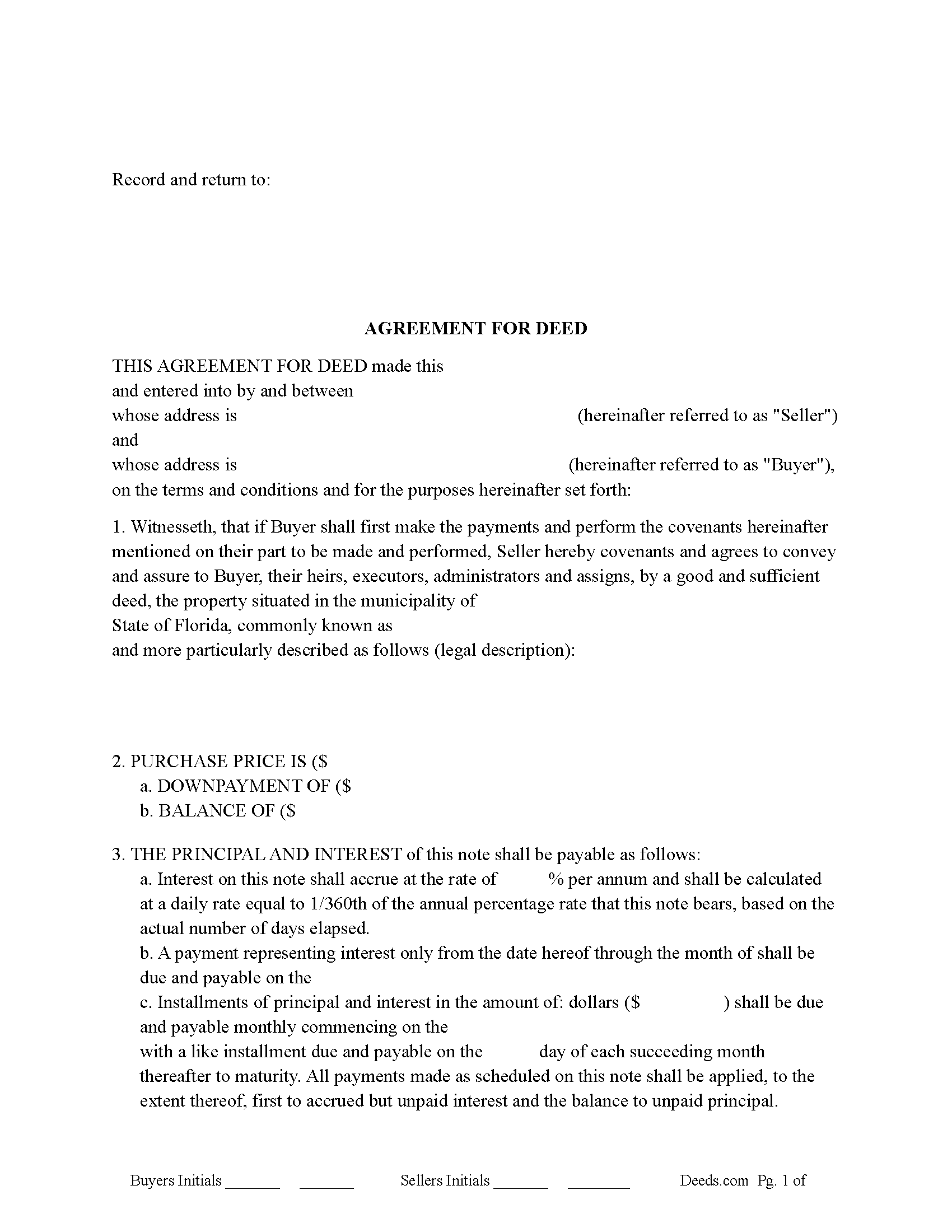

Saint Johns County Agreement for Deed Form

Saint Johns County Agreement for Deed Form

Fill in the blank Agreement for Deed form formatted to comply with all Florida recording and content requirements.

