Litchfield County Gift Deed Form

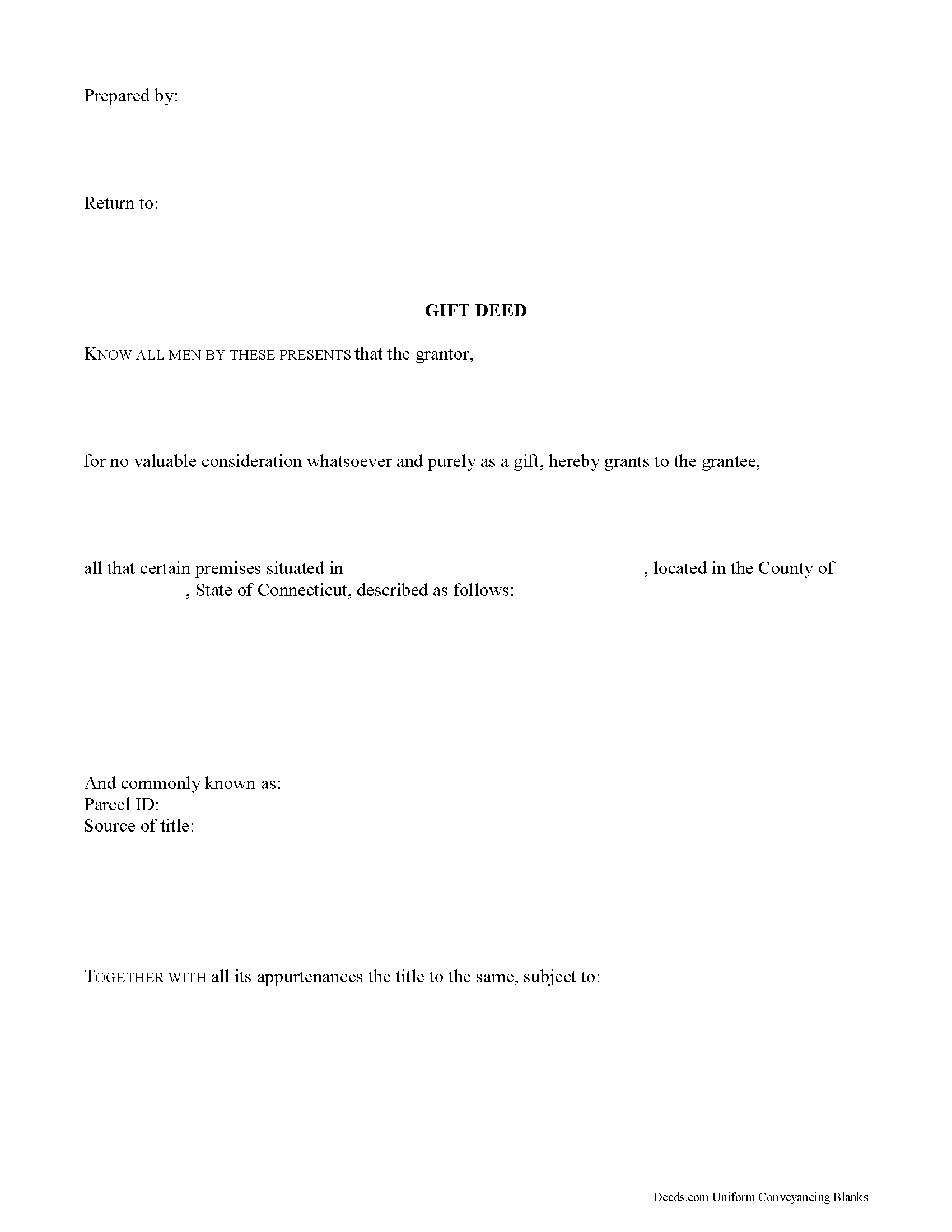

Litchfield County Gift Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

