Palm Beach County Personal Representative Deed (Intestate) Form

Palm Beach County Personal Representative Deed (Intestate) Form

Fill in the blank Personal Representative Deed (Intestate) form formatted to comply with all Florida recording and content requirements.

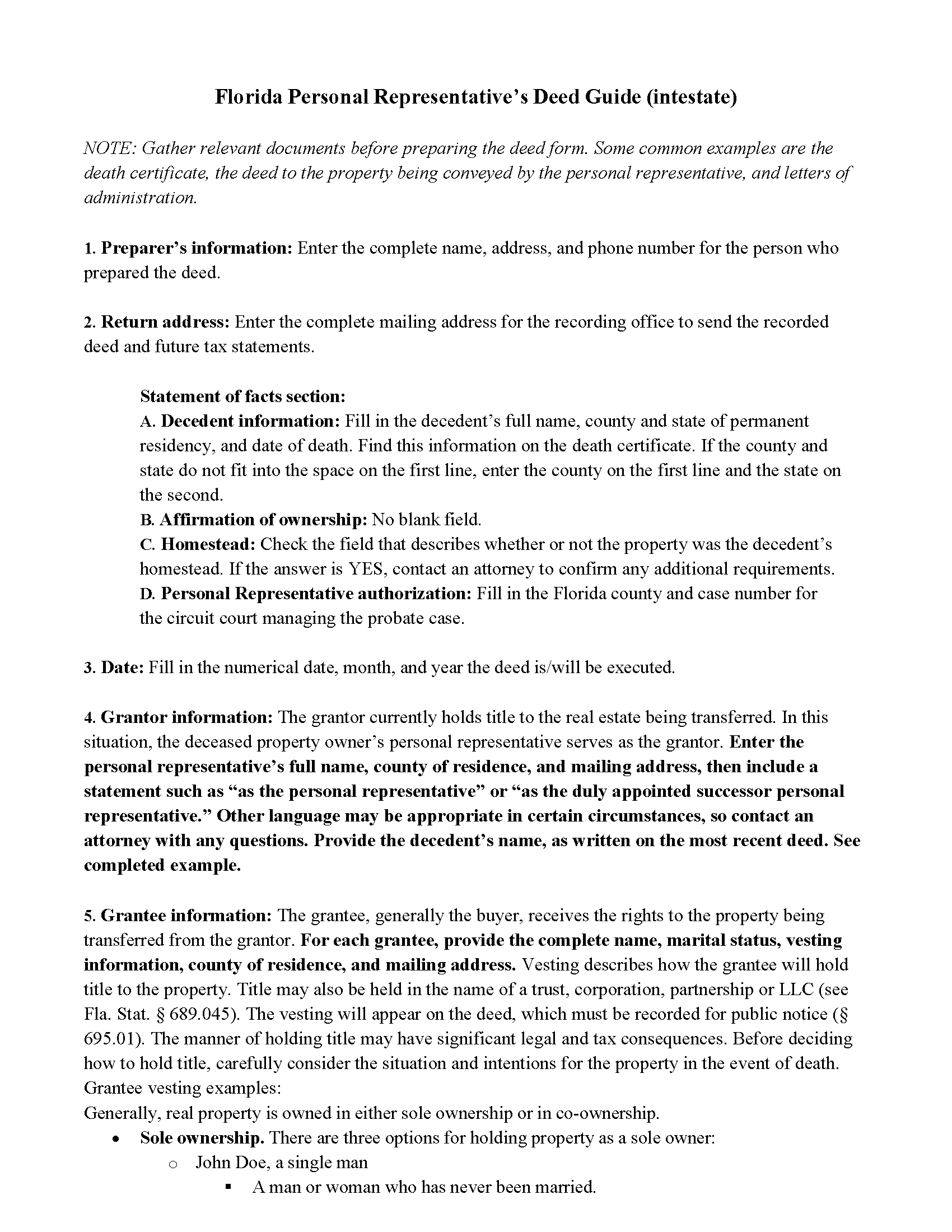

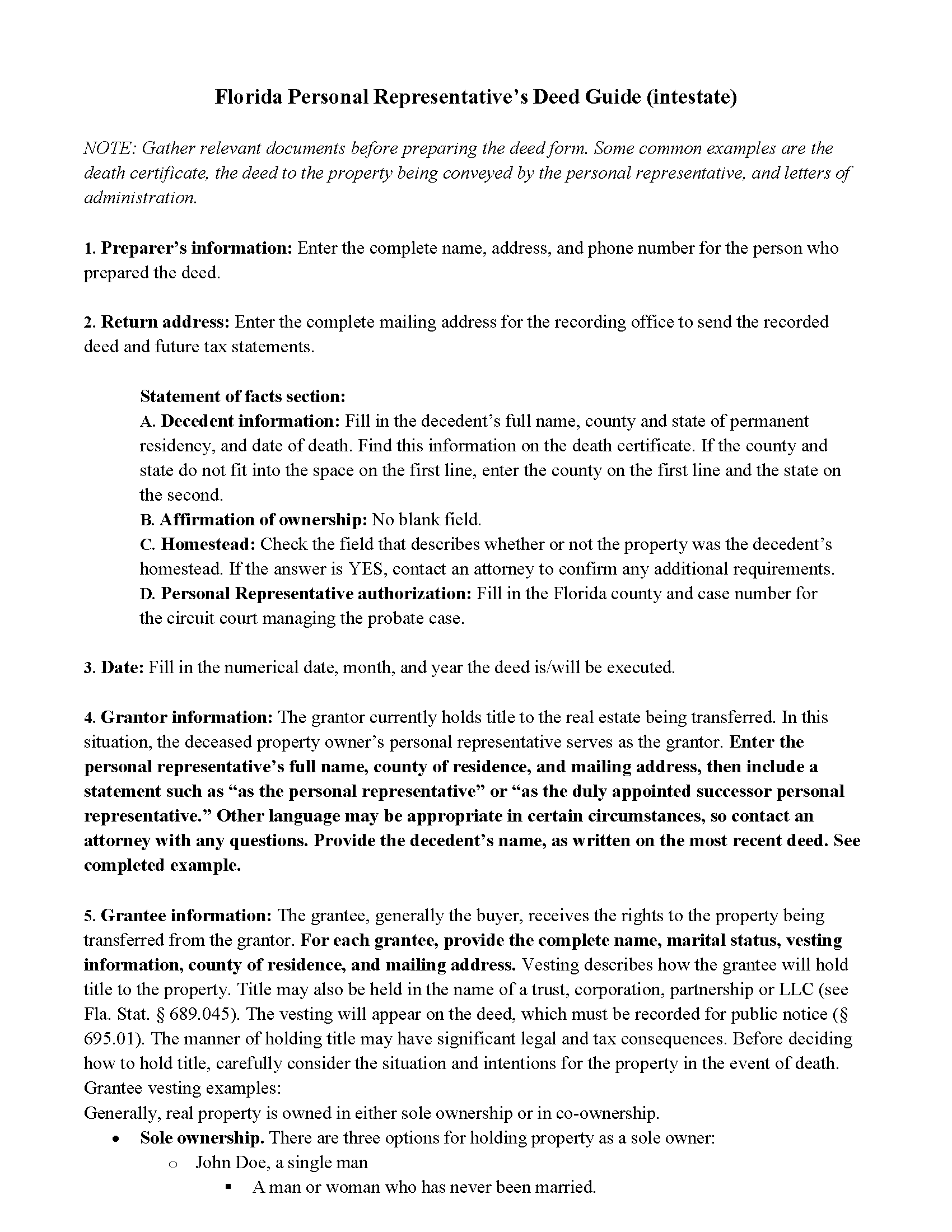

Palm Beach County Personal Representative Deed (Intestate) Guide

Line by line guide explaining every blank on the Personal Representative Deed (Intestate) form.

Palm Beach County Completed Example of the Personal Representative Deed (Intestate) Document

Example of a properly completed Florida Personal Representative Deed (Intestate) document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Florida and Palm Beach County documents included at no extra charge:

Where to Record Your Documents

County Clerk/Comptroller: Recording Dept - Main Courthouse

West Palm Beach, Florida 33401 / 33402-4177

Hours: 8:00am - 4:00pm M-F

Phone: (561) 355-2991

North County Courthouse

Palm Beach Gardens, Florida 33410

Hours: 8:00 to 4:00 M-F

Phone: Document drop-off only

South County Courthouse

Delray Beach, Florida 33444

Hours: 8:00 to 4:00 M-F

Phone: Document drop-off only

West County Courthouse

Belle Glade, Florida 33430

Hours: 8:00 to 4:00 M-F

Phone: Document drop-off only

Midwestern Community Service Center

Royal Palm Beach, Florida 33411

Hours: 8:00 to 4:00 M-F

Phone: Document drop-off only

Recording Tips for Palm Beach County:

- Verify all names are spelled correctly before recording

- Check margin requirements - usually 1-2 inches at top

- Recording fees may differ from what's posted online - verify current rates

Cities and Jurisdictions in Palm Beach County

Properties in any of these areas use Palm Beach County forms:

- Belle Glade

- Boca Raton

- Boynton Beach

- Bryant

- Canal Point

- Delray Beach

- Jupiter

- Lake Harbor

- Lake Worth

- Loxahatchee

- North Palm Beach

- Pahokee

- Palm Beach

- Palm Beach Gardens

- Royal Palm Beach

- South Bay

- West Palm Beach

Hours, fees, requirements, and more for Palm Beach County

How do I get my forms?

Forms are available for immediate download after payment. The Palm Beach County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Palm Beach County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Palm Beach County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Palm Beach County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Palm Beach County?

Recording fees in Palm Beach County vary. Contact the recorder's office at (561) 355-2991 for current fees.

Questions answered? Let's get started!

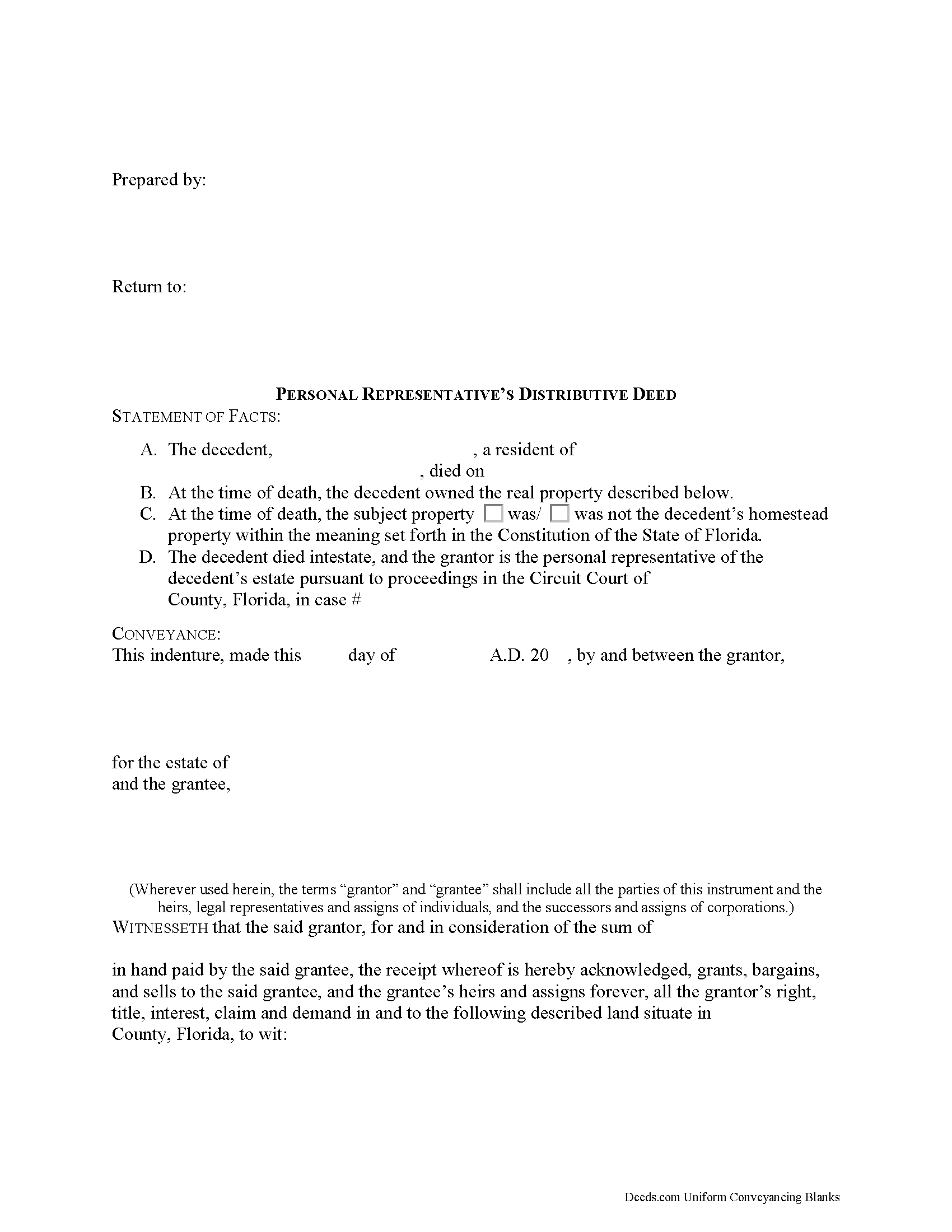

Florida Personal Representative's Distributive Deed (intestate)

This form is for use by the personal representative of an individual who died without a will.

Wills, or last wills and testaments, are estate planning documents used to organize and record how people wish to distribute their assets after death. If someone dies without executing and filing a will, their estate is identified as "intestate."

Without a will to manage this distribution, a personal representative is designated by the county Circuit Court. Because the personal representative in such situations is appointed, sales of assets are generally authorized by the court handling the probate case.

Real estate is a common asset, and with proper approval, a personal representative's distributive deed can be used if the personal representative is called upon to sell the property. These instruments are useful because they collect the relevant details about the transfer and the deceased owner into one document.

Personal representative's distributive deeds are used to transfer ownership of real property from an intestate estate. Each situation is unique, however, so contact an attorney with specific questions or for complex cases.

(Florida Personal Representative Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Palm Beach County to use these forms. Documents should be recorded at the office below.

This Personal Representative Deed (Intestate) meets all recording requirements specific to Palm Beach County.

Our Promise

The documents you receive here will meet, or exceed, the Palm Beach County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Palm Beach County Personal Representative Deed (Intestate) form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4600 Reviews )

