Union County Notice of Completion Form

Union County Notice of Completion Form

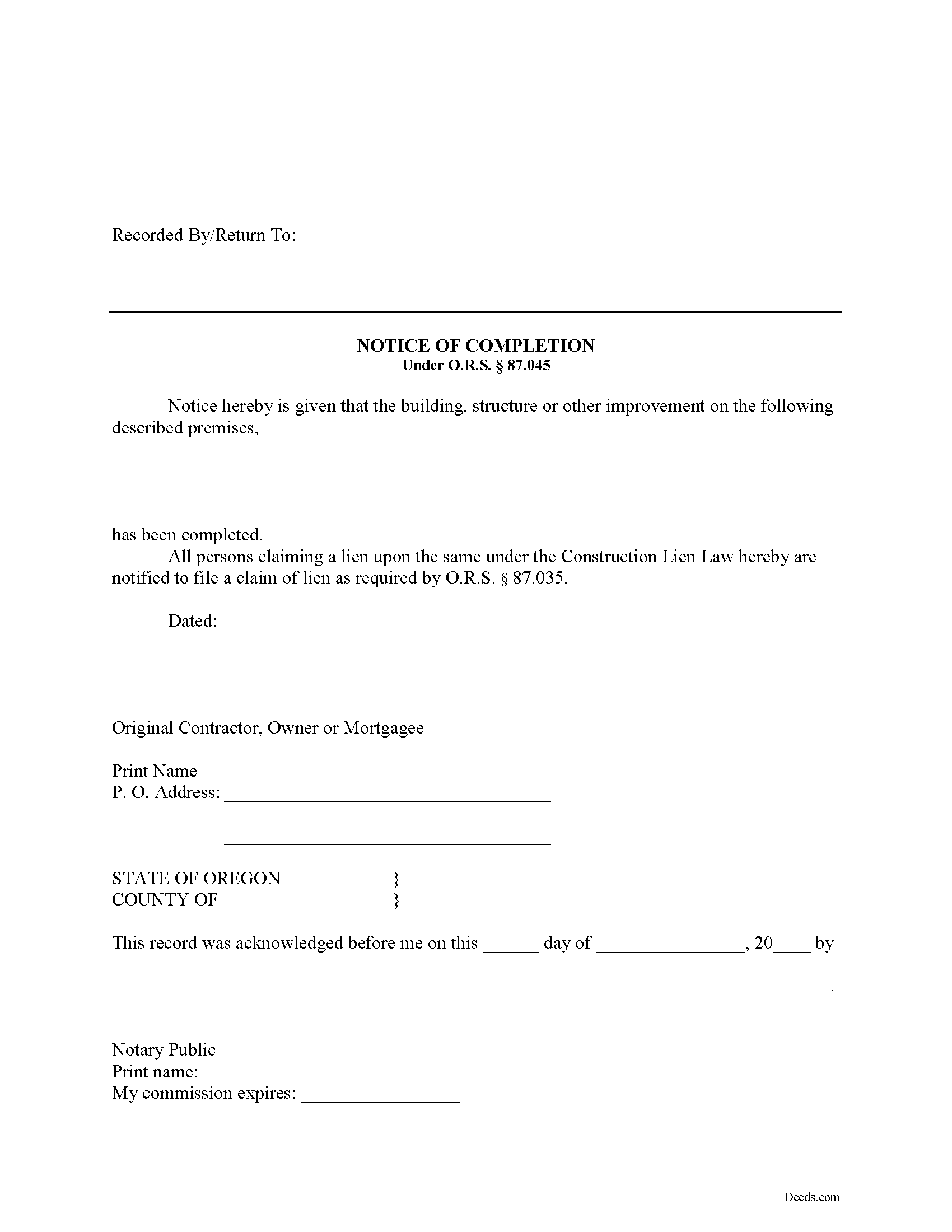

Fill in the blank Notice of Completion form formatted to comply with all Oregon recording and content requirements.

