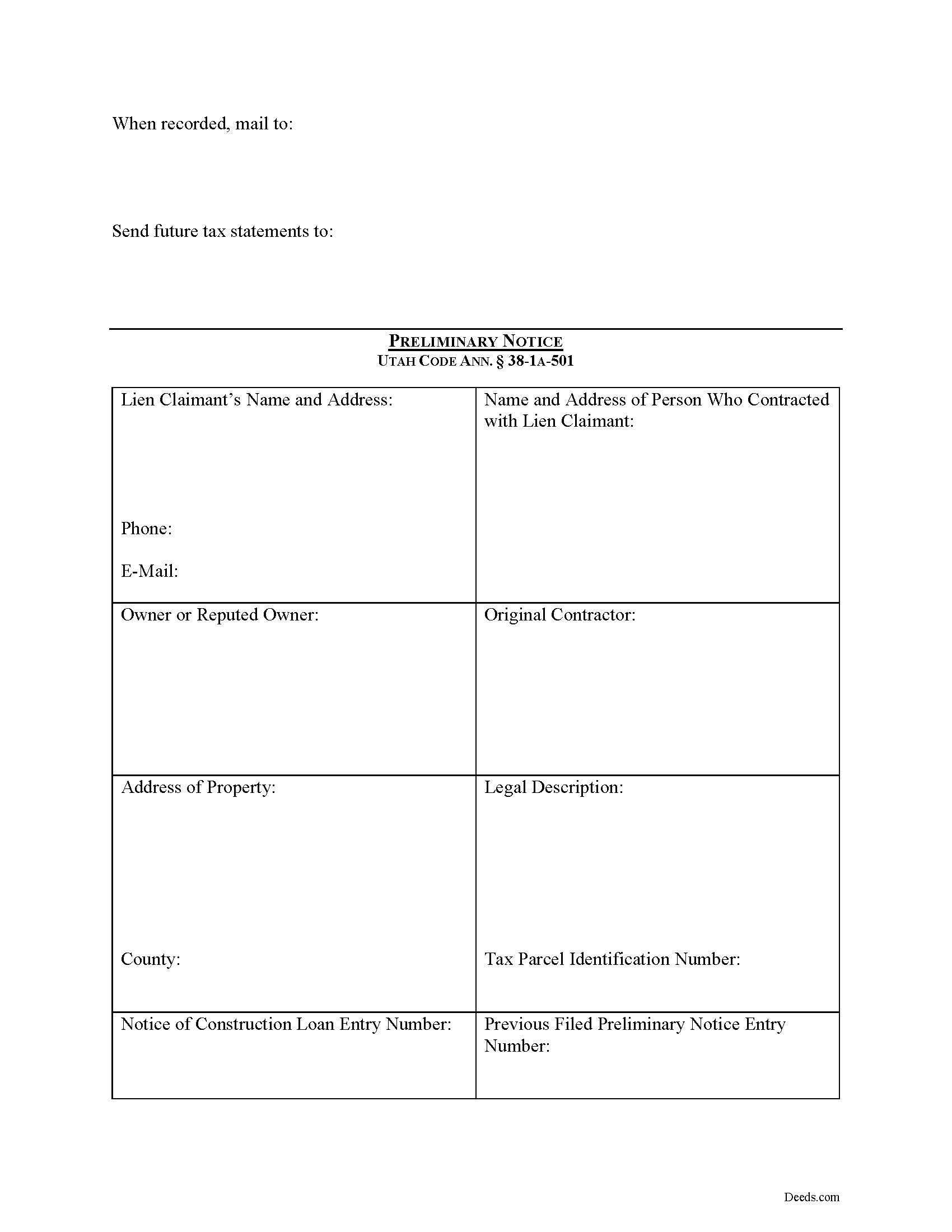

Kane County Preliminary Notice of Lien Form

Kane County Preliminary Notice of Lien Form

Fill in the blank Preliminary Notice of Lien form formatted to comply with all Utah recording and content requirements.

