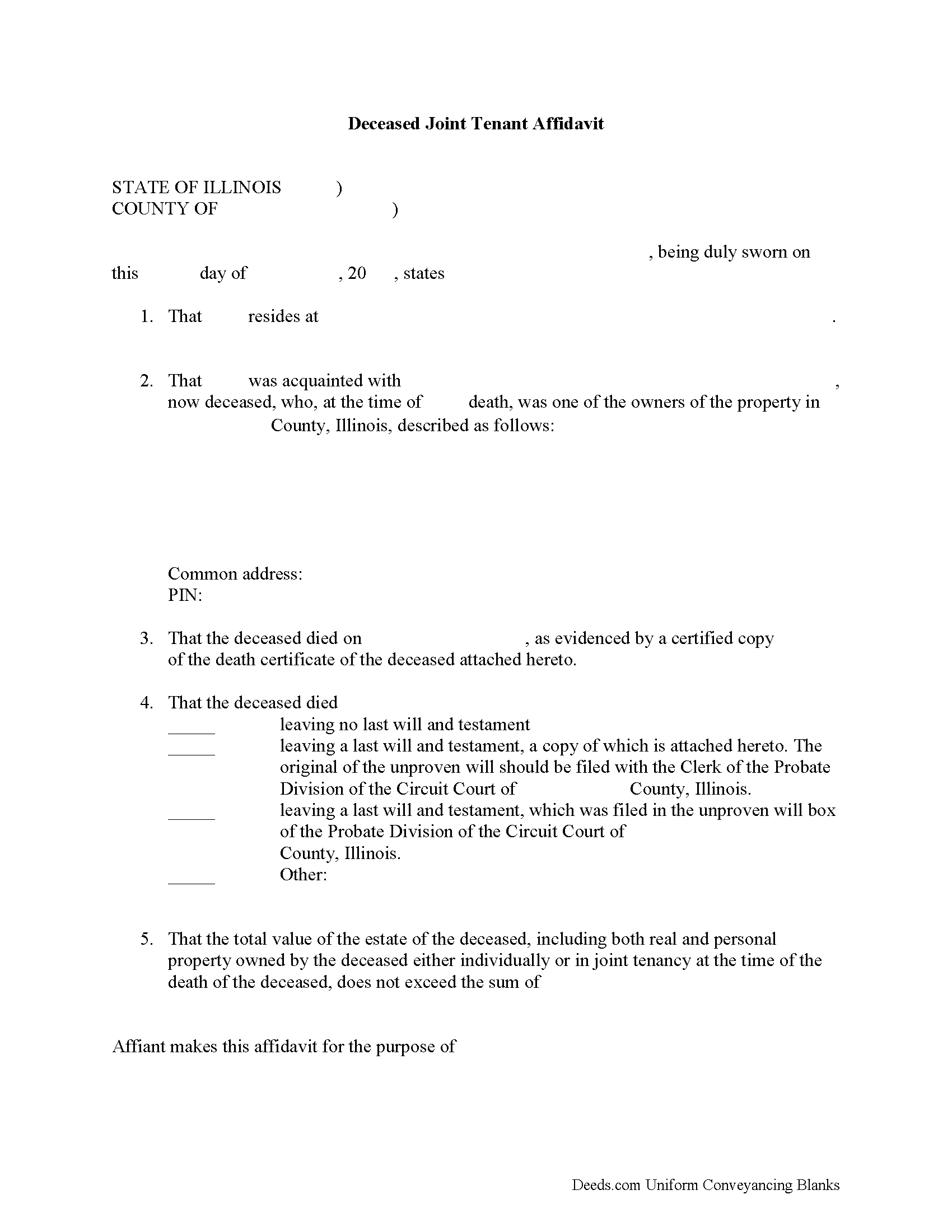

Saline County Deceased Joint Tenant Affidavit Form

Saline County Deceased Joint Tenant Affidavit Form

Fill in the blank form formatted to comply with all recording and content requirements.

