Polk County Transfer on Death Deed Form

Polk County Transfer on Death Deed Form

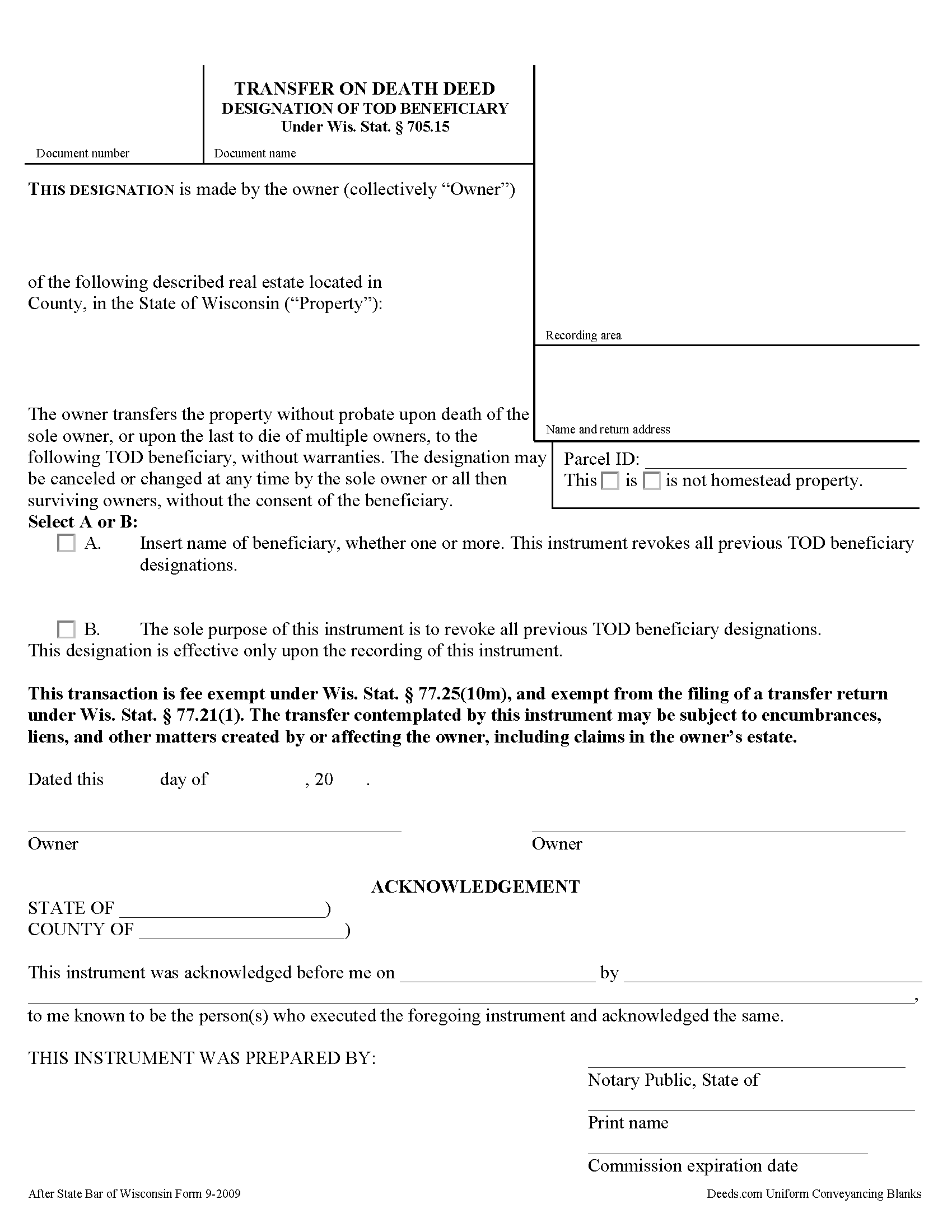

Fill in the blank form formatted to comply with all recording and content requirements.