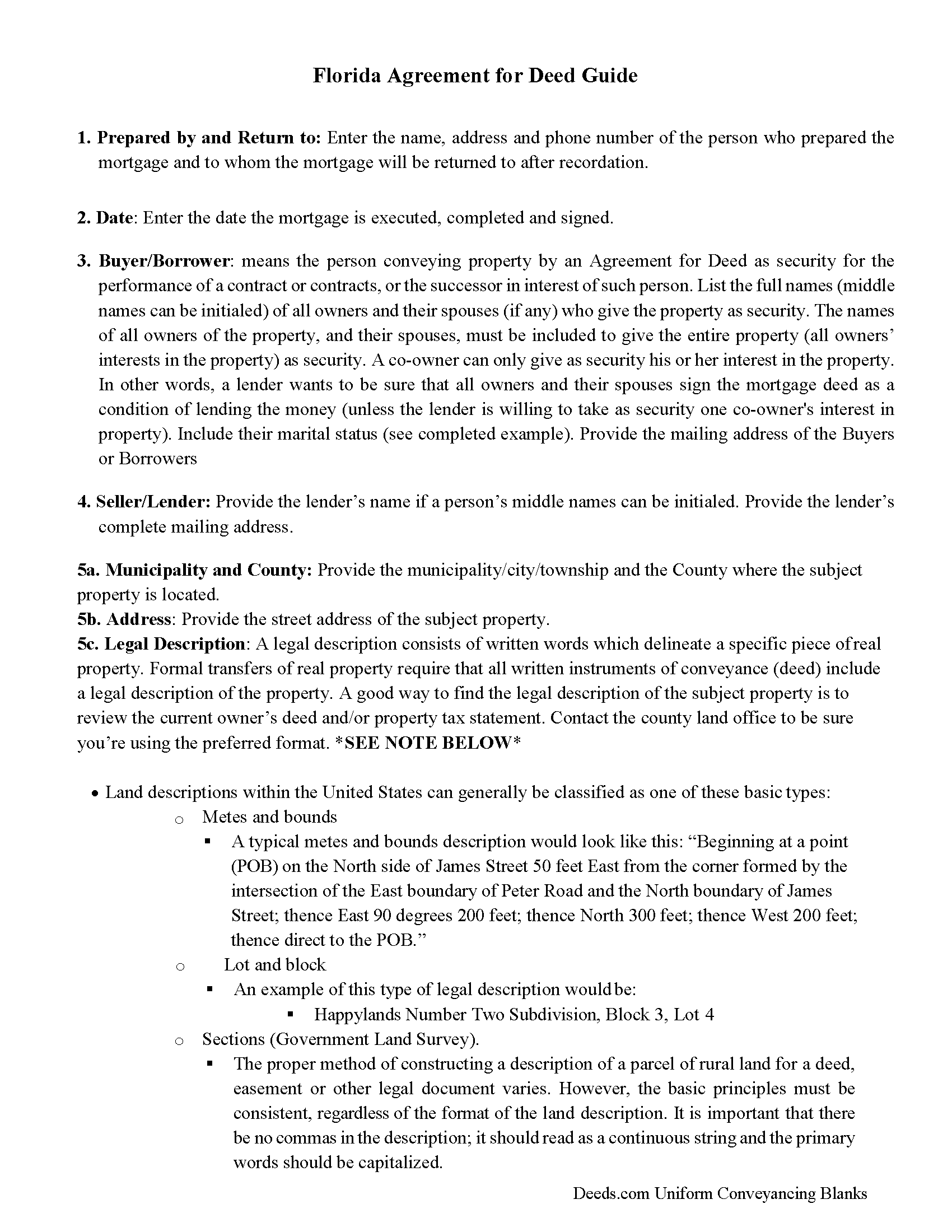

Saint Johns County Agreement for Deed Guide

Line by line guide explaining every blank on the Agreement for Deed form.

