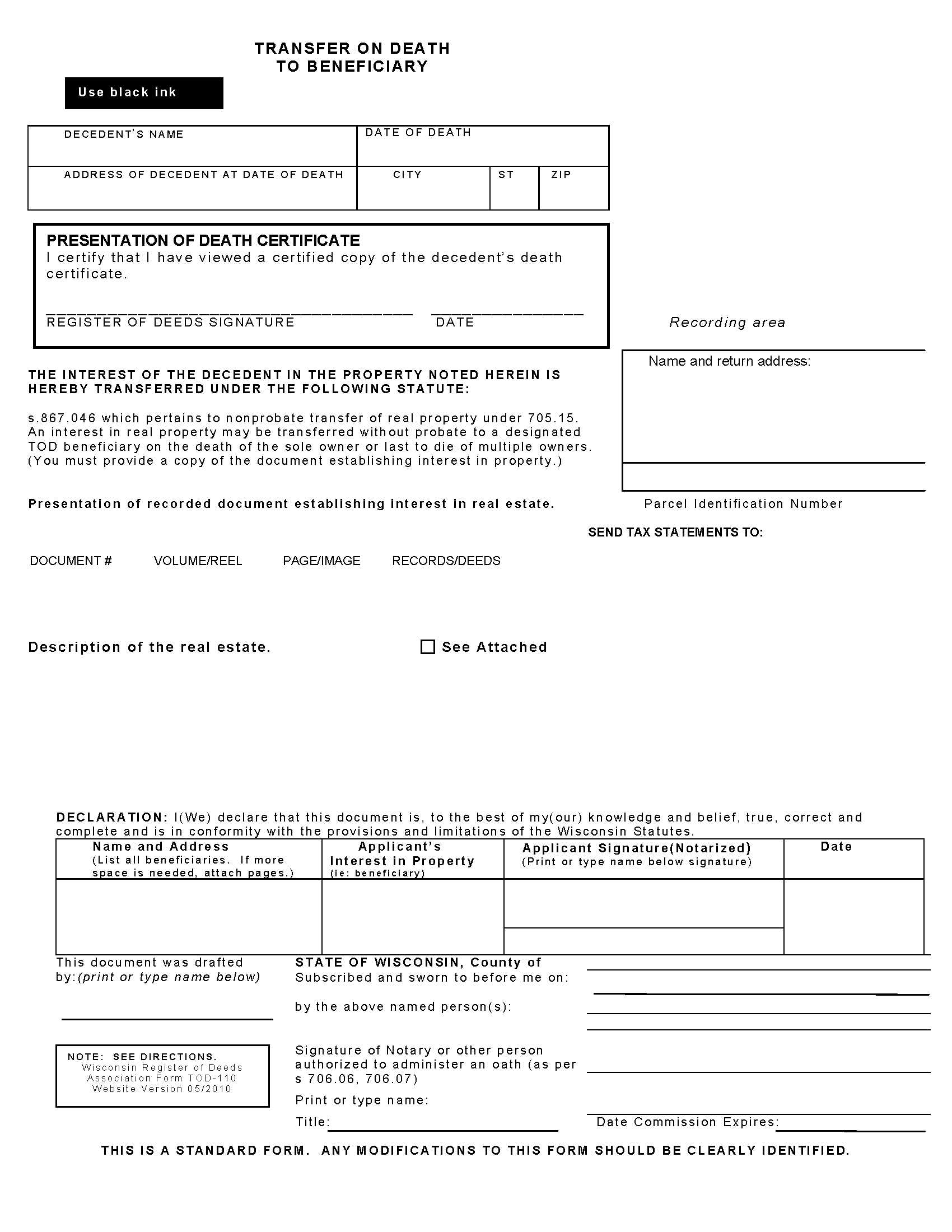

Outagamie County Transfer on Death to Beneficiary Form

Outagamie County Transfer on Death to Beneficiary Form

Fill in the blank form formatted to comply with all recording and content requirements.

