Hancock County Fiduciary Deed Form

Hancock County Fiduciary Deed Form

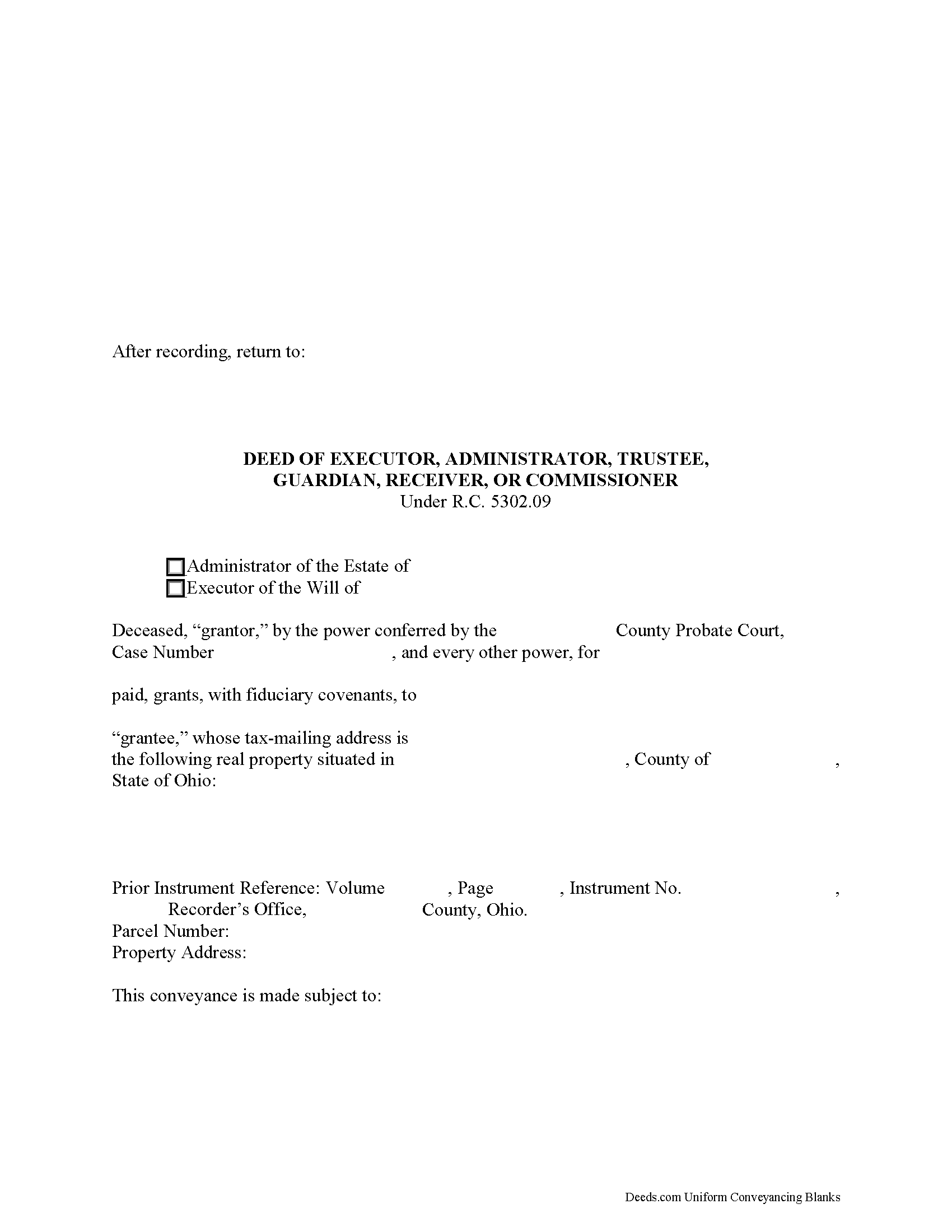

Fill in the blank form formatted to comply with all recording and content requirements.