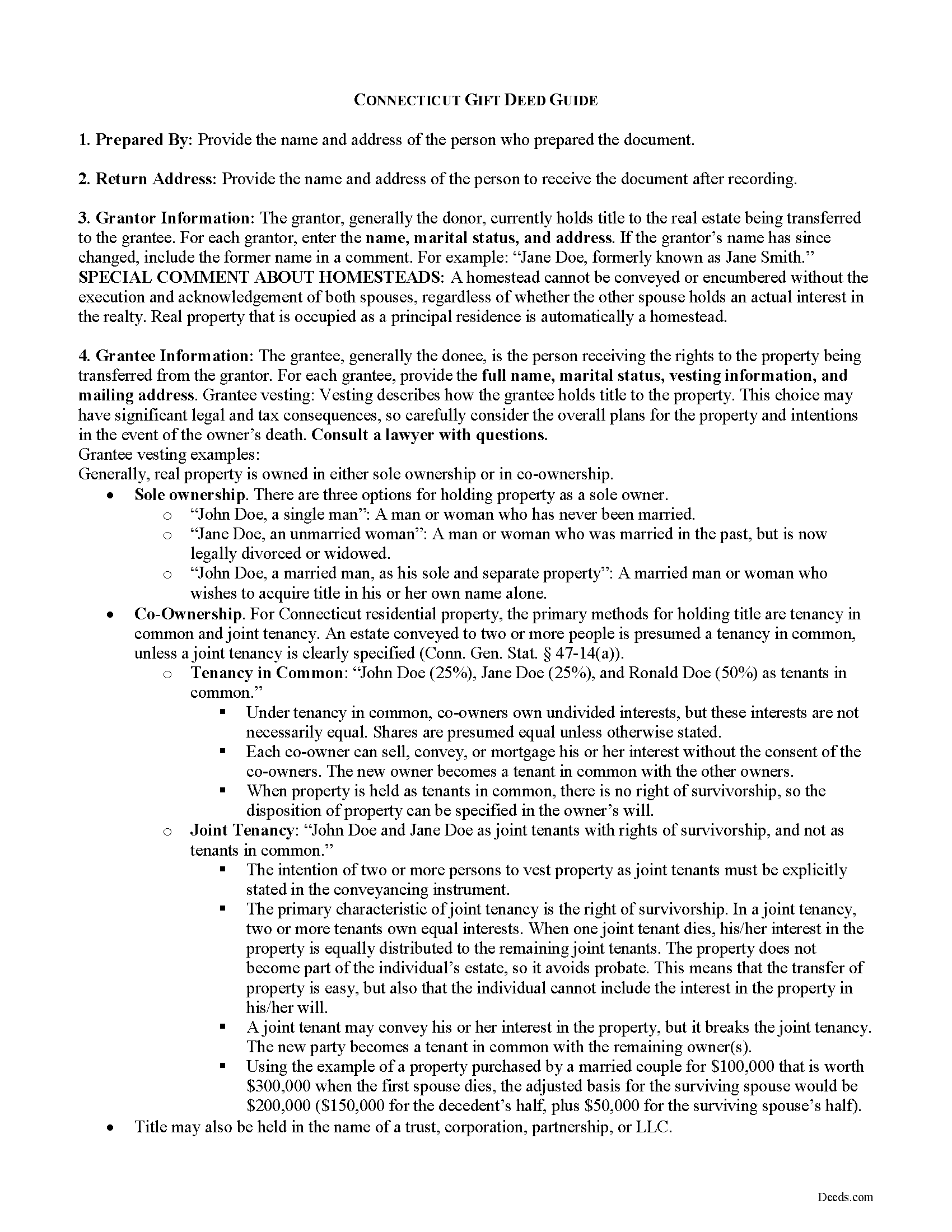

Litchfield County Gift Deed Guide

Line by line guide explaining every blank on the form.