Polk County Transfer on Death Deed Guide

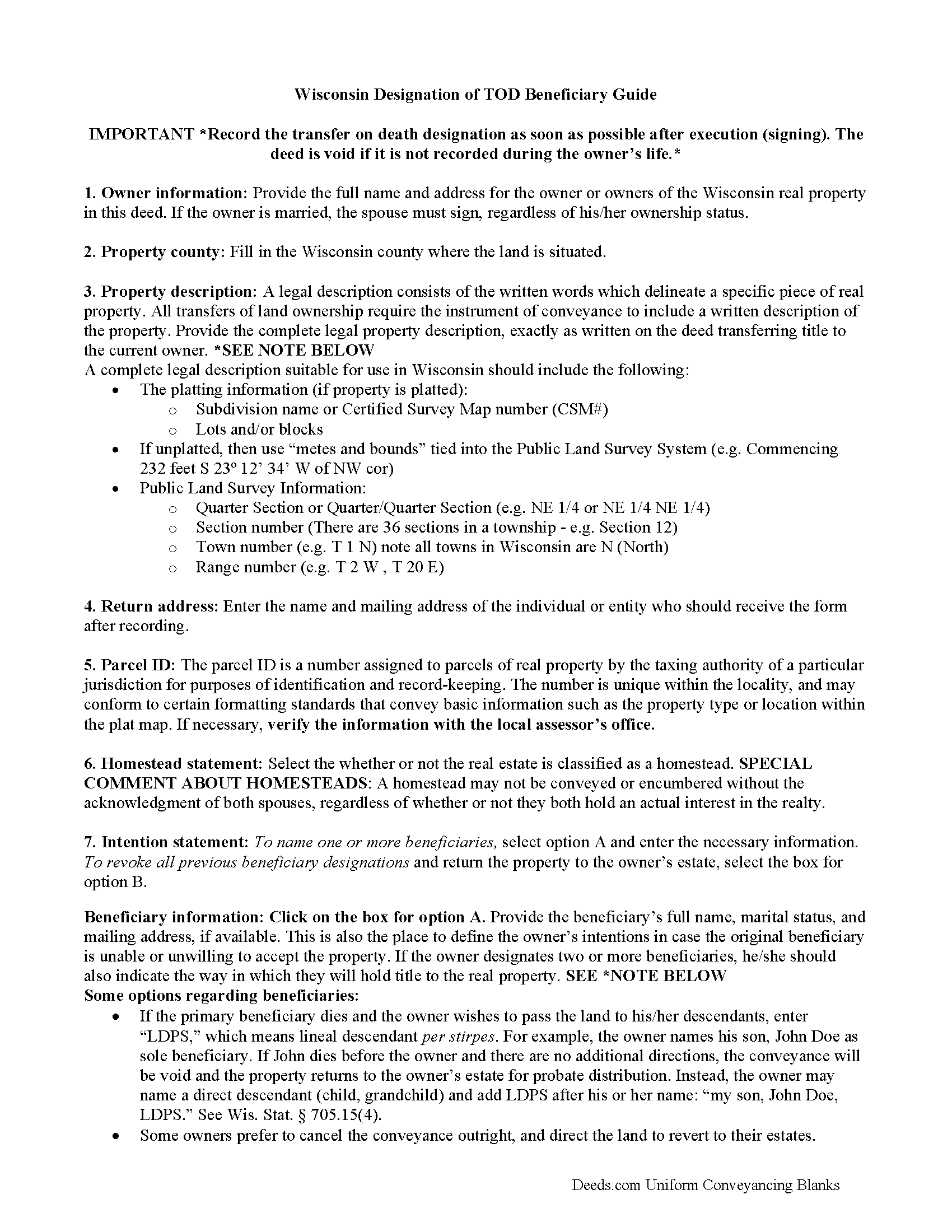

Line by line guide explaining every blank on the form.

