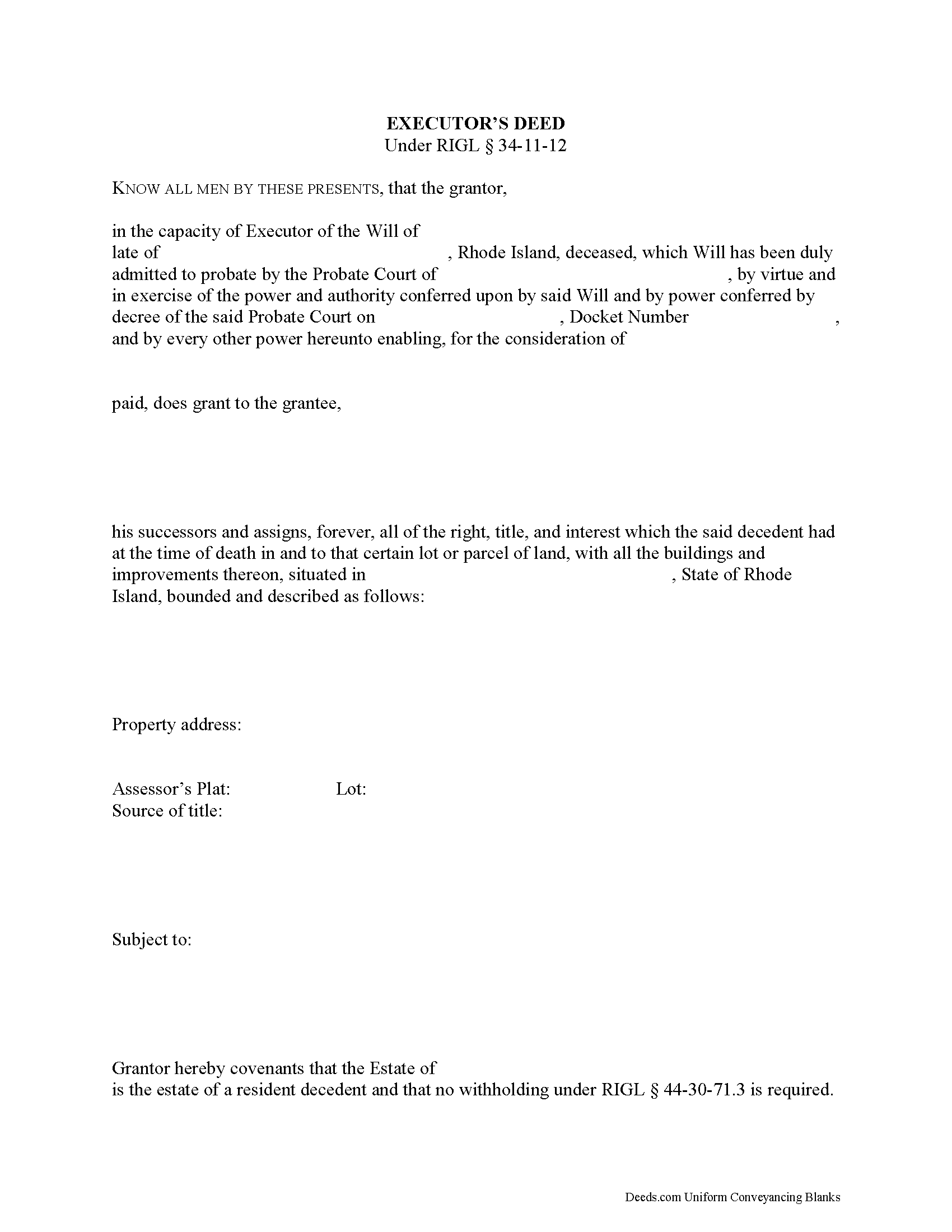

Bristol County Executor Deed Form

Bristol County Executor Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

