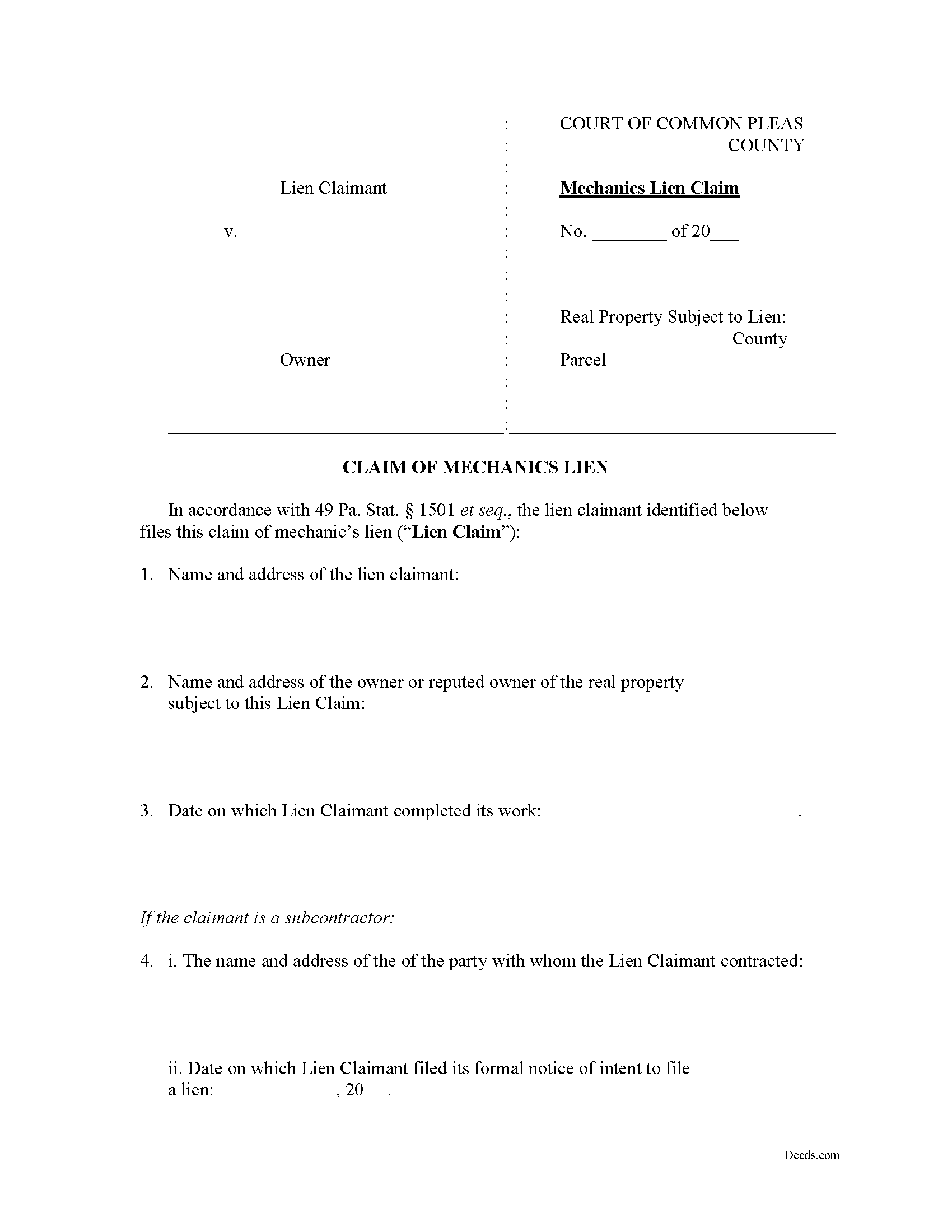

Carbon County Claim of Mechanics Lien Form

Carbon County Claim of Mechanics Lien Form

Fill in the blank Claim of Mechanics Lien form formatted to comply with all Pennsylvania recording and content requirements.

