Lancaster County Unconditional Lien Waiver on Progress Payment Form

Last validated February 5, 2026 by our Forms Development Team

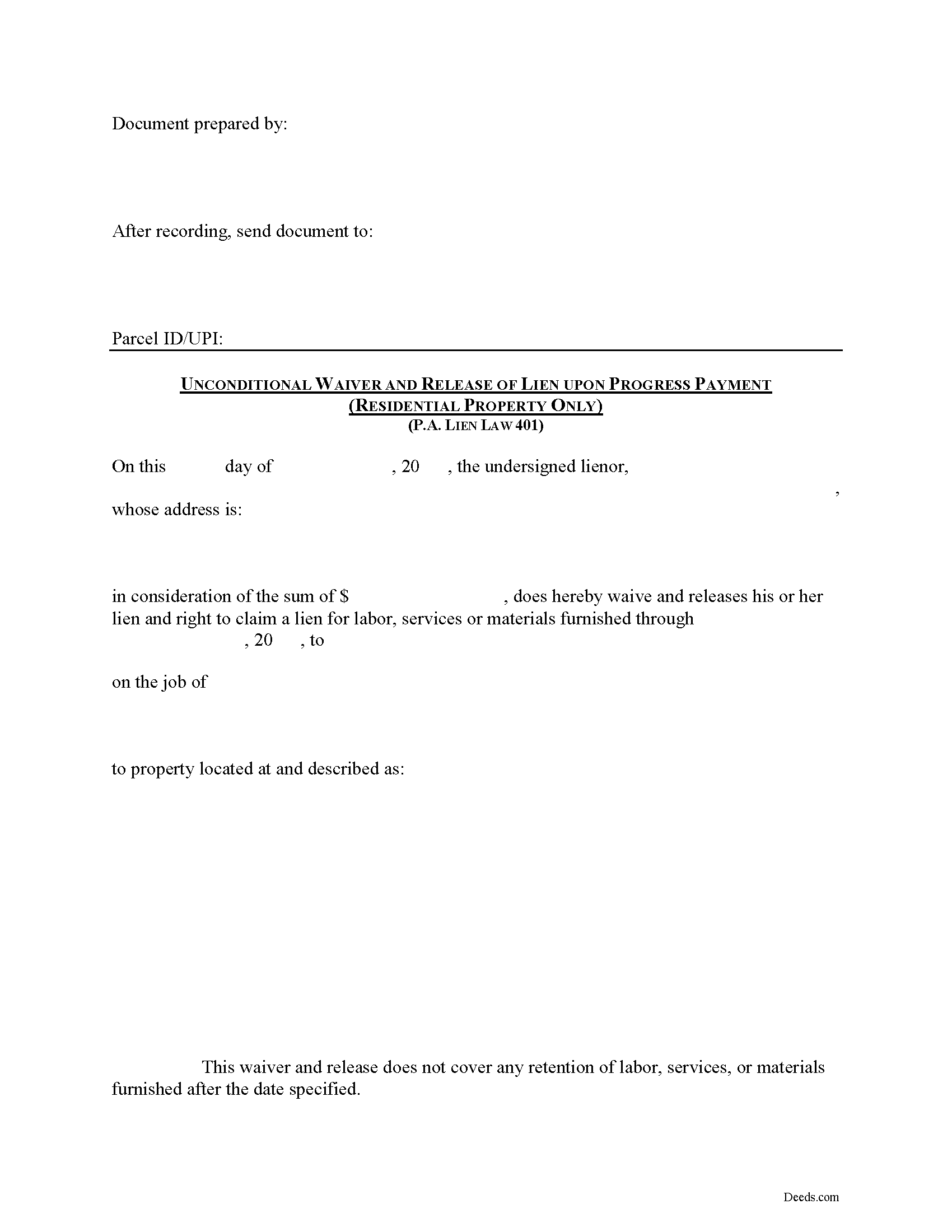

Lancaster County Unconditional Lien Waiver on Progress Payment Form

Fill in the blank Unconditional Lien Waiver on Progress Payment form formatted to comply with all Pennsylvania recording and content requirements.