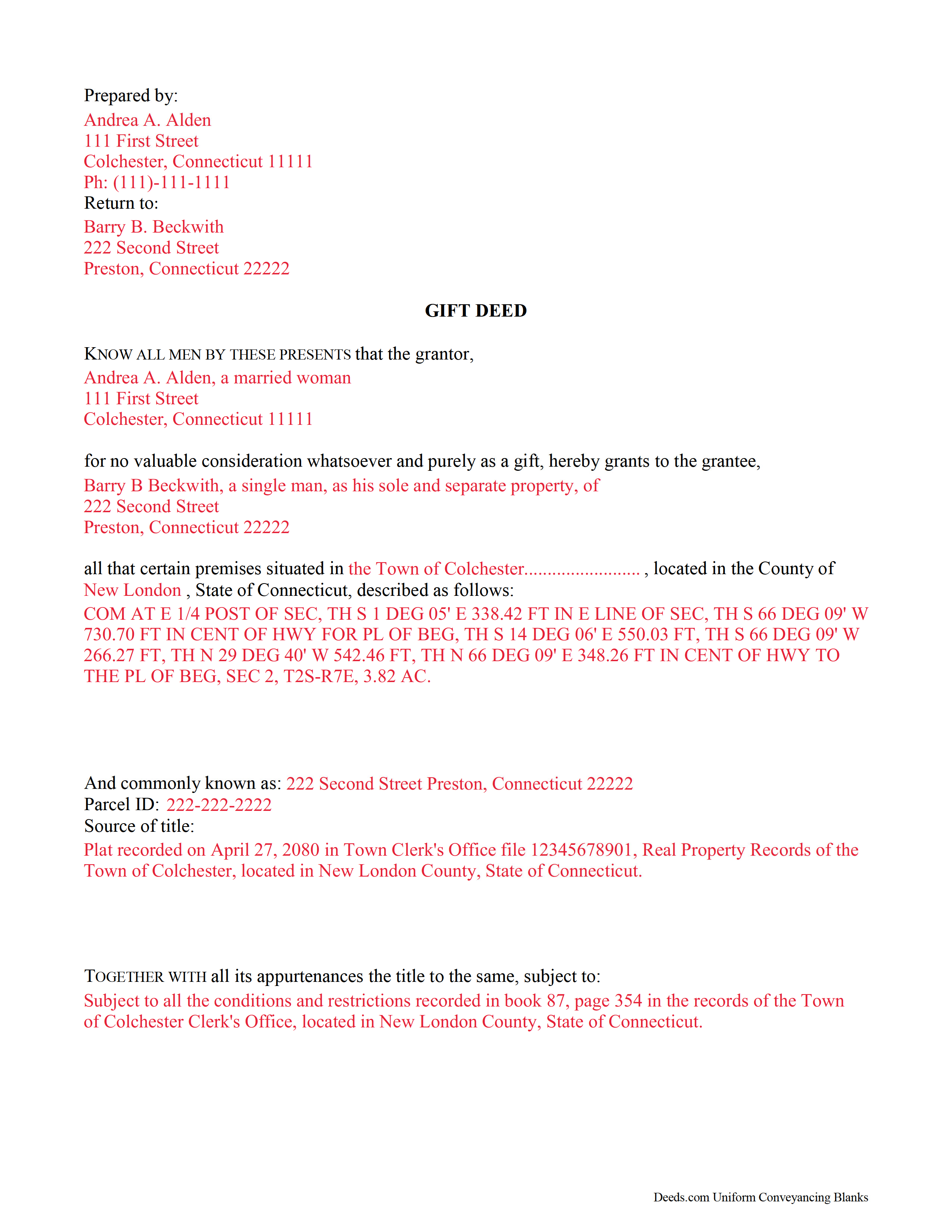

Litchfield County Completed Example of the Gift Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Connecticut and Litchfield County documents included at no extra charge:

Where to Record Your Documents

Barkhamsted Town Clerk

Barkhamsted, Connecticut 06063-3340

Hours: Mon, Tue, Thu 9:00 to 4:00; Wed 9:00 to 5:00; Fri 9:00 to 12:00

Phone: (860) 379-8665

Bethlehem Town Clerk

Bethlehem, Connecticut 06751

Hours: Mon closed; Tue-Fri 9:00 to 12:00; Tue 5:00 to 7:00; 1st & 3rd Sat 9:00 to 12:00 (exc July & Aug)

