Saline County Mineral Deed with Quitclaim Covenants Form

Saline County Mineral Deed with Quitclaim Covenants Form

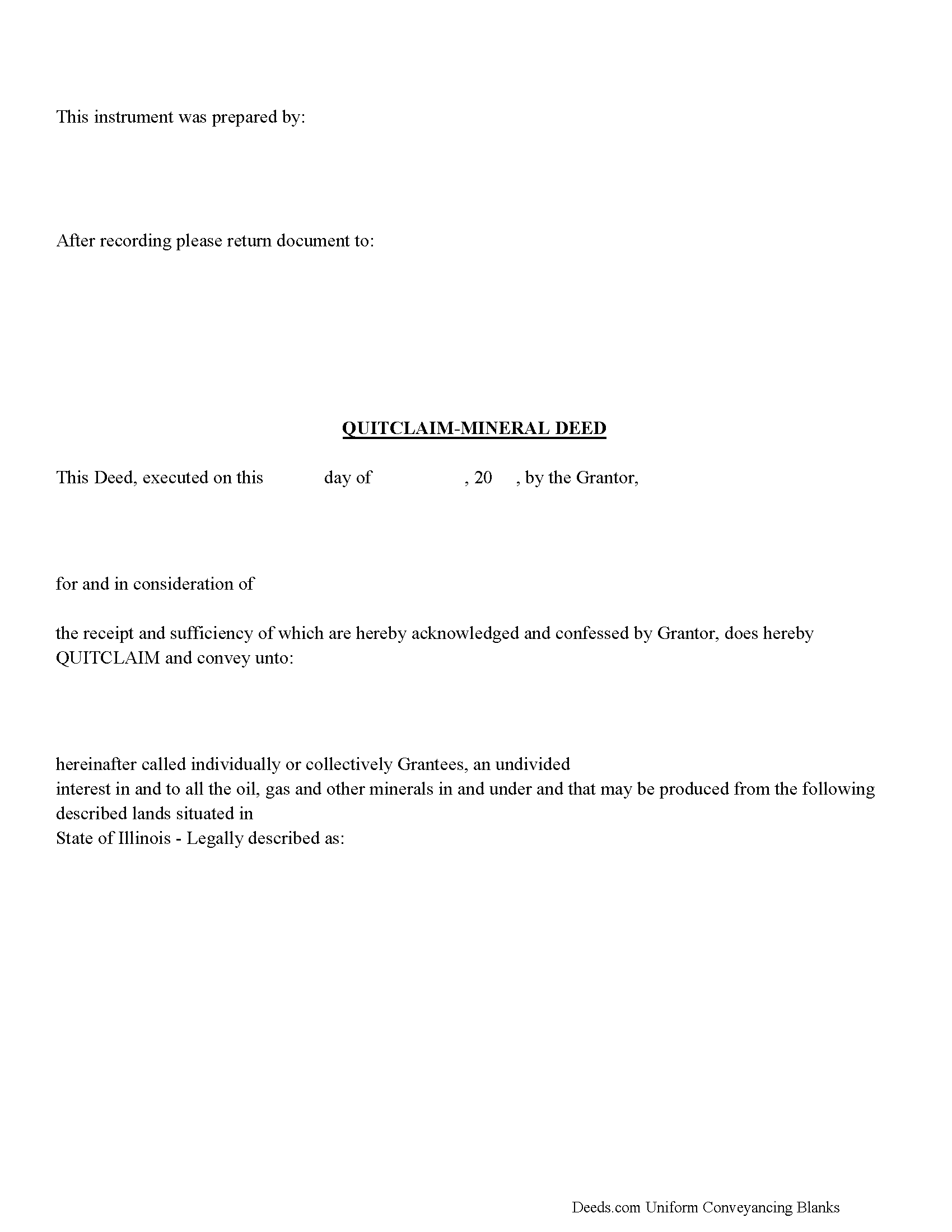

Fill in the blank Mineral Deed with Quitclaim Covenants form formatted to comply with all Illinois recording and content requirements.

