Saint Johns County Durable Limited Power of Attorney for Real Estate Form

Saint Johns County Durable Limited Power of Attorney for Real Estate Form

Fill in the blank Durable Limited Power of Attorney for Real Estate form formatted to comply with all Florida recording and content requirements.

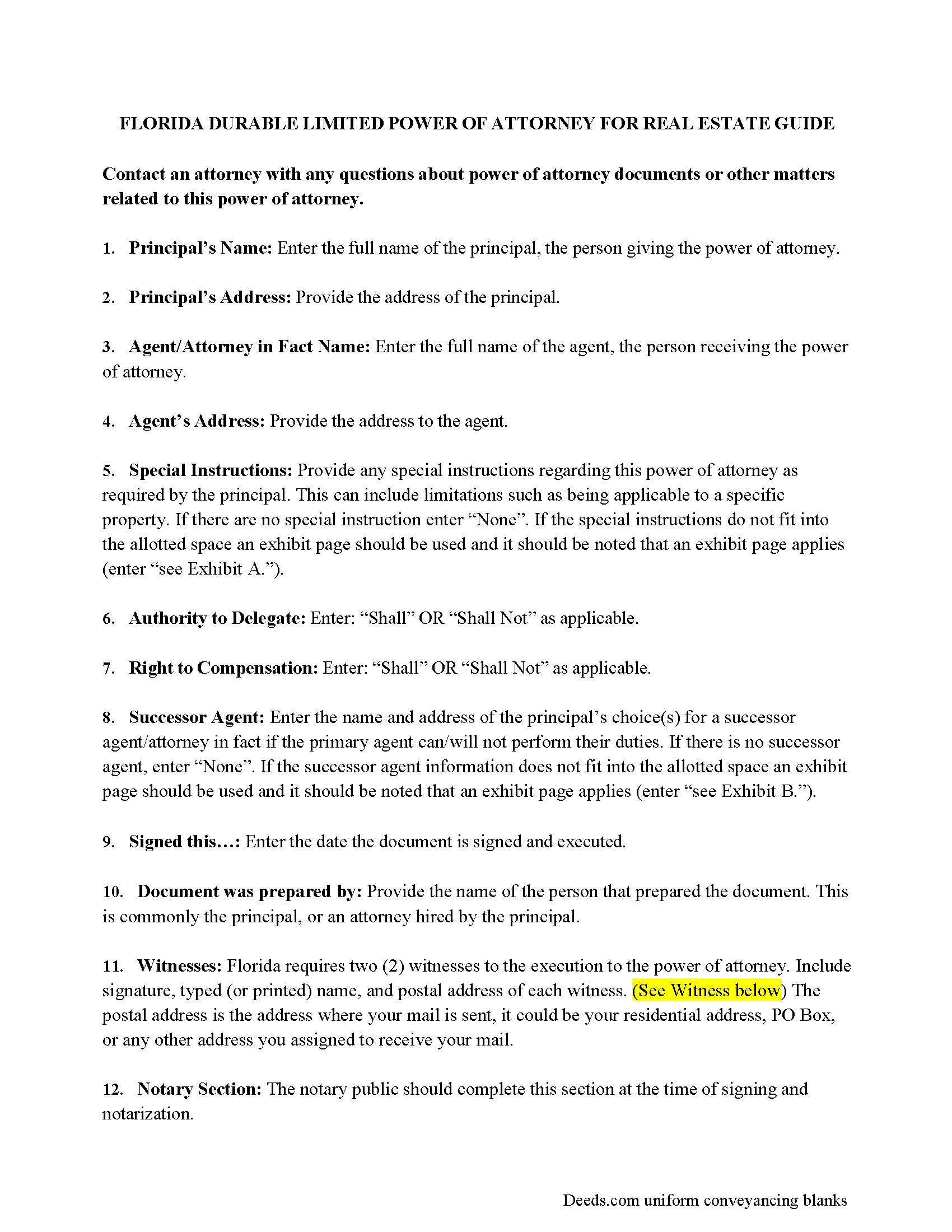

Saint Johns County Durable Limited Power of Attorney for Real Estate Guide

Line by line guide explaining every blank on the Durable Limited Power of Attorney for Real Estate form.