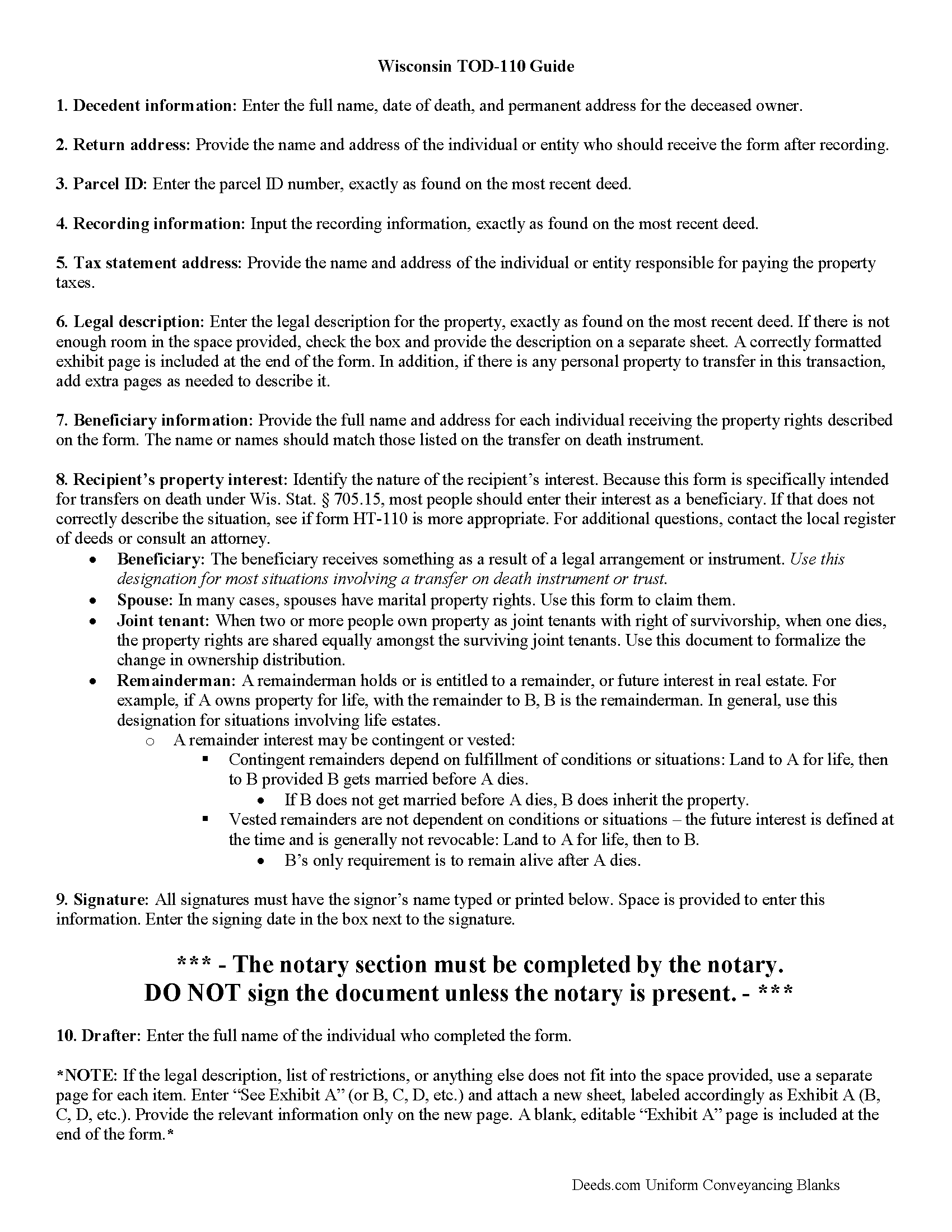

Outagamie County Transfer on Death to Beneficiary Guide

Line by line guide explaining every blank on the form.

