Shelby County Executor Deed Form

Shelby County Executor Deed Form

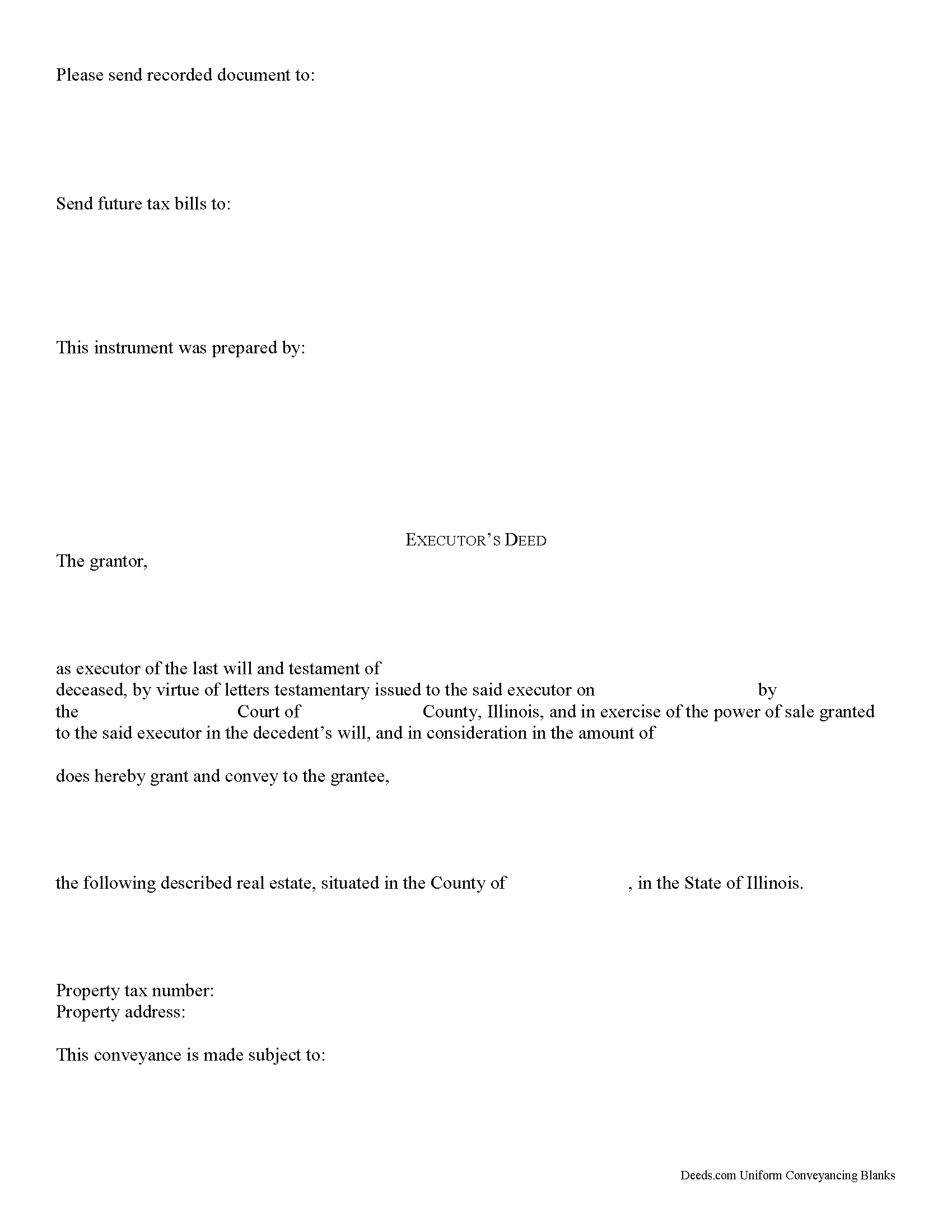

Fill in the blank form formatted to comply with all recording and content requirements.

