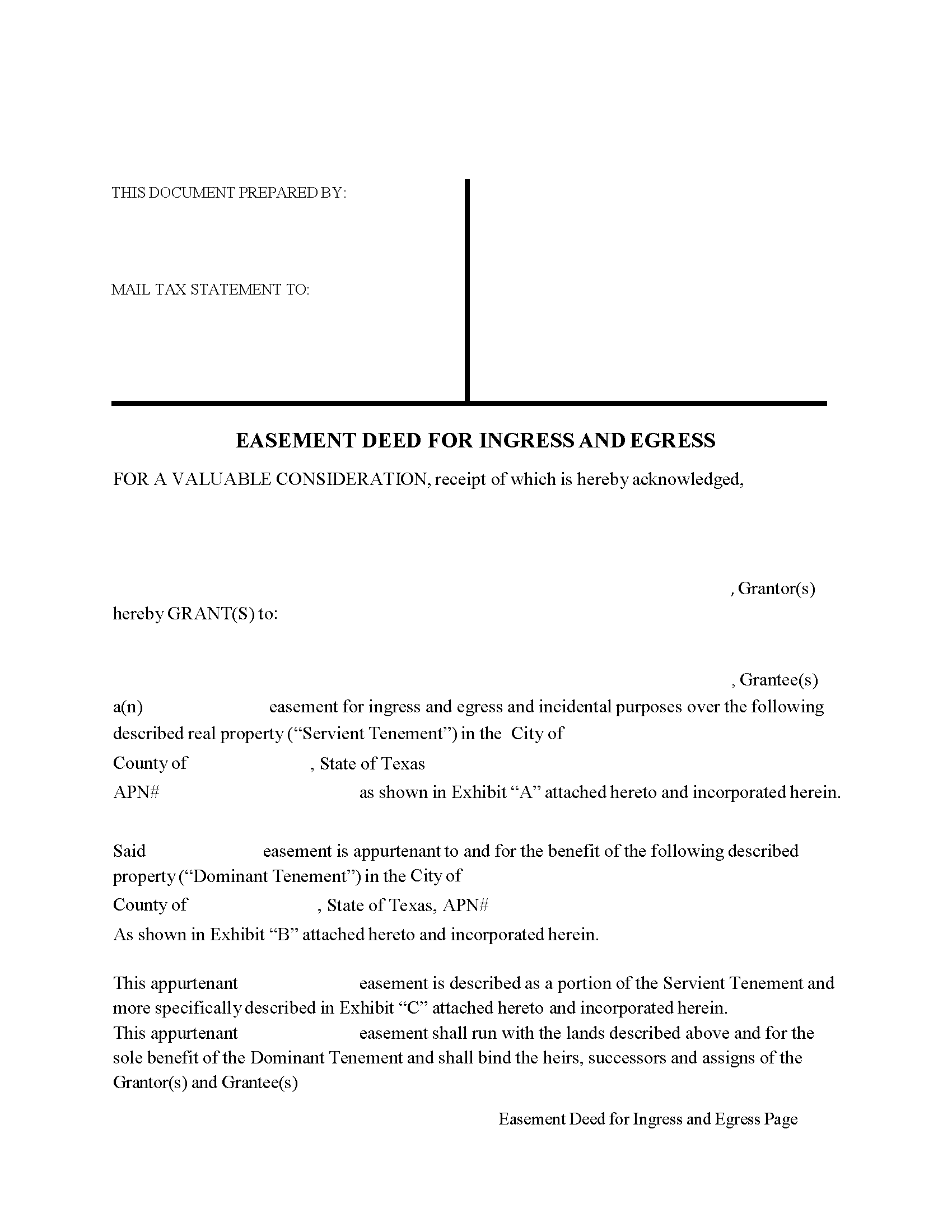

Calhoun County Easement Deed Form

Calhoun County Easement Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