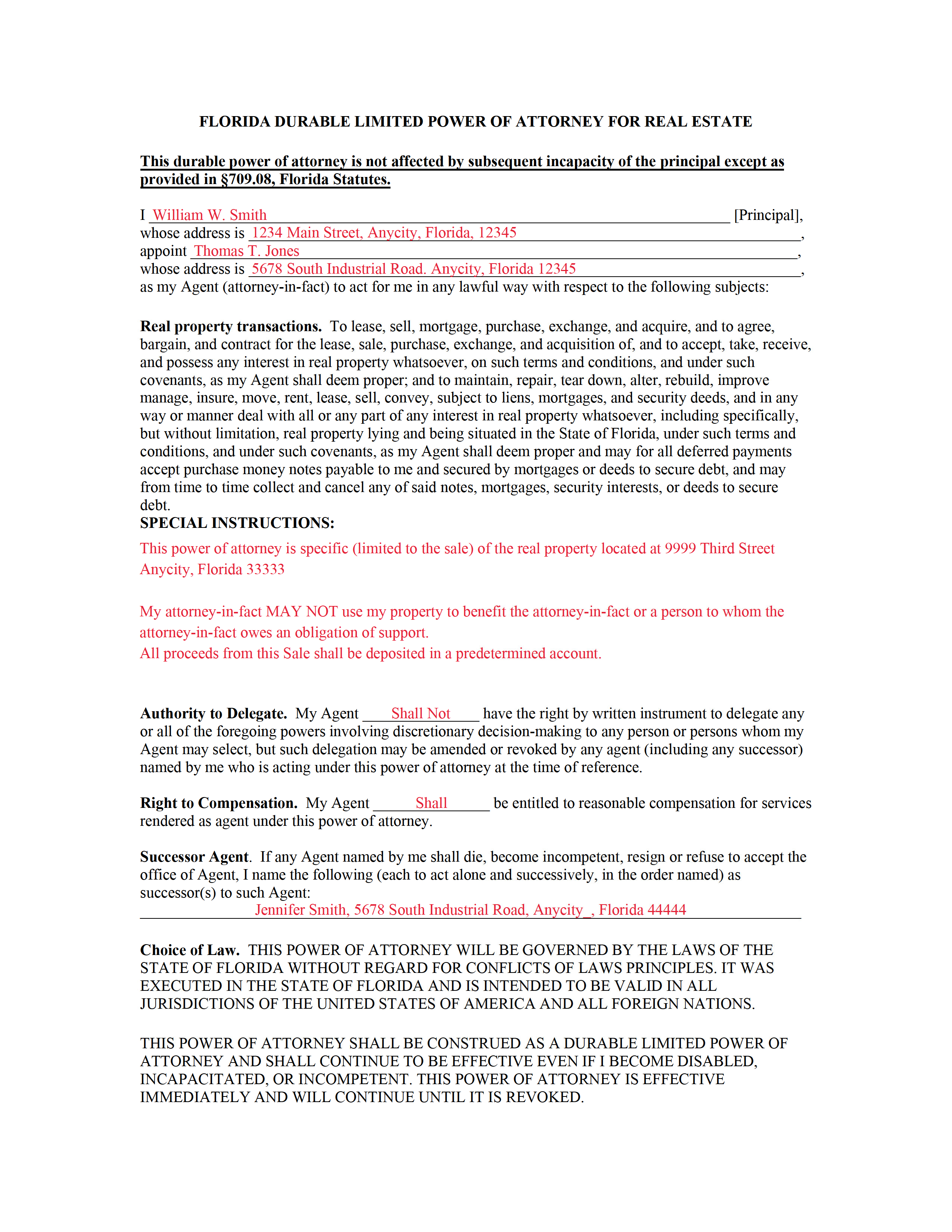

Saint Johns County Completed Example of the Durable Limited Power of Attorney for Real Estate Document

Example of a properly completed Florida Durable Limited Power of Attorney for Real Estate document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Florida and Saint Johns County documents included at no extra charge:

Where to Record Your Documents

St. Johns County Clerk of Courts

St. Augustine, Florida 32084

Hours: 8:00am-5:00pm M-F

Phone: (904) 819-3600 Press 6 for Recording

Recording Tips for Saint Johns County:

- Documents must be on 8.5 x 11 inch white paper

- Bring extra funds - fees can vary by document type and page count

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Saint Johns County

Properties in any of these areas use Saint Johns County forms:

- Elkton

- Hastings

- Jacksonville

- Ponte Vedra

- Ponte Vedra Beach

- Saint Augustine

- Saint Johns

Hours, fees, requirements, and more for Saint Johns County

How do I get my forms?

Forms are available for immediate download after payment. The Saint Johns County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Saint Johns County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Saint Johns County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Saint Johns County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Saint Johns County?