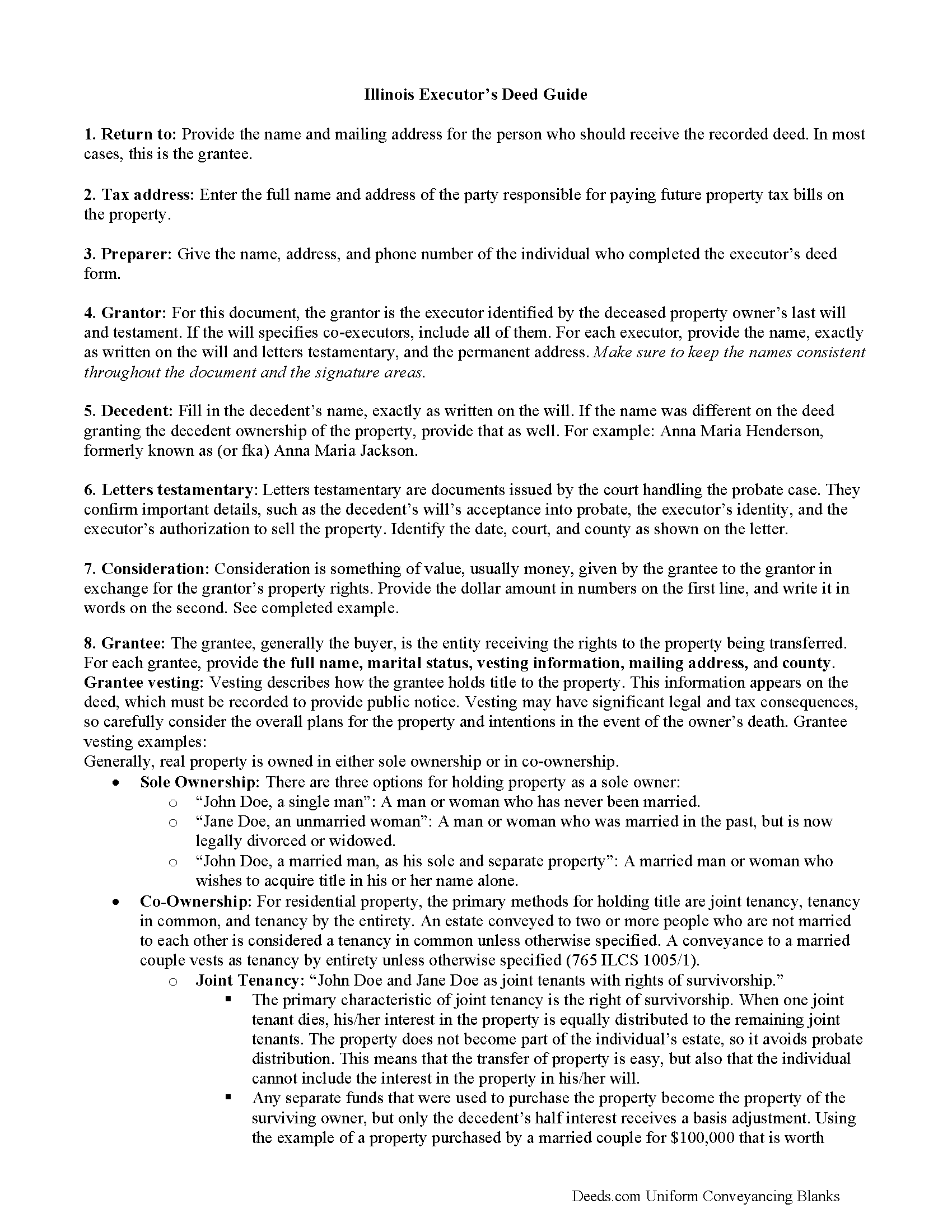

Shelby County Executor Deed Guide

Line by line guide explaining every blank on the form.

