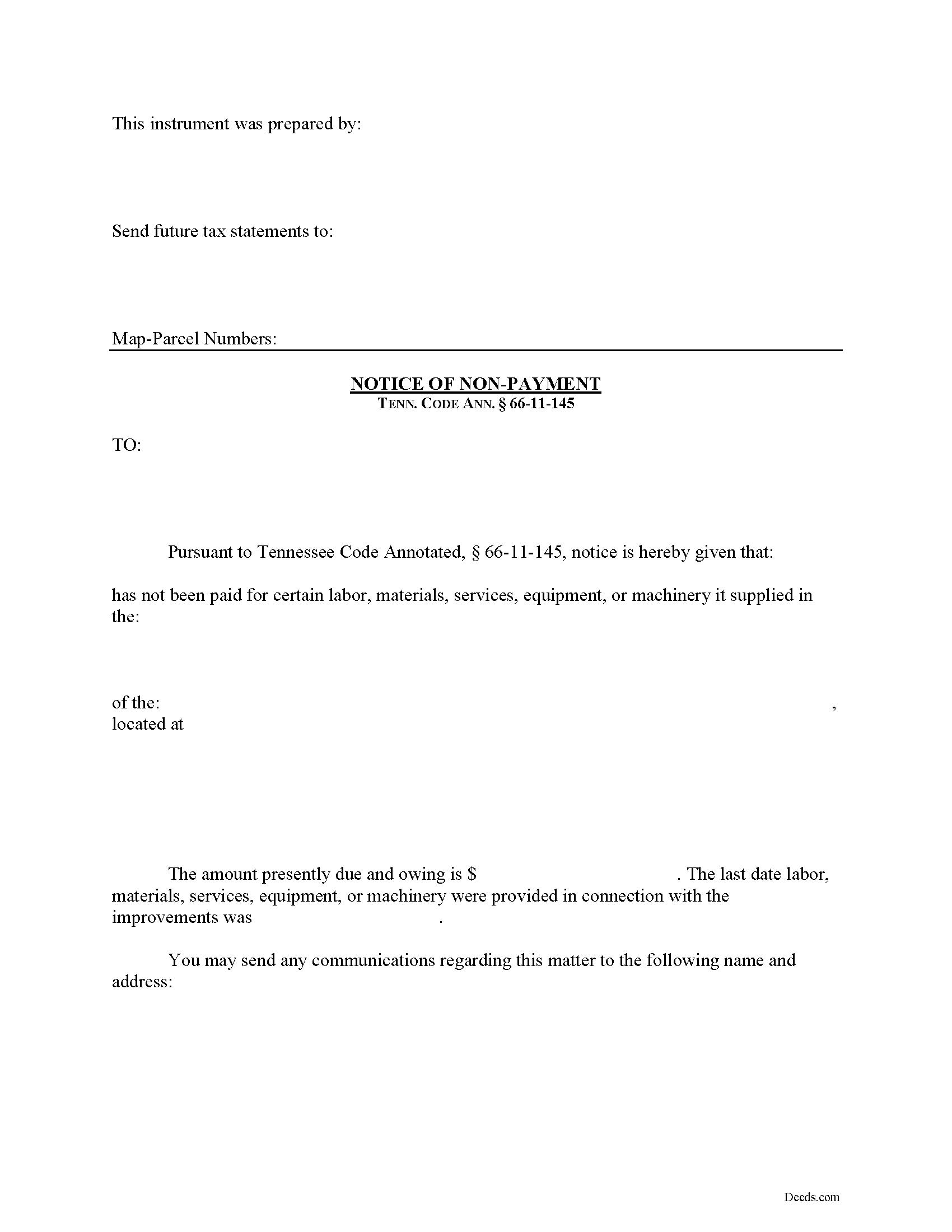

Tipton County Notice of Non-Payment Form

Tipton County Notice of Non-Payment Form

Fill in the blank Notice of Non-Payment form formatted to comply with all Tennessee recording and content requirements.

