Traill County Correction Deed Form

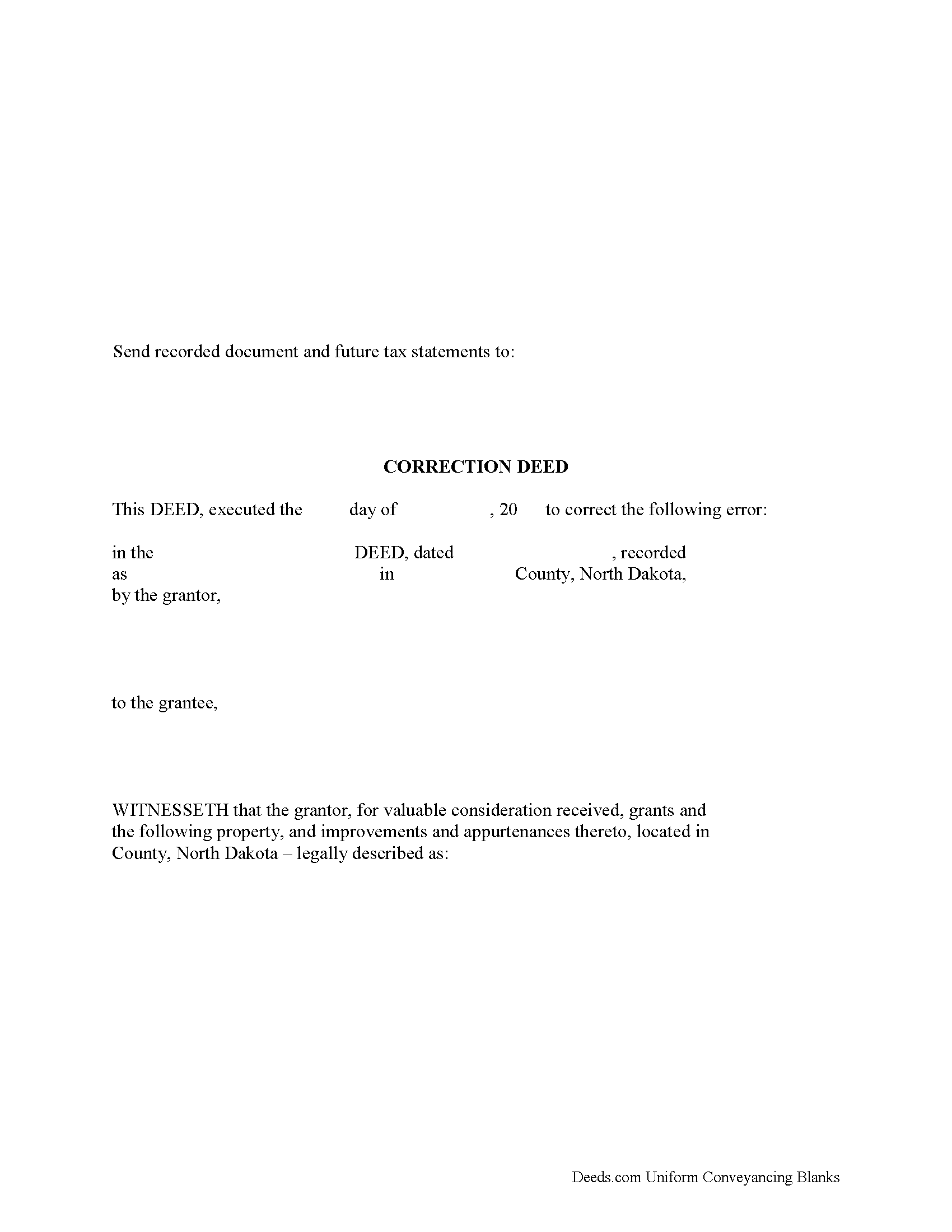

Traill County Correction Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