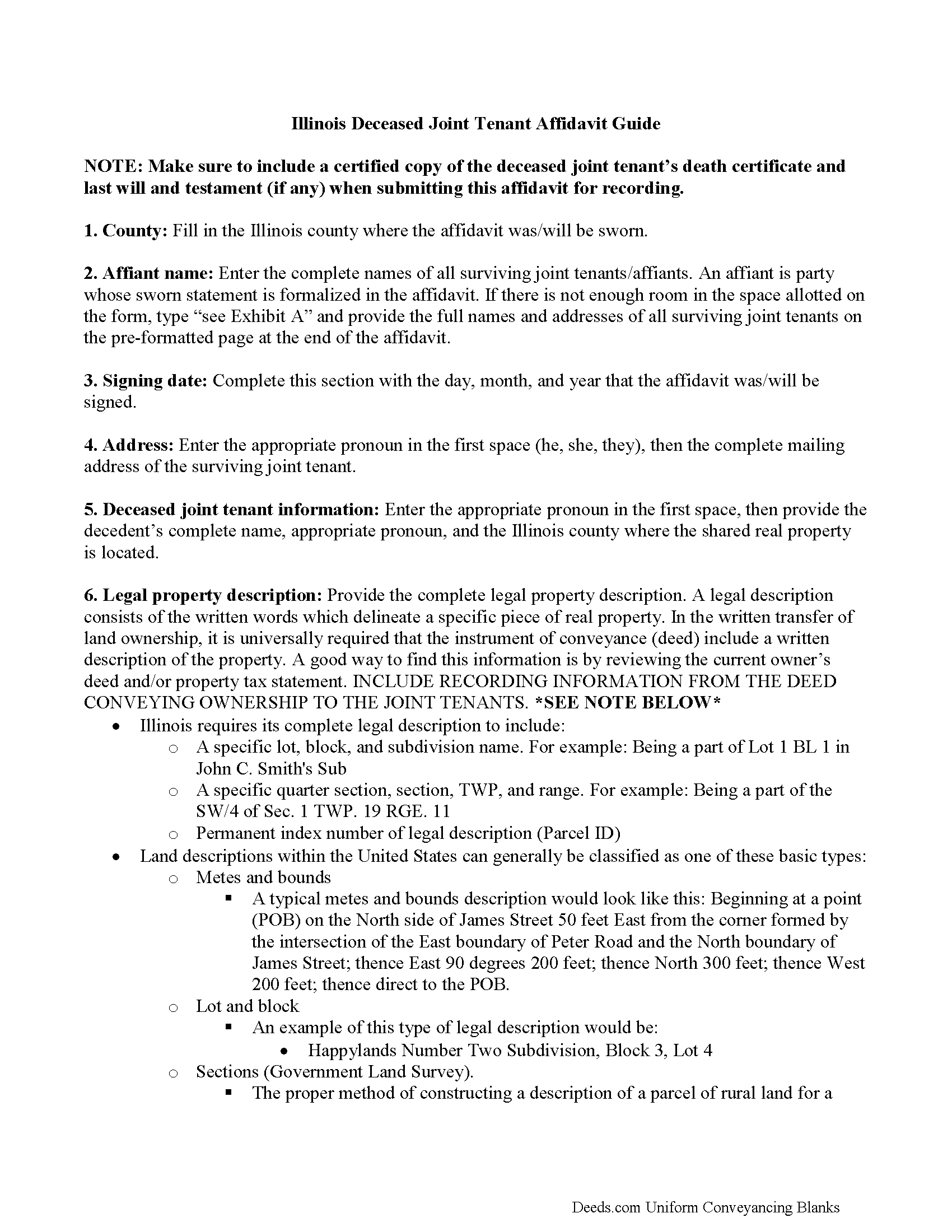

Saline County Joint Tenant Affidavit Guide

Line by line guide explaining every blank on the form.

