Linn County Personal Representative Deed Form

Linn County Personal Representative Deed Form

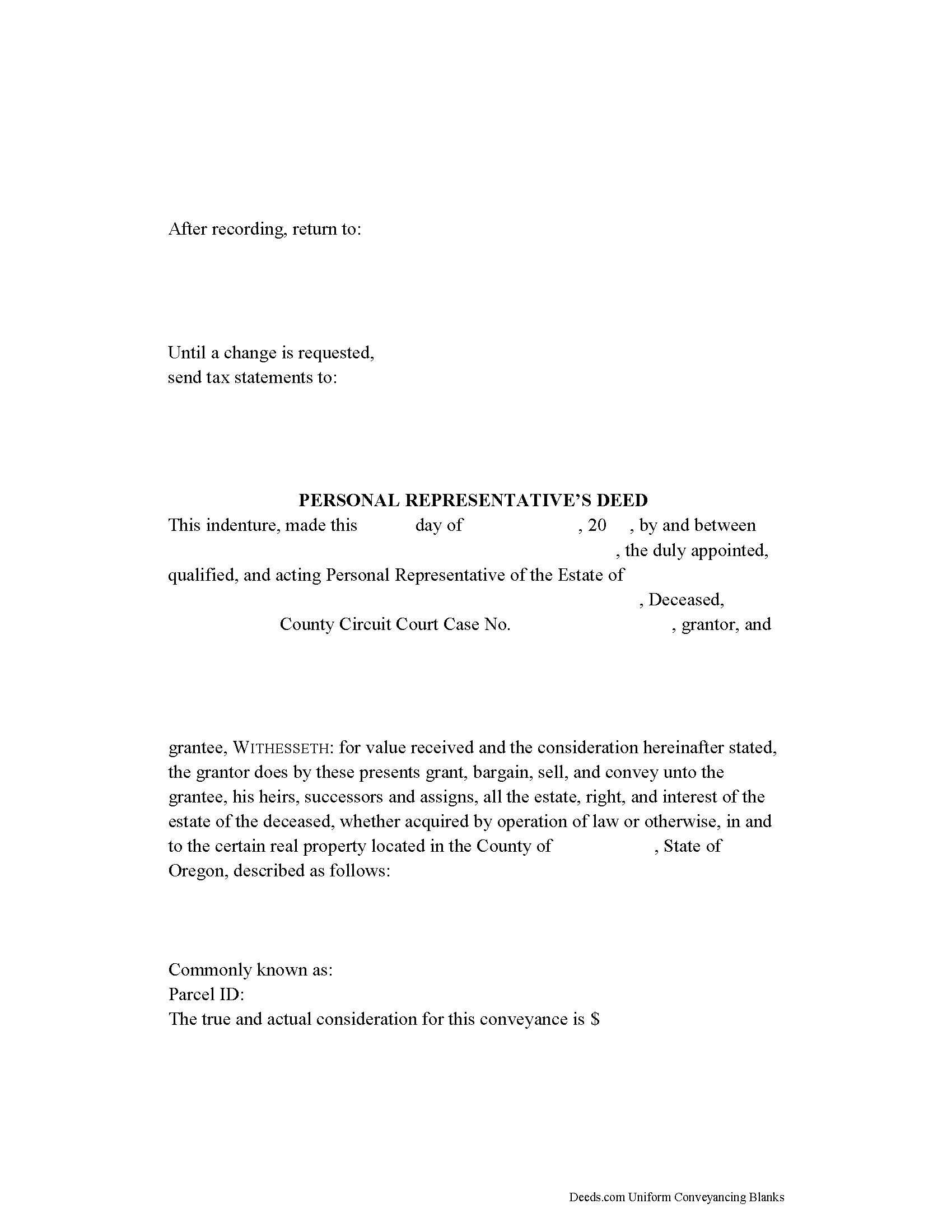

Fill in the blank form formatted to comply with all recording and content requirements.

