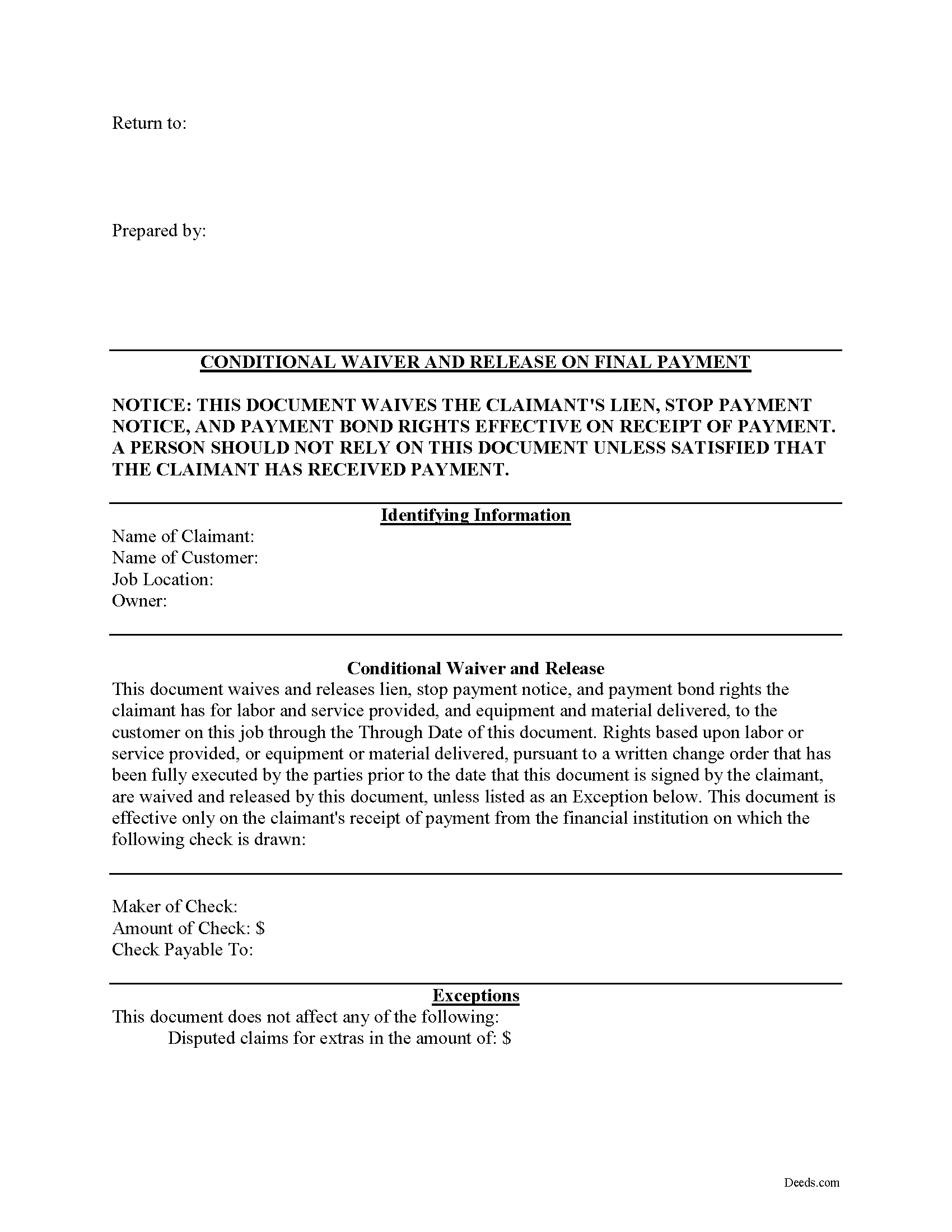

Smyth County Conditional Lien Waiver on Final Payment Form

Smyth County Conditional Lien Waiver on Final Payment Form

Fill in the blank Conditional Lien Waiver on Final Payment form formatted to comply with all Virginia recording and content requirements.