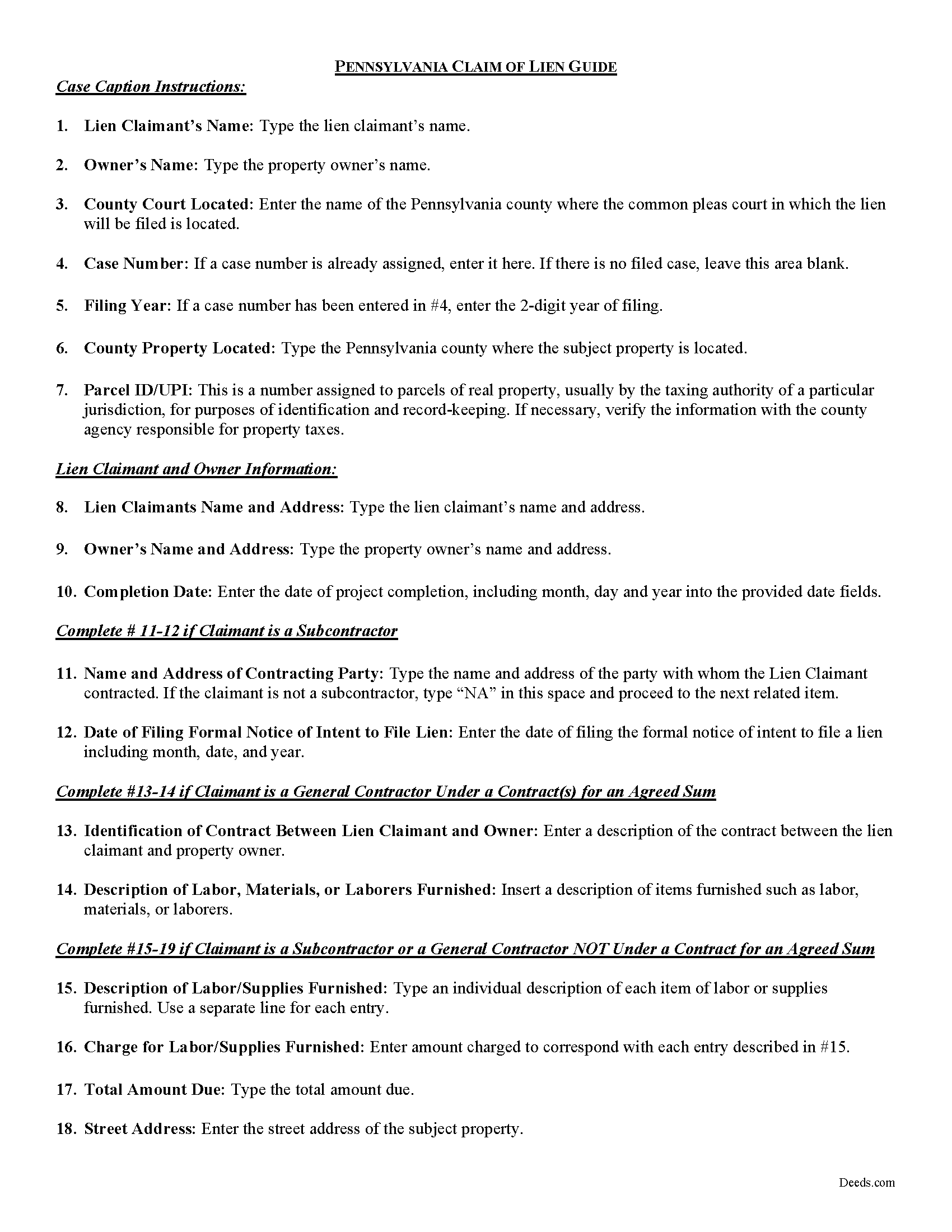

Carbon County Claim of Mechanics Lien Guide

Line by line guide explaining every blank on the form.

