Traill County Quitclaim Deed Form

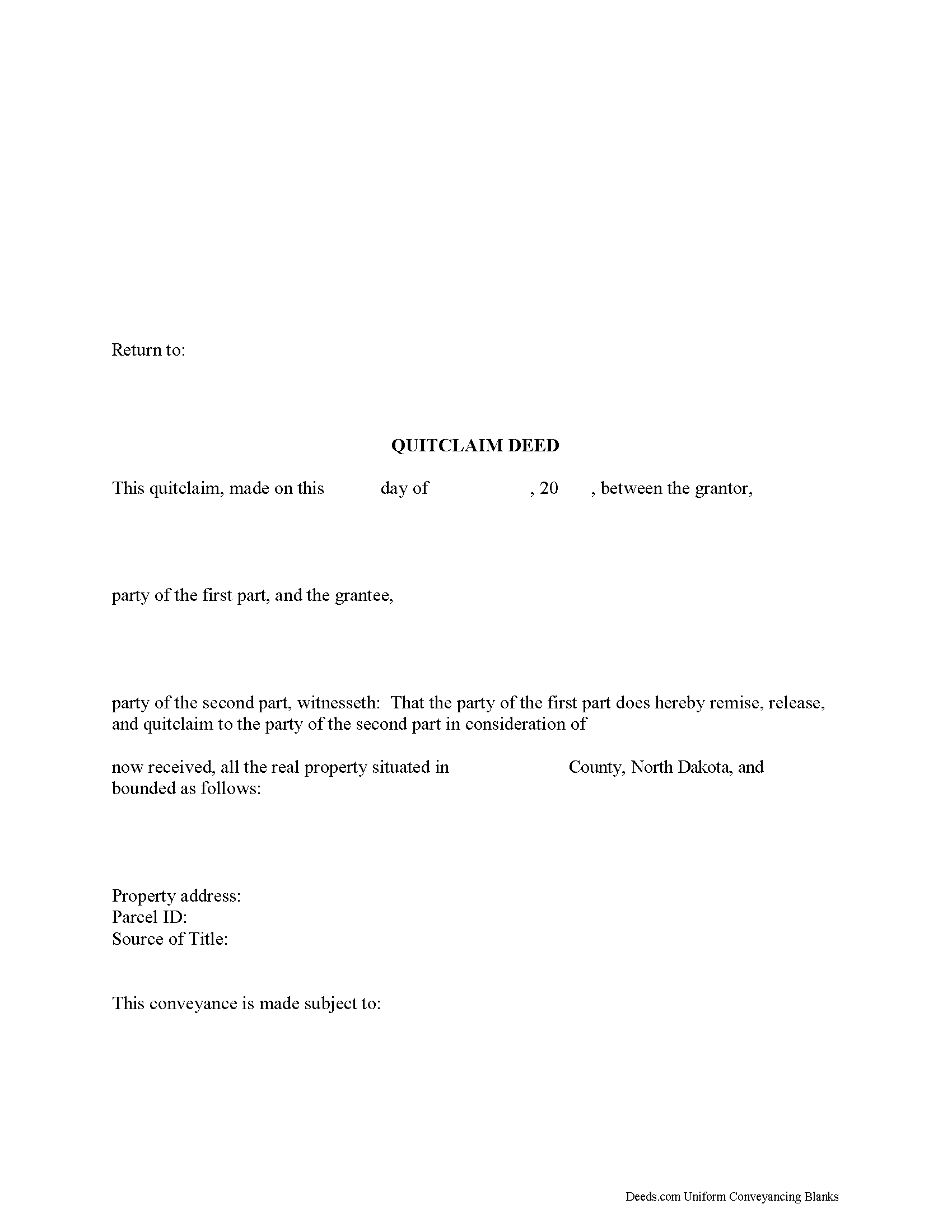

Traill County Quitclaim Deed Form

Fill in the blank Quitclaim Deed form formatted to comply with all North Dakota recording and content requirements.

