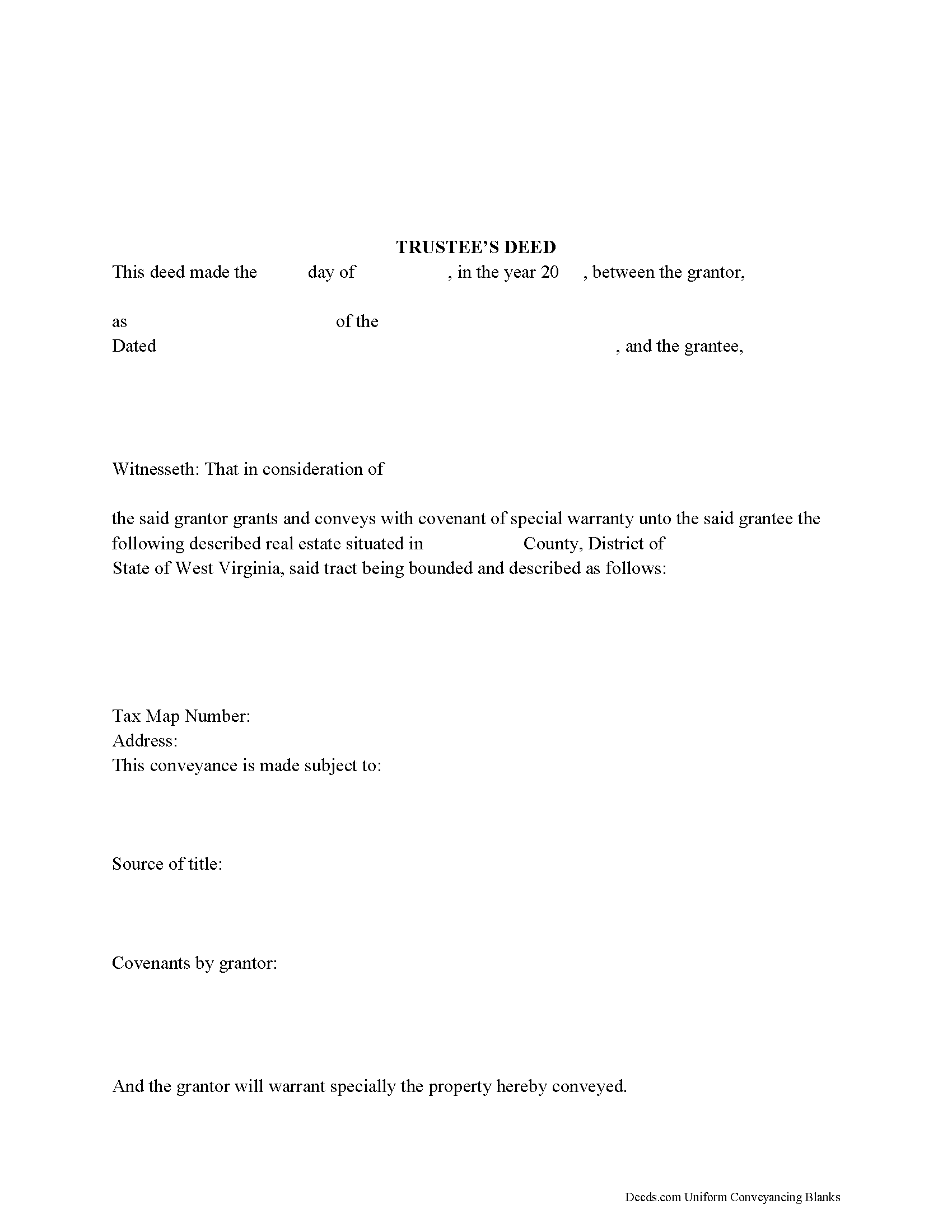

Barbour County Trustee Deed Form

Barbour County Trustee Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

