Weston County Transfer on Death Deed Form

Weston County Transfer on Death Deed Form

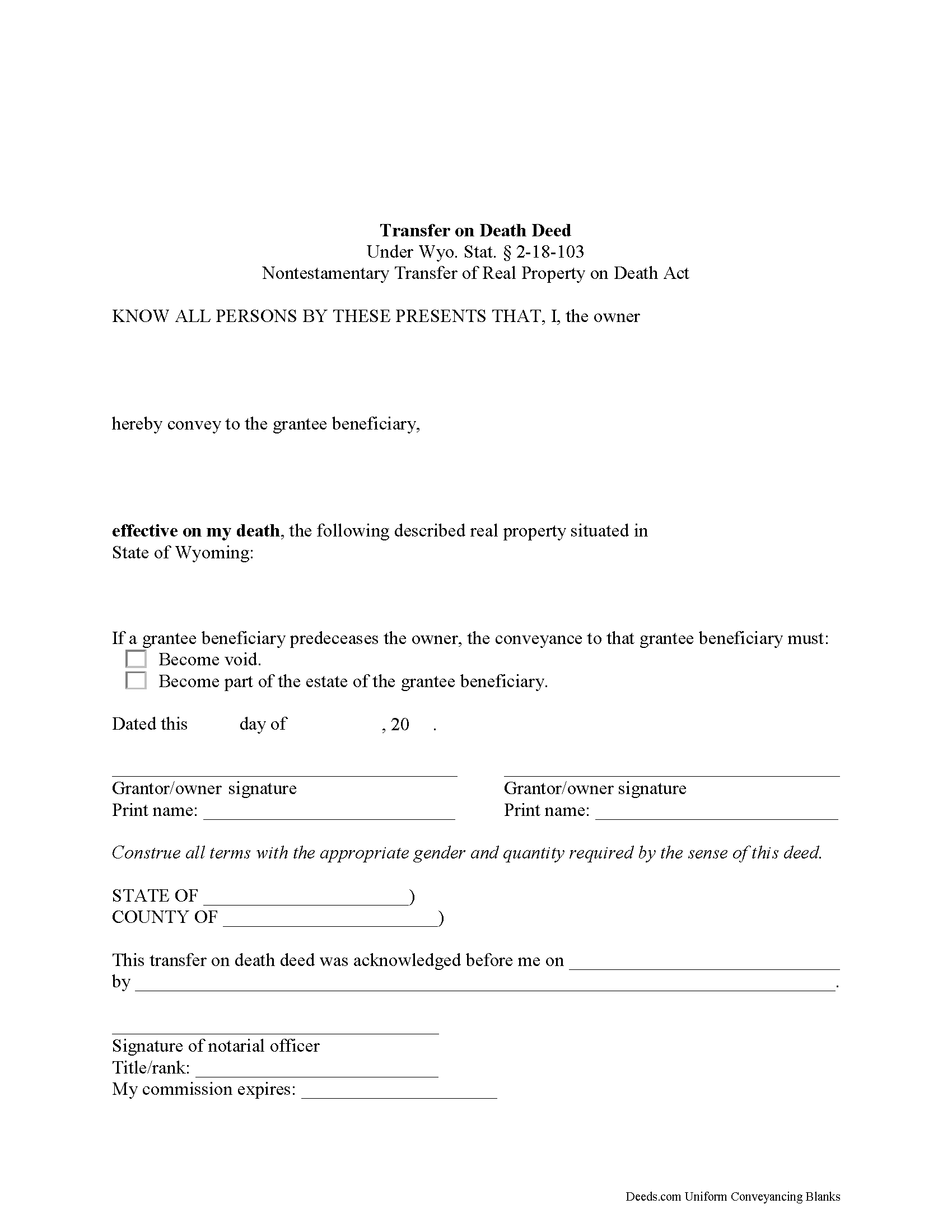

Fill in the blank form formatted to comply with all recording and content requirements.