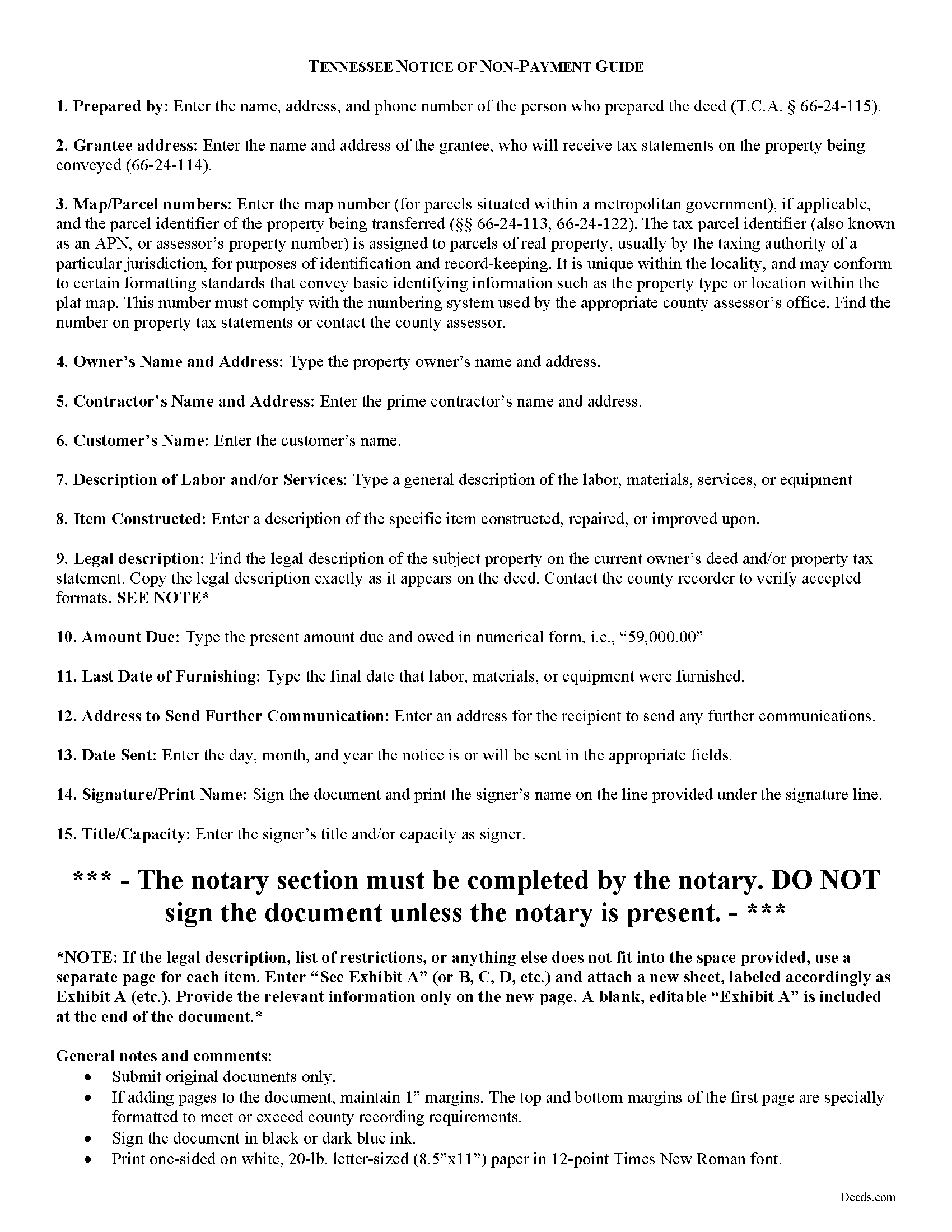

Tipton County Notice of Non-Payment Guide

Line by line guide explaining every blank on the form.