Linn County Personal Representative Deed Guide

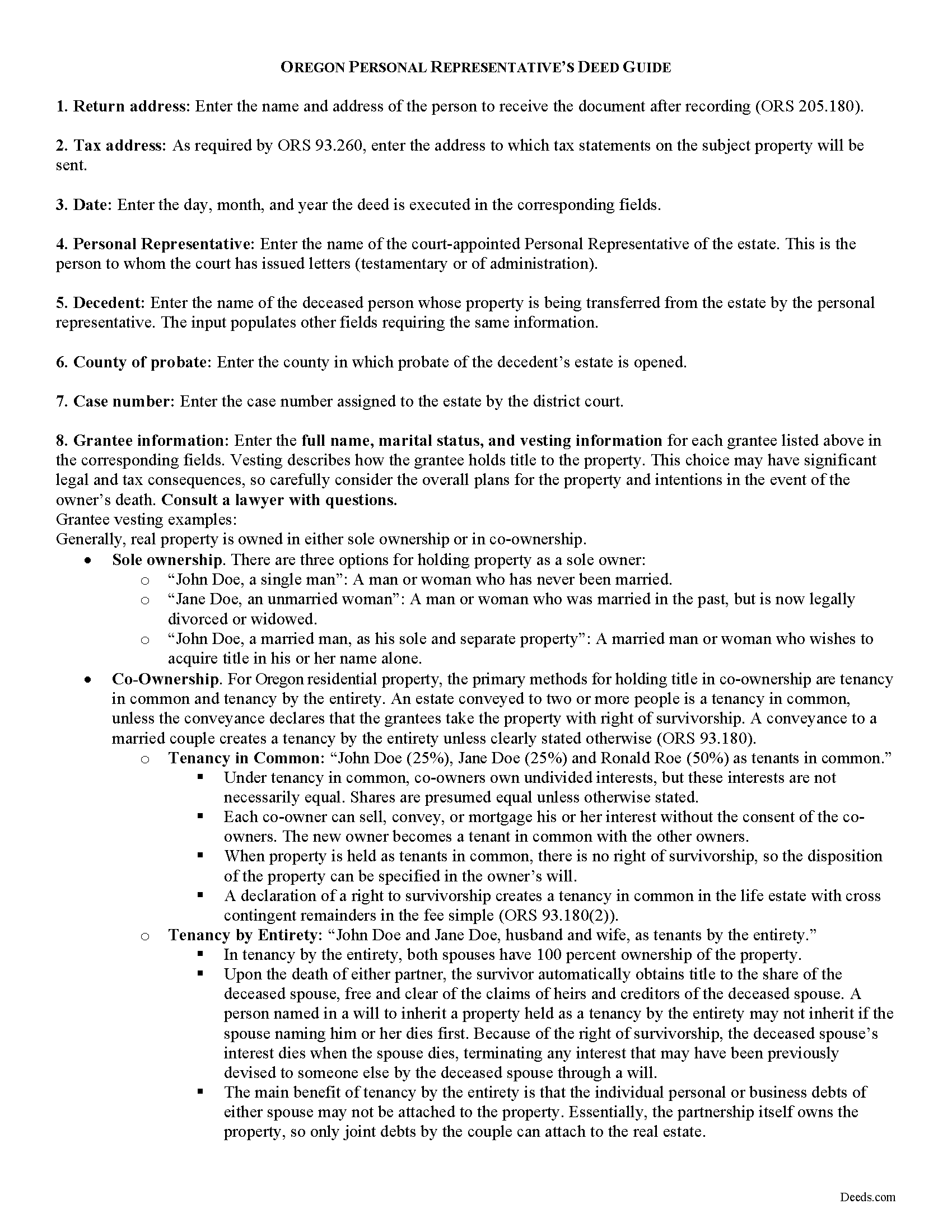

Line by line guide explaining every blank on the form.