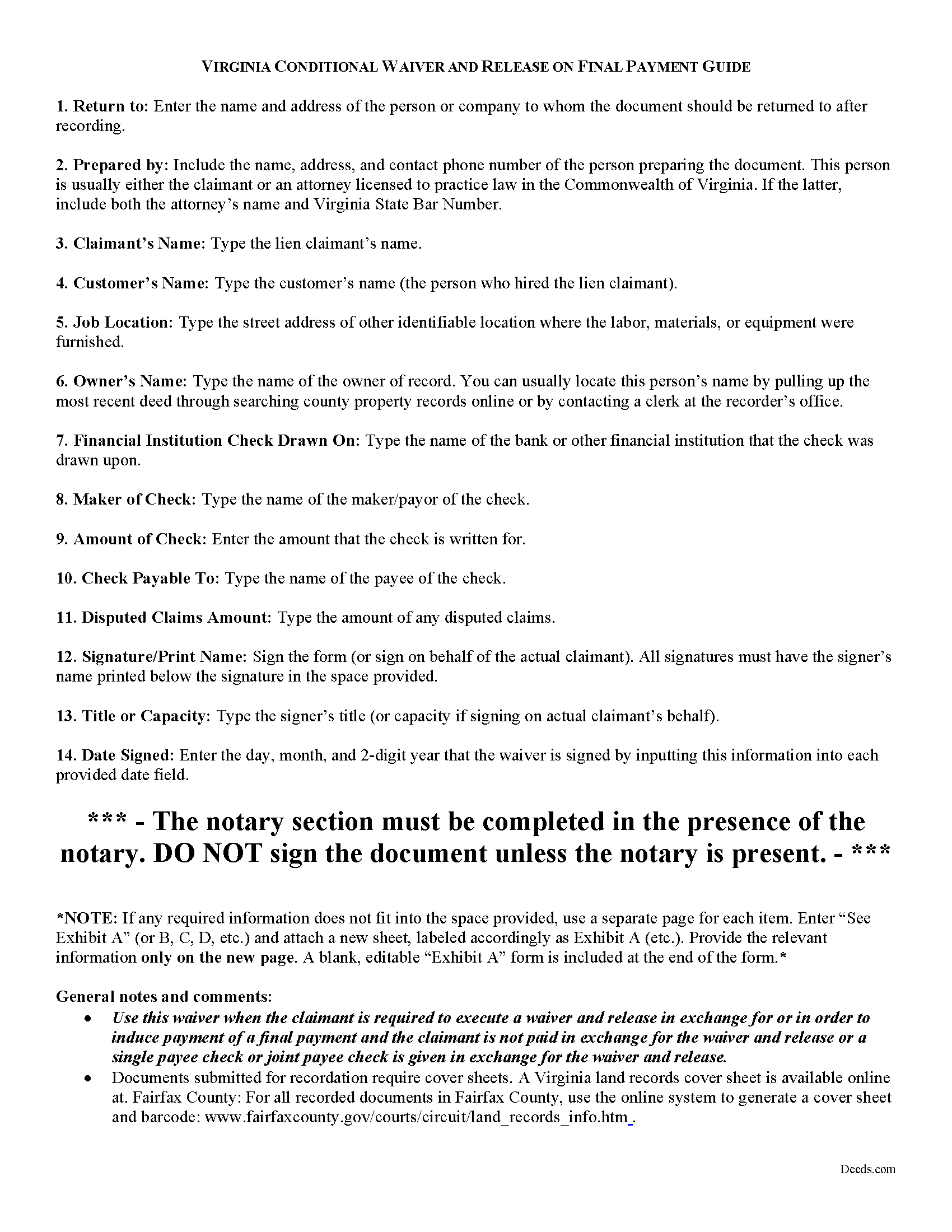

Smyth County Conditional Lien Waiver on Final Payment Guide

Line by line guide explaining every blank on the form.