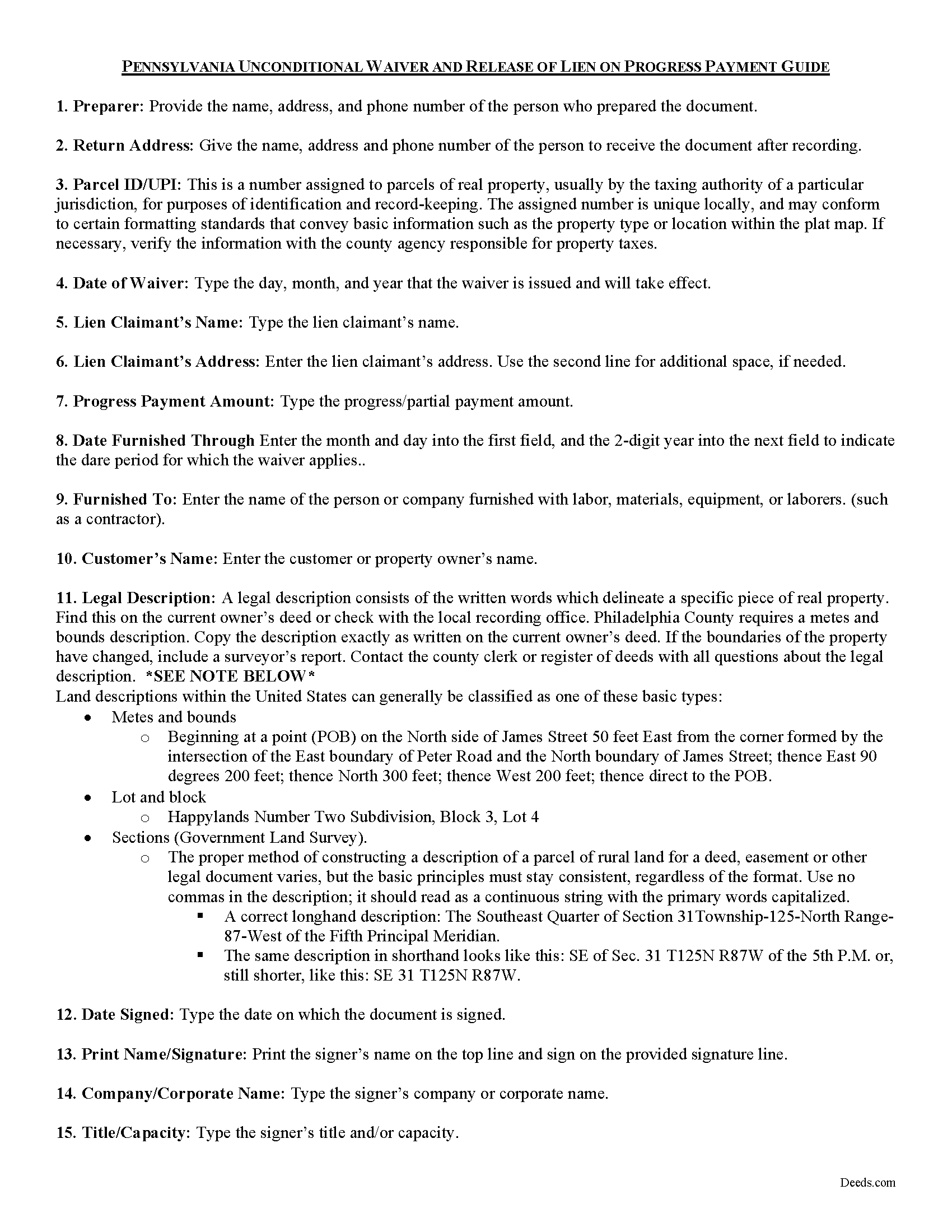

Lancaster County Unconditional Lien Waiver on Progress Payment Guide

Line by line guide explaining every blank on the form.

