Wheeler County Notice of Completion Form

Wheeler County Notice of Completion Form

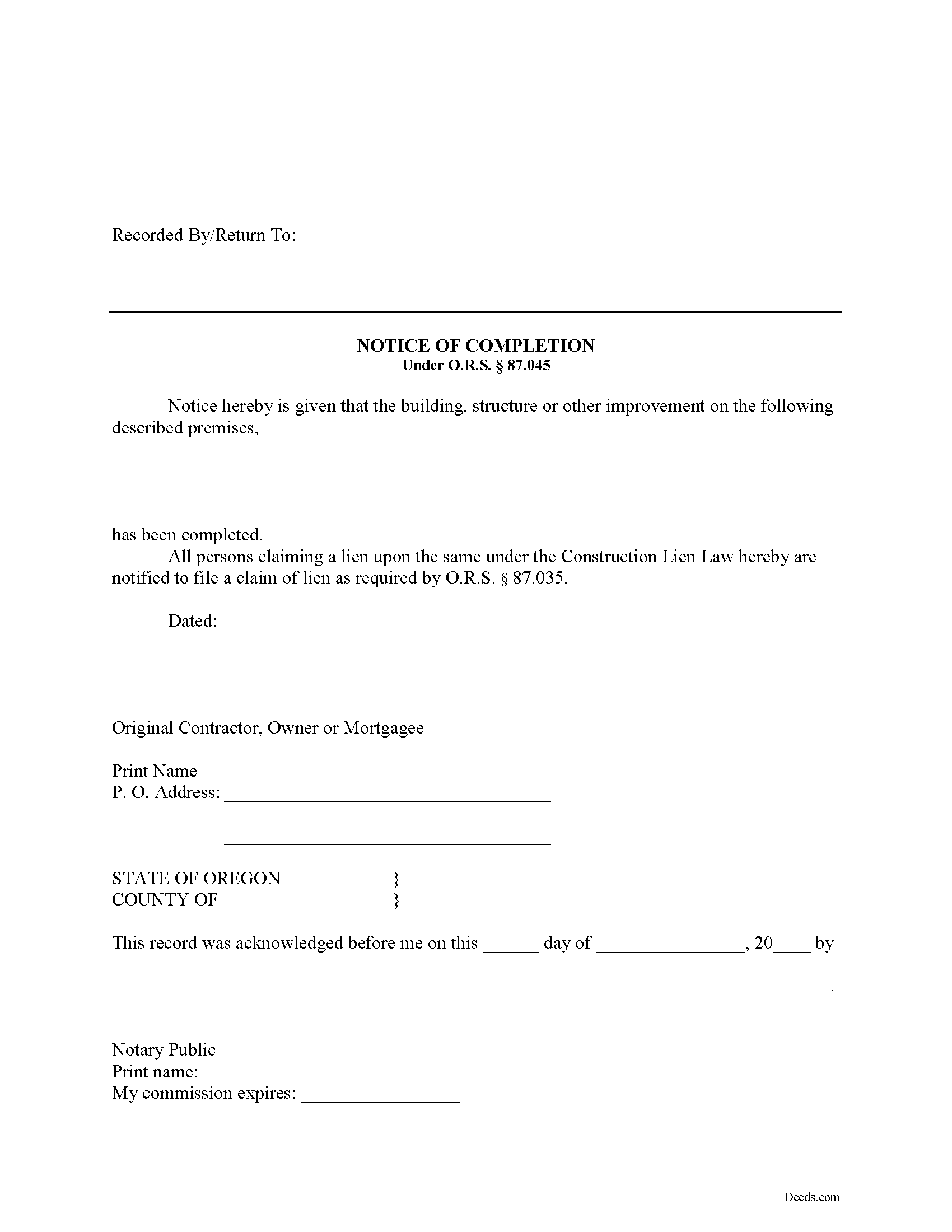

Fill in the blank Notice of Completion form formatted to comply with all Oregon recording and content requirements.