Phone: (203) 266-7510 Ext 207

Bridgewater Town Clerk

Bridgewater, Connecticut 06752

Hours: Mon, Wed-Fri 8:00 to 12:30; Tue 8:00 to 3:30

Phone: (860) 354-5102

Canaan Town Clerk

Falls Village, Connecticut 06031-0047

Hours: Mon-Thu 9:00 to 3:00

Phone: (860) 824-0707 Ext 10

Colebrook Town Clerk

Colebrook, Connecticut 06021

Hours: Mon-Thu 9:00 to 12:00 & 1:00 to 4:30; Fri 9:00 to 12:00

Phone: (860) 379-3359 Ext 213

Cornwall Town Clerk

Cornwall, Connecticut 06753

Hours: Mon-Thu 9:00 to 12:00 & 1:00 to 4:00

Phone: (860) 672-2709

Goshen Town Clerk

Goshen, Connecticut 06756

Hours: Mon-Thu 9:00 to 12:00 & 1:00 to 4:00; Fri 9:00 to 1:00 and by appt

Phone: (860) 491-3647

Harwinton Town Clerk

Harwinton, Connecticut 06791

Hours: Mon, Tue, Thu 8:30 to 4:00; Wed 8:30 to 6:00; Fri 8:30 to 12:30

Phone: (860) 485-9613

Kent Town Clerk

Kent, Connecticut 06757

Hours: Mon-Thu 9:00 to 4:00; Fri 9:00 to 12:00

Phone: (860) 927-3433

Litchfield Town Clerk

Litchfield, Connecticut 06759

Hours: Mon-Fri 9:00 to 4:30

Phone: (860) 567-7561

Morris Town Clerk

Morris, Connecticut 06763

Hours: Mon-Wed 8:30 to 4:00; Thu 8:30 to 6:00; Fri & 1st Sat 8:30 to 12:00

Phone: (860) 567-7433

New Hartford Town Clerk

New Hartford, Connecticut 06057

Hours: Call for hours

Phone: (860) 379-5037

New Milford Town Clerk

New Milford, Connecticut 06776

Hours: Mon-Fri 8:00 to 4:00

Phone: (860) 355-6020

Norfolk Town Clerk

Norfolk, Connecticut 06058

Hours: Mon-Thu 8:30 to 12:00 & 1:00 to 4:00; Fri 8:30 to 12:00

Phone: (860) 542-5679

North Canaan Town Clerk

North Canaan, Connecticut 06018

Hours: Mon-Fri 9:30 to 12:00 & 1:00 to 4:00

Phone: (860) 824-7313 Ext 106

Plymouth Town Clerk

Terryville, Connecticut 06786

Hours: Mon-Fri 8:30 to 4:30

Phone: (860) 585-4039

Roxbury Town Clerk

Roxbury, Connecticut 06783

Hours: Tue,Thu 9:00 to 12:00 & 1:00 to 4:00; Wed, Fri 9:00 to 12:00

Phone: (860) 354-3328

Salisbury Town Clerk

Salisbury, Connecticut 06068

Hours: Mon-Fri 9:00 to 3:30

Phone: (860) 435-5182

Sharon Town Clerk

Sharon, Connecticut 06069

Hours: Mon-Thu 8:30 to 12:00 & 1:00 to 4:00; Fri 8:30 to 12:00

Phone: (860) 364-5224

Thomaston Town Clerk

Thomaston, Connecticut 06787

Hours: Mon, Tue, Wed 8:00 to 4:00; Thu 8:30 to 6:00; Fri 8:30 to 12:00

Phone: (860) 283-4141

Torrington City Clerk

Torrington, Connecticut 06790

Hours: Mon-Wed 8:30-4:00; Thu 8:30-6:30; Fri 8:30-12:30

Phone: (860) 489-2236

Warren Town Clerk/Registrar

Warren , Connecticut 06754

Hours: Mon, Thu 9:00 to 1:00; Tue, Wed 9:00 to 4:00; Fri closed

Phone: (860) 868-7881 Ext 101

Washington Town Clerk

Washington Depot, Connecticut 06794

Hours: Mon-Fri 9:00 to 12:00 & 1:00 to 4:45

Phone: (860) 868-2786

Watertown Town Clerk

Watertown, Connecticut 06795

Hours: Mon-Fri 9:00 to 5:00

Phone: (860) 945-5230

Winchester Town Clerk

Winsted, Connecticut 06098-1697

Hours: Mon-Wed 8:00 to 4:00; Thu 8:00 to 7:00; Fri 8:00 to 12:00

Phone: (860) 738-6963

Woodbury Town Clerk

Woodbury, Connecticut 06798

Hours: Mon-Fri 8:00 to 4:00

Phone: (203) 263-2144

Recording Tips for Litchfield County:

- Avoid the last business day of the month when possible

- Ask about their eRecording option for future transactions

- Verify the recording date if timing is critical for your transaction

Cities and Jurisdictions in Litchfield County

Properties in any of these areas use Litchfield County forms:

- Bantam

- Barkhamsted

- Bethlehem

- Bridgewater

- Canaan

- Colebrook

- Cornwall

- Cornwall Bridge

- East Canaan

- Falls Village

- Gaylordsville

- Goshen

- Harwinton

- Kent

- Lakeside

- Lakeville

- Litchfield

- Morris

- New Hartford

- New Milford

- New Preston Marble Dale

- Norfolk

- Northfield

- Oakville

- Pequabuck

- Pine Meadow

- Plymouth

- Riverton

- Roxbury

- Salisbury

- Sharon

- South Kent

- Taconic

- Terryville

- Thomaston

- Torrington

- Washington

- Washington Depot

- Watertown

- West Cornwall

- Winchester Center

- Winsted

- Woodbury

Hours, fees, requirements, and more for Litchfield County

How do I get my forms?

Forms are available for immediate download after payment. The Litchfield County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Litchfield County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Litchfield County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Litchfield County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Litchfield County?

Recording fees in Litchfield County vary. Contact the recorder's office at (860) 379-8665 for current fees.

Questions answered? Let's get started!

Gift deeds convey title to real property from one party to another with no exchange of consideration, monetary or otherwise. Often used to transfer property between family members or to gift property as a charitable act or donation, these conveyances occur during the grantor's lifetime. Gift deeds must contain language that explicitly states that no consideration is expected or required. Ambiguous language, or references to any type of consideration, can make the gift deed contestable in court.

A lawful gift deed includes the grantor's full name and marital status, as well as the grantee's full name, marital status, vesting, and mailing address. Vesting describes how the grantee holds title to the property. Generally, real property is owned in either sole ownership or in co-ownership. For Connecticut residential property, the primary methods for holding title in co-ownership are tenancy in common and joint tenancy. An estate conveyed to two or more people is presumed a tenancy in common, unless a joint tenancy is clearly specified (Conn. Gen. Stat. 47-14(a)). The primary characteristic of joint tenancy is the right of survivorship. In Connecticut, when joint tenancy is declared, the right of survivorship is presumed ( 47-14(a)).

As with any conveyance of realty, a gift deed requires a complete legal description of the parcel. Recite the source of title to maintain a clear chain of title, and detail any restrictions associated with the property. Each grantor must sign the deed in the presence of a notary public for a valid transfer. Transfers in Connecticut require two witness signatures, one of which may be the notary official ( 47-5(a)(4)). All signatures must be original.

All conveyances of real property require a Real Estate Conveyance Tax Return (OP-236) in Connecticut, completed by the grantor. For property located in more than one municipality, Conn. Gen. Stat. 12-500 requires a completed Real Estate Conveyance Tax Allocation Worksheet. Record the completed deed, along with any additional materials, in the appropriate town clerk's office. Contact the same office to verify accepted forms of payment.

With gifts of real property, the recipient of the gift (grantee or donee) is not required to declare the amount of the gift as income, but if the property accrues income after the transaction, the grantee is responsible for paying the requisite state and federal income tax [1].

Gifts of real property in Connecticut are subject to the federal gift tax. The person or entity making the gift (grantor or donor) is responsible for paying the federal gift tax; however, if the donor does not pay the gift tax, the donee (grantee) will be held liable [1]. In accordance with federal law, individuals are permitted an annual exclusion of $15,000 on gifts. This means that if a gift is valued below $15,000, a federal gift tax return (Form 709) does not need to be filed. However, if the gift is something that could possibly be disputed by the IRS -- such as real property -- a donor may benefit from filing a Form 709 [2].