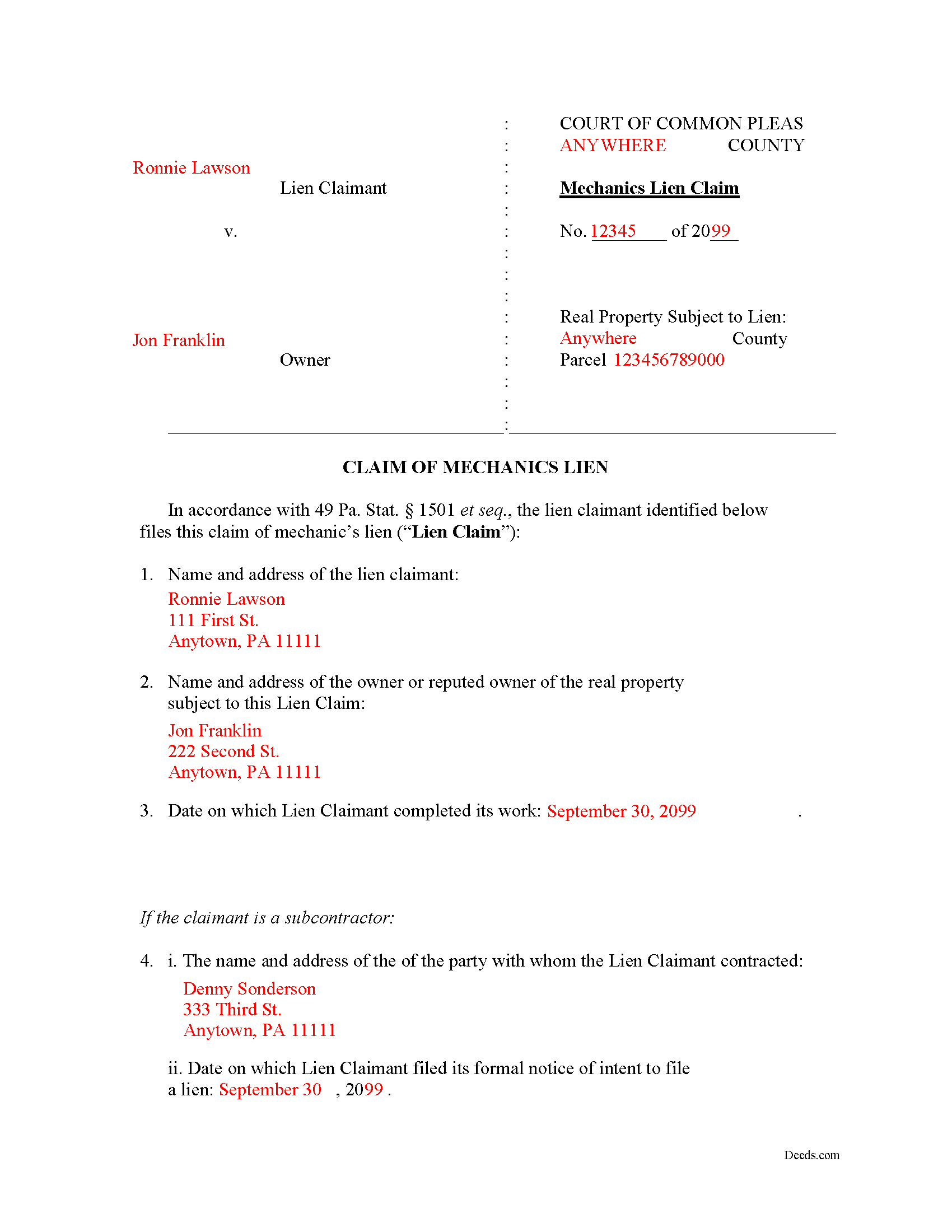

Carbon County Completed Example of the Claim of Mechanics Lien Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Pennsylvania and Carbon County documents included at no extra charge:

Where to Record Your Documents

Recorder of Deeds - Courthouse Annex

Jim Thorpe, Pennsylvania 18229

Hours: 8:30am to 4:30pm Monday through Friday

Phone: (570) 325-2651

Recording Tips for Carbon County:

- Ensure all signatures are in blue or black ink

- Verify all names are spelled correctly before recording

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Carbon County

Properties in any of these areas use Carbon County forms:

- Albrightsville

- Aquashicola

- Ashfield

- Beaver Meadows

- Bowmanstown

- Jim Thorpe

- Junedale

- Lake Harmony

- Lansford

- Lehighton

- Nesquehoning

- Palmerton

- Parryville

- Summit Hill

- Tresckow

- Weatherly

Hours, fees, requirements, and more for Carbon County

How do I get my forms?

Forms are available for immediate download after payment. The Carbon County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Carbon County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Carbon County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Carbon County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Carbon County?

Recording fees in Carbon County vary. Contact the recorder's office at (570) 325-2651 for current fees.

Questions answered? Let's get started!

Obtaining a mechanic's lien in Pennsylvania

Mechanic's Liens are governed by Title 49 of the Pennsylvania Consolidated Statutes.

A mechanic's lien is a type of security interest used to guarantee payment for work completed or materials delivered in connection with a construction contract. You might be familiar with other types of liens such as a judgment lien or tax lien. A mechanic's lien works the same way by attaching itself to the title (ownership) interest of the property and making it difficult for the owner to sell or refinance without first resolving the lien. Therefore, it's a powerful tool when it's used properly.

In Pennsylvania, the procedure for obtaining and enforcing a mechanic's lien is governed under the Mechanic's Lien Law of 1963 (49 P.S. 1101). Liens are available to general contractors, subcontractors, laborers, and material or equipment suppliers who meet the requirements for filing including sending the necessary notices of commencement and furnishing as well as the preliminary (pre-lien) notice.

A lien can be claimed for unpaid labor or materials provided for the construction, alteration, or repair that exceeds a value of $500.00 (301). The lien must reflect only the actual costs of labor or materials as well as lost profits and overhead. You cannot include items such as delay or impact damages from breach of the contract (although you may recover these in a separate lawsuit on the underlying contract).

The lien must also be filed no later than six (6) months after the lien claimant has completed work (502(a)(1)). Be sure to check the filing requirements for the clerk of courts in the county in which the property is located. You may be required to attach a cover sheet or additional documentation. Review the requirements by visiting the local court's website.

