Saint Johns County Claim of Lien Form

Saint Johns County Claim of Lien Form

Fill in the blank form formatted to comply with all recording and content requirements.

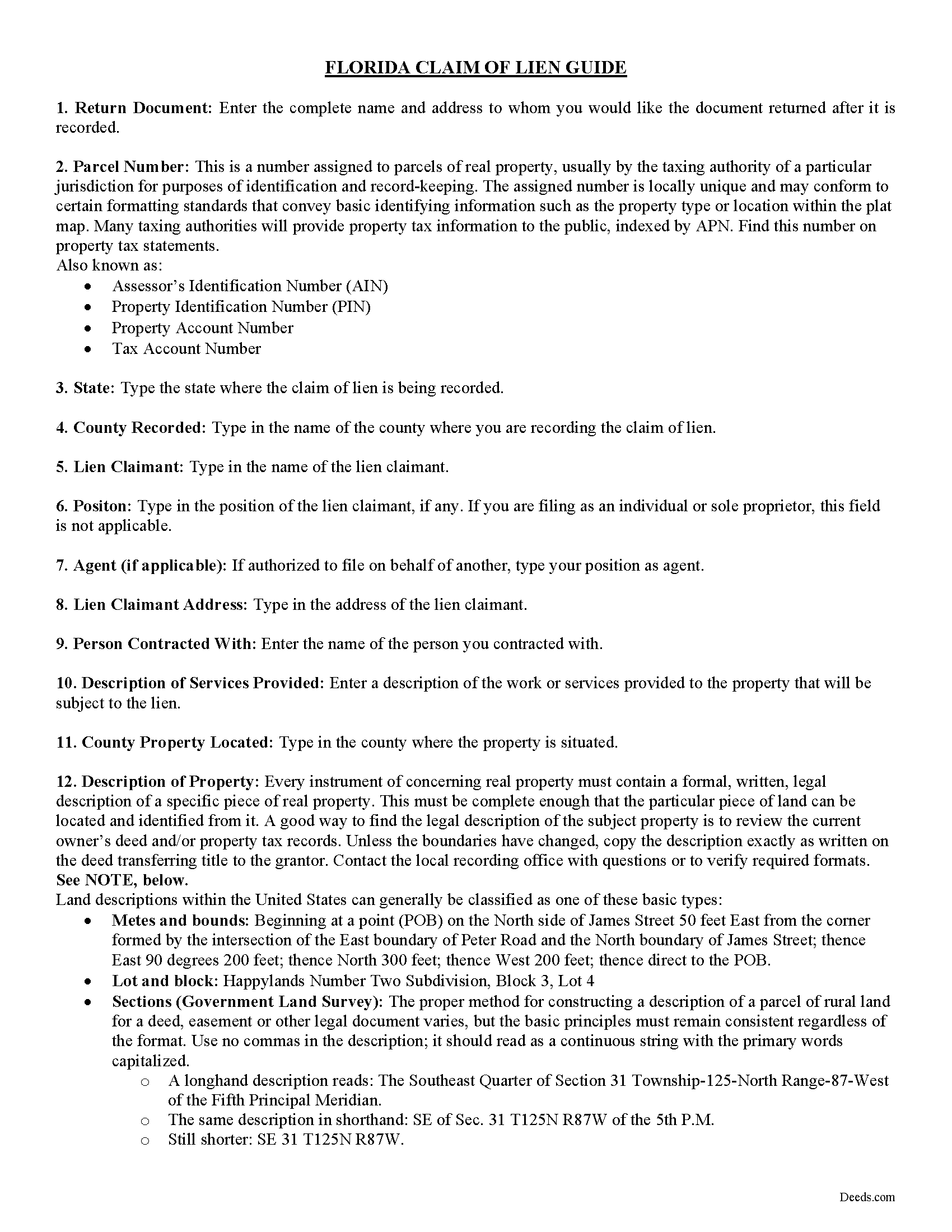

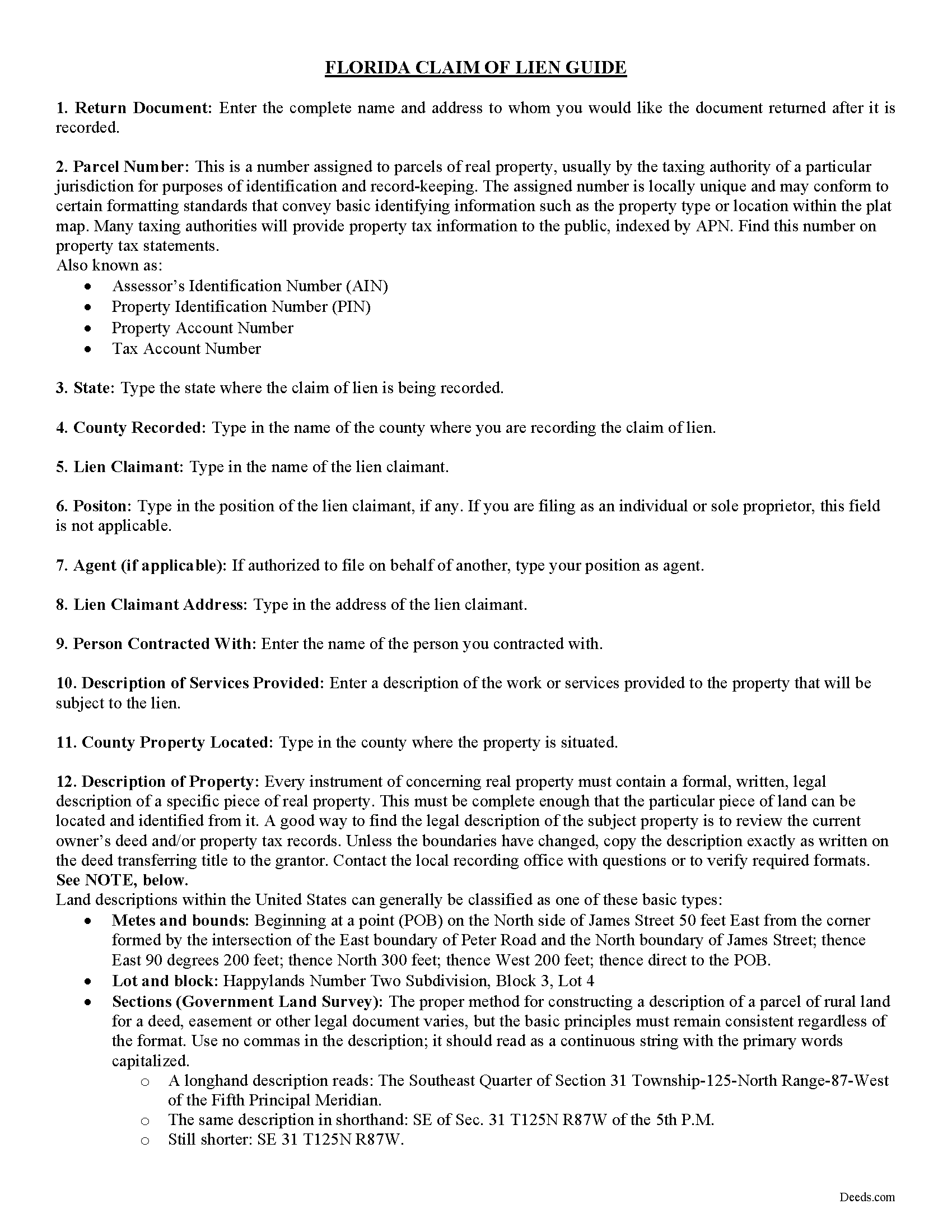

Saint Johns County Claim of Lien Guide

Line by line guide explaining every blank on the form.