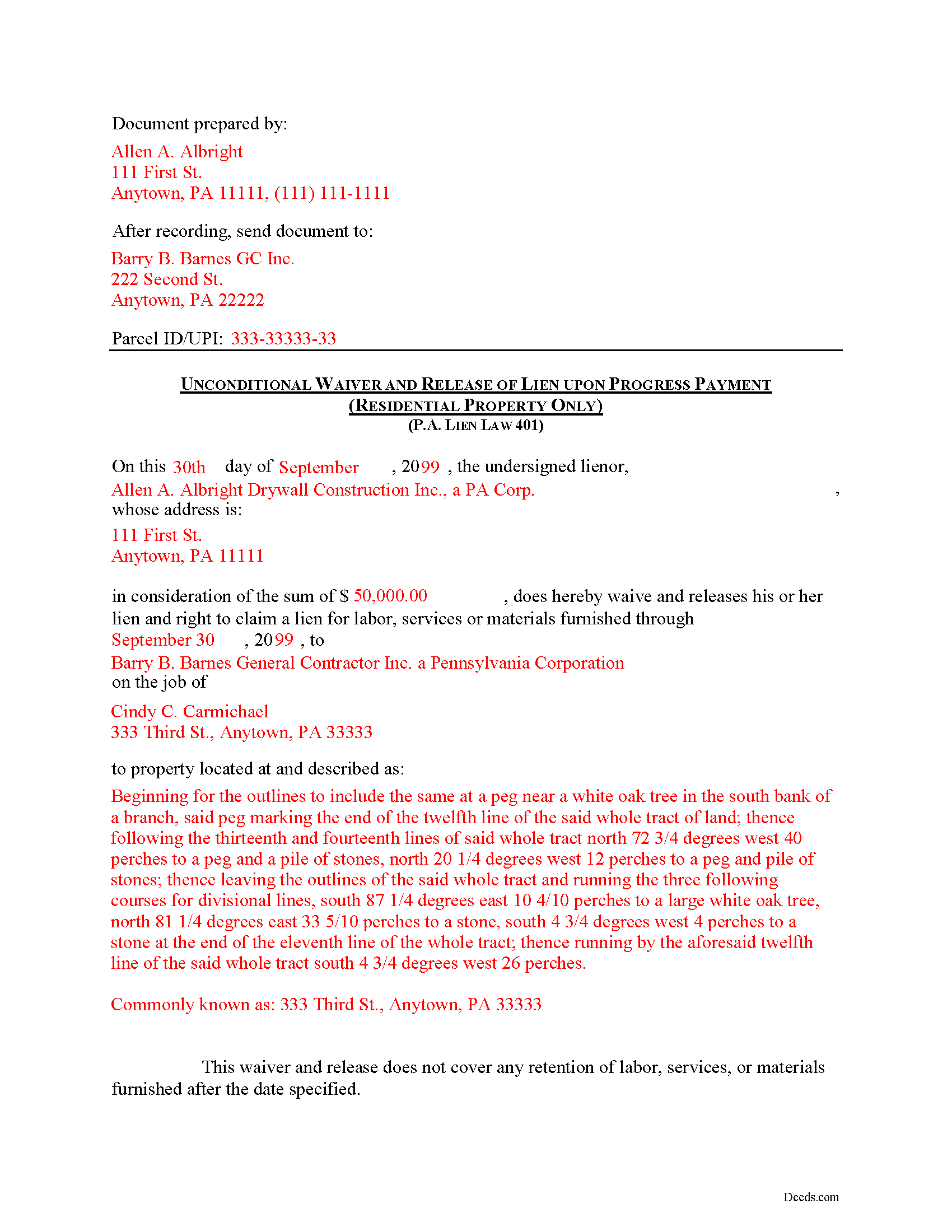

Lancaster County Completed Example of the Unconditional Lien Waiver on Progress Payment Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Pennsylvania and Lancaster County documents included at no extra charge:

Where to Record Your Documents

Lancaster County Recorder of Deeds

Lancaster, Pennsylvania 17608-1478

Hours: 8:30am - 5:00pm Monday - Friday / Recording until 4:30pm

Phone: (717) 299-8238

Recording Tips for Lancaster County:

- Double-check legal descriptions match your existing deed

- Bring extra funds - fees can vary by document type and page count

- Avoid the last business day of the month when possible

- Have the property address and parcel number ready

Cities and Jurisdictions in Lancaster County

Properties in any of these areas use Lancaster County forms:

- Adamstown

- Akron

- Bainbridge

- Bart

- Bausman

- Bird In Hand

- Blue Ball

- Bowmansville

- Brownstown

- Christiana

- Columbia

- Conestoga

- Denver

- Drumore

- East Earl

- East Petersburg

- Elizabethtown

- Elm

- Ephrata

- Gap

- Goodville

- Gordonville

- Holtwood

- Hopeland

- Intercourse

- Kinzers

- Kirkwood

- Lampeter

- Lancaster

- Landisville

- Leola

- Lititz

- Manheim

- Marietta

- Martindale

- Maytown

- Millersville

- Mount Joy

- Mountville

- Narvon

- New Holland

- New Providence

- Paradise

- Peach Bottom

- Penryn

- Pequea

- Quarryville

- Reamstown

- Refton

- Reinholds

- Rheems

- Ronks

- Silver Spring

- Smoketown

- Stevens

- Strasburg

- Talmage

- Terre Hill

- Washington Boro

- West Willow

- Willow Street

- Witmer

Hours, fees, requirements, and more for Lancaster County

How do I get my forms?

Forms are available for immediate download after payment. The Lancaster County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Lancaster County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lancaster County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Lancaster County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Lancaster County?

Recording fees in Lancaster County vary. Contact the recorder's office at (717) 299-8238 for current fees.

Questions answered? Let's get started!

In Pennsylvania, a contractor or subcontractor may waive his right to file a claim against residential property by a written instrument signed by him or by any conduct which operates equitably to estop such contractor from filing a claim. 49 P.S. 401(a).