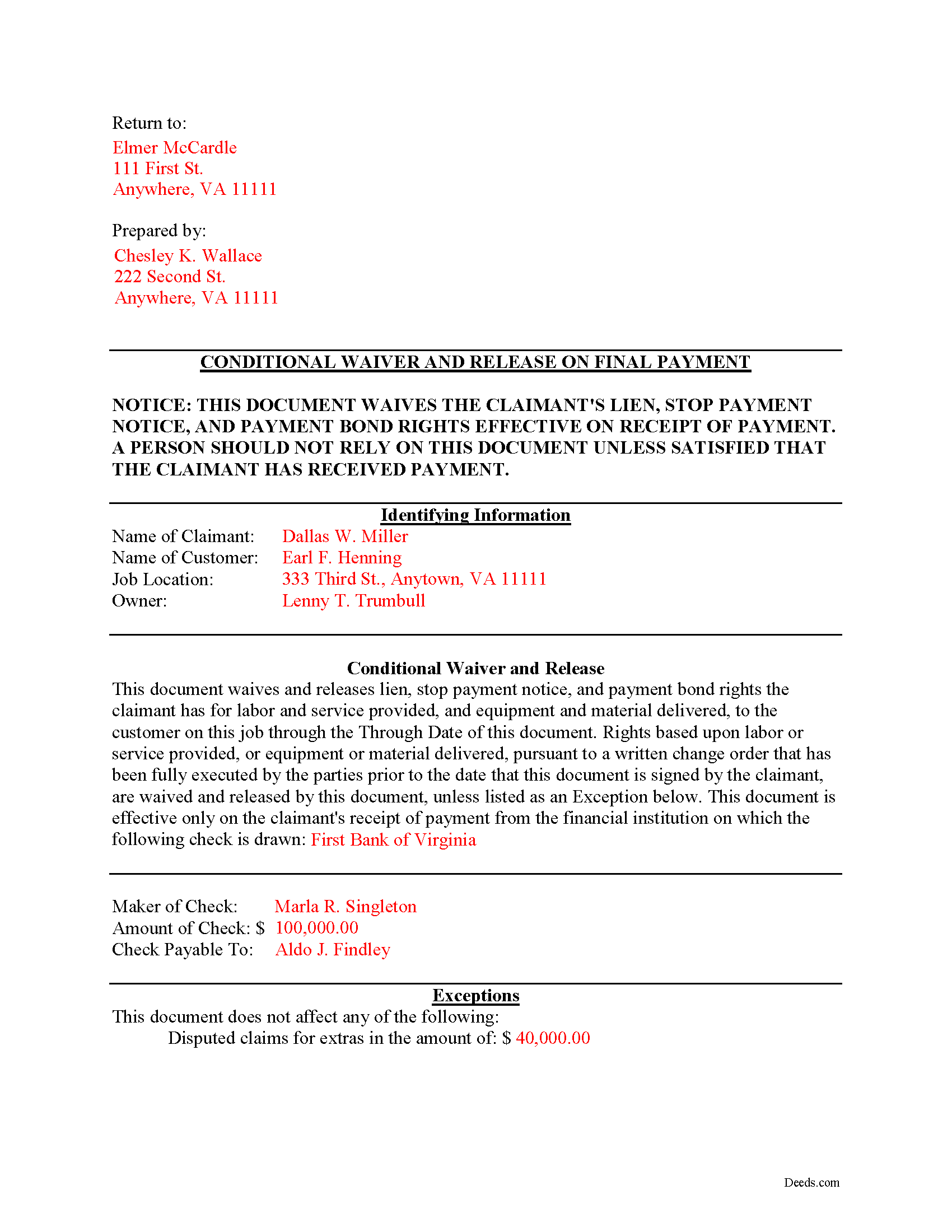

Smyth County Completed Example of the Conditional Lien Waiver on Final Payment Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Virginia and Smyth County documents included at no extra charge:

Where to Record Your Documents

Smyth Clerk of Circuit Court

Marion, Virginia 24354

Hours: 9:00 to 5:00 M-F / Recording until 4:30

Phone: (276) 782-4044

Recording Tips for Smyth County:

- Bring your driver's license or state-issued photo ID

- Make copies of your documents before recording - keep originals safe

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Smyth County

Properties in any of these areas use Smyth County forms:

- Atkins

- Chilhowie

- Marion

- Saltville

- Sugar Grove

Hours, fees, requirements, and more for Smyth County

How do I get my forms?

Forms are available for immediate download after payment. The Smyth County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Smyth County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Smyth County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Smyth County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Smyth County?

Recording fees in Smyth County vary. Contact the recorder's office at (276) 782-4044 for current fees.

Questions answered? Let's get started!

Lien waivers are quid-pro-quo arrangements between contractors and owners. The purpose of such waivers is to induce payment from an owner in return for the contractor waiving some or all available mechanic's lien rights. If the correct waivers are used, they offer advantages for both a contractor and owner.