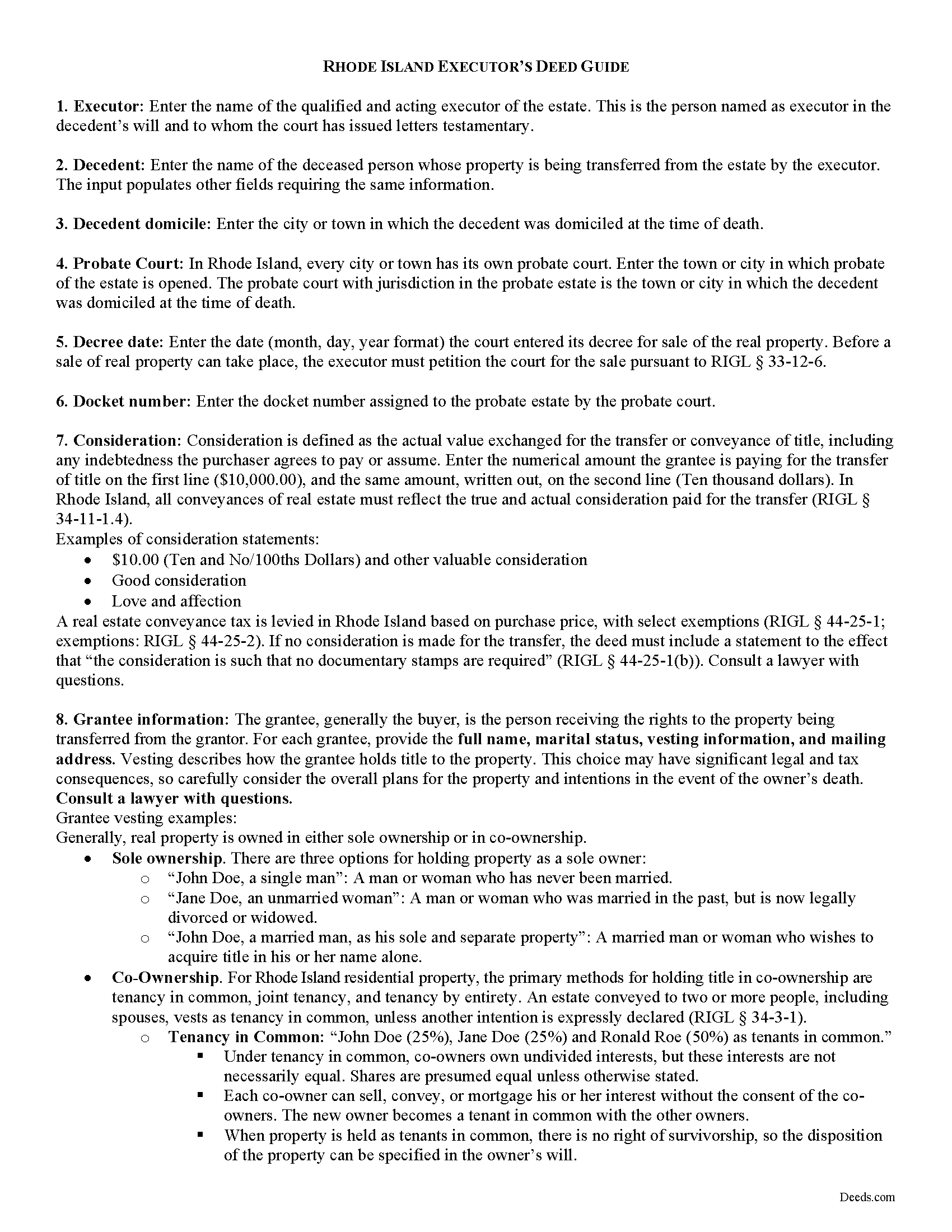

Bristol County Executor Deed Guide

Line by line guide explaining every blank on the form.