Contractors use lien waivers to forfeit or give up their right to claim a mechanic's lien. Usually, the purpose of a waiver is to alleviate concerns by a property owner or other contractor that a lien will be levied on the property. In return for waiving lien rights, the owner or other party makes a full or partial payment. The type of waiver used depends on the type of payment made.

Use a conditional waiver when payment hasn't been made at the time of the waiver or the payment method takes time to clear (such as a check or bank draft). Unconditional waivers are appropriate when a full or final payment has been made and evidence of the payment can be verified. Within each of these two categories, waivers can be granted for a full payment or a partial (or progress) payment.

In regard to subcontractors, a waiver by a subcontractor of lien rights is against public policy, unlawful and void, unless given in consideration for payment for the work, services, materials or equipment provided and only to the extent that such payment is actually received, or unless the contractor has posted a bond guaranteeing payment for labor and materials provided by subcontractors. 49 P.S. 401(c).

This Unconditional Waiver and Release of Lien on Progess Payment should be used when a partial or progress payment is made for any amount due on a residential job only and in return for the payment, the contractor agrees to waive a lien right towards the partial amount. Because the waiver is unconditional, it should only be used when the partial payment has been made and after verification of such payment.

A valid waiver identifies the parties, the location where the work or improvement took place, relevant dates, and amounts paid. In addition, the form must meet state and local standards for recorded documents. Submit the completed waiver to the recording office for the county where the property is situated.

Mechanic's Liens are governed by Title 49 of the Pennsylvania Consolidated Statutes.

This article is offered for informational purposes only and is not legal advice. This information should not be relied upon as a substitute for speaking with an attorney. Please speak with a Pennsylvania attorney familiar with lien laws for questions regarding lien waivers or any other issues with mechanic's liens.

Important: Your property must be located in Lancaster County to use these forms. Documents should be recorded at the office below.

This Unconditional Lien Waiver on Progress Payment meets all recording requirements specific to Lancaster County.

Our Promise

The documents you receive here will meet, or exceed, the Lancaster County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lancaster County Unconditional Lien Waiver on Progress Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4651 Reviews )

Dianne M.

June 30th, 2023

I find the resources on this website so helpful. The service is outstanding. Thank you.

Thank you!

Peter W.

February 28th, 2019

Thanks worked out great

Thank you for the follow up Peter. Have a great day!

Nancy A.

April 24th, 2024

This is an excellent resource. I was surprised because the price is so low I thought the products might be inferior. Not only were were the requested documents high quality, additional unrequested documents were added to my order that I didn't realize I would need until I read them. I especially appreciate that all the documents were specific to my county. I highly recommend using deeds.com.

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!

Shelly S.

November 12th, 2021

was fairly easy to work through the forms but needed better information on what goes on a few of the lines

Thank you for your feedback. We really appreciate it. Have a great day!

Robert B.

March 4th, 2019

Found this sight on the internet looking for information to add my fiance' to the house deed. Looks like the right place to be. Looking forward to getting the forms I need.

Thank you!

Stephen S.

March 18th, 2021

This is awesome. Making sure not only that everything is worded correctly but also formatted correctly is great. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Angela T.

June 21st, 2019

I love this website .. it has been very helpful in so many ways.. thank you so much..

Thank you!

David R.

January 11th, 2019

Great source of all required legal documents and supplements.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

SUZANNE W.

December 29th, 2020

Very quick and efficient. Received recorded document within hours after beginning the process. Very reasonable fees. Highly recommended!

Thank you!

Daron S.

July 2nd, 2019

A download in word format would be a lot better than the pdf download.

Thank you for your feedback. We really appreciate it. Have a great day!

Kathy O.

December 2nd, 2021

I was so happy to be able to print the Quit Claim Deed form and learn about other forms. Very pleased with this service! Took the stress out of preparing needed deeds for notirization for our Trust. Very grateful. Thank you. Kathy

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Deb D.

January 31st, 2019

Excellent website - easy to use, and found exactly the form I needed right away. Highly recommend.

Thank you for your feedback. We really appreciate it. Have a great day!

David N.

January 9th, 2025

Thank you fine Deeds Company. I hope all goes well for you and all your team!

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Andrea R.

December 25th, 2020

I was pleasantly surprised as I didn't even know you can record a quit claim deed digitally. I am in the mortgage business so I will gladly refer all my clients to this website! Deeds.com was prompt and fast with the entire process. My document was recorded and completed in less than 24 hours! Thank you again!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kathleen M.

July 21st, 2021

Wow, this was a breeze!! Best experience and fast. Great way to record documents in a matter of minutes. I recommend Deeds.com for anyone who needs to record documents quickly and conveniently.

Thank you for your feedback. We really appreciate it. Have a great day!