Polk County Completed Example of the Transfer on Death Deed Document

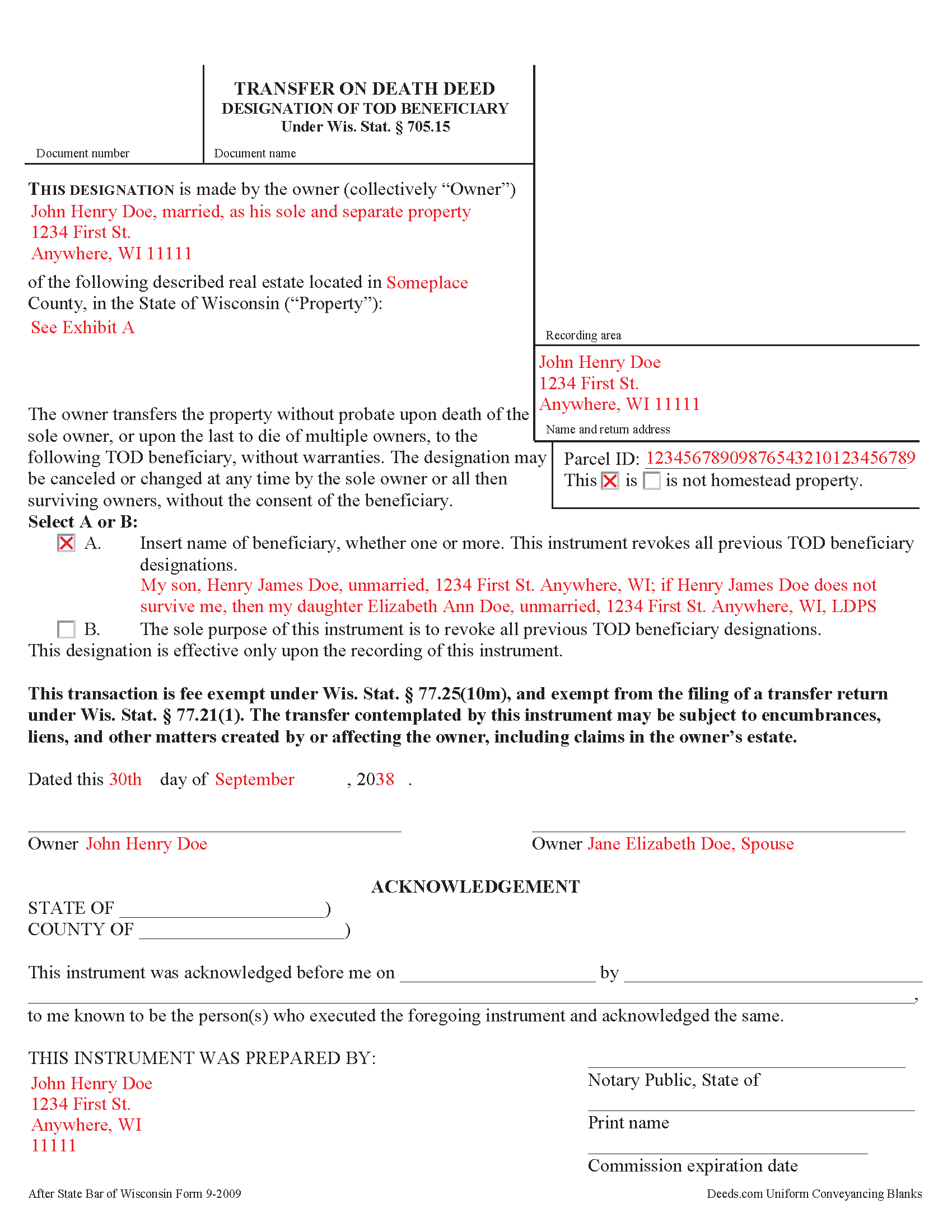

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Wisconsin and Polk County documents included at no extra charge:

Where to Record Your Documents

Polk County Register of Deeds

Balsam Lake, Wisconsin 54810

Hours: Monday - Friday 8:30am - 4:30pm

Phone: (715) 485-9240

Recording Tips for Polk County:

- Verify all names are spelled correctly before recording

- Make copies of your documents before recording - keep originals safe

- Leave recording info boxes blank - the office fills these

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Polk County

Properties in any of these areas use Polk County forms:

- Amery

- Balsam Lake

- Centuria

- Clayton

- Clear Lake

- Cushing

- Dresser

- Frederic

- Luck

- Milltown

- Osceola

- Saint Croix Falls

- Star Prairie

Hours, fees, requirements, and more for Polk County

How do I get my forms?

Forms are available for immediate download after payment. The Polk County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Polk County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Polk County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Polk County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Polk County?

Recording fees in Polk County vary. Contact the recorder's office at (715) 485-9240 for current fees.

Questions answered? Let's get started!