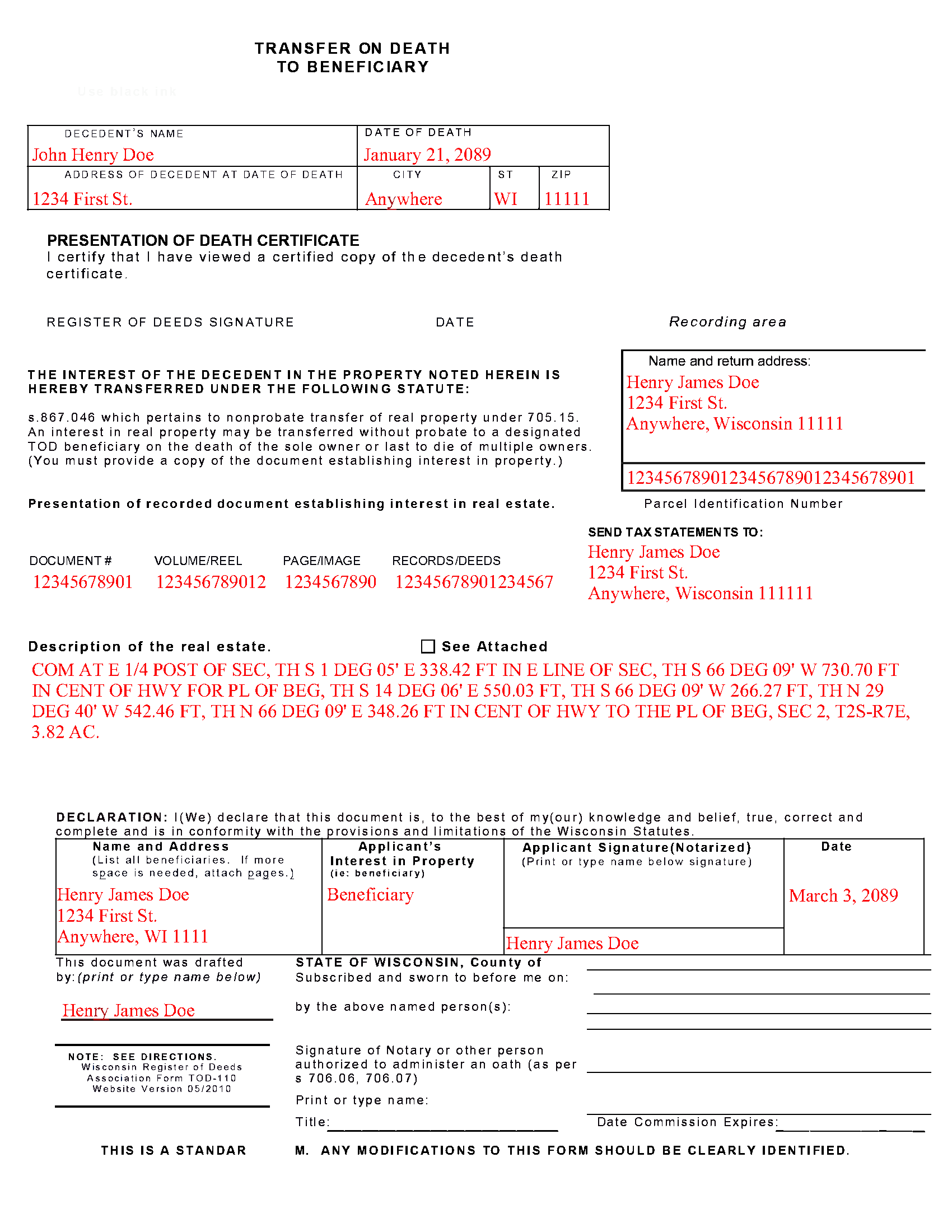

Outagamie County Completed Example of the Transfer on Death to Beneficiary Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Wisconsin and Outagamie County documents included at no extra charge:

Where to Record Your Documents

Outagamie County Register of Deeds

Appleton, Wisconsin 54911

Hours: Monday - Friday 8:00am to 4:30pm

Phone: (920) 832-5095

Recording Tips for Outagamie County:

- Ensure all signatures are in blue or black ink

- Both spouses typically need to sign if property is jointly owned

- Leave recording info boxes blank - the office fills these

- Recorded documents become public record - avoid including SSNs

Cities and Jurisdictions in Outagamie County

Properties in any of these areas use Outagamie County forms:

- Appleton

- Bear Creek

- Black Creek

- Combined Locks

- Dale

- Freedom

- Greenville

- Hortonville

- Kaukauna

- Kimberly

- Little Chute

- Nichols

- Seymour

- Shiocton

Hours, fees, requirements, and more for Outagamie County

How do I get my forms?