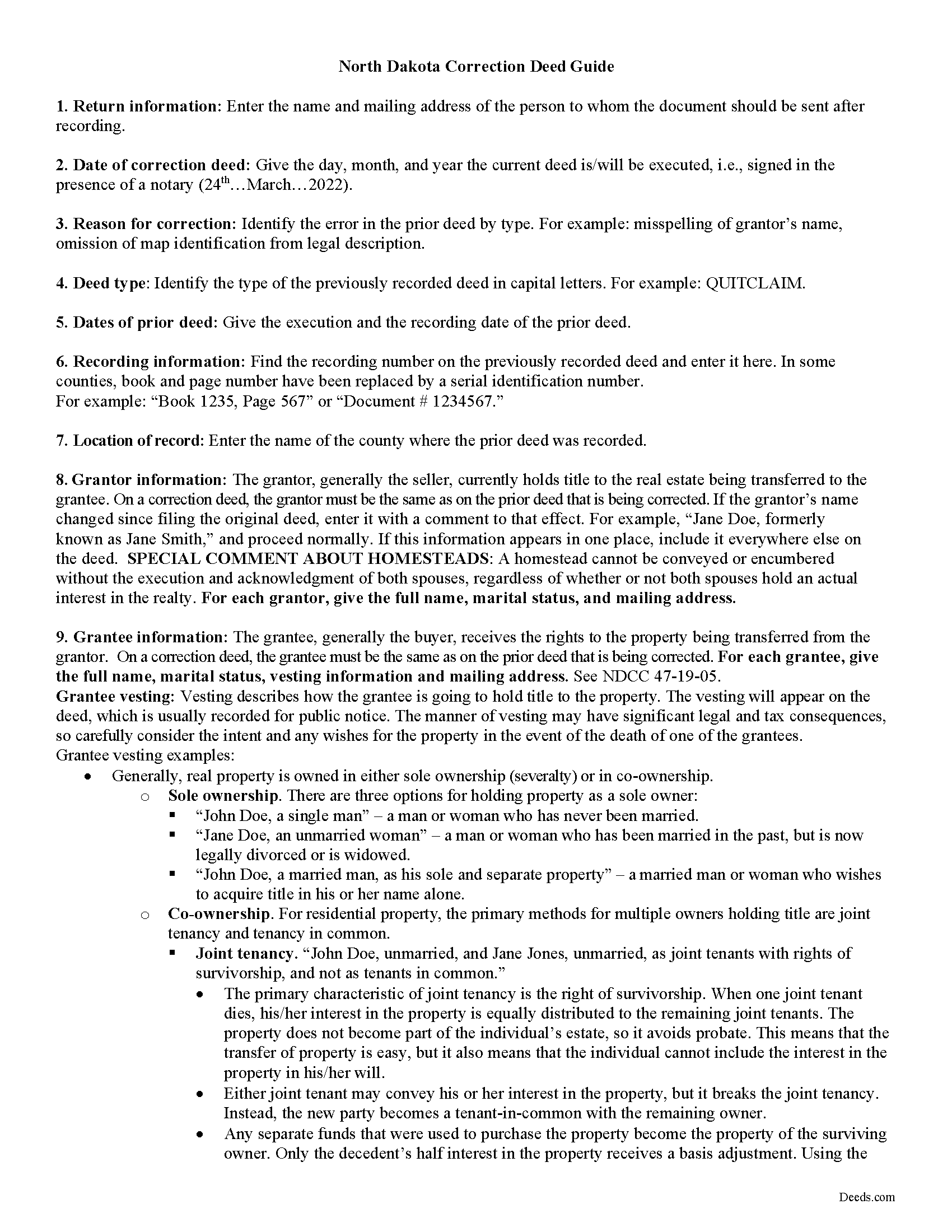

Traill County Correction Deed Guide

Line by line guide explaining every blank on the form.