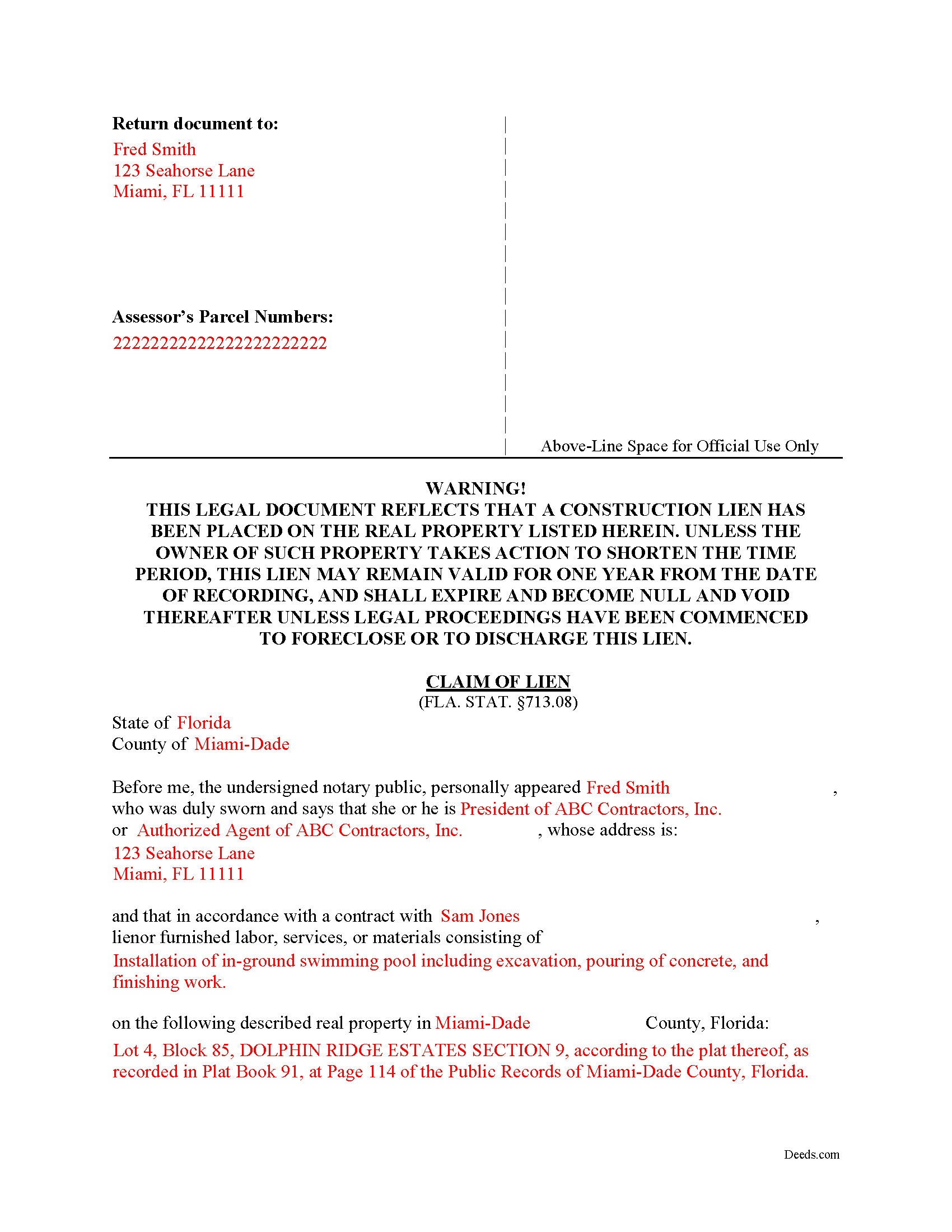

Saint Johns County Completed Example of the Claim of Lien Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Florida and Saint Johns County documents included at no extra charge:

Where to Record Your Documents

St. Johns County Clerk of Courts

St. Augustine, Florida 32084

Hours: 8:00am-5:00pm M-F

Phone: (904) 819-3600 Press 6 for Recording

Recording Tips for Saint Johns County:

- Recording fees may differ from what's posted online - verify current rates

- Bring extra funds - fees can vary by document type and page count

- Ask about their eRecording option for future transactions

Cities and Jurisdictions in Saint Johns County

Properties in any of these areas use Saint Johns County forms:

- Elkton

- Hastings

- Jacksonville

- Ponte Vedra

- Ponte Vedra Beach

- Saint Augustine

- Saint Johns

Hours, fees, requirements, and more for Saint Johns County

How do I get my forms?

Forms are available for immediate download after payment. The Saint Johns County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Saint Johns County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Saint Johns County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Saint Johns County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Saint Johns County?

Recording fees in Saint Johns County vary. Contact the recorder's office at (904) 819-3600 Press 6 for Recording for current fees.

Questions answered? Let's get started!

What is a Claim of Lien?

A claim of lien is a legal claim to property that operates as security against any amount of money or services owed to another person or entity. A claim of lien must be recorded in a public records office so that anyone else with a potential interest in the property has notice of the pending claim. Filing this form places a lien on the property, which restricts the owner's ability to use it as collateral for a loan, sell it, or otherwise transfer it. A lien can also be foreclosed by filing a lawsuit in order to force a sale and pay all lien claimants according to what they are owed and what order they are to be paid.

Filing and recording a claim of lien is an essential step in ensuring that you have priority of payment versus all other lien claimants with their own potential claims against the property. Unless you are providing labor only, prior to filing your claim of lien, you must first serve a notice on the owner setting forth the lienor's name and address, a description sufficient for identification of the real property, and the nature of the services or materials furnished or to be furnished. FLA. STAT. 713.06(2)(a).

You must file your claim on lien within 90 days from the last day you provided labor, services or materials to a construction or renovation project. It's usually good practice to record your claim of lien early. The earlier you record, the more likely you are in preventing the property owner from obtaining permanent financing or selling the property to a third party. Therefore, by recording early you can exert leverage on the owner to ensure greater chances of being paid.

The claim of lien may be prepared by the lienor or the lienor's employee or attorney and shall be signed and sworn to or affirmed by the lienor or the lienor's agent acquainted with the facts stated therein. FLA. STAT.

713.08(2). Be careful not to exaggerate your lien, because falsification of a lien will cause a forfeiture of your lien rights and is also a third degree felony in Florida. FLA.STAT. 713.31(3).