Ronald C.

January 31st, 2019

My goal was to find the Covenant, Conditions, and Restrictions for my HOA. From what I can read, these documents should be attached to our Deed (single family, patio home in New Hanover County). I am not sure if I have a copy of my Deed. I would need to check my Safe Deposit Box. Unfortunately, I was not successful at finding these documents from your Website. If you can help me find them, I would appreciate that.

It is most common to obtain a copy of CC&Rs directly from the HOA. Alternatively, they are also usually a matter of public record recorded with the local recorder and you can obtain a copy there.

Caroline W.

June 30th, 2019

They didn't have what I needed, but they were very quick in responding to let me know and where I needed to go to receive the desired information.

Thank you for your feedback Caroline.

Thomas V.

January 7th, 2019

Easy to use. Accomplished my goal

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Westcliffe C.

November 3rd, 2022

Like the setup Good idea on forms that help at a great price

Thank you for your feedback. We really appreciate it. Have a great day!

Herbert R.

November 12th, 2022

Your website was very helpful. Hopefully, I will have it completed correctly prior to use.

Thank you for your feedback. We really appreciate it. Have a great day!

Maryel T.

December 23rd, 2018

Good site, had the information I needed. Quicker than I expected. Thanks.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Paul R.

October 22nd, 2021

Worked very quickly and smoothly. Helps if you know what documents you need. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Clifford J.

July 4th, 2022

a lil pricey but i was able to knock out what needed to be done within 2 hours and not all day.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Melody P.

April 29th, 2021

Thanks again for such great service!

Thank you!

Javel L.

November 28th, 2019

The idea is great. I was not able to have my deed retrieved. Would have needed a verifies copy anyway.

Thank you for your feedback. We really appreciate it. Have a great day!

Jennifer R.

January 8th, 2022

The recording service has been very easy to use. It is efficient and no hassle.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Eppie G.

October 19th, 2021

Perfect

Thank you!

JoAnn S.

July 31st, 2021

Easy to process orders.

Thank you!

George W.

April 2nd, 2020

The process was easy and the forms were a very complete package. FAST AND EASY DOWNLOAD

Thank you George.

Jeffrey T.

December 1st, 2022

First Time User here. Simple and easy. Delivered Deed in excellent time. Sure beats going to the recorder's office.

Thank you for your feedback. We really appreciate it. Have a great day!