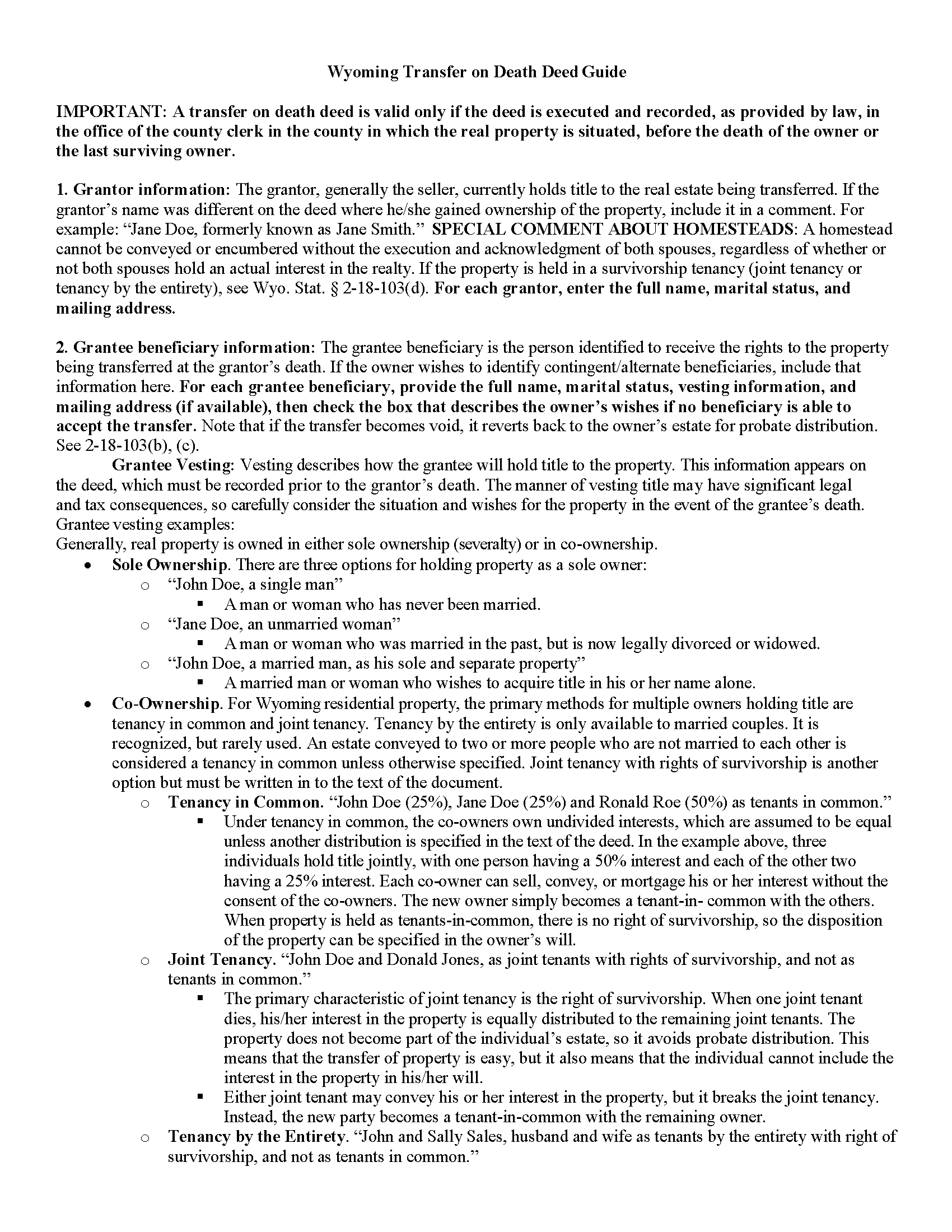

Weston County transfer on Death Deed Guide

Line by line guide explaining every blank on the form.