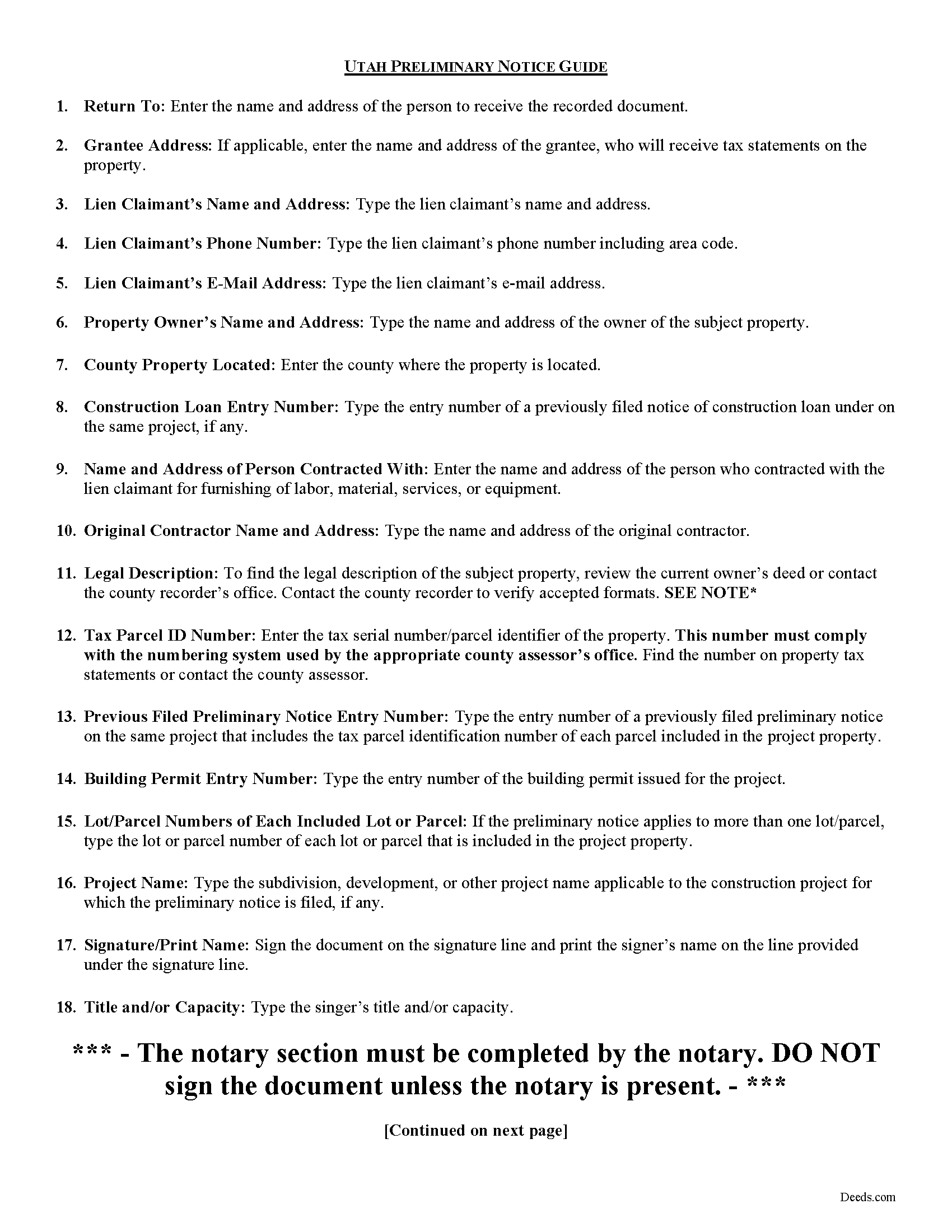

Kane County Preliminary Notice of Lien Guide

Line by line guide explaining every blank on the form.