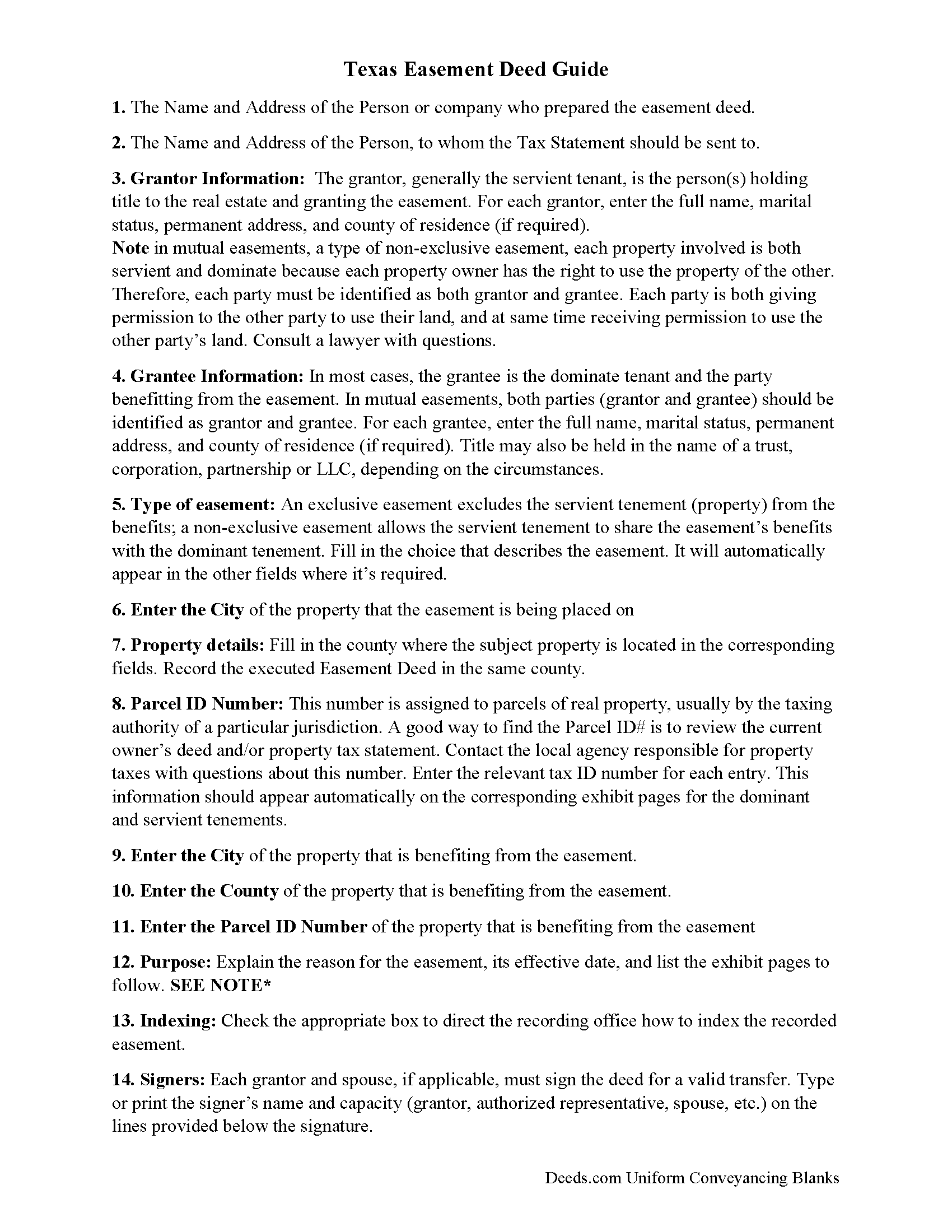

Calhoun County Easement Deed Guide

Line by line guide explaining every blank on the form.