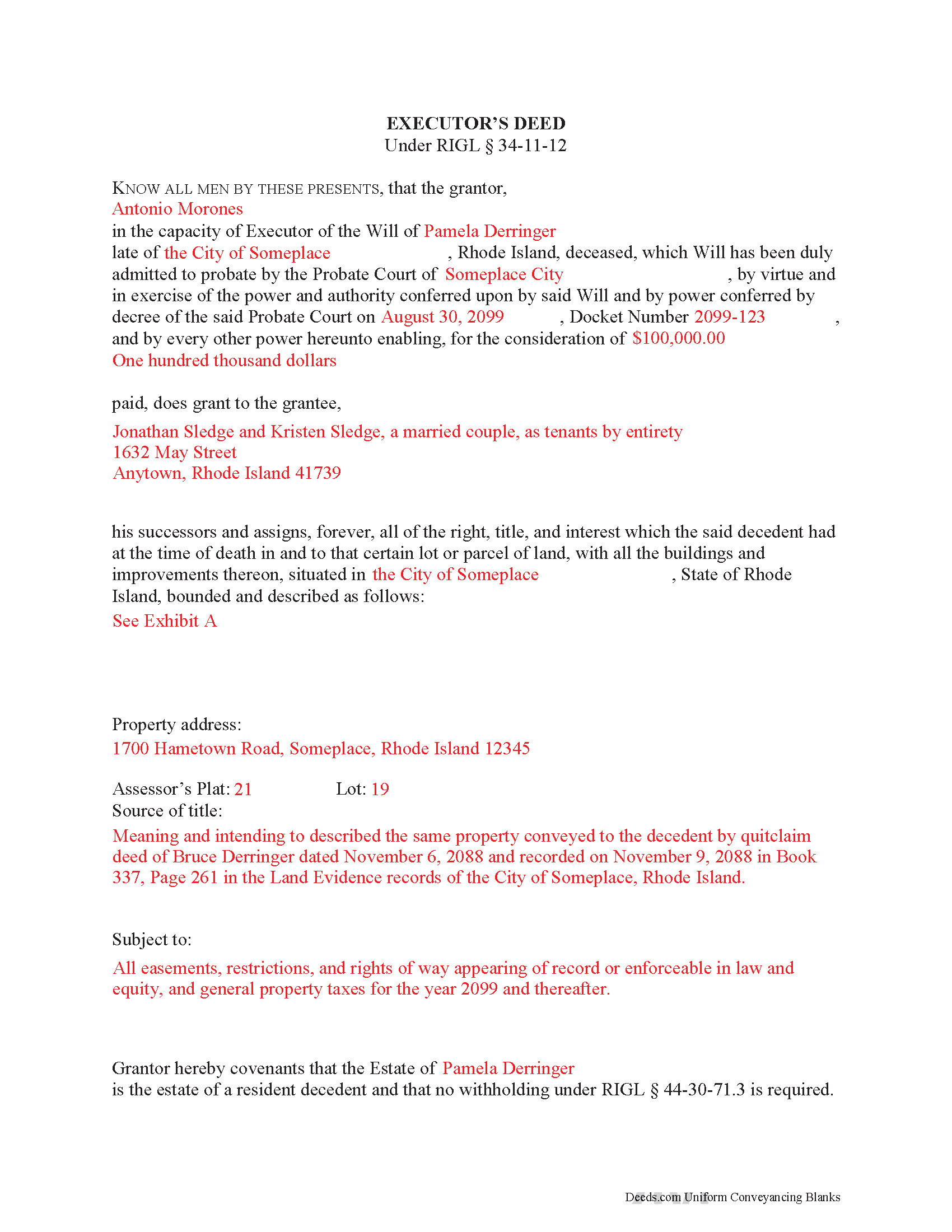

Bristol County Completed Example of the Executor Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Rhode Island and Bristol County documents included at no extra charge:

Where to Record Your Documents

Barrington Town Clerk

Barrington, Rhode Island 02806-2406

Hours: 8:30 to 4:30 M-F

Phone: (401) 247-1900

Bristol Town Clerk

Bristol, Rhode Island 02809

Hours: 8:30 to 4:00 M-F

Phone: (401) 253-7000

Warren Town Clerk

Warren, Rhode Island 02885

Hours: 9:00 to 4:00 M-F

Phone: (401) 245-7340

Recording Tips for Bristol County:

- Ensure all signatures are in blue or black ink

- Check that your notary's commission hasn't expired

- Bring extra funds - fees can vary by document type and page count

- Leave recording info boxes blank - the office fills these

Cities and Jurisdictions in Bristol County

Properties in any of these areas use Bristol County forms:

- Barrington

- Bristol

- Prudence Island

- Warren

Hours, fees, requirements, and more for Bristol County

How do I get my forms?

Forms are available for immediate download after payment. The Bristol County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Bristol County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Bristol County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Bristol County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Bristol County?

Recording fees in Bristol County vary. Contact the recorder's office at (401) 247-1900 for current fees.

Questions answered? Let's get started!

An executor's deed is a statutory form under RIGL 34-11-12 for sales of real property from a probated estate. An executor is a court-appointed fiduciary entrusted to administer a decedent's estate. He or she is the personal representative named in the decedent's will.

Use an executor's deed to transfer title to a purchaser with implied fiduciary covenants. Executor's deeds contain covenants that the grantor is the duly qualified and acting executor of the estate, that he or she has good right and lawful authority to convey the decedent's interest in the subject property, and that he or she, in his or her capacity, has given bond as required by law and has complied in all respects with the court's decree.

