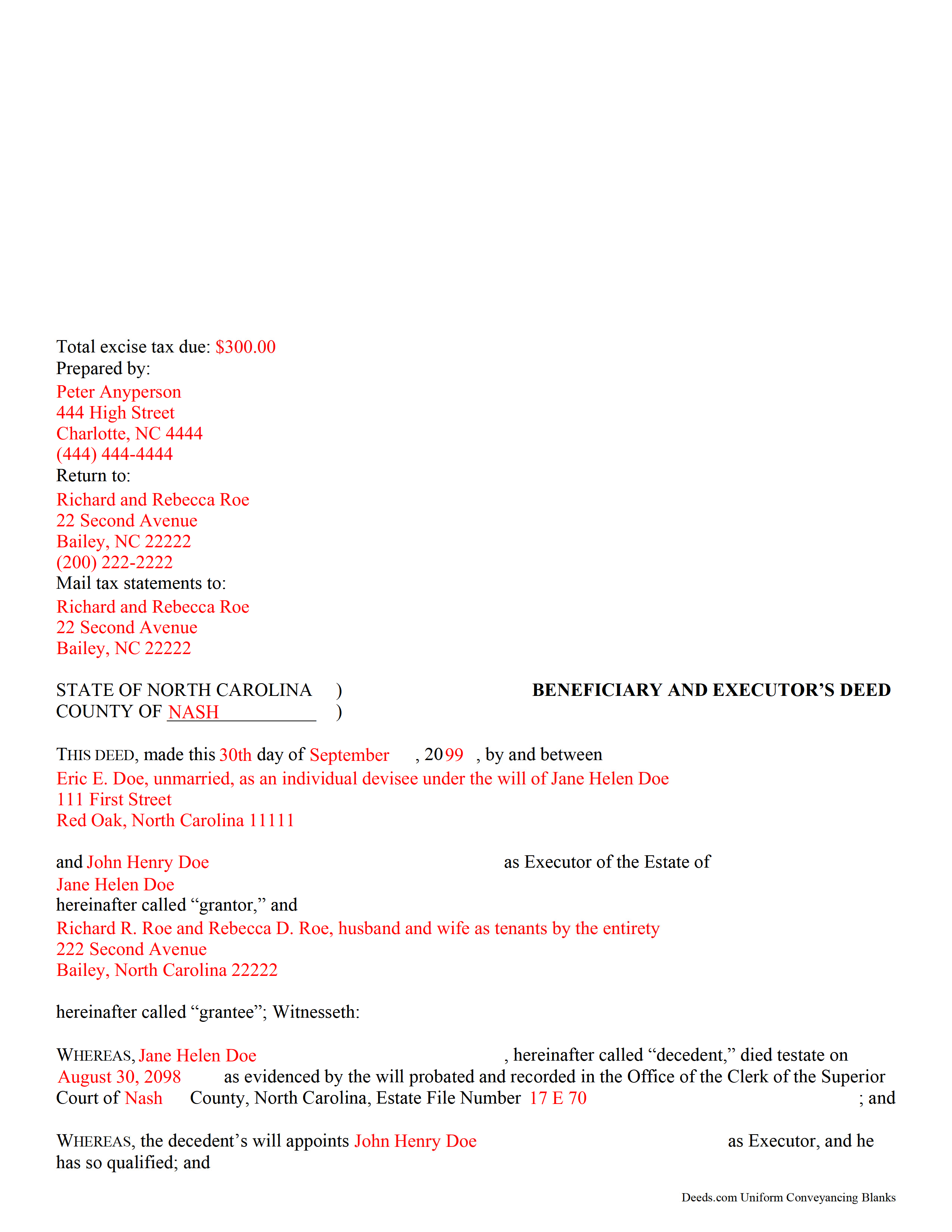

Alamance County Completed Example of the Beneficiary and Executor Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional North Carolina and Alamance County documents included at no extra charge:

Where to Record Your Documents

Register of Deeds

Graham, North Carolina 27253

Hours: 8:00am - 5:00pm M-F / Recording until 4:30pm

Phone: (336) 570-6565

Recording Tips for Alamance County:

- Verify all names are spelled correctly before recording

- Check that your notary's commission hasn't expired

- Check margin requirements - usually 1-2 inches at top

- Recording fees may differ from what's posted online - verify current rates

Cities and Jurisdictions in Alamance County

Properties in any of these areas use Alamance County forms:

- Alamance

- Altamahaw

- Burlington

- Elon

- Graham

- Haw River

- Mebane

- Saxapahaw

- Snow Camp

- Swepsonville

Hours, fees, requirements, and more for Alamance County

How do I get my forms?

Forms are available for immediate download after payment. The Alamance County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Alamance County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Alamance County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Alamance County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Alamance County?

Recording fees in Alamance County vary. Contact the recorder's office at (336) 570-6565 for current fees.

Questions answered? Let's get started!

Probate is the legal process of proving a decedent's (deceased person's) will, if any, valid and settling his or her estate. An executor is the personal representative named in the decedent's will to administer his or her estate.

When the estate's assets are not sufficient to pay debts, the executor may need to petition the superior court where the estate is open to obtain an order to sell the decedent's real property. In North Carolina, title to real property vests in the decedent's heirs upon death, and a special proceeding is required to bring the property into the estate.