Under Wisconsin Statutes section 705.15, owners of real property in Wisconsin may designate one or more people to gain ownership of their property outside of the probate process. The transfer on death deed form contains the designation and must be recorded, DURING THE OWNER'S NATURAL LIFE, for validity.

By executing and recording a transfer on death beneficiary designation, the owner retains absolute control over the real estate, and may sell, mortgage, or use the property in any legal manner, and change or revoke the beneficiary designation without penalty or obligation to inform the beneficiary.

Because the transfer does not occur until after the owner's death, there is no transfer tax due when recording the deed under 77.21(1) and 77.25(10m). While the change in ownership happens as a function of law when the owner dies, when the beneficiary claims the land, he or she must record form TOD-110 to make the transfer official and enter the updated information into the public records.

Wisconsin's transfer on death deeds are useful estate planning tools. Even so, carefully consider the potential impact of a non-probate transfer of property on taxes, as well as eligibility for local, state, and federal benefits. Each case is unique, so contact an attorney with questions or for complex situations.

(Wisconsin TODD Package includes form, guidelines, and completed example)

Important: Your property must be located in Polk County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed meets all recording requirements specific to Polk County.

Our Promise

The documents you receive here will meet, or exceed, the Polk County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Polk County Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Thaddeus E.

January 5th, 2025

Quick assistance with same day recording. The tech identified barriers to successful Recordation such as image quality and worked with me to get them resolved for timely submission.

We are delighted to have been of service. Thank you for the positive review!

Cindy H.

October 22nd, 2021

Very easy to use and organized. When I needed the form I needed it immediately. I didn't want to get locked into a monthly subscription. Deeds.com met that need. Thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Judith F.

May 6th, 2022

The form I needed was perfect!

Thank you!

NANETTE G.

March 6th, 2021

I was so Happy to find a website that had deeds for property, reasonable price, helpful directions for diy flling out the deed info, no surprise hidden fees at checkout...what a relief. Saved hundreds because I can do it myself! Great service here!!

Thank you for your feedback. We really appreciate it. Have a great day!

Julie R.

December 16th, 2020

Seamless and prompt service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tim G.

April 23rd, 2020

Pretty good all in all. I do wish I could download forms to a word doc instead of a .pdf. Word is more 'accessable'.

Thank you!

FLORIN D.

December 3rd, 2020

Excellent service, will use in the future and will recommend to anyone that needs to record documents.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Archie POA G.

January 25th, 2020

got what I ordered, as expected, in good time

Thank you!

Robert F.

July 11th, 2023

This service is excellent. I submitted a Quickclaim Deed so my home would be in the name of a Living Trust I had just created. This was my first attempted at any of this and the staff person, KVH, who reviewed my Deed was extremely helpful and quick to respond to any questions I had and to make sure the Deed had the correct information before submittal to the county for recording. I started the process one afternoon and by the next day, the Deed was submitted to, and recorded in, my county. I will use them again whenever needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gary K.

November 15th, 2019

Straightforward and pretty easy to use. The only downside is that there is no way to contact them directly. The number on the website is answered only by a voicemail with no return calls. Pricing seems fair compared to other services and much more efficient that filing "over the counter."

Thank you for your feedback. We really appreciate it. Have a great day!

Gary A.

March 15th, 2019

I believe this is the way to go without the need of a lawyer. Fast downloads, very informative, Now the work starts

Thank you Gary.

Brenn C.

April 11th, 2022

These products would be more useful if they final deed could be copied and pasted into a word document for proper formatting. Because most of the document is protected against selecting and copying, I did not find it useful. I would not purchase again.

Thank you for your feedback. We really appreciate it. Have a great day!

Thomas W.

January 16th, 2019

easy to use, no problems except in beneficiary box. Need to make the box bigger because I have 4 beneficiaries to list. how do I enlarge the box.

Thanks for reaching out. All available space on the document is being used. As is noted in the guide, if you have information that does not fit in the available space the included exhibit page should be used.

Stephen K.

July 5th, 2019

The forms were correct and the instructions and Completed sample were very helpful. I filled it out and filed it at the county office, they didn't question anything. Thank you.

Thank you!

william w.

January 23rd, 2019

Simple, straight forward, and easy to use.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!