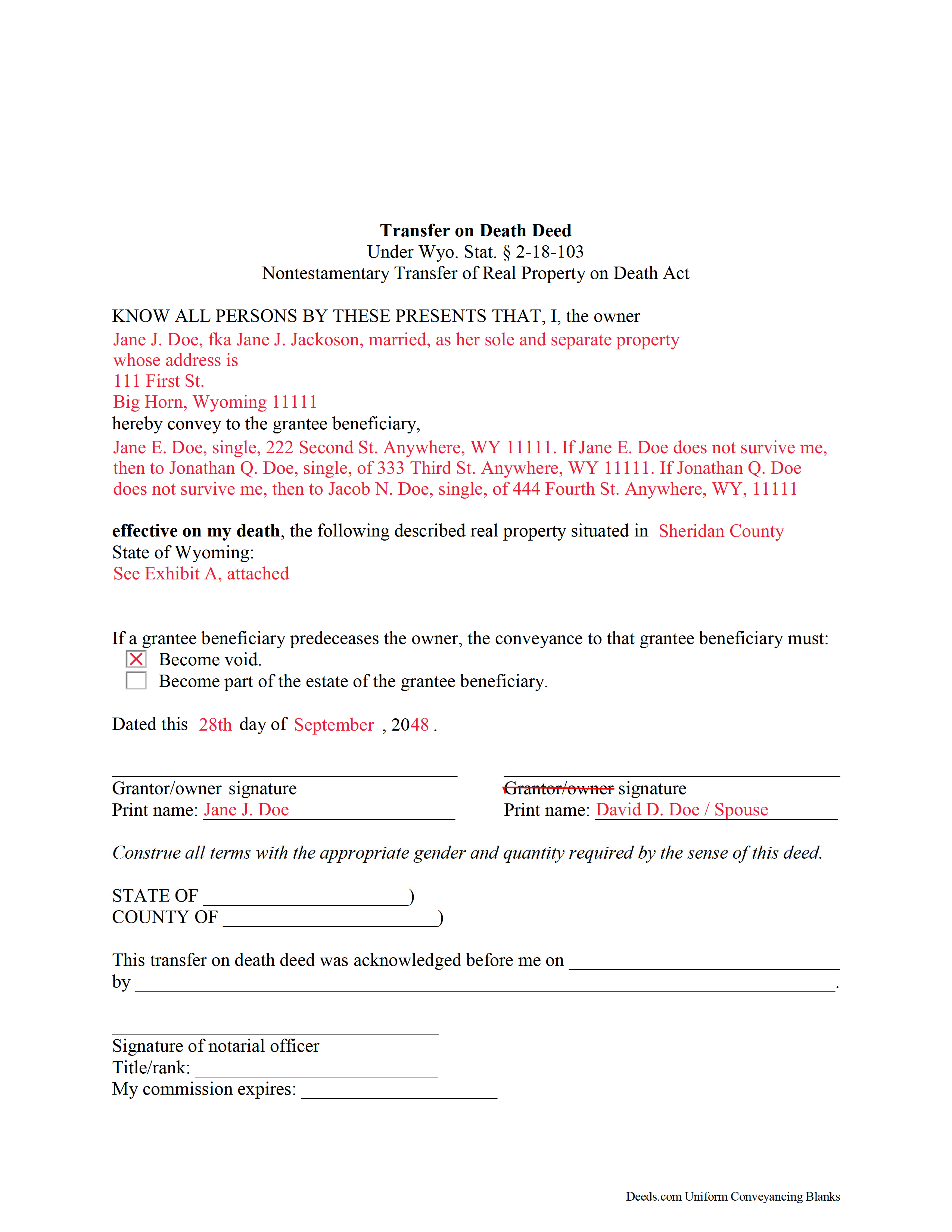

Weston County Completed Example of the Transfer on Death Deed Form

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Wyoming and Weston County documents included at no extra charge:

Where to Record Your Documents

Weston County Clerk

Newcastle, Wyoming 82701

Hours: Monday - Friday 8:00am - 5:00pm

Phone: (307) 746-4744

Recording Tips for Weston County:

- Double-check legal descriptions match your existing deed

- Leave recording info boxes blank - the office fills these

- Recorded documents become public record - avoid including SSNs

- Both spouses typically need to sign if property is jointly owned

- Recording early in the week helps ensure same-week processing

Cities and Jurisdictions in Weston County

Properties in any of these areas use Weston County forms:

- Four Corners

- Newcastle

- Osage

- Upton

Hours, fees, requirements, and more for Weston County

How do I get my forms?

Forms are available for immediate download after payment. The Weston County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Weston County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Weston County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Weston County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Weston County?

Recording fees in Weston County vary. Contact the recorder's office at (307) 746-4744 for current fees.

Questions answered? Let's get started!