The claim for lien must include the following: (1) The name of the party claimant, and whether he files as contractor or subcontractor; (2) the name and address of the owner (or reputed owner); (3) the date on which the claimant completed its work; (4) if the claimant is a subcontractor, the name of the person with whom the claimant contracted, and the date on which the formal notice of intention to file (if required) was given; (5) if the claimant is a general contractor under a contract or contracts for an agreed sum, an identification of the contract and a general statement of the kind and character of the labor or materials furnished; (6) if the claimant is either a subcontractor or a general contractor who is not under a contract for an agreed sum, a detailed statement of the kind and character of the labor and/or materials furnished and of the prices charged for each of them; (7) the amount or sum claimed to be due; and (8) a description of the improvement and of the property claimed to be subject to the lien, as reasonably necessary to identify them. (503)

After filing, the claimant must serve the lien on the owner. Service is a necessary part of due process that allows the owner to receive notice of the pending action and an opportunity to contest it. The traditional method for serving liens in Pennsylvania is by sheriff's service, although private process servers may also be employed. Not later than twenty (20) days after the lien claim has been served upon an owner or (where applicable) posted upon the improvement, the lien claimant must file with the prothonotary (clerk of courts) either an affidavit of service or a document signed by the owner accepting service (502(a)(2)).

Once you have your lien in place, you must sue to foreclose on the lien if the owner (or reputed owner) still hasn't paid. An action to obtain judgment upon a claim filed shall be commenced within two (2) years from the date of filing unless the time be extended in writing by the owner (701(b)).

At any time after the completion of the work by a subcontractor, any owner or contractor may file a document with the court called a "rule" which orders the lien claimant to file lawsuit foreclosing on the lien within twenty (20) days of the rules service on the claimant (506(a)). If the claimant fails to file suit within that time, the lien is declared invalid.

This article is provided for informational purposes only and does not constitute legal advice. Contact an attorney with questions about the Claim of Lien, or with any other issues related to mechanic's liens in Pennsylvania.

Important: Your property must be located in Carbon County to use these forms. Documents should be recorded at the office below.

This Claim of Mechanics Lien meets all recording requirements specific to Carbon County.

Our Promise

The documents you receive here will meet, or exceed, the Carbon County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Carbon County Claim of Mechanics Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4577 Reviews )

Ralph N.

April 5th, 2022

Fast download and clear, easy-to-follow directions. A great service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

ERHAN S.

February 3rd, 2023

amazing time and cost saving service for me. Thank you.

Thank you!

Della M.

July 7th, 2019

Very easy to purchase with immediate use of all of the forms that you need for probate of property. My parents had died and left equal shares of their home to my 2 brothers and I.

Thank you!

CARMEN R J.

August 7th, 2019

Thank you intensly

Thank you!

Debra C.

August 14th, 2019

The website is so easy to use. I was able to purchase and download my documents within seconds!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Larry L.

January 20th, 2022

I am completely satisfied. It was easy to find the correct form and download it. The instructions were very clear.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Melody S.

February 11th, 2021

Although I was given quite a bit of information, I wanted my property title. I was not informed of what I would receive before I paid for this service.

Thank you!

Dean P.

October 6th, 2021

Very fast, efficient, and convenient - thanks Deeds.com! I would recommend this service to everyone needing to record documents, especially out-of-state customers such as myself.

Thank you for your feedback. We really appreciate it. Have a great day!

Robert A.

June 9th, 2021

First timer with Deeds.com - excellent experience. I am a lawyer and do not record often. Did not have to pay membership- fast and easy upload of documents- fast response - fast recording time from county recorder- very legible documents- very reasonable price. I give 6 stars out of 5!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joyce S.

August 5th, 2019

Download very easy. Forms are just what I need. Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Michael C.

January 16th, 2019

I would appreciate being able to increase the size of the blocks such as the Grantor block and the legal description block where information is enter on the form and to adjust the font. Otherwise great product,

Thank you for your feedback Michael. We do wish we could make that an option. Unfortunately, adhering to formatting requirements (specifically margin requirements) leaves a finite amount of space available on the page.

Mark E.

March 12th, 2019

Thank you for your Swift response. Have docs I was looking for!

Thank you for your feedback. We really appreciate it. Have a great day!

Rebecca C.

January 19th, 2022

I actually like this site, Its quick and user friendly.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Roy T.

April 3rd, 2020

Thank you for an easy to use system. I was able to find all the information I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

john m.

June 17th, 2020

its a bit confusing for a novice computer user. I would prefer to print out the forms, fill them out on paper, then attach them to an email to discuss the accuracy of the forms with a friend, and then take the completed forms to the County office to be recorded

Thank you for your feedback. We really appreciate it. Have a great day!