Saline County Mineral Deed with Quitclaim Covenants Guide

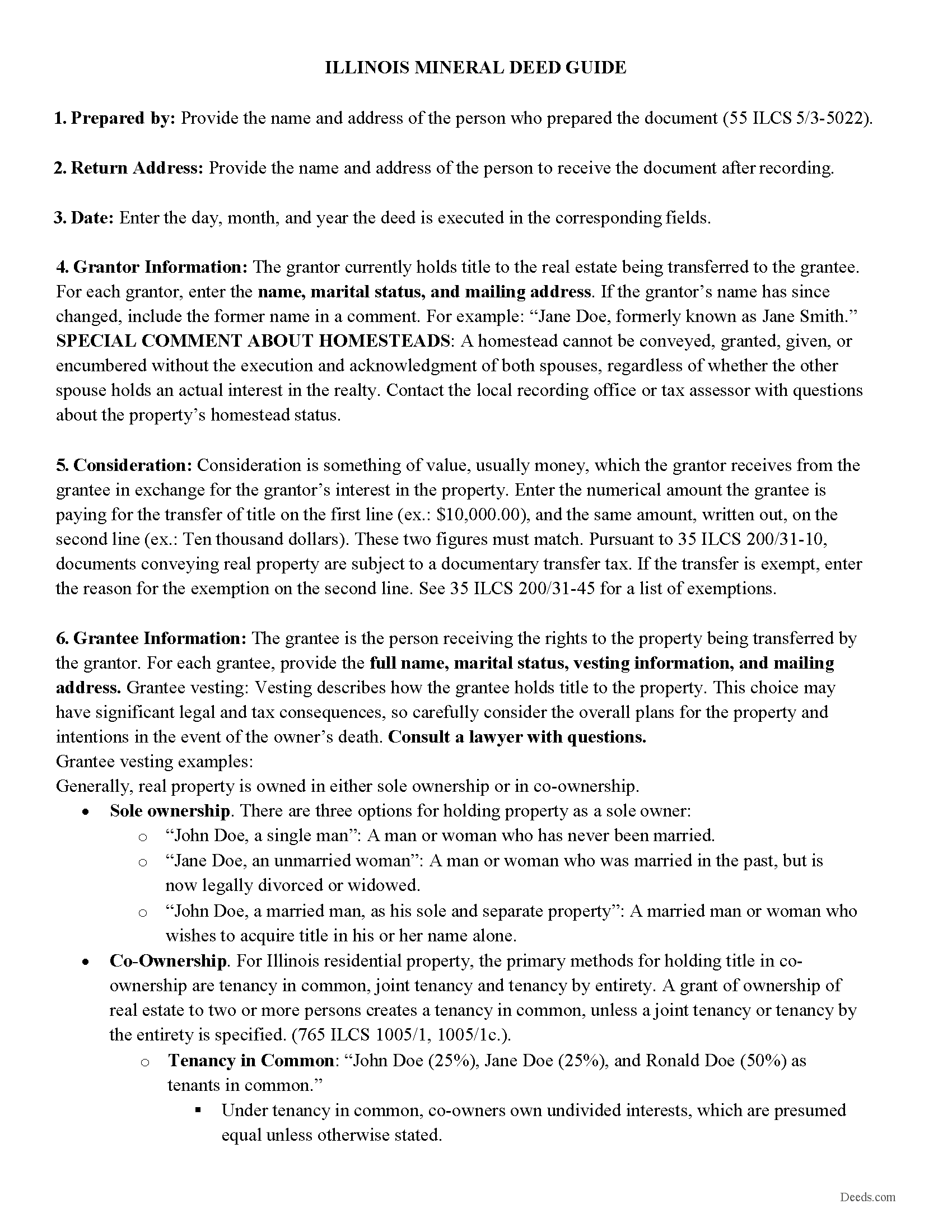

Line by line guide explaining every blank on the Mineral Deed with Quitclaim Covenants form.