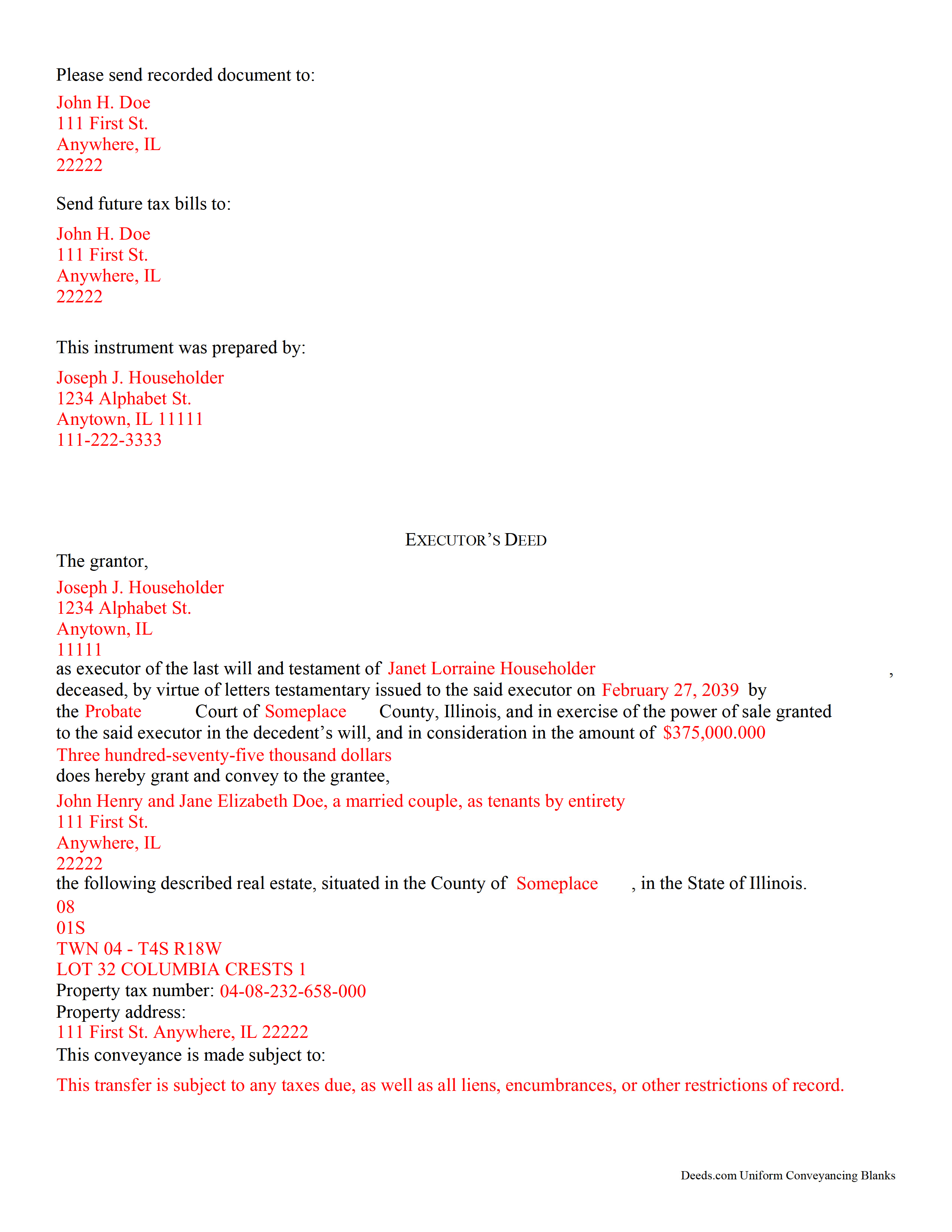

Shelby County Completed Example of the Executor Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Illinois and Shelby County documents included at no extra charge:

Where to Record Your Documents

Shelby County Clerk/ Recorder

Shelbyville, Illinois 62565

Hours: 8:00 to 4:00 M-F

Phone: (217) 774-4421

Recording Tips for Shelby County:

- White-out or correction fluid may cause rejection

- Bring extra funds - fees can vary by document type and page count

- Recorded documents become public record - avoid including SSNs

Cities and Jurisdictions in Shelby County

Properties in any of these areas use Shelby County forms:

- Cowden

- Findlay

- Herrick

- Lakewood

- Mode

- Oconee

- Shelbyville

- Sigel

- Stewardson

- Strasburg

- Tower Hill

- Windsor

Hours, fees, requirements, and more for Shelby County

How do I get my forms?

