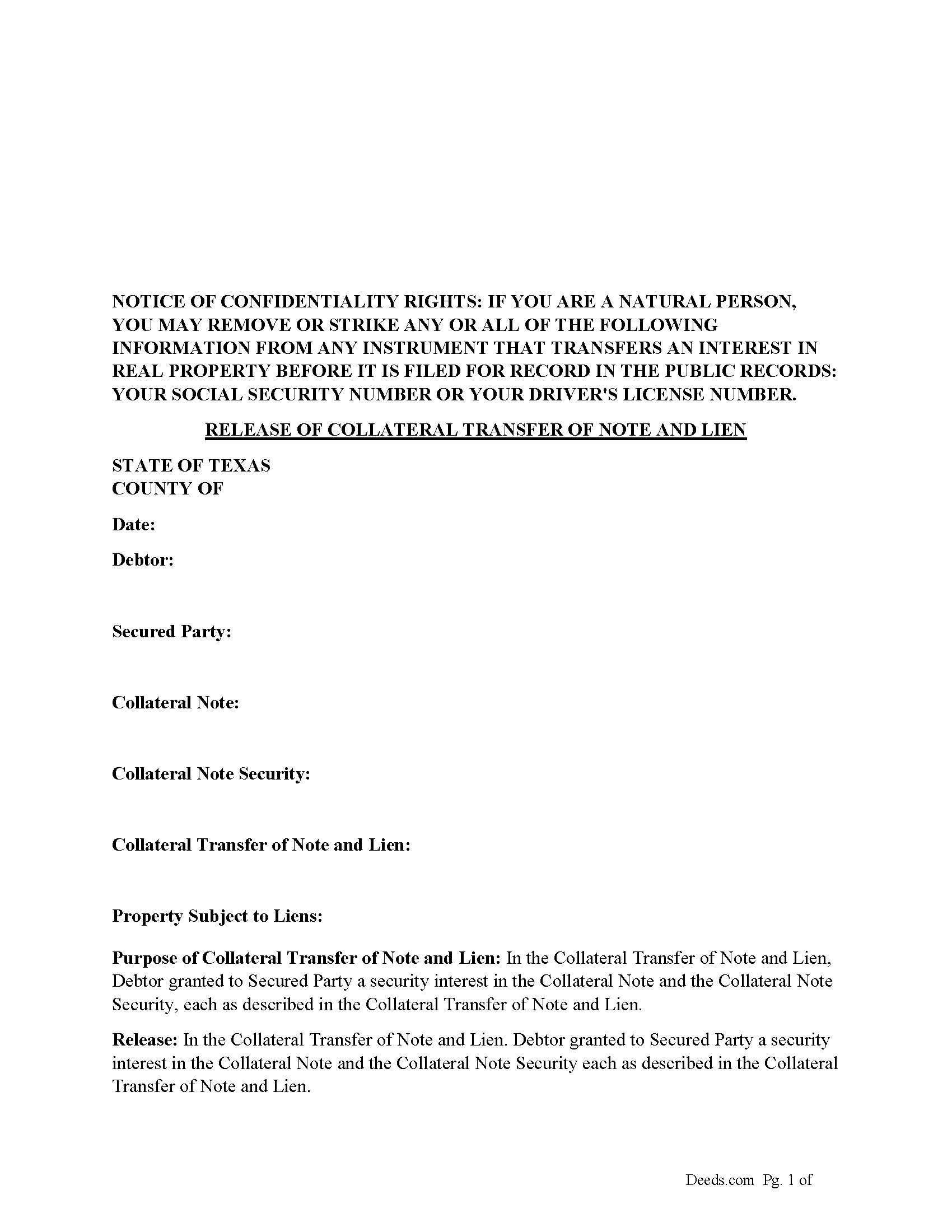

Gregg County Release of Collateral Transfer of Note and Lien Form

Gregg County Release of Collateral Transfer of Note and Lien Form

Fill in the blank form formatted to comply with all recording and content requirements.