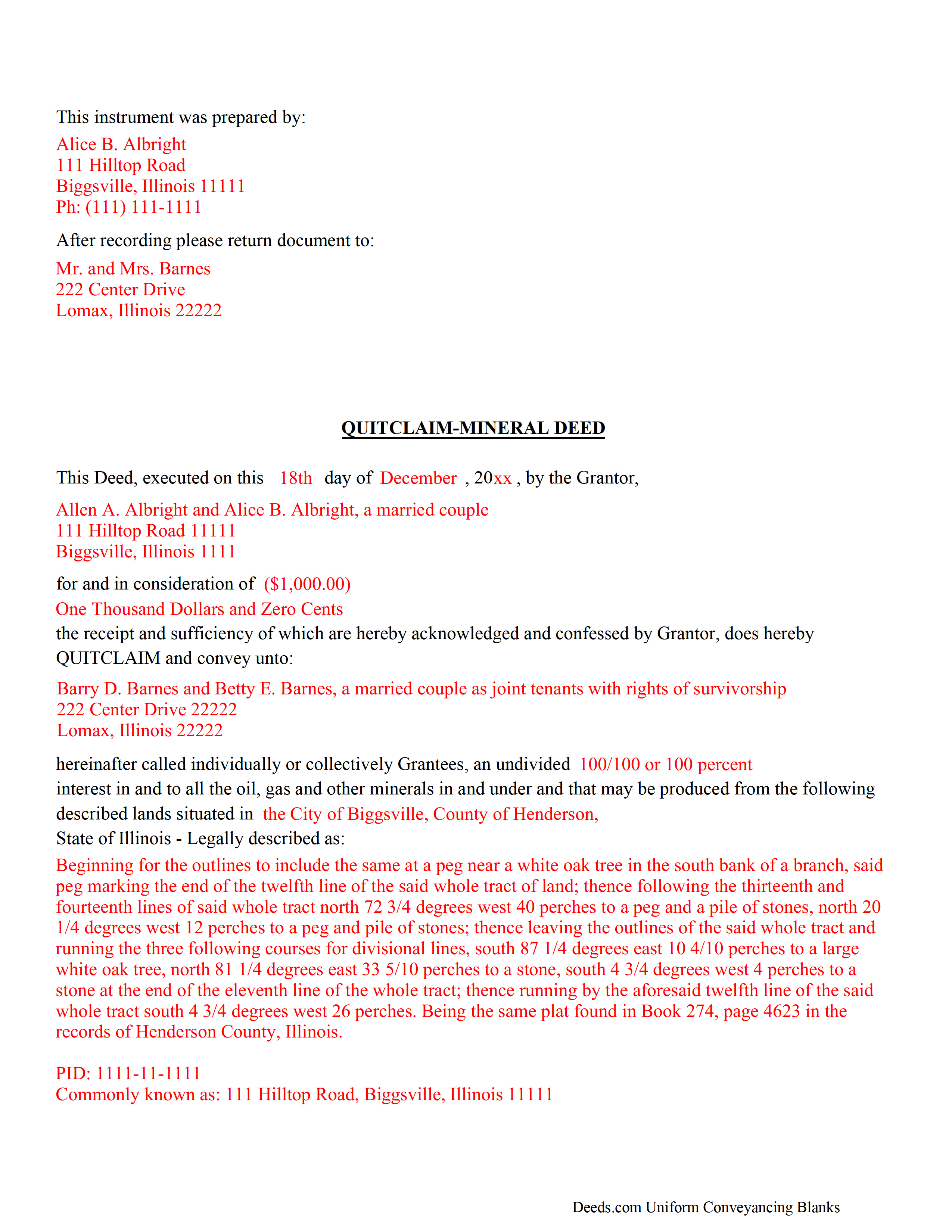

Saline County Completed Example of the Mineral Deed with Quitclaim Covenants Document

Example of a properly completed Illinois Mineral Deed with Quitclaim Covenants document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Illinois and Saline County documents included at no extra charge:

Where to Record Your Documents

Saline County Clerk/Recorder - County Courthouse

Harrisburg, Illinois 62946

Hours: 8:00 to 4:00 M-F

Phone: (618) 253-8197

Recording Tips for Saline County:

- Documents must be on 8.5 x 11 inch white paper

- Double-check legal descriptions match your existing deed

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Saline County

Properties in any of these areas use Saline County forms:

- Carrier Mills

- Eldorado

- Galatia

- Harrisburg

- Muddy

- Raleigh

- Stonefort

Hours, fees, requirements, and more for Saline County

How do I get my forms?