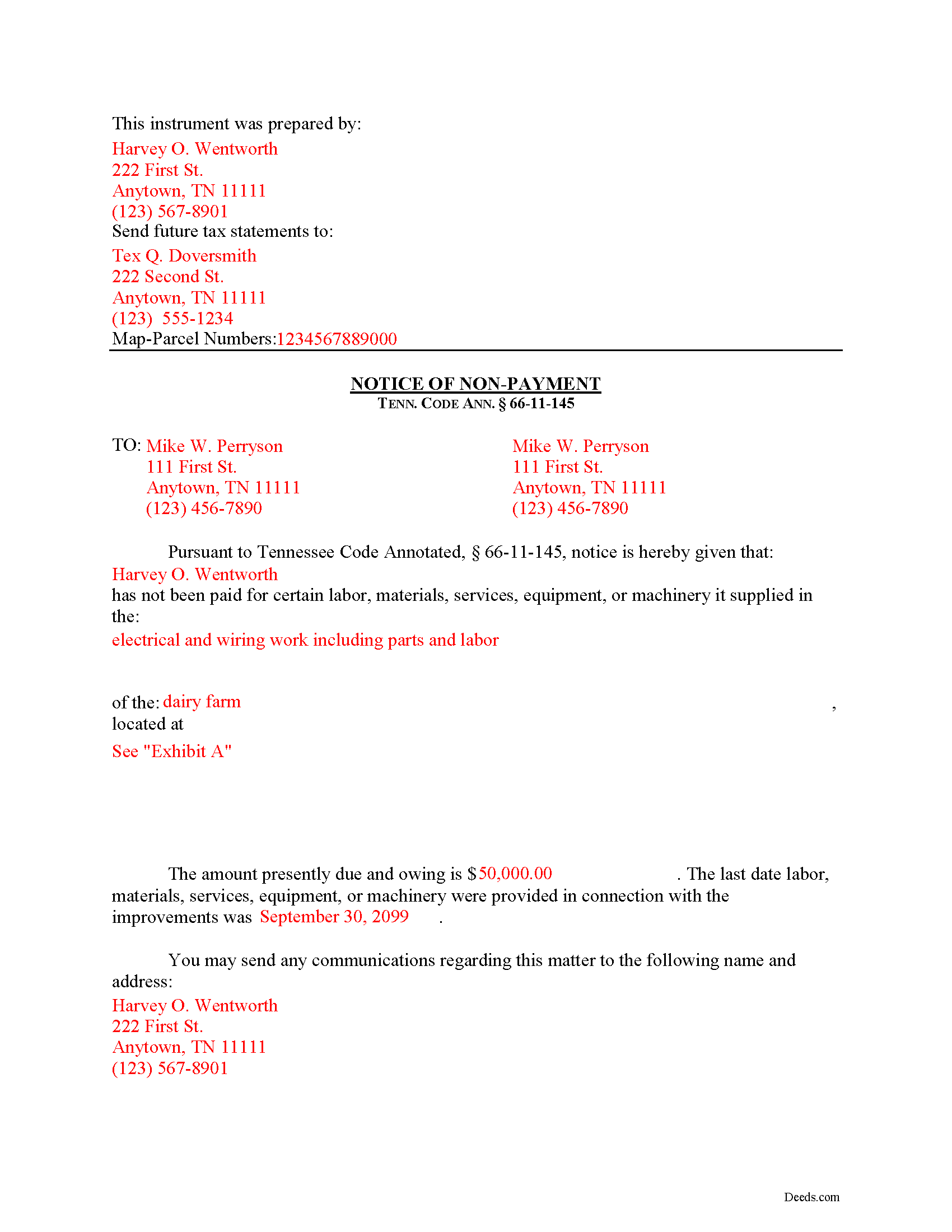

Tipton County Completed Example of the Notice of Non-Payment Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Tennessee and Tipton County documents included at no extra charge:

Where to Record Your Documents

Tipton County Register of Deeds

Covington, Tennessee 38019

Hours: 8:00am-5:00pm M-F

Phone: (901) 476-0204

Recording Tips for Tipton County:

- Ensure all signatures are in blue or black ink

- Make copies of your documents before recording - keep originals safe

- Both spouses typically need to sign if property is jointly owned

- Consider using eRecording to avoid trips to the office

Cities and Jurisdictions in Tipton County

Properties in any of these areas use Tipton County forms:

- Atoka

- Brighton

- Burlison

- Covington

- Drummonds

- Mason

- Munford

- Tipton

Hours, fees, requirements, and more for Tipton County

How do I get my forms?

Forms are available for immediate download after payment. The Tipton County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Tipton County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Tipton County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Tipton County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Tipton County?

Recording fees in Tipton County vary. Contact the recorder's office at (901) 476-0204 for current fees.

Questions answered? Let's get started!

Remote Contractor Claims in Tennessee

Remote contractors who have not contracted directly with the owner, must send a special type of notice when they are not paid at time. In Tennessee, that notice is called the "Notice of Non-Payment."