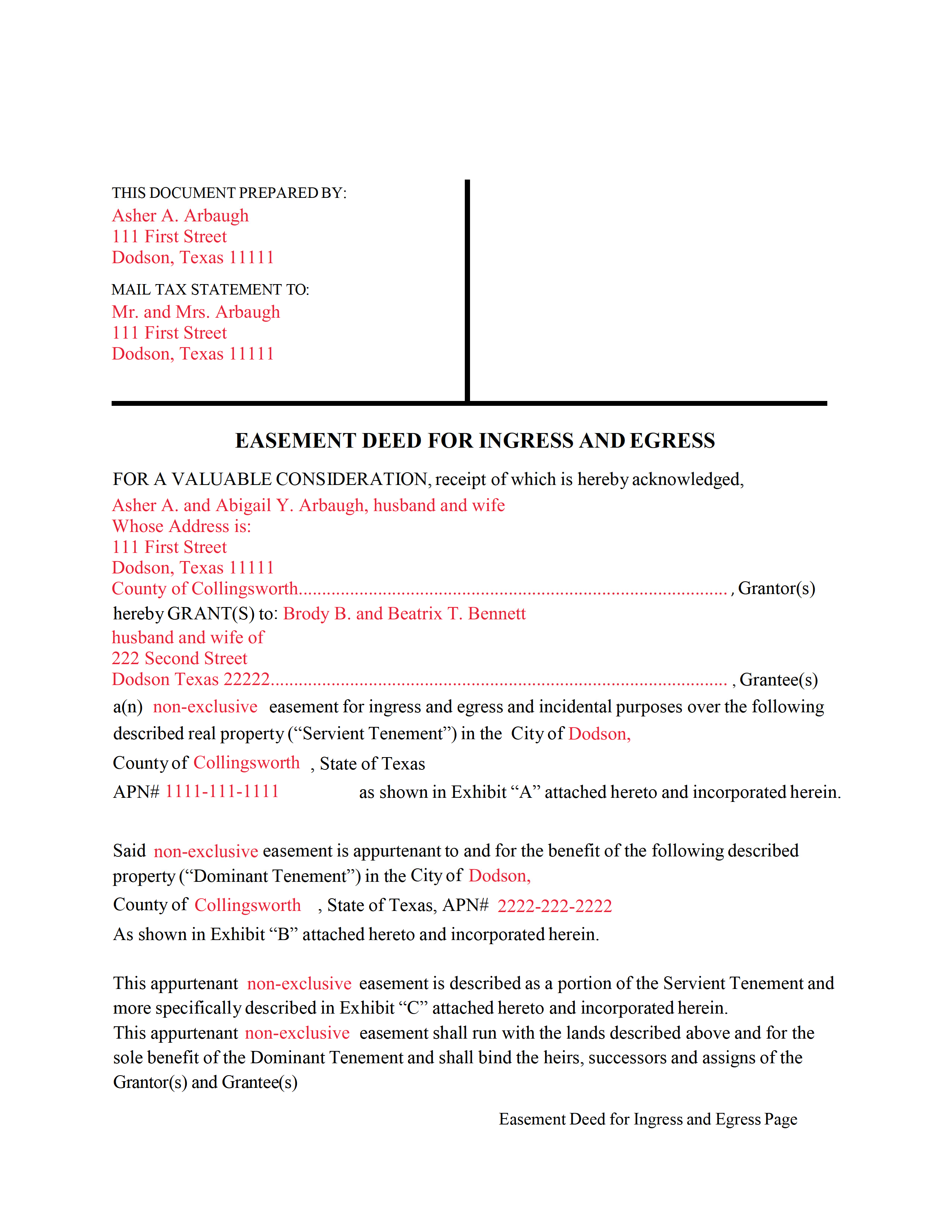

Calhoun County Completed Example of the Easement Deed Document

Example of a properly completed form for reference.