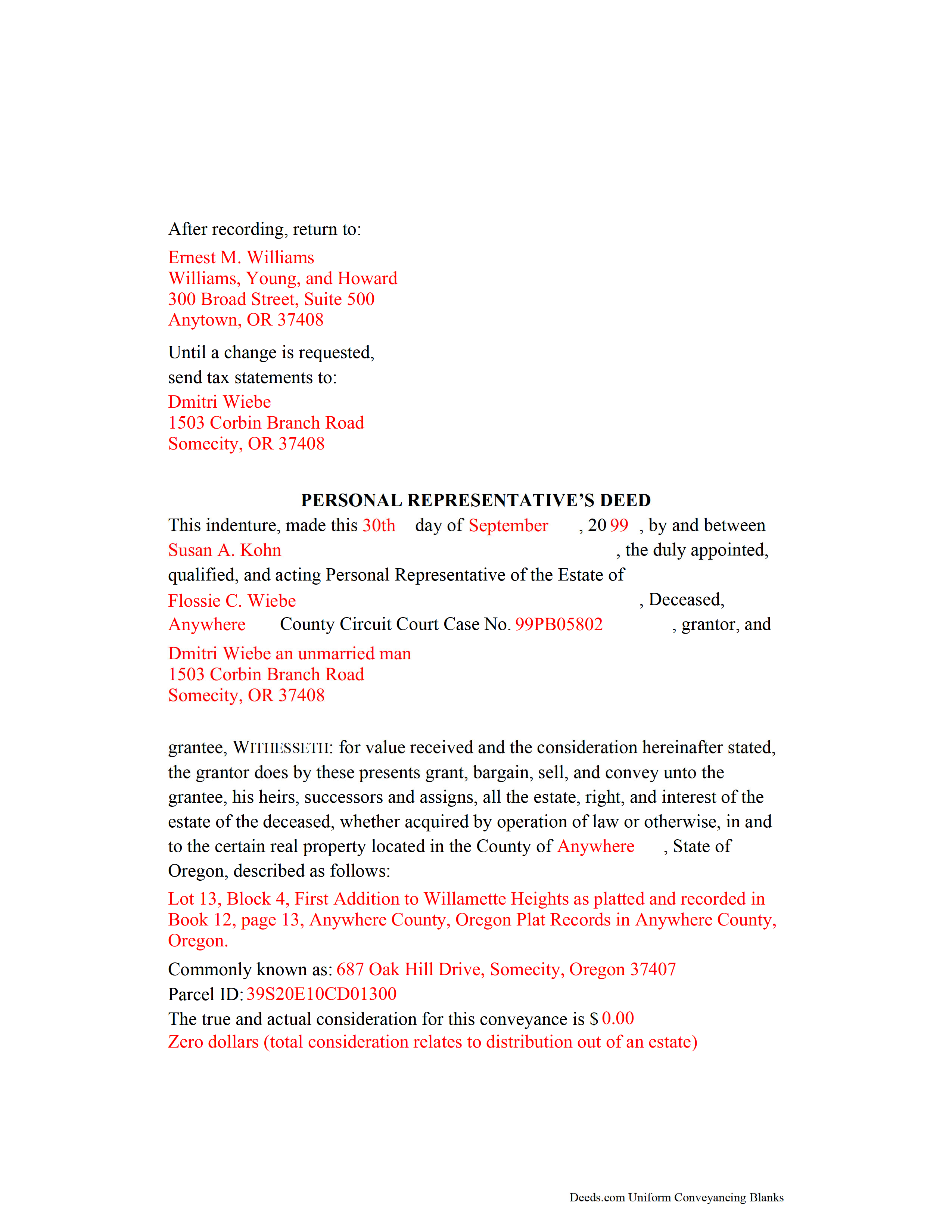

Linn County Completed Example of the Personal Representative Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Oregon and Linn County documents included at no extra charge:

Where to Record Your Documents

Linn County Clerk

Albany, Oregon 97321

Hours: 8:30 to 5:00 M-F / Same-day recording until 4:00

Phone: (541) 967-3829

Recording Tips for Linn County:

- Bring your driver's license or state-issued photo ID

- Ensure all signatures are in blue or black ink

- Check margin requirements - usually 1-2 inches at top

- Recorded documents become public record - avoid including SSNs

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Linn County

Properties in any of these areas use Linn County forms:

- Albany

- Brownsville

- Cascadia

- Crabtree

- Crawfordsville

- Foster

- Halsey

- Harrisburg

- Lebanon

- Lyons

- Mill City

- Scio

- Shedd

- Sweet Home

- Tangent

Hours, fees, requirements, and more for Linn County

How do I get my forms?

Forms are available for immediate download after payment. The Linn County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Linn County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Linn County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Linn County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Linn County?

Recording fees in Linn County vary. Contact the recorder's office at (541) 967-3829 for current fees.

Questions answered? Let's get started!

A personal representative's deed is a probate instrument used to convey real property in estate administration. It is one in a class of fiduciary instruments that is named after the capacity of the executing party.

A personal representative is the fiduciary assigned by the district court to administer a decedent's estate through the granting of letters (testamentary or of administration, depending on the testacy status of the decedent). Unless otherwise provided in the decedent's will, the PR has the power to sell or convey real property without a hearing, excepting certain circumstances (ORS 114.325).