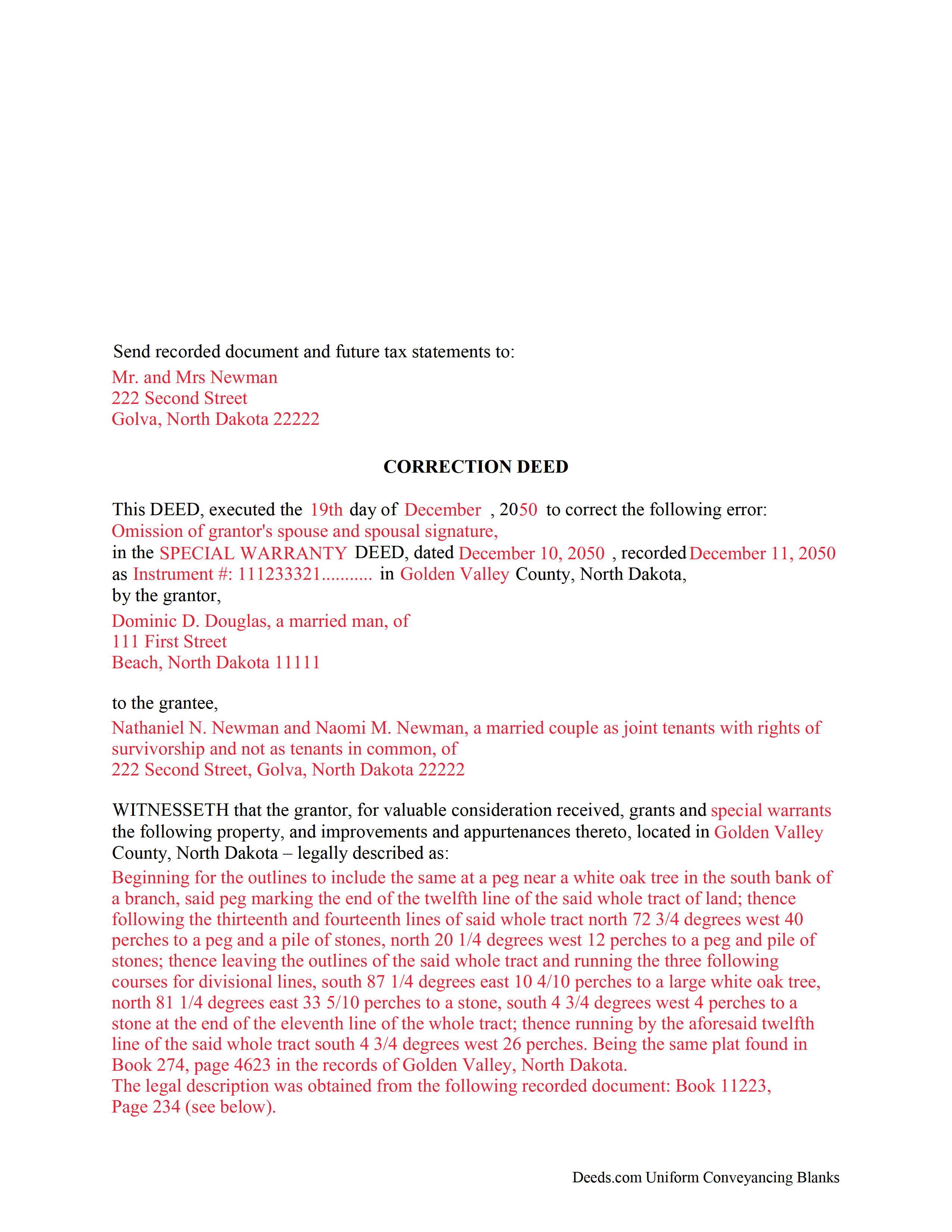

Traill County Completed Example of the Correction Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional North Dakota and Traill County documents included at no extra charge:

Where to Record Your Documents

Traill County Recorder

Hillsboro, North Dakota 58045

Hours: 8:00 to 12:00 & 12:30 to 4:30 M-F

Phone: (701) 636-4457

Recording Tips for Traill County:

- Bring your driver's license or state-issued photo ID

- Double-check legal descriptions match your existing deed

- Verify all names are spelled correctly before recording

- Leave recording info boxes blank - the office fills these

Cities and Jurisdictions in Traill County

Properties in any of these areas use Traill County forms:

- Blanchard

- Buxton

- Caledonia

- Clifford

- Cummings

- Galesburg

- Hatton

- Hillsboro

- Mayville

- Portland

Hours, fees, requirements, and more for Traill County

How do I get my forms?

