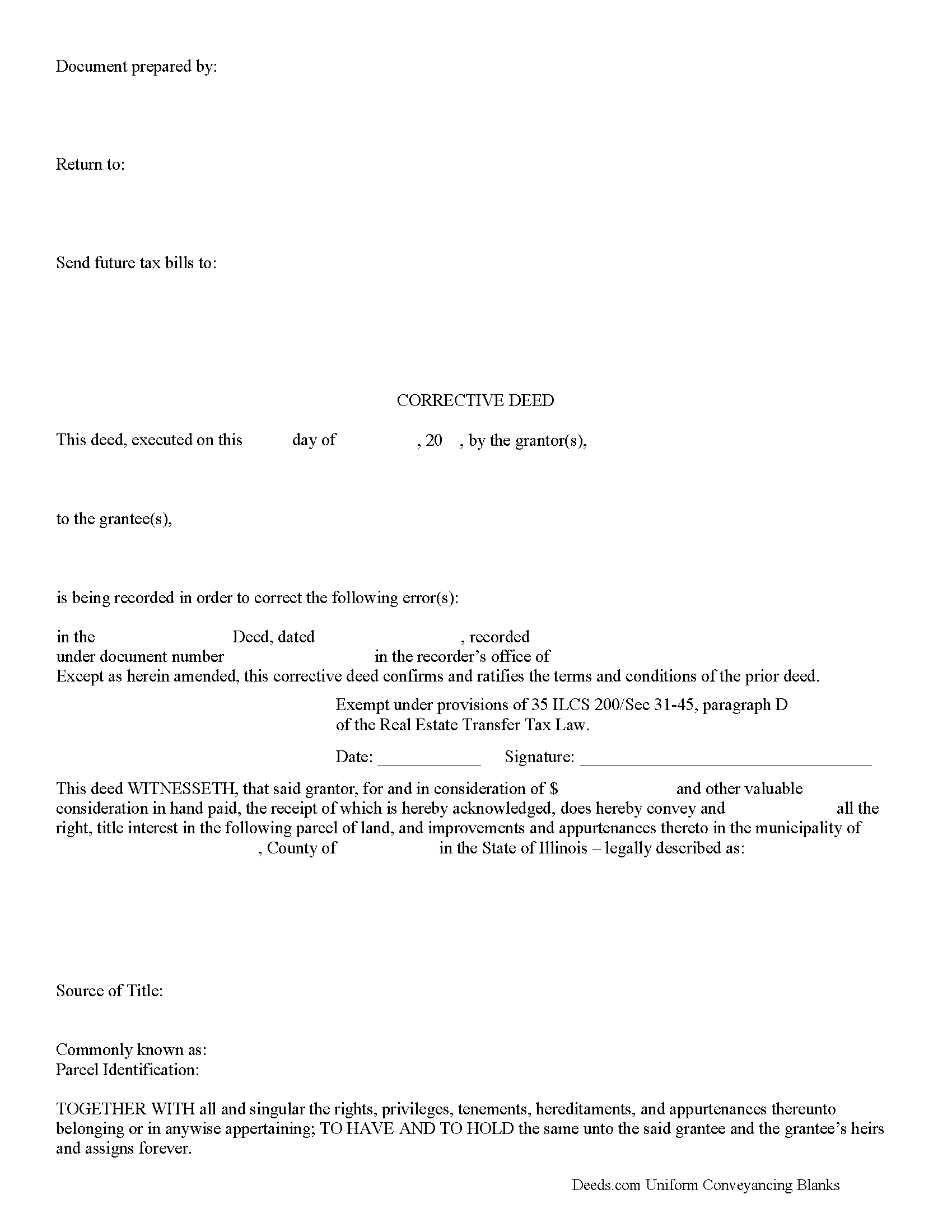

Warren County Correction Deed Form

Warren County Correction Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