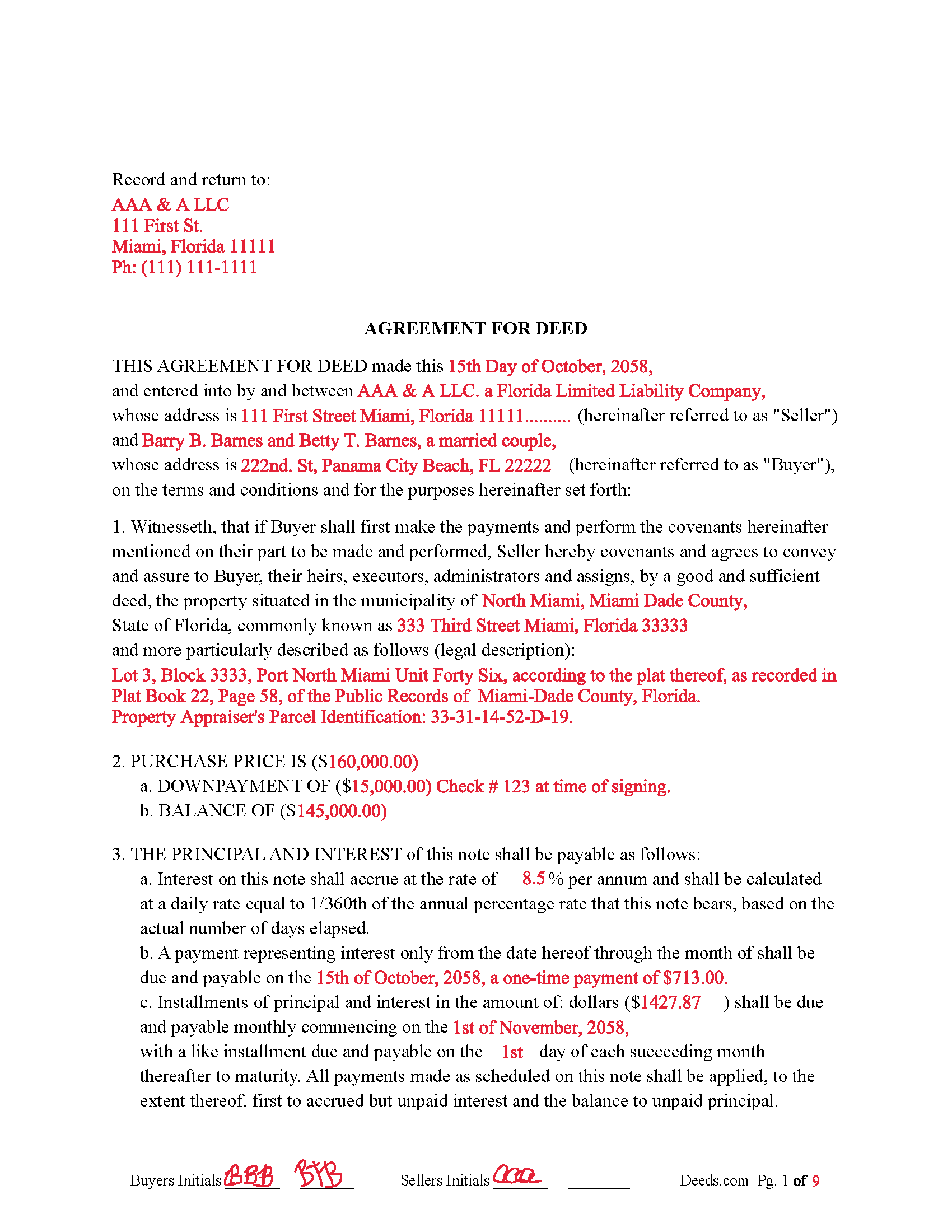

Saint Johns County Completed Example of the Agreement for Deed Document

Example of a properly completed Florida Agreement for Deed document for reference.