Hancock County Fiduciary Deed Guide

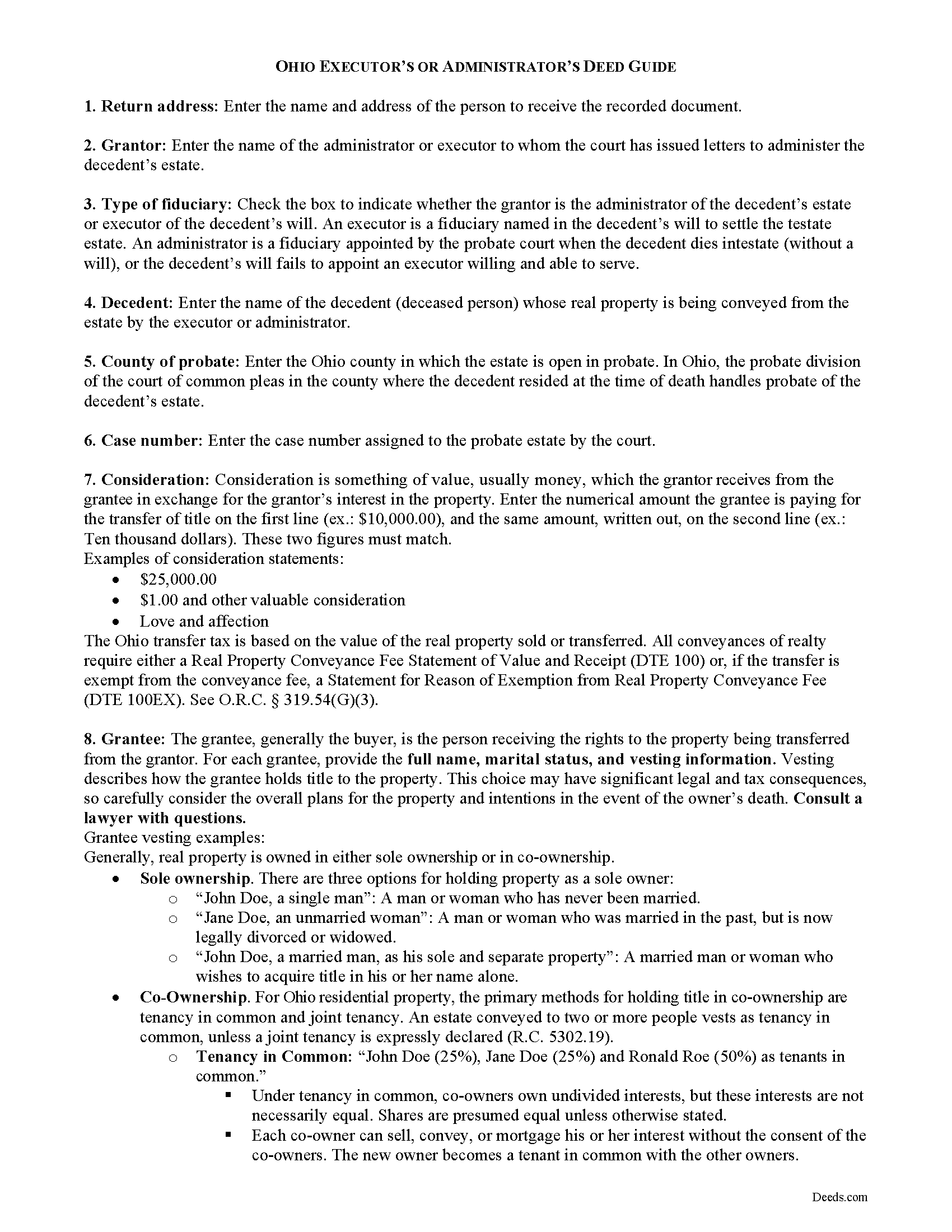

Line by line guide explaining every blank on the form.