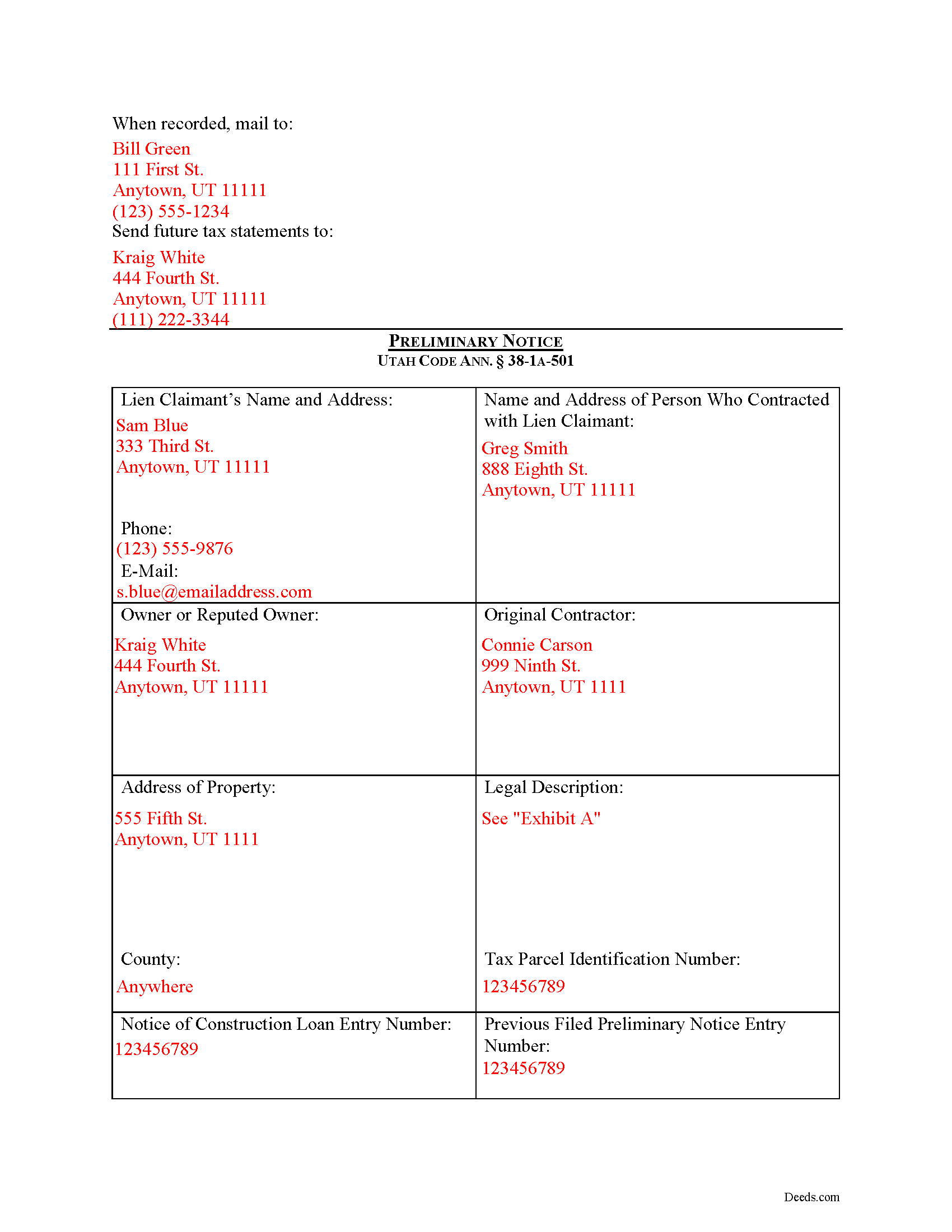

Kane County Completed Example of the Preliminary Notice of Lien Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Utah and Kane County documents included at no extra charge:

Where to Record Your Documents

Kane County Recorder

Kanab, Utah 84741

Hours: 8:00am-5:00pm M-F

Phone: (435) 644-2360

Recording Tips for Kane County:

- Bring your driver's license or state-issued photo ID

- Verify all names are spelled correctly before recording

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Kane County

Properties in any of these areas use Kane County forms:

- Alton

- Duck Creek Village

- Glendale

- Kanab

- Mount Carmel

- Orderville

Hours, fees, requirements, and more for Kane County

How do I get my forms?

Forms are available for immediate download after payment. The Kane County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Kane County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Kane County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Kane County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Kane County?

Recording fees in Kane County vary. Contact the recorder's office at (435) 644-2360 for current fees.

Questions answered? Let's get started!

In Utah, mechanic's liens are governed under Title 38, Chapter 1A of the Utah Code.

A preliminary notice is a type of pre-lien notice that must be served on a property owner before any lien can be claimed later on. The notice is a required process under Utah's mechanic's lien law, and failure to comply may result in loss of the potential claimant's right to a mechanic's lien.

Any person who desires to claim a construction lien against real property must file a preliminary notice with the construction registry no later than 20 days after the day on which the person commences providing construction work on the real property. UTAH CODE ANN. 38-1A-501(1)(a). The preliminary notice will then be effective as to all construction work that the person filing the notice provides to the construction project under a single original contract, including construction work that the person provides to more than one supervisory subcontractor under that original contract. 38-1A-501(1)(b).

If a person who desires to claim a construction lien on real property fails to file a timely preliminary notice within the above period specified, he or she may file a preliminary notice with the registry after the period specified. 38-1A-501(1)(c)(i). However, any person who files a preliminary notice is not permitted to claim a construction lien for construction work the person provides to the construction project before the date that is five days after the preliminary notice is filed. 38-1A-501(1)(c)(ii).

Aside from the exception described above, a preliminary notice has no effect if it is filed more than 10 days after the filing of a notice of completion for the construction project for which the preliminary notice is filed. 38-1A-501(1)(d). Any person who fails to file a preliminary notice as required may not claim a construction lien under Utah law. 38-1A-501(1)(e). A preliminary notice that is filed with the registry is considered to be filed at the time of the first preliminary notice filing. 38-1A-501(1)(f).

If a preliminary notice filed with the registry includes the tax parcel identification number (TPIN) of a parcel not previously associated in the registry with a construction project, the designated agent shall promptly notify the person who filed the preliminary notice that: (i) the preliminary notice includes a tax parcel identification number of a parcel not previously associated in the registry with a construction project; and (ii) the likely explanation is that the preliminary notice is the first filing for the project; or the tax parcel identification number is incorrectly stated in the preliminary notice. 38-1A-501(1)(g).

The preliminary notice document includes the following: (1) the name, address, telephone number, and email address of the person providing the construction work for which the preliminary notice is filed; (2) the name and address of the person who contracted with the claimant; (3) the name of the record or reputed owner; (4) the name of the original contractor; (5) the address of the project property or a description of the location of the project; (6) the name of the county in which the project property is located; (6) the tax parcel identification number of each parcel included in the project property; (7) the entry number of a previously filed notice of construction loan on the same project; (8) the entry number of a previously filed preliminary notice on the same project that includes the tax parcel identification number of each parcel included in the project property; and (9) the entry number of the building permit issued for the project. 38-1A-501(1)(h).

The notice also includes space for the optional provisions, if any apply, including: (1) the subdivision, development, or other project name applicable to the construction project for which the preliminary notice is filed; and (2) the lot or parcel number of each lot or parcel that is included in the project property. Id.