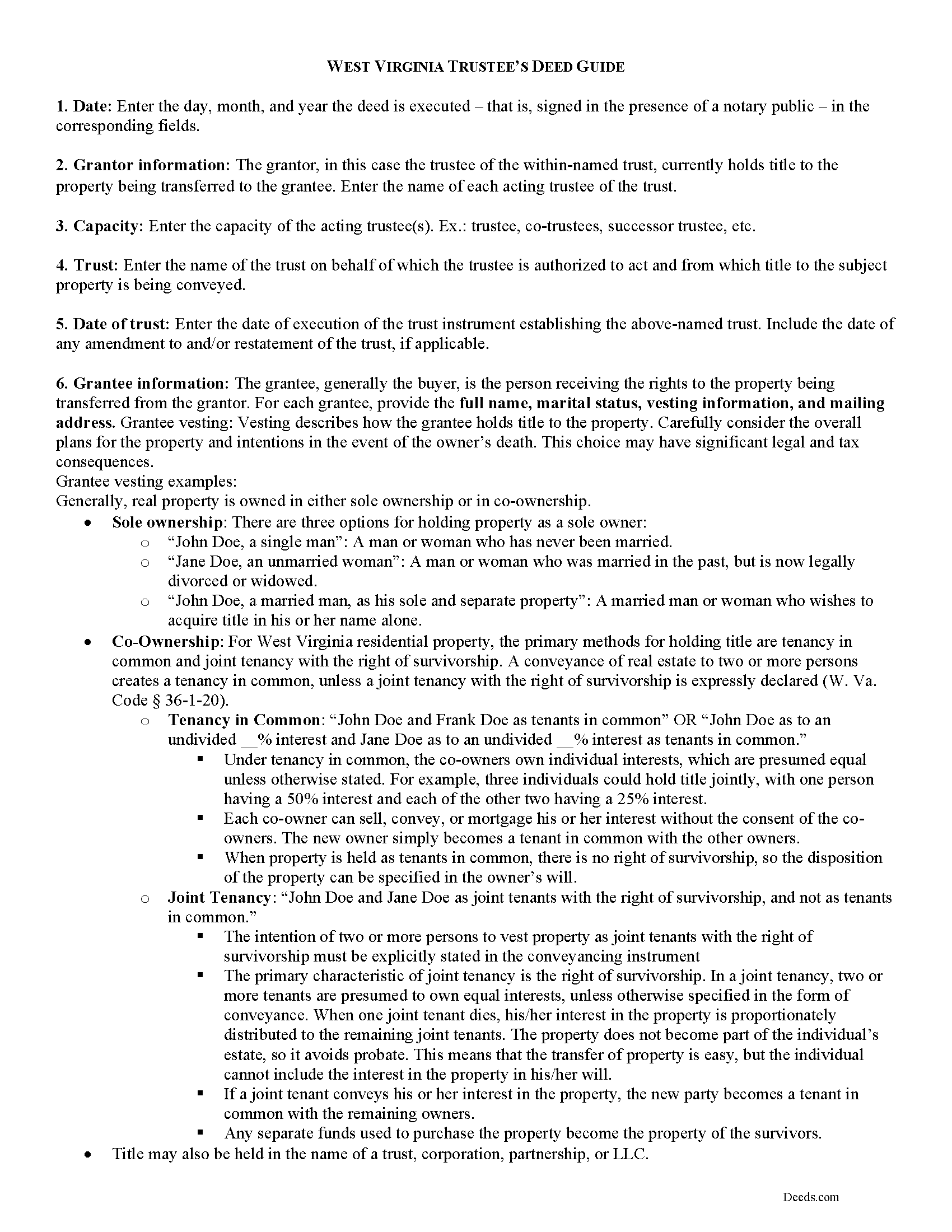

Barbour County Trustee Deed Guide

Line by line guide explaining every blank on the form.