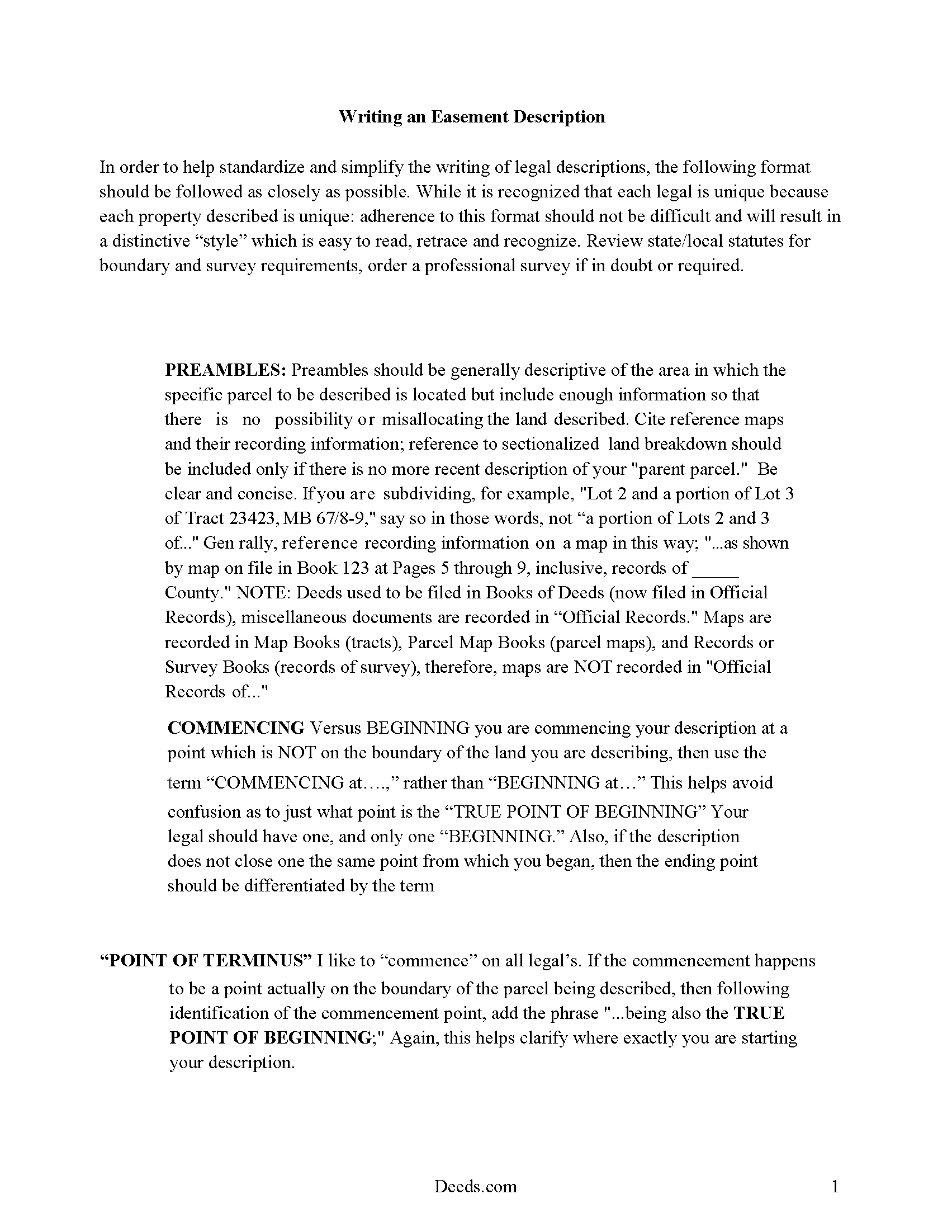

Calhoun County Easement Deed Description

A Description of the Easement will be required. This will show how to write an acceptable description for a Right of Way Easement, which gives access, to and from - point A to point B.

All 4 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Calhoun County documents included at no extra charge:

Where to Record Your Documents

Calhoun County Clerk

Port Lavaca, Texas 77979

Hours: Monday - Thursday 8:00 to 5:00 / Friday 8:30 to 5:00

Phone: 361-553-4411

Recording Tips for Calhoun County:

- Ensure all signatures are in blue or black ink

- Recorded documents become public record - avoid including SSNs

- Bring extra funds - fees can vary by document type and page count

- Ask about their eRecording option for future transactions

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Calhoun County

Properties in any of these areas use Calhoun County forms:

- Point Comfort

- Port Lavaca

- Port O Connor

- Seadrift

Hours, fees, requirements, and more for Calhoun County

How do I get my forms?

Forms are available for immediate download after payment. The Calhoun County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Calhoun County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Calhoun County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Calhoun County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Calhoun County?

Recording fees in Calhoun County vary. Contact the recorder's office at 361-553-4411 for current fees.

Questions answered? Let's get started!

An easement is the non-possessory right to use another person's real property for a specific purpose. Easements exist distinct from the ownership of the land and do not constitute full ownership of the property in question. Easements can be both private and public. Private easements are those in which the enjoyment or use is restricted to one or a few individuals, while public easements are those in which the right or enjoyment of use is vested in the public generally or a community. Private easements are either appurtenant or in gross. Section 23.006 of the Texas Statutes discusses access easements in relation to partitioned property. The rights contained in an easement are created by an easement deed.