The burden is upon the person filing the preliminary notice to prove that the person has substantially complied with its requirements. 38-1A-501(2)(a). This means the person files a preliminary notice that links, within the registry, to a preliminary notice filed by an original contractor for the same construction project, using the entry number assigned to the original contractor's preliminary notice. 38-1A-501(2)(b).

Substantial compliance as the remaining requirements of the notice may be established by a person's reasonable reliance on information in the registry provided by a previously filed: (1) notice of construction loan; (2) preliminary notice; or (3) building permit. 38-1A-501(2)(c).

Any person required to give preliminary notice is required to give only one notice for each construction project. 38-1A-501(3)(a). If the construction work is provided pursuant to contracts under more than one original contract for construction work, the notice requirements shall be met with respect to the construction work provided under each original contract. 38-1A-501(3)(b).

If filing a preliminary notice by alternate means, the person filing is responsible for verifying and changing any incorrect information in the preliminary notice before the expiration of the time period during which the notice is required to be filed. 38-1A-501(4). A person who files a preliminary notice that contains inaccurate or incomplete information may not be held liable for damages suffered by any other person who relies on the inaccurate or incomplete information in filing a preliminary notice. 38-1A-501(5).

Sign the document in front of a notary. Once completed, the notice is uploaded to the online Utah construction registry using an established account.

This article is provided for informational purposes only and should not be relied upon as a substitute for advice from an attorney. Please contact a Utah attorney with questions about preliminary notice or any other issues regarding construction liens.

Important: Your property must be located in Kane County to use these forms. Documents should be recorded at the office below.

This Preliminary Notice of Lien meets all recording requirements specific to Kane County.

Our Promise

The documents you receive here will meet, or exceed, the Kane County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Kane County Preliminary Notice of Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4586 Reviews )

Margarette S.

November 27th, 2019

I found your website easy to use and very informative.

Thank you for your feedback. We really appreciate it. Have a great day!

Johnny H.

September 15th, 2022

The format presented is exactly what is needed to produce a perfect listing in the registry of The Maricopa County Office of the Recorder. Thanks for an effective solution to a very important document.

Thank you!

Joyce M.

July 28th, 2019

Great website, but not helpful in locating my deed dated 1747.

Thank you for your feedback. We really appreciate it. Have a great day!

Amanda W.

August 18th, 2020

Very helpful.

Thank you!

Jodi W.

August 22nd, 2019

Absolutely horrible service and experience. Would not recommend to anyone. If there was an option to select a zero star rating I would have. I am sure this review will not be posted.

Thank you for your feedback Jodi.

Debby P.

October 5th, 2023

Great company! I have been using Deeds.com for many years. I just opened a new account when I retired from my Escrow job. My recording was flawless!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Catherine B.

September 15th, 2020

Trying to get a hold of someone in the office is very difficult. This made it so much easier, thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Frank C.

January 10th, 2023

Great experience and online account service

Thank you for your feedback. We really appreciate it. Have a great day!

Tim T.

November 6th, 2023

Straightforward and handy. Spacing of the spaces I filled out was not pretty, but it all worked.

We are motivated by your feedback to continue delivering excellence. Thank you!

diana l.

July 19th, 2024

Easy to use & got my one question answered in less than 5 minutes! Excellence.

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!

Michelle A.

January 5th, 2025

deeds.com is user-friendly and very easy to navigate. Guides, samples, and free supplement forms are available for every State and are frequently updated. The cost is economical. I recommend these products

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lillian D.

May 24th, 2020

I found the deeds.com site easy to use and very up to date. I am a senior citizen and not very tek inclined but I was able to reach the goal that I was seeking. I would use it again if the need arrived.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Susan Mary S.

August 24th, 2020

Thank you for the thorough assortment of forms!

Thank you for your feedback. We really appreciate it. Have a great day!

CHARLES S.

March 7th, 2021

Easy to purchase and a reasonable price. Documents were easy to add information. Examples proved handy.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Amanda P.

April 14th, 2021

Quick kind and useful feedback provided related to issues.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!