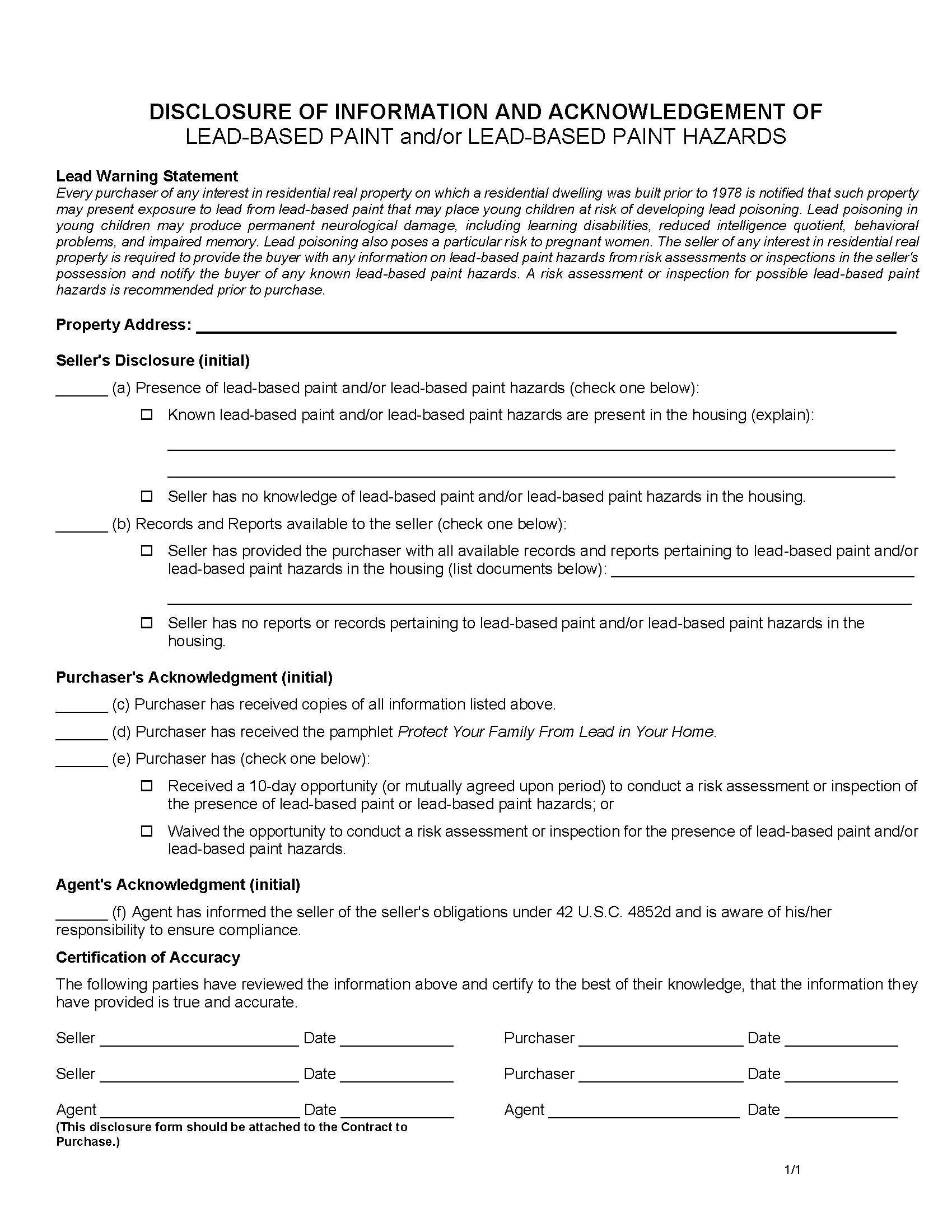

Saint Johns County Lead Based Paint Disclosure Form

Required for residential property built before 1978.

Saint Johns County Residential Property Disclosure

Required form for residential property.