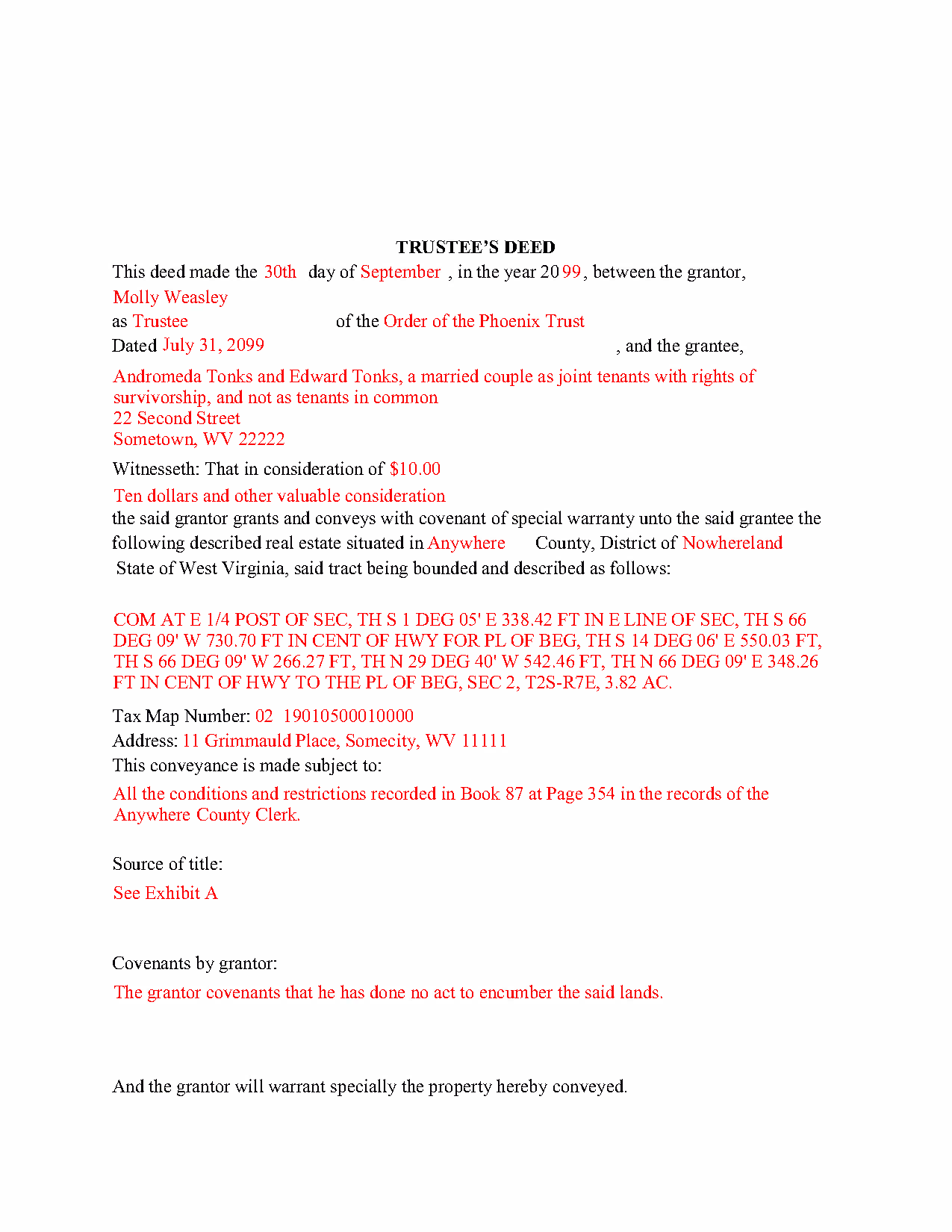

Barbour County Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional West Virginia and Barbour County documents included at no extra charge:

Where to Record Your Documents

Barbour County Clerk

Philippi, West Virginia 26416-1140

Hours: Monday-Friday 8am-5pm

Phone: (304) 457-2232

Recording Tips for Barbour County:

- Bring your driver's license or state-issued photo ID

- Leave recording info boxes blank - the office fills these

- Both spouses typically need to sign if property is jointly owned

- Request a receipt showing your recording numbers

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Barbour County

Properties in any of these areas use Barbour County forms:

- Belington

- Galloway

- Junior

- Moatsville

- Philippi

- Volga

Hours, fees, requirements, and more for Barbour County

How do I get my forms?

Forms are available for immediate download after payment. The Barbour County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Barbour County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Barbour County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Barbour County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Barbour County?

Recording fees in Barbour County vary. Contact the recorder's office at (304) 457-2232 for current fees.

Questions answered? Let's get started!

In a living trust arrangement, a settlor transfers property to another person (the trustee) for the benefit of a third (the beneficiary). The settlor establishes the trust by executing a document referred to as the trust instrument and by contributing assets to the trust. The trust instrument, generally unrecorded, contains the settlor's estate plans and dictates how the trust will be administered. In many living trust arrangements, the settlor serves as the trustee during his lifetime, and designates a successor to take over trustee duties upon his death or incapacitation.

When real property is transferred into trust, the settlor executes a deed naming the trustee as the grantee. The trustee then holds legal title to the property as the administrator of the trust. In order to convey the interest in the property from the trust, the trustee executes a trustee's deed.

The trustee's deed takes its name from the role of the executing party. In most states, deeds are differentiated and named after the type of warranty the grantor makes. In West Virginia, however, no distinction is made between different types of deeds (W. Va. Code 36-3-4).