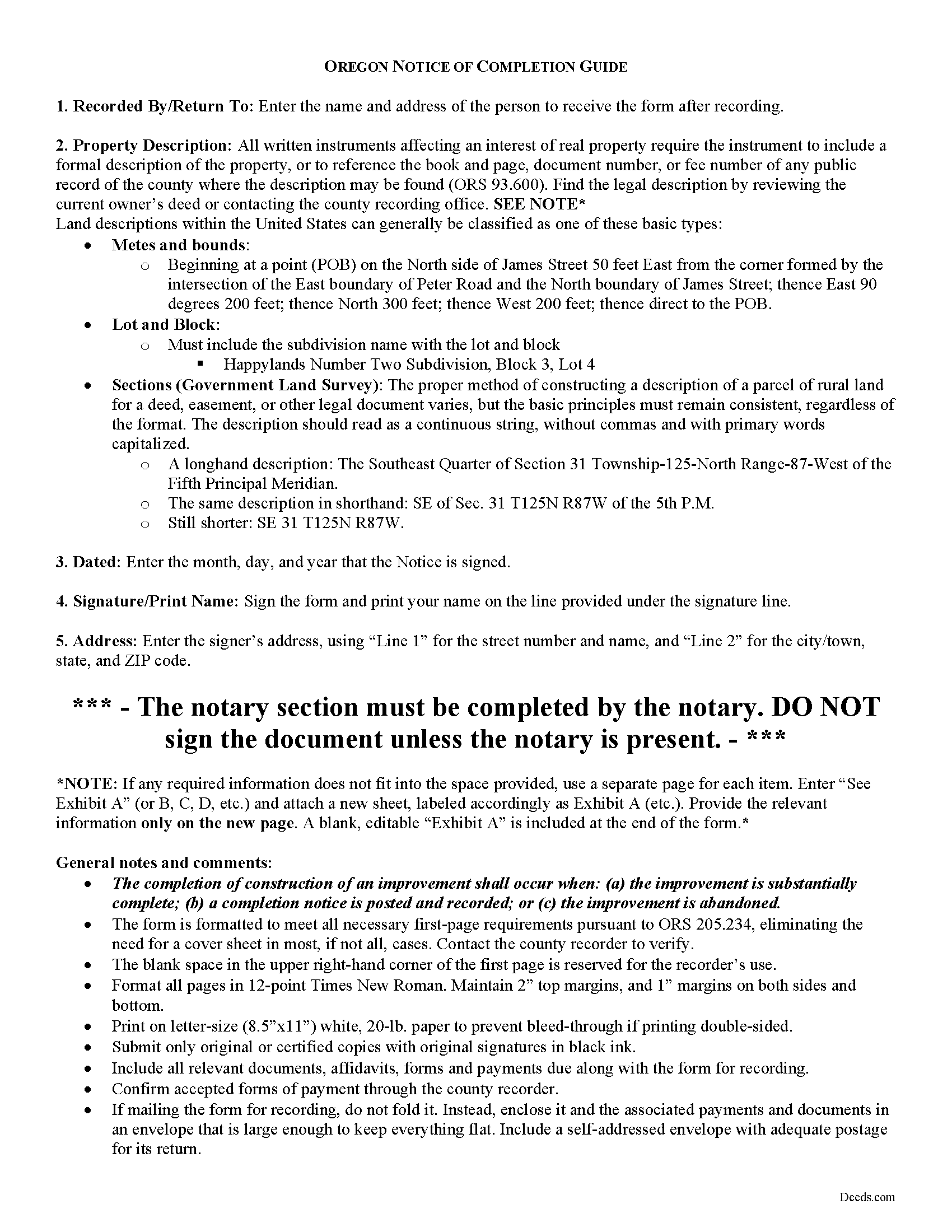

Union County Notice of Completion Guide

Line by line guide explaining every blank on the form.