The claim of lien must be served on the owner by actual delivery or common carrier service such as registered/certified mail. If actual delivery or common carrier service are not feasible, service can be accomplished by posting the notice at the job site. FLA. STAT. 713/18(1). Failure to serve any claim of lien before recording or within 15 days after recording shall render the claim of lien voidable to the extent that the failure or delay is shown to have been prejudicial to any person entitled to rely on the service. FLA. STAT. 713.08(4)(c).

In Florida, all claim of lien forms must contain the following language in all upper-case:

WARNING! THIS LEGAL DOCUMENT REFLECTS THAT A CONSTRUCTION LIEN HAS BEEN PLACED ON THE REAL PROPERTY LISTED HEREIN. UNLESS THE OWNER OF SUCH PROPERTY TAKES ACTION TO SHORTEN THE TIME PERIOD, THIS LIEN MAY REMAIN VALID FOR ONE YEAR FROM THE DATE OF RECORDING, AND SHALL EXPIRE AND BECOME NULL AND VOID THEREAFTER UNLESS LEGAL PROCEEDINGS HAVE BEEN COMMENCED TO FORECLOSE OR TO DISCHARGE THIS LIEN.

This claim of lien form must be signed and notarized before filing it with the Clerk of Court for the county where the project is located. In most counties, the claim of lien is filed with the Clerk of Courts, but some counties have a separate County Recorder department so it is important to verify the correct office for filing.

After the lien is recorded, you have one year to file your foreclosure suit on the lien. If the owner contests the lien in a judicial action, the time can be shortened to sixty (60) or twenty (20) days.

Each case is unique, and lien law is complicated, so contact an attorney with specific questions or for complex situations relating to Mechanic's Liens in Florida.

Important: Your property must be located in Saint Johns County to use these forms. Documents should be recorded at the office below.

This Claim of Lien meets all recording requirements specific to Saint Johns County.

Our Promise

The documents you receive here will meet, or exceed, the Saint Johns County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Saint Johns County Claim of Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

Robert V.

March 20th, 2019

Website seems to work great and documents are very clear and easy to review and download, thank you. Regards, Bob

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Brian O.

June 27th, 2020

It's an instant download. I was very pleased that it included instructions and any necessary additional forms. Much easier than spending 3 hours on a county assessor's website searching for every single form. A good deal and I don't know how Deeds.com keeps up with thousands of counties. The fillable .pdf capability is a great enhancement.

Thank you for your feedback. We really appreciate it. Have a great day!

Sherri P.

May 6th, 2020

I thought it was easy, but I wish it were faster. I uploaded my document Monday night (after 5pm) and got my invoice the next morning Tuesday paid it right away. and my document was not sent to me as recorded until Wednesday morning even though it was recorded the day earlier at 8:30am. So there was a delay of almost 24 hours letting me know that my document was recorded. So if they could speed that up so that we knew exactly when it got recorded immediately I would give it a million stars

Thank you!

Earnestine C.

September 4th, 2019

Informative and instruction clear and concise, which made it easy for a person without real estate knowledge to acquire needed information. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Julie Z.

December 7th, 2024

Just getting started with this process, but I was delighted to find this resource to speed up the decision making. Excellent! Very helpful!

Thank you for your positive words! We’re thrilled to hear about your experience.

Carolyn L.

February 17th, 2021

Easy and quick and reasonable!

Thank you for your feedback. We really appreciate it. Have a great day!

Martin B.

August 12th, 2020

Excellent Detailed and clear Easy to use

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Catherine C.

February 26th, 2021

This was great. Happy I found you!

Thank you!

George D.

August 23rd, 2020

The TODD form has been notarized and registered with my county Register of Deeds office, so it works just fine. My only quibble is that when I printed it out, it missed part of the last line of the notary's info and the fine print in the bottom corners. When I printed it at 90% scale, it included those things.

Thank you for your feedback. We really appreciate it. Have a great day!

Bernique C.

May 18th, 2022

Was very pleased to be referred by another user for needed documents. Add me to "satisfied customers"

Thank you for your feedback. We really appreciate it. Have a great day!

Gordon W.

April 7th, 2022

Nice forms but it sure would have been nice to be able to at least print the guide and the example so that I don't spend all of my time bouncing back and forth between windows on a laptop.

Thank you for your feedback. We really appreciate it. Have a great day!

Laurentina F.

December 10th, 2020

Great and efficient.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Peggy H.

December 9th, 2022

Very good!

Thank you!

carol g.

May 3rd, 2019

very good. got my info in minuetes. thank you

Thank you for your feedback Carol, have a great day!

Michelle M.

April 24th, 2023

This was an excellent source. The fee was much lower than the first site I checked. The sample form was very helpful.

Thank you!