The beneficiary and executor's deed is an instrument executed by a decedent's heirs and joined by the executor of the decedent's will to convey an interest in real property from a testate estate (so called when the decedent leaves a will) to a purchaser.

When the estate is still open in probate, the executor joins in the deed consenting to the sale of the real property described within as required by N.C.G.S. 28A-17-12. By signing the deed, the executor waives the possibility of opening a special proceeding to bring the property back into the estate later.

Unless a) the decedent wills the realty to the executor or directs to the executor to sell the realty with only the proceeds of the sale directed to devisees, or b) the will confers a power of sale upon the executor and devises the property to the estate (and not a devisee), heirs must execute the deed for a valid transfer. Because title is legally vested in them, the executing heirs may make warranties of title, but the executor typically does not. Any warranty language included in the deed is binding on the heirs.

Recitals of a beneficiary and executor's deed include a statement that the decedent died testate and information regarding the probated will, including the date of death, the county of probate, and the file number assigned to the decedent's estate by the clerk of superior court. In addition, the deed contains statements that the executor named within was appointed by the decedent's will and is duly qualified to administer the estate; that a notice to creditors has been given and the estate is still open; and that the executor joins to evidence consent to the sale.

A lawful deed in North Carolina states the consideration made for the transfer of title, contains an accurate legal description of the subject parcel, recites the grantor's source of title, and indicates whether the property conveyed comprises any part of the primary residence of the grantor. When properly executed and recorded, the beneficiary and executor's deed vests title to the within-described property in the named grantee(s). For a valid beneficiary and executor's deed, the signatures of heirs and their spouses must be present to release homestead rights. Any restrictions to the transfer should be noted in the body of the deed.

Both the heirs' signatures and the executor's signature must be acknowledged in the presence of a notarial official before the deed can be recorded in the county where the subject property is located. An affidavit of consideration or value is required for deeds recorded in Currituck County.

Consult an attorney licensed in the State of North Carolina with questions regarding beneficiary and executor's deeds, as each situation is unique.

(North Carolina B&ED Package includes form, guidelines, and completed example)

Important: Your property must be located in Alamance County to use these forms. Documents should be recorded at the office below.

This Beneficiary and Executor Deed meets all recording requirements specific to Alamance County.

Our Promise

The documents you receive here will meet, or exceed, the Alamance County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Alamance County Beneficiary and Executor Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4583 Reviews )

Jeremiah W.

August 2nd, 2020

Very helpful information and great forms.

Thank you for your feedback. We really appreciate it. Have a great day!

Sarah N.

July 3rd, 2019

This is not at all the form that I needed. I am trying to disclaim my interest in a property, but this form is much too rigid to work for my case. It would have been nice to know some of the more specific details before purchasing the document.

Thank you for your feedback. Sorry hear of your confusion. We have canceled your order and payment. We do hope that you are able to find something more suitable to your needs. Have a wonderful day.

Jeane W.

April 13th, 2024

I needed to add my partner to my warranty deed and deeds.com made it easy to understand what form I needed, attached a great explanation of the form and a sample of the form filled out. Couldn't be happier. In fact I'm researching a Revocable Transfer on Death Deed now and they've given me the confidence to rewrite my own will on my own.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

ALI T.

January 31st, 2024

It is very easy to use Deeds.Com to perform eRecording. The case staff are very professional and punctual. My eRecording package was completed within a day where it usually takes months. Thank You

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lori F.

July 16th, 2020

These folks are so amazing! They were very kind, patient and the communication was above and beyond. Basically, THEY ROCK!

Thank you!

Jeanne V.

December 20th, 2021

The service your provide is awesome. I rarely need to file a deed through e-recording, but when an emergency arose and I needed to get the deed recorded fast, your program came through. Well worth the $19.00 cost! It was very convienent and easy to use. I will definitely use this service again!!

Thank you for your feedback. We really appreciate it. Have a great day!

Ken W.

March 24th, 2025

Deeds.com provides outstanding service! Quick e-recording, at a reasonable price, and if there are any issues, they work with you to resolve them. I'm recommending them to everyone I know who buys and sells land.

Knowing our customers are happy is our top priority. Thank you for the wonderful feedback!

Edward L.

March 6th, 2019

Excellent web site with just the right documents. Filled a very important need in less tha 2 minutes time.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert G.

January 4th, 2019

Very nice. Especially liked that I could re-use the form since I have a couple of properties.

Thank you!

Thomas R.

June 21st, 2024

First time user. Was pleased with the easy of use and the step-by-step directions provided by the website.

We are motivated by your feedback to continue delivering excellence. Thank you!

Charlotte H.

July 16th, 2022

Easy to use and download. Everything we needed with a guide for accuracy.

Thank you!

HELEN F.

July 12th, 2019

Was straight to the point... Easy to read instructions... smooth process

Thank you for your feedback. We really appreciate it. Have a great day!

Diane J.

October 20th, 2021

Worked great very quick and easy without the sample model for my state would have been difficult for me thank's

Thank you for your feedback. We really appreciate it. Have a great day!

Jay T.

August 6th, 2020

I filled out the deed, had it notarized, and recorded. No problems. I put this off for so long. Once I had the form it was recorded in one day.

Thank you for your feedback. We really appreciate it. Have a great day!

Linda L.

July 7th, 2021

The service was excellent. The fee to use Deeds was more than I expected however, but the service was excellent!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!