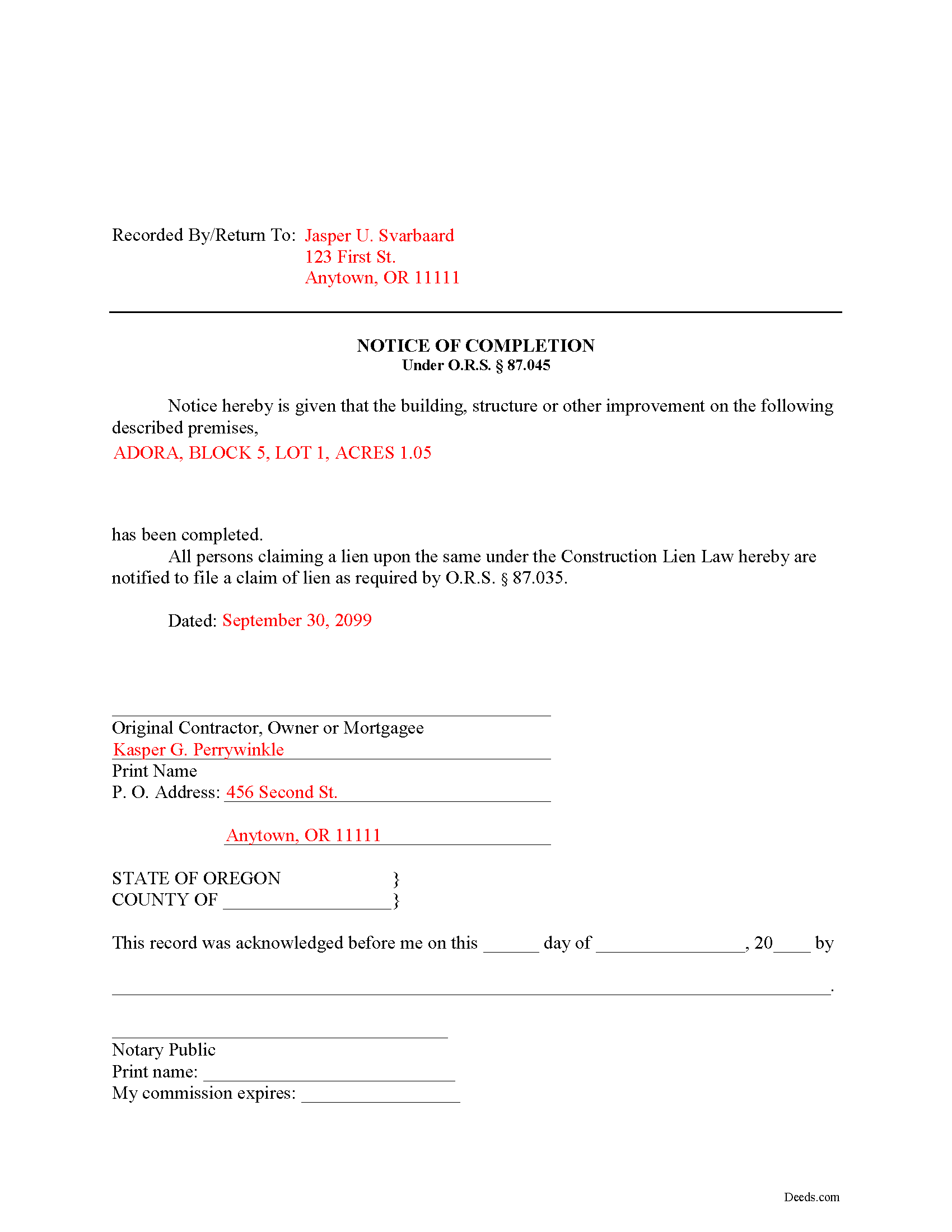

Union County Completed Example of the Notice of Completion Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Oregon and Union County documents included at no extra charge:

Where to Record Your Documents

Union County Clerk

La Grande, Oregon 97850

Hours: 8:30 to 5:00 Mon-Thu; 9:00 to 4:00 Fri

Phone: (541) 963-1006

Recording Tips for Union County:

- Ensure all signatures are in blue or black ink

- Bring your driver's license or state-issued photo ID

- Have the property address and parcel number ready

Cities and Jurisdictions in Union County

Properties in any of these areas use Union County forms:

- Cove

- Elgin

- Imbler

- La Grande

- North Powder

- Summerville

- Union

Hours, fees, requirements, and more for Union County

How do I get my forms?

Forms are available for immediate download after payment. The Union County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Union County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Union County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Union County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Union County?

Recording fees in Union County vary. Contact the recorder's office at (541) 963-1006 for current fees.

Questions answered? Let's get started!

Oregon's Construction Lien Law is codified at ORS 87.001 to 87.060 and 87.075 to 87.093.

Property owners and other interested parties who contract for construction work need to be vigilant and ensure that their property remains free from a mechanic's lien, especially those of any "hidden" lien claimants that may be working under another party and the owner is unaware. Therefore, an owner should draft, record, and post at a job site, a Notice of Completion, upon the jobs completion, because a lien must be perfected no later than 75 days after the project has ended or been abandoned.

In Oregon, a construction project is deemed complete when (a) the improvement is substantially complete; (b) a completion notice is posted and recorded; or (c) the improvement is abandoned. O.R.S. 87.045(1).