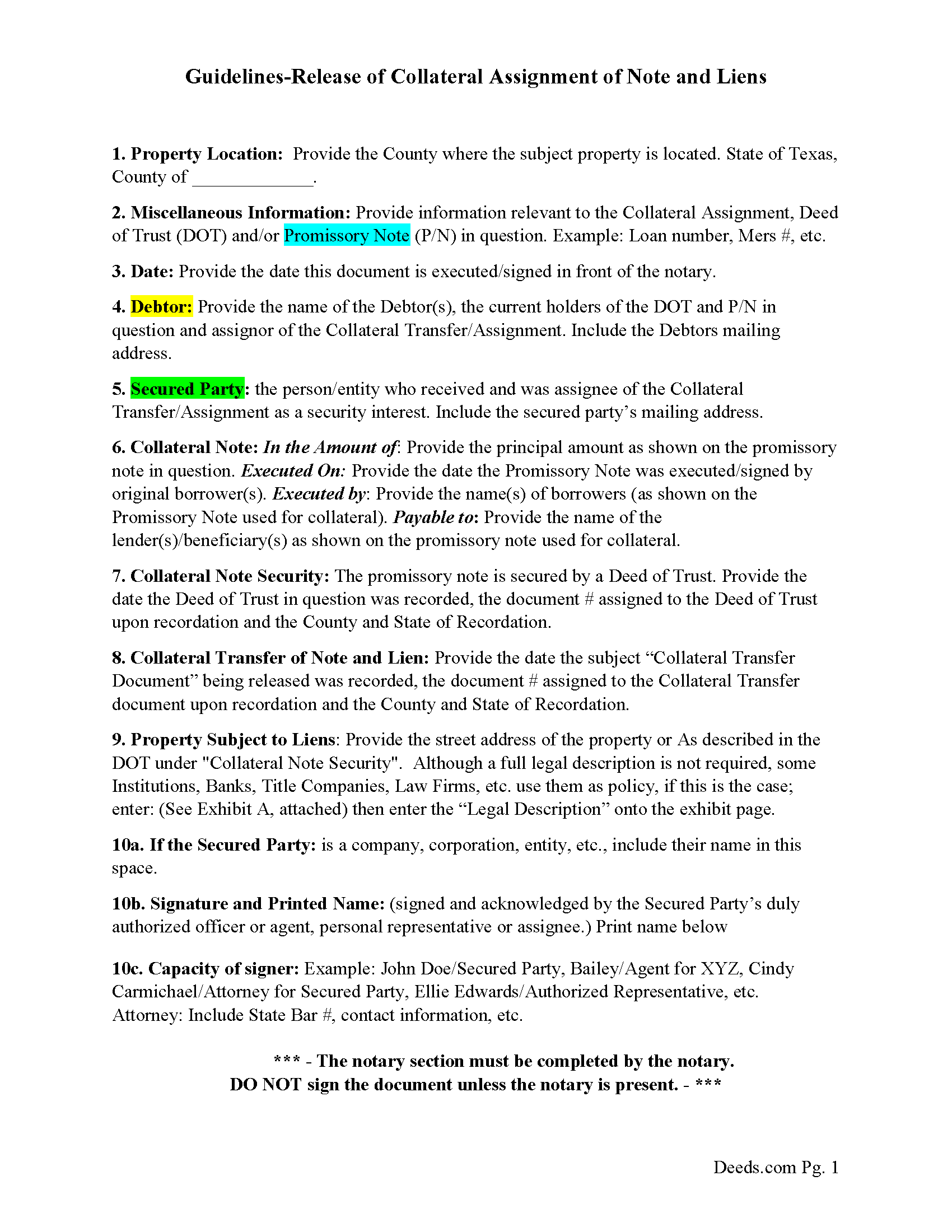

Gregg County Guidelines for Release of Collateral Transfer of Note and Lien

Line by line guide explaining every blank on the form.