In Virginia, any right to file or enforce any mechanics' lien may be waived in whole or in part at any time by any person entitled to such lien, except that a subcontractor, lower-tier subcontractor, or material supplier may not waive or diminish his lien rights in a contract in advance of furnishing any labor, services, or materials. Va. Code 43-3(C). A provision that waives or diminishes a subcontractor's, lower-tier subcontractor's, or material supplier's lien rights in a contract executed prior to providing any labor, services, or materials is null and void. Id.

The Virginia legislature does not mandate a required form of a lien waiver, so common law principles of contract allow for the parties to use any form that clearly spells out their intentions. Note that it is a felony for any person to knowingly present a waiver form to an owner, his agent, contractor, lender, or title company for the purpose of obtaining funds or title insurance if the person forges or signs the form without authority. Va. Code. 43-13.1.

Waivers fall under two broad categories of "conditional" and "unconditional," and there are two subcategories of waivers for a "partial" or "final" payment. Each type comes with benefits and risks, so take care to use the correct form for the situation.

A conditional waiver depends on the actual receipt of payment, so use a conditional waiver when a party pays with a check but the claimant doubts whether it might clear. Therefore, if the check doesn't clear the bank, it is still possible to claim a lien down the line. This type of waiver offers greater protection to the contractor.

Use a full waiver on final payment when the fees/debt is completely paid. So, this might be the appropriate form for a situation where the owner submitted a check for the balance due, but the claimant wants to preserve the right to claim a lien until after the check clears the bank.

In this way, waivers can facilitate the flow of business and encourage prompt payment without any unnecessary holdups.

This article is provided for informational purposes only and should not be relied upon a substitute for the advice of an attorney. For any questions about Virginia lien waivers, please speak with a lawyer.

Important: Your property must be located in Smyth County to use these forms. Documents should be recorded at the office below.

This Conditional Lien Waiver on Final Payment meets all recording requirements specific to Smyth County.

Our Promise

The documents you receive here will meet, or exceed, the Smyth County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Smyth County Conditional Lien Waiver on Final Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Charles W.

July 7th, 2019

I was vey pleased with this service. It offered all of the necessary step by step information guides for completing the forms. Again, thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Martha G.

January 7th, 2020

Well-designed site. Incredibly easy to find what I needed, very reasonable cost.

Thank you for your feedback. We really appreciate it. Have a great day!

Valerie I.

November 19th, 2020

Quick and easy! Had my document submitted to the county and back in one day. Good rates as well!

Thank you!

Daniel Z.

September 13th, 2022

All is well that ends well and this form service seemed to work quite smoothly, even though my printer gives me fits at times, having to hand feed the blank paper.

Thank you for your feedback. We really appreciate it. Have a great day!

Thomas W.

July 14th, 2020

Very quick and responsive. Faster than finding out by mail if you've done something incorrectly. Very satisfied with offerings and service.

Thank you for your feedback. We really appreciate it. Have a great day!

Patrick K.

September 1st, 2020

Fast and easy to use. Great update communications

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Karen T.

April 22nd, 2019

Thank you for the feedback. I reviewed this with my client/friend and she is following up with the appropriate people, including the Police and a lawyer. Thank you for your help.

Thank you!

Patricia R.

October 26th, 2022

Very quick to respond with the obvious answers. I asked what form to use when adding my daughter to deed. Answer: talk to an attorney duh.

Thank you!

Judith F.

June 29th, 2022

Was easy to use the eRecording service.

Thank you!

Elizabeth F.

February 14th, 2022

This was great other than exemption codes did not populate and I couldn't refer to it.

Thank you for your feedback. We really appreciate it. Have a great day!

Ruthea M.

March 18th, 2025

It was easy to download, but you need to open an account before doing so. That was not clear.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

Susanne N.

February 25th, 2021

It's hard having to change names on an account when someone dies. I called and was helped by a rep named Lilah. She was most helpful and comforting. Thank you again Lilah.

Thank you for taking the time to leave such kind words Susanne, we appreciate you.

Carrie A.

September 28th, 2020

Great service fast and easy.

Thank you!

DENNIS M.

January 18th, 2023

very simple and complete

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jean W.

April 21st, 2021

helpful if there was a space so one could type in the exemption # on the blank form before printing

Thank you for your feedback. We really appreciate it. Have a great day!