Forms are available for immediate download after payment. The Shelby County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Shelby County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Shelby County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Shelby County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Shelby County?

Recording fees in Shelby County vary. Contact the recorder's office at (217) 774-4421 for current fees.

Questions answered? Let's get started!

Find the laws governing the probate administration of real estate at 755 ILCS 5/20.

The executor of an estate is a person named in the decedent's will to manage the distribution of the estate's assets.

An executor's deed is a special document used by the executor of a decedent's estate to transfer real property out of that estate. This document must meet the same form and content standards as so-called "regular" warranty or quitclaim deeds, and incorporate additional information related to the specific transaction. The details may vary based on the situation, but typically include facts about the decedent and the nature of the probate case. (765 ILCS 5/12)

Depending on the case, the executor might include documents such as letters from the probate court or a certified copy of the death certificate when recording the deed. Consult with the court officer or attorney supervising the distribution to confirm which, if any, supporting documentation might be required. After the deed is executed (signed in front of a notary), confirm it with the court if necessary, then file it in the public records for the Illinois county where the property is located.

This information applies to many, but not all, situations. Contact an attorney or the probate court officer responsible for the case with specific questions.

(Illinois Executor Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Shelby County to use these forms. Documents should be recorded at the office below.

This Executor Deed meets all recording requirements specific to Shelby County.

Our Promise

The documents you receive here will meet, or exceed, the Shelby County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Shelby County Executor Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

ERHAN S.

February 3rd, 2023

amazing time and cost saving service for me. Thank you.

Thank you!

ROBERT K.

April 12th, 2021

It was so easy to obtain the necessary documents.

Thank you for your feedback. We really appreciate it. Have a great day!

Catherine J S.

November 17th, 2022

Did not like that the lines aren't lining up smoothly to make the document look more professional.

Thank you for your feedback. We really appreciate it. Have a great day!

Larry B.

September 30th, 2020

Clear Directions; worked well.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Marsha D.

September 25th, 2020

Outstanding product and so easy to use! Highly recommend this product. We successfully used the Virginia deeds. Thank you.

Thank you!

jerry k.

May 27th, 2021

very easy to download, works great

Thank you for your feedback. We really appreciate it. Have a great day!

Virginia P.

December 10th, 2019

Not user friendly despite additional guide. There are other products out there that are superior. A waste of $20.

Sorry to hear that Virginia. Your order and payment has been canceled. We do hope that you find something more suitable to your needs elsewhere. Have a wonderful day.

Lanette H.

September 9th, 2020

I liked getting the forms but I was charged twice for some reason. I'm not sure what happened with that. Can you reimburse me? Thank you. Lanette

Thank you for your feedback Lanette. In review, it looks like your first payment was declined, second one was approved and processed. What you are seeing is one payment and a hold placed by your financial institution for the declined attempt. We are not sure why they do this but the hold usually falls off after a few day depending on their policy. If you have further questions about this you can contact your financial institution and they will explain. Have a great day.

Samantha A.

June 9th, 2022

Its exactly what it said it was. I received multiple downloads, loaded fast and was pretty easy to navigate.

Thank you for your feedback. We really appreciate it. Have a great day!

Marilyn S.

January 7th, 2021

I was fine. But I don't like surveys.

Thank you!

LISA B.

December 5th, 2019

GOT WHAT I NEEDED FORMS WORKED FINE.

Thank you!

Kim P.

July 23rd, 2021

I want to thank you so much. You made a stressful process easy. The customer service was amazing. There is no doubt I will use your service again.

Thank you!

Richard D.

January 18th, 2019

We are pleased with your service. It is user friendly and efficient,

Thank you!

Jenifer L.

January 2nd, 2019

I'm an attorney. I see youve mixed up the terms "grantor" and "grantee" and their respective rights in this version. Anyone using it like this might have title troubles down the line.

Thank you for your feedback Jenifer, we have flagged the document for review.

David P.

August 26th, 2020

Easy to use and very straight forward. Glad I used Deeds.com

We appreciate your business and value your feedback. Thank you. Have a wonderful day!