If a federal gift tax return is required, a state gift tax return (Form CT-709) is also required for Connecticut residents, as well as non-residents when the subject property is situated in Connecticut [3]. For questions regarding state taxation laws, consult a tax specialist.

This article is provided for informational purposes only and is not a substitute for the advice of an attorney. Contact a Connecticut lawyer with any questions about gift deeds or other issues related to the transfer of real property.

[1] http://msuextension.org/publications/FamilyFinancialManagement/MT199105HR.pdf

[2] https://www.irs.gov/businesses/small-businesses-self-employed/frequently-asked-questions-on-gift-taxes

[3] http://www.ct.gov/drs/cwp/view.asp?A=1508&Q=266846

Important: Your property must be located in Litchfield County to use these forms. Documents should be recorded at the office below.

This Gift Deed meets all recording requirements specific to Litchfield County.

Our Promise

The documents you receive here will meet, or exceed, the Litchfield County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Litchfield County Gift Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Steve W.

February 3rd, 2023

Simple and easy transaction

Thank you for your feedback. We really appreciate it. Have a great day!

Don M.

February 17th, 2023

The process was easy going. The process is one thing, the results another. I have attempting to resolve this matter, of claiming sole ownership of the property for several YEARS. I lost my Bride of 65 years in 2015. A lawyer I hired failed in his attempt, so I'm waiting to see the actual results. I also have two parcels in New Mexico under the same situation, so if this is successful, I'll gladly be back. Thank You so very much. Don Martin

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

MARY LACEY M.

June 25th, 2020

Excellent service! From setting up an account to successfully recording, the instructions were clear and easy to follow. I am very pleased to have this service available, and favorably impressed by our current Maricopa County Recorder for pursuing its availability. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ernest K.

July 27th, 2020

Im an out of state realtor, but couldnt believe how quick and easy the process was. Recieved my deed within 15 min of submission. I will be referring clients to this service.

Thank you!

Doreen P.

December 13th, 2018

I have uploaded 2 documents for E recording, I have searched thinking it would prompt me to a business customer service contact info tel no. ? I am concerned as to the fees related to the recording of both instruments? please advise? thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Sherri S.

July 3rd, 2019

Appreciate your diligent assistance.

Thank you!

Charles S.

July 7th, 2021

Quick and easy. Highly recommend. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Edwin M.

July 2nd, 2021

Good marks from me. Keep up the good work !

Thank you!

Ronald W.

July 30th, 2020

User friendly, but couldn't find the information needed.

Thank you for your feedback. We really appreciate it. Have a great day!

Charles B.

April 5th, 2020

KVH really went above and beyond to help me try to find what I needed.

Thank you for your feedback. We really appreciate it. Have a great day!

SHERRI B.

December 14th, 2021

World class forms and service. Downloaded and prepared the deed in minutes. Used the recording service (digital), so convenient.

Thank you for the kind words Sherri. Have an amazing day!

Mary S.

March 26th, 2022

Wonderful!! So easy to locate the file you need and printing is a snap!! Thank you so much for this service! I will definitely be sharing your site!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Carl S.

February 29th, 2020

Five Stars!

Thank you!

Alexandra M.

April 28th, 2021

Needed a Limited Power of Attorney form for a real estate transaction in another state. Proper form came up immediately and was fairly easy to complete. I think the sample completed form should have been more completely explained in layman's language instead of legalese (such as person granting permission instead of grantor or something like your name and address and the person who will be signing on your behalf) but since the form was one price no matter how many ways it was printed out, it was fine. I just filled it out several ways and had it notarized and sent it to my sister. Whichever combination is appropriate she and the lawyer will have. I found the site easy to navigate

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Geraldine B.

December 7th, 2019

Top notch real estate forms. Easy to use, printed out nice, and the guide and example are priceless. You're not going to find anything better anywhere.

Thank you for the kind words Geraldine! Have an incredible day!