Barbour County Transfer on Death Deed Form

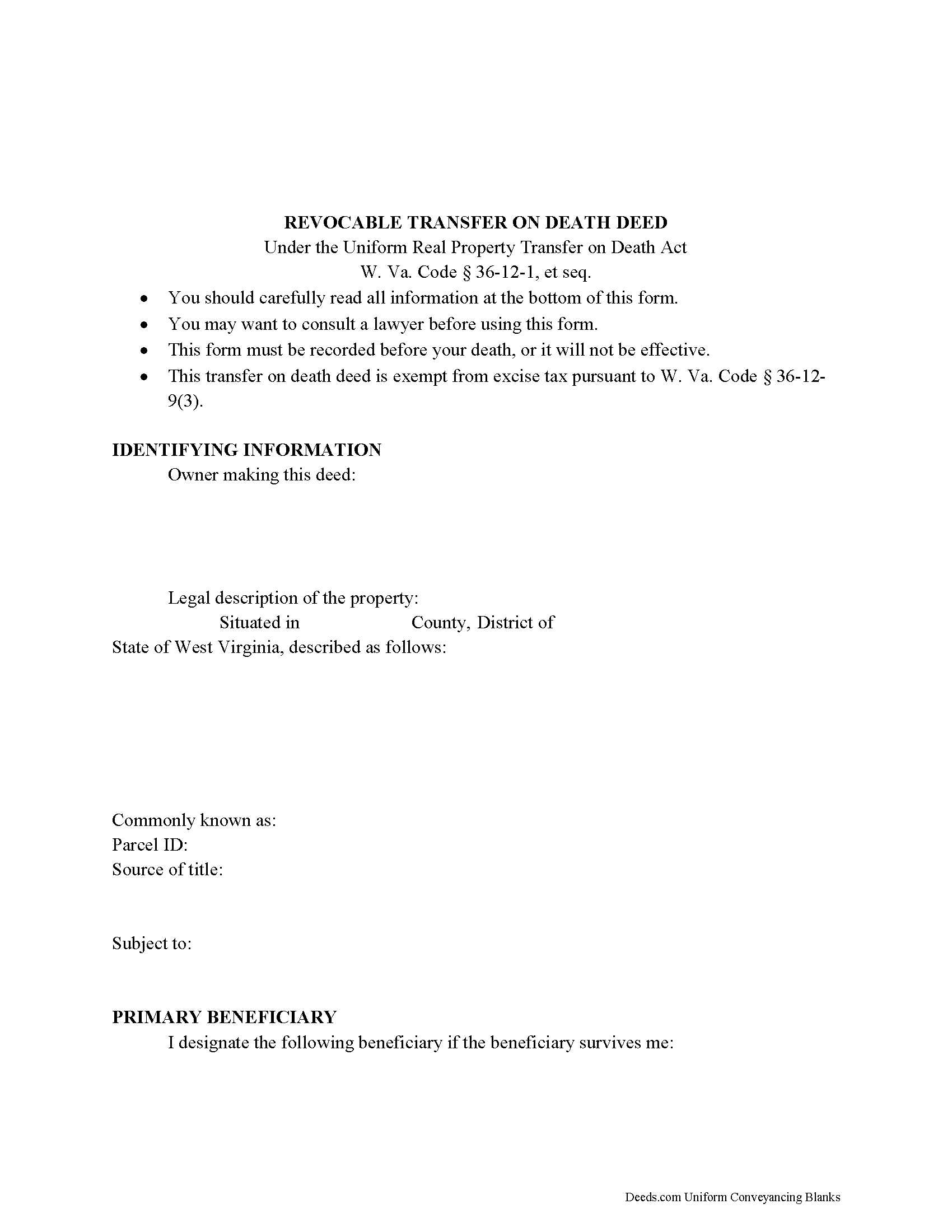

Barbour County Transfer on Death Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