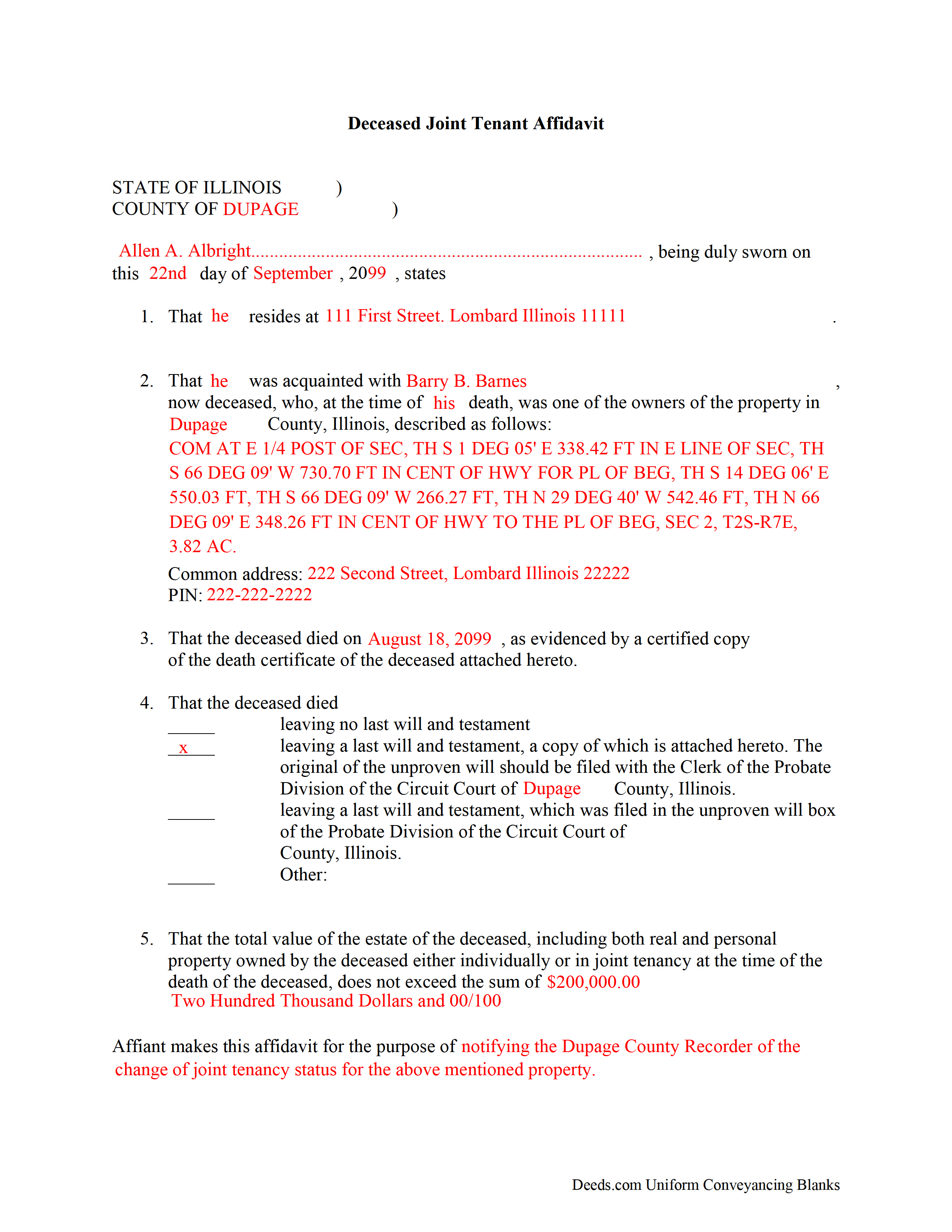

Saline County Completed Example of the Deceased Joint Tenant Affidavit Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Illinois and Saline County documents included at no extra charge:

Where to Record Your Documents

Saline County Clerk/Recorder - County Courthouse

Harrisburg, Illinois 62946

Hours: 8:00 to 4:00 M-F

Phone: (618) 253-8197

Recording Tips for Saline County:

- Documents must be on 8.5 x 11 inch white paper

- Request a receipt showing your recording numbers

- Both spouses typically need to sign if property is jointly owned

- Recording fees may differ from what's posted online - verify current rates

Cities and Jurisdictions in Saline County

Properties in any of these areas use Saline County forms:

- Carrier Mills

- Eldorado

- Galatia

- Harrisburg

- Muddy

- Raleigh

- Stonefort

Hours, fees, requirements, and more for Saline County

How do I get my forms?

Forms are available for immediate download after payment. The Saline County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Saline County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Saline County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Saline County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Saline County?