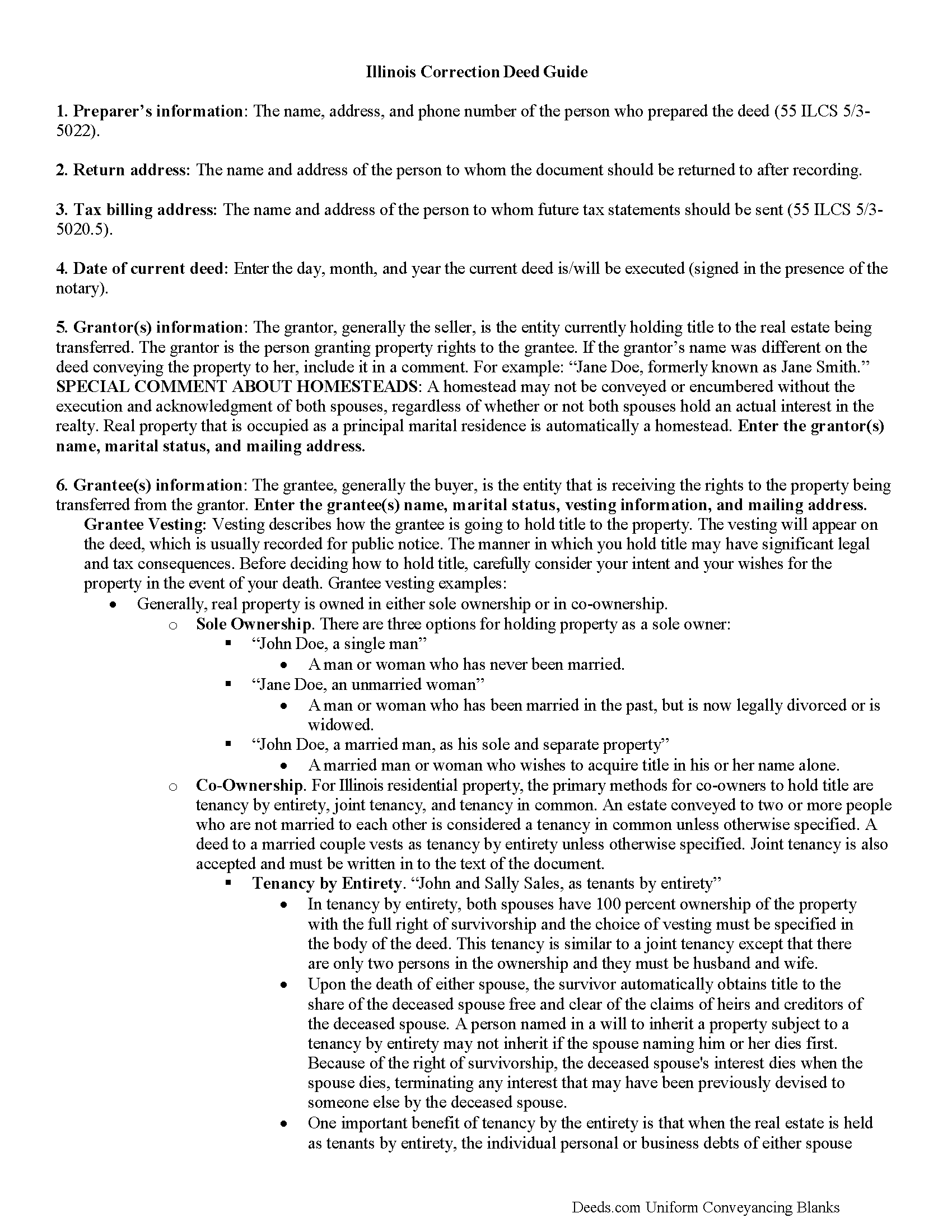

Warren County Correction Deed Guide

Line by line guide explaining every blank on the form.