A PR must execute a deed in order to distribute real property from the estate pursuant to a judgment of final distribution. A PR may also be used to carry out a sale. The sale of real property may be necessary to pay spousal support, child support, the elective share of the surviving spouse, or claims and expenses of administration.

When signed by the executing PR and acknowledged in the presence of a notary public, the PR deed transfers all the decedent's interest in the subject property at the time of his or her death to the purchaser or successor in interest. When recorded to effect distribution, the PR deed updates the chain of title and legitimizes the successor's interest. A PR deed typically carries no warranties of title.

The PR deed incorporates information regarding the probated estate, such as the personal representative's name, the name of the decedent, the county in which circuit court probate is taking place, and the case number assigned to the estate. To property vest title in the purchasing party or successor in interest, the deed must contain the grantee's full name, mailing address, marital status, and manner of vesting.

All conveyances of real property in Oregon are required to reflect the true and actual consideration made for the transfer. Consideration is defined as the actual value exchanged for the transfer or conveyance of title, including any indebtedness the purchaser agrees to pay or assume (ORS 93.030). While there is no state transfer tax in Oregon, transfer tax may be due at the county level. Deeds affecting property situated in Washington County are subject to a local transfer tax, though some exemptions apply and are recognized with the proper paperwork in place.

Any documents affecting an interest in real property requires the full legal description of the subject property, or must reference the book and page, document number, or fee number of public record of the county where the description may be found (See ORS 93.600). Oregon law also requires a mandatory statement on all instruments for conveyance of fee title to real property (see ORS 93.040). In compliance with ORS 93.260, the form must reflect the address to which tax statements on the subject property should be sent.

Submit the completed, signed, and notarized PR deed in the recording division of the appropriate county clerk's office. Include all appropriate attachments, depending on the situation; these may include a copy of the relevant court order authorizing sale or distribution, if applicable.

The information provided here is not a substitute for legal advice. Consult an attorney licensed in the State of Oregon with questions regarding PR deeds, as each situation is unique.

(Oregon PRD Package includes form, guidelines, and completed example)

Important: Your property must be located in Linn County to use these forms. Documents should be recorded at the office below.

This Personal Representative Deed meets all recording requirements specific to Linn County.

Our Promise

The documents you receive here will meet, or exceed, the Linn County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Linn County Personal Representative Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4601 Reviews )

John D.

June 3rd, 2019

Forms were easy to complete, with the instructions that were provided. Very satisfied!

Thank you!

Maribeth M.

June 25th, 2021

Usually I have trouble registering things online, even though people tell me it's easy. This time, it WAS easy and fast, and I'm grateful I didn't have to drive somewhere and stand in line. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Elizabeth P.

October 20th, 2020

Perfect quitclaim form. Easy to fill in with the required information and all the required information has a place (no easy feat in our county!). It is helpful that they include exhibit pages for larger blocks of information (our legal is 2 pages long). Great job folks!

Thank you for the kind words Elizabeth. Have an amazing day!

Christina W.

September 4th, 2019

I stand corrected. I received my report and it was exactly what I requested.

Thank you!

Hilda R.

January 16th, 2019

It very convenient and fast. Thank you Hilda Reyes

Thanks so much Hilda, have a great day!

William G.

July 21st, 2023

Exactly what I needed and saved me a bundle by not having to hire an attorney. My county clerk said it was exactly correct.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Larry P.

June 27th, 2023

Easy to follow step by step in completing form. Filing successful on first try. Economical cost. Would highly recommend.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jon I.

May 27th, 2020

I liked the information I download. Just what I was looking for.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Willie T.

March 8th, 2019

Great

Thank you for your feedback. We really appreciate it. Have a great day!

Christine P.

April 19th, 2020

Great service! Just what I needed and a bunch of informative extras too. Thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Johnnie W.

June 26th, 2023

Five stars for quick retrieval/no hassle of forms. Will review them again once I have completed the forms and they have been accepted.

Thank you for your feedback. We really appreciate it. Have a great day!

Jeffrey W.

April 29th, 2020

One of the most user-friendly services I have used. HIGHLY reccomended.

Thank you!

Coby A.

May 26th, 2021

great service and quick filing.

Thank you!

matt k.

March 16th, 2022

you guys/girls are the bestest..

Thank you!

Stephen S.

March 18th, 2021

This is awesome. Making sure not only that everything is worded correctly but also formatted correctly is great. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!