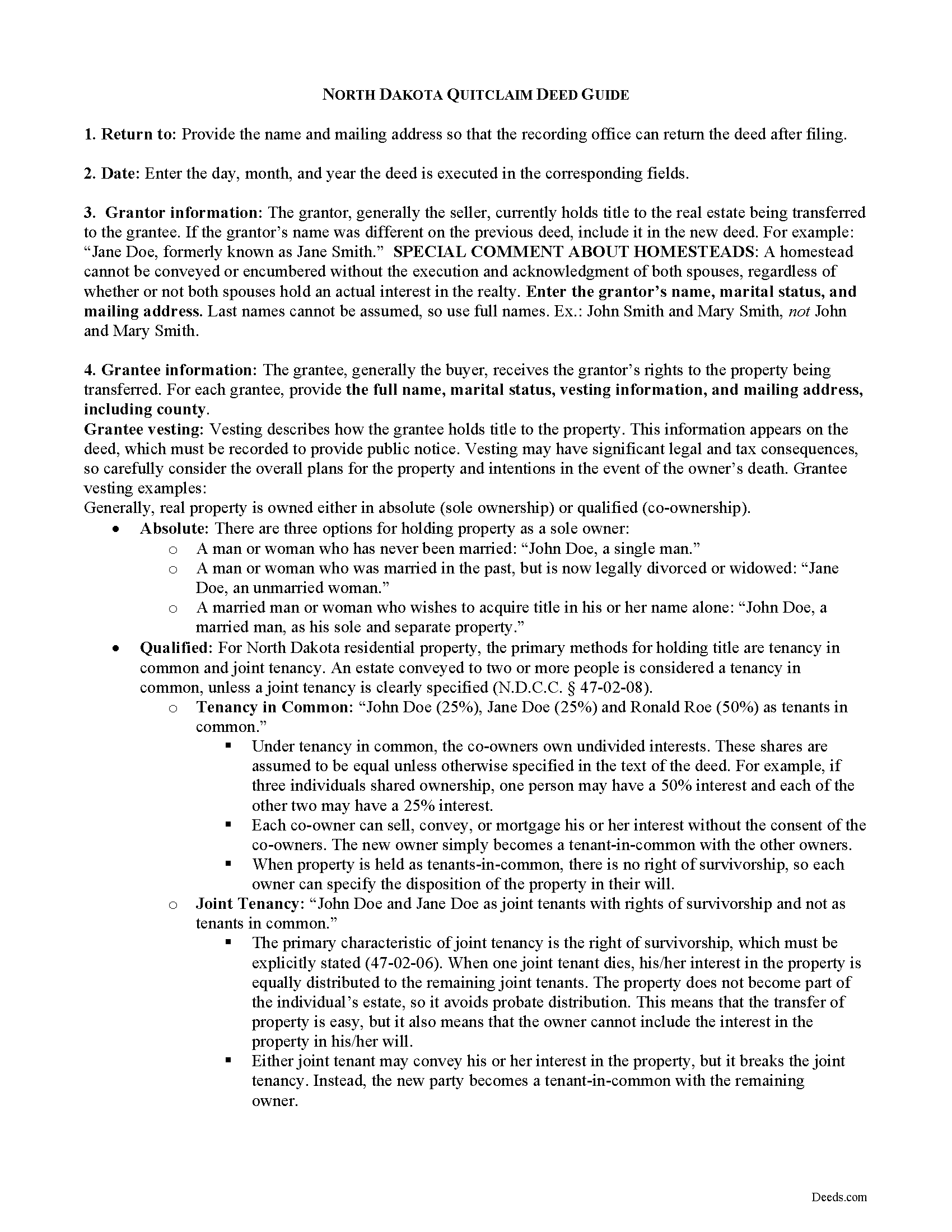

Traill County Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

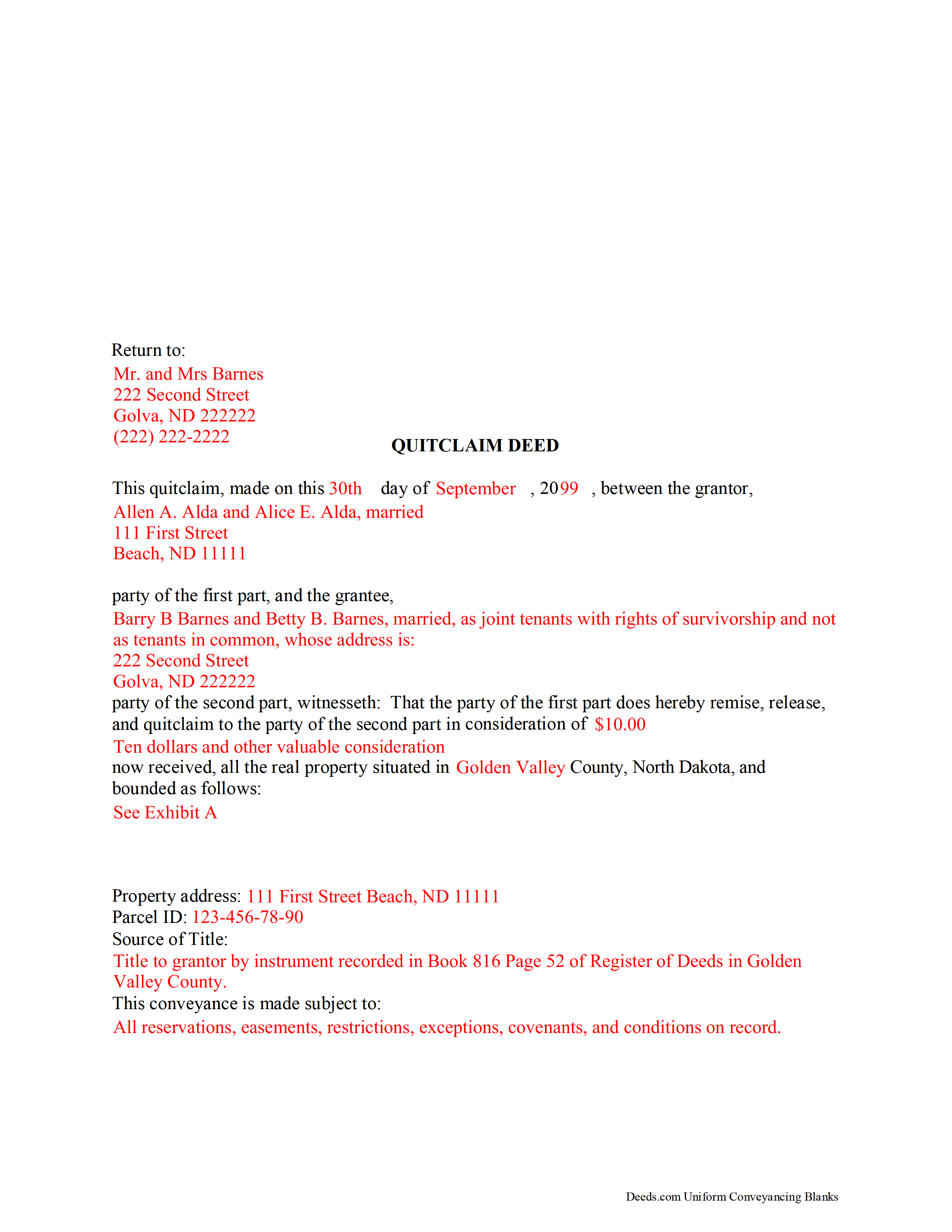

Traill County Completed Example of the Quitclaim Deed Document

Example of a properly completed North Dakota Quitclaim Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional North Dakota and Traill County documents included at no extra charge:

Where to Record Your Documents

Traill County Recorder

Hillsboro, North Dakota 58045

Hours: 8:00 to 12:00 & 12:30 to 4:30 M-F

Phone: (701) 636-4457

Recording Tips for Traill County:

- Bring your driver's license or state-issued photo ID

- Leave recording info boxes blank - the office fills these

- Recording fees may differ from what's posted online - verify current rates

- Bring extra funds - fees can vary by document type and page count

- Recorded documents become public record - avoid including SSNs

Cities and Jurisdictions in Traill County

Properties in any of these areas use Traill County forms:

- Blanchard

- Buxton

- Caledonia

- Clifford

- Cummings

- Galesburg

- Hatton

- Hillsboro

- Mayville

- Portland

Hours, fees, requirements, and more for Traill County

How do I get my forms?

Forms are available for immediate download after payment. The Traill County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Traill County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Traill County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Traill County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Traill County?