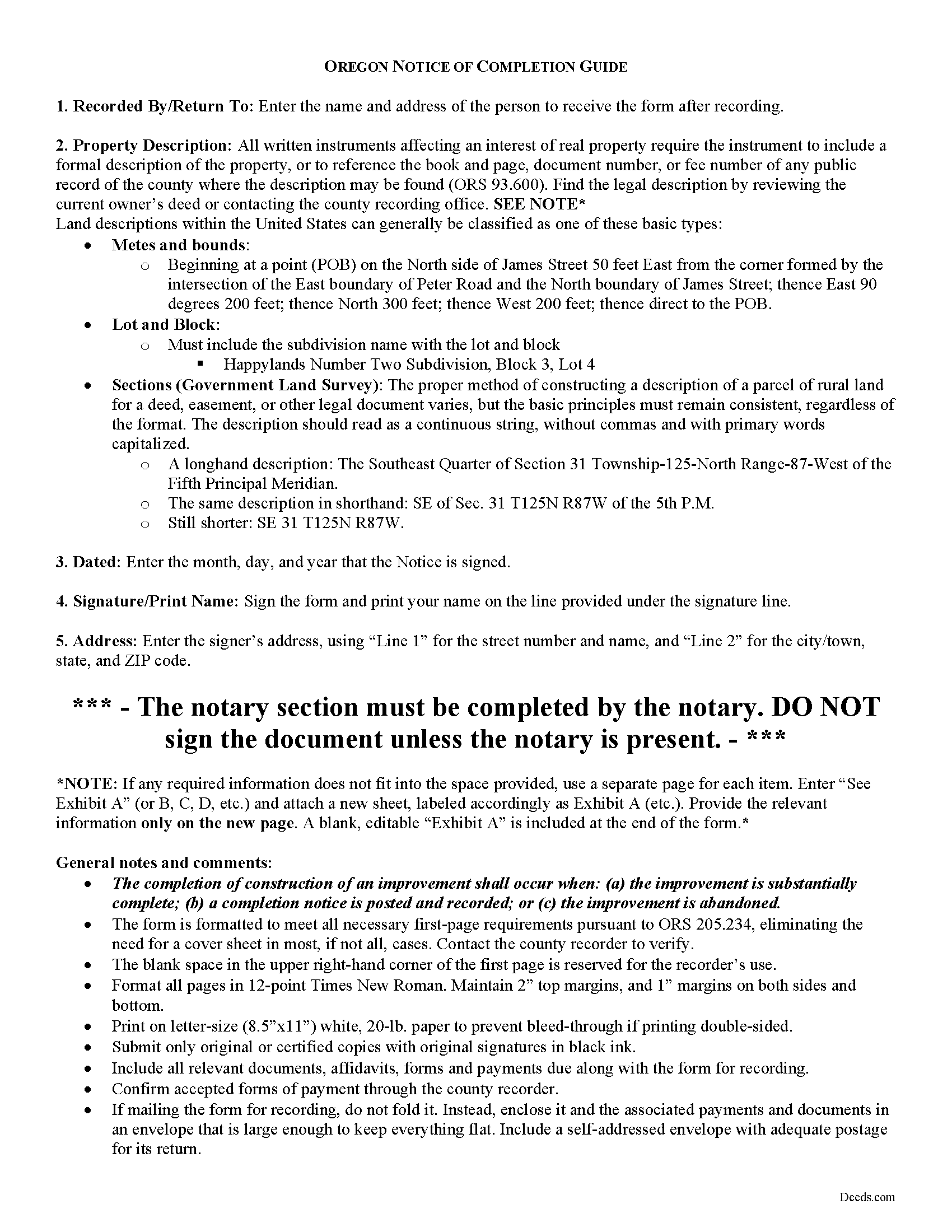

Wheeler County Notice of Completion Guide

Line by line guide explaining every blank on the form.