The statutory form for deeds in West Virginia is codified at W. Va. Code 36-3-5. This general statutory deed can then be modified to include covenants (found at 36-4) made by the grantor. The trustee's deed typically includes a special warranty covenant, ensuring that the grantor "will forever warrant and defend" the grantee's title "against the claims and demands of the grantor and all persons claiming by, through, or under him" ( 36-4-3). The more limited warranty is fitting for individuals acting in a representative capacity, as their knowledge of the standing of title is naturally limited to the scope of their office.

A deed executed by the trustee must name the trust and the date of trust in addition to the currently acting trustees (when real property is correctly titled into the trust, the vesting statement includes this information). The deed should meet all requisites of conveyances affecting interest in real property, including the name, address, and vesting information of the grantee, a statement of consideration made for the transfer, a properly formatted legal description of the subject property, and the necessary signatures made in the presence of a notary public. Deeds are recorded in the office of the county clerk wherein the property is situated.

Because the transaction pertains to real property, a memorandum of trust under 36-1-4a may need to be recorded. Consult a lawyer regarding trustee's deeds in West Virginia to address your unique situation.

(West Virginia TD Package includes form, guidelines, and completed example)

Important: Your property must be located in Barbour County to use these forms. Documents should be recorded at the office below.

This Trustee Deed meets all recording requirements specific to Barbour County.

Our Promise

The documents you receive here will meet, or exceed, the Barbour County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Barbour County Trustee Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Susan K.

February 16th, 2019

Very helpful; information included on the form explanations about Colorado laws in regards to beneficiary deeds helped us understand the issues involved.

Thank you for your feedback. We really appreciate it. Have a great day!

Reliant Roofers, Inc. N.

September 20th, 2023

Great communication. Quick response. deeds.com is timely and efficient.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Eddie S.

May 19th, 2022

love the site very helpful and easy.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

katherine a.

July 20th, 2021

loved the ease of use for the forms. went on line to find out about Adobe Reader, too. Had a test to see if I had it. Took few seconds. Then on to ordering and downloading which took only 5 minutes for the three forms I wanted. Thanks, Katie Anderson

Thank you for your feedback. We really appreciate it. Have a great day!

Caroline E.

February 14th, 2021

VERY easy to register, to request relevant deeds that apply to your own county/state, and to download. And bonus - you get instructional materials too! Highly recommend! Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Stephen B.

March 22nd, 2021

5 stars. Licensed to practice law for 25 years in multiple jurisdictions, the most dreaded part of doing what you already know how to do is researching again to make sure the legislatures have not changed the rules while you were doing something else. 22 bucks for this package is one hell of a deal and a real timesaver. Many thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Glenda M.

November 9th, 2021

I am very pleased with my purchase of the Affidavit Death of Joint Tenant form. I previously purchased this form from the leading providing of DIY legal forms and it was rejected by the Registrar in my state. I then had to start over. Plus I needed a form that would show me a completed example and give me line-by-line instructions. Deeds.com filled the bill perfectly. Their website also let me know the last date the form was updated.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joshua W.

May 9th, 2021

Very efficient and easy to use, worth the price.

Thank you for your feedback. We really appreciate it. Have a great day!

Misty M.

April 14th, 2021

I appreciate the Guide and the Sample pages.

Thank you!

Kenneh C.

December 23rd, 2022

I was looking for something this website does not offer. Very dissapointed.

Sorry to hear that. We do hope you found what you were looking for elsewhere.

maria b.

November 1st, 2020

really easy and and helpful.

Thank you!

Sarah H.

December 11th, 2020

Very helpful and great price

Thank you!

Margaret A.

April 30th, 2021

Thank for the help. Needed that disclaimer to avoid filing a full ITR tax return to get an L-9

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John E.

November 14th, 2020

This process exceeded my expectations. A great customer experience!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

cora c.

December 30th, 2021

ALTHOUGH IT TOOK A LITTLE LONGER THAN EXPECTED TO RECEIVE AN INVOICE TO ALLOW ME TO PAY THE REQUIRED FEES AND HAVE MY DOCUMENT SUBMITTED FOR RECORDING, I REALLY APPRECIATED THE SERVICE AND PROMPT RESPONSES TO MY MESSAGES, SEEKING ASSISTANCE. THANK YOU SO MUCH!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!