Florida Certificate of Trust Forms

Florida Certificate of Trust Overview

How to Use This Form

- Select your county from the list on the left

- Download the county-specific form

- Fill in the required information

- Have the document notarized if required

- Record with your county recorder's office

Governed by the Florida Trust Code under Fla. Stat. 736.1017, any trustee may execute and sign a certification of trust in lieu of furnishing a trust instrument (Fla. Stat. 736.1017(2)). The document is proof of a trust's existence, as well as the trustee's authority to act on behalf of the trust.

Lending institutions or other parties might ask for a certification of trust before processing a request, such as opening an account in the trust's name or transferring assets into or out of the trust. The certification contains only the information about the trust needed for the specific pending transaction, and the identities of those having a beneficial interest in the trust remain confidential; trust documents are usually unrecorded and therefore not a matter of public record.

A recipient can request excerpts of the trust instrument concerning the appointment of the trustee and the trustee's powers, as well as excerpts of relevant amendments, but may rely upon information presented in the certificate as fact.

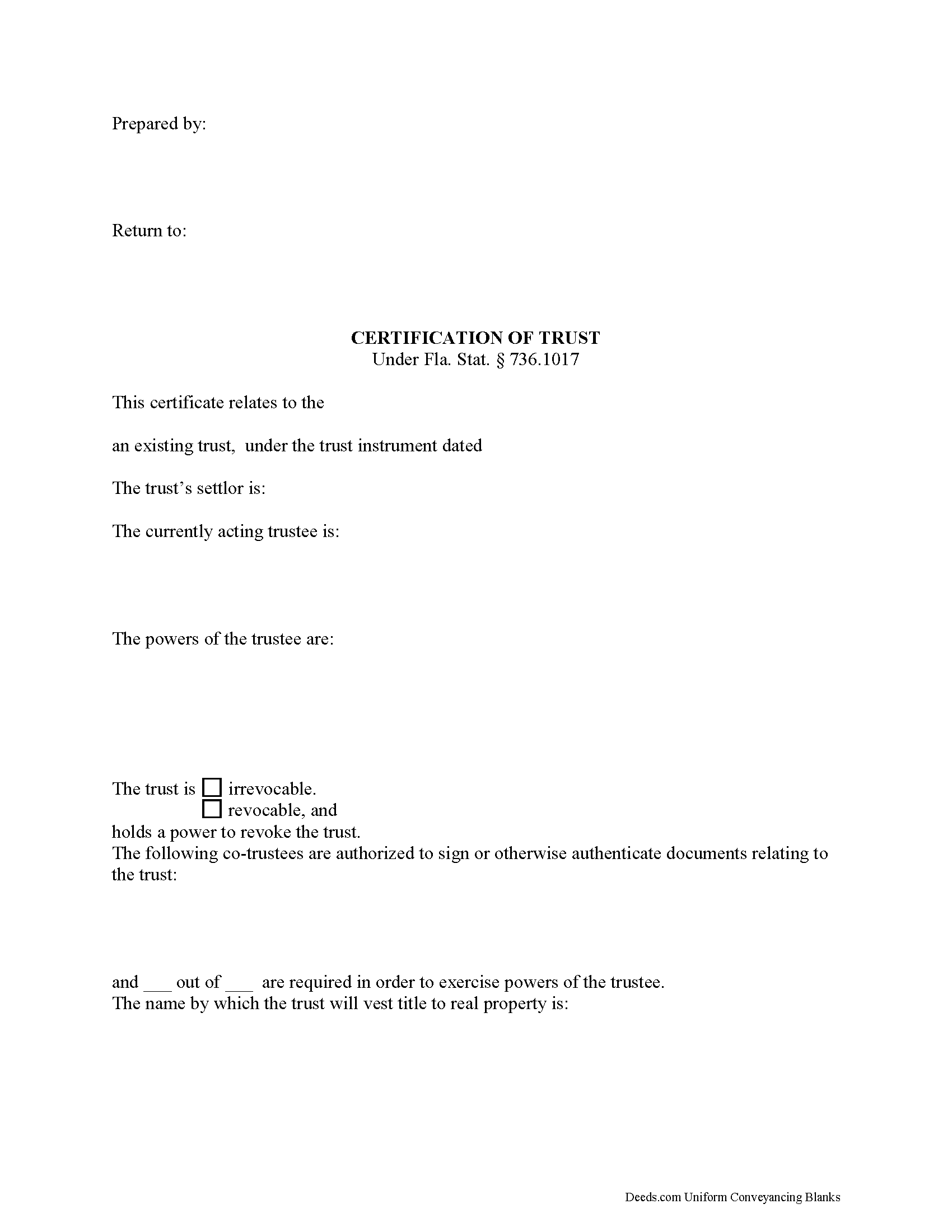

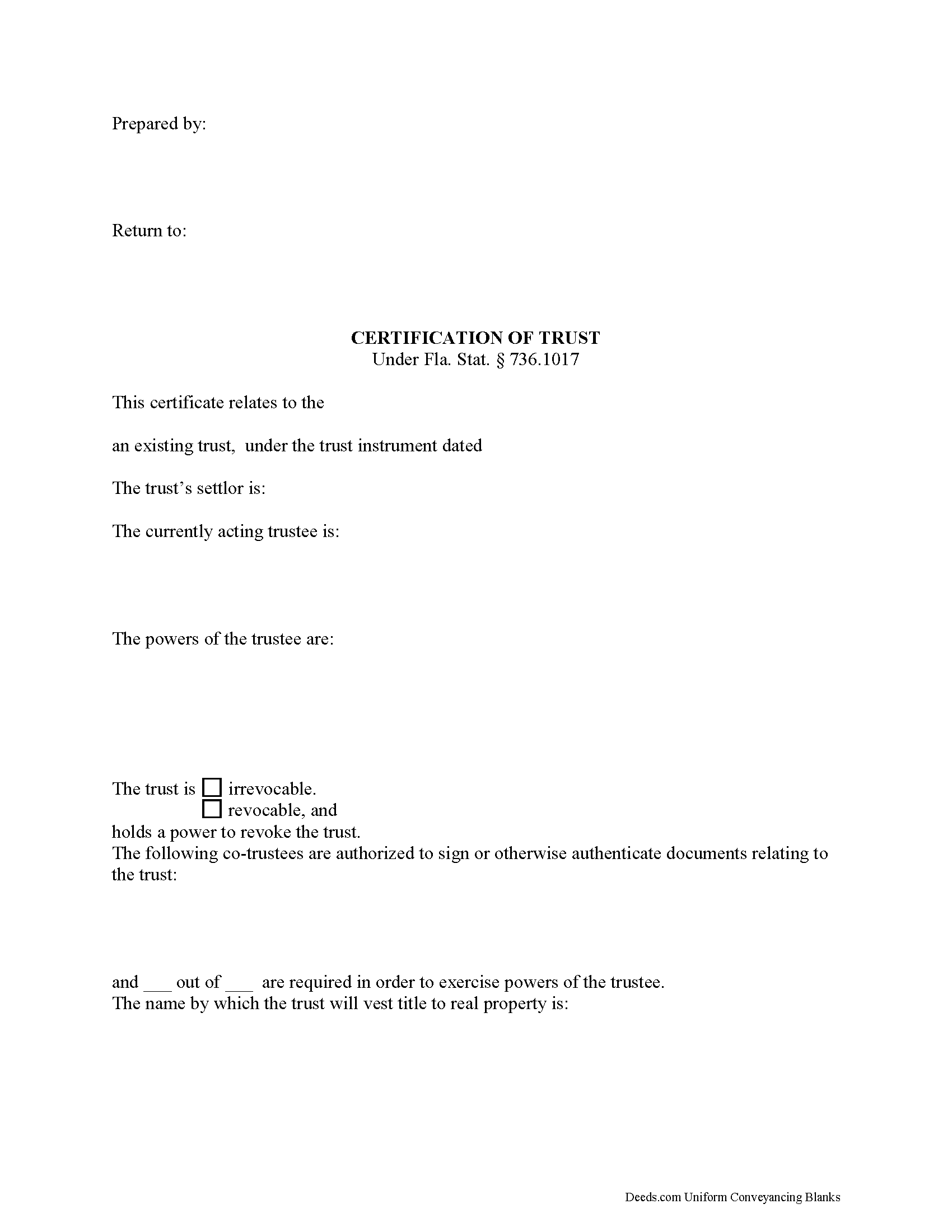

The requirements for a valid certification of trust include the trust's name and date of the trust instrument; the settlor's name; the acting trustee's name; and the trustee's powers relevant to the situation. In addition, the certificate states whether the trust is irrevocable or revocable, and who has the power to revoke the trust in the case of the latter. If the transaction involves real estate, include the legal description of the subject property or properties.

If the trust has more than one acting trustee, the certificate shows who is authorized to sign documents relating to the trust, and how many are required to sign. The certificate also confirms the name by which the trustee, as representative of the trust, is to take title to trust assets.

Finally, the certificate requires a statement that the trust has not been modified in any way that would invalidate any information presented within.

The executing trustee signs the certificate in the presence of a notary public and two witnesses, as per Fla. Stat. 117.05. If the document is being recorded, submit it in the county in which the subject real property is located.

(Florida Certificate of Trust Package includes form, guidelines, and completed example)

Contact a lawyer with any questions regarding certifications of trust or trust law in the State of Florida, as each situation is unique.

Important: County-Specific Forms

Our certificate of trust forms are specifically formatted for each county in Florida.

After selecting your county, you'll receive forms that meet all local recording requirements, ensuring your documents will be accepted without delays or rejection fees.

How to Use This Form

- Select your county from the list above

- Download the county-specific form

- Fill in the required information

- Have the document notarized if required

- Record with your county recorder's office

Common Uses for Certificate of Trust

- Transfer property between family members

- Add or remove names from property titles

- Transfer property into or out of trusts

- Correct errors in previously recorded deeds

- Gift property to others