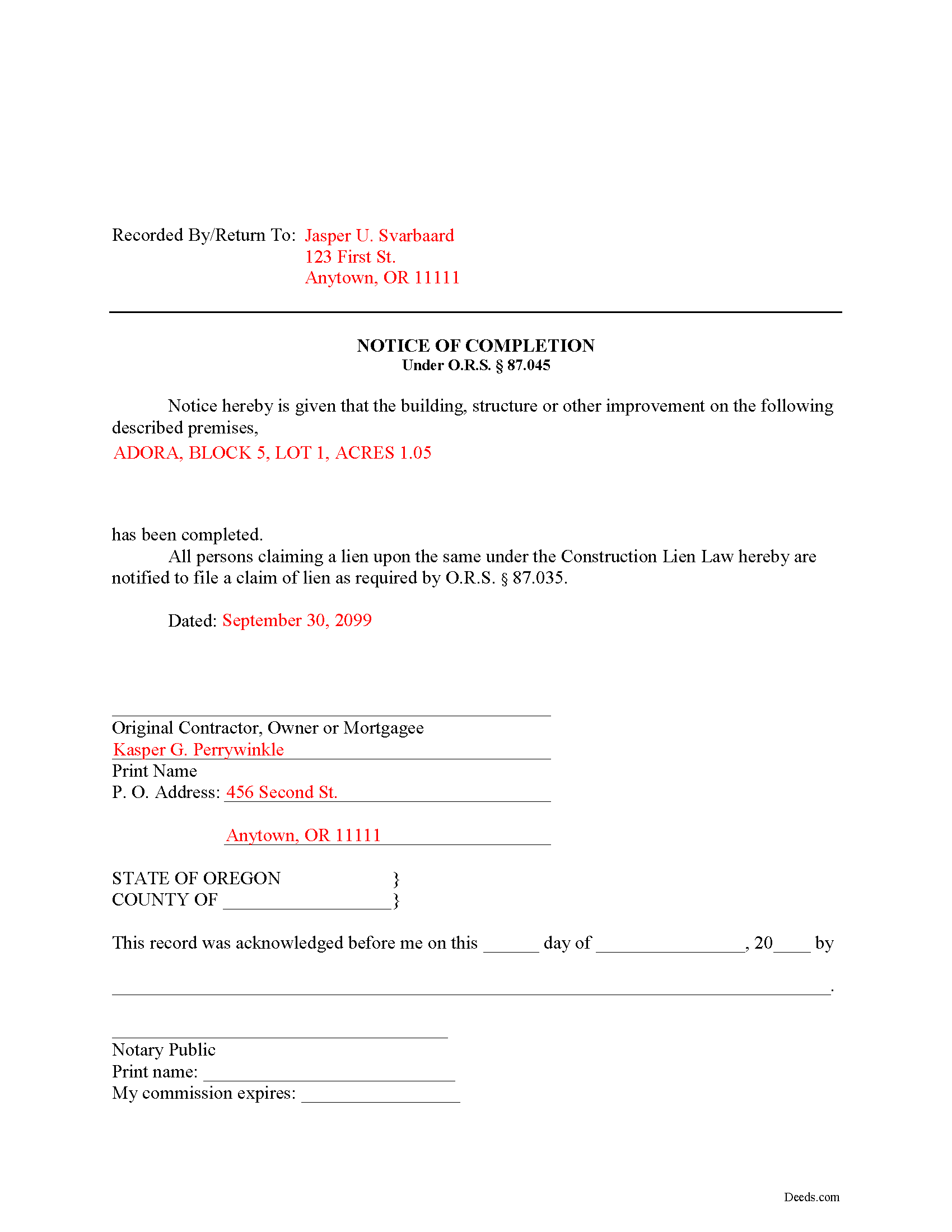

Wheeler County Completed Example of the Notice of Completion Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Oregon and Wheeler County documents included at no extra charge:

Where to Record Your Documents

Wheeler County Clerk

Fossil, Oregon 97830

Hours: M-F 8am - 12pm & 1pm - 4pm

Phone: (503) 763-2400, 763-2374, 763-2373

Recording Tips for Wheeler County:

- Ensure all signatures are in blue or black ink

- White-out or correction fluid may cause rejection

- Leave recording info boxes blank - the office fills these

- Recording fees may differ from what's posted online - verify current rates

- Verify the recording date if timing is critical for your transaction

Cities and Jurisdictions in Wheeler County

Properties in any of these areas use Wheeler County forms:

- Fossil

- Mitchell

- Spray

Hours, fees, requirements, and more for Wheeler County

How do I get my forms?

Forms are available for immediate download after payment. The Wheeler County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Wheeler County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Wheeler County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Wheeler County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Wheeler County?

Recording fees in Wheeler County vary. Contact the recorder's office at (503) 763-2400, 763-2374, 763-2373 for current fees.

Questions answered? Let's get started!

Oregon's Construction Lien Law is codified at ORS 87.001 to 87.060 and 87.075 to 87.093.

Property owners and other interested parties who contract for construction work need to be vigilant and ensure that their property remains free from a mechanic's lien, especially those of any "hidden" lien claimants that may be working under another party and the owner is unaware. Therefore, an owner should draft, record, and post at a job site, a Notice of Completion, upon the jobs completion, because a lien must be perfected no later than 75 days after the project has ended or been abandoned.

In Oregon, a construction project is deemed complete when (a) the improvement is substantially complete; (b) a completion notice is posted and recorded; or (c) the improvement is abandoned. O.R.S. 87.045(1).

When all original contractors employed on the construction of the improvement have substantially performed their contracts, any original contractor, the owner or mortgagee, or an agent of any of them may post and record a completion notice. O.R.S. 87.045(2). The completion notice must include a legal description of the property, the date the notice was sent, and the signer's name and address. Id.

When completed, the Notice must be posted on the date it bears in some conspicuous place upon the land or upon the improvement situated thereon. O.R.S. 87.045(3). A copy of the Notice must also be recorded within five days from the date of its posting, by the party posting it (or his or her agent), in the recording office of the county in which the property, (or some part) is situated. Id. A copy of the notice, together with an affidavit made by the person posting the notice, stating the date, place and manner of posting the notice, must be attached to the Notice of Completion when it's recorded. Id.