Forms are available for immediate download after payment. The Saline County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Saline County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Saline County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Saline County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Saline County?

Recording fees in Saline County vary. Contact the recorder's office at (618) 253-8197 for current fees.

Questions answered? Let's get started!

The General Mineral Deed in Illinois Quitclaims oil, gas, and mineral rights from the grantor to the grantee. THIS IS NOT A LEASE. There are no Exceptions or Reservations included.

The transfer includes the oil, gas and other minerals of every kind and nature. The Grantor can stipulate the percentage of Mineral Rights the Grantee will receive.

This general mineral deed gives the grantee the right to access, for the purpose of mining, drilling, exploring, operating and developing said lands for oil, gas, and other minerals, and storing handling, transporting and marketing of such.

The seller, or grantor Quitclaims the mineral rights and does NOT accept responsibility to any discrepancy of title (This assignment is without warranty of title, either express or implied)

Uses: Mineral deeds with quitclaim are often used in situations where the grantor wants to quickly release any interest they might have in mineral rights, such as in settling estates, resolving disputes, clearing up uncertainties about ownership in a title's history or when mineral rights have previously been severed or fragmented from surface rights and cloud a title, making it difficult to transfer property. Resolution often involves the holder(s) of the mineral rights, quit-claiming any rights he/she/they have or might have in the subject property.

Use of this document can have a permanent effect on your rights to the property, if you are not completely sure of what you are executing seek the advice of a legal professional.

(Illinois Mineral Deed with Quitclaim Package includes form, guidelines, and completed example)

Important: Your property must be located in Saline County to use these forms. Documents should be recorded at the office below.

This Mineral Deed with Quitclaim Covenants meets all recording requirements specific to Saline County.

Our Promise

The documents you receive here will meet, or exceed, the Saline County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Saline County Mineral Deed with Quitclaim Covenants form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Fawn T.

March 31st, 2023

So easy, forms were great, examples of filled out forms, and instructions guide. Made it way easier, totally worth it!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lori G.

October 28th, 2020

This was so easy and seemless. I wish I had found deeds.com for eRecording sooner! I submitted my documents from the comfort of my office, they were great about communicating in a timely manner with updates. The next day I had copies of my recorded documents! I would highly recommend deeds.com!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tammy B.

August 13th, 2020

I am so happy that I was able to get these forms. So simple to get and seems like will be easy to fill out . Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Maryanne M.

May 6th, 2019

Excellent service and actually better than expected. Plus if the information is not available you refund my money immediately. I will use this service again and again. Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Jo Carol K.

October 17th, 2020

The information/forms/and ease of filling in the blanks provided me with the confidence to "do it myself". Excellent customer service. Thank you for being there.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Deborah D.

January 12th, 2021

Very easy to use, got everything I needed. Reasonable price.

Thank you!

Melanie K.

December 27th, 2019

Great service! Super easy to use! I used the service to download a deed notice to do a TOD on a property in Fairfax County, VA. Just a heads up that Fairfax County required me to add the last deed book and page # onto the deed notice but otherwise all was just as they required!

Thank you!

Ted C.

May 7th, 2021

Everything was straight forward. I think I was able to accomplish my objective.

Thank you!

Dan P.

June 25th, 2020

Great service and well done forms thank you

Thank you!

Pamela S.

January 6th, 2021

Great experience! Instructions are very clear and thorough. The completeness of the instructions really inspired confidence. Within minutes of uploading my document, I received a message that it had been prepared and submitted to the county for recording. Makes it so simple! Well worth it.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Monique C.

August 21st, 2020

Very quick and efficient service! I will continue to use them for future reference.

Thank you!

Anita B.

April 15th, 2020

Service was fast and complete. Would use again.

Thank you!

Pauline C.

June 29th, 2025

Everything that was stated to be included in my order was complete. Very satisfied

Thank you for your positive words! We’re thrilled to hear about your experience.

LINDA C.

June 29th, 2020

EASY, FAST, AND CONVENIENT.

Thank you!

Bryan A.

April 9th, 2020

Very easy thank you for this quick process.

Thank you for the kind words Bryan.