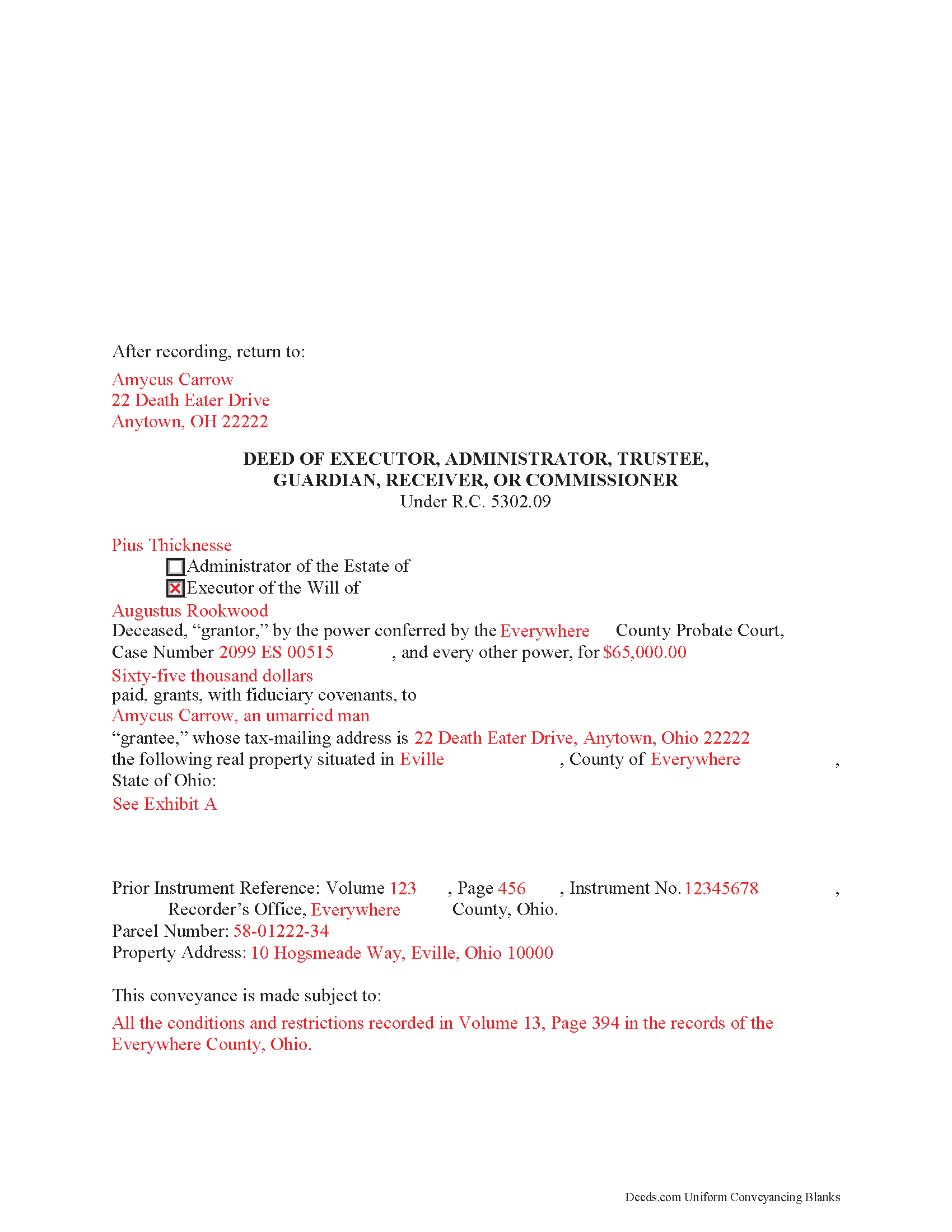

Hancock County Completed Example of the Fiduciary Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Ohio and Hancock County documents included at no extra charge:

Where to Record Your Documents

Hancock County Recorder

Findlay, Ohio 45840

Hours: 8:30am to 4:30pm Monday through Friday

Phone: (419) 424-7091

Recording Tips for Hancock County:

- Ensure all signatures are in blue or black ink

- Ask if they accept credit cards - many offices are cash/check only

- Recording fees may differ from what's posted online - verify current rates

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Hancock County

Properties in any of these areas use Hancock County forms:

- Arcadia

- Arlington

- Benton Ridge

- Findlay

- Jenera

- Mc Comb

- Mount Blanchard

- Mount Cory

- Rawson

- Van Buren

- Vanlue

- Williamstown

Hours, fees, requirements, and more for Hancock County

How do I get my forms?

Forms are available for immediate download after payment. The Hancock County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Hancock County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Hancock County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Hancock County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Hancock County?

Recording fees in Hancock County vary. Contact the recorder's office at (419) 424-7091 for current fees.

Questions answered? Let's get started!

Ohio Fiduciary Deed for Executors and Administrators

Probate is the legal process of settling and distributing a decedent's estate according to the terms of a probated will or laws of intestate succession. In the context of estate administration, a fiduciary is either an executor (when named in a will) or an administrator (when the decedent dies without a will or does not name an executor) assigned by the court of common pleas to administer the decedent's estate.

If the estate's assets are insufficient to pay debts, the fiduciary may need to sell the decedent's property. Fiduciaries must obtain the court's permission to sell assets from the estate, unless authorized or directed by the decedent's will.