Every remote contractor with respect to an improvement, except one-to-four-family residential units, shall serve, within ninety (90) days of the last day of each month within which work, material, or labor was provided, or machinery furnished and for which the remote contractor intends to claim a lien, a notice of nonpayment to the owner and prime contractor in contractual privity with the remote contractor if its account is, in fact, unpaid. Tenn. Prop. Code 66-11-145(a). Serve the notice via registered or certified US Mail, or any other service with official delivery confirmation.

The notice shall contain the following: (1) The name of the remote contractor and the address to which the owner and the prime contractor in contractual relation with the remote contractor may send communications to the remote contractor; (2) A general description of the work, labor, materials, services, equipment, or machinery provided; (3) The amount owed as of the date of the notice; (4) A statement of the last date the claimant performed work and/or provided labor or materials, services, equipment, or machinery in connection with the improvements; and (5) A description sufficient to identify the real property against which a lien may be claimed. Id.

If a remote contractor fails to provide the notice of nonpayment in compliance with the law, he or she may lose the right to claim a lien (except with regard to a certain amount or percentage of the contract amount retained to guarantee performance of the remote contractor). Tenn. Prop. Code 66-11-145(b). Even though the notice of nonpayment is a required step in the lien process, be aware that it is NOT the same notice required to fulfill a notice of an impending lien, which must be drafted and sent separately. Tenn. Prop. Code 66-11-145(c).

This article is provided for informational purposes only and should not be considered legal advice or relied upon as any substitute for speaking with an attorney. Please consult a Tennessee attorney familiar with construction law for any issues regarding mechanic's liens.

Important: Your property must be located in Tipton County to use these forms. Documents should be recorded at the office below.

This Notice of Non-Payment meets all recording requirements specific to Tipton County.

Our Promise

The documents you receive here will meet, or exceed, the Tipton County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Tipton County Notice of Non-Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Rhoads H.

December 3rd, 2020

Excellent, thank you.

Thank you!

Sera E.

January 25th, 2022

East, fast, reliable. Great service!

Thank you!

Robert K.

September 6th, 2022

Easy site to use. Well worth the time spent to complete the form.

Thank you!

ed d.

December 23rd, 2020

Fast efficient hassle free

Thank you for your feedback. We really appreciate it. Have a great day!

Trina F.

November 13th, 2020

Easy to purchase. Everything you need to get the job done!

Thank you!

Michael C.

November 20th, 2022

No Search feature on the site? How do I look for forms?

Thank you for your feedback. We really appreciate it. Have a great day!

Ronene T.

August 14th, 2020

I cannot believe how fast your service is! Thank you!

Thank you!

Catherine M.

April 30th, 2021

Great service, very efficient and super fast.

Thank you!

Jayne S.

December 20th, 2023

Simple and quick -- just what we needed!

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Catherine E.

January 7th, 2021

I was referred to your company, but when i tried to process the recording of a deed to a property in City of Philadelphia my service was rejected. I appreciated the feedback i received from one of your representatives who instructed me in the right process for recording a deed in philadelphia. Thank you for all your help. The deed that needed to be recorded was overnighted yesterday. Stay safe and mask up

Thank you!

Tawnya B.

December 28th, 2018

The document I needed and easy instructions!

Thank you!

Ira S.

June 8th, 2022

Hi, 1. I need a password to be able to copy and paste from the deed. 2. It would be more convenient if all documents could be downloaded together. Ira

Thank you for your feedback. We really appreciate it. Have a great day!

Carole L.

December 30th, 2018

Perfectly easy, perfectly complete! I had no problems with downloading these forms. I have been a paralegal for 20 years and came up on a situation where I was not familiar with the forms. Deeds.com saved my life and allowed me to get the documents done and done right. I will keep deeds.com on my list of favorites!

Thank you Carole. Glad we could help. We appreciate you taking the time to leave your review.

Abram A.

February 26th, 2019

Very easy to navigate around and to obtain desired forms and service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

randy j.

December 15th, 2018

the deed format and fill-in language are very specific to one type of easement and are not generally applicable to any other type; in other words it is not useful in a majority of situations and i would recommend against purchase unless you are creating an easement for an appurtenant landowner ONLY

Thank you for your feedback. We really appreciate it. Have a great day!