Recording fees in Saint Johns County vary. Contact the recorder's office at (904) 819-3600 Press 6 for Recording for current fees.

Questions answered? Let's get started!

This document creates (under the Florida Power of Attorney Act (Florida statute 709.2101 - 709.2402)) a durable, limited power of attorney for real estate. A power of attorney is a legal document delegating authority from one person to another. In the document, the maker of the power of attorney (the "principal") grants the right to act on the maker's behalf as that person's agent.

The document is specific to real estate (real property), and includes a section to included "specific instructions" to further limit the powers given.

This power of attorney must be signed by the principal and by two witnesses to the principal's signature, and a notary must acknowledge the principal's signature for the power of attorney to be properly executed and valid under Florida law.

Also included is an Affidavit and Acknowledgment of the agent.

This is a LIMITED power of attorney. What is a limited power of attorney? A "limited power of attorney" gives the agent authority to conduct a specific act. For example, a person might use a limited power of attorney to sell a home in another state by delegating authority to another person to handle the transaction locally. Such a power could be "limited" to selling the home or to other specified acts.

(Florida Durable Limited POA Package includes form, guidelines, and completed example)

Important: Your property must be located in Saint Johns County to use these forms. Documents should be recorded at the office below.

This Durable Limited Power of Attorney for Real Estate meets all recording requirements specific to Saint Johns County.

Our Promise

The documents you receive here will meet, or exceed, the Saint Johns County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Saint Johns County Durable Limited Power of Attorney for Real Estate form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Michael L. G.

October 1st, 2022

Thank you, Deed.com provided the needed forms to change county and state information after the passing of my father, saved me a trip to law office, especially after the lawyers would not return my calls, so I would recommend you check Deed.com for information, saved my family money for lawyer fees, would use Deed.com again. Mike

Thank you for your feedback. We really appreciate it. Have a great day!

Douglas D.

March 18th, 2021

WOW! What a great service! Incredibly fast (just under 3 hours from creating the package to getting a receipt from the county recorder!) Will definitely use this service again!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Roger G.

March 23rd, 2023

was difficult to find the location on the website to actually download the form I needed. Initially was directed only to information pages related to the form I needed

Thank you for your feedback. We really appreciate it. Have a great day!

Thomas W.

February 4th, 2020

The serevice was fast and accurate. I would highly recommend Deeds.com to my friends and associates.

Thank you!

James B.

January 18th, 2021

This was very easy to do. Great experience. These are the forms I needed. I would recommend these to anyone.

Thank you!

David M.

March 8th, 2023

Fast, reliable, up to date service that I've used several times in the past and will continue to use in the future.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jack S.

March 5th, 2019

Excellent and timely responses. Do you offer an annual rate? Thank you.

Thanks again Jack. Unfortunately we do not offer any annual rates or subscriptions, sorry.

John L.

April 22nd, 2023

WOW, This site saved me from going to a lawyer. Not only do they give you great directions, they also include a sample that is extremely helpful.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Teri A S.

November 21st, 2019

Received the quit claim form as ordered. Seemed clear and concise, easy to follow instructions and the completed example was helpful.

Thank you Teri, have a great day!

Jennifer O.

March 2nd, 2022

Quick, easy, affordable, eliminated the need for a lawyer.

Thank you for your feedback. We really appreciate it. Have a great day!

ANGELA S.

February 13th, 2020

My E-deed was not excepted by the county, so I had to snail mail the documents to the recorders office. Will probably not use this site again, as it did not fulfill my purpose, but would recommend to those who do not have complicated forms.

Thank you for your feedback. We really appreciate it. Have a great day!

Rebecca M.

December 28th, 2023

Great service! fast turnaround! I’ve used Deeds.com multiple times, and the software interface is easy to use. I was able to get Deeds for Nevada re-recorded (errors on my lawyers part), quickly with Deeds.com support. Thanks Deeds.com!!

It was a pleasure serving you. Thank you for the positive feedback!

Julia M.

June 26th, 2024

I live in AZ and have an existing beneficiary deed on my property. I needed to know the process of revoking a beneficiary deed. Your site was very helpful by providing the correct form and instructions for recording it. Thank you!

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!

Valerie S.

July 16th, 2020

The service was easy, fast, and cheap and we were able to close our sale 2 days after we downloaded the deed! Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Joyce F.

March 31st, 2019

The forms are simple to follow. I was hoping I would be able to add my personal info. That would make the forms even more simple.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!