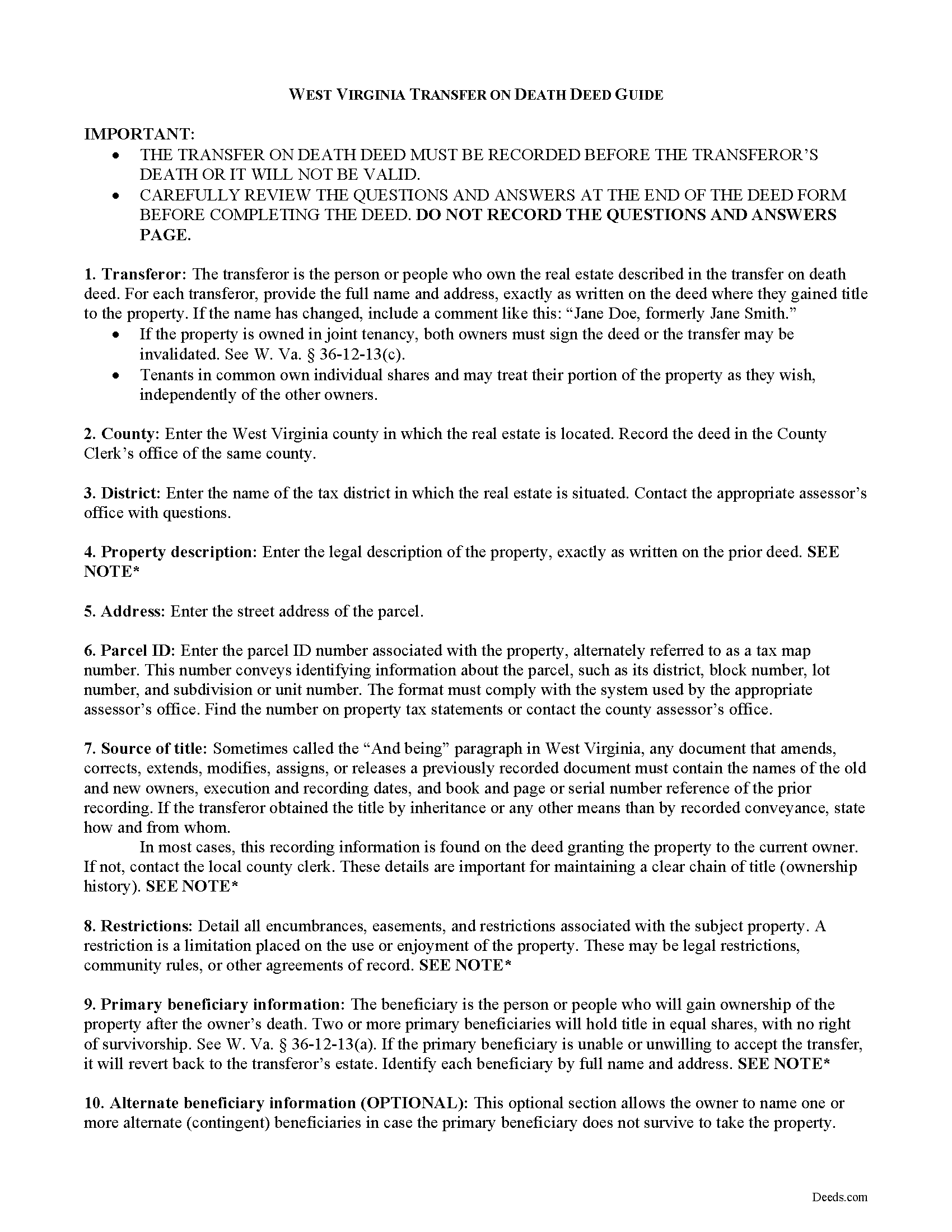

Barbour County Transfer on Death Deed Guide

Line by line guide explaining every blank on the form.