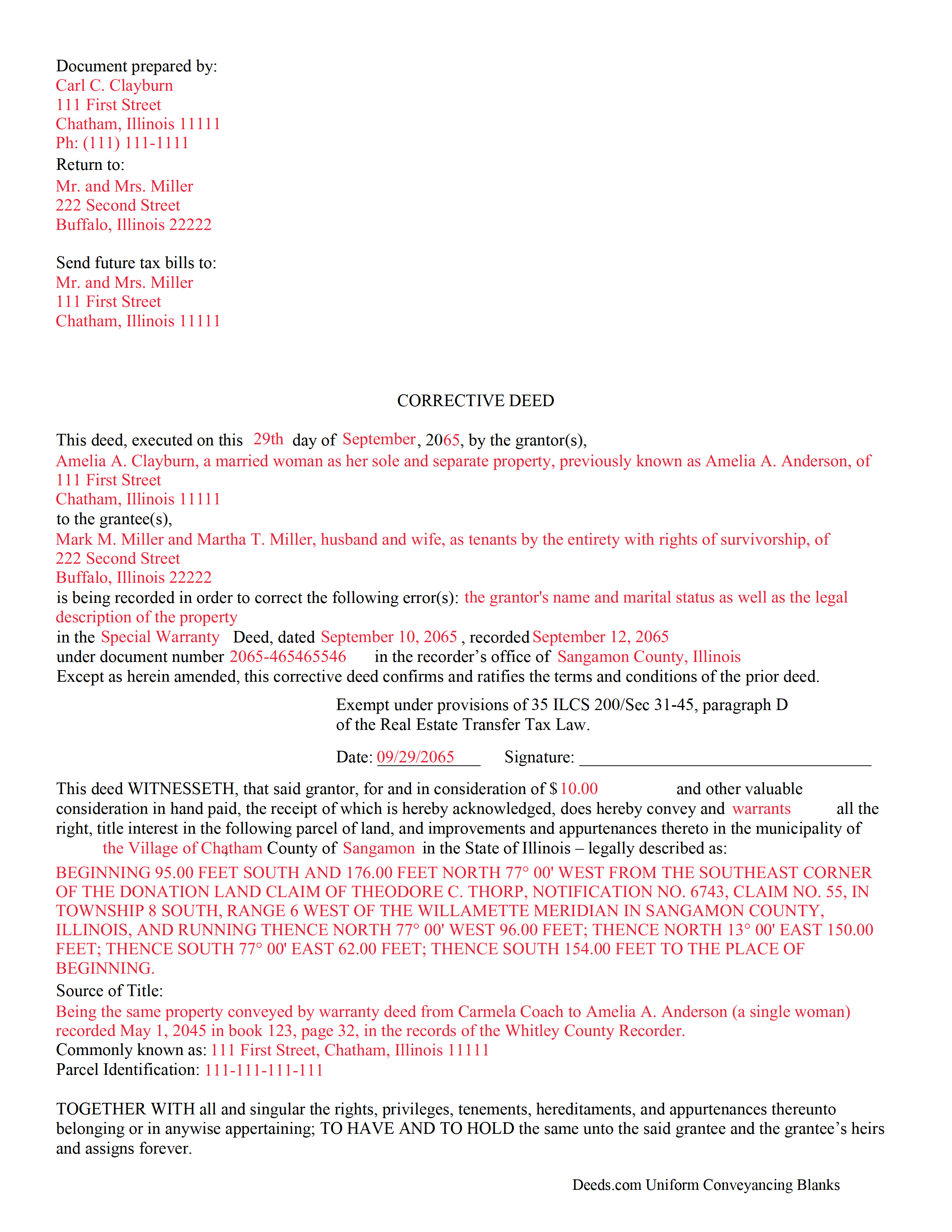

Warren County Completed Example of the Correction Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Illinois and Warren County documents included at no extra charge:

Where to Record Your Documents

Warren County Clerk / Recorder

Monmouth, Illinois 61462

Hours: 8:00am to 4:30pm M-F

Phone: (309) 734-8592

Recording Tips for Warren County:

- Ensure all signatures are in blue or black ink

- Ask if they accept credit cards - many offices are cash/check only

- Both spouses typically need to sign if property is jointly owned

- Consider using eRecording to avoid trips to the office

Cities and Jurisdictions in Warren County

Properties in any of these areas use Warren County forms:

- Berwick

- Cameron

- Gerlaw

- Kirkwood

- Little York

- Monmouth

- Roseville

- Smithshire

Hours, fees, requirements, and more for Warren County

How do I get my forms?

Forms are available for immediate download after payment. The Warren County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Warren County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Warren County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Warren County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Warren County?