When all original contractors employed on the construction of the improvement have substantially performed their contracts, any original contractor, the owner or mortgagee, or an agent of any of them may post and record a completion notice. O.R.S. 87.045(2). The completion notice must include a legal description of the property, the date the notice was sent, and the signer's name and address. Id.

When completed, the Notice must be posted on the date it bears in some conspicuous place upon the land or upon the improvement situated thereon. O.R.S. 87.045(3). A copy of the Notice must also be recorded within five days from the date of its posting, by the party posting it (or his or her agent), in the recording office of the county in which the property, (or some part) is situated. Id. A copy of the notice, together with an affidavit made by the person posting the notice, stating the date, place and manner of posting the notice, must be attached to the Notice of Completion when it's recorded. Id.

Anyone claiming a lien created on the premises described in a completion or abandonment notice for labor or services performed and materials or equipment used prior to the date of the notice must perfect the lien on the 75th day after work on the construction of the improvement ceases. O.R.S. 87.045(4).

Proper use of a Notice of Completion will protect property owners by allowing them to know who might have a potential lien claim and start the clock ticking for the time to record such liens.

This article is provided for informational purposes only and should not be relied upon as a substitute for the advice of an attorney. Please consult an Oregon attorney with any questions about the Notice of Completion or other issues related to liens.

Important: Your property must be located in Union County to use these forms. Documents should be recorded at the office below.

This Notice of Completion meets all recording requirements specific to Union County.

Our Promise

The documents you receive here will meet, or exceed, the Union County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Union County Notice of Completion form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Terry C.

July 29th, 2021

It is a difficult challenge -- trying to take the needless jargon out of legal transactions so ordinary citizens can manage their affairs. Deeds.com hasn't solved all the problems, but has made a super effort to help us achieve self-sufficiency.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kevin T.

January 22nd, 2021

amazing customer service. thank you deeds.com. I just wish I knew about this company earlier. Kevin

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gary H.

October 18th, 2023

The package was very helpful and very easy to use. I saved me a lot of time and eliminated attorneys being involved. I would highly recommend your forms.

It was a pleasure serving you. Thank you for the positive feedback!

Kimberly J H.

August 1st, 2023

The Washington State Transfer on Death Deed I purchased worked perfectly.

Thank you for your feedback. We really appreciate it. Have a great day!

Carlene J.

August 12th, 2021

Great way to do business with Dc Government! I submitted my documents and received everything back and approved on the same day! No wait , no line! Lol

Thank you for your feedback. We really appreciate it. Have a great day!

ROBERT D.

October 16th, 2019

VERY HAPPY WITH YOUR SERVICE !

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John P.

December 8th, 2019

Working with one document at a time every thing was great, but the program will not let multiple documents save independently. When I saved a document and created another document the changes I made on the second document were on the 1st document. No big deal if your printing, but if your saving to email later, its an issue.

Thank you for your feedback. We really appreciate it. Have a great day!

Scott R.

September 22nd, 2020

Thanks that was great.

Thank you for your feedback. We really appreciate it. Have a great day!

Judith G.

January 25th, 2019

Thank you, it was easy and fast. The clerks office filed without question.

Thank you Judith, have a fantastic day!

john o.

August 8th, 2020

very simple to use

Thank you!

Joseph B.

December 24th, 2021

Multiple attempts to straight answers to very simple straight forward questions about why my submission is not being accepted have gone unanswered. It's been two days and no answer that solves my problem.

Sorry we were unable to assist you Joseph. We do hope that you find something more suitable to your needs elsewhere. Have a wonderful day.

Thomas W.

February 4th, 2020

The serevice was fast and accurate. I would highly recommend Deeds.com to my friends and associates.

Thank you!

Helen M.

May 19th, 2020

The forms are very confusing when there is so much to download! Trying to keep track and make sure you have everything needed is terrible! I think I have everything but I was under the impression I would be filling it out online and with instructions... I am very disappointed to say the least!

Sorry to hear of your disappointment Helen. We have gone ahead and canceled your order and payment. We do hope that you are able to find something more suitable to your needs elsewhere. Have a wonderful day.

Daniel L.

April 27th, 2019

Very good. The right forms and instructions . Thanks

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jany F.

November 8th, 2021

Great and quick service.

Thank you!