In Rhode Island, the probate court must authorize sales of realty from the estate (RIGL 33-19-3). Prior to the sale, the executor files a petition for the sale of real estate with the court, which must include the reason for the sale. Valid reasons for petitioning for the sale of real property under RIGL 33-12-6 include enabling the payment of debts or facilitating efficient administration of the estate. This authority excludes sales of real property that is specifically devised by the decedent's will, unless the devisee(s) give consent to the sale. An executor with a power of sale under a will must also obtain consent to sell specifically devised real property (RIGL 33-12-6).

In addition to meeting the standard requirements for form and content of deeds in Rhode Island, the executor's deed should reflect the true consideration paid by the grantee for the grantor's interest in the realty. Rhode Island levies a real estate conveyance tax based on purchase price, to be paid by the grantor, due upon recording (RIGL 44-25-1). Submit a conveyance tax return (CVYT-1) to the Rhode Island Division of Taxation. The executor may also be asked to furnish an affidavit of residency to the buyer, unless the deed includes a statement that no withholding of tax under RIGL 44-30-71.3 is required.

The executor must sign the deed in the presence of a notary public for a valid transfer. Recording in Rhode Island is done at the municipal level in the town or city where the property is situated. Submit the completed, signed, and notarized deed, along with any supplemental documents, to the land evidence division of the town clerk in the municipality where the subject parcel is located.

The information provided here is not a substitute for legal advice. Consult an attorney licensed in the State of Rhode Island with questions regarding executor's deeds, or for any other issues related to settling an estate, as each situation is unique.

(Rhode Island ED Package includes form, guidelines, and completed example)

Important: Your property must be located in Bristol County to use these forms. Documents should be recorded at the office below.

This Executor Deed meets all recording requirements specific to Bristol County.

Our Promise

The documents you receive here will meet, or exceed, the Bristol County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Bristol County Executor Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

MICHAEL D.

April 4th, 2020

I had a wonderful experience and am looking forward to doing business with you again.

Thank you!

Janet R.

September 2nd, 2019

Thanks great site

Thank you!

steven l.

July 29th, 2020

As a first time user and not having knowledge of how your site worked it was awkward to upload a file and not know what to do next. I found out there is nothing to do next but that after some time looking for a submit button or some kind of confirmation that I was doing the right thing. Ended up being very easy, just wasted time trying to figure out what to do when there was nothing left to do.

Thank you!

Robert R.

September 7th, 2025

I found the form I needed. I ordered the wrong ones the first time. I didn't know if I could get refund or not. The information with the forms is very helpful Thank you

Thank you for your feedback. We’re pleased to hear you found the forms and supporting information helpful. Your initial order has been canceled and refunded, and we’re glad you now have the correct forms in hand. We appreciate your business and are here if you need further assistance.

Teri A S.

November 21st, 2019

Received the quit claim form as ordered. Seemed clear and concise, easy to follow instructions and the completed example was helpful.

Thank you Teri, have a great day!

Ben C.

December 8th, 2024

Easy and Quick,Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Richard C.

March 3rd, 2021

Amazing from start to finish!

Thank you for your feedback. We really appreciate it. Have a great day!

Rachel C.

November 29th, 2019

Excellent information, and form source.

Thank you!

Mark S.

September 14th, 2023

The forms were easy and convenient to use

Thank you Mark. We appreciate your feedback.

Robby T.

February 16th, 2022

Most people coming to this sight will not have the knowledge for deeds. Therefore, I wish there were more instructions on when the Grantor signs and when the Grantee signs and the process steps to making the transaction final. I would give it 4 out of 5 starts

Thank you for your feedback. We really appreciate it. Have a great day!

Christopher H.

July 21st, 2021

The product is as advertised. I was unable to navigate this process because It is complicated and I am concerned about doing it wrong. The law is written in stupid language to make it difficult for all and keep the layering business going. Its a solid form but did not work for me. Thanks Chris

Thank you for your feedback Christopher. Sorry to hear that we’re not comfortable completing the process. It is always best to seek the advice of a legal professional is you are not completely sure of what you are doing.

Janey M.

March 12th, 2019

Easy to use site. Just what I needed!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kathryn C.

January 2nd, 2020

I truly appreciate you and you service for all you do to help me ThankYou kathrynchertock

Thank you for your feedback. We really appreciate it. Have a great day!

Christine W.

December 30th, 2020

excellent

Thank you!

Benjamin A.

November 27th, 2019

This method seems simple for me to complete. Wish me luck.

Thank you for your feedback. We really appreciate it. Have a great day!