In Ohio, executors and administrators use fiduciary deeds to convey real property from an estate to a purchaser pursuant to a court order. A fiduciary deed is a statutory form (R.C. 5302.09) containing fiduciary covenants that the grantor is the duly appointed, qualified, and acting fiduciary, and that he or she is authorized to make the sale and conveyance of the within described real property. Additionally, the grantor covenants with the grantee that in the proceedings of the sale, he or she has complied with statutory requirements (5302.10).

A fiduciary deed names the executing fiduciary's as grantor, and identifies the county and case number in which the decedent's estate is opened in probate. The deed states the amount of consideration the grantee is paying for the transfer of title, and titles the property in the name and manner of vesting of the grantee.

Deeds in Ohio require a recital of the grantor's source of title, including the prior instrument volume and page numbers. A full legal description of the subject parcel is required. Any restrictions on the property should also be noted. The executing fiduciary must sign the deed in the presence of a notary public before recording in the county where the subject property is located.

The information provided here is not a substitute for legal advice. Consult an attorney licensed in the State of Ohio with questions regarding fiduciary deeds, as each situation is unique.

(Ohio Fiduciary Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Hancock County to use these forms. Documents should be recorded at the office below.

This Fiduciary Deed meets all recording requirements specific to Hancock County.

Our Promise

The documents you receive here will meet, or exceed, the Hancock County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Hancock County Fiduciary Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4614 Reviews )

Catherine B.

October 26th, 2021

Was looking for information and forms relating to a trust my parents created, but what I purchased seems geared toward trusts containing real estate only, which is not what I needed. Clearly I missed something prior to purchasing something I can not use. Perhaps additional clarification for us without any experience is this area would be helpful.

Thank you for your feedback. We really appreciate it. Have a great day!

Christine P.

April 19th, 2020

Great service! Just what I needed and a bunch of informative extras too. Thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jerry W.

March 16th, 2020

Great program and easy to follow instructions.

Thank you for your feedback. We really appreciate it. Have a great day!

Lisa C.

December 5th, 2023

Thank you. Very easy!

We are delighted to have been of service. Thank you for the positive review!

Jim D.

October 28th, 2020

A bit pricey for someone on a fixed income.

Thank you!

Rick R.

February 5th, 2021

So far excellent service - I made a boo boo on the deed - no problem they made the change before they sent it off to be recorded. I will never drive to the Recorder's office again.

Thank you!

Ralph E.

March 24th, 2019

I wish I had found this site earlier!!! Not only was it helpful and just what I needed but I got my information so fast AND on the weekend. I would recommend this site to everyone. I plan on using it more. Its cheap and I can get my information while sitting at home. Very impressed!

Thank you for the kinds words Ralph. Have a great day!

Ken J.

May 14th, 2022

I liked the software, it's very easy to use. Once it's saved as a .pdf document on your computer, the source document is lost when you log out. I wish it could be saved and then edited on their site later instead of having to create a new document from scratch each time.

Thank you for your feedback. We really appreciate it. Have a great day!

Mohamed ali H.

December 21st, 2020

My experience on this website has been amazing and the process was very easy to understand and I was able to get my document filed within 3-4 hours. I plan to use this service in the future if I need to. Thank you for your excellent service!

Thank you for your feedback. We really appreciate it. Have a great day!

Spencer A.

January 25th, 2019

Deeds.com made it so easy to file my paper work with the county. It saved me half a days travel and cost me about a tank of gas. This service was well worth the saved travel time and energy. I would highly recommend this service to other individuals. The other companies I spoke with only service law firms, title companies & banks etc. Thanks deed.com, I'll be back and will refer all my friends too.

Thank you so much Spencer, we really appreciate your feedback!

Luis C.

May 10th, 2019

Excellent forms but the instructions are not to clear.

Thank you for your feedback. We really appreciate it. Have a great day!

Joyce S.

June 28th, 2019

The site was very easy to understand and to download the required documents I need to prepare a release. Response of the documents ready for my use was very efficient.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Susan Z.

February 1st, 2019

Helpful website. Couldn't use the forms for my situation and area

Thank you for your feedback Susan. We don't want you to have to pay for something you didn't use, we've gone ahead and canceled your order and payment. Have a great day!

Joe S.

July 6th, 2020

Easy to use, reasonable price and excellent customer service! I would not hesitate to use Deeds.com again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ralph H.

May 8th, 2019

Your documents resolved my problem. Thanks.

Thank you Ralph, we appreciate your feedback.