Recording fees in Traill County vary. Contact the recorder's office at (701) 636-4457 for current fees.

Questions answered? Let's get started!

A quitclaim deed in North Dakota will take effect and will vest the interest intended to be transferred by the grantor to the grantee upon its delivery (47-09-06). The post office address of the grantee is a prerequisite to recording (47-10-07). Additional requirements, such as a Certificate of Real Estate Value, signature of the grantor, and an acknowledgment, can be found in the North Dakota information section.

Every grant of an estate in real property in North Dakota is conclusive against the grantor and everyone subsequently claiming under the grantor, except a good faith purchaser or encumbrancer who acquires a title or lien for valuable consideration by an instrument that first is duly recorded (47-10-08). Recording a North Dakota quitclaim deed provides notice of the contents to all persons (47-19-19). If a quitclaim deed is not recorded, it is void as against a subsequent good faith purchaser who purchases the same real estate for valuable consideration (or portion of it) whose conveyance, whether it is entitled to be recorded or not, is first duly recorded in the proper county in North Dakota. If a quitclaim deed is recorded first, this does not affect the question of the good faith of the subsequent purchaser (47-19-41). An unrecorded quitclaim deed is valid between the parties to it and those who have notice of it (47-19-46). However, having knowledge of a quitclaim deed that is outside the chain of title does not constitute notice (47-19-41).

(North Dakota QD Package includes form, guidelines, and completed example)

Important: Your property must be located in Traill County to use these forms. Documents should be recorded at the office below.

This Quitclaim Deed meets all recording requirements specific to Traill County.

Our Promise

The documents you receive here will meet, or exceed, the Traill County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Traill County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Arthur L.

October 31st, 2020

The directions were clear, I typed the deed out and it was successfully recorded and mailed back to me in less than a week.

Thank you for your feedback. We really appreciate it. Have a great day!

DENIS K.

July 17th, 2020

Excellent, invaluable and reasonable!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Julie C.

July 21st, 2020

The process worked great! It's a great solution for recording documents at the county during the pandemic and in the future if you don't want to leave home!!

Thank you!

Kristen H.

August 29th, 2019

This was such a money saver. I was told by someone at the courthouse that I had to have a lawyer prepare the paper work for my mom. They stated that family members couldn't prepare the papers. I was hopeful when I found that I could prepare the survivorship affidavit on Deeds. I was able to prepare everything myself and had no issues today when at the courthouse for all the changes. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

kelly W.

June 10th, 2019

Your customer service person was very professional and polite and helpful.

Thank you!

Anne G.

April 6th, 2020

I used deeds.com's services for the first time while the Stay at Home Order is in effect and found it to be very user friendly and seamless. I am very impressed.

Thank you Anne, glad we could help.

Laurie D.

January 24th, 2024

Comforting that you include an example of a completed TOD Deed form. Just downloaded all forms for my state & county and I'm SURE this will save a paying for a massive attorney fee!

We are grateful for your feedback and looking forward to serving you again. Thank you!

William K.

May 21st, 2019

I filled out the Xfer on Death Deed and turned it in to the County Recorder - everything went well. I did NOT like the Huge Print over like a stamp of "DEEDS.COM" on some of the material - it just made it hard to read.

Thank you for your feedback. We really appreciate it. Have a great day!

Janis H.

February 13th, 2020

Amazing! Great forms - created the quitclaim fairly easy, recorded with no issues. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Ruthea M.

March 18th, 2025

It was easy to download, but you need to open an account before doing so. That was not clear.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

Nancy G L.

March 25th, 2022

Using your site was simple, and the forms downloaded as expected.

Thank you!

Byron M.

June 17th, 2021

Very easy to sign up. Very quick to respond for payment once uploaded. Great communication. More expensive than other recording services.

Thank you for your feedback. We really appreciate it. Have a great day!

Iryna D.

March 31st, 2020

Exelent work!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

William A.

September 11th, 2019

I was able to get the documents I wanted, and very quickly. Good service.

Thank you!

Kathleen H.

July 21st, 2020

Very disappointed that the Recording Information section did not state where to get the information required.

Sorry to hear that we failed you Kathleen.