Recording fees in Saline County vary. Contact the recorder's office at (618) 253-8197 for current fees.

Questions answered? Let's get started!

Complete this affidavit and submit it, along with a certified copy of the decedent's death certificate (required) and last will and testament (if available), to the county office responsible for maintaining land records. Once recorded, it serves as public notice of the change in property ownership.

(Illinois Deceased Joint Tenant Package includes form, guidelines, and completed example)

Important: Your property must be located in Saline County to use these forms. Documents should be recorded at the office below.

This Deceased Joint Tenant Affidavit meets all recording requirements specific to Saline County.

Our Promise

The documents you receive here will meet, or exceed, the Saline County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Saline County Deceased Joint Tenant Affidavit form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

L B W.

January 22nd, 2021

Bottom line - it was certainly worth the $21 (+-?) I paid for the form and instructions, etc. Admittedly the form is a little inflexible in terms of editing for readability but I understand that offering greater flexibility would likely make theft more likely. So I'm happy with what I got. One suggestion - add more info about what's required in the "Source of Title" section.

Thank you for your feedback. We really appreciate it. Have a great day!

Christine L.

April 18th, 2019

I would like the ability to edit the document.

Thank you for your feedback Christine.

Jane N.

February 17th, 2022

Good morning, It seems to be easy to navigate and print out the form I needed. Great!!! Jane

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lawrence D.

March 14th, 2019

My first time using it; very fast service. I am an estate planning attorney (44 years). None of my old title company contacts are around anymore to provide deed copies, so this is a great source. I will be using it again.

Thank you Lawrence, we appreciate your feedback. Have a fantastic day!

Stephen N.

February 11th, 2021

Excellent service.

Thank you!

Abigail Frances B.

December 28th, 2018

Thanks for the easy download, clear instructions, good price- I'm looking forward to filling them out.

Thank you for your feedback. We really appreciate it. Have a great day!

Beata K.

November 14th, 2019

Loved it! Extremely easy to use. Quick and efficient. I was able to officially record my documents within a day.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

JOYCE R.

June 25th, 2019

I am a tax attorney and had worked as a Valuation Engineer with Internal Revenue Service. I can access (almost immediately) complete title reports and transactions history of real estate transfers. It is a joy to have access to your valuable service. JOYCE REBHUN,JD,MBA,PhD,EA

Thank you for your feedback. We really appreciate it. Have a great day!

Cecelia C.

December 16th, 2021

Service was fantastic. So helpful and they promptly get back with you. No reason to drive if you are out of state and need to get a deed filed. Safe way to file if you don't want to go to public office or can't physically get there.

Thank you for your feedback. We really appreciate it. Have a great day!

John V. B.

April 11th, 2019

I have not yet used the site however, I feel that this site could be a big asset to the genealogical community. It is well laid out thus easy to use.

Thank you for your feedback. We really appreciate it. Have a great day!

Joseph P.

April 28th, 2023

I purchased the Affidavit of Surviving Joint Tenant document and found the whole package of documents to be useful and practical. Successfully recorded!!! While the fillable PDF files are good enough, I personally prefer a Word document as it is easier to modify font or spacing.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mallah B.

October 7th, 2021

I think this company offers a great service that is non-discriminatory and allows me to save time going downtown and hassle dealing with different personalities.

Thank you for your feedback. We really appreciate it. Have a great day!

William S C.

June 11th, 2021

The Lady Bird Deed appears to be fine with me as are the instructions. However, there apparently are no specific laws in Texas addressing them other than they are OK. The problem is that lenders are surely going to use them as triggers for their due on sale clauses, especially as the current small mortgage rates begin to increase. The solution to that seems to be to sign and have them notarized, but not to record them unless the holder needs to enforce the provisions. It seems to me that you should consider your solution to that problem in your instructions.

Thank you for your feedback. We really appreciate it. Have a great day!

Charles F.

April 28th, 2020

Hi Please do not take time to respond to my previous inquiry - - - I figured it out. Deeds.com is a great tool for those of us who have occasional need for your type of services. Thanks ! Chuck

Thank you!

TAMARA B.

December 17th, 2020

Great service

We appreciate your business and value your feedback. Thank you. Have a wonderful day!