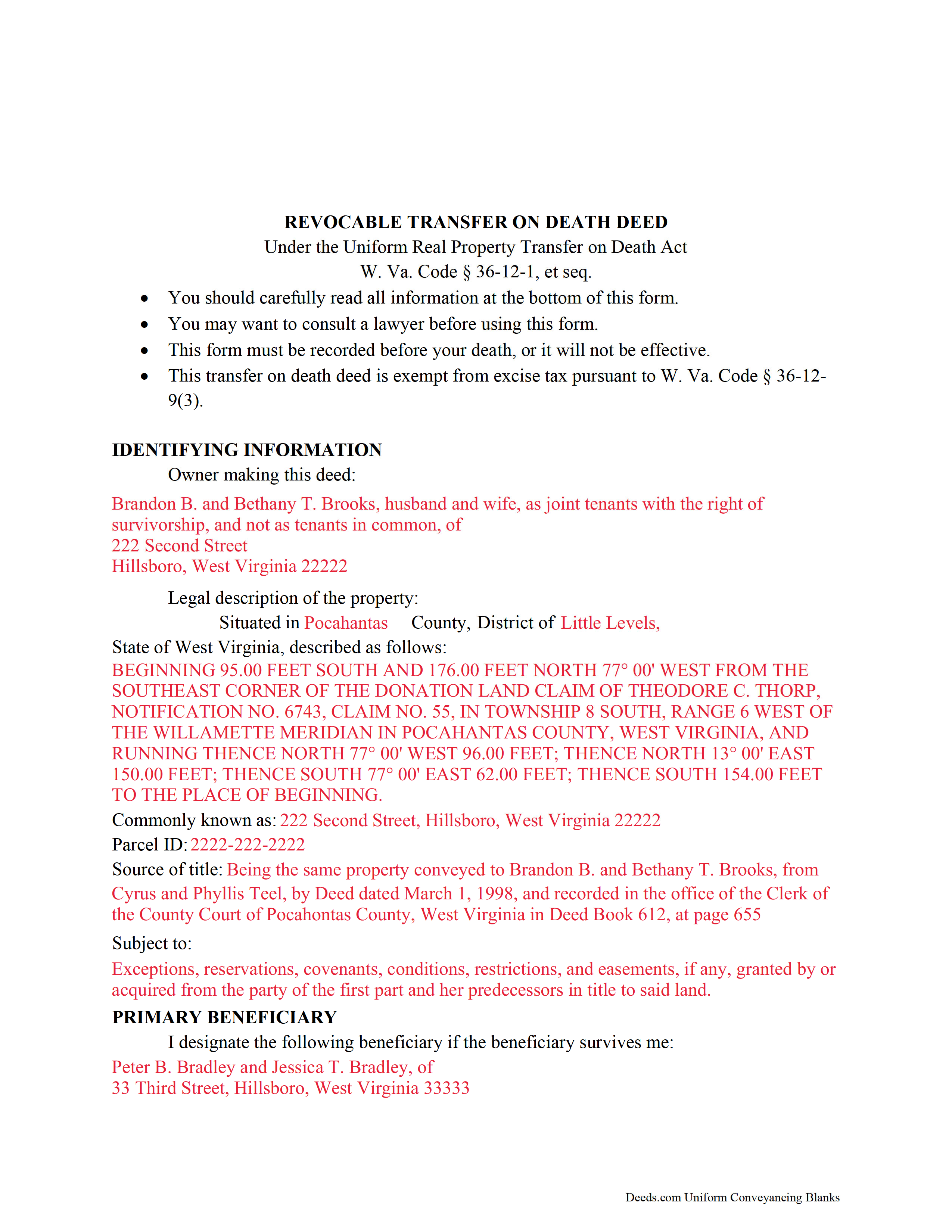

Barbour County Completed Example of the Transfer on Death Deed Form

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional West Virginia and Barbour County documents included at no extra charge:

Where to Record Your Documents

Barbour County Clerk

Philippi, West Virginia 26416-1140

Hours: Monday-Friday 8am-5pm

Phone: (304) 457-2232

Recording Tips for Barbour County:

- Verify all names are spelled correctly before recording

- White-out or correction fluid may cause rejection

- Avoid the last business day of the month when possible

- If mailing documents, use certified mail with return receipt

Cities and Jurisdictions in Barbour County

Properties in any of these areas use Barbour County forms:

- Belington

- Galloway

- Junior

- Moatsville

- Philippi

- Volga

Hours, fees, requirements, and more for Barbour County

How do I get my forms?

Forms are available for immediate download after payment. The Barbour County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Barbour County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Barbour County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Barbour County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Barbour County?

Recording fees in Barbour County vary. Contact the recorder's office at (304) 457-2232 for current fees.

Questions answered? Let's get started!

The West Virginia legislature voted to join with 13 other states and adopt the Uniform Real Property Transfer on Death Act (URPTODA). The law is found at 36-12-1 et seq in the Code of West Virginia, and went into effect on June 5, 2014. This act allows owners of real property in West Virginia to control the distribution of what is often their most significant asset, their real estate, by executing and recording a transfer on death deed (TODD).