Wyoming's Non-testamentary Transfer of Real Property on Death Act went into effect on July 1, 2013. Find it at Sections 2-18-101-106 of the Wyoming Statutes.

A transfer on death deed is valid only if it is lawfully executed and recorded in the office of the county clerk for the county in which the real property is situated, before the death of the owner or the last surviving owner. See 2-18-103(d) for the rules concerning joint property owners, or contact an attorney for additional clarification.

By using transfer on death deeds (TODDs), people who own real estate in Wyoming have access to a flexible tool that allows them to direct what happens to their land after they die, independent from a will, and without the need for probate. As defined at 2-18-103, a TODD conveys the owner's interest in real property, subject to any debts or obligations in place during the owner's lifetime, to a designated grantee beneficiary. Note that, in addition to the providing the information required by the statutory form, TODDs must meet all state and local standards regarding format and content.

Until death, though, owners retain absolute interest in and control over the property, including the power to sell it to someone else, to change the terms of the future transfer, or to revoke the transfer outright, without notice to or permission from the beneficiary. This feature is important because it allows owners to respond to changes with minimal expense.

There are three primary ways to revoke a recorded transfer on death deed. Owners simply execute and record either

-a statutory revocation document;

-a new statutory transfer on death deed; or

-a traditional deed, such as a warranty or quitclaim deed, transferring the property to another party.

Modifications are fairly simple, but it is important to make sure that any other estate documents, such as wills, reflect the same wishes. Otherwise, the conflicts could lead to unnecessary delays and expenses.

Overall, Wyoming's transfer on death deeds can be a useful part of a comprehensive estate plan. Even so, they may not be appropriate for everyone. Please consult an attorney with specific questions or for complex situations.

(Wyoming TODD Package includes form, guidelines, and completed example)

Important: Your property must be located in Weston County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed meets all recording requirements specific to Weston County.

Our Promise

The documents you receive here will meet, or exceed, the Weston County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Weston County Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4614 Reviews )

Linda S.

August 9th, 2019

I had no problem signing up to Deeds.com. It was easy and effective. I was able to retrieve my records.

Thank you!

Judy H.

October 20th, 2023

great response to my question.

We are delighted to have been of service. Thank you for the positive review!

Karen M.

May 6th, 2019

This was a very easy and organized system to use.

Thank you for your feedback. We really appreciate it. Have a great day!

Carl T.

October 1st, 2020

Awesome! Quick service and well worth the very minimal fee for the convenience of being able to quickly record my mothers will without having to leave the house. Also, our court is currently closed due to Covid. So happy to have found Deeds.com

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Karen F.

July 29th, 2022

Very easy to understand instructions. I was able to order, download and print.

Thank you for your feedback. We really appreciate it. Have a great day!

Geoffrey M.

February 17th, 2021

Very convenient online document recording with great and quick service. Thank you!

Thank you!

Gerald S.

August 15th, 2022

The paperwork for our transfer on death deed was easy to fill out and the county has excepted it for recording Very satisfied.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ben G.

September 21st, 2020

Faster AND less expensive than recording in person. Will be using again (and not just because of COVID).

Thank you!

Justin C.

January 28th, 2021

I was a first-time customer to Deeds.com and was very pleased with my ability to navigate the site and find just what I needed in a very short time. Great value for the price.

Thank you for your feedback. We really appreciate it. Have a great day!

donald h.

August 1st, 2022

good, however, I haven't figured out how to save my filled out form

Thank you for your feedback. We really appreciate it. Have a great day!

Vanessa W.

April 7th, 2019

This site is very useful and reasonable. Comes in handy when you need a deed in other states.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joanne D.

May 14th, 2020

Loved your easy to follow instructions along with the paperwork forms that I was looking for. Would highly suggest this service to everyone. You should share this platform with other counties!! Extremely helpful

Thank you!

Dawna M.

June 15th, 2021

Easy to use website and immediate documents appropriate for my area. My only complaint is that the forms had an alignment problem where the fields that were filled in by me did not line up with the template text. I tried to correct it to no avail so I ended up having to retype the entire document. I purchased two templates and both had the same issue.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

April L.

March 21st, 2020

It was easy and I will use it again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joseph S.

May 4th, 2022

The best solution in creating deeds.

Thank you!