All 5 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Florida and Saint Johns County documents included at no extra charge:

Where to Record Your Documents

St. Johns County Clerk of Courts

St. Augustine, Florida 32084

Hours: 8:00am-5:00pm M-F

Phone: (904) 819-3600 Press 6 for Recording

Recording Tips for Saint Johns County:

- Double-check legal descriptions match your existing deed

- Ask if they accept credit cards - many offices are cash/check only

- Check that your notary's commission hasn't expired

- Recorded documents become public record - avoid including SSNs

- Bring multiple forms of payment in case one isn't accepted

Cities and Jurisdictions in Saint Johns County

Properties in any of these areas use Saint Johns County forms:

- Elkton

- Hastings

- Jacksonville

- Ponte Vedra

- Ponte Vedra Beach

- Saint Augustine

- Saint Johns

Hours, fees, requirements, and more for Saint Johns County

How do I get my forms?

Forms are available for immediate download after payment. The Saint Johns County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Saint Johns County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Saint Johns County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Saint Johns County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Saint Johns County?

Recording fees in Saint Johns County vary. Contact the recorder's office at (904) 819-3600 Press 6 for Recording for current fees.

Questions answered? Let's get started!

An "Agreement for Deed," also known as a land contract or contract for deed, is a financing arrangement where the seller retains the legal title to the property until the buyer fulfills the terms of the agreement, typically by paying the purchase price over time. In Florida, this type of agreement can be useful in specific situations:

When to Use an Agreement for Deed in Florida

1. Buyers with Limited Financing Options:

Credit Issues: Buyers who may have difficulty obtaining traditional mortgage financing due to poor credit scores or lack of credit history can use an Agreement for Deed.

Self-Employed or Irregular Income: Buyers with irregular income or those who are self-employed and may not meet traditional lending criteria can benefit from this arrangement.

2. Seller Financing:

Investment Strategy: Sellers who prefer to receive steady payments over time rather than a lump sum can use an Agreement for Deed as a form of seller financing.

Retaining Title: Sellers who wish to retain legal title until the buyer has paid in full can protect their interest in the property through this method.

3. Ease of Transfer:

Simplified Process: This type of agreement can simplify the process of property transfer, avoiding some of the complexities and costs associated with traditional mortgages and closing procedures.

4. Negotiable Terms:

Flexibility: The terms of an Agreement for Deed can be tailored to fit the needs of both the buyer and seller, including down payment amount, interest rate, and payment schedule.

5. Quick Sale:

Market Advantage: Sellers can use this agreement to attract buyers in a sluggish real estate market by offering more flexible financing options.

Legal Considerations and Requirements

• Documentary Stamp Tax: As mentioned, Florida law considers an Agreement for Deed a transfer of interest in real property, subject to documentary stamp tax at the time of recording the contract. Imposition of Documentary Stamp Tax: Florida law considers the execution of a land contract as a transfer of interest in real property. Consequently, the documentary stamp tax applies to the full purchase price outlined in the land contract. This tax is similar to the tax imposed on traditional deeds.

• Timing of Tax Payment: The documentary stamp tax must be paid at the time the land contract is recorded. The responsibility for this tax typically falls on the seller, but the terms can vary depending on the agreement between the buyer and seller.

• Tax Calculation: The tax is calculated based on the purchase price of the property. As of now, the rate is $0.70 per $100 of the total purchase price, although this rate can change, and there may be additional surtaxes in certain counties.

• Default and Foreclosure: If the buyer defaults, the seller may need to follow formal foreclosure procedures to reclaim the property.

• Consumer Protection: Florida law requires certain disclosures and protections for buyers in these agreements, such as the right to cancel within seven business days of execution without penalty. 498.028 CONTRACTS AND CONVEYANCE INSTRUMENTS.--The contract for purchase of subdivided lands shall contain, and the subdivider shall comply with, the following provisions:

(1) The purchaser shall have an absolute right to cancel the contract for any reason whatsoever for a period of 7 business days following the date on which the contract was executed by the purchaser.