Because an easement represents an interest in land, it is required to be in writing, subscribed by the grantor, and delivered (Sec. 5.021). In order to be recorded, an easement deed must be signed by the grantor and properly acknowledged, sworn to with a jurat, or proved according to law (Sec. 12.001a). Original signatures are required. An easement deed may be refused for recording unless it has been signed and acknowledged or sworn to by the grantor in the presence of two or more credible witnesses or acknowledged and sworn to before and certified by an officer authorized to take acknowledgments or oaths (Sec. 12.001b). If the deed is acknowledged before a notary public in another state, it will be invalid for recordation in Texas if it does not have an official seal attached only if the jurisdiction in which the acknowledgment was taken requires the notary public to attach an official seal (Sec. 12.001d).

An unrecorded easement deed will be binding on the parties to the instrument, the party's heirs, and on a subsequent purchaser who does not pay a valuable consideration or who has notice of the instrument (Sec. 13.001c). An easement deed in this state will be void as to a creditor or subsequent purchaser for valuable consideration without notice unless the deed has been acknowledged, sworn to or proved, and filed for record (Sec. 13.001). An easement deed that is recorded in the county where the property subject to the deed is located will serve as constructive notice to all persons of the instrument and will also be open to public inspection (Sec. 13.002).

(Texas Easement Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Calhoun County to use these forms. Documents should be recorded at the office below.

This Easement Deed meets all recording requirements specific to Calhoun County.

Our Promise

The documents you receive here will meet, or exceed, the Calhoun County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Calhoun County Easement Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

John F.

May 30th, 2019

Excellent service, very reliable.

Thank you for your feedback. We really appreciate it. Have a great day!

Terry S.

February 14th, 2023

I was very happy with the document package that I purchased. It contained all of the necessary documents and a few extras I had not thought about. Perhaps if you provided a link to download all of the documents with one click, it would make it a little easier.

Thank you for your feedback. We really appreciate it. Have a great day!

Alexander H.

August 17th, 2019

As an experienced attorney new to estate planning, I attest that this website and its documents were very helpful. Their documents including everything one needed to know and was very comprehensive.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Marcia H.

April 18th, 2021

This was so easy and fast! Plus it had all the information I needed in one place. The example was right on point too!

Thank you for your feedback. We really appreciate it. Have a great day!

Gloria R.

September 12th, 2023

The website was easy.

Thank you!

Christina P.

July 28th, 2023

Fantastic!! The gals at Deeds really seem to have their stuff together! Great Forms, easy, exhaustive, and most importantly... accepted at the recorder the FIRST TIME!

Thank you so much for your review! Your feedback is highly appreciated, and we look forward to assisting you again in the future!

Anna L W.

December 19th, 2021

Was insecure about being able to access the information but pleasantly found that the site was easy to use. Seems that I can use it repeatedly to go back and reprint the forms once I paid.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sharon B.

August 11th, 2022

My questions were answered promptly. I was not able to locate the deed I was searching for because my county has not uploaded the documents to be accessed through this system. I am sure I could have found what I was looking for had the information been available through the system. Thank you for your assistance.

Thank you!

Patricia N.

May 7th, 2025

Wonderful fast service, quick thoughtful responses on chat! Files download easily too, great pruces

We are delighted to have been of service. Thank you for the positive review!

Lisa m.

April 25th, 2020

Very fast and easy! Thanks!!

Glad we could help. Thank you!

Monica M.

September 15th, 2020

I was very impressed with the quick responses I received from my questions. Usually when forced to communicate via email, responses aren't received right away. Thank you for being on top of things.

Thank you!

Giovanni S.

February 23rd, 2023

Simple and easy going process

Thank you!

Rebecca M.

May 3rd, 2025

EASY DOWNLOAD AND PRINT AND / OR SAVE TO YOU PC WHICH SHOULD BE DONE BEFORE FILLING OUT. AFTER I actually use them I'll let you know if its all good, Thanks

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Sheryl G.

November 27th, 2021

Simple way to complete documents with very detailed instructions. And to be able to e-file them is great too.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Laura J.

April 6th, 2021

Very satisfied. Highly recommend!

Thank you!