Forms are available for immediate download after payment. The Outagamie County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Outagamie County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Outagamie County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Outagamie County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Outagamie County?

Recording fees in Outagamie County vary. Contact the recorder's office at (920) 832-5095 for current fees.

Questions answered? Let's get started!

Transfer to Beneficiary -- TOD-110

Completing the Change of Property Rights from a Wisconsin Transfer on Death Deed

When a grantor/owner of real estate under a Wisconsin transfer on death deed dies, the named beneficiary or beneficiaries gain the rights to the property by function of law. Even though this transfer is, in theory, automatic, the best way to ensure accurate and up-to-date ownership records is to file a completed and notarized transfer on death to beneficiary form TOD-110 with the register of deeds for the county where the land is located. By recording this document, the new owner formalizes the transfer and provides public notice of the new status.

(Wisconsin TOD to Beneficiary Package includes form, guidelines, and completed example)

Important: Your property must be located in Outagamie County to use these forms. Documents should be recorded at the office below.

This Transfer on Death to Beneficiary meets all recording requirements specific to Outagamie County.

Our Promise

The documents you receive here will meet, or exceed, the Outagamie County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Outagamie County Transfer on Death to Beneficiary form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4591 Reviews )

Barbara S.

February 28th, 2019

I had an issue due to the fact that I had many beneficiaries. I was and still am not sure how to handle this. We do have Adobe Pro and can modify the form, if needed. But I would like to talk to your organization for more information.

While we are unable to assist you specifically with completing the document we can note that this is addressed in the guide. Information that does not fit in the available space should be included in an exhibit page.

Jennifer K.

March 4th, 2021

User friendly!

Thank you!

Rhonda D.

February 24th, 2021

The boxes do not allow you to add the entire information. The after recording return to box would not let me add a zipcode.

Thanks for the feedback Rhonda, we’ll take a look at that input field.

Tracy M.

July 9th, 2020

The form is easy to use. However, the quit claim deed form seems to be for parcel of land, because the word "real property" is not in the form.

Thank you for your feedback. We really appreciate it. Have a great day!

Joe S.

July 6th, 2020

Easy to use, reasonable price and excellent customer service! I would not hesitate to use Deeds.com again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Nick A.

January 13th, 2022

Easy to use website. Found what I was looking for.

Thank you for your feedback. We really appreciate it. Have a great day!

Lenore B.

January 13th, 2019

Thank you for making this deed available. The guide was such a big help.

Thanks Lenore, have a great day!

David C.

July 21st, 2021

I was very impressed. Your program makes it very user friendly which is a must for most of the public . I have recommended this site to various clients for estate planning documents with simple estates.

Thank you!

Virginia S.

October 24th, 2021

Very quick process and forms were downloaded. I am very pleased with the detailed information for filling out the forms. Would use again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Aleksander M.

May 2nd, 2023

So far all is perfect! Thank you for all your help!

Thank you!

Judith C.

February 3rd, 2021

very happy so far. Haven't gone to record deeds yet so am in good hopes everything will be in good order. Time saver!!!

Thank you!

Willie P.

May 13th, 2020

Your service was excellent

Thank you for your feedback. We really appreciate it. Have a great day!

Gjnana D.

April 23rd, 2022

These guidelines and form helped me lot in preparing quit deed to add my spouse's name in tittle property

Thank you for your feedback. We really appreciate it. Have a great day!

Leon S.

June 26th, 2023

I am happy that I found Deeds.com. It provided me with all the information I needed to prepare a quit claim deed, and at a reasonable cost.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sara P.

February 1st, 2019

Wonderful response time, and patient with me. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!