Recording fees in Warren County vary. Contact the recorder's office at (309) 734-8592 for current fees.

Questions answered? Let's get started!

Use a correction or corrective deed to clear up a title flaw in a deed recorded in Illinois. This form allows for correction of errors in one or multiple sections of the deed.

When correcting an error in a deed in Illinois, there are two basic options: 1) re-record the original deed with corrections made on the face of it by striking out the wrong item; or 2) record a correction or corrective deed. While some counties prefer re-recording the original deed, others recommend the cleaner recording of a new deed. So it is always a good idea to check with the local recorder's office. The gravity of the error and correction it requires also will determine which option to choose. Use the re-recording of the original deed primarily for smaller typographical mistakes.

When correcting a minor error and re-recording the prior deed, use the original deed only, strike through the wrong information, and write the correction down close to it and by hand. Usually, a cover page must be added, stating the important identifiers, as well as the reason for re-recording. For a more involved error, the correction deed might be a better option. Except for the corrected error, it restates and confirms all information of the prior deed, referencing it by date, recording number, and identifying the corrected error by type. In terms of recording fees, there may be a small difference between the two options in some counties.

A corrective deed is exempt from transfer tax according to 35 ILCS 200/35-41 (d). Add a sentence stating this exemption to the cover page when re-recording the original deed. On the corrective deed form, a tax statement, along with a line for the signature of the buyer, seller, or a representative, serves that purpose.

(Illinois Correction Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Warren County to use these forms. Documents should be recorded at the office below.

This Correction Deed meets all recording requirements specific to Warren County.

Our Promise

The documents you receive here will meet, or exceed, the Warren County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Warren County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Aubrey M.

May 31st, 2020

I am an attorney who was trying to draft some deeds in arizona. The deed templates coupled with the document instructions saved me hours work. At 1st I was skeptical, so spent hours figuring out how to draft the documents, but could have saved so much time If I had just spend the $20 sooner. Would use again is needed a deed format as a basis for my drafting.

Thank you for your feedback. We really appreciate it. Have a great day!

Michael H.

July 30th, 2019

Found documents I needed quickly and at a reasonable price. MH

Thank you for your feedback. We really appreciate it. Have a great day!

matt k.

March 16th, 2022

you guys/girls are the bestest..

Thank you!

George S.

September 16th, 2021

Excellent product- very easy to use. Will use again...

Thank you for your feedback. We really appreciate it. Have a great day!

Robert W.

January 18th, 2019

Perfect timing. Everything was consistent and timely.

Thank you Robert, we appreciate your feedback.

Jill R.

May 12th, 2025

So helpful and extremely responsive. Such a convenient way to record deeds.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Meg R.

August 19th, 2020

Good system fairly easy to use

Thank you!

Helen H.

August 31st, 2022

I had a notary to read over my quitclaim deed and she said it looked good. So I am pleased.

Thank you!

CHERI I.

August 4th, 2021

I was so pleased with how easy this form was to download and print! Thank you and I am sure we will use you again in the future!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Marjorie K.

August 13th, 2021

This was super easy to use, especially if you remember to look for a downloaded PDF file, not a Word file. Found the files right away after the light bulb went on! Thank you!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Hilary C.

October 9th, 2020

Within 10 minutes I had my Deed!!! Fantastic!!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Leonard N.

January 21st, 2021

Nice and clear. Can't wait to process the completed documents at the Recorder's Office

Thank you!

Barbara S.

February 28th, 2019

I had an issue due to the fact that I had many beneficiaries. I was and still am not sure how to handle this. We do have Adobe Pro and can modify the form, if needed. But I would like to talk to your organization for more information.

While we are unable to assist you specifically with completing the document we can note that this is addressed in the guide. Information that does not fit in the available space should be included in an exhibit page.

Stephen W.

May 16th, 2020

It provided the forms I could not find elsewhere. Thank you.

Thank you!

SHARON D.

December 23rd, 2018

This is one of the easiest sites to purchase and download needed forms. I would highly recommend this site.

Thank you Sharon. We really appreciate you. Enjoy your holidays.