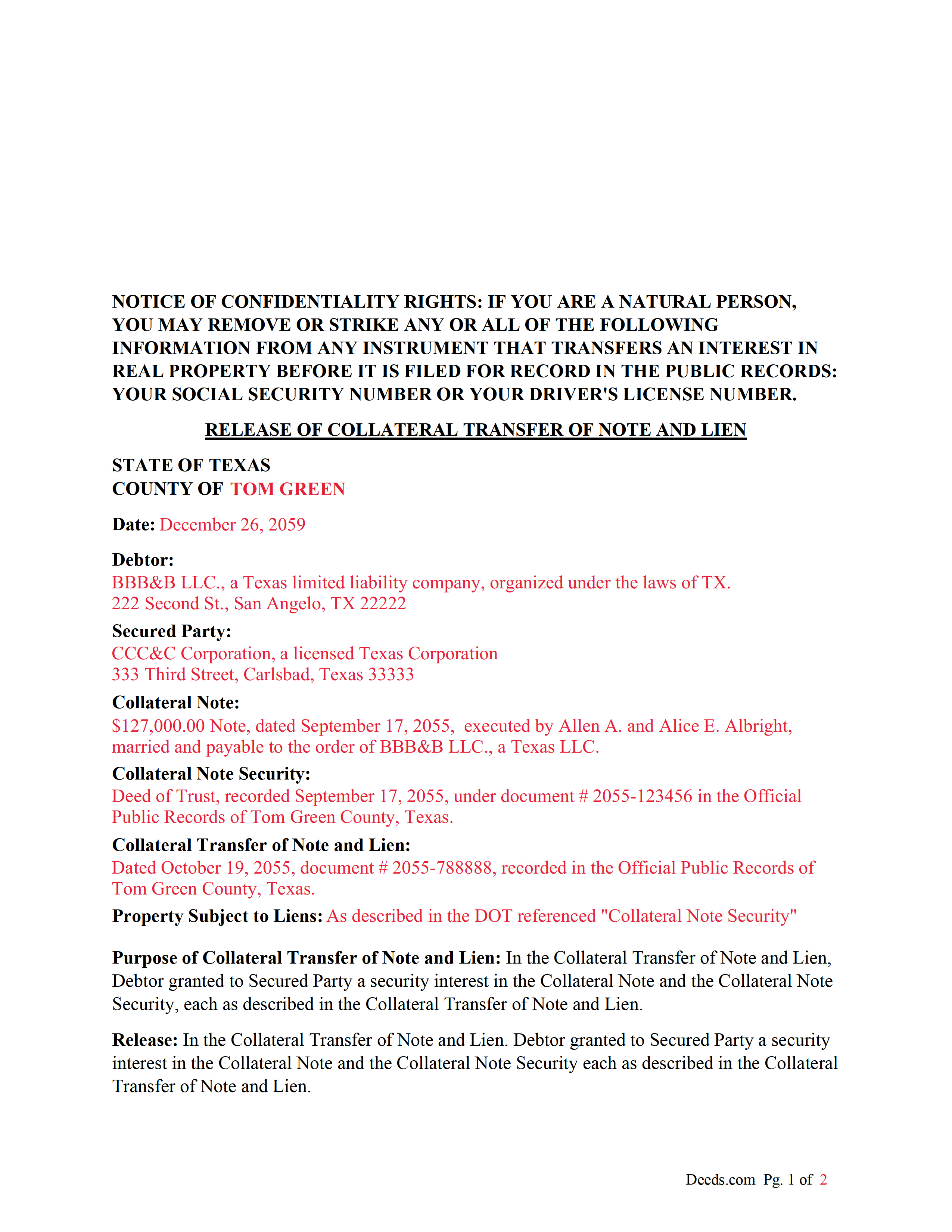

Gregg County Completed Example of the Release of Collateral Transfer of Note and Lien Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Gregg County documents included at no extra charge:

Where to Record Your Documents

Gregg County Clerk - County Courthouse

Longview, Texas 75601

Hours: Monday - Friday 8:00am - 5:00pm

Phone: (903) 236-8430

Recording Tips for Gregg County:

- Check that your notary's commission hasn't expired

- Bring extra funds - fees can vary by document type and page count

- If mailing documents, use certified mail with return receipt

Cities and Jurisdictions in Gregg County

Properties in any of these areas use Gregg County forms:

- Easton

- Gladewater

- Judson

- Kilgore

- Longview

- White Oak

Hours, fees, requirements, and more for Gregg County

How do I get my forms?