Transfer on death deeds are non-testamentary, which means ownership of the property passes to the beneficiary without including it in a will or a need for probate (36-12-7). Still, sensible estate planning dictates that the will and the TODD should not be in conflict.

West Virginia's version of the URPTODA sets out the specific requirements for lawful transfer on death deeds:

- The capacity required to make or revoke a transfer on death deed is the same as the capacity required to make a will (36-12-8, 41-1-2).

- The transferor must be least eighteen years old; and

- Be mentally competent

- It must contain the essential elements and formalities of a properly recordable inter vivos deed, such as warranty or quitclaim deed (36-12-9(1))

- It must state that the transfer to the designated beneficiary is to occur at the transferor's death (36-12-9(2))

- It must be recorded before the transferor's death in the office of the clerk of the county commission in the county where the property is located (36-12-9(2)).

During the owner's life, the beneficiary has no rights to the property. Instead, it remains in the transferor's absolute control. This includes the freedom to sell or transfer it to someone else, and to modify or revoke the intended transfer on death (36-12-12). The option to revoke is why these deeds do not require notice to the beneficiary or consideration for the owner (36-12-10).

The beneficiary gains rights to the property ONLY when the owner dies, according to 36-12-13. Note, however, that the beneficiary must be alive at the time of the transferor's death or the interest returns to the estate (36-12-13(a)(2)). To prevent this from happening, the owner may identify one or more contingent beneficiaries (36-12-2(2)). All beneficiaries take title subject to any obligations (contracts, easements, etc.) associated with the property when the transferor dies (36-12-13(b)).

With the new transfer on death deeds, real property owners in West Virginia have a convenient, flexible tool for managing one aspect of a comprehensive estate plan. TODDs may not be appropriate for everyone, though. Since each situation is unique, contact an attorney with specific questions or for complex circumstances.

(West Virginia TODD Package includes form, guidelines, and completed example)

Important: Your property must be located in Barbour County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed meets all recording requirements specific to Barbour County.

Our Promise

The documents you receive here will meet, or exceed, the Barbour County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Barbour County Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Glenn M.

July 21st, 2023

Fast, easy, saves money!!!

Thank you!

Christina P.

July 28th, 2023

Fantastic!! The gals at Deeds really seem to have their stuff together! Great Forms, easy, exhaustive, and most importantly... accepted at the recorder the FIRST TIME!

Thank you so much for your review! Your feedback is highly appreciated, and we look forward to assisting you again in the future!

Donald B.

November 21st, 2021

Pretty good forms, they would probably be better if I read the directions but...

Thank you!

Richard H.

October 5th, 2022

Excellent service, very user friendly

Thank you!

Jessica F.

February 8th, 2020

Found exactly what I was looking for in a matter of minutes at a very reasonable fee.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mack H.

July 16th, 2020

I got what I was looking for! Turned out well and like I thought it would.

Thank you!

Barbara M.

November 21st, 2020

We love this service - so easy to use and quick. It is the second time we have used Deeds.com, in two different states. Wonderful service!

Thank you for your feedback. We really appreciate it. Have a great day!

Charles C.

January 30th, 2019

Using an I pad and cannot type on form that was downloaded. I do not have a computer Charles

Thank you for your feedback Charles. You might want to make sure you have the Adobe app on your Ipad: https://itunes.apple.com/us/app/adobe-fill-sign/id950099951?mt=8

Bobbi W.

February 16th, 2019

Site was super easy to use. After frustrating search for the item I needed I found it here!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sandra B.

February 15th, 2022

Easy to navigate through. Documents were in orderly fashion. Highly recommend. Step by step instructions

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Roger W.

August 3rd, 2020

worked very good or me

Thank you Roger, have a great day!

Theresa B.

September 10th, 2019

Will review after I attempt to complete. I like your site. Im very nervous to try this Hope not outdated information. Will let you know if filing goes okay.

Thank you!

Tim G.

April 23rd, 2020

Pretty good all in all. I do wish I could download forms to a word doc instead of a .pdf. Word is more 'accessable'.

Thank you!

Dale K.

August 11th, 2020

A very user friendly website!

Thank you!

Terreva B.

August 9th, 2019

Yes it helped with some things but I need more info

Thank you!