Forms are available for immediate download after payment. The Traill County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Traill County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Traill County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Traill County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Traill County?

Recording fees in Traill County vary. Contact the recorder's office at (701) 636-4457 for current fees.

Questions answered? Let's get started!

Use the correction deed to correct an error in a previously recorded deed of conveyance in North Dakota.

Correcting an error in a recorded deed helps prevent problems that might arise when the current owner tries to sell the property. The best method for correction is to prepare and record a new document, a so-called correction deed. This document does not convey title; instead, it confirms the prior conveyance of the property.

Apart from supplying the correct information, the new deed must give the reason for the correction by identifying the error. It also must reference the prior deed by title, date, and recording number. The original grantor has to sign again, which confirms the property transfer to the grantee. Generally, corrective deeds are used to address minor errors in a deed, such as typos, accidentally omitted suffixes or middle initials of names, and other minor omissions. When in doubt about the gravity of an error and whether a correction deed is the appropriate vehicle to address it, consult with a lawyer.

For certain changes, a correction deed may not be appropriate. Adding or removing a grantee, for example, or making material changes to the legal description, especially deleting a portion of the originally transferred property, may all require a new deed of conveyance, instead of a correction deed. When correcting the legal description, both grantor and grantee should sign the corrective instrument to avoid doubt regarding any portions of the conveyed property.

(North Dakota CD Package includes form, guidelines, and completed example)

Important: Your property must be located in Traill County to use these forms. Documents should be recorded at the office below.

This Correction Deed meets all recording requirements specific to Traill County.

Our Promise

The documents you receive here will meet, or exceed, the Traill County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Traill County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Ottomar H.

January 15th, 2022

Deeds site was easy to use and allowed me to print the forms I needed. No need to change anything.

Thank you!

Charles F.

April 28th, 2020

Hi Please do not take time to respond to my previous inquiry - - - I figured it out. Deeds.com is a great tool for those of us who have occasional need for your type of services. Thanks ! Chuck

Thank you!

Donaldo C.

August 7th, 2020

Deeds.com is very helpful when filling a Deed. I appreciate that. Thank you.

Thank you!

Paul R.

May 19th, 2021

So far, so good. Great looking site.

Thank you!

Judith A.

January 14th, 2022

Excellent

Thank you!

Elizabeth L.

November 5th, 2019

Used this site and the forms a few times now and always a good experience. It's so nice to be able to download these forms to my computer and work on them there. So many others want you to do everything online, pain in my opinion. Thank you Deeds!

Thank you for your feedback. We really appreciate it. Have a great day!

William M.

May 22nd, 2021

On multiple tries, I could not get validation mail through my Yahoo email address. I tried Gmail, worked the first time. The rest of the process was super easy and fast.

Thank you!

Sandra M.

November 17th, 2019

The forms were easy to use but there was a software issue that made it impossible to get the county name to appear on the form in the correct place. It made the deed look a little sloppy

Thank you!

Peter M.

July 30th, 2020

GREAT! site, had everything we needed to complete our estate planning for our children

Thank you for your feedback. We really appreciate it. Have a great day!

Patricia And James J.

January 1st, 2019

No review provided.

Thank you for your feedback. We really appreciate it. Have a great day!

David A.

April 23rd, 2019

Excellent service. I have been looking for a beneficiary deed for quite a wile with no success. My friend found your site and I was overjoyed. Fast, easy to use, and understand.I recommend this site to anyone.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Valerie S.

July 16th, 2020

The service was easy, fast, and cheap and we were able to close our sale 2 days after we downloaded the deed! Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Marilyn S.

January 7th, 2021

I was fine. But I don't like surveys.

Thank you!

Stan B.

March 19th, 2022

Very satisfied with the PDF documents that I purchased. Will be able to transfer property without hiring an attorney. Well worth the price I paid. Stan

Thank you for your feedback. We really appreciate it. Have a great day!

Janepher M.

January 27th, 2019

Easy and informative site. Helped me figure out what I was looking for.

Thank you Janepher, we appreciate your feedback!