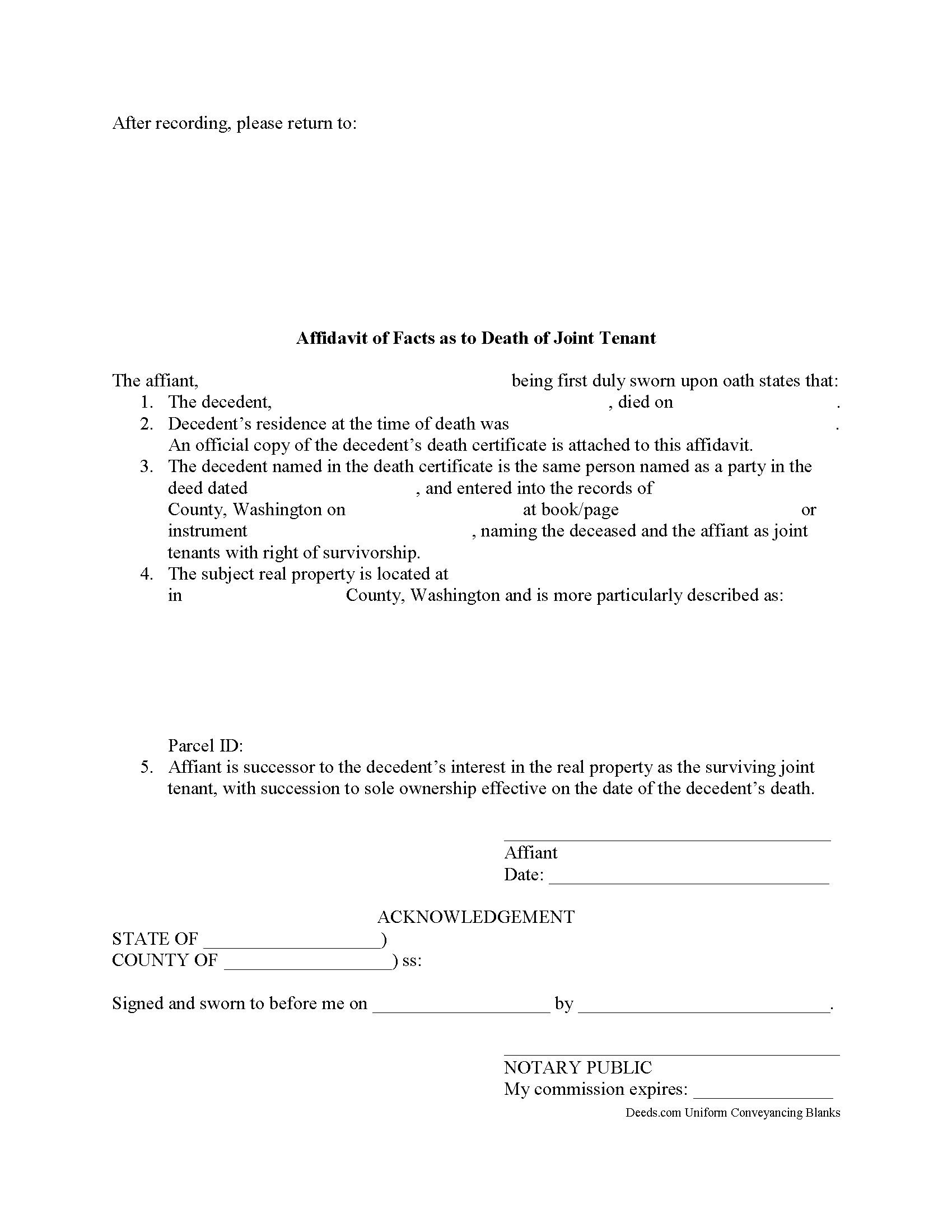

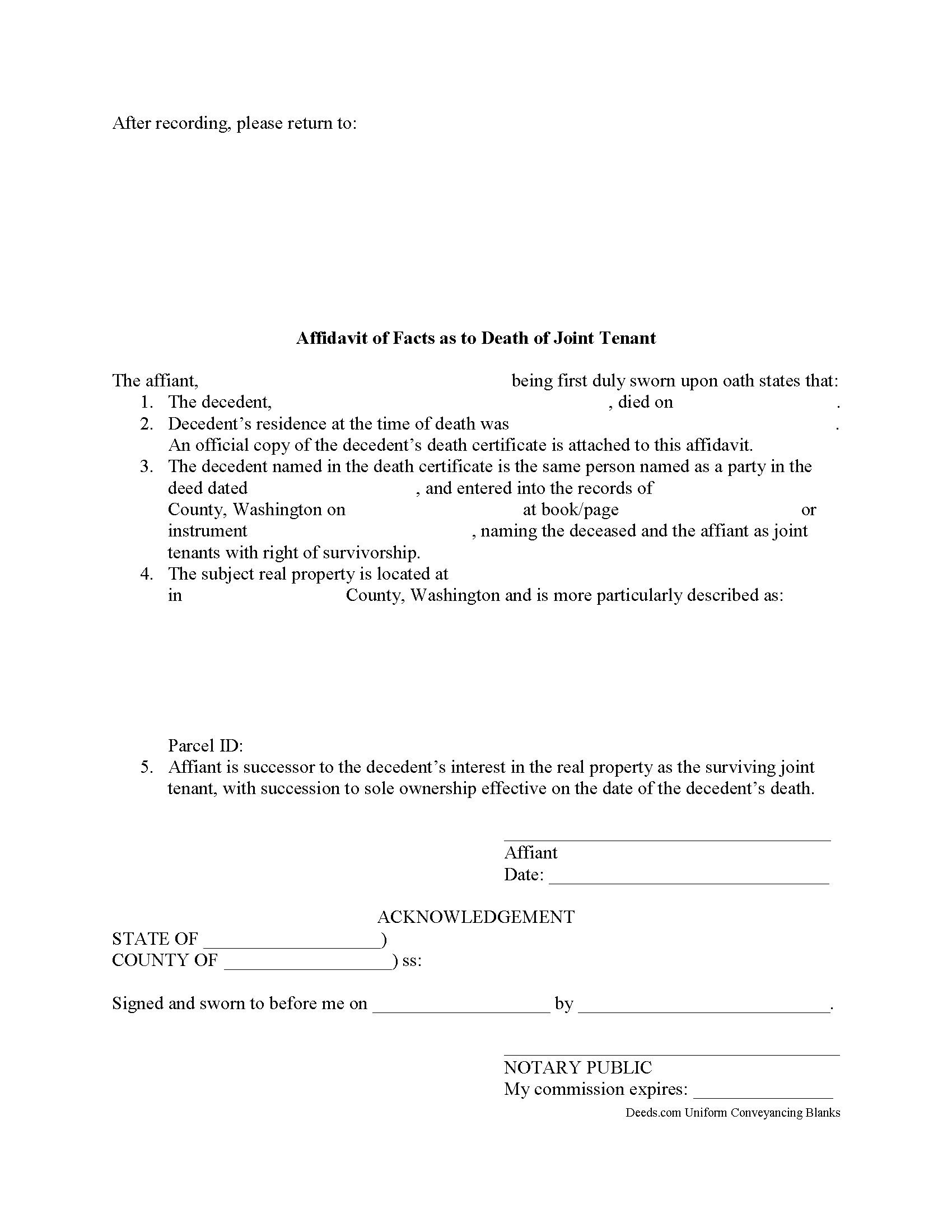

Download Washington Affidavit of Deceased Joint Tenant Legal Forms

Washington Affidavit of Deceased Joint Tenant Overview

Removing a Deceased Joint Tenant from a Washington Real Estate Title

Washington's statutes define joint tenancy at RCW 64.28.010. This law states that "joint tenancy with right of survivorship permits property to pass to the survivor without the cost or delay of probate proceedings." Property titled this way is not passed in a will; instead, a deceased joint tenant's share is distributed equally amongst the survivors as a function of law until only one person holds the property in sole ownership.

While technically accurate, this description oversimplifies the situation. What happens when it's time to sell the property? Unless the local recording office cross-references death notices with real estate records, the deceased owner's name remains on the title. This inaccuracy can create confusion during a title search and slow down the transfer process. In addition, outdated information might interfere with property tax billing, possibly leading to fees and/or penalties.

The surviving owner(s) can prevent these potential issues with a simple step: when one joint tenant dies, the other(s) execute and record an affidavit of facts as to death with the local recording office. It is possible to address this at the time of sale, but it makes sense to handle it within a short time after the owner's death. This action keeps property records up-to-date, verifies interests and rights to the title, and ensures smoother transfers in the future.

Each circumstance is unique, so please contact an attorney with questions or for complex situations.

(Washington AODJT Package includes form, guidelines, and completed example)