Anyone claiming a lien created on the premises described in a completion or abandonment notice for labor or services performed and materials or equipment used prior to the date of the notice must perfect the lien on the 75th day after work on the construction of the improvement ceases. O.R.S. 87.045(4).

Proper use of a Notice of Completion will protect property owners by allowing them to know who might have a potential lien claim and start the clock ticking for the time to record such liens.

This article is provided for informational purposes only and should not be relied upon as a substitute for the advice of an attorney. Please consult an Oregon attorney with any questions about the Notice of Completion or other issues related to liens.

Important: Your property must be located in Wheeler County to use these forms. Documents should be recorded at the office below.

This Notice of Completion meets all recording requirements specific to Wheeler County.

Our Promise

The documents you receive here will meet, or exceed, the Wheeler County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Wheeler County Notice of Completion form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4614 Reviews )

Maree W.

August 5th, 2022

I am so impress with the forms that is needed for your state. It makes your task so easy and no worries. This was a big help in taking care of business. Thank you so much.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Marie A.

February 12th, 2019

Easy to download, helpful information and forms quick when you need them. Thank you Deeds.com.

Thank you Marie!

Robert H.

June 23rd, 2025

Great service, easy way to get accurate documents

Thanks, Robert! We're glad you found the service easy to use and the documents accurate—just what we aim for. Appreciate you taking the time to share your experience!

Timothy M.

June 2nd, 2019

I like what I see so far!

Thank you!

Harry S.

March 30th, 2021

This is my first time using the service. Wow! How efficient and effortless! Keep up the good work!

Thank you!

TEDDY Y.

January 29th, 2022

this experience was made possible with the ease of using your service thank you

Thank you!

Dretha W.

January 11th, 2019

Ordered the fill in the blank form for a deed. Very professional looking but more importantly, correct for my recording office. It was recorded with no question. The guide was a big help in completed the deed.

Great to hear Dretha. We appreciate you taking the time to leave your feedback. Have a wonderful day!

Alexandra M.

April 28th, 2021

Needed a Limited Power of Attorney form for a real estate transaction in another state. Proper form came up immediately and was fairly easy to complete. I think the sample completed form should have been more completely explained in layman's language instead of legalese (such as person granting permission instead of grantor or something like your name and address and the person who will be signing on your behalf) but since the form was one price no matter how many ways it was printed out, it was fine. I just filled it out several ways and had it notarized and sent it to my sister. Whichever combination is appropriate she and the lawyer will have. I found the site easy to navigate

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kevin & Kim S.

August 20th, 2020

So very easy to use and we're so glad we could do everything from our home office.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Don R.

January 26th, 2022

From Pennsylvania here. Documents are great and easy to fill out however you are lacking a couple of things. You only provide the option for a Grant Deed when you purchase by your county which is Mercer County for me. Why not give the ability to get a Warranty Deed that better protects the Grantee? Also, being from Pennsylvania and in a county that mined Buituminous Coal we are required to include the Coal Severance Notice and Bituminous Mine Subsidence and Land Conservation Act Notice. You can check the box on your Deed form that they are required and attached but you do not provide the verbiage or form for this. You state that you know what each county requires and include everything required but you do not include these two required Notices. This has been a requirement for years and the wording never changes. I had to look for these Notices and hand type this information and include it on another seperate page after the Notary section on the Deed. The Grantor has to sign the Coal Severance Notice and be witnessed by a Notary so I had to add another place for the Notary and will have to pay twice for witnessed signatures when it could have been included in your document. My Deed from 2003 was done that way and then the Notary statement after that so it was only one notarized witness of signature.

Thank you for your feedback. We really appreciate it. Have a great day!

Fred A.

April 15th, 2019

Very nice forms offer, very thoughtful to include other related forms that may be necessary. The site was easy to use, and very fast. Thank You.

Thank you!

Michael V.

April 30th, 2020

Exactly what I needed and VERY fair price. I paid $19.97 for what a local attorney wanted $200 to do. I filled out the form using the line by line guide and filed it at the court house today. Absolutely no problems.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Marilyn O.

March 9th, 2021

Good resource. Got what I needed easily

Thank you for your feedback. We really appreciate it. Have a great day!

Michael L.

April 25th, 2024

Professional, simple. Very good.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Barry N.

February 14th, 2019

The form was straight forward and very easy to complete. It took me less than 15 minutes to complete. Make sure you have the "current deed' available' when completing the form.

Thank you for your feedback Barry. Have a fantastic day!