(2) In the event the purchaser elects to cancel within the period provided, all funds or other property paid by the purchaser shall be refunded without penalty or obligation within 20 days of the receipt of the notice of cancellation by the developer.

(3) If the property is sold under an agreement for deed or a contract for deed where title to the property is not conveyed to the purchaser within 180 days or if the promised improvements to the property have not been completed, the agreement or contract shall contain the following language in conspicuous type immediately above the line for the purchaser's signature:

YOU MAY NOT RECEIVE YOUR LAND UNDER THIS CONTRACT IF THE SUBDIVIDER FILES FOR BANKRUPTCY PROTECTION OR OTHERWISE IS UNABLE TO PERFORM UNDER THE TERMS OF THIS CONTRACT PRIOR TO YOUR RECEIVING A DEED EVEN IF YOU HAVE MADE ALL THE PAYMENTS PROVIDED FOR UNDER THIS CONTRACT. IF YOU HAVE ANY QUESTIONS ABOUT THE MEANING OF THIS DOCUMENT, CONSULT AN ATTORNEY.

• Recording the Agreement: To protect both parties, the Agreement for Deed should be recorded with the county recorder's office.

Use for residential, vacant land, rental property, condominiums and planned unit developments. For use in Florida only.

Important: Your property must be located in Saint Johns County to use these forms. Documents should be recorded at the office below.

This Agreement for Deed meets all recording requirements specific to Saint Johns County.

Our Promise

The documents you receive here will meet, or exceed, the Saint Johns County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Saint Johns County Agreement for Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Donna M.

August 27th, 2021

Very easy to use, found the forms I needed right away. Downloaded and paid for within minutes! Excellent!

Thank you!

Robert K.

July 9th, 2022

This document was exactly what I needed and with the corresponding sample I was easily able to complete it. This saved me a lot of money by not having to hire an attorney to fill out a form. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Donald C.

February 22nd, 2019

No review provided.

Thank you!

Brian B.

May 13th, 2021

Very good price. It came with instructions and a sample filled out. Very helpful.

Thank you for your feedback. We really appreciate it. Have a great day!

Thomas G.

March 16th, 2020

A few parts are confusing'.Like sending Tax statements to WHO ?/ The rest is simple I hope.Have not tried to record yet

Thank you!

Christine L.

May 13th, 2025

User friendly!

Thank you!

Penny S.

July 18th, 2020

Was very simple to use and the email communication was very efficient. Appreciated getting my document recorded in a timely manner. Thank you deeds.com

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

TIFFANY B.

April 24th, 2024

THIS SERVICE IS AMAZING! IT SAVES ME SO MUCH TIME!

We are grateful for your engagement and feedback, which help us to serve you better. Thank you for being an integral part of our community.

Keyuna C.

April 25th, 2020

Speedy process, they provided me with the exact documents that I needed.

Thank you!

Kelli B.

January 31st, 2019

Amazingly simple and fast. A great service.

Thank you!

Timothy N.

September 21st, 2020

Extremely easy and fast recording of real estate records. I was impressed that it was less than 6 hours from the time I uploaded the document to Deeds.com to receiving confirmation that it was recorded by the county clerk. I would highly recommend this service to save you time and quickly get documents recorded!

Thank you for your feedback. We really appreciate it. Have a great day!

ronald d.

February 19th, 2021

I found that the website was laid out well and referenced documents were professionally created.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Holly K.

November 4th, 2022

This is the simplest way to record a deed ever. Just uploaded the deed and the professionals at deed.com did the rest. Within 8 hours, I had my recorded deed back. The price is fantastic. It would have cost me more in gas to drive to the county where I had to record the deed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Timothy C.

February 17th, 2022

Very easy to use, guides are also nice to have. thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

DENIS K.

July 17th, 2020

Excellent, invaluable and reasonable!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!