Forms are available for immediate download after payment. The Gregg County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Gregg County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Gregg County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Gregg County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Gregg County?

Recording fees in Gregg County vary. Contact the recorder's office at (903) 236-8430 for current fees.

Questions answered? Let's get started!

This form is used by the secured party to release a collateral interest in a property, that was previously assigned and recorded with a "Collateral Transfer of Note and Lien" document, in which Debtor granted to Secured Party a security interest in the Collateral Note and the Collateral Note Security (typically a Deed of Trust), each as described in the Collateral Transfer of Note and Lien.

For use in Texas only.

Important: Your property must be located in Gregg County to use these forms. Documents should be recorded at the office below.

This Release of Collateral Transfer of Note and Lien meets all recording requirements specific to Gregg County.

Our Promise

The documents you receive here will meet, or exceed, the Gregg County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Gregg County Release of Collateral Transfer of Note and Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4577 Reviews )

Paul R.

October 22nd, 2021

Worked very quickly and smoothly. Helps if you know what documents you need. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Melanie N.

October 12th, 2019

I'm happy with the forms, thank you.

Thank you!

Thomas H.

August 31st, 2023

Absolute crap. I would give it 0 stars for user-friendliness.

Sorry to hear that we failed you Thomas. We do hope that you found something more suitable to your needs elsewhere.

Carol M.

April 26th, 2021

Very user friendly. Glad I found your site.

Thank you!

Eleanor W.

November 27th, 2019

Easy to find the form I needed. And the instructions helpful on how to fill out the form.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

ian a.

September 28th, 2022

Your website advertising was somewhat deceptive regarding doing a quitclaim on a name change. "If you are transferring the property to yourself under your new name, all you have to do is update the deed from your former name to your current one." This made this sound easy. But when I downloaded the material for my state, expecting to find an example, there was no example of how to do a name change quitclaim deed! I therefore had to figure this out myself. You might have provided a warning about certain uses that were not covered in the material so that people know ahead of time that the use they needed to know about wasn't covered in the material.

Thank you for your feedback. We really appreciate it. Have a great day!

Elliot M V.

July 28th, 2021

Easy to use

Thank you!

Robert H.

April 18th, 2020

I am very pleased with your service.

Thank you!

Roger M.

January 9th, 2019

Great package it was nice to be able to get everything required for recording this deed in one place.

Thanks Roger, we appreciate your feedback.

Reed W.

May 19th, 2022

Thanks

Thank you!

Jose D.

January 27th, 2021

A little difficult in the beginning but with the messaging back and forth it was very simple and fast. Thank you for your help.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dennis M.

April 24th, 2022

Deeds was responsive and got back to me right away suggesting I go to the county and retrieve copies of the deed there. It's a couple of hundred miles away so was hoping I could do it online. A pretty good website though. Sorry we couldn't do business.

Thank you for your feedback. We really appreciate it. Have a great day!

Shirley C.

November 17th, 2019

I liked that the documents could be filled in on my computer. All the documents came out nice, better than I expected really.

Thank you Shirley, we appreciate your feedback. Have a great day!

James S.

August 26th, 2020

unbelievable Deeds Rocks Start to finish 2=Day Recommended by Coconino County Recorders office in Arizona there were incomplete sections. I would correct and resubmit . All done Yeah!!!!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Deanna S.

May 6th, 2020

I loved the fact that the forms came with examples of the required info. That was helpful and made filling out the forms so much easier. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!